Real Homes of Genius – 1 out of 21 distressed properties show up on the MLS for Pasadena. Examining four foreclosures in the Pasadena housing market.

Southern California housing is entering a special kind of rehab and not the kind seen on HGTV. There is still this lingering nostalgia from many that I have spoken to that somehow we are only a few months away from entering another glorious housing bull (bubble) market. Some are pointing to the almighty Federal Reserve and their manufactured attempt at Quantitative Easing. People forget that the Fed has already embarked on this and look how well that Midas touch turned out. What many fail to understand is that without real income growth there is little point in juicing up the banking market yet again. All this will do is prolong the misery and put the U.S. dollar at risk for further weakness which long-term is probably more distressing. Yet everything is different in the sunshine state and math doesn’t apply in Hollywood right? Well let us look at a few examples in Pasadena and see what is going on in the trenches.

Pasadena home #1

550 E ASHTABULA ST Pasadena, CA 91104

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 964

According to the ad, this is a “corporate owned†foreclosure. This home sold for $400,000 back in 2006. The current list price is $275,000. What will this sale do to future comps? It will certainly push prices lower. $400,000 for a place with bars on the window and 964 square feet of space may be a bit high? I wouldn’t be so quick to think that $275,000 is some kind of bargain.

Pasadena home #2

1687 N GARFIELD AVE Pasadena, CA 91104

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 940

Here is another tiny place. This ad tells us that this place is a “charming Spanish style†home but at 940 square feet there is only so much charm you can have. This home was listed on 10/08/2010 and the current list price is $314,900. The home sold for a whopping $535,000 back in May of 2007 and this is for a home with 940 square feet of space. Just because of the Pasadena label and the toxic mortgage market did this even happen. But here we are in November of 2010 and this home will sell for a major price cut and bring comps down in the area.

Pasadena home #3

1838 E VILLA ST Pasadena, CA 91107

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,245

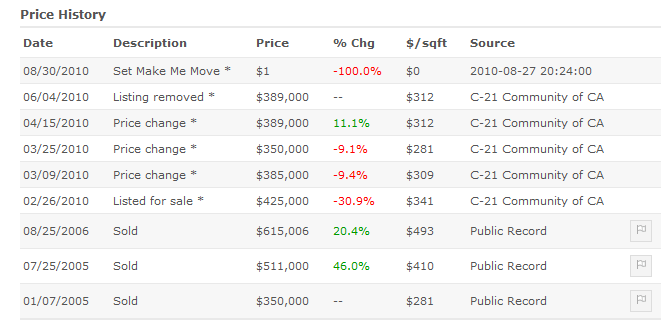

This home went through a flipping process in the bubble:

It sold three times in 2005 and 2006 and ultimately had a peak sales price of $615,006. Not sure why the $6 were tacked on at the end but hey, after $600,000 what’s another 6 bucks going to do? Maybe it has to do with some lucky number superstition. Anyway, this home is now back on the market and the current list price is $329,900. Think this place is going to sell? Real Homes of Genius are alive and well in Southern California and this will be the added pressure on the market for years to come.

Pasadena home #4

2894 EAST ORANGE GROVE BOULEVARD Pasadena, CA 91107

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,724

Here is a home in a nicer part of Pasadena for those that think foreclosure is merely a lower end game. This home sold for $732,000 in 2005. The current list price is set at $635,900 or nearly a $100,000 price cut over five years. That doesn’t seem like price inflation to me.

Interestingly enough the MLS only lists 29 homes as foreclosures for Pasadena. I did a quick search on the shadow inventory (NODs, scheduled for auction, and REOs) and pull up 636 homes for Pasadena. In other words, the MLS is only showing us 1 out of every 21 homes in distress for Pasadena. Just for reference, the median household income of Pasadena is $61,000.

Today we salute you Pasadena with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

68 Responses to “Real Homes of Genius – 1 out of 21 distressed properties show up on the MLS for Pasadena. Examining four foreclosures in the Pasadena housing market.”

Another great post. I used to love when the used house loan agent would send me a stip to “show photos of windows without bars” For my $150 fee I would drive back out to the property, take a photo fo the home showing no windows……and before I finished the rear photo they were putting them back on the front. Besides communicating that fact to the used house loan agent via email (with read receipt) I began to time and date the photos in the report. Scumbags 97% of them, appologies to the other 3% that did not bankrupt the system.

That last one is what I’d like to see more of! 🙂

I think the fundamental understand of what half a million dollars should buy is finally hitting people and they’re no longer so quick to just shell out money for a home that could be worth less in a year.

In the past, people probably thought they should just buy any random piece of home and could sell it for any inflated amount they wanted down the line if need be. They’re not making anymore land in Pasadena right? Right?

$275k for a very small house in an area you have to have bars on the windows?

Absurd, absolute madness.

If the state and local govt’s start laying off employees, look for more homes to go into “distressed” mode. I read that John Paulson, hedge fund genius, told people to go out and buy multiple homes right now. But I think this is flawed logic as homes are purchased with the most leverage the average guy can get their hands on. So even during high inflationary times, maximum debt still is the ket factor for prices to rise. Home are not through deleveraging yet.

I would say that these houses should have appreciated in value since the peak. After all, where are the garbage cans!? That should add $100K right there!

Also I think that when they say “bull” market, DHB, it has a slightly different connotation than in the past. Or rather maybe the same connotation, just less belief in the mass delusion that Pamplona = intelligence.

But let’s play with some numbers.

The nicer house sticker price ($635K) is still more than 10x median income, and the cut is 1.4x total, or $20K per year (.33 median). Still way too high.

Now look at the Zestimate curves on either side of its last sale! From 2005 to 2006, the taxes doubled with the sale. Tax assessment shows $639K–which puts the value back at the second quarter of 2005. At the end of first quarter 2001, the house was valued in the $360s. That’s STILL 6x today’s median income. Even if values reverted 2001, a 3x median price would require a household income of $120K. OK, that’s doable in SoCal for some. But that’s another 40% or so downslide. Exactly what some people think will happen.

Obviously banks/lenders are trying to hold on for inflated prices, because that means inflated interest curves in the first 19 years of a fixed 30. (The more people refi, the more they make, because the interest curve resets to the fat part each time.)

If anyone were going to buy, they’d be fools to sink equity into a downside pricing market. Better just to take the cheap mortgage debt. But the interest nut is STILL way too high. The current sticker price of that nicer house ALONE is 10x median income. Add in the total interest, and you’ve got housing that’s 20-30x the median income. That means that you, dear buyer, would be paying a bank 10x your income just for the privilege of being in debt on a house that’s going to lose value.

Gee, I wonder why folks aren’t stepping up for these great deals? Maybe we need a government program to FORCE people to buy.

Oh wait, we already have that. And you and I are in it.

http://www.doctorhousingbubble.com/fha-has-become-the-new-toxic-lender-of-first-resort-backing-million-dollar-real-estate-in-manhattan-and-socal-real-estate/

http://online.wsj.com/article/SB122079276849707821.html

Sure, visible garbage cans but there is a distinct lack of white plastic patio chairs. How can a property look inviting without a least a few white plastic patio chairs on the lawn? By my calculation, this property should have at least 5. I can see it missing maybe 1, but after that, it’s something like $30,000 off for each subsequent one. That’s like $120,000 right there. Don’t question the value of well placed white plastic patio chairs.

All of those houses are way overpriced. The first three are in a rough part of town, and the fourth is in a nicer area but should be priced at a much lower price. I’d say the first three are worth between $100,000-125,000, and the fourth house $250,000. The Pasadena/ LA county bubble is still in full effect.

Way to go, Informed SideLiner! Your home price estimates are good ones. There is still a massive bubble. Do you know that Barack Obama said in his last State of the Union Address that the government (and the banks) are WORKING TO KEEP HOME PRICES HIGH? HARD TO BELIEVE ISN’T IT? It’s also INSANE, but that’s what he said!

Obama: “That’s why we’re working to lift the value of a family’s single largest investment — their home.”

It’s not the government’s job to artificially prop up housing prices! Who wins with higher home prices? The banks and governments (higher interest payments and higher property taxes) Who loses? Homebuyers who are working hard and saving to buy a home. The free market should determine home values, not governments and not banks.

I know you’re speaking tongue-in-cheek but it is incredibly short sided to say that anyone “wins” with over-inflated house prices. Sure, in the short term, taxes and mortgage fees might increase. But when that mentality is carried to its logical end, you get a completely siezed market and a credit crunch.

I know you understand that it is lower prices, not higher, that will return liquidity to the housing market but it just absolutely infuriates me when I see pundits and politicians imply that repairing the current situation should somehow involve pushing prices far beyond what is fundamentally supported.

An article in the LA Times yesterday was entitled, “Pay the mortgage, hurt the economy.â€

It turns out the bigger problem for the economy is when people who are underwater continue to pay on houses, that are worth far less than before the bubble. 15 million homeowners are underwater and 7.8 million owe at least 25% more than their properties are worth. Billions of dollars that might be used for other forms of consumer spending will be spent on underwater mortgages, which is a drag on family finances, the housing market and the overall economy. BTW, here is the reason why this nation is so screwed up. The number 1 story on Yahoo News is the “McRib Returns.â€

http://news.yahoo.com/s/yblog_newsroom/20101102/bs_yblog_newsroom/the-mcrib-returns;_ylt=AkaOby7zc3hdrgDv7s7e.g8DW7oF;_ylu=X3oDMTMyNDVydXZ1BGFzc2V0A3libG9nX25ld3Nyb29tLzIwMTAxMTAyL3RoZS1tY3JpYi1yZXR1cm5zBHBvcwMyBHNlYwN5bl9hcnRpY2xlX3N1bW1hcnlfbGlzdARzbGsDdGhlbWNyaWJyZXR1

The effect of paying the debt on underwater houses was raised as a reason by a few economists who promoted the idea of cram-downs or otherwise relieving house-buyers of their debt (and their houses).

One economist was a fellow from China, who assumed that we’d have cram-downs. There was no other alternative, he implied. What this communist didn’t understand is, in America, we *believe* *in* capitalism… but we don’t understand capitalism.

And of course since housing can’t save us, consumerism can.

It’s turtles all the way down, young man.

Or maybe more like violently insane Russian nesting dolls.

Well, in defense of Yahoo and their “news”, it *IS* the McRib. 🙂

The Fed can print all the money they want. If it doesn’t wind up in the hands of the working class who will spend it in the form of wage inflation or easy credit it means nothing. We already had inflation from 2001-2008. That’s where all the crazy home, education and auto prices come from. Anyone could get a loan for these things then.

We’re not going to return to easy credit or “credit innovation” as no one will go for that trick again. We’re not going to get wage inflation either. The situation is out of control. Still think Jubilee is the only thing that will help but it would really chafe those that did not spend unwisely as few and far between as those individuals may be.

Still love seeing these tiny homes, smaller than my apartment and still waaaaay more money. Prices still need to go down much farther to make sense in the real economy.

Record foreclosures, record low rates, record inventory, and record government manipulation. And still no movement in the market, other than down. The writing is on the wall, for those who choose to see it.

Another 25-30% drop is on the way.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Quantitative easing isn’t supposed to raise house prices – it’s supposed to prevent deflation, and reduce unemployment.

I love reading your blog. Your articles are always well researched and detailed. But I disagree with you on using ‘median household income’ of a city to determine what the house prices should be in that neighbourhood. ‘median household income ‘ includes data of renters too and this skews the results. The ‘median household income ‘ should include data of only homeowners.

Hello Sunil. Why should only homeowners be counted as living in a place for purposes of calculating median income? I think you’re confusing median income with a measurement of people who pay property taxes. Many homeowners are underwater – should they count? Defaulters and foreclosures-in-the-making don’t pay property taxes and demonstrably can’t afford their homes – should they count?

What about people who own in one place but rent where they live?

Simpler just to take the median of all local residents without worrying about their mortgage status.

Why should it be income of only homeowners when we’re doing a general measure of affordability?

Let me explain why..

Let us assume City X has 60% rental apartments and only 30% houses while City Y has only 10% apartments and 90% houses and all the people who are living in houses have theorotically $150K in income while those living in apartments have $50K income. Also assume that a single family home in both the cities costs $350K. In this example the median income of City X will be less than that of City Y. By using this number you will get the impression that the people living in the houses in City X are living beyond their meand while those in City Y are not. But the people living in all the houses are making $150K. So if you are trying to measure affordability, you are using the wrong measure.

The concept doesn’t work when you factor in new homes, fluctuations between renter->owner/owner->renter, constant buying/selling, etc. The market will have to reach some sort of equilibrium based on the collective income of owners and would-be owners (includes renters).

Furthermore, in an environment where the rental population is increasing (owners => renters or renters waiting on the sidelines), it’s harder to predict what is ‘affordable’ based on simply the homeowners’ incomes.

http://news.yahoo.com/s/ap/20101102/ap_on_bi_ge/us_homeownership

WASHINGTON – The nation’s homeownership rate remained at its lowest in more than a decade, hampered by a rise in foreclosures and weak demand for housing.

The percentage of households that owned their homes was unchanged at 66.9 percent in the July-September quarter, the Census Bureau said Tuesday. That’s the same as the April-June quarter.

The last time the rate was lower was in 1999, when the rate was 66.7 percent…

Can anyone anywhere show me where the house prices are selling at a 3 times multiple of average income. Cant be done. Were still in a bubble.

Of course we’re still in a bubble–the MOTHER OF ALL BUBBLES.

Read on…

The Biggest Debt Bubble In The History Of Our World

How much will the dollar fall?

How much purchasing power do we lose?

What happens to the US$ world reserve currency status?

We got problems.

Detroit?

We’ve all been screwed, *ucked, and taken for suckers. The banks and the govenment have kept housing prices artificially high, and home prices remain prohibitively high in many places (as seen above in Pasadena). People who buy at these insane prices will end up “holding the bag” and will end up as suckers and losers – they will lose tons of money and maybe their homes (no offense to any homebuyers intended). And it shouldn’t have to be this way.

Our economy is being devastated. How can home prices start to rise? How can home prices even level out? The correct answer is THEY CAN’T. HOME PRICES WILL CONTINUE TO FALL, DRASTICALLY. People don’t have good jobs. Many people are struggling to put food on their tables. The middle class in America is dying (by design). Buying a home now (in places like Pasadena) is like swallowing a lit stick of dynamite.

Well Said

That first one is in a wretched part of town. $100K would be perhaps reasonable for that place.

The only one in a good area is the Orange Grove house, the others, forget it! I was born here and still live here but I’ll never be buying a home here.

Good Luck to California with their new Govenor and his old ideas…

Many of us here are very happy to be getting Brown. I mean, Meg Whitman? Stupid.

Oh, I see vote for Meg. Get real

According to Mortgage-info.com houses have historically appreciated 6% per year. Interesting. I’ve always read that 3% was considered the average and if you look at the housing market during the 90’s it seems to be lot lower than that. With these numbers in mind, the Pasadena house #4 sold for 285,000.00 in 1988 (according to redfin.com). At 3% appreciation that would bring the house to >500K. At 6% the house would be potentially worth 643K. Of course if you look at the pictures of the garage with the cracks in the floor, etc you wonder what the selling strength is.

1988 was the peak of a housing bubble in Los Angeles. Prices were up a lot, and when the bubble deflated, it would collapse from 88 to around 93. The mitigating factor in this house was that houses in the area were probably worth a lot less than 285k before the bubble. Orange Grove had been ravaged by the 210 freeway construction, which turned both sides of the ‘way into a ghetto.

If my salary was 275K I’d have bought that house.

IF, IF, IF, Consider yourself lucky! IF you wait a year or so you could ? buy ? 20-30% more house. Patience and good luck. LOW Ball to the max their are alot of SMART sellers out there and all they can say is Y or N. IT WILL BE A BUYERS MARKET AND ONLY GET BETTER WITH TIME

If I made $275K, I could surely find a better way to live than any of these houses.

I live much better than that NOW, and I don’t make anywhere near that salary.

Feel sorry for folks in that income bracket whose imaginations and dreams are so stunted that they can’t think of any better manner of life than to borrow to their eyeballs for some small, ordinary house of the type that was built by the dozens for aircraft workers back in the WW2 era.

Instead of bailouts, and pussy footing around, we need to get these properties given back to the banks, and maybe provide education or re-education programs on responsible home ownership and investing.

Is the education you mentioned for the home “owner” or the banks, neither has been very responsible?

@ We’ve all been *ucked

You speak the truth my friend. Prices in Pasadena and most of LA county are insane. Anyone who currently buys a house in Pasadena or most parts of LA county, is going to take a big devastating hit.

Now that the Fed has announced QE-2 (Quantitavie Easing, or Printing money out of thin air) maybe all homes will be worth a million dollars! But those dollars will be worth a dime.

How in the world or what in the world do people do for a living to be able to afford to pay this much for a home?

That’s part of the key to this…it’s not that jobs or ideas paying enough to buy these houses don’t exist. It’s the number of slots that’s the problem. The average home price and average home owner’s earnings and savings ex-home are way out of line. Million dollar houses are all over CA and nothing special but $300K wage earners are quite a bit more rare.

In the past people got here by trading inflated equity over time. That game is over so now its back to wages, and wages were never high enough. If people try to keep prices here you basically squeeze out the next generation who will never have access to the ponzi home equity game of the last 30 years (driven by demographics and interest rates going from 20% to 6%) to get into decent houses or move up. Fundamentals just aren’t there now nor in the future. We need jobs to get wages up and people working, not some “government sit on your but and handout my tax dollars for votes job” either but real private market growth doing real stuff.

I can perhaps offer one answer – anecdotal evidence – to X’s question. One of my best friends recently sold his house in the upper area of Alta Dena. Nice place – not huge; maybe 1,100 square feet 2+1 with fireplace, real porch and basement, lots of good upgrades like full copper plumbing and restored vintage appliances and with a great piece of property @ 1/3 acre. No bars on the windows in his neighborhood. He bought in 2003; paid around 220k. He went into escrow last week (house was only on the market 6 days) and signed an acceptance for 490k, cash. He had two other offers as well, but both would have required financing.

The lady who bought is a writer who currently works at the L.A. Times. There are plenty of careers here in So-Cal which pay the sort of money that allows people to buy homes at any price, especially anything connected to the entertainment industry. The trick is keeping that career long-term.

Was wondering if I can bounce some thoughts off of you guys reading this blog (and Dr. HB as well).

In the prime areas, like Beverly Hill, Palos Verdes and Malibu, is median income necessarily the absolute rule in determining home prices? I know that income is a strong factor to determine what one can buy, but the higher up the social ladder you go, doesn’t income gradually become less a factor in purchasing power? Wealthy people tend to have more assets that are not tied with household income (i.e. stocks, land, savings, etc).

In areas like that, shouldn’t we also take into consideration the overall net worth of individuals living in the area? Perhaps use a function of income and net worth to determine a more accurate appraisal of a home?

Gary, thats a good point! However, this current Real estate bubble was still part of the earlier and continuing post WWII house price bubble. If you look at it historically families never paid more than TWO times annual income for a mortgage. the Three times annual salary yearly figure is the absolute MAXIMUM mortgage debt that was to be allowed using 30 year mortgages. Think about these additional factors: The earlier 15-20 year mortgages were based on a single income earner in a family that also had a real defined benefit pension plan (non-401k) that most employers provided. But there is more. With the disaster on Wall street came the realization that these phoney baloney and TOXIC waste mortgage CDO’s, and SIV’s were mostly consisting of OUR PENSION PLANS. It is incumbent on ALL of us to consider that with the pillaging of our pension plans by the banking, mortgage and Real Estate sector also occurs at the same time that the Social Security System is being recognized for what it is….a GIANT government issued Ponzi scheme. What to do? Save save and save! How can you save if most of your income goes to pay a mortgage that you can just barely afford at the 3X level? The solution is to cut back and PAY YOUR SELF FIRST. Forget about trusting the bansksters, your 401K plan, or the Social Security System., We are really all on our own…and NO ONE IS HERE to help us! Not banks, not government and especially not real estate salesmen and other cheerleaders! THEY ONLY MAKE A PROFIT WHEN YOU BUY. SO DO NOT BUY UNTIL THEY GET CHOKED OFF—like the cancer they are.

I have been following my advice and found that renting is not bad. If a landlord PAYS a mortgage—then THEY are in misery. If a landlord misses only ONE rent payment, it costs them a minimum of 8%. Two months with no rent they lose 16.7%. Thats big bucks…a few months like that and it is foreclosure time for them. As long as landlords have a mortgage, organized renters can EASILY push rents DOWN. I have and it works. GREEN MONEY TALKS—when you use it wisely. Save save and save will slay the banking and mortgage dragons. Organize renters for SPECIFIC landlords (mine owns over 70 houses)…they need money —if you don’t hand it to them , they are on the way to financial destruction no matter how many politicians that they may try to influence. We need a MORATORIUM on houses just like a moratorium on drugs. JUST SAY NO—-in only two years—the banksters will be on their knees ….it will be worse than the mortgage crisis for THEM. If you HAVE NOTHING—or have lost your assets —what is there to lose?

I’m not sure that all the post ww2 prices are a bubble. The FHA helped to make more renters into owners, and that certainly contributes to rising prices, but when does it become a bubble? The post-ww2 era saw rising prices, but also a huge expansion in new inventory, and increasing floorspace. Going from 2x income to 3x income isn’t that terrible if you consider that credit had been expanded, and houses got larger.

The latest bubble saw skyrocketing prices but with less room to expand, condos instead of SFRs. Used houses shot up in value – despite the fact that all houses are a depreciating asset and normally decline in value over time unless repaired regularly.

My strategy has been successful in allowing me to progressively reduce my rent. I AM NEVER LATE with my rent AND NEVER ANY EXCUSES….but I let my landlord know that I have reduced hours, and lower income. I PAY AS AGREED—they get to worry—about “Will this excellent no problem tenant move out—leaving me with 1 2 3 months of NO RENT…like the dozens of other EMPTY houses the same size with FOR RENT SIGNS on them in the same area? Or will I lower the rent 5% per year to “help” them out? The worse fear they have—? Is that I will go out and buy a house leaving them with another EMPTY RENTAL with property taxes and mortgage to pay. MY rent has been dropping each year—I know when to stop pushing—because I can look up the loan information with the county. How do they handle it? EXTEND AND PRETEND! OH YES—they are re-financing at lower rates to get through this “temporary” lull in house prices. But we all know–if WE DO NOT BUY—and strive to get lower rents we cqan STOP and POP the bubble and force these people to get a real job and work for a living instead of leaching off us. I have saved so much money by renting a newer mid sized house. that today I CAN PAY CASH FOR ONE. BUT after ALL of my rice and beans and hot dogs meals and forced frugality—I KNOW I will prevail since I DO NOT NEED A MORTGAGE TO BUY. I am now in the drivers seat and won’t let up until my rent goes lower and lower —-as I smile and watch the greedy real estate-banking sector sink in the SWAMP of their making. NO credit cards or super monster mega banks banks for me. Just save and stash it at an NCUA insured Federal Credit Union or in my pillow case… UNTIL I am ready and convinced that these criminal banksters wiull meet legal justice. HAPPY DAYS ARE HERE FOR ME….just watching the bankster -real estate misery. CASH IS ALWAYS KING.

Yes, cash is always King. Until cash is deflated to such a low that no matter how much you have in your pillowcase, its worthless. That is where we are heading. If you have savings accounts or cash investments for retirement, you would be very prudent to put them in another type of investment, as the value of the dollar is starting to really plunge and its going to take anyone who has cash ‘investments’ with it. You are FAR FAR better off buying a modest home where you can have a garden, and feed yourself and possible others, and have it paid for. Then you can ride the slide when taxes go down as the market craters.

I don’t view rentals as “sucking” because they do provide a place for people to live. You are the benefit of that. What I find troubling is your complete lack of respect to the struggles that your landlord is going through – to prevent the roof from being sold or repossesed from over your head.

Please look at my 7:31 post. My landlord owns over 70 single family dwellings and is a REALTOR. This person is also a licensed general contractor and has family members who run the city council and manage the building and safety and planning departments. In California, the real estate contracts have pagfes and pages of legealses that in essence says I KNOW NOTHING about construction, even though they built the houses. Why should I feel sorry for the people who tried to exploit me? All they have to do is tell me they will not lower my rent, and I will move a few houses down the street and pay lower, while they will have at least 30 days of zero occupancy at an annual loss of 8%! Two months= 16.7% . Building these poorly built below code houses was THEIR choice. My choice is to pay the lowest rent I can so I don.t givre away my money. While you are feeling sorry for the landlord-Realtor-flipper -“Get rich quick” crowd, think about this. My landlord is now building MORE houses in this area. The house is under cinstruction with NO ROOF ON IT, and it has been raining on and off for two months. The house will list for about $900,000 and yet there are three similar sized houses for sale across the street for under $500k —listed for about 6 months. Its called GREED! I checked the county recorder and found his banker buddy who GAVE him a $700k construction loan—even though it would never cost more than 200K to build. Talk about FRAUD! He can worry about my rents and hyping these over priced houses and keep driving his Escalades while I count my money. I hope the feds catch up to his scam—something isn’t right but who will investigate? His brother the city councilman? Or his inlaws who own the bank. They made their bed—let them wallow in debt. I can walk at any time with a 30 days notice—he has mortgaged his life away to bubble dreams. Would YOU buy a 4,000 sq ft house next door to a sewage treatment plant? Its all legal here in California—just put up some green trees and some grass and bushes and it will be all better. The ads say “bubbling stream” within walking distance—but NO one will climb the fence to catch anything swimming in that muck.

The trick is marketing—they ONLY market to people from other states or big cities who don’t know about the morsels floating in the stream… Yeah honest? I am not crying for the landlords.

@ Marcy

Yes, you are right, there are jobs in the area that can enable a person to buy a house for “any price.” There are also people with “old money” that they inherited. Here’s the catch. That $490,000 house you talked about is probably actually worth a lot less. It sold for $220,000 in 2003, so in actuality, it is probably worth less than that at this current time. Yeah, some sucker did just buy it for $490,000, but what if that person needs to sell it in the near future. Yeah, the owner did pay cash which means he or she has no mortgage. The owner could rent it out and move if needed, but he or she would still be stuck with a piece of property that is depreciating in value. That owner better be willing to hold onto that property for years to come, because that $490,000 price tag may never come to be again for a long time. Imagine what that person could have done with an extra $250,000 dollars in his or her bank account.

Many people don’t understand how much a house should really cost. Many people just don’t have a total understanding of what caused the last bubble and how prices increased to unsustainable and unrealistic prices. Many people are tired of waiting for prices to decrease in certain areas like Pasadena and Altadena, so they go out and buy overpriced properties. That is a decison based on emotion not logic. That is a bad decision. Do you get my drift. With the economy the way it is, now is not the time to make risky financial decisions. Buying an overpriced house equals making a risky financial decision.

What if the writer has 10x the value of the home in other assets/cash? What if this person is overall financially responsible and just decided she wanted a small luxury (relative to her wealth) and not an investment? Or perhaps the home is an investment (via inspiration) to her creative asset (writing)? I think there are lots of holes to fill in, but to bring up all the negative aspects as if the writer did a bad thing is unfair.

I think everybody understands how much homes should cost: Affordable. What is affordable to one person may not be affordable to another. The general public desire lower home prices because they don’t earn enough to support payments for the current prices. However, there’s a select few who have the luxury of paying now and not waiting 2 or 3 years for another 10~20% drop. If they can remain financially stable despite buying a home during a deflationary trend, is that necessarily a bad or risky decision?

@marcy it is true there are people in the entertainment industry who do make some decent money and can afford these prices. I’m one of them and I overpaid and spent 420k in 2005 for a piece of crap in Highland Park that I had to do a lot of work to. looking back I definitely got in at a BAD time. Luckily, my wife and I are gainfully employed and can afford the mortgage, and refi’ed with the super low rates As for our first investment property however, we’ll definitely be waiting and watching the market drop before we move on that. Overpaying once is enough for me!

I think a 25% drop in the market is one scary number to consider. After just coming back from a trip to Memphis TN I have a different vision on what “poor housing” means. I really hope we don’t go that direction with our housing. The Sacramento model is working but the situation here is a bit unique.

speaking of Altadena, how’s this for a correction? peak price of 1.2 mil in may of ’06. Now listed at 537k http://www.redfin.com/CA/Altadena/524-W-Palm-St-91001/home/7252545

@Blue

Sorry to hear, but thanks for sharing your advice with others.

It’s definitely a scary time, though where I work most people seem to still be going on with business as usual. It will be interesting to see who makes it out on top in the next 5 years and what the trends will be.

Pasadena is a nice city, but not all parts of it.

I started reading this blog a year or so ago so I will start with this: I wish that I read and knew stuff like this in 2005. The predicament that I am in is of my own making and I am in no way a “victim” of anyone. I made a stupid decision. I write this at the risk of sounding even more so.

That being said, maybe some of you very informed folks here can help me with a disagreement between my wife and I. Some background:

We both work in very stable industries. We are both in our late 40’s, and have been with our employers for 20 years. Our jobs are not likely to go anywhere. We have no debt except our mortgage and a small HELOC. Our oldest son has “left the nest” and is in the military. Our youngest is in high school.

We “bought” a house in northern Glendora in 2005. A great area. good schools, etc. We paid a little over 800,000. Zillow shows is in the mid 500s now. We are underwater to the tune of 70,000 and growing. We are in a 30 year fixed rate mortgage at 5.875% We put 20% down. Obviously, that has evaporated. Our payment (P&I) is about 36% of our take-home pay. I pay taxes and insurance separately.

My wife feels that we should get out of this money trap and walk away. She feels that we are throwing away money that could be put to better use. I agree that things are not going to get better but will get worse. We will never again see what we paid for this house and it will likely continue to go down.

I can not stomach the idea of walking away from our obligations. I just have a hard time with it. We can afford to pay the monthly payment. We have more than enough saved up to pay off the HELOC, but I would rather hold on the cash at this point, the payment is puny.

Am I continuing to be an idiot? I kick myself daily over the poor choice that I made in ’05 but feel that morally, we should not default. By what I read, this is not going to get better for a long, long, time. So, we are at an impasse…

This is not a joke nor am I a troll. Just looking for some opinion from the folks here that have been more intelligent than I have.

Keep up the good work with the information and education!

Thanks all for reading.

FSC, I’m in no position to give you advice or to judge you, but I will respond.

Looking at your situation I would say it’s smarter to walk away. I say this because you are not getting off lightly. You’ve lost your 20% down and your credit will be hurt for it. That is the consequence that the lenders understood would happen in case you ever did default on the loan. You both lose.

If you stay, you are helping to prop up a housing market that was built on artificial money. Think of it this way – if your home goes into foreclosure and sells for its true assessed value, homes in the same area will start to fall and so on. I read an article yesterday that suggested underwater mortgage holders are actually hurting the market by continuing to paying to prop it up. Very true if you think about it.

As for the moral issue, you sound like a good person that just bought in at the wrong time (whether you were naive about it or not). The lender gets their house back, you lost your 20%, so let’s call it even. Did the lenders, real estate agent, or even the federal government exercise any morality when they led us straight into this mess? The answer is no. Do what is right for your family and do whatever it takes to get this burden off your chest. The pain will be severe but the recovery can begin immediately versus a prolonged decline without any promise of a recovery.

One other thought. You say that your jobs are stable and are not going anywhere. Even if it were true, you could still be paying into a home that may never reach the peak you paid for it in your lifetime. Is that worth it for you? I’d rather go home and rebuild with my wife, cut losses and let the healing begin. Good luck and let us know how it goes.

concerned, thanks for your concern 🙂 Naive doesn’t scratch the surface. We bought our previous house for 200,000 and sold it for 550,000. If I had educated myself on the coming train wreck, we could have saved that profit and just rented for a while like folks that I read about here. I pushed for this thinking and believing the hype that that we just had to trade up now or lose the chance forever. My didn’t agree but went along with me.

So, that’s where our differences are, she thinks we have lost enough and should cut loose before we lose more. Although there are compelling arguments from you and her, I have a hard time with the concept. Our marriage is fine, we just disagree on the path to take.

I have told younger friends and co-workers about this blog and our story so that they don’t make the same mistakes. There is a lot that can be learned.

FSC, I hear you loud and clear about not wanting to walk away from obligations. I am the same way. But I think these times call for different behavior. The major institutions of society have progressively walked away from their obligations. These days, it’s every man for himself. I can hardly believe I’m saying this, but that’s the way it is.

FSC, my wife and I are in the same position. Got excited about being homeowners for the first time and overpaid for a condo in 2004. It’s now worth $100k less than we paid (300k-200k). We too have learned a lot since then and pay it down as fast as possible (now down to $220k). My stomach was telling me the same thing yours was, pay your obligations.

People here will argue that we should walk away (and they are probably right). Some even say that paying our obligations prolongs the pain and hurts the economy. On the flip side, everytime we make an extra payment, it feels like food for the soul. The hard work we’ve put in to try and make good on our word makes us stonger, better, and closer to the debt free individuals we have learned to become.

Obvioulsy the dollar amounts for us are smaller, so that has significance. To each their own. All the best.

$800K for Glendora?!? LOL. Sorry FSC, I just can’t imagine Glendora having any sort of home (or two combined) worth remotely close to $800K. Personally, I say walk. “Morality” be damned – I don’t see much morality in the banks walking away from their obligations and sticking it to we the people. Stop paying and tell the bank you want a principal reduction of $300K or they can take the house (or what’s left of it after ‘vandals’ get through with it).

@ Ed

I respect your argument, but the writer could have saved over $200,000 dollars. Now if $200,000 dollars is chump change to the writer, then go ahead and buy. Is this writer worth $50 million dollars? I doubt it, but then I’m just speculating. Maybe she bought the house for a relative, and she is not even going to live in it. I doubt it, but I’m just speculating. I believe this person is not a multimillionaire and just overpaid $200,000 dollars on her house.

You remind me of those people back in 2005 who stated there were so many Californians earning over $100,000 who could purchase overpriced homes. Or the people who stated that everyone wanted to move to California and that is why there was such a demand for houses. Or the people who said home prices would keep going up because prices always go up.

Well, if I were one of those people, I’d be paying off quite a heft mortgage right now. As it is, I’m a renter and have never owned. I opted to put money into other investments in the early 00’s, as I’ve never considered a home (residence) as any sort of real investment.

That said, I don’t disagree that the buyer probably overpaid 200K, or even 300K for that matter. I just disagreed with the your conclusion that it was a bad decision. We can speculate in either direction to convince each other that it as a bad or good decision, but speculation is speculation. I thought it was an unfair conclusion

Ok for a bit more fun: Here’s the numbers that will be swallowed into the shadow:

Pasadena:

30 days late 133

60 days late 54

90 days late 31

120-180 days late 161 (Exclused NOD or NTS Data)

Sorry for being ignorant, Brad:

How reliable is your data? From public source?

One thing that hasn’t been directly addressed here (to my knowledge) is the phenomenon of finished, slick, turn key flipped houses in areas that contain mostly older dilapidated homes. I live in Highland Park and I am continuing to see people pay top dollar for these home. check this one that just got its offer of 531k and closed yesterday:

http://www.redfin.com/CA/Los-Angeles/6220-Hillandale-Dr-90042/home/7085260

mind you there is NOTHING SPECIAL about this street. not exactly dumpy, but a LONG way from anything resembling a more desirable area in Pasadena.

and this one with sale pending at 499k (may have gone over asking or perhaps right at asking price):

http://www.redfin.com/CA/Los-Angeles/6147-Strickland-Ave-90042/home/7084742

This one is on my street which is also a “decent” street but nothing special. My contention is that there is a proportionally small number of houses in this kind of turn key condition in an up and coming neighborhood like Highland Park. Therefore since those kinds of houses are highly desirable to successful, professional people who don’t have the time or inclination to do tons of work on their houses, I would say that it skews the law of supply and demand in favor of the seller. Sure there is a lot of inventory on the market, but most of it is crap being picked up by investors. There are relatively few of these kind of turnkey houses in this neighborhood and I’m seeing these houses still get multiple offers and be sold very quickly. I wonder if the Doctor has any thoughts about this. Seems like there is no sign of the end of these little diamonds in the rough being snapped up by professional, successful people who have been waiting and saving. Mind you these aren’t people getting tax credits as this has expired.

@ Ed

I think your argument is fair and logical. I can respect that.

Leave a Reply