10 Reasons Why Buying a Home in Southern California today is a Mistake. California Housing and Financial Market Analysis produces no Green Shoots.

The real estate siren call is echoing through the Southern California landscape. You get the sense that we are back in 2005 and 2006 when real estate was the golden child of the investment world. How quickly the psyche erases tough losses when it wants to find profit. If you talk with some people, you would think that the March 9th low in the stock market and the end of the world sentiment at that time has some how evaporated into the California springtime air. Yet one thing remains. The fundamental factors that have depressed and caused the California real estate market to crash still remain, especially here in Southern California. The U.S. Treasury and Federal Reserve are leaking results from the stress tests (can’t call it a test if you can’t fail) and even with worse than expected information, the market still rallies.

I’ve argued that the stock market is now completely disconnected from Main Street. Even with GM announcing a 1-for-100 reverse stock split, basically telling common shareholders the stock is worthless, the stock only moves slightly down. This “ignore reality” sentiment is exactly the kind mentality that led up to the California housing bubble. We got rid of 3-times gross income ratios. Ignored the tried and tested value of 30 year fixed mortgages. We also learned in bubble mathematics that down payments are for chumps. That flawed calculus obviously came back and bit us in the rear end yet here we are, in the midst of dealing with the fallout and many are eager to jump back in! In this article I will mainly focus on Southern California real estate but I will also talk about California overall. I’m going to give you 10 reasons (I can give you more) why buying a home right now is a bad move.

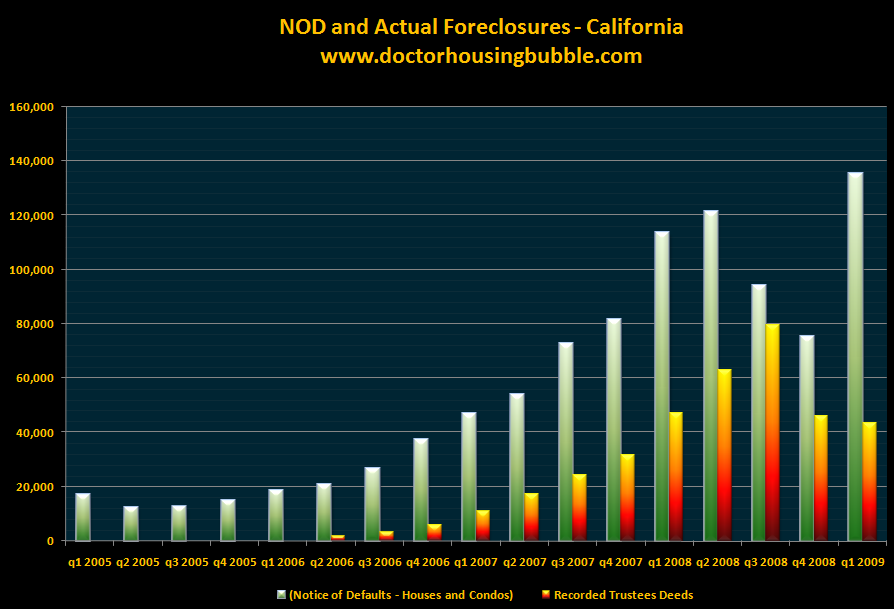

Reason #1 -Â Notice of Defaults and Foreclosures

Take a really close look at this chart. Do you see in the chart how in Q4 of 2006 notice of defaults (NODs) started spiking off the charts? This was the canary in the subprime coalmine telling us to gear up. Yet people kept on buying only to see the market collapse in 2007 and 2008. It was a warning sign. Many pundits in the industry point to the Q3 and Q4 2008 drop in NODs and foreclosures yet fail to mention one thing. This was a government sanctioned moratorium. Sales did not increase by any sizeable portion to justify the fall. What caused this drop was artificial.

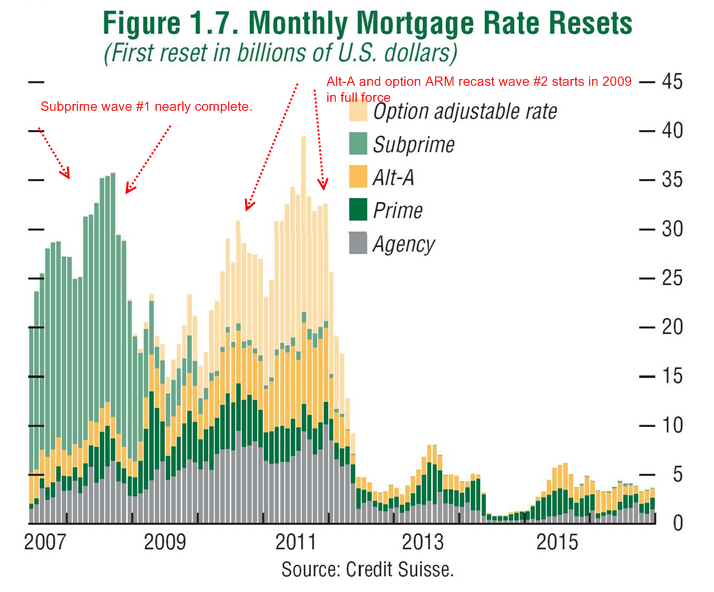

The artificial propping up is now completely gone. That is why for Q1 of 2009 we are witnessing the largest amount of NODs in the history of California real estate. I wish that were hyperbole but that is simply the fact. What this tells us is a tsunami of inventory is going to be flooding the market in late 2009 and early 2010. Keep in mind, most of the subprime waste has washed through the system. That battle is largely over. The next big issue is the Alt-A and Pay Option ARM fiasco. And many of the properties with the Alt-A and Pay Option ARMs are in more middle-class to upper-class areas. So what is the point you ask? The point is, many of the great deals people are seeing at the lower end of the market are because of the flood of foreclosures and REOs. Yet the middle to upper priced areas have yet to see any significant movement down. All we know is that a flood of inventory will be hitting these areas. Simple economics will tell you that more supply and equal or less demand usually will mean lower prices. There is absolutely no rush to buy a home right now.

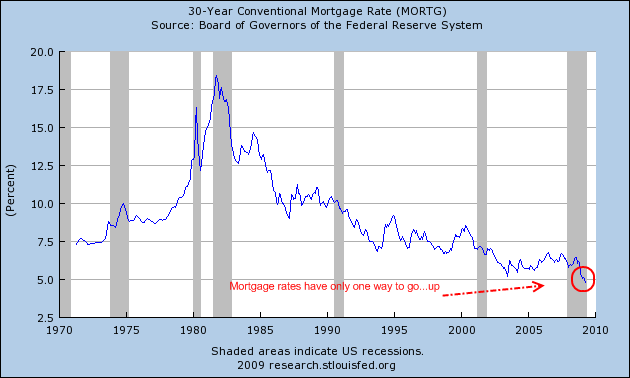

Reason #2 – Mortgage Rates

One argument making the rounds from bottom callers is mortgage rates are at historical lows. I actually take this argument as a reason not to buy. Why? Well look at the above chart. Mortgage rates are being artificially pushed down by the government through various programs at the Federal Reserve. This cannot go on forever. Here is a scary thought. I ran the numbers above to find the average 30 year fixed rate since 1971. Want to know what that is? 9.08 percent. Big deal right? Well let us run the numbers with the current 4.81% rate and the 9.08% rate on a $500,000 mortgage:

PI @ 4.8% $500k = $2,623/month

PI @ 9.08% $500k = $4,051/month

Now here is the thing, sure you can buy the home at the low rate but let us say rates in 5 to 7 years when you are looking to sell are now closer to the historical average? Who are you going to sell too? If we have a Japan like multi-decade stagnant economy, you better get ready to stay in your home for the duration. Like I said, rates have only one way to go and that is up. Some view this as a plus, I view this as a liability. Give me a good price and a higher interest rate over a high price and a low interest rate any time. You have more option with a low priced home with a high interest rate. You can refinance at another time, pay it down quicker cutting into principal faster, or you can sell and have a bigger pool because it is a better price. A low rate by itself is not a good thing. If that were the case, those teaser 1.25% toxic mortgages would be all the rage again.

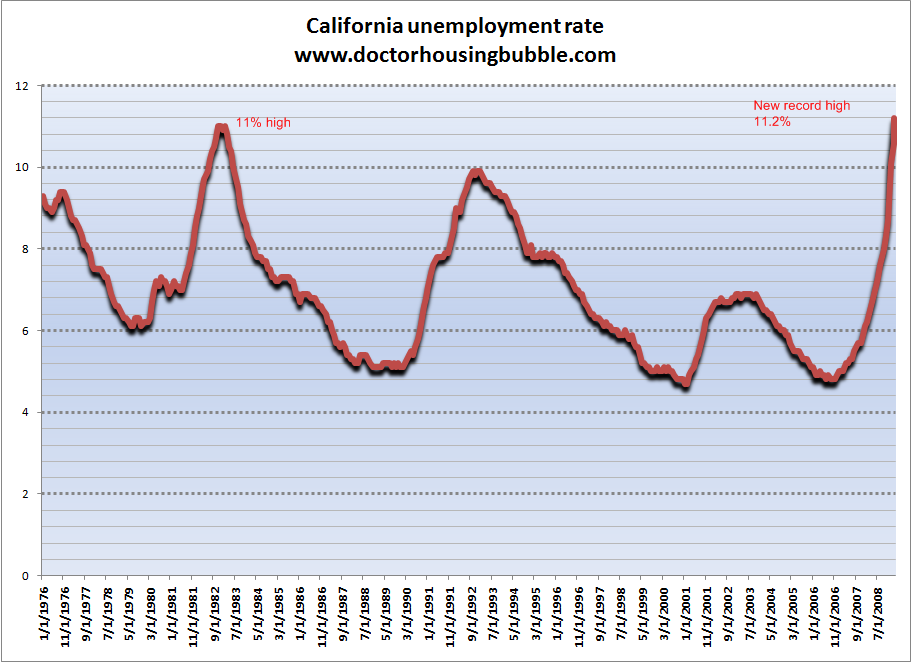

Reason #3 – California Unemployment

People forget that California had a real estate bubble/burst in the late 1980s and early 1990s. Yet the burst in that bubble was led by targeted job losses in big industries like aerospace especially here in Southern California. The bubble burst when the early 1990s recession hit but that recession was nothing compared to what we are facing. Take a look at the unemployment rate in California above. Not only have we surpassed the 1990s recession but also the early 1980s recession.

Here is the problem as I see it with the California economy. For two decades, we have gone from bubble to bubble. We went from the technology bubble in the 1990s to the real estate and finance bubble in 2000. This past decade, we relied so heavily on real estate and finance that it became intertwined with the fate of the economy. In previous real estate bubbles you normally saw separate industries (i.e., technology) create bubble markets because of all the newfound wealth. In this bubble, we had an incestuous relationship where real estate went up because real estate jobs were going up and real estate jobs paid well. Selling homes with the most toxic mortgages paid good money to brokers. Brokers sold the loans off to Wall Street who made beacoup money packaging the junk up and selling it on the global markets. Yet none of it was sustainable.

So now that the toxic part of the market has collapsed. We have yet to deal with the more typical reason why real estate values will go down. This includes a horrible economy. Take a look at Michigan for example. Cheap prices does not mean good deals. You need a healthy economy to support prices. Yet here we are, with the highest unemployment since World War II and people want to call a bottom? This is not only impacting the lower end of the market, but the higher end. Let us take a look at the high end.

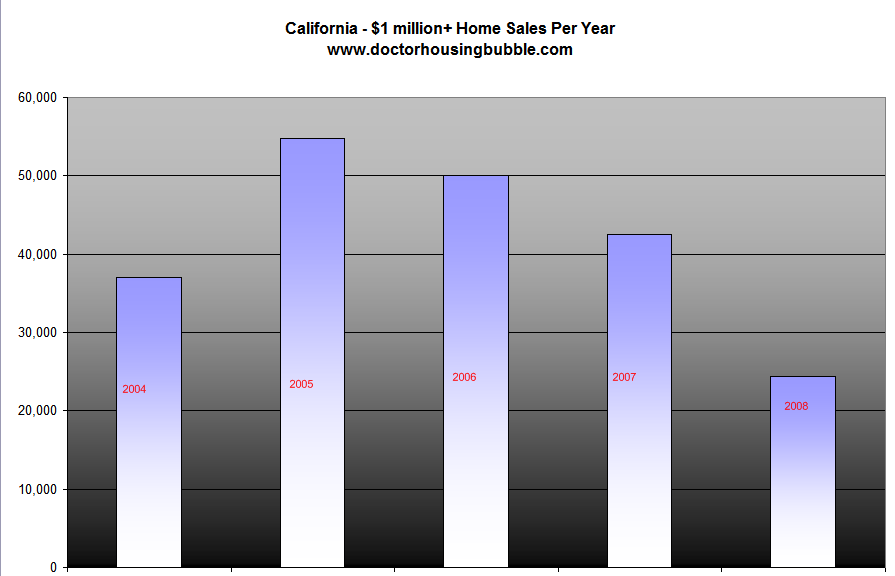

Reason #4 – Drop in Million Dollar Priced Homes

Another argument being thrown around is “well the top end will never see price drops.” That is absolutely false. In fact, million dollar home sales have fallen consistently since 2005. In 2005 there were 50,010 homes sold in California above $1 million. In 2008, that number was 24,436. In fact, even in 2007 there were 42,506 homes sold over the $1 million mark. So in one year, sales have fallen by 42 percent in the supposedly untouchable range.

What this tells you of course is that not even the high end is immune. Sure, it takes longer for prices to fall and you probably won’t be seeing 50 percent cuts in La Jolla, but to think these areas are immune is wrong. The median price per square foot of these homes was $569, a drop from the $588 reached in 2007. Also, 24 percent of home buyers in this range paid cash. How do you think that is going to impact home sales in 2009 when the stock market got obliterated in 2008?

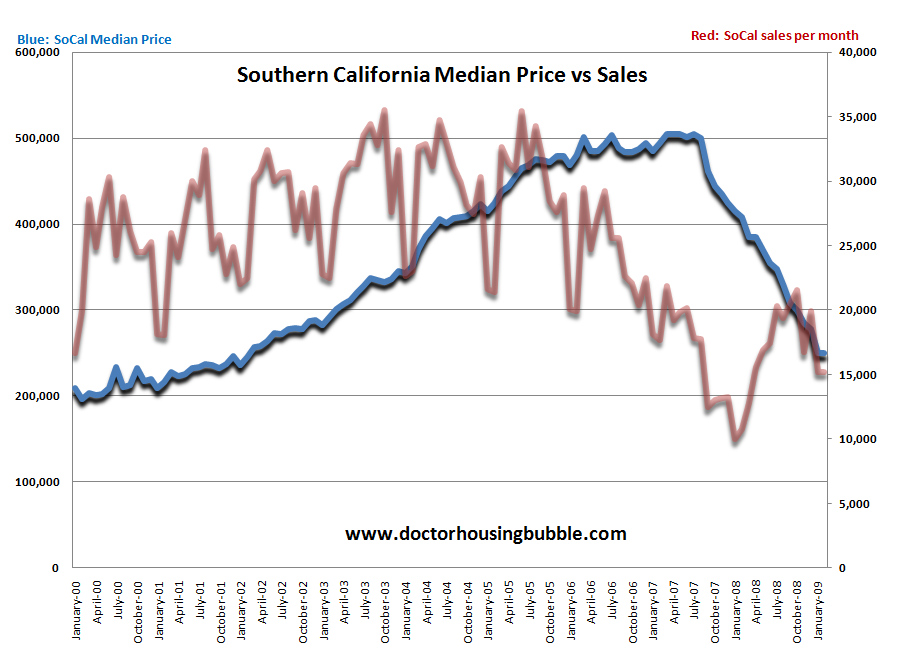

Reason #5 – SoCal Sales Still Low

I think it is worth examining the above chart. You will learn much about the real estate seasonal pattern. This data looks at Southern California home prices and sales for the entire decade. The up and down pattern in sales occurs because of the fall and winter selling seasons. Yet the long-term trend is what is important. For the entire decade, the pattern was unmistakably moving higher. Yet all of a sudden in 2006 we saw sales tumble. Yet prices still went up. Sales are a leading indicator. And you see this argument being made that just because sales are moving up, we are gearing up for another explosive move in price. That is nonsense. When you look at the above chart even though sales have jumped up, we are still below the sale numbers that caused the bubble.

In March 2009 there were 19,486 homes that sold in Southern California. That is a significantly better number than the 12,808 that sold in March of 2008. But again, look at the chart above. We have yet to see a 30,000 sale month in 3 years and this was common from 2000 to 2005. So yes, sales are moving up but there is no reason to believe this is reason enough to push prices higher. If we were selling 35,000 homes a month then maybe we can talk about another bubble forming or missing out on big price moves to the upside. For what it is worth, 55 percent of all those March 2009 sales were foreclosure re-sales. Meaning, 10,717 of those homes probably sold at discount prices.

When you combine this data with the NOD tsunami, unemployment and rising foreclosures it is hard to see how prices at the upper range don’t start falling later this year. And speaking about foreclosures, they are still at record levels.

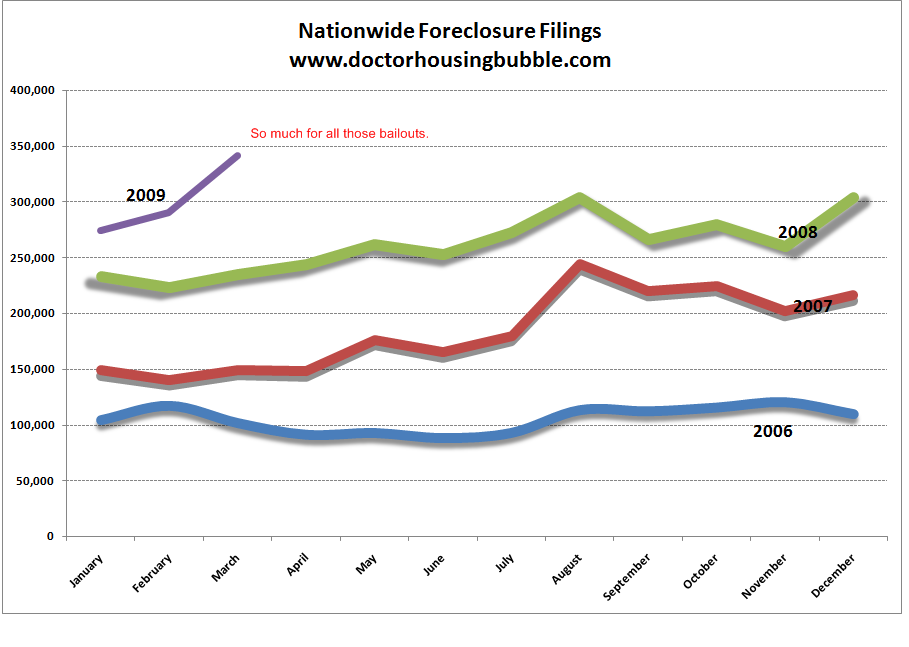

Reason #6 – Foreclosures Still Rising

This chart is probably the most astounding. We have taken virtually every measure possible to prop up the crony banking model and thrown trillions at the housing problem. Yet foreclosures are still at record highs nationwide. At the core of it all, this is still a housing problem. TARP #1 was initially designed to eat up toxic mortgages remember? Now here we are with the PPIP, another project looking to eat up toxic mortgages.

It is hard to look someone straight in the face and say this is the bottom with unemployment rising and foreclosures still at peak levels. What is occurring is things are getting worse at a slower pace. Yet does that warrant all this false green shoot optimism? Would you be excited to know that we are entering a lost decade like Japan? Once people realize that we are all bubbled out, this temporary euphoria will come back down to reality.

Let us parse the above data to California. Let us take a look at foreclosure data for last month:

March 2009 California Data:

NOD:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 58,858

NTS:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 34,575 (notice of trustee sale)

REO:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14,352Â

If we had in Q1 of 2009 nearly 135,000 NODs, then that 58,858 in March puts us at an even higher pace for Q2 of 2009 if it holds up! That is insane. Plus, look at the NTS and REO information which is actual foreclosures or bank owned property. If we combine these two, you find that in March alone we had 48,927 distressed properties hit the market. Want to know how many homes sold in all of California for March? 36,215. What this means is we are going to have a flood of inventory coming in the second half. Maybe the U.S. will see a second half recovery (doubtful) but certainly California will not.

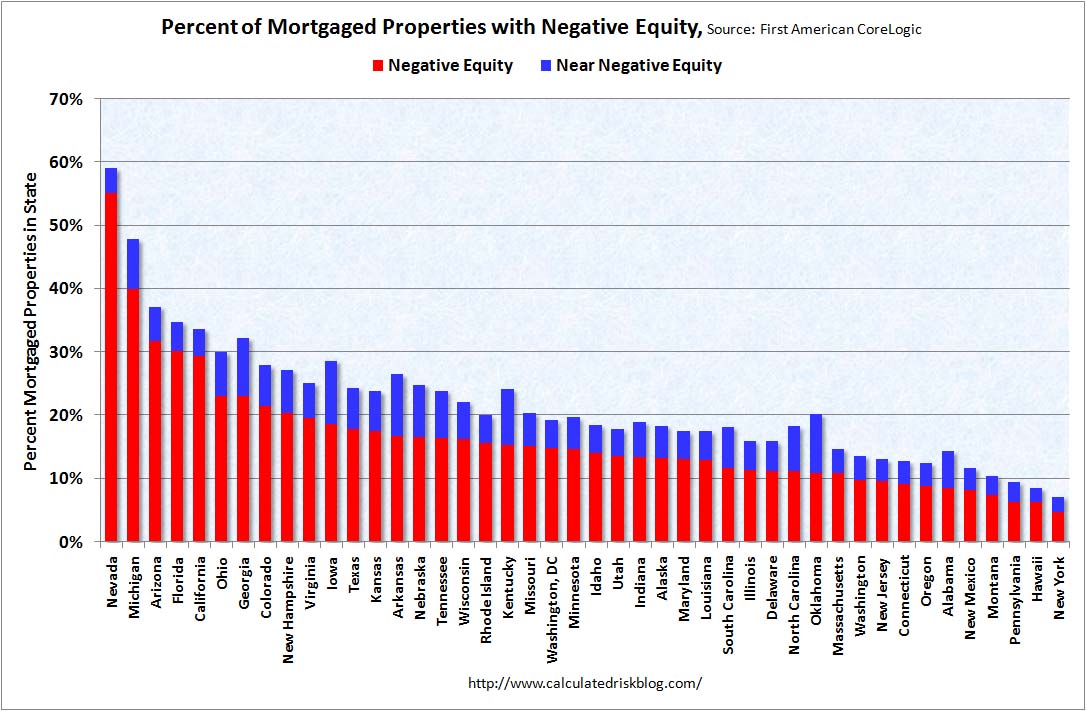

Reason #7 – Underwater Mortgages

Source:Â Calculated Risk

The most motivating factor to moonwalk away from your mortgage is negative equity. I remember when I started talking about this over a year ago that many people seemed stunned that people would actually walk away from their homes. There is nothing stunning about that. The problem is people in their mind’s eye saw folks handing the keys over to the bank in some clean process. Not really. See the NOD charts above? Basically many people right now are realizing these banks are overwhelmed and many new unemployed are also overwhelmed but they are just sitting tight in their home, not making any payments waiting till the day of reckoning. Of course cramdown legislation once again was stripped just like it was from the initial TARP plan back in September of 2008 because most of our politicians obey and are governed by the banks. This would probably be the only way to actually help a sizable amount of people stay in their homes (but honestly, this isn’t about protecting homeowners but protecting banks), and banks will have none of that. Just wait until they unload all the crap through the private-public investment program and then, maybe we’ll talk about cramdowns when there is nothing left to cram.

The above chart is stunning. Nearly 30 percent of all mortgaged property in California has negative equity. What does that mean? It basically means you owe more than the home is worth. That is not a good spot to be in. So again, with rising foreclosures and sales dropping in higher priced areas, what really is the rush to buy right now? One only wonders.

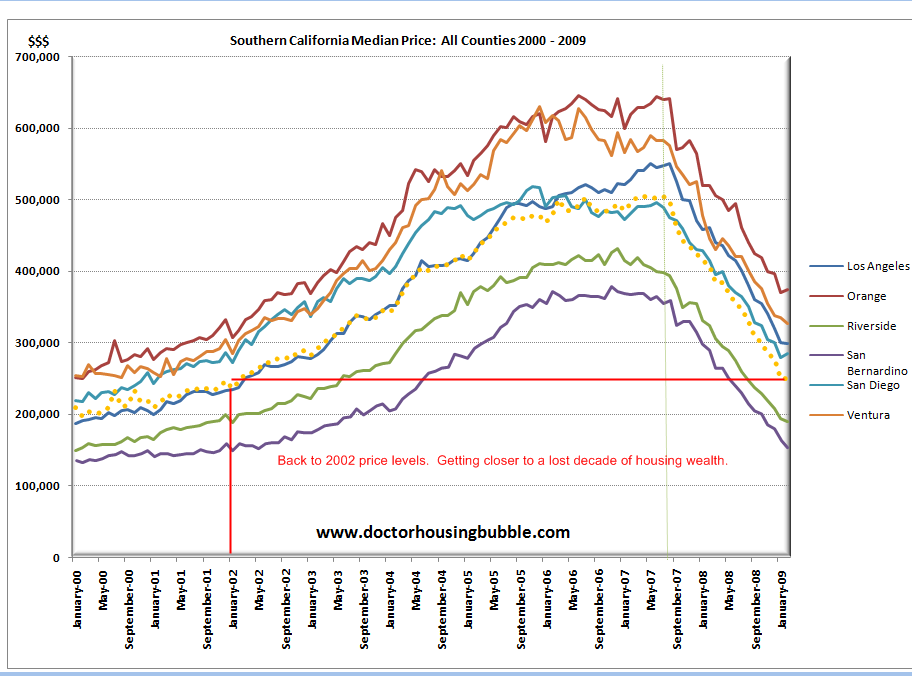

Reason #8 – Real Estate Psychology Broken

Let us admit this, California is obsessed with real estate. People here talk about zip codes and area codes as if it were a royal family last name. Where you live makes an impact to many. But more importantly, real estate prices never went down. This mantra was uttered over and over during the decade long bubble. If I had a nickel for every time someone told me this phrase, I would be able to buy 10 Real Homes of Genius. And part of this psychology drove prices up as well. During the bubble, prices went up 15, 20, or even 25 percent year over year! All this while wages remained stagnant. It was freaking ridiculous. Take a look at this price movement action in SoCal:

Yet try telling someone who just “made” $100,000 in equity that their home price isn’t justified. It was a Ponzi scheme. The only way prices could have gone up is if more and more suckers kept jumping into the game. Those in early and who sold, made out. Those in at the end, paid the price. Amazingly, you see some of this mania sentiment coming back. “Hey, prices are down 30 percent but come on! Mortgage rates are at record lows. Plus, I don’t plan on selling in 5 to 7 years.” Really? What if prices drop another 10 or 15 percent (which they will in mid to upper range areas) and you can’t sell? Now that you are required to have a down payment, you just lost all your money because you couldn’t wait one or two years. My argument from last summer still stands and I don’t see California housing hitting any sort of noticeable bottom until 2011.

And even though there is sizeable amount of people with short-term memories, there is a significant amount of people that will never believe “real estate never goes down” ever again. That changes the landscape.

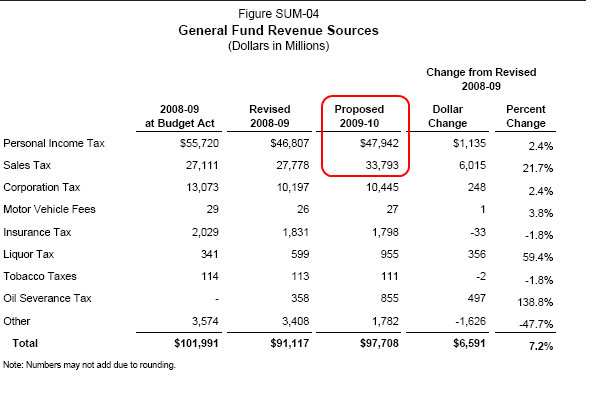

Reason #9 – California Budget Crisis

People seem to think the California budget is okay. It isn’t. In fact, it is still in dire shape. That is why we have a big election on May 19th. Yet our options are painfully obvious. We cut government spending, a state with big government, and cause a massive surge in unemployment. Or we raise taxes and put a higher tax burden on a population that is already taxed a lot. We don’t have good choices here. This isn’t a 3 choice problem here. We have two bad choices to make. Either way, both are bad for the long-term value of California real estate.

This is unavoidable. Take a look at how our state brings in money. We get most of our money from sales taxes and personal income taxes. Well in a bad economy like this, people buy less and if you don’t have a job, chances are you aren’t paying personal income taxes. So there goes two revenue sources. Until we stabilize employment, I really see no bottom to this.

That is why you cannot argue on an economic level that buying a home in California, especially in the mid to upper range is a smart move right now. Sure, there are speculators buying up homes in the Inland Empire to rent or flip but they are getting properties at 60 or 70 percent off. Try getting that in Santa Monica, Pasadena, Irvine, or other more desirable areas. Yet no one knows how bad things are going to get once we hit wave 2 of this tsunami. Only the most pessimistic even envisioned prices falling by 50 percent on a median basis for the entire state in one year. Heck, even I thought we would see two to three years of 10, 15, or 20 percent drops but not a 50 percent cut.

Yet one person I talked to had a succinct answer. “We are buying because I’m tired of waiting! I don’t care. We need to start a family and I want a place.” I can take that for an argument. But economically speaking, you’ll probably kiss goodbye 10, 15, or 20 percent equity in the upcoming 2 years. If you don’t mind flushing down the toilet $100,000 or $200,000 of your down payment, then by all means buy now. I’m sure you’ll make a lot of realtors and bankers happy.

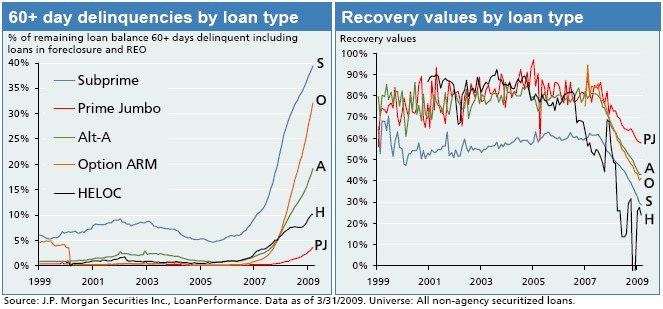

Reason #10 – Mortgage Recasts Coming Down the Road

Reason number 10 is probably the most significant reason and ties into some of the items above. This is the wild card. No one really knows how California will deal with all these toxic Alt-A and Pay Option ARMs. What we do know however is these loans are as toxic as subprime loans and the data backs us up:

Now I’m sure the crony bankers are itching to unload this crap onto the unsuspecting taxpayer but I doubt even Sheila Bair at the FDIC would want to take some of these California loans into the PPIP. I think most bankers think they are going to be able to unload anything so long it works in their scheme of things but I doubt it. If we go down this path we’ve ushered a lost decade. Why? Because at some point someone will need to pay the cost for these toxic mortgages. And that is the point I think most miss. This isn’t a Staples commercial where we can push the easy button and start over. These things happened and happened over a decade. We have never seen a bubble of this magnitude. And gigantic bubbles like this including historical one’s like the Tulip Bubble or the South Sea Bubble ended so badly that they knocked powerful economies into doldrums for years, sometimes decades. So to think that we’ll have a second half recovery is hubris to the maximus courtesy of our Federal Reserve and U.S. Treasury.

So tying all this together, there is absolutely no reason to believe California housing prices especially in the mid to upper range have found a bottom. With unemployment spiking and our budget in shambles, why would you even want to rush to buy a home right now? We’ve refuted the low mortgage rate argument or the historical drop in price arguments. The only reason to buy right now is devoid of economics and is based on the same principles that led to the bubble in the first place. If you are buying, at least be honest that the economic fundamentals don’t back you up at the moment.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

48 Responses to “10 Reasons Why Buying a Home in Southern California today is a Mistake. California Housing and Financial Market Analysis produces no Green Shoots.”

You are correct- Wall St. is totally disconnected from the economy.I live in an upper middle class area in Calif. My neighbors, with 20 or 30 years, with one company, are losing jobs left and right. Most can not even get an interview.

This is not a normal recession, but a restructering of the economy.

In my neighborhood, in April 2008,

a certain model of house sold for $858,000. Same model house, same street, just sold(May 2009) for $633,000.

Quite a drop, in ONE YEAR!

Fasten your seat belts- this is going to get very, very bad.

I really detest our government. As a teacher, I cannot afford a decent home unless I am willing to commute for two hours in the morning and two hours at night. And yet my idiotic government tries to prop up the very same bubble that keeps me “homeless.” And to prop up this bubble they are using my hard earned tax money. The unfairness of this scenario makes me so furious that I sometimes have trouble sleeping at night.

I’ve been thinking more seriously about leaving this country entirely…

I moved to New Mexico, i will never go back to california, the state of perpetual renting

Here is a bubble deluxe story from the bleeding edge of the depression, Michigan.

My best friend’s wife bought a house in Grand Rapids in 2003. Price 91,500. Not long after the value had “appreciated” and she took on a second mortgage to pay off credit card debt. Total debt load on house 112,000. Eventually she lost her job and could not keep up with payments. In August of 2007 the mortgage holders refused a short sale for 70,000. Understandable right? After all that would be quite a beating for them. So they foreclosed and my friends are now renters of a much nicer house for far less than the previous mortgage payment. The house sat unsold for over a year. It finally sold in February of this year. Price? 29,900.

I should point out too that Grand Rapids is not at all like Detroit. If you compared the two you would say that GR is an urban utopia.

I’d love to see someone defend that we are seeing a bottom in CA after reading this article.

All throughout the SFV all I see are 650k+ houses selling for 575k+ and Realtors saying this is a bargain. And people are actually buying out there, nothing to call a bottom, but noticeable. But unfortunately these are people who are going to default once again, because they are coming in with 3% down FHA loans, and as the market continues to tank they will be underwater as well and the cycle continues…

I am waiting for mid to higher end prices in Sherman Oaks, Granada Hills, Northridge, Tarzana… to hit 99-00 levels, which means a price for a normal 4-2 bath house is mid 3s. Nice house huge backyard, I’d pay 400k. It better have a freaking lake as a backyard if I pay >700k!

Reason #11: California’s domestic net out-migration numbers. For the fourth year in a row in 2008, domestic out-migration exceeded domestic in-migration. Presumably, lost with those former Californians are there jobs, many of which have fled to lower cost, lower tax, and less regulating states. That unemployment has rocketed as high as it is even as population growth slows, obscures how bad the employment situation really is in the (not so) Golden State. It’s worse even than the very bad numbers indicate.

Communities are just like any other commodity. If the price goes too high, people find alternatives. The price of living in California, in terms of cost-of-living, taxes, and regulations, just got too high for people to want to live there, so now, naturally, real estate is searching for a new equilibrium point. Government efforts to forestall that process only prolong the bleeding.

“Yet here we are, with the highest unemployment since World War II and people want to call a bottom?” It would seem totally plausible to expect a bottom in the real estate market to coincide with a top in unemployment. However, I’m sure we’re not at a top in unemployment.

My fiance and I are both teachers and fall into the category of “We are buying because I’m tired of waiting! I don’t care. We need to start a family and I want a place.†It was a difficult decision because we have read Dr. Housing Bubble and other insightful websites knowing what we were walking into. We finally decided on a small 2 bedroom foreclosure on a nice quiet street in a small city for $240,000. I know we could be shooting ourselves in the feet but we are not buying as investors but for a greater purpose of actually starting a family and becoming a part of a neighborhood. Our mortgage is only a couple hundred more then renting so we feel we made the right decision. Thank you for such great coverage of what is really going wrong in housing industry as well as our government.

The flip side is that the Fed and the Administration are effectively printing money. Inflation could become a big issue in the nead future. What are your thoughts on that?

Alon, good for you. My family did the same. We got a forcloseure with a mortgage payment below our former apartment rent, though it has almost 3x the space. We are taking the traditional view of housing, namely that it is a place to live and raise a family, not an exciting investment that “gains” 10% a year. We bought with the thought that we will stay here 30 years and pay off the mortgage if we have to. Hilariously, our realtor kept insisting on showing us tiny “starter” houses with the assurance that we can easily sell for a profit in a couple years and get something bigger. How scary that realtors either have no understanding of the current market whatsoever or are willing to lie to clients in ways that could damage them financially for a decade or more.

My wife (RN) and I (gov contractor) are moving our family out of LA this summer. Moving to NC. Hopefully before the riots start.

X,

Realtors have no “understanding”? HAHA!!!

Realtors, like all criminals, understand exactly what is going on.

The NAR houses the largest number of scumbags in any single organization; the U.S. Congress is a close second.

Buying now is not a bad idea if it fits into your life plans. As a pure investment not so much. Your principal will stay above your home value on a graph for five years or so. But they will switch at some point and then that gap will get bigger exponentially, in your favor, and you will be looking good.

If you are serious about leaving the country, Australia would be a good choice.

1. English spoken everywere -Warm weather- Sydney is similar to San Francisco or LA.

2. Not much involvement in foreign adventures( They do not feel that they need to be policeman to the world)

3. Safe large cities.

4. Maybe the only place left in the world that still like Americans.

There is another reason not to buy in the state of CA and I would consider it to the most important of all: the baby boomers are going to be out of the SoCal real estate market very soon. They will either be dying, moving in with families, moving into assisted living, or leaving for states with cheaper housing and lower tax burdens. As they die off or move out they will leave even more homes to add to the inventory. Who is going to buy those homes? I know very few people in my generation(gen X) that could swing a big asset purchase right now. They spend heavily and are deeply in debt. Most are not really interested in purchasing a house right now anyway because of concerns about loss of job mobility and watching others get burned in this last bubble. Even if all the younger generations wanted to and could buy houses is that going to be enough people to make up for the huge amount of boomers leaving the real estate market? I don’t think so.

Access is better than ownership.

Reason #12 – Generational Demographics. As the Baby-Boomers, desperate for some type of retirement money, begin to offload their large houses on the smaller, much less affluent Generation X, (that they created and then happily exploited), The supply of houses will be in a near-permanent state of overhang. Consequently, prices will have to be in a near-permanent state of decline to compensate. I don’t see how that trend can be avoided. Only another (unfortunate) wave of immigrants could stabilize the “buyer” side of the equation – and for that reason I’m sure the Gov’t will allow and encourage that wave. Bulldozers can also do the job.

Great post. You may have shown it in another post but I would like to see the unemployment chart (reason #3) superimposed with housing prices.

Doctor Doctor,

Can you please explain the history of these “non-recourse” mortgages? Why would banks make such a loan, what’s in it for them? Are they still making them? What fraction of mortgages in the US are non-recourse? I haven’t heard of such loans being made in any country apart from the US.

Your chart shows mortgage rates have fallen from 6% to 5% since the start of the financial crisis. The banks’ margin over the Federal rate must have widened enormously. Has that provoked an outcry over mortgage gouging? Why can’t interest rates drop to, say, 3%, wouldn’t that go a long way towards halting the foreclosures and impending ARM resets?

Dr. HB,

I thank you for another excellent post! Once again you make a comprehensive and convincing case. I can’t imagine why this site doesn’t get the 1000’s of replies that it deserves (like at Mish amd Calculated Risk).

Re: #3 – the unemployement picture is dark. I seen no light in the form of new jobs – or even old ones coming back! Note to self: THEY ARE NEVER, EVER COMING BACK. The unemployment/underemployment will be the final undoing of the entire fragile system.

Where is the outrage at the huge losses being reported? Where is the dialogue about what it all means and about what our future holds? Are we so beat to a pulp that we can’t see what’s happening (we’re in shock)? OR we’re just plain beat down and afraid (thoroughly shocked and awed) that we can’t find the words to express ourselves?

What I do know is that we can’t stay like this (shocked and awed) for long or we’re doomed. It’s up to us to start thinking and talking about re-creating our future. To re-vision our way of life. IT’S OUR ONLY WAY OUT.

What’s the old saying? As California goes, so goes the rest of the country, I believe it went.

The United States has made a living from financial scams ever since we began to bleed manufacturing after 1975. It was in the late 70s, after the first oil price shocks and the morphing of the Steel Belt into the Rust Belt, that the first ARM home loans appeared. I remember we baby boomers were having a hard time getting jobs and affording houses, and the introduction of ARMs triggered a housing bubble that was unprecedented. My mother’s house in suburban St. Louis, for example, only appreciated $2000 between 1954 and 1974. Suddenly, in the late 70s, it TRIPLED in value, doing nothing for her but hiking her taxes.

Then, in the 80s, it was one securities scam right after another. Drexel Burnham’s junk bonds, Prudential’s limited partnerships, the Denver, Salt Lake City, and Vancouver penny stock scams, then a real estate bubble that burst in 1991 or thereabouts and generated a rather large number of suspicious apartment building fires in prime neighborhoods here in Chicago.Then, securitization of debt really took off, but it did not metastasize into the bubble we have seen since until Glass Steagal was repealed and replaced by the Graham Leach Bailey Financial Modernization Act.

I said, at that time, we have had it, watch, we are setting up for another 1929.

And THEN came the Long Term Capital Bailout, which told the Street clearly that they could do anything and we would step in to bail them out.

Between Graham Leach Bailey, and the LTC bailout, we gave Wall Street an unlimited line of credit and told them they could run it up all they wanted and never have to pay it back. Like handing your kid an American Express Card and saying do what you please, I will pay for it.

This was all to spin the deception that we were still a productive country. We borrowed money from other, more productive economies, like China, and had a good time and fooled ourselves into thinking that we were still the prosperous, productive, leading-edge country we were fifty years ago.

And we will be paying for this binge for the term of our natural lives, and so will our grandchildren.

Robert: Lowering interest rates would do nothing to help foreclosures and impending ARM resets.

~

These loans, the “option ARMs,” were called “liar’s loans” because they allowed people to buy far beyond their means. The only way they could swing it was that they didn’t have to document their income and they could choose to pay any amount (often including a “pay nothing this month” option) on the loan. Comrade HB has shown examples of people making $24K/year “buying” $750K houses this way. So even at zero percent, these people could never afford the true monthly payment on their house. So when the loan recasts, they’re out.

~

And that’s the way it should be. Only after these get washed out of the system will housing prices start to drop to where they should have been all along. It is a real shame Obama has decided to scuttle his presidency by embracing the same failed economic policies that brought this about. But at least he hasn’t given in (yet) to the clamor of those in trouble with their “liar’s loans” to have the taxpayer buy their houses for them.

Been in Sydney since 2000… going for citizenship shortly (had perm residency for a few years now)… truly God’s Country and they do like Americans here! We have a lot in common w/them. and nothing ever happens here… which is a good thing! Aussie banks never bought into the retail mortgage madness. RE is high because of land use laws, zoning, etc around the Cap Cities and the market is soft because of China and yes, they went credit card crazy too here…but in general the recession has a less hard edged feel to it right now. unemployment still under 6%… tho it will hit 8% by year’s end

Reason #13 – The FHA has completely taken over the despicable role of Subprime lender. Surely this has stabalized prices – a little – for now. But a huge part of those loans will inevitably blow up right in time for the “recovery”, just give it a few more years.

Reason #14 – Shadow Inventory – the millions of houses that Banks own, but refuses to put on the market, lest their true market (not mark-to-model) price be discovered.

The mortgage debt market per the FED flow of funds report has increased the past 6 years from 5 trillion to 11 trillion. Hold for investment has been a banking failure since the late 80’s and securitization necessary to provide liquidity to such a super sized debt market is not possible without significant foreign central bank participation.That leaves the Federal Government and FED to provide the necessary liquidity necessary to provide even fundamental rollover of the 11 trillion debt. How long the government will be able to provide this type of funding given shrinking tax revenue, new wars and Katrina type events in the future. Those buying RE today based on the assumption that financing for future buyers will be available may find instead that market conditions in later years will require all cash or very large cash down payments.

We are going from excessive credit expansion into credit contraction which will impact very large debt markets like residential RE which is now taking the lion share of credit available but priorities change, buyer beware!

CAR Forecasts 24% Price Drop for California Houses

May 08, 2008

The California Association of Realtors is forecasting that the median price of a California house will fall 24% this year to $424,000 — a price not seen since 2003.

In March, CAR was forecasting a 9.5% price drop statewide, to $505,100. The median price of an existing single-family house in California has been above $500,000 since 2005………..

http://seekingalpha.com/article/76279-car-forecasts-24-price-drop-for-california-houses

Doc, the wildcard here is inflation. Everyone is concerned with deflation right now with good reason, but in the near future this flood of money is going to kick in. When that happens if nothing else, nominal prices will start going back up which may flow over to real estate also. Granted you purchasing power will be less, but nominal pricing may go higher pretty quickly.

regarding prices hitting 99-00 levels..not saying it’s unrealistic, but more like unlikely. interest rates were far higher then, and it has been a decade since that “pre-bubble” level. when factoring in inflation over a ten year span as well population growth and interest rates, i don’t see us going back to 99-00 prices…especially in more desirable areas like the ones you’ve mentioned.

but if it does, by all means purchase!

inflation will never take hold of a product that requires financing in this economy…..this is the same argument that rental prices will go sky high?? impossible unless you loan renters money to pay rent. when prices get too high, no one will be able to buy. either we have wage inflation (impossible) or a new round of liar loans (improbable) or we keep going down the deflation rabbit hole………….

The above comment by hahaha is absolutely correct and brilliant because it summarizes the situation perfectly. Any inflation that (may) come will simply not make housing prices go up. With the massive unemployment we have, incomes are going to be declining for quite a while. Therefore, house prices cannot shoot up without another crazy financing bubble or some massive wave of immigration (God forbid) increasing demand greatly. Both situations seem highly unlikely for the foreseeable future.

Me three on the anti-inflation side. Way too much slack in the labor market for inflation to take hold. There could be some inflation head fakes but it simply can’t be sustained in the current environment. Of course, we have had high unemployment and inflation before, but there were significant differences in that environment. Wages were relatively higher for those who were employed, plus we had significant savings and were not under a crushing mountain of personal debt.

Thanks for a great post — great history lesson! Your remarks remind me of a line from the show “The Wire” in which a character says something to the effect of “We used to build things in this country…now it’s just one guy putting his hand in another guy’s pocket.” Pretty much sums it all up, doesn’t it?.

So what would you say to a bull that says the NODs will not go to foreclosure and they will get re-worked, loan mods, principle reduction, interest rate reductions and a few short sales.

I second that.

I am a life long Democrat and I feel HAD for voting these people in. The unfortunate theing is the Republicans would have done the same, more or less.

The fact is we are screwed!

Could anyone tell me why the following is NOT a good idea?

The following idea is based upon the fact that the FED is monetizing the debt and inflation is sure to come and therefore housing may correct via inflation rather than price drops.

Anyway, why not get a house with 3% down? If the bet goes the wrong way, I could just walk away and only lose the three percent, assuming I had a non recourse loan. Yes it is a gamblet but with the amount of printing the fed is doing it is a fair bet.

I would also lose my credit rating but if houses go down further I wouldn’t need credit and besides, the punishment seems to be very short lived for dead beats.

Here is how interest rates can affect prices.

>>>>

$100000 house and assume 4.96% mortgage. (Since muni bonds would return about the same rate, any downpayment has to be treated as ‘what it would have earned but-for putting it into the house.) Assume $57 real estate taxes per $100000 and $100 per month in insurance. Total payment per month is $534 + 157 or $691. Assume that the huse is 28% of gross income – a safe margin so not overextended. That needs an income of $2467 or $29614 a year (in fact just abut median wage in the US.)

>>>

Per Schiller’s work, over time, houses only gain about 3.5% a year – right about the same as historical inflation. For the past 30 years, incomes have been flat or falling relative to inflation so assume that it will stay that way.

>>>>

5 years from now the buyer needs to move – could be job related, divorce, larger family, whatever. Theoretically they would expect to get $118,800 for the house with an increase in value of 3.5% a year and if potential buyers similar to them in income had incomes that kept pace with inflation, the next buyer would have an income of $35,172. That buyer would be able to afford a payment of $820 a month with $67 to taxes and $118 to insurance leaving an amount of $663 for the house price. At 4.96% interest rates, that would be a $118,900 house.

>>>>

Now what happens if interest rates revert to the 30 year average of around 9.25%? Now that house payment is $822 plus the $67 for taxes and the $118 for insurance with a grand total of $1007. Housing costs of $1007 require an income of $43,157 or 22.7% MORE than what the seller and buyers like him have.

>>>>

Now for a potential buyer in the same income bracket as the seller to afford that house, the house payment has to drop to $663 which only covers a price of $80,600. And the seller takes a $19400 loss on the sticker price plus having to pay a Realtor another $4800 plus paying closing costs of probably $2000. The seller is now OUT $26,200. And that works out to a loss of $436 every month for 5 years on top of what they are paying in taxes, insurance & payments.

>>>>>

And when interest rates are at a ‘historic low’, there is no where for them to go but up!

There seems to be much debate on whether the Westside will correct more this summer during the traditional selling season. A stalemate has occured over the last year and a half. But now we are headed into a second summer season, after the first credit freeze in August of 2007. Will sellers be able to hold out for another year if they don’t sell this summer? With Alt-A and Prime loans resetting and recasting, I don’t believe so. The stalemate ends this summer as sellers have to reduce prices in order to make a sale. Buyers are holding the cards now and have time on their side.

http://www.westsideremeltdown.blogspot.com

Like someone mentioned in the first few comments, domestic out-migration is increasing. I work in the tech industry in the Bay area, and I know a lot of my friends and colleagues move out of CA, and buy houses in other states, like Texas.

Not only is CA losing personal income tax this way, they are also losing sales tax on big ticket items and other stuff that those ppl might have bought here. And, its not just people leaving CA, a lot of ppl have actually left the country to go back to their home countries, since inspite of being in this country for years, they still cannot afford to buy a decent house in the bay area. It really is a sad situation, not just for CA, but for the country as a whole.

Yes, the housing situation in CA is still bad… I am single and make $100K per year and just don’t see that it makes financial sense for me to buy a house even after the prices have come down this much. I feel that things are still over-priced. It’s a shame because I’ve owned a house in FL (3bed/2 bath and brand new cost me only 100K in 2000) and know how much more satisfying it is to own your own home… sigh).

Also rents in Pasadena area are still too high; it just feels like people are still holding onto so much greed in this area and we have a long way to fall yet…

I was one of those “we want to buy a house for our family and am tired of waiting” people. We bought a San Diego house in 2007, even though I knew for certain prices would continue to fall. But I got a good deal, relative to prices at the time, and the banks were still willing to loan me 100% of the purchase price even though San Diego prices had already been falling for 18 months at that point. I thought they were crazy, but I figured “cool, I don’t have to risk my own money on a house that is declining in value because the banks will let me risk their money at very low interest rates.” So, even though I had enough to put 20% down, I put nothing down (I even walked away from escrow with a $6,000 check). It was a good thing because a year later I lost my job and that extra money in the bank allowed me to make it through a year of being unemployed. When I bought, I bought about 15% below the market prices, since then prices have dropped about 40% leaving my house 25% underwater. So I defaulted on my 2nd mortgage (80% primary, 20% second mortgage) and am settling it for pennies because the 2nd mortgage bank would get zero in foreclosure. So effectively I got to buy my house at todays prices 2 years ago and now I’m only slightly underwater. I still haven’t risked a dime of my own money. Unfortunately anyone buying today is going to come up with a 20% downpayment (which the banks should have asked for all along), so you are risking your own money.

Two arguments that confuse me:

1) The money supply has grown so radically that we will soon be in hyper inflation. All of the foreclosures virtually stop when prices are rising.

2) The government and banks will do and redo loan mods until there are no further problems.

How do you respond to these arguments?

Thanks, Doc and keep it up!

“You cannot legislate the poor into freedom by legislating the wealthy out of freedom. What one person receives without working for, another person must work for without receiving. The government cannot give to anybody anything that the government does not first take from somebody else. When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that my dear friend, is about the end of any nation. You cannot multiply wealth by dividing it.” Dr. Adrian Rogers, 1931 – 2005

Inflation will lead to increases in interest rates, which almost always implies lower asset prices — and especially here where asset prices are so firmly tied to interest rates, i.e., affordability. Only wage inflation high enough to offset the adverse impact on affordability caused by increased interest rates would push asset prices nominally higher. Oops, just saw the posts below on this same issue . . . I agree completely.

We have a bid on a short sale in a nice neighborhood in Burbank.

We bid $450,000 ($12,000 over asking price) of course other people bid even higher but the seller took our offer. We made $175,000 between us last year and are doing OK this year, but her job will end soon (contract work) and I lost my job but am now making my money through self employment and unemployment. Comps in the area recently are going for $560,000. We will be paying about $700 more on the mortgage then we are currently paying for apt. rent. With the tax breaks our payments will be roughly the same as they are now.

Being that this is a low end home (unlike much of what the article is describing) and it is a desirable neighborhood, I wonder…Are we doing the right thing?

Please advise.

Even if this scenario is correct, and assuming all those people underwater will be defaulting in the future, the bottom line is THEY STILL NEED A PLACE TO LIVE. That means they’ll most likely be renting. Well, banks don’t rent out foreclosed properties–they just sit empty. That means houses available for rent become saturated. That will drive rent up first, and when rent goes up, people will buy houses again to flip / rent as investment.

All the facts in the article make great sense, and I think prices will still drop, but can’t drop too far in areas like Inland Empire. Otherwise rent will exceed mortgage.

Call me naive, but if the future of this country really goes to the $hitter, then what does it matter how much money you save in the bank anyway? I’d rather have a house to live in than $1 million worth of toilet paper.

1) inflation will cause mortgage rates to rise which will cause prices to drop – which will just exasperate the problem.

2) ya right. we can count on the government to get it right

‘but can’t drop too far in areas like Inland Empire.”

HAHAHAHHAA. The birth place of the 40k millionaire, over extended wannaB yuppy douche bag families and the interest only option ARM loan.

You are NAIVE.

the industry point to the Q3 and Q4 2008 drop-in NODs and foreclosures yet fail to mention one thing.

Leave a Reply