10 Reasons why there will be no Second Half Recovery in 2008: Federal Reserve, Housing, and Jobs.

Ben Bernanke is spending some quality time in Jackson Hole Wyoming. In his prepared speech, Federal Chairman Ben Bernanke talked about “reducing systemic risk.” The problem however is that as the credit crisis has rippled throughout the economy the mystique of the Federal Reserve has diminished greatly. The former Federal Chairman Alan Greenspan still had the magical pixie dust to convince the markets that the Federal Reserve always had the right recipe to keep the economy going forward. Monetary policy as many learn in their first college economics class is limited in the scope of what it can do. To a certain extent monetary policy can help when money does get tight but has little ability to help in providing solvency to a market that is largely insolvent. Once this perception is shattered, it is hard to recover.

I’ve gotten a few e-mails about uber bank failure IndyMac Bank and there new method of helping out delinquent mortgage borrowers. The plan includes modifying 25,000 currently delinquent loans to a 3 percent interest rate and extending the term of the mortgage:

“(LA Times) The regulators operating failed IndyMac Bank said Wednesday that they would try to modify about 25,000 troubled mortgages by slashing interest rates to as low as 3% for five years, extending payments over 40 years and in some cases charging interest on only part of the loan balance.

The plan, aimed at about 37% of IndyMac’s seriously delinquent borrowers, is the start of a modification program that eventually could involve thousands of other borrowers at the savings and loan. Sheila Bair, chairwoman of the Federal Deposit Insurance Corp., said she hoped it would become a model for the reeling mortgage industry.”

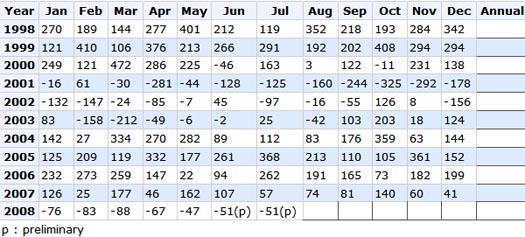

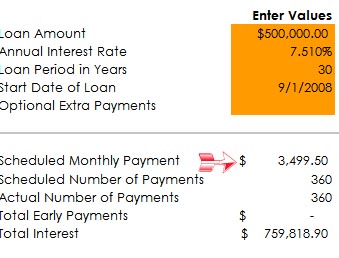

Let us do some of the math on this first. In the article we are also told that many of these loans are currently at 7.51%. They will extend some of these loans out to 40 years and allow the new 3% interest rate for the first five years. Let us take a hypothetical $500,000 mortgage here:

Initial Terms and Monthly Principal and Interest:

On a $500,000 loan, the principal and interest works out to $3,499. With the new terms and the new rate, the monthly principal and interest drops by half:

What a fantastic deal right? Not exactly. The first assumption is that many of these people will stay in their homes. This also doesn’t mitigate the fact that should this owner want to sell in the future, they may be solidly underwater. For example, say that the home was purchased at the peak for $500,000. Now the home is worth $350,000. As many of you know during the first years of your mortgage you are hardly building any equity. Most of the equity built during the first few years are not because the balance is declining but because of normal appreciation. That is not happening. In fact we are seeing massive depreciation. So this homeowner should they want to sell in 5 years and assuming prices haven’t recovered, would still need to pony up money to sell his own home. Basically it is a deal with the devil. You stay put in your home, forget about selling for many years, and you can get a major 5 year teaser rate. But after 5 years the rate will start to increase by 1 percent per year up until the standard rates of 6.5%. Once that happens, the payment will jump back to nearly $3,000 per month and the fundamental issues are still not resolved.

Ultimately, I think this is a non-issue and I know many of you were furious that this would encourage many to become delinquent on purpose. Maybe. We’ll find out soon enough how many people really want to stay (or can stay) in their homes. For what its worth, the above person would need to bring home $54,700 in gross per year to fall within the 38% debt-to-income ratio. You get a nice 5 year teaser mortgage on a 40 year term. The more and more time goes on, the Housing and Economic Recovery Act of 2008 is going to show to people how useless it will be.

With that said, I’ll give you 10 reasons why the United States economy will not recover in the second half of 2008. I personally think many of these problems will linger well into 2009 but the line in the sand is drawn and many people adamantly believe the second half of the year will bring recovery. Of course many of these vocal folks earlier in the year have gone silent in recent months.

Reason #10 – Federal Reserve:Â A Paper Tiger

The Federal Reserve is impotent. All their tough talk about inflation has fallen by the wayside since they are clearly like a barking Chihuahua with more bark than bite. First, they can protect us against inflation to a certain extent. Raise rates. Yet they are beholden to Wall Street and international banks and know that raising rates would cement the end of easy credit. Bernanke at Jackson Hole stated three items that the Fed is taking on to help the current crisis:

(1)Â “First, we eased monetary policy substantially, particularly after indications of economic weakness proliferated around the turn of the year. In easing rapidly and proactively, we sought to offset, at least in part, the tightening of credit conditions associated with the crisis and thus to mitigate the effects on the broader economy.”

(2)Â “The second element of our response has been to offer liquidity support to the financial markets through a variety of collateralized lending programs. I have discussed these lending facilities and their rationale in some detail on other occasions. Briefly, these programs are intended to mitigate what have been, at times, very severe strains in short-term funding markets and, by providing an additional source of financing, to allow banks and other financial institutions to deleverage in a more orderly manner.”

(3)Â “The third element of our strategy encompasses a range of activities and initiatives undertaken in our role as financial regulator and supervisor, some of which I will describe in more detail later in my remarks. Briefly, these activities include cooperating with other regulators to monitor the health of individual financial institutions; working with the private sector to reduce risks in some key markets; developing new regulations, including new rules to govern mortgage and credit card lending; taking an active part in domestic and international efforts to draw out the lessons of the recent experience; and applying those lessons in our supervisory practices.”

First, all three of these items are laughable. The Federal Reserve not only has been asleep at the wheel as financial regulator and supervisor but has encouraged the actual credit shenanigans that got us here in the first place! Alan Greenspan dropping rates to 1 percent and pontificating about the virtues of adjustable rate mortgages was the most irresponsible drivel I have ever seen. Now they want to regulate the market? Yeah right.

If you haven’t noticed their alphabet soup of programs have all been utter failures. Well, not completely. If you are a large Wall Street firm you may have come out ahead but for the vast majority of Americans these exercises in crony capitalism are not helping the overall economy. The Federal Reserve is virtually powerless. If they lower rates in the second half they risk fueling the flames of inflation further. If they raise rates, the housing and credit markets will face even larger pain. Call this the end game of their power. For these reasons, the Fed will actually contribute to no second half recovery and not be a player in the recovery.

Reason #9 – Energy Prices:Â Still at Record Highs

Everyone is running around cheering, as if $115 per barrel oil is some kind of bargain. Tell that to GM and Ford. Let us look at the cost of oil shall we?

Last August, crude stood at $69.27 per barrel. So even with the major correction from the peak prices reached a few months ago, we are still up a stunning 67 percent in one year. The bottom line is that higher fuel prices are here to stay. We can expect these higher fuel costs to keep a lid on any major economic recovery for the second half.

Reason #8 – Education Getting More Expensive

As a nation, we have always championed education as a means of pulling yourself up from your bootstraps. The fact that California now has a 7.3% unemployment rate, the third highest in the nation, is largely in part because so many people relied on the housing market for their employment. That bubble has now burst and is not coming back. Many of these people will need to go back to school to retrain if they want any chance of making similar incomes in the new economy. As it turns out, education just got more expensive:

“(LA Times) Despite angry protests from students that led to 16 arrests at UCLA, California’s two public universities took actions Wednesday to charge higher fees for education in the fall.

The trustees of the Cal State University system voted to raise annual undergraduate student fees 10%, or $276. A key committee of the University of California regents approved a 7.4%, or $490, raise per year for undergraduates that is expected to be endorsed by the full Board of Regents today.”

Education has gone up across the board for our country. The fact that the two largest university systems in California the UC and the CSU are raising rates is simply indicative of the consumer inflation we are seeing.

There is a limited supply of money. If you go back to school, that is money you aren’t spending on consumption. If you are in school full-time, you aren’t working therefore pushing the tax revenue base lower. I’m all for going back and retraining and getting yourself ready for the new economy. The fact that only 1 in 4 Americans has a 4-year degree does cause one to pause for a second. Yet seeing the cost of education, there may be some economic reasons for this.

Reason #7 – Elections and Political Calculus

The California budget is now into record territory and not in a good way. We’ve been talking about this economic budget for months yet nothing has gotten done. In fact, you would think that we would have better solutions than “no taxes period” or “raise taxes on everyone” from both parties but there you have it. This is the inability to compromise and reach a middle ground. This is unfortunately an issue our country has always faced. People do not want nuisance in their answers but simple easy to read responses.

Given that the elections are heating up, you can expect no major changes to happen. This is another contributing factor to seeing no second half recovery. What needs to happen is bold reform and legislation and there is no way that is going to happen in the next few months. Heck, we can’t even agree on a freaking budget here in California!

Reason #6 – Lenders are Stuck

Lenders are sticking their fingers in their ears and trying to ignore the bombastic sound of the piper coming down the street. They don’t want to listen to the utter reality that we have $500 billion in shameless toxic pay option mortgages that are set to reset starting NOW. These loans will prove to be more troublesome than the subprime loans for a variety of reasons. First, the housing market has no buffer room anymore. That is, the entire housing market is in shambles and people will now be selling at the worst time possible. In addition, there was something about looking at subprime loans as the “other” in the economy. That is, “subprime” had a connotation of poor and of course anyone with an Alt-A or prime loan is nowhere near that. Only subprime people don’t make their payment. Well here’s a newsflash, we are all subprime.

These loans are just as toxic if not more so because they carry larger loan balances and people will not hesitate to stop making payments on a home that is severely underwater. California is seeing this happen in real-time.

Reason #5 – Employment Still Faltering

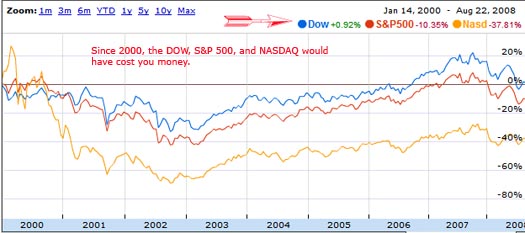

Employment is still not picking up. Take a look at the chart below:

Since the start of 2008, over 463,000 jobs have been lost. Keep in mind that for us to remain a healthy and growing economy we need to have 100,000 to 150,000 jobs being added each month. This is clearly not happening. The fact that we are a “consumerist” economy and for the past decade much of employment growth has been in the FIRE economy (finance, insurance, and real estate) there is little reason to believe that job growth will happen anytime soon. In fact, there is still too heavy of a reliance on these industries and these industries are largely dependent on a healthy housing market. Do you really think housing is going to get better in the next few months?

Employment is vital for keeping an economy healthy. The massaged numbers used by the BLS vastly under report unemployment and I would say that true nationwide unemployment is over 10 percent.

Reason#4 – People Don’t Believe the 10% Solution

Take a trip to a Barnes and Noble store and stroll down to the finance section. You’ll see tons of books highlighting the ease of becoming a millionaire overnight or starting your own real estate empire. No time in our nation’s history has this dream been sold to more people. Yet here is an observation. How is it that with so many books and seminars about becoming rich that our nationwide income distribution has actually gotten worse over this time? In fact, there has never been a time when people where in such horrible debt like we are in today’s economy.

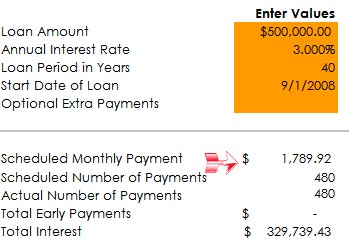

This dream is starting to find cracks. In fact, many of these people were simply selling the books with sizzle but no steak. That is, you buying many of these books were making the author/publisher rich while you remained stuck in your lot in life. Some of the advice was flat out wrong. One solution recycled over and over is putting away 10% of your money in the DOW, NASDAQ, and the S&P 500. How has this performed for this decade:

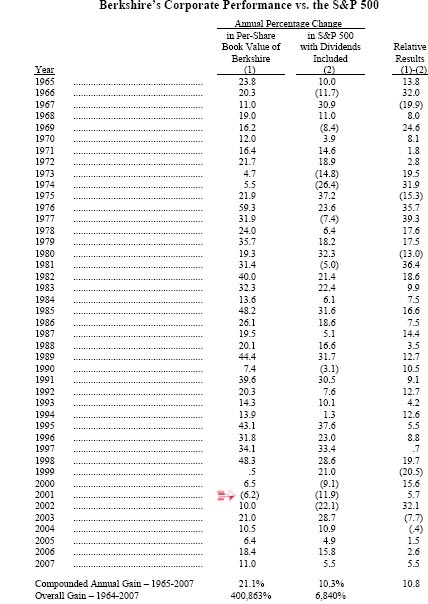

If you put $10,000 in the S&P 500, NASDAQ, and DOW in January of 2000 you would have actually lost money. Even after almost 9 years, the DOW is up only about 1 percent, the NASDAQ is down 37%, and the S&P 500 is down 10.35%. So much for that 10 percent solution. After a decade given the U.S. Dollar destruction plus stagnant wages you actually lost much more in real terms if you left your money in these markets. Most books nearly follow this investing philosophy like a Wall Street religion but many are now figuring out that something is rotten in Denmark. Even the sage Warren Buffet who has had 42 years of stellar returns is seeing some problems. Since 1965 Warren Buffet’s Berkshire Hathaway had only one down year in 2001 and that was a 6.2 percent drop. Take a look at the data from their annual shareholder letter:

*Source:Â Berkshire Shareholder Yearly Letter

How is Berkshire doing this year?

Berkshire Hathaway is down 17.62% for the year. The worst year to date performance ever. If the sage of Omaha is having problems with this economy are you really going to think some over the counter guru is going to have the magic bullet for every American to become the next Donald Trump?

Reason #3 – Consumer Psychology

People are now realizing that you cannot become wealthy with too much debt. In fact, they are realizing that stealing money from Peter to pay Paul is not a recipe for success. Consumer psychology is changing because the market is forcing people to live within their means. This is a global recession. The idea that we were going to decouple is now being proven false. The size of the largest economies are so intertwined that pain in one will ripple to another. The United States, Japan, China, the Euro-zone are all facing hard economic times.

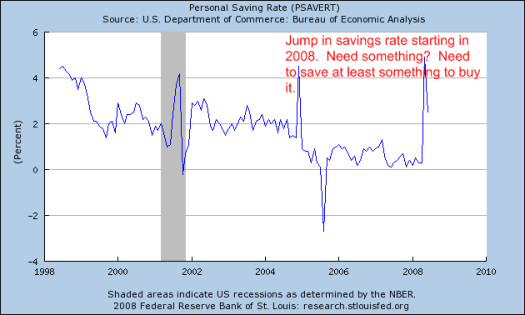

I recently showed a chart that had a boost in the savings rate:

Initially my assumption was that people were saving money and being more prudent. After reading a few articles and seeing the overall contraction in M3 my perspective has now shifted a bit. This increase in savings looks more like people moving money from 401(k)s, investment accounts, bonds, or any other form of longer term investments into checking accounts to pay day to day needs. This is definitely not good. What I initially thought to be a silver lining is simply people raiding the storage cabinet to live for today.

Another sign that the economy is not recovering anytime soon.

Reason #2 – Too Much Debt

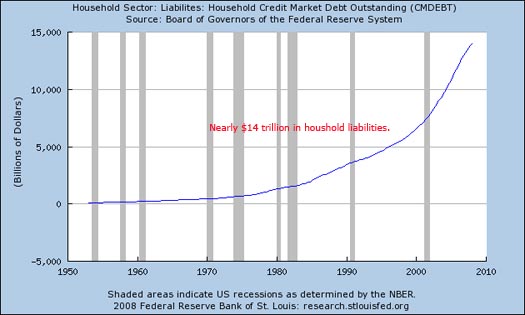

No time in our history has their been so much debt outstanding. Take a look at this chart:

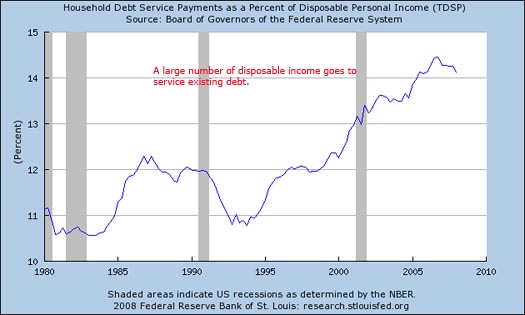

Even with the contraction in the economy, debt is in a perpetual upward movement. With nearly $14 trillion in household liabilities out there, we have now reached a precarious situation. The United States economy, the largest in the world has a GDP of $13.84 trillion in 2007. What this means is the households of Americans are carrying more in debt obligations than what we actually produce! Some may say so what and this doesn’t matter but it does when more of your money is being used to service this existing debt:

As you can see from the chart above, more and more disposable income is going to pay for debt service. This is a very unproductive use of money. First, this is money that isn’t going into the consumer economy. It also puts a burden on the ability of households to invest money for long-term planning. Basically we have reached a point of maximum debt saturation. The good news however if you want to see it this way is there is a major onslaught of debt destruction going on. Each mortgage that isn’t paid in full decreases the overall debt obligations out there. If a $500,000 mortgage defaults and the lender can only get $300,000, $200,000 of debt has just been destroyed. This however is going to make lenders more restrictive with their money and ultimately force consumers to rely more on actual income than debt.

Reason #1 – Housing is Nowhere Near a Bottom

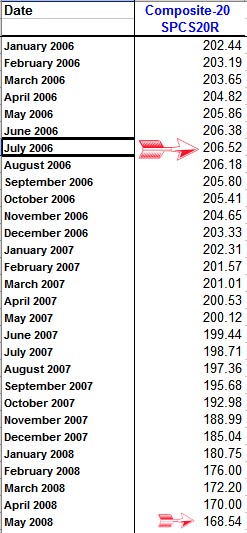

Finally, who can forget the housing market. With $12 trillion in mortgage debt outstanding this is by far the largest obligation of Americans. Yet prices are falling at a faster rate than at anytime in history including the Great Depression. Given this immense debacle, people are feeling the negative pangs of wealth destruction. At the height, $24 trillion in residential real estate wealth was out there. Now, we are seeing estimates at $19 or $20 trillion giving us a destruction of $4 or $5 trillion. To be exact, we can multiply the Case-Shiller decline to the overall peak price:

$24 trillion x 18.39% = $4.4 trillion in equity gone

At the peak in July of 2006 the Case-Shiller Index stood at 206.52. Currently it stands at 168.54, a decline of 18.39% from its peak nationwide. So with that, we can multiply the decline to the peak estimate residential wealth and you can see that $4.4 trillion in housing equity is gone. The trend is also heading lower so each subsequent decline is further equity destruction. Keep in mind that the debt remains the same. That is the problem with falling prices. The underlying debt reflects bubble prices and doesn’t adjust but the market value of the asset is falling and falling.

These are 10 reasons why there will be no second half recovery. There are other reasons but these are sufficient to keep us from seeing any major changes for a very long time. Anyone telling you otherwise is probably just trying to sell a book or a seminar.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

15 Responses to “10 Reasons why there will be no Second Half Recovery in 2008: Federal Reserve, Housing, and Jobs.”

I was interested your comment on this: http://mortgage.freedomblogging.com/2008/08/23/lessons-from-the-biggest-housing-crisis-of-all/

A friend pointed something out to me awhile back; the first impression of Greenspan by Monkey Boy(GW) was not very good. After their big meeting at the White House, they were buddies, one could conclude that if you give me low interest rates, you get one more term, the “phony†economy will look good for sometime, and just too bad it didn’t last a few more years. The Fed is just trying their best to make it the next president’s problem.

Lee

its very very depressing. God Bless America

A great post Dr. Thank you.

>

My son’s tuition at the Univ. of AZ is now $3,000 a semester. Schools seem to still have money for liberal programs as in the past but that too will eventually pass.

>

Thanks for getting to the meat of the Fed bailout. Looks like it won’t benefit many. When will we realize that these things can’t be corrected by legislation?

>

Glad to see energy as #2. This is a sleeping giant. Prices are up in the stores and quanties down. The fed does a great job of skewing the facts. The big 3 auto makers are in big trouble; airlines as well. This is gonna change the way we live.

>

The stock market is a shell game proliferated by the spin doctors on CNBC and CNN. Be better off puting your money in a sock or under your bed but you can’t hide it from inflation.

This action by the FDIC will drastically reduce foreclosures in a limited area. Other institutions following this will also. This will take supply out of the market and delay the bottoming of the housing market. Thus, no 2009 Jim Cramer bottom, but a 2011 to 2013 bottom.

Politicians do not fix problems but push them out to the next president or next congress.

This is a perfect example.

By redoing these loans to 3% and 480 months they can be placed on the books as ‘held to maturity’ at par.

Thus they move from ‘mark-to-market’ at 50% to ‘held to maturity’ at 100%. Isn’t modern accounting wonderful!

“Smoke and mirrors†is what we are seeing. Technically, this looks like a way to get solvency. However, it does not create liquidity and we are still stuck with no credit to cause the printing of new Federal Reserve Notes.

For that, we will see New Deal like infrastructure projects being created in 2009.

So for now deflation, followed by inflation, but only if they get it right, and their track record so far indicates that they will f*ck up.

Jim Cramer and others on the financial cable channels are in denial. They don’t want to see the truth. “They can’t handle the truth.†They will not dig down to see the difference between ‘organic’ and other sales. They are looking for the bottom in order to call it. But, bottoms are only called after they have passed. Catching a falling knife or safe is not my idea of good timing.

Perma-bulls do not easily turn into bears. While it is often the case that when the perma-bulls change into bears, a bottom has passed, this time is different (I know, watch out whenever someone says that.). There will be many bottom calls. And for some locations, this will be true, that is rents and prices come in line in those locations but not everywhere.

For the broader market, in 2012 baby boomers will start turning 66 and qualify for full retirement benefits. In 2024 the peak boomers born in 1957 turn 68, and qualify (unless the law changes again and pushes out full retirement). There are going to be a lot of large houses for sale and many will retire ‘early’ (especially when full retirement is re-defined to 75).

I cannot see a general bottom occurring before 2011. However, severely depressed and overbuilt areas such as parts of Florida or the Great Central Valley of California, could find a bottom in 2009 or 2010 as baby boomers buy here and sell their large houses in other areas. Remember, that many of these ‘large’ houses were bought before the boom and some of these boomers will exit early (before prices decline further) and buy cheap retirement properties in Florida and the Central Valley of California.

Other areas could benefit such as Arkansas, Austin TX, San Antonio TX, South Carolina, etc. as retirees are looking for amenities but not jobs (although some will have to look for jobs).

Bottom line, debt must either be service or defaulted on. It is clear that in the current crisis it can not be serviced, thus much will be defaulted on. And in a highly leveraged credit market, we call that ‘Deflation’.

The 40yr loan sets a bad precedent, as it will go from unusual to mainstream. The new 5yr extention will certainly extend the length of time before the market bottoms. Very frustrating.

To oilwelldoctor

Of course you can hide from Inflation

Gold – silver – or even,,,,,oil vil hold value against the SINKING fiat Dollar

or EVEN…..Real estate,…under NORMAL sercomstanstaces…. looks wrong spelt….

Who is going to pay for that ??

Is it INDYmac ‘s own bonds, that they will except only 3% on ? ?

I thought they had no CASH.

Or is it the bond buyer ? ? china or ? that will be so happy with half of what they

purchased with CASH

There must also be a tax defferel on the loss.

The doc has it quite right about the absurdity of buying books by financial gurus to become the next real estate tycoon like Donald Trump (reason #4). Trump was born rich, went to an exclusive business school, then started out at his father’s firm. That is the way to the top, not “over the counter financial gurus” or cnbc. Trump struck it rich by being born, not flipping properties.

Alas, Doc HoBub, always asking such tough questions: “How is it that with so many books and seminars about becoming rich that our nationwide income distribution has actually gotten worse over this time?”

The remedy is thus: one simply has to read the appropriate books and attend the appropriate seminars in the appropriate sequence, where such appropriate sequence is appropriately anchored to reading and re-reading “The Secret.”

Hence, a general pictorial outline for guaranteed seven-figure annual residual income success can be set forth as follows, where “book n” corresponds to essentially any success book of one’s choice:

Book 1 –> The Secret –> Seminar 1 –> The Secret –> Book 2 –> The Secret –> Seminar 2 –> The Secret…

Of course, true “Achievement Eagles” that aim a bit higher than average, e.g., towards a nine-figure annual residual income, understand that merely reading “The Secret” isn’t quite sufficient.

Rather, attending the appropriate “manifestation seminars” and “co-creation consortia” are crucial. After all, as we now know, the real secrets behind The Secret were somehow left out of the movie (mastersofthesecret.com informs us that this is so).

Hence, Americans simply need to follow the correct manifestation / co-creation self-improvement / wealth building recipe, and they’ll essentially immediately be back on top of da world, livin’ large, and pimpin’ 24 / 7 /365.

Oprah should have Ben Bernanke on as a special guest, such that they can really drive this point home. After all, the best part about The Secret is that all of an individual’s failures in life are their own fault, attributable solely to their lack of expertise with The Secret. The Federal Reserve is thus exonerated from housing bubble culpability.

“The 40yr loan sets a bad precedent, as it will go from unusual to mainstream.”

I think you’ve hit the nail on the head Kim. In my more tin fail hat moods, I’d say this is a plan, to make people mortgage slaves for longer and longer periods of time. Mortgage slaves have social uses: they make good loyal employees, they don’t tend to be boat rockers, political agitators, or even entrepreneurial risk takers, they don’t become financially independent early and just quit the system. And besides far more to the point they are profitable to banks!

As we know ultimately housing prices need to be related to income, but with longer mortgage periods you can have higher housing costs without needing a bigger income. And the bank gets even more years of mortgage payments out of you. What a steal.

Oh I’m styling it with my trendy (comes in a multitude of styles and colors) tin foil hat, I know. But think, once upon a time 15 year mortgages were common. Now it is true that only 40% of the population could afford houses then, but there is no way even 40% of the people could afford *15 year* mortgages now much less with a single income as they usually did in those days! So are we getting richer yet?

And yes the 40 year thing might fail (one can only hope), but then it will have only succeeded in pushing the crisis out 5 years as mentioned. That seems to be what we as a society love to do, defer problems which ultimately multiplies them rather than solves them.

@OC Bear: Looking at that article, it pretty much answers some of the questions:

” I think the main reason is when they started making loans the Depression had bottomed out. Also, interest rates declined, so they benefited from lower and lower funding costs on the debt they issued.”

Given HOLC didn’t get started until around the market bottom anyway, it’s actually surprising to me that they couldn’t do better than break even (which may or may not include the $200MM taxpayer startup costs).

Very well said, we’ve been saying that all year and now we finally will have a monthly sell signal on the S&P 500 which will intensify the selling pressure.

Interesting tidbit about Berkshire Hathaway, but be careful that the table you cite is the book value of the company and teh stock chart is the market value. Not necessarily th esame thing.

— Timeline Guyâ„¢

Btw, WBuffet is a.k.a. the Oracle of Omaha, not the “…sage of Omaha…”.

Leave a Reply