2014 housing forecasts filled with euphoria: Estimates looking at higher rates combined with higher prices and stagnant incomes.

Euphoria unlike housing inventory is in plenty supply when it comes to 2014 real estate forecasts. The glue holding the housing market comes from investors and generous banking policy. The one thing about economics unlike other hard sciences is that it happens in real-time. It also assumes certain rules are fixed but that really act more like clay to fit the whims of the power structure. It was interesting to see how few analysts at the end of 2012 predicted the massive run-up in real estate prices during 2013. What is typical of course is that analysts usually go with the momentum so it is no surprise that predictions for 2014 are rosier than they were for 2013 even though most are forecasting higher interest rates and most will acknowledge that this current pace is unsustainable. Yet higher rates will add pressure on income constrained households. Investors are already showing signs of pulling back in certain markets. Let us examine the 2014 real estate forecasting landscape.

Examining 2013 predictions first

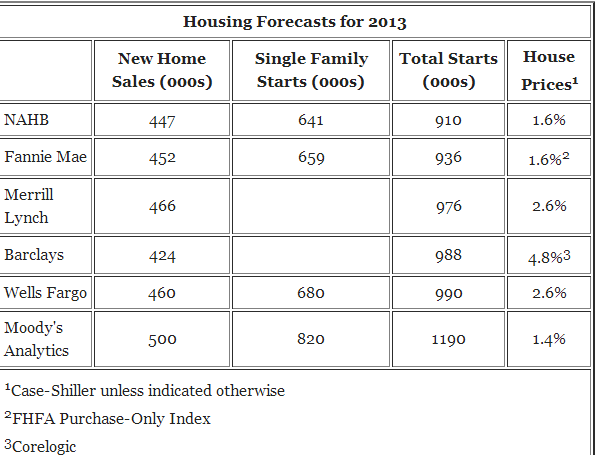

Below you will find some predictions made late in 2012 in regards to 2013 housing:

Source:Â Calculated Risk

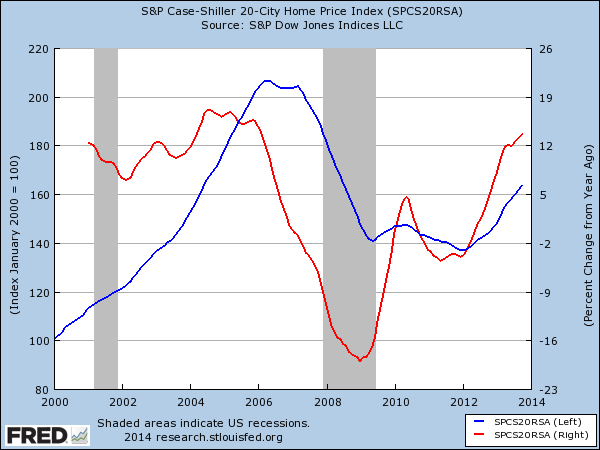

Most of the above forecasted price increases of 1.4 to 2.6 percent with the outlier being Barclays projecting a 4.6 percent gain in home prices for the year. Every one of these forecasts was dramatically off. Investor demand with tight supply created a dramatic rise in prices:

Prices were up over 12 percent for the year. That is a big difference. What is interesting is that home sale forecasts and starts were not that far off. New home sales look to be around the 460,000 range so most of the analysts nailed this. Housing starts ranged from the 900,000 to 1,000,000 annualized ranges so this also stayed within forecasts. Yet they were dramatically off on the price changes. For one, this is no open-market so it is hard to apply models on a market that is essentially driven by the Fed, investors, and artificially low inventory:

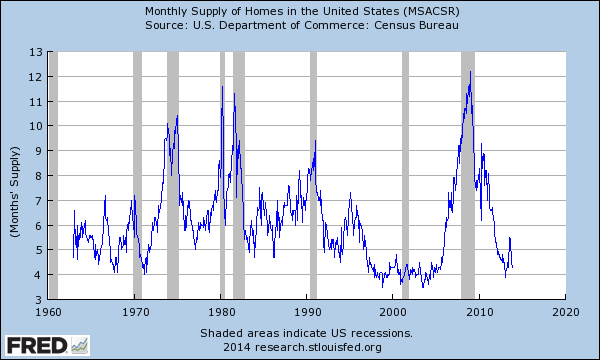

Supply while increasing early in the year retreated once again once rates spiked over the summer. Banks are fully metering properties out even though you have near record low levels of inventory and prices surging. Prices are surging precisely because of the slow leakage but this has caused a market fully dominated by investors. Some people act as if they missed the boat when they stood no chance against the investor crowd that relied on non-traditional financing. Remember the days of having to write a handcrafted letter begging the seller to give you a chance to buy?

What is interesting about the start of this year is we begin the year with a few givens:

-1. Prices surged dramatically last year (fastest rate since the last bubble)

-2. Rates begin the year at multi-decade highs and presumably will move higher thanks to the Fed tapering but also the success of the stock market / economic indicators

-3. Inventory is back to low levels

-4. High level of investors but a slow reversal in many markets

With that said, let us look at forecasts for 2014.

Forecasting 2014

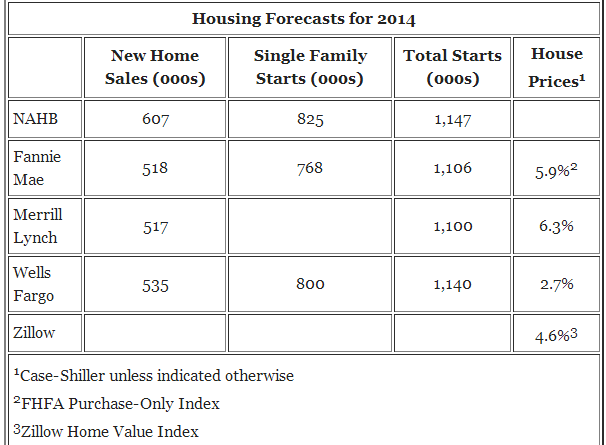

While the forecasts for 2013 were relatively conservative especially when we consider the source, the 2014 forecasts are downright optimistic:

Source:Â Â Calculated Risk

The most conservative measure comes from Wells Fargo predicting a 2.7 percent increase in prices. Merrill Lynch has the most aggressive forecast at 6.3 percent. What we should learn from the 2013 forecast is that chances are, all of these will be off. The question is, will these be off on the upside or downside?

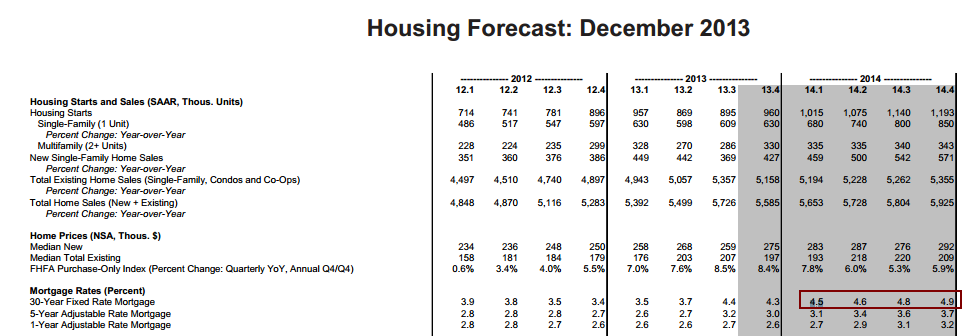

What is interesting is that many of these forecasts already price in higher interest rates throughout the year:

Fannie Mae is forecasting a 30-year fixed rate mortgage rate of close to 5 percent by year-end yet has a 5.9 percent price increase for the year. We already witnessed how quickly the market momentum stalled out over the summer once interest rates went up. This will impact cash strapped home buyers who live on a razor thin margin for the monthly payment.  Fees were set to go up on traditional mortgages but of course, the government and banking apparatus stepped in like a deus ex machina to keep the party going.

The housing market of today is driven by speculation and momentum. 2011 through 2013 was hot. Yet the slowdown is now starting. Depending on investor sentiment, this can tilt the market either way. The assumption is that when prices turn, investors will work collaboratively like banks to meter their way out of the mess. Of course there is no unifying protection system that has the power to freeze mark-to-market or that has the Fed’s blessing in terms of hedge funds or big money investors. Some may think 2014 is a good year to take money off the table and get back into the stock market which returned close to 30 percent for 2013.

Keep in mind these are analysts and organizations that live and breathe real estate. So what is your forecast for housing in 2014?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “2014 housing forecasts filled with euphoria: Estimates looking at higher rates combined with higher prices and stagnant incomes.”

So is the RE Market going to stay flat, rise, or is the bubble going to burst?

What say u, those of you experts out there?

Housing To Tank Hard in 2014!

Of course it will Jim 🙂 It’s feeling a lot like 2007 around here…

What I find most interesting is that the Bulls want to have it both ways. They use the most cloudy of new paradigm metrics as gospel of a perma-bull run, yet will disallow nearly every historic metric that envisions a crash. This is most suspect thinking when the historical metrics are only 6-8 years old and PERFECTLT predicted the bursting of Housing Bubble 1.0. “But it’s a new QE powered paradigm” they counter. There is nothing “new” about QE and it, like all the other central bank interventions before it either leads to a total meltdown at worst, or a continuing boom-bust cycle of increasing volatility. Under now mathematical or economic concept can a permanent run up of prices combined with stagnant wages be plausible. If the minimum wage gets raised to $15 and hour AS WELL as some form of tariffs and price controls are instituted you MIGHT have a working model for an extended bull run. And your more likely to see Jesus descend and wag his finger disapprovingly in Barack’s face than that form of economic intervention.

So for the cheap seats…

OUR ENTIRE ECONOMY IS SMOKE AND MIRRORS! I’m sure the game can continue to be played for quite some time. But the system, by the very nature of what it is REQUIRES booms AND busts. I look forward to all you Rentier Class wannabes being very unpleasantly suprised by this fact.

I predict that Jim “The Tank” Taylor will cut and paste the same comment for each new article of 2014.

NZ, it truly is amazing how terming the same shit by a different name (QE) can easily hoodwink some into believing that this time is different. It’s never different this time.

Hi. New here. Would you mind citing reasons for your opinion on housing in 2014?

Kind Regards,

Have been a broker in LA for 33 years. This run up will

go for years. Real estate moves in long cycles. 401’ks

and pensions from baby boomers in lump sums will

see residential real estate moving up a long time.

Prop 13 must stay, or it gives the gov chance to increase

taxes and spend unwisely.

I’m no economist, but I am a semester away from a PhD in Clinical Psychology, and what I do know about human behavior is:

1. They learn from past trauma.

2. Many were hurt by the last housing bubble.

3. Prices rose way too high in contrast to income and job creation.

4. Banks panicked 4th quarter 2013

5. Investors who speculated without considering incomes will panic by October 2014.

6. Poor sales in summer combined with volatility in the stock market will create a crisis in late October.

7. Home prices will take a dive by Dec. 2014.

8. Unlike the previous bubble, this one will be harder to manage due to the large quantity of investors involved.

9. Greed in the mutual fund market will win over patience.

10. RE Mutual fund investors will dump properties in deference for opportunities in the stock market.

11. The inventory will increase despite efforts by the banks.

12. Home prices will drop and take longer to recover.

13. Greed in banks will lure them to raise interest rates in response to the demand for mortgage loans.

14. We will see the rise of overextended borrowers in ARMs result in a new wave of foreclosures.

15. 2008 will seem benign compared to 2015-2016.

USA home prices increased by an average of about 1/2 % per year from 1890 to 2008, according to Robert Shiller . Thanks to the heavy-handed interventions of government and the Fed, housing has become a speculative asset for the past 20 years…guaranteeing that any forecasts from anyone will be 100 % WRONG.

All asset classes will be at varying degrees of boom and bust levels for the remainder of my lifetime. Of that, I am 100% certain. I prefer to make the house I live in my paid-off home. There’s enough risk with other investments !

http://realestate.msn.com/article.aspx?cp-documentid=23764511

you are a 100% right

over 30years real estate broker California. pay cash for your home is the only way to go. so where are you going???

Already gone, having cashed out of Cali in March …..now in cold country with a bigger new home at a cheaper price. All cash. Enough left over to winter out of the snow country when so inspired.

Cold vs. one-party union-controlled Communism…..I chose the former.

My prediction: The federal government will print whatever virtual money and issue whatever favorable banking regulation is required to keep housing prices climbing in 2014 and beyond. My guess is that the federal government will begin loosening lending restrictions for individual buyers via ARMs to take up the slack of any institutional investor retreat from the market.

Those who currently own a home or carry a mortgage are infinitely more powerful than those who don’t. They want buyers NOW. Falling prices would guarantee that incumbents lose elections, and no incumbent of any party will allow that as there is no personal downside risk for them for propping up the market.

Those who do not carry a mortgage have been indoctrinated for decades to believe that they are second class human beings until such a time as they buy a home, so they will suffer any hardship that is asked of them in order to supplicate themselves to a bank. Prospective buyers provide no check on this market. They want access to unlimited debt NOW. Anyone who believes that the average American consumer was in any way chastened by recent events is a fool or a propagandist.

The instinctive and unspoken (and maybe even unrecognized) goal of the Obama administration will be to make sure that this mess is handed off to the next president by any means necessary. They can see the finish line now. I don’t fault him for it. He’s doing what any modern politician would do under the same circumstances. Any governing class as a whole is a cipher. They don’t do anything the people don’t demand of them or that isn’t in their own personal interest.

I agree 100%.

I agree with your 2014 predictions.

Another possibility is that the current regime in power doesn’t care how it all plays out. He can just declare martial law and stay in power indefinitely. Thanks to the National Defense Authorization Act (NDAA) and his Executive Order 13603, the regime can conduct mass roundups of any opposition and place them in FEMA detention camps. Sound crazy? Well, it’s happened before in history under similar regimes.

Here is my interview with Bloomberg Financial and on my 5 2014 Housing Predictions.

It’s going to be a Housing Inflation Story this year and if the 30% plus cash buy drops then you’re looking a lot negative year over year comps

http://loganmohtashami.com/2014/01/01/my-interview-with-bloomberg-financial-on-my-2014-housing-predictions/

That headline has all the elements of a scam. Inflation of prices when data indicates just the opposite should be occurring.

Business as usual in a world run by banksters.

Short- term viewpoint buyers will continue to purchase using 3,5 & 7 year ARMs in order to fit the payment into their current budget. This trend began in 2013 and will definitely accelerate during the next several years. The result will be continued price increases as new buyers assume more risk going forward. This trend has a few more years to go. A few headwinds to consider in the new Qualified Mortgage guidelines, 43% debt to income max and no interest only loans will definitely impact the higher end over $1M.

I’m an unhappy bull. I think houses will rise in prices over 2014, though not as much as in 2013. I put this down to…

* Inflation due to money-printing. (Those chickens have to come home to roost sooner or later.) This means higher home prices.

* Fear of inflation. People will want to move money into solid assets, which will retain at lease some value, before money cheapens in value.

* Fear of rising home prices. After 2013’s price increases, people will want to buy before prices rise even higher and they further “miss the boat” on a good deal.

* Pent up demand. People have been holding out, waiting for prices to lower and for inventory to rise. They’re tired of waiting.

* Like Chris D said, the government will pursue whatever monetary policy is required to keep house prices high, however artificially.

I agree with your predictions too. You and Chris D nailed it.

I disagree. Housing will tank this year. Investors are looking for the ROI, which housing afforded. However, as the 10 year increases investors will dump the housing on the markets, and flee to other investment vehicles that do not deter profits, ie treasuries. You simply cannot have high interest rates with high prices. Along those lines I full expect Fannie and Freddie to curtail loans as they are already experiencing high default rates.

Housing will see a 5% or more 30 year rate about May time frame. Investors are the folks the banks are targeting, you will see a more balanced market in terms of price and sales to buyers not investors.

China continues to lag in its quest to be the dominant world player, you will see a surge in US investment in MFG and countries turning again to America. As long as the worlds currency is still the dollar and it will remain so, watch for us to have a spike in our economy.

When the FED turns away from a fed rate of near 0% by late 2014, you will see a huge rise in American investment and spending from folks who have been tied up for several years. Many don’t give a hoot about the stock market, they will spend their interest money and I predict to spur spending, IRS will rescind paying taxes on interest earn in 2016.

Most people can and will accept 30 year mortgage at 6%, the economy will start to zoom in late 2105 and be red hot in 2016. China will fall back even further, their communist Govt will blame the West for its demise, although the world knows they couldn’t possibly have China ( a communist state) as the economic engine of the planet.

America will be again for forward thinkers, folks who dream that housing will return to 25 t0 40% discounts will again be left behind. Nothing stays the same forever, we have a had the down cycle for ten years, it will be all up hill in the next ten, be ready and see the forest thru though the trees, America is coming back big in 2015 and beyond.

Late 2014 is for you folks to set yourself up to be in the party, don’t look back, it is like moving back to the old neighborhood , it never is the same and never works out?

“…a surge in MFG,”

I wonder how much of a surge? Will the rate of productivity exceed that of exported inflation?

A spike in the US economy? So consumerism comprising ~70% of GDP will increase? What will be the trigger for job growth? The MFG surge? With WTI at ~100USD the cost of energy inputs may counter some of that surge? In view of food and energy costs rising how will the average US household possess more disposable income at the end of the month to convey the econ spike?

Kind regards,

Great article! Here are some additional charts showing that we are in ANOTHER housing bubble. http://confoundedinterest.wordpress.com/2014/01/02/2013-housing-becomes-less-affordable-as-prices-skyrocket-and-real-incomes-stagnate/

I believe the term of art is “link pimping” when you point to your own blog.

I appreciate the links

There’s such low supply and steady demand that I doubt things will change much in 2014. I don’t see a euphoric attitude either. There’s a steady amount of worry out there. Even rising rates my light a fire under some people to buy. But with a large percentage for buyers using cash, how much does the interest really matter?

I don’t know the exact figures of private party sales vs bank sales in 2013, but the two sales that involved our family in 2013 were both private party. Our Daughter and her husband bought a house from older people who were downsizing, and sold their town home to rebounding folks who had lost a house in the first crash. No banks involved in selling either property. We did use family assets to help insure they could compete for the new house, so in a sense we were investors. Can Dr B help out with the California and National figures for the percentages of bank vs private home sales in 2013?

Housing bulls lining up nicely.

I’ll predict multiple self congratulatory posters soon crop up eagerly describing when they bought, where they bought, how much they and their SO make, how much the house they bought has increased in value, neighborhood gentrifying, desirable areas will be unaffected by economy, perhaps buying SFR for investment, etc.

Things are getting interesting.

Love it, drinks!

People who are bullish on the economy, in any way, are reminiscent in a certain way of cult members. You can almost see the googly eyes and the moment when the person decides to break with reality: “They will just keep manipulating the economy forever, might as well give in!” It’s like a girl in a cult saying “Brother Jimbo is God, he told me so, his face lit up and got all shiny and stuff, now I’m wife number 134 and couldn’t be happier.”

News flash: If they had more tricks up their sleeves to keep house prices up, you would have seen them by now. Prices will crash and the crash will only be that much more severe considering how long they have staved it off, by warping economic REALITY. I’m talking about overall prices. Sure, there will still be bubble areas. But the general attrition will affect all or most of them, too. Even assuming L.A. is really some place where all those with money want to be, how attractive is it likely to be once it turns into a series of walled-off enclaves of moneyed folk surrounded by seething ghettos full of unemployed and illegal immigrants? The very combination of extreme rich and poor I’m talking about is totally apocalyptic and ominous. And let’s throw in a big earthquake on top of that. The whole place feels like it’s on the lip of a volcano.

Anyone who thinks L.A. is on an upward trajectory, well, refer to my first paragraph. Though delusional thinking is a global phenomenon — this is ground zero, well, maybe second to North Korea.

Regarding “Out Of California,” I sense a disconnect among the populace.

KFI-AM’s John and Ken talk about the impending pension crisis, and how L.A. and California are on the brink of financial collapse. People talk about Obamacare, hyperinflation, that we’re overdue for an earthquake, and that last year was one of the driest in recent history.

And yet, I walk the streets of Santa Monica and Brentwood. I see HUGE McMansions being built all over North of Montana, in both Santa Monica and Brentwood. New McMansions that occupy at least THREE house lots. Some of them look more like institutional buildings than private homes, but private homes they are.

People on the streets are cheerful and upbeat. Oblivious to earthquake threats or financial crises or water shortages.

The stats say multiple crises are at hand. But the populace’s mood says happy days are here again.

Record setting buildings are a ‘tell’ that the end is neigh:

Chrysler Building, Empire State Building — end of Roaring Twenties during design & financing — finished during the Great Depression.

Petronas Towers, Kuala Lampur — end of booming nineties — coincided with Asian currency crisis that put Timothy Geithner on the financial map.

(Petronas Towers featured in the film: Entrapment)

Burj Kalifa — end of the Dubai super boom — needed emergency financing that caused it to earn a new name.

This also extends to residences — though they are not as celebrated. The Roaring Twenties featured epic Hollywood homes — one of which became the Playboy Mansion decades later.

So, huge construction splurges are to be expected at the end. So much so that they are a disturbingly consistent signal that a MAJOR economic trend has come to an end.

The main real estate market hollows out — and these spectaculars are all that’s left a-building.

Scary, then.

2014 Predictions:

1. Mortgage Rates will move from 4.55% (TODAY) to 6% by year’s end.

2. Inventory will bounce hard off lows this winter and rebound significantly as sellers see the writing on the wall and seek to take profits off the tables.

3. Investors will pull back from market and put their properties on the market. They will compete with each other and will not be afraid to offer price cuts to make sales happen.

4. Buyers will be hesitant as they run the rent vs buy calculations with interest rates in the 5.x% range and see the numbers don’t favor buying given the run up in prices the past few years.

5. Home values will be flat this year, which will set up declines for 2015 for desirable areas.

Hello – nice summary, but if lending rates go up, then prices must drop, as Joe Average can only spend the same amount per month on a mortgage.

Sellers are not selling yet (for reasons discussed many times over.) There are enough investors/traditional buyers to soak up whatever low inventory is there. The Fed will continue QE (even if 6.5% unemployment rate is reached.) Banks can still mark to unicorn. John Boner and the Repubs caved (no drastic spending cuts). No change in laws as they relate to loopholes/incentives for RE (Prop 13 in CA, mortgage int deduct, tax free cap gains, etc.) I say 2014 prices go up 10%+ nationally on low volume, maybe 15-20% in CA.

Once the Fed starts tightening around 2016, then you gotta look out below….potential for epic collapse. Investors and sellers will come out of the woodwork to try to cash in whatever capital gains they may have, and that is when the party comes to an end. (Unless the banks and GSAs reduce lending standards over the next couple years. In that case, the bubble could last even longer.)

I Really Think Obamas Legacy will be to create the largest land grant to the renters in

good standing who have been renting from the banks or hedgefunds who have

essentially walked away from the SFH market when yields sour

I’m not quite sure I can follow your train of thought.

1) Big Banks should not be conflated with the hedge fund crowd. They are working to a different impulse: they want OUT of their REO positions. For a slew of regulatory reasons, the LAST thing any bank wants on their books is REO.

To the extent Big Banks are in the market, it’s as custodian for this or that trust instrument — coincidental to the issuance of mortgage backed residential securities. The Fed is sure to be pushing them to roll these turkeys off as fast as they can — as long as they don’t break the market.

Towards this end, the Fed is buying mega quantities of mortgage debt — even printing money to do so.

2) There is no SFH pricing service to embarrass hedge fund managers. So they can mark their portfolios to dreams. This is in complete contrast to financial portfolios: stocks and bonds. That stuff is ruthlessly market to market every trading day. Most funds are proscribed from even dealing in illiquid securities. (Pink Sheet stuff, etc.) Some such boilerplate is normally tucked into their offering pledges.

Consequently, I can’t imagine ANY hedge fund heading for the hills if the real estate market plateaus — or even backs off. The controlling player is STILL going to get his 2%. That’s got to look pretty good, these days.

Further, his co-investors are looking for CASH FLOW not appreciation. The hedge funds involved aren’t hedging at all. They are merely conduits for pensions that can’t directly own and manage real estate. (IRS regs prohibit leverage for them — but they can hold a PASSIVE piece of the action if the active partner is working the deals.)

…

Speaking of Hawaiian real estate experiences: the Big Boys buy and hold, and hold, and hold, and hold. This trait is so pronounced that the Hawaii legislature had to enact a compulsory sales law. The Big Boys fought it all the way to the US Supreme Court.(!)

That should tell you about the mentality of those controlling the real estate market. When rental income is their game, they NEVER want to sell. And with new monies flowing in — relentlessly — they have absolutely no pressure to liquidate — ever.

The new monies, of course, come in by way of the pension funds — who are sure to love an investment that does not embarrass the pension trustees.

This dynamic must mean that, at the end of the day, the Big Money is going to pile into American real estate for at least another solid generation. The hedge funds have solved the IRS regulations for them. Until now, those regs had kept them at bay.

BTW, a real return of 3% — INFLATION PROTECTED — is a classic norm — going back centuries. It’s enough to draw pension funds from the Moon. Believe it!

If they could do it, they’d prefer to hold merely the land — and work the leasehold scheme so famous in England and Hawaii. (Lord Mayfair == hereditary scion of the West End — as in: those properties are sitting on top of his land — as leaseholds. Not surprisingly, he’s consistently one of Britain’s wealthiest men. — He holds land in Hawaii — and even I was a (sub-sub) tenant on his property, hence my awareness.)

For Californians — study up on the Hawaiian real estate market… its concentrated nature… and all of the politics surrounding.

[ O/T: As a much younger man, I exposed the fulsome corruption of Hawaii’s Chairman of the Ways and Means Committee — by accident. She was holding court WRT permitting gambling in the Islands — for revenue raising purposes. I stood up to demand that the Big Boys chip in for the massive real estate improvements (freeways, rapid transit, etc.) that benefited them so hugely while sending the bill on to the general man/ taxpayer. She used a secret hand signal to notify all three local TV news crews to cease video recording. All three did so — in unison — and in a flash. With that it became obvious to HPD — and active citizens — that she (Hawaii Kai) was getting graft from Campbell Estate. (Ewa Beach) For you Californians: that’s the exact opposite side of the island! No-one had made the connection before.

Sitting right behind me was one active citizen. He went on to become the campaign manager of her successor.(!) From that moment onwards, he spent all of his energies towards defeating this crook, to include sponsoring her replacement — a guy totally new to politics! She was the ONLY legislator defeated that fall! She lost the single most powerful chairmanship to be had. (Even beat the speakership — for graft opportunities.)

And, obviously, his tale of that day was the heart of his crusade. Once he knew where to look, I’m sure more dirt was found.

Such is accident and incidence.

BTW, HPD major and captains left the meet with ‘stink-eye.’ They figured it out, too.

This is EXACTLY the kind of ‘market logic’ that’s driving the Big Money towards real estate. There is no pretense of legal blues: insider dealing is A-Okay in all real estate markets.

My prediction is that every predition will be wrong…

I see a recurring theme in predictions everywhere:

1- Real estate prices will continue to rise (reasons varying from person to person).

2- Interest rates will rise.

That leads me to think neither will happen.

Throw inflation in there too as a fairly common consensus.

Rising interest rates are a slam dunk, IMO. Lots of folks already looking at a 4% 10-year note to hit this year. Inflation is a function of monetary velocity, and I think the average consumer (you know, the “99%”) and business still has no interest in really ramping up spending/investment. So, increasing interest rates + low inflation = flat/down housing market in 2014. We’ll see.

Here’s what I think:

http://www.truthingold.blogspot.com/2014/01/mondays-pending-home-sales-report-more.html

The housing market is going to re-collapse this year.

i think things will get better and get worse, simultaneously.

I don’t think we can just generalize the change in home prices across the whole market. I think that the highest priced homes will continue to raise in price, say 5%. Those folks that are in the top 5% income bracket have the means to keep up this pace.

But low and middle income housing can’t continue to go up IMO. So I’ll spitball it and say that’s going down 5-10% this year.

I just don’t see any reason to think that price changes are going to be consistent across the whole market, just as they won’t be consistent across the whole country.

I need to know whether to buy my first home now, or wait.

As mentioned earlier I feel like I missed the boat. RE in my area rose 23% last year. Pretty soon, it’s going to be at the insane prices they were before. Jobs, however, are still hard to come by. Incomes haven’t gone up that much. Businesses cut back and they refuse to restaff because their hard working employees will do anything to keep their job and they have a “I’m just grateful to be here” mentality.

In the mean time, business has picked up a bit for some of these companies. Just too greedy to employee the staff back that they should have their in the first place.

Those “greedy employers” are facing a bevy of new taxes and regulations since the recession. Why would you dare risk expanding your business if more than half the profit would be paid to the government in taxes? I wouldn’t. Oh, yeah, that’s why I moved to Florida so that I could at least get the Franchise Tax board off my back and to compensate against Prop. 30, the federal tax increases of 2013, and all of the wonderful Obamacare taxes that I now get to pay.

Please dont respond like you know my industry.

Healthcare benefits were slashes to alleviate that

and I’m not referring to that.

I’m referring to the growth in my industry.

So please, go away troll.

Don’t talk to me like you know what industry I’m referring to. I stick to at I know, and what I know is the field in which I work in. Don’t make generalized statements to ONE remark I made and brush it all of to Obama Care.

This was going on long before that. While I realize some employers are NOT greedy and are having to cut back, this does not go for all (obviously) so don’t respond as such.

Zip your lip or answer my first question.

Mr (or Mrs) Decisions, I would suggest you check that attitude at the door. When you’re asking for advice, you should be grateful when you receive it.

By the way, you have provided nowhere near enough information for anybody to give you a high quality detailed response. There is a saying that goes “garbage in… garbage out”.

When I was running my own firm ALL of my hires had insanely inflated notions of how profitable it was to wholesale goods.

Indeed, many are the budding entrepreneurs who go belly up precisely because THEY held inflated ideas of how much they were making.

////

At almost every turn, I run into quasi-savvy, college educated, folks who have yet to figure out how much they’re earning.

It’s NEVER the figure posted to the W-2 for Federal Income Taxation.

EVERY employee has to FULLY earn his W-2 wage — PLUS — ALL of the direct labor taxes and retirement plans solely associated with his own hire.

These figures are digitally recorded with each paycheck — and are spelled out in capital letters by every accounting software package out there. All of them.

FIGURES:

Nominal wage: $ 30.00 journeyman carpenter on the West Coast.

Actual cost to the employer — and the TRUE wage earned: $ 48.00.

The extra $ 18.00 had sure better be earned by output — or the man is sure to be terminated from employment. Within that $18.00 per hour:

0-care (or company health plan)

FICA

Workman’s Comp Insurance

Federal Unemployment Insurance (most folks don’t even know this tax exists)

Direct accounting overhead (usually trite, but is significant for administrative employers.)

Retirement schemes (endless variations)

Profit sharing

Vacation pay (allocated back upon hourly nut)

Vehicle (gas, insurance, etc. is commonly picked up — even in the trades: foremen)

Union fees (if a signatory)

NOT ONE of the above expenses is truly covered by the employer. They are covered by the output of the employee. Should he not do so. He’s fired/ laid off/ … on ‘Book 3’

The firm merely handles the paperwork — under the authoritarian guidance of the government and the union. (if applicable)

////

Even this very day I heard my relative explain to me that her pension was paid for by the company. As IF! It was simply part of her compensation package — which was structured to suit the tax schemes of that era — and for the executive mandarins.

Employers are NOT Santa Claus.

The market for small firms is never fat enough for the owners to play that role.

There is only one Santa out there: Barry.

And he runs his workshop on free labor: you and I are his elves.

Don’t you feel lucky?

There is no “the” boat, but rather a bunch of boats. Boats come and go. You missed the previous boat, maybe the next one will be better. Stop with the missing the boat wining. Good lord.

Someone mentioned in another thread why investor class would be buying a fixed asset such as a house. Somehow or some way they see/know inflation is coming…but where is it going to start…China? their game is cheap labor, cheap production. If china crashes, we do too..we are joined at the hip so to speak. So where is inflation hyper inflation going to come from? if you can answer that question and create the fact sheet to confirm it, that person will have the real estate future price question..

after all, buying a home is just securing a fixed price on a semi hard asset, if it goes up and you sell, you have to buy something else at that price..if it goes down, same theory applies…

Red China has pervasive capital controls to hold back the flood of liquidity that they’ve created.

The ramp in Beijing real estate prices is breathtaking to behold. Red China has asset inflation of an astounding character.

You can check out some of the stats at ZeroHedge — and everywhere else.

The Chinese look upon American real estate as if we’re just giving the stuff away!

I love reading that prices for homes went up only 5% nationally in 2013.

Then right after I can flip through prices on ListingBook and notice that the houses down the street in the decent neighborhood went from $155K-$170K (in January of 2013) to $249K and up now. And that isn’t even with short sales factored in the comps!!!

Then you’ll appreciate that most of the nation never participated in the super boom of the last fifteen years.

Indeed, many northern cities look like they’re tracking Detroit — with a time lag of one generation.

(Cleveland, Chicago, Akron, …)

The hedge funds are placing their bets right back in the old boom time states: California, Arizona, Nevada, Florida, …

For another zany boom: try Canada and Australia. They’ve blown clean through all American excesses to establish the mothers of all bubbles.

This chart pretty much confirms in black and white what has been predicted by the more astute analysts over the past several years. The precipitous plunge was much well established by 2007 when most prescient observers saw the handwriting on the wall followed by a permanently impaired systemic failure of the housing market bouncing along the bottom with zero possibility of recovery by 2009.

Yet if you only focus on the trend from mid 2010 until the present which many of the government and industry cheerleaders concentrate on with the intent of misdirecting the public attention, new home sales have more than doubled. And this of course was only gratis of further fraudulent and lax credit evaluation practices on loan applications and of course the largesse of the FED liquidity injections into major financial institutions which subsequently entered the housing market en masse.

I’ve noticed this fallacious and myopic perspective in sparring with the clowns on the comment board at Seeking Alpha. It’s a foregone conclusion that the housing and MBS market is running on fumes, the persistent statistical manipulation of our ministry of truth, and worst of all the naive perceptions of a misinformed consumers and investors chasing a rapidly devaluing US$ into a financial abyss of no return.

This collective mirage of economic recovery will be the last illusion to vanish with dire and even fatal consequences for many.

When extend and pretend finally ends, the free market in housing here in soCA could get apocalyptic for those sitting in homes in the formerly lower middle class hoods.

I agree with yard farmer, but how many times in the past have we watched the housing bubble strengthened by fed rate drops and media hype that continues the trend of rosy forecasts by most of the above posters.

If you are not a perma bull, you must have your head in the sand.

Most of the job creation since 2008 has been retail and food service workers. These are minimum wage jobs unless they get lucky and find work at In-N-Out burger or Costco.

Pay raises in 2013 are in the 1% range. This does not bode well for housing inflation.

The U-3 unemployment rate in Los Angeles is 10.2% and the U-6 underemployment rate is 20.1%. These are some of the worst employment rates in the U.S. for a major metro area, and they have barely changed in 2 years.

GDP is in the 2% range (stall-speed growth, lower than 2% a recession usually follows).

Since housing inventory is tightly metered (at least until 2016 to 2019), the laws of supply and demand kick in.

A historically low volume escalating in price should not be confused with a normal volume of sales escalating in price. Anyone with minor intellectual capacity knows that if you yank 1/2 the beef off of the market, the price of meat is going up. Ditto here.

This is what is happened with the 2013 stock markets as well (stock prices foamed and bubbled on some of the lowest market volume in 20 years). Prices go up until the number of qualified buyers start to run out.

Which brings us to SoCal real estate for 2014. Upper tier will continue to rise since they are not constrained by interest rate changes. The middle-tier areas are running out of qualified buyers (even on historically low inventory). The working class areas have run out of qualified buyers at 4.5% interest on the 30 year mortgage.

When interest rates hit 5.25% in 2014 the sounds of bubbles popping in some mid-tier areas, and the crashing in the working class areas will be unmistakable.

I submit that 0-care is so huge and so disruptive to the American economy that everything is going to turn on it.

It’s ALREADY apparent that cash flow is being disrupted in Texas… and that Americans are being driven from the hospitals/ clinics with financial threats WRT medical liabilities for what had been routine procedures last Monday.

There is absolutely NO WAY for Healthcare.gov to be fully coded in less than a year.

The current scheme is a fraud. It’s a short analysis to find that Medicaid is mandated — so short that it’s the one area of the code that’s working correctly.

Everything else is actually not working. They’re faking it. Even hyper-liberal states that were totally on board with 0-care (Oregon) couldn’t get their system to work — for weeks on end.

As for the cash flow: it’s not flowing.

Everyone is discovering that they’re uncovered. That includes the US Territories. (Guam, Virgin Islands, PR…) Pelosi left them entirely off the statute for the exchanges!

Further, even non-0-care health insurance is morphing into a clone of 0-care. Those regulations are being hatched right now.

Because these travails are being hidden from public view by vested interests, it’s actually impossible to figure out just how disruptive 0-care can get…. But it’s looking like Barry has brought the Third World’s chaos to America.

Not only is the health insurance industry suborned… the chaos has every manner of contract bidding in total upheaval. What this usually entails is a complete cessation of contracting, of bidding, of deal making, of work.

The implicit poll tax of 0-care is a complete show-stopper in the construction trades. The uncertainty is so epic it’s paralyzing. This will become ever more pronounced as 2014 ages, and the figures begin to jump all over the place.

As for the medical profession: they’re now to become the dogs of bio-mechanics.

Barry is going to call all of the shots from downtown.

(Kind of brings back fond memories of Mitch and Murray handing out the good leads.)

///

What am I to make of a President who watches more TV than a retiree? Yes, it’s official. Barry is a Boob-Tuber investing more time than a pre-teen on what’s light and hip.

///

Because the commercial banks have unloaded their ‘duration’ onto the Federal Reserve, we’re in for a treat: they would actually prefer to see interest rates rise — just a tad. They are no longer in any position to cash out US Treasuries for capital gains. Lending dear while paying cheap must be their new route to income. What was old is new again.

None of that is to mean that the system is going to pay depositors decent interest.

A rising prime interest benchmark will begin the revival of ordinary commercial lending. Until the risk adjusted profit margin is there, no bank is going to extend credit to Main Street. It’s really that simple.

Expect the Fed to talk up commercial lending rates… a tad.

Sadly, ultra low interest income for the proles is going to deter the formation of small businesses. Until the senior generation sees that cash flow from interest and dividends is enough to cover living standards, no-one will extend Angel financing — even to their own kin. It’s just too scary.

Without small business initiations, job growth will be pathetic. Ditto for wage incomes.

Intangible wealth will continue to be destroyed — as careers just don’t get started on time, and the seasoned talents take premature retirements.

These cross currents tell me that the Fed and it mandarins will not be able to get though 2014 without some serious cow pies.

I would bet on chaos, some choice panics, perhaps even failures of the bullion banks/ trading syndicates. The silver short position is a duzzy, vulnerable to sovereign wealth fund attack.

I figure that liberal states will ramp de facto property taxes via every manner of bizarre fees tacked on to essential services. (Sewer, garbage, …) These, in harmony with firm and mildly rising nominal interest rates, will put a capper on bread and butter housing.

We could start a municipal bond roll-over panic half-way through the year: so many of the states use July 1 as their fiscal year. Rising long term rates are going to absolutely kill retail lust for municipal bonds.

I’d expect the ‘Wisconsin story’ to go national. Labor relations — civil servant unions — will be a big fat topic this year. Something’s got to give.

Do you read http://www.pensiontsunami.com ? They have amazing stories of public sector benefits excess and how the unions would rather drag down an entire school district/city/state than compromise. Unfortunately, a lot of locales have low information voters, so they simply fall for simple tag lines like “war on school teachers.”

Unfortunately, my perspective is that you may have to move in order to find fiscal sanity rather than waiting around for your fellow voters to finally understand what’s truly going on.

Oh blert get over it

Blerts got it right!

Especially interesting thoughts on municipal bonds.

Interesting predictions. On their face, whether bull or bear, most seem plausible (which is scary, but makes sense). We have nearly 12 months to go in the year and its not prime selling season so personally I have trouble making any valid prediction. Also, are predictions nationally, CA, Vegas, super prime areas? Way too many macro and micro factors involved. I predict if I make a prediction it will be wrong. If a gun is pointed at my head, due to the insane amount of manipulation in housing currently/interests of the fed, govt and richie riches all being pro housing, I’d say slightly down to flat to slightly up is statistically more likely than a crash for 2014 at least. Wouldn’t shock me if things tumbled down to the last crash level/give up gains from bubble 2.0 at some point relatively soon. Just hard to put a date on that. Someone had a good quote about the market staying irrational longer than one can stay solvent. It would be interesting/funny to see the NAR, etc predictions for the years housing crashed to see how off/biased they were.

Here in the Bay Area, it really can’t (?!) get much hotter. Here in Marin County, I see very little activity, but what I do see are crap-shacks fetching over $1MM that most people would not pick if there was a choice (i.e., more inventory). Without much to pick from, people are “settling” for overpriced houses that really aren’t what they would want if asked for a list of their “wants” such as a quiet (vs. busy) street, larger (more than 6K) lot, unimproved/unupdated (vs. “I get to pick out the granite and re-do the inside”), etc. Fixers around me are going to all-cash investors (I called listing agents for a couple near me and that’s what they told me, usually 5+ all-cash offers on Day One), not “end users.” So the only choices for buyers who want to live in the homes are houses that have already been fixed up and are priced high. And there aren’t many of those (extremely low inventory). So, unless you are in the top 5 percent (over $200K a year in income), don’t bother looking in higher priced areas of CA unless you are willing to take a risk of price declines and go “all in.” I don’t see this changing even if rates go up because of ARMs, I-O loans, etc. that seem to be making a comeback. Plus, I see things like doctors charging whatever they want to for services (recent neurology visit for my daughter was almost $800 for one visit to a UCSF non-surgical pediatric neuro for about 30 minutes, which really could have been done in 10…this same doctor last year charged around $400-500). The rich are ramping up and charging more, and spending more (on houses). I see no cracks in the dike from where I sit here in Marin. It’s crazy. And it doesn’t have that “it’s about to blow” feel to it either. 2014-2015 at least will likely be very similar.

Marin County is filled with the hypocritically rich leftist 1% who voted for the likes of Obama, Nancy Pelosi, and Barbara Boxer. They thrive on crony capitalism and their Democrat Party connections. They claim to care about income inequality but they really enjoy living like royalty in their mansions while enjoying tax breaks unavailable to most working and middle class taxpayers.

It’s funny reading all these predictions. Based upon events from the last five years, NOBODY has any clue what lies ahead. What you do have is facts and information that exists TODAY. Instead of guessing, hoping, praying, fortunate telling…base your decisions on facts you know today. That’s why buying a few years ago at or below rental parity was a no brainer.

Take it with a grain of salt, here are my “predictions” for 2014.

Housing prices will be flat.

Rates will inch up.

Inventory will remain tight.

Rents will definitely increase.

Fed/Government/PTB support for housing continues.

Divide between rich and commoners keeps growing.

Yes Lord B, that is why I chose my handle. The business of predictions is a highly challenged one. But, I agree with this prediction by ZigZag above: “All asset classes will be at varying degrees of boom and bust levels for the remainder of my lifetime.”

And the first half of what Bay Area Renter wrote (minus the dollar amounts) describes EXACTLY the situation where I live….Asheville, N. Carolina (metro pop. 500,000 plus a lot of tourism). I’ve tracked this market closely for over 2 years; well before moving here in Apr 2013. And there has been mostly junk on the market for about 5+ months now or over-priced remodels (after a very active Spring & Summer, when anything decent went under contract within 1 to 5 days; some over asking price).

At 54 years old, I am about to, mostly, tune out of all this real estate discussion as I did recently nail an absolutely perfect house for me and at a fair price given its’ superior condition and location. It will be THE LAST HOUSE I buy. Yes! I’m planted where I want to be and have my own biz so, that’s it. Paying cash so don’t care where interest rates go and am relieved to plough a good chunk of dough into something other than financial assets. Because I think the eventual likelihood of some sort of bail-in of liquid, financial assets by our dear .Gov is better than average. The property even has enough level, sunny yard to grow as many veggies as I could eat, if I decide to become farmer Jane.

Closing in a couple of weeks and am a happy camper!

This is what I hope to do this year – have to buy whether I like the prices or not and really don’t have $500K cash to put into it, but do have very good size down payment and solid credit/solid income. We’ll miss you here but so happy you’ve found your place – hang onto it and enjoy.

Read “The Creature From Jekyll Island”. You will be shocked at how we are repeating history today.

Free link:

https://ia601202.us.archive.org/11/items/CreatureFromJekyllIslandByG.Edward-G.EdwardGriffin/CreatureFromJekyllIslandByG.Edward-G.EdwardGriffin.pdf

I follow your blog daily and in general strongly agree that a second bubble has formed…but economics is not generally considered a hard science as suggested in todays post.

http://en.wikipedia.org/wiki/Hard_and_soft_science

“economics unlike other hard sciences”

Economics is no more a “hard science” than phrenology or astrology.

Cost estimates for President-elect Donald Trump’s proposed border wall vary wildly, with the current Congressional estimate ranging from $12 billion to $38 billion.

Even the high end of that range is much less than our government spends annually on much less useful endeavors which are less clearly in line with Washington’s sworn duty to the American people.

http://dailywesterner.com/news/2017-01-10/cost-for-a-single-year-of-obamacare-exceeds-highest-cost-estimates-of-border-wall/

Take ObamaCare, for example. According to the Congressional Budget Office, the federal government will spend $1.34 trillion on that massive boondoggle over the next decade, if it’s not repealed. 2016’s ObamaCare spending was estimated at $110 billion.

That’s an awful lot of money to spend on a program that very few people are happy with, a program that made life much worse for the millions of Americans who got saddled with lower-quality insurance at higher prices. Not only are those people paying higher premiums and deductibles, but their tax money is being used to patch up the thousand leaky holes in the hull of the S.S. ObamaCare.

Leave a Reply