5 charts exploring the financial quicksand that real estate is stuck in for 2012 – Public debt now larger than GDP, entitlement challenges, post-bubble lows for housing, two lost decades for income, baby boomer demographics not looking positive for real estate.

As we look into 2012 we have much to be hopeful for but real estate is not a sector to pry into if you are expecting a rosy and sunny projection. Real estate boomed because of easy access to what appeared to be an unlimited supply of debt. Archimedes understood the power of leverage and this is what was applied to our stagnant economy early in the 2000s. The flow of debt largely went into real estate and this is a key point that people seem to ignore; Herculean leverage is now gone. The ability for real estate to reach astronomical values with no rise in household incomes was only accomplished by access to debt. This worked for many years as investment bankers gorged on the global naiveté regarding our real estate markets and mortgage backed securities. Yet the charade is now up and that is why the Federal Reserve and government are largely the only game in town when it comes to U.S. mortgage purchases. The days of a household making $70,000 a year and purchasing a $600,000 home are now long gone. Yet some want to resurrect the housing bubble. With shadow inventory at peak levels, baby boomers retiring in mass, and the growth of lower paying jobs there is little reason to believe that real estate values will soar in 2012.

GDP and government spending

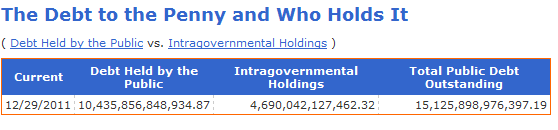

I was talking with a colleague and commented about the significant ending to 2011. Few even realized that in the last few days of 2011 we crossed a somewhat dire line in the sand. Our total public debt outstanding surpassed our annual GDP for the first time since World War II:

Source:Â U.S. Treasury

This should tell you a couple of things about the recovery. First, a large part of the recovery is largely based on massive government spending and banking bailouts. The next thing it should tell you is that the problems of yesterday will only get more difficult as we look into the future:

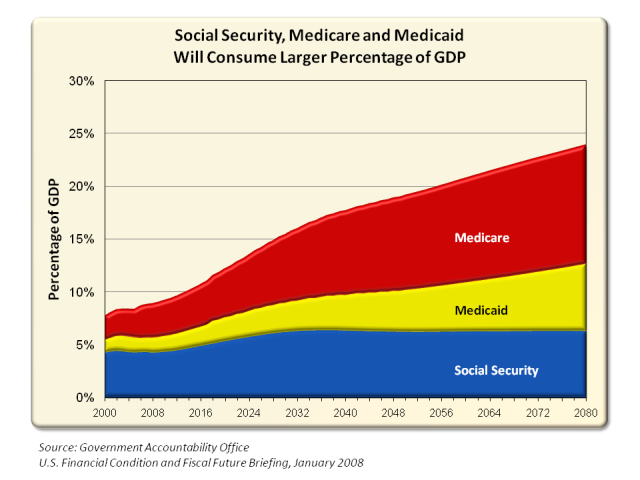

Source:Â Perot Charts

This is a startling chart. In only a few years Social Security, Medicare, and Medicaid will consume over 10 percent of our annual GDP. You can rest assured this will be on the political agenda for years to come since it appears that banks have complete control over Congress and the only entitlements that are up for debate are those that actually end up in the wallets of the public.

So why is this a big issue for housing? Well think about how we can approach the problem. You either raise taxes or cut spending. In the end, this means less money in the hands of the public. Since access to debt has been massively curtailed, people now need to have collateral to make purchases. Buying a home is the biggest purchase most Americans will make in their lifetime so anytime you start constricting discretionary income you can expect a direct impact on the real economy. And where do most Americans store their net worth? Most Americans have their net worth tied up in real estate and this sector isn’t exactly doing well.

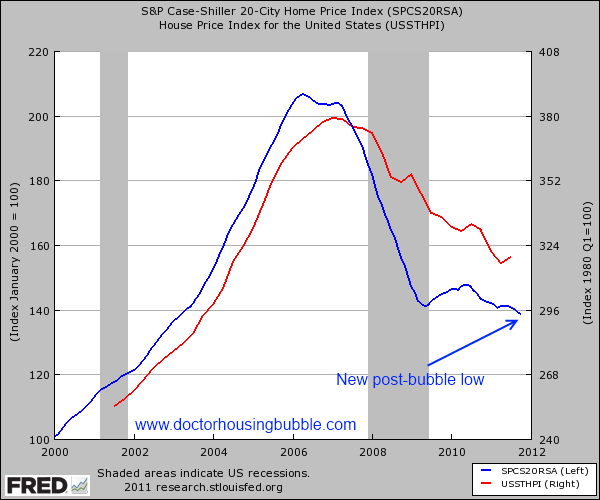

Case Shiller home prices reach new low

Only a few days ago we had official confirmation that U.S. home prices have now made a new post-bubble low:

Americans derive a large part of their net worth from housing, not the stock market. So while the stock market has soared back from its 2009 lows the housing market has done the opposite. This is critical because a large portion of housing stock is in the hands of now retiring baby boomers that were counting on inflated gains to whisk many into a life of comfortable retirement. According to a report from the Society of Actuaries (SOA) most Americans have two-thirds or more of their wealth locked up in real estate. Take a glance at the chart above again and you realize the recipe for problems here.

And why should we expect home values to go up in this environment? It is nonsense to believe that low interest rates or rich foreigners are going to suck up the 6,000,000 homes in the shadows and distressed inventory. Even based on stories I have heard, many young working couples not born in the U.S. are leaving to lower cost states where housing is actually affordable. In essence the demand for housing is for cheaper based homes. This is why 2011 was a banner year for investors. They weren’t out paying peak prices to delusional baby boomers who think the real estate prices of 2006 or 2007 were somehow real.

Many younger families, the prime group for first time home buying, have been hit hard by this recession. Many have large student loan debt and they no longer have the mortgage leverage of the bubble years to stretch their tight budgets. This is the prime group of buyers for non-distressed sellers. And student loan debt is a big part of a younger couple’s budget. Many bought homes in the 1970s, 1980s, and 1990s where there was nothing remotely close to the housing bubble of the 2000s. You also had an economy that wasn’t stratified like it is today. You have a small segment making good to really good money and a hollowed out middle class. This might be good if you are living in La Jolla or the Hamptons but not really a big impact for where the vast majority of Americans live.

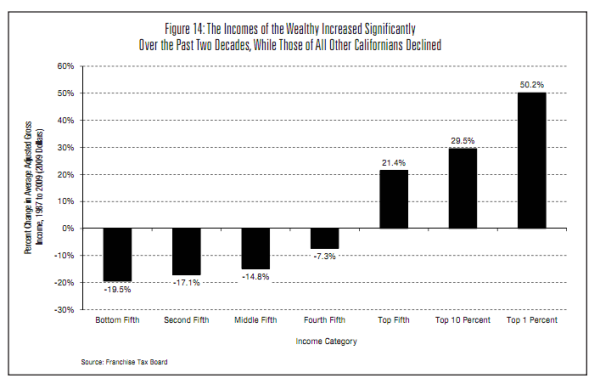

Income gains California

This trend of income stratification is reflected in the bubble state of California. Take a look at income gains over the past two decades based on tax records:

Source:Â CBP

This is an incredibly telling chart and really reflects the economic struggles many families are feeling. 80 percent of Californians actually moved backwards in the last 20 years when it comes to real inflation adjusted incomes. If this is the case, how could an across the board real estate bubble even exist? That is the core of the problem. All of the income gains went largely to a small segment of the population. Even when the top 20 percent data is broken down, you can see that income gains went to a very small sliver of the population. Did this justify 100, 150, or even 200 percent price increases for real estate in the state? Absolutely not and that is why we are in the mess we are in today.

The first place I looked when home prices moved up was at real household incomes. Why? Largely because household income should be a major driving force in real estate values. Yet no gains were to be found and the chart above simply is a testament to this. That is for the last two decades 80 percent of Californians have seen a cut to their real income. The data unfortunately extrapolates to the rest of the nation. Yet places like Las Vegas have quickly fallen to levels where homes can be had for less than $100,000. Even with a couple both working at Wal-Mart buying a home is doable although how secure is that job in this environment?

Employment in California

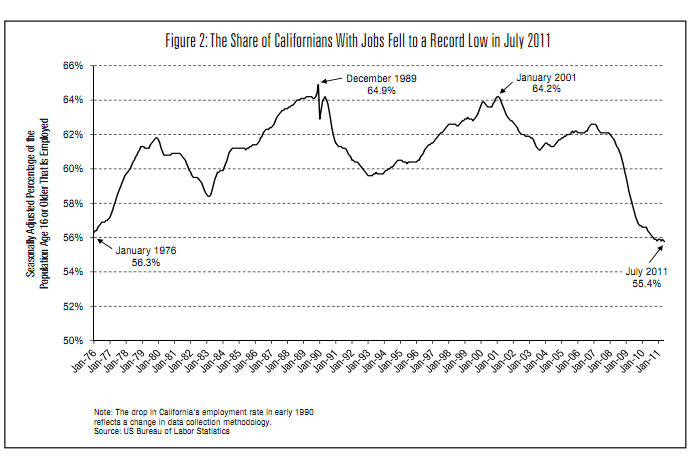

As much as we hear about the recovery it is largely a small group that is reaping the rewards of the banking bailouts and stock market recovery. The housing sector is mired in problems. Many that lost high paying jobs have seen household incomes go from $100,000+ to $30,000, $40,000, or even $50,000 a year. So the employment gains are hiding a deeper troubling trend in our economy. Take a look at the share of Californians with jobs:

Source:Â CBP

This is the worst employment market for Californians in record keeping history and some are scratching their head as to why real estate values continue to fall. The answer is rather simple but the headline unemployment rate does not capture the entire picture. Think of all the mortgage brokers, real estate agents, bankers, construction workers, auto dealerships, home renovation groups, and other markets that benefitted from the bubble. These were very high paying jobs but only existed in their volume because of the bubble. These jobs evaporated in mass starting in 2007 so now going into year 5 of the crisis, many of these people have had to take other jobs or face lower wages. The overall trend points to lower paying jobs yet the unemployment rate falls. This does very little to keep real estate prices inflated.

Demographic trends for California

So it should be clear that you have a wealthier baby boomer generation that would like to sell to a younger less affluent group of Americans. Something has to give. Either sellers remain delusional and receive no bids (this is what is occurring) or realize that new households are less affluent and adjust prices accordingly. Since old habits are hard to break, most of the selling action is coming from distressed homes where unemotional banks are off loading properties for whatever the market can support.

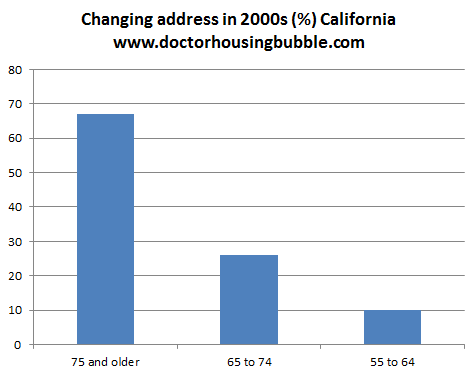

The trend does not look promising for California:

I wrote this a few months ago but it is important to bring up once again:

“67 percent of those 75 and older changed addresses in the last decade, 26 percent of those 65 to 74 changed addresses, and finally 10 percent of those 55 to 64 changed addresses from 2000. This is important to note because in a state like California with a housing bubble still going, you have a wealthier older generation now selling to a generation that has a lower standard of living. Banks can play charades and hide inventory in balance sheet trickery but there is nothing that can reverse the aging of this nation. And many baby boomers are still expecting top dollar for their inflated real estate. Who will they sell to? One another?  A younger and poorer generation? The math simply does not compute. The Fed would like to entice more suckers into the game by artificially slamming mortgage rates to record lows.â€

There is little reason to see real estate as a good investment for the next year and probably for many years to come. We still have millions of properties in the shadow inventory that will surely add more pressure to lower home prices. It is clear that household incomes are lower so it is unlikely that large household income gains will push prices higher. The global markets have no faith in this game and that is why the Federal Reserve and our government is largely the only player in the mortgage game. Yet this is unsupportable for the long-term. Throw into the mix the political bread and circus system we now call our government and you can see that investment banks will continue raiding the public blindly. Don’t expect the press to cover this, just like they missed the biggest economic crisis since the Great Depression. 2012 looks to be a year of more clearing for distressed real estate.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “5 charts exploring the financial quicksand that real estate is stuck in for 2012 – Public debt now larger than GDP, entitlement challenges, post-bubble lows for housing, two lost decades for income, baby boomer demographics not looking positive for real estate.”

Great article Dr. HB. You covered most of the reasons we won’t have a housing recovery anytime soon. I expect another few years of pain before housing prices even stabilize…and then what happens when interest rates go up? Don’t expect any appreciation in housing this decade (especially in still inflated socal).

I wouldn’t underestimate the abilities of the bankers and pols to pull another rabbit out of the hat and find some way to inflate yet another round of RE bubbles. The people I see day to day are fully conditioned to embrace and use debt, even for entertainment, food and gasoline. We are just a few laws removed from a cashless society where variable-rate debt becomes the defacto currency, and anyone paying cash is immediately suspected of being a “hoarder” or a criminal.

The mall and restaurant parking lots were packed this weekend, and houses are selling at a decent clip again, albeit at deflated prices. The “new normal” is debt forever at low rates with a side of commodity inflation. Mortgages will soon be yet another federal entitlement, the pols will muddle through and their banker friends will write the campaign contribution checks and continue to skim their fees from an increasing volume of debt-based transactions.

Short of a violent revolution, I just don’t see any way this mess gets fixed. The money men control the whole thing now and they aren’t letting go without a fight.

Have to agree with your main points. Since a tipping point is generally seen in the rear-view mirror, we are probably well past it (100% Debt/GDP is a figure often used). I too am astounded at people’s indifference to the rapid economic destruction happening all around us. I don’t think things will change much until the credit simply is turned off. How long can the governments keep buying their own bonds. No sane person would suggest indefinitely. I hear everyone complain about the economy, but see no one acting in a manner consistent with their words.

I believe hyperinflationary depression will cause things to truly spiral out of control this year. Food prices have skyrocketed in 2011 while container/packaging has shrunk. I can’t believe how much prices have gone up at Costco, Ralphs, and local markets in 12 months. Also restaurants have not passed on the costs to customers yet. I know several restuarant owners that told me they are barely making it or losing money because of cost of food. Add the high gas prices already going back to $4 a gallon.

Jon wrote: “The mall and restaurant parking lots were packed this weekend..”

Of course the malls and restaurants were packed.

Assuming you are in the L.A. metro area, about 55% of the population are renters. Home prices peaked in July 2007. We can infer that maybe 10% to 20% of the home loans were taken out at the top of the bubble: i.e. July 2005 to July 2007. What this comes down to is that 5% to 10% are significantly affected by the deflating bubble. Guestimating that 50% did not lie about their finances when acquiring the loan at the crest of the bubble, that would put the financially impacted at 2.5% to 5% of the general population.

This explains the crowded parking lots I too have been witnessing.

Well, there are a few points in the article I think are much worse than stated for almost everyone. First, it was a terrible year to be an investor in the US; most saw losses in their 401k and the only positive stock index was the Dow. Worldwide stock indexes plummeted. Pension plans of many states are now underfunded and badly so as to Illinois, for example. As to the wealthy getting wealthier, I speak from first hand knowledge of their taxes; the wealthy make a LOT of money that isn’t taxable in any particular year or ever, and a fair number of California wealthy maintain their wealth in other states or tax shelters. The top 1% do far better than stated in terms of net wealth aggregation than tax returns show. Also, the bottom of the bottom don’t file tax returns, so that if their actual incomes (HOWEVER, plus government welfare) is also charted in to the equation, they actually do pretty well thanks to the growth of entitlements. California, more than any other state, still has a bubble in dot.com’s for San Francisco and LA. As to most Americans having net worth in housing, well, if we counted all the households including single people, we know that the majority of Americans do not have a net worth exceeding a very low number net of debt (perhaps only 40% have a net worth in excess of some low number, such as $10,000 or $25,000). Remember, most Americans can’t skip one paycheck, can’t raise $2000 cash in 30 days, etc. The readers of this blog are clearly in the higher groups, by and large, and that isn’t how 80% of Americans live. Finally, we are in a real estate bubble: record low interest rates, usually no down payment or nominal for the majority of houses sold at all prices nationwide, and this mortgage finance income still is essential to “save the banks at all costs”. Government deficits support fifteen million jobs in excess of a balanced budget…or more, perhaps. However, four million homes are still selling every year, 10,000 a day, regardless of falling values. I predict mortgage rates will be forced down even further, and savers will still suffer zero effective rates (negative real rates) to save the banks, at huge direct cost to taxpayers as well. Anyone know one economist, blogger, pundit, politician, who has a clear and no-waffling predictive view of the broad economy over the next three years?

It probably doesn’t matter that much for housing, who gets elected in 2012.

The big story for the next 4 years is the economy- not the U.S. economy, but the World economy. If we have gradual improvement, housing will find a bottom, and start going back up around 2016.

However, if Europe implodes, the Euro tanks, or China does not continue to grow, all bets are off. Housing will sink like a satellite coming back to earth.

I attended the Los Angeles County Tax Default Auction in October. There were several properties that I was interested in and researched thoroughly. By the time of the auction, said properties had their taxes paid by the bank and were no longer available, (in fact, there was only one home left, the rest were vacant lots). Anyway, I looked yesterday and none of these properties are for sale. In order to get to the auction the taxes had not been paid in 5 years. So here is my question…How can the banks afford to keep these properties off the market? Won’t they eventually need the cash? Or was the bailout money enough for the banks to keep running the shell game with these distressed properties and they don’t need the cash? And finally, what are they hoping to achieve with the smoke and mirrors? Do the banks really, really, believe that the bubble will re-inflate any day now? What will it take for them to wake up and smell the coffee?

When businesses are going under the people in charge pocket as much as they can for as long as they can and now, thanks to lower taxes they can keep most of it. Even after filing for bankruptcy the court will grant them ‘retention bonuses’ on the premise that only the ‘leaders’ of the company can manage to save it during ‘reorganization’ so they get paid extra to stick around. Laugh if you want but I’m not making this up. The banks, if they can’t get more free dollars from the ‘fed trough’, are all bankrupt.

the banks are palying a 10 yr slow deflation/survival game…with Gov backing and support.If the banks sell these props at reduced prices they take a hit on their books.

They can’t afford too as they are insolvent anyway.Its just a survival ploy by the cartel.

I love this Blog. Thk u Dr. HB. I am understanding from reading this blog for over a year that in 2001 when the economy started to go down it was propped up by the Fed lowering interest rates which began a booming industry of Real Estate which included as you said in this blog, mortgage brokers, builders, suppliers to builders, Real estate agents, appraisers, etc. Their income was pumping up the economy as they were spending like crazy. Since most of these people are self employed, they do not register or collect umemployment benefits and did not show up in the unemployment statistic . We are in the electronics business and in 2001 business started to go down even before 9-11; The housing market started to go up. I would think how is this possible? People are loosing jobs and the Real Market is booming. (we live in central Ca) Now I get it though reading this Blog. Happy New Year! I seriously mean that!!!

Our “wealth” is in our commercial property, paid off in the ’70s thank goodness. Still, no plans to sell even as we are in our 50s. We can live here and rent out the other units. Wonder if commercial RE is affected the same as home prices..

Your commercial property value will probably not be adversely impacted, assuming the property is maintained and that the Net Operating Income does not decline. Cap Rates on multifamily properties are still at rock bottom which means very high values, and for other commercial property cap rates are generally holding up pretty well.

You have people losing homes and moving into multi-family units, putting a floor underneath apartment rents. What happens if/when the economy worsens, and these people can no longer afford even rent payments? You have hoards of families squatting and not paying rent. How long can one stay in an apartment without making rent payments, and what is the process like to kick-out dead beat renters?

Well, we only have 4 apts and never had a problem renting them since we bought in ’63. We have two commercial spaces and they have always been occupied as well. Lucky we are in So. Pasadena. People love to live here and we have beautiful old Craftsman style units. My dad made a good decision when he bought the place. Yes, we are always in the black!

Throughout this writing you could have easily replaced ‘ California ‘ with ‘ Japan ‘. I read recently that the underemployment rate for the USA is 18%, whereas in Japan it is at 33%. I don’t recall seeing the data for CA, but I assume it is greater than the national stats. There is not much that public policy can accomplish with these types of data. Japan has tried it all despite two decades of rolling recessions and deflated RE values. Correction : Japan tried it all except for restarting the NINJA loose lending machine, that is.

The next shoe to drop will be forced austerity within the public sector. Little will happen in this regard for ’12. In 2013, look out below.

The last thing we need in Southern California, or other high value areas, is increased home price. Housing costs, whether purchase or rental, take up far too much of our declining incomes, and redistribute it to a relatively few already wealthy people.

This redistribution is supported by the mortgage deduction and tax breaks of all sorts that support the important but relatively small, relatively prosperous real estate/loan/construction etc. industry.

Housing recovery will happen when incomes, and prospects of security, improve and level across the economic strata.

In SoCal, on the surface, housing market appears to be calm, unlike Nevada and Florida. However, who knows how many owners have already stopped making mortgage payments or are contemplating doing so? The banks are so reluctant to foreclose and the Fed is pulling out tricks after tricks to prolong the inevitable deflating of the bubble. As a potential buyer, it would be absolutely foolish to jump into this artificially inflated mirage of a market which is not a natural marketplace but one that is at the mercy of the Fed’s/banksters’ whims.

Thank you Dr. H for the great reads in 2011 and looking forward to more in 2012.

Article this week in the uniontrib.com. Jobs are not happening in the car selling business. Sales have gone up 16% this year and 15% last year. But only 300 new jobs added to 14,500 created this year in California

Sales of cars are half what they were in 2005. Plus there were 20,800 jobs in 2005.

Should have said existing 14,500 jobs not created.

Great Post, Dr. HB.

All over West LA, I see crowds buying and dining at fancy resturants. I see shopping malls at full capacity. I see street crowded with fancy, late model cars. It is like an alternate universe. Five years into the bust, no one can seriously attribute even a significant portion of this spending to consumer debt. Those debtors got largely burnt out two or three years ago and are wiped off the books, credit wise.

My only conclusion is that West LA is home to a significant percentage of the wealthies Americans who are all doing spelndidly even now, as those “nobodies” in the surrounding communities drift off into abject poverty by the thousands.

And it is no wonder. My family budget this year has us breaking even every month despite making 200K plus per year. We live well but not THAT well. Inflation is a major wealth destroyer even at todays muted levels.

200k a year?

Normal people really make that kind of money?? I can’t even imagine the movies, cars, clothes, iPads I’d be buying if I made that! Wife and I pull only 75k a year, paycheck to paycheck life, with one child…but we rent a nice home in orange, our cars are paid off, I’m bald so I don’t have to pay for haircuts!

Every time I come on this blog, I enjoy being educated by drhb, but also amazed at some of the salaries posted here!

Not as great as you think, Zack. Unless you get over the 350K mark, it can still be tough to truly get ahead if you have a large family and live in an expensive area. The tax man takes an even greater bite at the higher income level. ALL the deductions go away except mortgage interest and a couple piddly thousand per dependant. Both parents are working to obtain this. That means a full time nanny is required. Tutors needed for older children. But the budget does factor in a nice vacation, eating out, cable, cell phones etc. But 200-250K a year is no dream ticket for a family of five in West LA where both parents work, trust me. You are still hussling.

LOL! Same here! I’m happy making $50K, can’t imagine making even 2X this. I’d be going to Hawaii more, that’s for sure 😉

Glad I didn’t have kids…Hawaii here I come.

$200K puts you into the high tax zone. Its enough to land you in the 35% bracket + state income taxes + FICA + VAT and you’ll be paying maybe 50-55% of your income as tax. At this level of income, you’ll want to fully fund your 401k, which is another 8%, and there may be additional costs like comprehensive insurance that the less well to do skimp on but shouldn’t. Add $10K for property tax to add another 5%.

Still, $70-80K take home should be plenty for any family.

The real wealthy make most of their money on investments. For that, they pay only 15% capital gains, and often can be heard arguing that it should be zero!

Yes, the Westside is a whole different animal. I have a friend who is an heir to a major Swiss watch fortune, and he recently bought a small house a few doors up from the Venice boardwalk. All cash, just over $1M. Travels all over the world whenever he wants…what a life!

I hate him… but will GLADLY crash his parties, drink up his liquor, and steal his Eurotrash GFs… lol. 😉

yes, 1% made live among the 99%.what you need to worry about is what the 99% sees and wants.

Sadly, many commenters, as well as the good Doctor himself, seem to believe inflation is a problem. It’s not. Core inflation is low, and bond yields continue to plumb record lows. If inflation were anticipated, you can bet those yields would reflect it.

Awareness also appears relatively low that the U.S. can create money at will. The Fed certainly knows this. It created $16 – $29 trillion to bail out the Finance / Insurance / Real Estate (FIRE) sector of the economy as the crash occurred. (The figures are from the Fed audit sponsored by the congressional odd couple — Ron Paul and Bernie Sanders).

Incidentally, this makes the entire deficit debate moot. Q: How much risk does one take lending to a borrower that can (legally) create infinite amounts of money? A: None.

Notice also that the bailout money went to the same criminals and bad actors who inflated the bubble, not their victims. A small portion of that bailout could have funded every mortgage default in the country several times over.

Anyway, if simply “printing” money makes inflation occur…where is it? (Answer: that’s not what makes inflation occur…spending the money does that)

And if Social Security / Medicare are problems, and would take less than a few trillion to cure, why did FIRE get so much more money at the drop of a hat, but we’re fresh out when Grandma asks for what her FICA / Medicare taxes paid for? Isn’t that even a little fishy to y’all?

The other issue not much mentioned here is that the criminals are in charge of the markets. Who but insiders is going to trust their pension, or anything else, to such crooks? Who is going to invest? Aren’t people rather more likely to rush for the exits than getting into markets?

And where is the economic recovery going to get any capital if no one invests…besides government, now thoroughly captured by the criminals?

We’re in a tough spot, but some Occupy justice would handle a lot of it, as would guaranteed employment. I know guaranteed employment sounds suspect, but it’d be a way to get money into the hands of the 99%. It’s recommended by the Modern Monetary Theorist school of economics. (See Yves Smith’s “Econned” … essential reading)

Excellent post, Adam.

Yes, indeed, where is the money for those who paid the taxes, the middle/working classes?

Crooks, indeed.

Leave a Reply