65% of Southern Californians are Delusional. No wait, 65% Jump in Southern California Home Sales. No wait, 38% Record Median Price Drop. No wait, 50% of all sales are from foreclosures. Housing and Foreclosure Voodoo Headlines.

Break out the bubbly, hang up the festive piñata, and dig out those togas because the goods times are here again! Southern California home sales are up an “unprecedented” 65% from last September. That is right folks, happy days are here again. That is until you look at the actual data in this report.

Leave it to the spin masters to turn a pathetic report into an amazing feat of economic accomplishment. I’m surprised these people don’t give each other a Pulitzer just for getting out of bed and brushing their teeth correctly. Yes, the sales volume is up an unprecedented 65% but you can also say in the same headline that the median price is down a record 38%. Both are unprecedented records and guess which one the media ran with?

Oh yes! Fantastic. Time to get my agent on the phone.

Shouldn’t the headline above be 50% of all Southern California home sales are foreclosures? The L.A. Times does a better job with their headline. After all, they are here in the area so they have a better sense of what is going on:

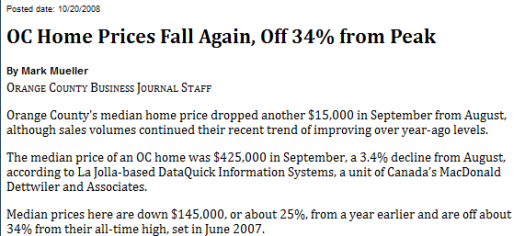

The L.A. Times headline offers a much more tempered report and headline. But leave it to the Orange County Business Journal to tell you how it is:

That is the true headline here. The incredibly steep drop in prices. The peak for Southern California was reached only last summer and stood at $505,000. The current price for a median priced home is now $308,500. Why is this significant? Because Southern California has more people than many states in the entire union:

Population:Â SoCal by County:

Los Angeles:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 9,948,081

Orange:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,002,048

Riverside:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,026,803

San Bernardino:Â Â Â Â Â Â Â Â Â 1,999,332

San Diego:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,941,454

Ventura: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 799,720

Total SoCal Population:Â Â Â Â Â Â 20,717,438

To put this into perspective, Texas has 23 million people in their entire state. Alaska on the other hand has 670,053 people, or the size of Ventura Country. Bwhahaha!

Enough of that. Let us now put on our thinking caps and dig into the craptastic numbers that really show an ugly and Medusa like picture. You’ll turn away quickly once you see the data but be warned, you may turn into your favorite granite counter top:

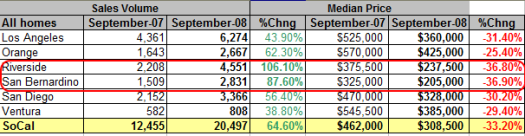

Let us first work through the numbers. I’ve circled the two biggest counties responsible for the sales jump. You’ll also notice one important point here. They are the cheapest and have seen the steepest price drops of all counties! Even though San Bernardino and Riverside account for 19% of the Southern California population they made up 36% of all sales last month for the region! That is why Riverside is up 106% from a year ago. Then again, the current median price is $237,500 so how will that person feel that bought a home near the peak in December of 2006 when the median price in Riverside was $432,000? That is over a 45% drop from the peak price. The price of a home in San Bernardino county in December of 2006 was $370,000. The current price of $205,000 is a 44% drop from that point. What a shocker that homes are selling after having prices cut in half.

Every county in the area is down approximately 30% in one year and much more from the actual peak. If you really dissect the numbers, this September jump isn’t that big. Let us take the largest county, L.A. and see how the past 8 Septembers have done:

L.A. County September Sales

September 2008:Â Â Â Â Â Â Â Â 6,274 <—“Amazing” 65% jump from last year

September 2007:Â Â Â Â Â Â Â Â 4,361

September 2006:Â Â Â Â Â Â Â Â 7,917

September 2005:Â Â Â Â Â Â Â Â 10,988

September 2004:Â Â Â Â Â Â Â Â 10,501

September 2003:Â Â Â Â Â Â Â Â 11,395

September 2002:Â Â Â Â Â Â Â Â 10,808

September 2001:Â Â Â Â Â Â Â Â 8,831

Is this really a number to go running home about? Just because we had a horrific September last year of course any anomaly is going to give a minor boost in home sales. In this case, it was the fact that Riverside and San Bernardino had a crazy amount of swap meet like bargains and people bought them up. It is also the case that 50% of all sales last month were foreclosures. How is this fantastic news?

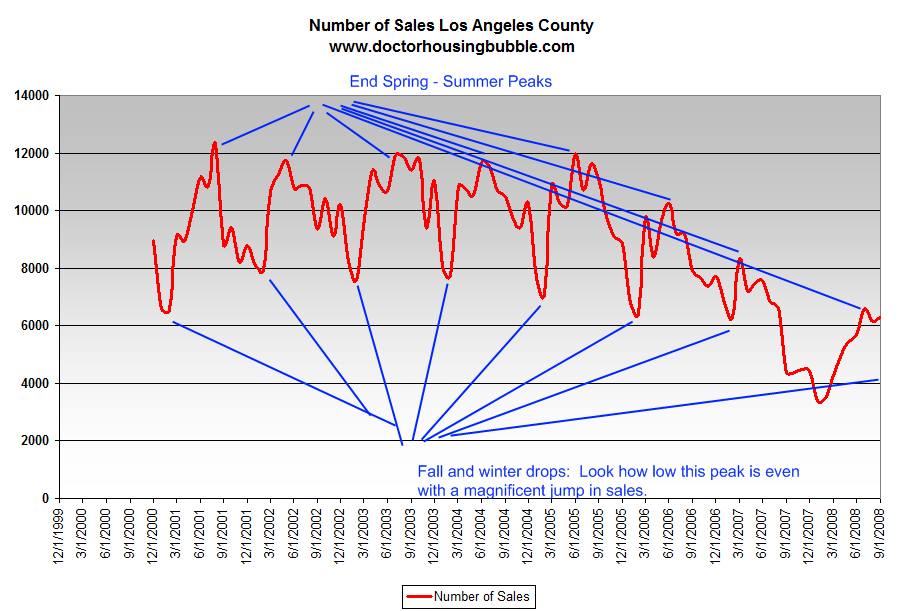

In addition, many of these sales occurred in the middle of the summer before the global stock market smack down occurred. With these numbers my thesis on why home prices in California won’t see a bottom until 2011 is even further reinforced and all 10 reasons are even more viable today. It is also the case that the summer selling season data has just come to a close. This is a typical seasonal pattern. Take a look:

*Click for a bigger picture

Like clockwork, the end of spring and summer are the best selling seasons for housing especially here in California. The above chart highlights this trend to perfection. Take a look at the seasonal drops in fall and winter. The frightening thing is that if you look at the final point on the chart which includes the unprecedented rise this summer, we are at the lowest peak from the last few years. It will only go down from here since:

(a)Â Option ARMs are going to recast in large numbers Q4 of 2008 and Q1 of 2009.

(b)Â This last month does not include the global market fiasco.

(c) California is in a deep recession. 7.7% unemployment rate and the budget is being held together with chewing gum.

(d)Â We are entering into the slow fall and winter selling season

Although there are glimmers of hope in this report, there is much more to be pessimistic about. Prices are going to drop 50% from their peak. This isn’t some doomsday prediction because as you saw, Riverside and San Bernardino are already down approximately 45% from their peak so they will arrive at this milestone first. L.A. County which hit a peak of $550,000 is now at $360,000 or a drop of 34%. If L.A. County can see the median home price lose $190,000 in value in one year, is it a stretch to say we will see another $85,000 reduction in the next 3 years? Or a better question is what is going to push prices higher? Jobs? Demand? Somehow I think believing prices are near a bottom is unprecedented.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

10 Responses to “65% of Southern Californians are Delusional. No wait, 65% Jump in Southern California Home Sales. No wait, 38% Record Median Price Drop. No wait, 50% of all sales are from foreclosures. Housing and Foreclosure Voodoo Headlines.”

sales happen when bid prices meet asking prices. previously there was a relatively wide spread between bid and asking prices, so nothing sold. now, asking prices are falling to meet bids. fewer and fewer sellers are willing or able to hold on their dream asking prices. bid prices will continue to fall as banks tighted credit, incomes fall (aggregate of job losses), and energy and food prices rise.

Any way we can get a graph of sales that goes further back? In all the data I see, I try to go beyond 2001 cause them be the bubble years, where NOTHING is normal. Whats the median selling #s spanning the last ~20 years?

Also…

median OC household income = $67k*

median OC home = $480k

historical ‘multiplier’ for income -> home = 4.7**

67k * 4.7 = $315k

yup. prices still have another 165k to fall to get to historical norms.

* http://huntingtonhomes.freedomblogging.com/surf-city-population-income-and-education/

** http://spreadsheets.google.com/pub?key=pGy0BQU1PZ9And2KJvInRJg

Please Google Simon Bowers of The Guardian UK.

Article written on October 18, 2008 explaining that $70 Billion of the $700 Billion bail-out is going to wall street bankers/staff in the form of BONUSES!!!!

WTF??!?!

Watch for protest news on the “National Walk Out”

I think this is good and bad news. By having a sales increase, it means that the market is functioning, buyers and sellers beginning to agree on a price for a property. It also can mean bad news. Think about this, there was a 30% decrease in housing prices and the year-over-year sales increased which is good. However, the way the economy is in shambles adds uncertainty and fuels fears which pulls buyers out of the market. Point blank, I think the market has a ways to go before we can even begin to appreciate any good news coming our way

The dead tree media continues to push this 65% sales increase number as hard as the 95% of all taxpayers will get a reduction in their taxes claim. Why not honestly look at the figures. 2667 units sold in OC, of which at least 45% were distressed. This means organic sales (MrMortgage/MIImplode term) were 1,467. In September 2007 there were 1643 homes sold of which 14% were distressed. The organic sales then were 1412. Net increase comparative then is 55 units. Woo Hoo! 55 units more sold in OC in September compared with September 2007. This in a County of 3 Million people.

What is also missing is that some of the July/August distressed sales are being spun by investors and resold at closer to market prices. This then means there is some amount of double counting – One sale in July, same property sold in September which is only an increase in flipping, not a transactional increase.

Percentages are such a joke. Your talk about the actual numbers really puts things in perspective. Nice work.

They all better ready for the next wave of ALT A defaults – then on to the POA’s!

http://tinyurl.com/558bbd

Not even close to bottom yet…

This may not be relevant to the current article but I want to share an idea that a government can implement to create a bottom in the market.

This deleveraging problem has three fundamental issues:

The market has recognized that energy production and other essential materials are not going to be in expanding supply. Therefore the model for economic expansion is not going to be sustainable anymore. America will have to think about sharing the resources of the planet or follow the path of war and self destruction. The new focus has to be in sustainability.

In USA the baby boomer generation is starting to retire and the following X and Y generation don’t have the capital to buy the asset that the previous generation has amassed. There is a generational shift happening.

Credit creation and management has been the focus on this economy, credit has been our main product and a big part of the problem.

So I think that to stabilize the markets there has to be a focus on the assets that are the system is based on, and that is housing.

Government has a key roll in propping up demand, but at the same time let some of the natural correction to continue.

Create a tax incentive to new home buyers something between $10,000 to $25,000 depending of the value of the home.

Support a mortgage plan backed by the government through Fannie and Freddy. 30 yr. Fixed only 4% to 5% annual interest rate. But it needs to have some restriction:

You will need a 10% to 20% down. And the more you put down the more you can buy the interest rate.

For the incentive to work you should not be able to sell the house in three years for new home buyers.

And finally it should have a cap in the mortgaged amount from 3 to 5 times the amount of gross income from your tax return in 2007.

Now for the stock market: Move the cap for the ROTH IRA accounts and 401K to double what they are.

heres the reality – a vicious feedback loop is already underway.

http://www.gold-eagle.com/editorials_08/lundeen102508.html

two years from bottom. most people will be wiped out before this is all over.

Our citizens need to realize that the prices of houses in Los Angeles City areas will only decline to a certain level. The city of Los Angeles is land locked. The land under the houses is not declining in pricing. The pricing of house can not decline less than the cost to build a house. The average cost per square foot to build a house in LA is is $200. The average cost per square foot for land is $28.40. We should not hold our breath waiting for housing prices to decline the cost to rebuild turn key homes.

Leave a Reply