Economic Main Street Manifesto: 10 Reasons how this Bailout Fails the Middle Class American Worker.

The question that most Americans have on their mind about this historical government intervention is whether this program is ultimately going to work. In short, no. In this article I’m going to highlight 10 major reasons why this global intervention is nothing more than stitches on breaking economic flesh from preventing the world from going into the infected abyss. Just like I highlighted why the California housing market will not hit a bottom until May of 2011, I believe that this current intervention is simply window dressing on a dry and stale turkey.

Make no mistake, we were on the precipice of systematic failure in our financial system. What has occurred only ensures that we don’t go into Mad Max territory. In addition, the global turmoil has once again cemented the fact that we are all bound by the hip and we are all going to face pain together. A severe recession is baked into the global financial cake.

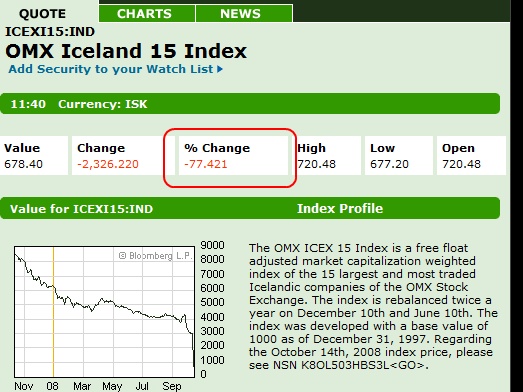

If you really want to see a financial system go off a cliff take a look at the Icelandic stock market which opened up again:

That is precisely what we were on the verge of seeing. Of course Iceland is simply a microcosm of a country that became too dependent on the global 2.0 financial system. A drop of 77% is no small order. The DOW is still 34% below its October 2007 peak even after the greatest one day point gain in history. Ironically as the media touted this saving grace moment little do they focus on that during the Great Depression, we saw the largest gains and drops on the DOW. Volatility does not equal stability.

What we are seeing is a battle between the majority of Americans on Main Street and Wall Street. Most Americans can now see through the nonsense that is the extreme free market fundamentalist perspective. That is, no regulation and let the market do what it will. This was similar to the free wheeling days of the early 1900s. Now, we swing to the other side of the pendulum and become massive interventionist. These free market fundamentalist have a hard time admitting their model of the world had some serious flaws. Specifically, greed is a powerful motivator. Those on Wall Street never had the best intention of those on Main Street and many decades later we are left with an economy that has sold off its manufacturing base and is basically operating on a model of selling cars and houses to one another so we can have a place to off load all the goodies from Wal-Mart. These are the same people that say a government health care system would push us into a Marxist world yet conveniently will give nearly a trillion dollars to their crony capitalist socialist on Wall Street. This is actually the worst form of socialism since the majority of people don’t even get a piece of the action and yet they are paying for it. Like going to a nudity bar blindfolded.

These are the 10 reasons why the global market intervention will have very little impact in your life assuming you make less than $250,000 a year.

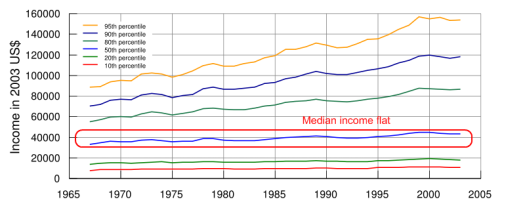

Reason #1 – Stagnant Wages

The current median income of an American household is $46,326. As you can see from the above chart over the past 40 years the top 10 percent of households have seen steady gains (the chart is based on 2003 dollars) while the other 90 percent of our population has seen virtually stagnant growth. That is why most American families may have more money on a nominal level but are actually poorer. What this graph displays is a disappearing of the middle class.

Stagnant wages are also part of the global market landscape. It is hard for American workers to compete with low wage nations yet our insatiable appetite for consumer goods has also led to this downfall. Look at the stock price of Wal-Mart. While the stock market is tanking they are up 14% on the year.

Although many like to beat on the global drum of keeping jobs here in the country, silently Americans are still voting with their pocketbook and buying foreign goods. It is hard to blame the middle class since they are being pinched from every different angle. The economic condition of many reflects this struggling sense of uncertainty.

You really want to break this down. Let us look at this median income family versus the top 0.1% of income earners to see this “fear of taxes””

Annual Gross Pay:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $46,326

Federal Withholding:Â Â Â Â Â Â Â Â Â Â Â Â Â $3,923

Social Security:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,872

Medicare:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $671

California State:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $599

CA SDI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $370

Net Yearly Pay:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $37,888

Annual Gross Pay:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,600,000

Federal Withholding:Â Â Â Â Â Â Â Â Â Â Â Â Â $526,537

Social Security:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,324

Medicare:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $23,200

California:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $149,498

CA SDI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $693

Net Pay:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $893,746

Now you may be thinking, “wow, they sure pay a lot in taxes.” A couple of things. It takes a bunch of hard work to sink a company like WaMu or Wachovia into the ground. Not everyone can drive a 100+ year old company into self-destruction. This above is a quick calculator example. This doesn’t include putting money into IRAs, 401(k)s, college savings plans, rental properties, bankrupting companies, and other nice tricks that will lower their tax base. In addition, Social Security tops out at slightly over $100,000 so anything beyond that is not paid. If this person lives in a state with no income tax, remove that line as well. Anyone in the top 0.1% knows these tricks and isn’t paying as much as many would like to believe and certainly not what I quickly calculated.

Even if these tax evangelists drop the rate on the median income family by 10%, they will only save $392 while the top 0.1% family will save $52,653. Their savings is more than the median household income! Put those cups out because trickle down economics here we go.

So how does this bailout help in the wage column? It doesn’t. The impact in this arena is zero. How is bailing out institutions going to increase wages? It won’t.

IMPACT-METER:Â Zero

Reason #2 – Employment

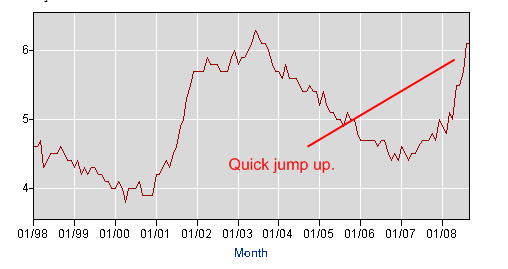

Before you can worry about your stagnant income, you first need a job (a more challenging task as we are now seeing). The unemployment rate now stands at a 5 year high at 6.1% and is steadily increasing:

Since the start of the year we have lost 760,000 jobs. That is not a good sign given that we need approximately 150,000 jobs a month added just to keep pace with our growth. What is even more troubling is many of the jobs that are being lost were contingent on a booming housing market. Not a healthy steady and sustainable housing market but a booming bubble market. That is not coming back. So many of the unemployed will need to be absorbed back into the economy.

How does the bailout help in this area? It has a minimal impact in keeping some institutions alive thus providing employment for those workers. Yet this is only a bandage on a bigger economic crisis. It only avoids the inevitable at the cost of the majority of Americans. How does this bailout help the employment situation? That is, how does it spur job creation? It doesn’t even though it has the price tag that will run in the trillions. Imagine that. A trillion dollar bailout with no job creation aside from the team that will be implementing this plan ironically.

IMPACT-METER:Â Minimal

Reason #3 – Inflation

Make no mistake, the government loves inflation. This is the only way we are going to get out of our $10+ trillion national debt. The worst mega nightmare that is the political economist boogeyman is deflation. Why? Well if you think about it, inflation makes the most sense from the government stand point. If we have steady inflation, that $10 trillion starts to look smaller and smaller as time goes by. If we hit deflation, then we have a fixed amount of debt that we are paying off with weaker amounts of funds.

So even though the government is publicly saying they are trying to control inflation they are silently screaming about the prospect of deflation. Why do you think they did not hesitate to inject the world with trillions in funds which by its nature is inflationary? They don’t care. All they care about is avoiding deflation which will crack the credit markets.

If you weren’t paying attention because of all the background noise, the CPI actually went negative for the first time in August since October of 2006. So if inflation was their true concern, the market has already corrected that. Lower fuel costs, dropping commodities, and lower home prices. Yet just look at their actions. This is not what they want.

The bailout in this regard almost assures some inflationary reactions. So there will be an impact here. A few months ago Americans were screaming about high energy prices. Well, energy has gotten a whole lot cheaper but it also means you won’t have much access to credit. That decision wasn’t taken too well.

IMPACT-METER:Â Noticeable

Reason #4 – Strong Dollar Policy?

U.S. policy makers say publicly they want a strong dollar. Yet their actions show that they want the weakest dollar possible. Why? First, it will help exports but most important it will make our debt held by many foreigners just drift away. In fact, during this economic turmoil the dollar was getting stronger:

This chart is the most telling of all. During the 8 day turmoil the dollar went steadily up. Why? Well as the decoupling myth was being shattered people still went to the U.S. Dollar. It is still 60%+ of the world reserves and in times of panic, people still have faith in the greenback.

What do policy makers do? They enact massive bailout funds and Federal Reserve action that is essentially assuring a cheaper dollar. The world takes a deep sigh but people need to tell any policy maker that stands for a strong dollar to shut their trap because their actions show otherwise. If they really believed this they can do two quick things:

(1)Â Raise the Fed Funds rate

(2)Â Stop all these infinite bailout promises

Again, policy makers would love nothing more than a weak and pathetic dollar. Refer to reason #1 to put the other side of the equation.

IMPACT-METER:Â SignificantÂ

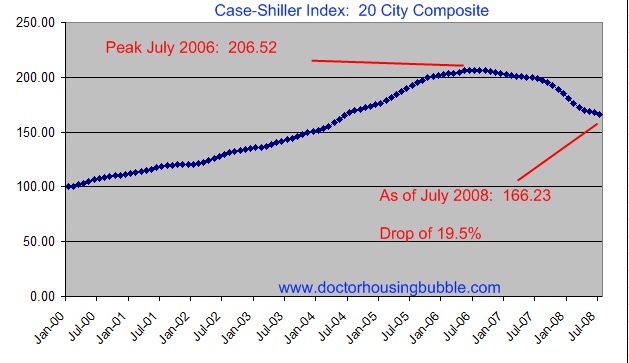

Reason #5 – Housing Prices

The dumbest ideas are usually found on CNBC and CSPAN. The new catchphrase that I hear being thrown around is “the government must stabilize home prices” and I’ve heard this sufficient times from a few anchors. This is frankly one of the most economically uninspired ideas that we can hear. They are calling for a floor on housing prices. Jim Cramer made this call as well after the Fannie Mae and Freddie Mac bailout. The idea was idiotic then and is even more idiotic today.

Why is this a boneheaded idea? First, home prices are determined by local market factors. How much do households make in the area? Are there good schools? What is the employment outlook for an area? Does the buyer have a good credit score? These are all factors that will determine a home price. Home prices historically reflected a 3 or 4 time ratio of the local area income. If the median household income is $70,000 then a $280,000 home is priced within this range.

During the bubble, here in Los Angeles County where the median household income is roughly $50,000 the median home price hit $550,000. A ratio of freaking 11 times annual income! Even now that the median price if $380,000 it is still much too high since income hasn’t moved and the employment situation is deteriorating here.

Take a look at the Case-Shiller Index for 20 of the largest metro areas:

Even though we have seen prices drop from the peak by 19.5%, we need to realize that from the 2000 starting point, we have doubled the price of a home. If we are to believe estimates that home prices are going to drop 30 to 40 percent nationwide, we are merely halfway through. And if you look at housing on a micro level, this makes absolute sense since many of these areas still are too high. So what CNBC and other representatives of Wall Street are saying is actually going to hurt Main Street. Why? It will keep prices artificially high and we are left with another stalled market when wages are stagnant. Look at the Inland Empire here. Prices are off 50 to 60 percent in one year and guess what? Homes are moving! These people really need an economics lesson.

This bailout will only help lenders to clean up some of their irresponsible lending practices. Main Street impact? Very little. Maybe it will help a few more people get loans but if you look at income and employment, we are having a race in the opposite direction. What is the use if a home is $100,000 but people have no job? Take a look at areas in Michigan and you will understand why some homes are being sold for a few hundred dollars.

IMPACT-METER: Minimal  Â

Reason #6 – FIRE Economy

FIRE stands for finance, insurance, and real estate. What a shocker that the government has bailed out Bear Stearns (finance), AIG (insurance), and Fannie Mae and Freddie Mac (real estate). Amazingly these are chump change in comparison to what is unfolding. We are now on the hook for over a trillion dollars in these few industries. Now why doesn’t the government bailout P.F. Changs or Best Buy since they are hurting this year as well?

The thing is, the crony capitalistic model has become dependent on these four areas. In their myopic world view, the pinnacle of an economy is a legion of over paid investment bankers sitting in their Manhattan offices while a fleet of people trade homes to one another comparing notes on what is the best kind of granite for your counter-top. Since 2000 nearly 30% of our employment growth has been in the FIRE economy. So the fact that they are trying to prop this up is a testament to what industries these plutocrats value. You can create an entirely new industry with $1 trillion. Instead, we are going to plunk it down in toxic assets. Smart buy. It definitely tells you who is running the show.

The bailout will only help the crony capitalist and give the impression to the public that all is well. No, unless wages and employment are addressed the silent desperation will only continue while income divergence keeps showing up

IMPACT-METER:Â Minor

Reason #7 – Healthcare

Our healthcare system is broke. I don’t need to tell you that. But with the oncoming tsunami of baby boomers moving from protesting in the 60s to watching their 401(k) take a beating, our healthcare system is going to face major strains in the near future. The entitlement programs are such a gigantic liability that to bring that up in our current environment will probably give us a “throw your hands up in the air moment” were the entire house of cards comes crashing down.

Healthcare costs have been skyrocketing in the past few years. According to the National Health Coalition on Health Care:

“In 2007, employer health insurance premiums increased by 6.1 percent – two times the rate of inflation. The annual premium for an employer health plan covering a family of four averaged nearly $12,100. The annual premium for single coverage averaged over $4,400.”

So even though an employee may have low premiums, the burden is then squarely on the employer. Can you see why our competitive advantage is dwindling? How can you compete when a country like China where this line item is zero?

At this cross road, we either decide healthcare is a right or a choice for the privileged. The median income isn’t going up and our society demographic is going to see a lot more aging people soon. We need to make a decision quickly.

How does this bailout help? Bwhahaha! It does nothing in this area even though we’ll be in the hole for over a trillion when all is said and done. Another strike against Main Street.

IMPACT-METER:Â Zero

Reason #8 – Education

So how are people being lost in the blistering FIRE economy going to retool for the jobs of tomorrow? Most of the job growth is going to be in healthcare (no surprise) and in engineering especially if we go the alternative energy path. But the cost of education is soaring:

The average private school tuition for one year is now close to $40,000. The chart above stops at 2006. Even for public schools, the cost has gone up near $15,000. As wages stagnant, this forces a trap for most. You have no choice but to go in debt to get a college degree to be competitive. Think this isn’t real?

“(LA Times)Â The trustees of the Cal State University system voted to raise annual undergraduate student fees 10%, or $276. A key committee of the University of California regents approved a 7.4%, or $490, raise per year for undergraduates that is expected to be endorsed by the full Board of Regents today.”

This in a state that is seeing massive unemployment and heavily relied on FIRE economy. So here is a double whammy. First, unemployment is sky rocketing and many of these jobs were high paying (bubble) jobs. Now what? Folks need to go back to school with lost income while the cost of education just went up. Things that are vital are going to get more expensive since demand is only going to increase.

The bailout has no impact here whatsoever again. Even though many Americans say they value education they don’t show it in the way they vote. Sort of like saying “keep jobs here!” yet shopping like a maniac at Wal-Mart and buying an import. Nothing wrong with either but it shows the cognitive dissonance now breaking out as anger in the public.

Reason #9 – Energy

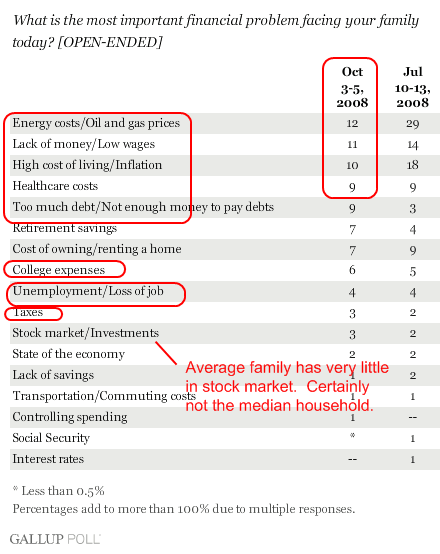

Gallup had a fascinating poll showing that many Americans now do not care as much about energy costs. In a poll done on July 10-13, 2008 29 percent of Americans said energy costs/oil and gas prices was the number one issue. The second issue at the time? Lack of money/low wages which came in at 14 percent.

Now it is a very different picture. The survey conducted on October 3-5, still found energy number 1 at 12% but now lack of money/low wages came in at a close 2nd at 11 percent and a close third was high cost of living/inflation at 10%. Take a look at this stunning poll which only highlights the 10 points we are making here:

*Source:Â Gallup.com

You’ll also notice that very few are worried about the stock market. Even though the media pundits are wetting themselves as they look at their investments most Americans are worried more about the most basic levels of life.  Energy, lack of money (low wages), inflation, healthcare, and too much debt. Seems like the average American knows what really is hurting.

I think during spring and summer when we saw oil hit $147 a barrel, the politicians tried to spin the issue of energy as the source of all economic problems. It wasn’t. Energy should be lower on the list. After all, if people were making $100,000 across the country then $4 a gallon gas doesn’t seem too bad. But if you are unemployed what does it matter that gas now costs $2 a gallon?

We’ll still see fuel much higher than it ever was but this is only reflecting the reality that the Main Street family is on the verge of bankruptcy. Energy was simply a misnomer of the true issue. Wall Street has bamboozled the public and has left us with a huge debt. They have the government by the throat and here we are paying them even more! Look at the issues on this poll! The bailout will have little if any impact on the most important issues. In fact, the tanking market took care of high energy costs and inflation which are high up on the list.

IMPACT-METER:Â None

Reason #10 – Economic Psychology

If you want to see a breakdown of responsibility it would be something like:

55%Â Wall Street/Lenders/FIRE Economy

35%Â Crony Politicians

10%Â The Public

I mean if Wall Street didn’t have this insatiable appetite, people would never have had the money to inflate the bubble. Without massive deregulation, the environment would not be in place. And frankly, speculators and borrowers also share in the responsibility. But I don’t agree like some blowhard radio personalities that this bubble was caused by poor people in sub-prime loans. Please. Yes, let us once again blame the poorest in society for swindling Wall Street out of trillions. The credit default swap market is somewhere around $50+ trillion. Currently there are about $500 billion in sub-prime loans out there. This is beyond that. This is a massive Ponzi scheme perpetrated by greedy and crony capitalistic on Wall Street and their tools in D.C. That era is now coming to a spectacular end.

I’m not sure how the public is going to respond to a forced austerity. We really have no choice here. We have too much debt. With our entitlement programs starring at us directly in the face, we will have another major issue to confront once we work this bailout deal.  Frankly, the central banks are praying this works. The Euro-zone injected over $2 trillion into their system and Paulson is now backing off that idiotic initial toxic waste dump idea and moving faster to capital injections into the “best” banks. How will this work out? Who really knows. In Japan they injected some $400+ billion when their real estate bubble burst and they had a lost decade. Are we to think this time it will be different?

Quietly, I’m thinking many of these central bankers are hoping for a lost decade instead of a global collapse and Mad Max universe. I also think they are trying to help out key parties while their actions clearly ignore the Main Street person. The psychology is already changing. During the debates, I was watching CNN with their little audience meter on the bottom and the quickest way from the middle to the top was bashing Wall Street. Some issues took time to work up or down but whenever someone said “corporate greed” or “Wall Street speculators” the bar shot up. This is class warfare folks. We are seeing a generational system collapsing and many cannot confront the idea that their ideology was so utterly wrong. Many will have to wrestle with their own internal cognitive dissonance. Some will channel this toward unjustified anger and some will adjust to the new way credit will be in the world. At this moment, we need to do all we can via pressure/voting/action that this money is at least channeled to efforts that will help our employment base, help fix the healthcare system, and do things that protect the majority of Americans.

As you can see from the above 10 reasons, these economic measures do very little aside from stabilizing the financial market and giving us a false sense of security. There are many better ways to spend a trillion dollars and Main Street has a few ideas yet Wall Street and the politicians have others.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Â

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

24 Responses to “Economic Main Street Manifesto: 10 Reasons how this Bailout Fails the Middle Class American Worker.”

I love your site and think that your arguments are great. However, I get confused when on one hand, you dismiss arguments saying that the poor and speculators are at fault, and on another that “corporate greed” is class warfare. So who is at fault?

While I agree that the bail-out is just that (not a “rescue), I was a little disappointed by the first point which said, “While the other 90% of our population has seen virtually stagnant growth” regarding income for American families. That’s simply wrong, and not supported by the graph. The graph which is displayed appears to break the population into ten groups by income and track their progress. However, only six of the ten groups are depicted. The graph shows the 20%,50%, and 80% groups, but doesn’t show the 30%, 40%,60% and 70% middle class groups. It is incorrect that “the other 90% of our population has seen virtually stagnant growth.” The poor have had flat income, the higher up the ladder you go, the better people have done. And since the graph goes back to the 60’s, it isn’t the same people who are poor. In the 60’s the poorest groups were blacks and whites. Since then we have imported tens of millions of poor, uneducated hispanics who have “dragged down the average.” We can not expect to import millions and millions of largely uneducated poor people and expect wages for the lowest strata of our society to do anything but stagnate, at best. If results for the 60 and 70% groups had been included you would not have seen stagnant earnings for these middle class groups. The 80% group climbed from around 55K to about 85K over that period. Very nice growth indeed. The 60% and 70% groups would have been somewhere below, with substantial gains also. They’ve taken that increased income, which granted largely came from the bubble economy lately, and bought wave-runners and big cars and too-large houses instead of saving the money or investing it in productive ways through the stock market, as was pointed out. As was pointed out, the productive economy has been allowed to be hollowed out to the point where GE, Ford, and GM teeter on the brink of bankruptcy. We grow and export food, like a third world country, and we have been producing and exporting “toxic waste” derivatives. I read there were $10,000 in derivatives for every human on the planet. The derivatives market is, what, three times as large as the US stock market! It would seem that one of our biggest export items has been worthless, silly paper. CDOs- more worthless, silly paper. The dollar has been strengthening lately, basically from force of habit. When the world begins to realize that the dollar is just another sort of worthless, silly paper we’ve been exporting, look out below. The game is over. Contrary to your first point, thus far the upper end of the middle class has done quite well. And considering the tens of millions of poor people we’ve imported, stagnant wages for the lower groups is actually a remarkable achievement. But soon that will be just a memory. We will have to get back to exporting real stuff to support our “oil habit” in stead of worthless, silly paper.

I can account for much of the increased cost in education. When I went to college we had bare bones facilities and junk cafeteria food. Now colleges compete for students with luxury recreational athletic facilities and fancy food. The buildings are also more luxurious.

Where I last lived they built a new school because the old one, which was totally serviceable, had become dingy and worn. Meanwhile most private schools survive quite well on public school cast-offs and educate their students at a fraction of the cost of public schools while getting better results.

Our concept of what constitutes a necessity and what is a luxury has shifted so far that people have gone deep into debt for what they think are necessities.

Meanwhile those of us who remain debt free are bailing out the irresponsible with our tax dollars so they can stay in homes they never really owned.

Go to yahoo finance, download an excel spreadsheet of the Dow since 1928, and take a look at every time the Dow has rallied by 5% or more. Almost all of the time, they occur before a “suckers rally”, and the Dow ends up being lower later on down the road. This occurs 17 out of 18 times in the Great Depression, 1 out of 1 times in 1987, and 2 out of 2 times in 2002.

The lone exception is 4/19/1933.

Given the history of the market, where do you think the Dow will be in the future? It looks to me like the odds point to it going even lower than 8451.19. Sure, past performance is not indicative of future results, and there has been one and only one exception, but do you really think that human behavior has changed?

I am always amazed by your research Doc! Good job.

During the days of easy lending and getting a loan was as easy as changing your underwear nobody discussed area salaries! The fact that your income did not support the loan did not matter. A comment I heard over and over was ” don’t worry you can always refinance before the loan resets”, made by realturds off course!

Today prices are down but not enough as doc pointed out. our president Mr “W”, on the brink of economic collapse he said the following”with this bailout we will be able to stabilize home prices and get them back up where they belong”.

Basic economics is not his strong side! Even today nobody is discussing salaries. With a mortgage payment a family can afford, they will have money leftover to spent on the local economy such as restaurants and retail. In other words a strong local economy based on salaries!!! I think you need to discuss this issue more doc!

Great points. I 100% agree with your premise for the reason why the government want inflation and not deflation.

Awesome post. Thank you.

Stan, spoken like a true top 10%-er. Do the REAL math, Stan, don’t try to make statistics prove your point: the median HOUSEHOLD income is $46K. Now go back to 1998 and check the median household income for that year. I bet you’ll find that it looks pretty much the same as today’s numbers.

I can take you to neighborhoods and entire towns where there is no “imported Hispanic” poor class. It’s still blacks and whites. Maybe in certain local areas, your argument holds water, but for the most part, it does not. Regardless, the fact still remains that wages must increase if the government and the banksters want to keep housing prices at the artificially inflated levels where they’ve resided for the past 15 to 20 years. Just because someone is stupid enough to pay $400,000 or more for a building does not mean that the building is worth $400,000 — it just means that PT Barnum was more a prophet than he ever was a showman.

Doc, excellent post, as always. Please keep up the good work, you are helping to make a difference.

I think the point stan was trying to make is that the graph shown doesn’t really account for upward mobility. My own case in point: I graduated from college about 3 1/2 years ago. When I started working, I was largely unproven and accepted a temp status with my first job. That temp status rolled to permanent after a few months, then a lateral (well, slightly upward) movement to my next employer again improved my situation, and a promotion and raise after 9 months with them has resulted in my own wages seeing approximately a 50% increase in those 3 1/2 years. That is clearly not reflected on the graph.

My own critique on that particular section of the article is that the graph really should be normalized and show growth rates rather than raw wages. The absolute values shown have little value, especially on a common and linear scale.

Dr. HB,

I blame those ‘poor americans’ (translation-blacks & hispanics) just as much as Wall Street for this mess. Remember, it was you who said buying a house was a privilege, not a right.

TedR

However you want to break it down, arguing over the actual details of the statistics entirely misses the points: The vast majority of us are headed for disaster because we never learned the oldest lessons in the book: Live within your means, love your neighbor, do the right thing, don’t steal, don’t envy, a penny saved etc. The principles didn’t change–we decided we were somehow smarter than all of the wise men that ever lived because we know how to program a VCR or something.

We’re still pumping out lawyers and investment bankers from our schools and importing engineers. How stupid are we??? Our Reagan dogma has to change–the guy was an actor and somehow we think he was Jesus Christ. He was wrong–dead wrong. He made us feel good and started us on the disasterous ski run we’ve been on for almost 30 years. Now we’re at the bottom with a broken leg and the paramedics are only coming for the uber-rich.

@dangermike – the mistake that you’re making is saying that the graph doesn’t account for “upward mobility”. It does – people simply move upward into the next percentile. Just because you’re making more now doesn’t mean that your real wages aren’t stagnant – it means that you were highly underpaid as a temp, and underpaid again at your next job before you finally arrived at your current position. Like yourself, I had a low-paying job when I got out of college. I’ve worked extremely hard (60 hr weeks are the norm), got a promotion and began making more money. But, ever since that first big promotion that put me into the realm of the “working professional”, my wage increases and bonuses that I get each year do not keep pace with standard inflation or the “forced inflation” of higher energy costs, insurance, healthcare costs, food costs and taxes. And now my company is expecting me to work even more hours, because “times are tight, and everyone needs to pitch in.” So even though I’m making $10K/yr more than I did two years ago, I still have less to save and spend after all my necessities are paid. Not to mention, I’ve got less free time. Hence, a stagnant wage. All of my friends are experiencing the same thing, and we all fit in the 60th & 70th percentile.

Lakotawolf, the point I’m trying to make is that the statistics on the chart are incomplete. They are adjusted to “1963” dollars. The chart shows that the “real income” of the bottom 50% hasn’t increased. I happen to think that illegal immigration has played a big role in that, and the immigrants don’t have to live in your neighborhood or even state to drive down wages for unskilled work across the country. But that isn’t my main point. The lines representing real wages for much of the middle class are not displayed. From statistics I’ve read elsewhere, I’m confident that if they were, they would show substantial growth. The poor have held even, and lately begun to sink. The lower middle class has held even, and lately begun to sink. The upper middle has experienced real growth since 1965, but lately has begun to sink. The upper class has experienced the greatest growth, which in the last few years has accelerated. It is simply incorrect that real income growth has stagnated since 1965 for 90% of the population. That’s just not true. And I’m accustomed to a high degree of accuracy in this blog.

Alan makes the bigger point above. We’re headed for disaster because somehow too many in our generation missed out on the lessons about living within your means, saving for a “rainy” day, telling the truth (whether on a balance sheet or a loan application) and helping our neighbors.

Sorry, Steve, I don’t buy it. First, assuming that the trend has continued at its 2002 rate (another huge, glaring hole: why does the chart stop during our last recession?) and wages have been more or less flat across the board, I started between the bottom two lines and have since crossed the second one and expect to past the third in another 5 years. I’m going to have a house and a BMW before I’m 30, and I will be living within my means. My wages are not stagnant. I work hard to ensure that, and that is the power of capitalism and freedom. I don’t care so much if the separation between pay percentiles continues to increase; I will continue to climb to meet them. Now my previous anecdote was merely to suggest that perhaps a previous unpopular comment may have missed its intend mark and to provide some more direction to the discussion that it might have spurred with better focus. The real payload was in the critique of the chart being discussed. I think it would be much more telling to see the data crunch to set a zero date and normalize the reported wage trends to each other (similar to the case schiller chart) and then present the subsequent data as a series of growth trends, preferably on a logarithmic scale, and now that I’ve looked at it again, with a more complete set of data that include a wider range of dates. I think the conclusion presented (rich getting richer, etc.) are indeed sound, however the chart shown is so highly loaded in its presentation that it loses a significant of merit in proving its point.

Another outstanding post by Comrade Dr. Housing Bubble! Does anyone know how to place his name in the hat with the Nobel nominating committee for economics? Then again, does anyone know his real name???

~

The blog reiterated what the Dr. has been saying for a long time: the mother of all bubbles has burst but few people are talking about it in that sense. This is not a cyclical downturn that will quickly pass with injections of morphine to put us back on the old trajectory. This is a paradigm shift, a new epoch and it is long overdue. To give it perspective, I predict that the 21st Century will be as different from the 20th Century as the 20th Century was from the 19th Century. We are already starting to see the dominoes fall from the FIRE industries to the auto manufactures and airlines. These iconic industries will be barely recognizable in the future. Our whole living arrangement will change. Yes comrades, the times they are a changin’.

Hi Doctor, thanks for your thoughts. Your perceptions are, as always, crystal clear.

>

Several comments though.

>

In my mind, the Middle Class or as you refer to them as the “Main Street Person(s)†are the very ones that brought this on. After all, they (we) are the ones that do most of the campaigning and voting in this country. They (we) are the ones that write to legislators; not the poor, nor the few rich (the 96th percentile as your graph suggests). The rich are in fact presently the ones suffering the most in this thing… and as they should for being fools enough to take unprecedented risks.

>

We as Americans want equal rights so we ask our politicians to enact laws which provide them. We want to help the poor, so we allow/ask our politicians to relax lending standards. We want health care for all thus the push toward socialized medicine. We want to protect our elderly, thus increase Medicare/Medicaid benefits. We want to support/promote liberal curriculum in our schools, thus we stop promoting hard sciences. We want cheap goods abd services thus turn to the third-world to provide. We want democracy throughout the world, thus we are fighting wars on two fronts. Just listen to either presidential candidate make promises they cannot keep but promises we want to hear.

>

Problem is, we can’t afford most of what we want so we borrow money from foreigners.

>

Finally, and as always, we as Americans look to place blame for our own poor judgment.

Good discussion going here. I’m surprised no one has locked onto the U.S. Dollar debate and the phony notion that our U.S. Treasury and Federal Reserve actually want a strong dollar policy. They don’t. If that is the case, then why do they publicly state this? Debt.

I think much is being made about the income graph. Here are the facts. The chart is adjusted to 2003 dollars. So let us be clear on that. The current median household income in the United States is $46,326. What does this mean? As of the 2000 Census there are 105,480,100 households. What this tells us is that at least 52.7 million households make $46,326 or less.

Keep in mind that the chart goes back to 1965. So for those 52.7 million households, income has been 100 percent stagnant accounting for inflation. What would be even more disturbing is the fact that we now have many more dual income households. What this means is the Leave it to Beaver typical middle-class family that with one parent in the workforce and the other as a full at home parent is quickly disappearing. So even with that fact, we have more people working just trying to keep up with the cost of living. Again, even if you look at the higher brackets you also have to account for higher healthcare costs, energy, and housing that have sky rocketed over time. Here is a stunning fact. 42% of all households have 2 income earners.

In addition, when you examine the numbers more closely you can see why the middle class is being squeezed. Only 10% of all U.S. households make $118,200 a year or more. Only 1.5% of U.S. households (that is 1,582,201 out of a set of 105,480,100 households). In fact 80% of all U.S. households make $91,202 or less. That is a pretty large number.

I understand people are frustrated on both sides of the debate but even if you look at the Gini Coefficient or other measures of income inequality, this is one of the biggest periods of income inequality in our country. That is simply a fact and you have to ask yourself why is that happening. If you look at the 10 points above, I think you’ll have a better idea.

Dear Dr Housing Bubble,

I look forward to you comparing the current performances of Texas and California art some stage – and explaing why the former is booming and the latter tanking. Indeed California led the charge in bringing the global financial system to its knees.

Why did California inflate its housing out to in excess of 9.0 times household income – Los Angeles the worst in the world at 11.5 times household income – while Texas kept to 2.5 times annual household income through this period of easy money?

Most importantly – what policies should California be putting in place to ensure these destructive housing bubbles dont get underway again? And what can California learn from Texas?

Yours sincerely,

Hugh Pavletich

Co author

Annual Demographia International Housing Affordability Survey

http://www.demographia.com

Christchurch

New Zealand

Latest Release: “Housing Bubble Induced Severe Recession” (Google Search)

I am a managing principal of a small securities brokerage, and therefore have to listen to CNBC’s brainless blather the whole day.

Usually I tune their twaddle out, it’s just part of the background noise, but my ears are attuned to certain “keywords” and “key phrases”, so the yap about “putting a floor on housing prices” made it through all my filters, and put my blood pressure up the whole session.

Back during the rampage, if you had suggested anyone put a CAP on prices, or even put reasonable lending standards in place across the board, you were accused of being a Whiny Loser who just lost out and can’t afford a house because she’s an economic incompetent. Everyone screamed FREE MARKET!.

But now, these same people want to bind the Invisible Hand that is bringing housing down into the realm of affordability, and “stabilize” prices at levels where they are still unaffordable and make no sense, and then wonder why no one is buying.

What the authorities are really trying to accomplish, of course, is a return to the Screaming Days of EZ lending, so we can have an even bigger debacle to deal with down the road, if that is possible. They won’t stop until the country has completely collapsed economically and become another Argentina. Or Ivory Coast.

Hugh,

I think a factor as to why TX didn’t have the same housing inflation as other states is that TX didn’t allow home equity loans until relatively recently (1997).

It is ESSENTIAL that we carefully and correctly identify the problem we face otherwise we might well dismiss those ideas that could save us.

Lots of pundits these days are pointing fingers at the failure of “free market fundamentalism” and praising Keynesian policies, (as if our corpgov had abandoned these policies). What we’ve been witnessing the execution of false flag economics. The “free market” is being targeted for what is really an operation carried out by a Corpgov Keynesian Fascist Frankenstein. Free markets by definition are not manipulated – that’s why they’re called free. Should they be manipulated, by whatever ways or means, they are by defintion no longer “free”.

If you want to see how a truly free market operates, go to the gold and silver auctions on eBay or other sites and compare those final bid numbers to those manipulated numbers coming out of the Comex cloaca.

god bless you “dangermike” cause you will need one to survive with world with your “sharp knowledge.” jesus christ. which college did you graduate from?

we will never have “deflation.” period. inflation/deflation have nothing to do with cpi index or sorts. inflation/deflation is based on the currency in circulation. our government does not have any capital to buy back our dollar. unless our government magically comes up with gold/silver reserve or other capital, we will face continued inflation. in fact, there is a chance for “hyper inflation” if our government continues to “print out” dollars as they are doing these days.

just my 2 cents

Current events are offering each of us a Ph.D. in macroeconomics and finance…for the price of an Internet connection and our own willingness to learn and evolve. It is time to broaden our thinking toward a meta-view of just what the banking industry is, and does.

~

I recommend to any of you who aren’t 100% sure you understand the Federal Reserve Bank, fractional reserve banking, and how monetary policy is set and conducted in this nation…that you watch this 47-minute animated film. It’s a painless, fun-to-watch, and well respected introduction to all of this, prepared by a Canadian artist for a sustainable economics community initiative in British Columbia.

~

Money as Debt

http://video.google.de/videoplay?docid=-9050474362583451279&q=money+as+debt

~

If this link doesn’t treat you well, look up the title, and its animator, Paul Grignon. It also appears in various places on YouTube; search on the title and Paul’s name.

~

I’d like to share some of the ideas for wealth redistribution that we’ve been kicking around here at Chez Ultima Thule…but I’m feeling a bit sheepish about this being my 8th comment so far this month. 🙂

~

rose

Leave a Reply