Real Homes of Genius: Culver City 969 Square Feet Dreaming. When Prime Real Estate gets tough, the tough get West Los Angeles.

Culver City is considered an upper-middle class city here in Los Angeles County. For a very long time, it would seem that the West Los Angeles region was somehow immune to the rules and economic laws that impacted the entire country. This is not the case. It may have taken a longer time for certain niche markets like Santa Monica and Culver City to start seeing any significant drops but the drops are now here. In today’s article we will examine a home in Culver City that has all the HGTV touches but is now a bank owned foreclosure. But first, let us discuss what has been going on in other news.

I have been examining the wealth of data at the Bureau of Labor and Statistics. One piece of data that I haven’t seen being talked about but serves as a leading indicator of Main Street pain is the mass layoff data. What exactly is mass layoffs and how is it calculated? These are monthly numbers gathered from establishments where 50 or more unemployment claims have been filed in a 5-week period. Why is this important? Because it can give you a sense of the severity of layoffs. Larger layoffs come from bigger institutions which are normally a bit more resilient than mom and pop shops. In fact, many small business have less than 50 employees so they would rarely show up in this data. The information here is big companies laying off large numbers of people. Let us look at a chart:

As you can see from the chart we had the most mass layoff events since September of 2001. In September of 2008 we had 2,269 mass layoff events. Keep in mind this can also mean that a company has had more than 50 unemployment claims filed against it. This will be an important data set to look at to determine the severity of the recession we are in.

In addition, it is simply stunning who is looking to get a piece of the $700 billion TARP bailout action. It’s as if an uncle hit the lottery and all of a sudden opportunistic family members want to spend quality time with him. Let us quickly run a list of some of those who have already been given government welfare assistance:

Support Already Received or Committed

Bear Stearns

Bank of America

JP Morgan

Wells Fargo

Consumer Debt

Student Loan Debt

American Express

Hartford Financial Services

Those Standing in Line

GM

Ford

Chrysler

States

Cities

Insurance Companies

There is no reason or rhyme to who may qualify for access to the $700 billion TARP. Initially, at least from the preliminary plan, the major focus was on buying toxic mortgage assets at face value prices. An extremely stupid idea. Well, after some thought they decided to become a symbolic manifestation of the spending habits of Americans and bailing out practically everything within walking distance. How many requests are coming in?

“WASHINGTON (AP) — At least 110 banks have requested more than $170 billion from the Treasury Department’s rescue fund, and many more are expected to have submitted applications before Friday’s deadline.

The requests would come from the $250 billion the Treasury set aside from the $700 billion fund to purchase stock in banks.”

The line is getting busy. There may be a G20 meeting/photo op this weekend but the real group is lining up outside the U.S. Treasury. Talk about your tax payer money well spent. I have to make a quick comment. I was watching CNBC last week and they were grilling the bailout for American automakers. They were criticizing how American autoworkers are paid excessively, have inflated pensions, and suck on company healthcare resources. A bailout for them would be absurd they yelled! We’re talking about $50 billion here, twice the amount already flushed down the toilet at AIG. It was fascinating to see the passion they had railing against the auto industry yet I have never seen such passion against over compensated Wall Street CEOs who make multiple times that of those in the auto industry. They never screamed so loud against the $700 billion TARP or the already large allocation of capital to a select number of banks.

I’m not saying I’m for the auto bailout. What I am saying is these pundits are the biggest bunch of hypocrites I have ever seen and they seriously have contempt for the American middle-class. Even though I disagree with bailing out the American auto industry, I see just as much merit as say bailing out American Express. Yet they have this arrogant attitude of the middle class and blue-collar workers. To them, it is all about financials. What a sad state of affairs. As I was watching the talking head orgy go after the American auto industry I only kept thinking to myself, “and yet we have $2 trillion in off balance sheet securities in the Fed from banks and another $250 billion already allocated to some of the largest banks.” No yelling or screaming about that. These arrogant chatterboxes have probably never worked with their hands in their entire life.

Real Homes of Genius – Culver City  Â

Today’s home takes us to the West L.A. area. The city we will be looking at is Culver City. Once thought by many expert L.A. agents, actors, and otherwise tarot-reading brokers to be an unstoppable region in Southern California. Culver City it was thought had a moat built around the city that only allowed appreciation to come in but the bridge would close when any of it tried to leave. That bridge has now fallen and the appreciation is leaking out of the city.

The above home is a 969 square foot palace with 2 bedrooms and 2 baths. It was built in 1954 and has been sitting on the market for 54 days. This home has the nice touches which we have all come to love via the HGTV network or Flip this House shows.

Nice bathroom. Simple and affordable upgrades. A bucket of bright paint and a few accessories from your local Home Depot or Lowes. We also have the standard kitchen with standout tile:

I’ve seen enough of those shows to see what is going on here. So the home is in good shape. What are they asking for it? How about $459,900. Before you think this is a fabulous deal, let us look at the sales history:

01/20/2006: $630,000

10/28/2004: $415,000 Â Â

Already we see a 27% price decline from the previous sale. That is a significant drop in a so-called prime area. Recently, I’ve noticed a new trend. Now, whenever I pick out homes in prime cities like the last Pasadena Real Home of Genius I get some people saying, “well, its not in the prime area of the city.” So now we went from prime cities to prime locations in the city. Do you notice that the places to hide are getting smaller and smaller? This mega economic crisis will impact every area especially all those in California. Now that the U.S. Treasury and Fed have stated they won’t be using TARP money for toxic assets, 2009 is going to be a watershed year for the $300 billion in pay Option ARMs here in California alone.

The average household income isn’t high for this area. It is currently at $71,203 which will in no way cover the payment for this home. That puts the current yearly income to home price ratio at 6.459. We’ve mentioned before that the mortgage amount on a home should never be more than 3 or 4 times (max) your yearly income. Let us say the average household income family puts down 10% to buy this places:

Down payment:Â Â Â Â Â Â Â Â $45,990

Amount financed:Â Â Â Â $413,910

Mortgage amount to yearly income ratio:Â Â Â Â Â Â 5.81

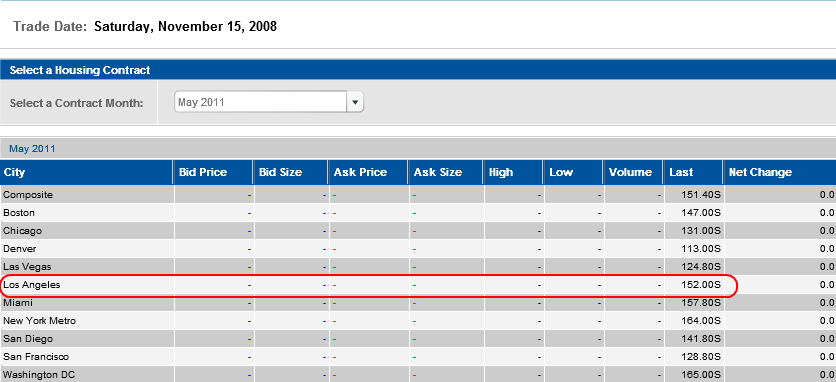

The ratio is still too high. The mortgage amount would have to be no higher than $284,812 to fall within these guidelines. Assuming a 10% down payment, that would put the estimated housing price at $300,000. Still a lot further to go. I’m not the only one who thinks prices will fall further. Let us look at the Case-Shiller futures market:

The last trade for a May 2011 contract put Los Angeles at 152.  What is the current index value for Los Angeles?  189.18. What this means is people are betting that Los Angeles still has 19.6% more to go before hitting a nominal price bottom.  I tend to agree. If you need 10 reason as to why California won’t see a bottom until May of 2011 read further.

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

15 Responses to “Real Homes of Genius: Culver City 969 Square Feet Dreaming. When Prime Real Estate gets tough, the tough get West Los Angeles.”

1. I think you meant to say that the mortgage should be between two and three times annual household income, not between three and four times. And even though the median price for a house should adhere to these median-income value ratios, there will always be more expensive homes in an area where those earning above the median income would want to live. But the 969 SF house shown doesn’t exactly shout “above median income family lives here,” even with the garden hose and formaldehyde cabinets.

~

2. I’m with you on the hypocritical punditry. Since most of these gas bags earn millions of dollars a year, and their target demo is the same (or “wannabes” – you can tell by all the Mercedes ads,) they’re just another head on the propaganda hydra. And now AMEX wants to reinvent itself so it can join the looting of the treasury? Wonderful. You’re right about the motivation.

~

3. The right-wing media will use any bailout of the auto industry, if it happens, to obliterate another union. We certainly can’t tolerate uppity “workers” who have the gall to demand a safe workplace and a livable wage, can we? This time it’s the UAW. That’s almost irresistable to them and you can tell this by how they excitedly include some derogatory term that includes the word “union” when pontificating on “what must be done to save the auto industry.”

~

Why aren’t these guys swinging from lamp posts?

Hey doc and everyone just wanted to share a story that relates to this article.

I work at a HS out here in the IE. I stopped by to see our office manager to talk to her and housing came up. I told her that many of the builders are starting to move away from 3000+ sq.ft homes to smaller 1400 sq.ft homes to cut cost and make the homes more affordable. She shared with me that KB Home (next to Devry where the 57 and 10 meet for those of you who know the area) called our school site and asked if we were interested in office furniture they wanted to donate. My office manager says that she asked why and that the person admitted that they were reducing their work force to 25 from 200! My jaw just dropped. I visited that office before and I’m sure that they employed more than 200 people so it had reduced its work force before this as well.

I just wanted to add that some of these same pundits that you mention also said that universal health care was going to be too expensive. Now it seems like a bargain. The irony is that some middle class people who were against universal health care are now for this bailout because of the fear that the media instilled in them.

PSPS I hear you on your #1. I might be able to afford this place but I would not pay to live there. Its far from a dump but far from being worth the money too.

Another good post Doc.

I see student loans on your list. Gee… so much for living prudently and working while going to school. What a bunch of dopes that did and didn’t get in on the gravy train. Some people never learn.

I am still at a loss when people talk of deflation, which by definition is the opposite of inflation. Home and oil prices coming down is a bad thing? To offset it the government gives away billions?

The auto industry. Come on. I’m from a right to work state and always begrudged people making so much to do so little. Short sided managers that handed the unions cozy contracts then took their bonuses and bailed. I honestly hate to knock American products but resale values alone will tell you the Japanese have been making a superior product for years.

I am afraid people look to our president elect euphorically but in reality there is little he can do to fix this mess.

Culver City had been a good alternative to pricier areas on the Westside. An independent city, with percieved better schools and more of a community, It used to be you got more bang for your buck there. However, as westside property exploded, Culver City went through the roof. A well kept secret became just another big bubble. Looking at average incomes compared to home prices, I think it is safe to say, it will suffer one of the worst declines once the housing meltdown runs its course.

http://www.westsideremeltdown.blogspot.com

We are shifting back to fundamentals and this area has a ways to go.

Wow. Smaller than my apartment more than twice as much a month. Still crazy out there.

Bailing out the auto industry is distasteful but ultimately necessary. Otherwise we’ll lose what’s left of our manufacturing base. The last several months have shown the folly of thinking we can base our whole economy on trading paper and flipping houses; we need to remain a nation that can make things.

I back DHB on including student loans on the government welfare list. I’m not against government welfare per se, since government ought to be a mechanism for smooth flows of wealth to where it will have the best and most powerfully positive results for the most people over the long haul.

~

Yet we have no formulations or standards for what a reasonable load of student loan debt is, neither for an individual nor for our nation. Similarly, we have no larger game plan on what debt, at what rate, for which people, will generate measurable desired results. We just set certain things up as sacrosanct. We throw money at these, and we exempt the richest/most powerful from paying their share and squeeze the middle through threats of falling into the underclass. Then we privatize the gains and socialize the costs.

~

College education has become an expensive rite of life and class passage. Its relationship to actual observable outcomes, like the ability to think, observe, communicate, interact, and work productively, is far less certain.

~

The Ed Biz constantly trots out studies that show that if you get this degree versus that one or none at all, you’ll make more money than these other people they compare you to. But these studies cherry-pick their comparisons and ignore macroeconomic trends. They attribute all rises in income to degrees, and all falls to lack of them. They ignore the fact that EVERYONE’S dollars have been systematically devalued since the ’70s, and EVERYONE’S wages suppressed in real terms. They gloss over the seizure of the Ed Biz by corporations, which has turned education into a life-long schooling-acquisition tax whose profits flow mainly from the middle class and mainly to the corporations.

~

These studies also ignore the fact that when the education cartel makes sure that no one can get hired in higher-paying jobs without a degree, of COURSE people with degrees will get paid more.

~

For an example of this, compare high-skill-level job listings for, say, federal civilian jobs (go to http://www.usajobs.gov/), and similar state jobs at, say, the UC-Berkeley. The ones I look at most often are IT project managers and engineers.

~

In federal civilian job hiring up to about GS-13 or -14, what they assess is demonstrated skill and experience. If you have that, but no degree, proven experience is considered just fine. In many of the federal civilian job listings, you will see an item that notes that college degrees are no substitute for the proven ability to do the job with strong positive results. This is as it should be.

~

In Ed Biz jobs (public or private, in my experience) it goes *exactly the opposite way*: you can substitute degrees for proven experience and skills. They don’t care about your skills and experience so much as the fact that, at some point in the past, you bought their product! And, of course, that you can conform to the Ed Biz culture of postmodernism, political correctness, and youth-worship.

~

I constantly advise people to forget about how they can get the debt for a college degree. If you can’t afford college, put it off till you can. There are so many options for navigating a useful, challenging, productive life. Too many people want to substitute debt-funded degrees for wits and skill, partly because the trades, or life education, are so hideously devalued in this culture.

~

We are reaping the harvest of this classist approach to American life and society: at just the point where we need to live by our wits, and work our way out of the problems we ourselves have created, we are looking for more and more ways to extend the dance of debt-funded class accoutrements.

~

rose

There seems to be a massive effort to save the unrealistically high principal with an equally unrealistic low interest rate, when the problem would be smaller by lowering the principal to a realistic level and raising the interest rate to a realistic level.

It would make more sense to write the principal down on the outstanding loans by 30% (considering the locales causing most of the problem have dropped in value by more than that) and simultaneously moving the loans to a fixed rate at say 8.5%. The banks would have to take a 30% writedown, but the total interest paid would be roughly the same (and possibly more). Meanwhile, the borrower saves roughly $300 a month. At least this way the banks have a known loss of 30% of principal – right now nobody knows what the loss is and is pricing in losses of 70% or more (considering the prices Chase paid for WaMu, and other takeover purchases).

A 30% shave won’t save every bad loan, but it would certainly reduce the volume of foreclosures straining the system; and at the present rate of REO sales a 30% across-the-board haircut might be prefereable to the 60%+ haircut taken on REO sales. A fixed 450K loan at 6.25% returns slightly less overall interest than a 315K loan at 8.5%. But knocking a 450K loan down to 315K sounds better than foreclosing and selling that same property at 250K. Instead we get plans from the FDIC et al that leave the ridiculous principal alone and play games with the rate and term and sales provisions

Lowering the principle seems to be the most logical approach in that we “all” know that the values of these properties were based on money/income that never existed. But there is no incentive for the banks/gov’t to do that since that would be facing reality…keeping the values high also gives many the idea that we are not in a recession. And of course we don’t want property taxes to be affected with many states already facing large losses with more to be expected.

Why should we bailout the automakers? They haven’t been able to compete because their costs are too high and their products aren’t as good as the Japanese vehicles. I don’t feel like subsidizing autoworkers at over $100/hr!

The automakers must renegotiate their contracts with the UAW and bring their costs in line with reality or go out of business!

Toyota and Honda make cars in this country and they aren’t looking for a handout from Uncle Sam.

Dr.,

I love ya, you make total sense, but you are scaring the bejesus out of me!!!!!

compass rose,

I agree with you about the student loans because that’s an issue that hits close to home. I have a lot of student loan debt obtained to fund a law school degree.

You see, some college degrees are worthwhile and some are worthless. I know people with college degrees who learned engineering, accounting, law, medicine, biology, business, etc and they have good jobs making good money, and no amount of experience would satisfy the necessity for a degree. College teaches the basics and the work experiences builds on that.

On the other hand I have friends with liberal arts degress who are customer service associates and shelf stockers. They were lazy and unskilled to begin with and college was just four years of dope smoking and binge drinking and now they’re paying for it.

The real issue is that college has gotten VERY EXPENSIVE. My law school was $30k A YEAR. My boss graduated from Northwestern 35ish years ago and it was $3,000 a year.

The reason education has gotten expensive is student loans. Think about student loans for a second….large sums of money given to people with little or no credit history, expected to be paid back over 30 years, some with variable interest rates, and when it comes time to repay them after graduation, the borrower has little disposible income. Sounds like a textbook subprime mortgage to me. What’s even more insidious is that they also have the option arm neg am provision too. If you graduate from school and can’t make the payments then you can pay a teaser rate and the rest get tacked to the principal balance!

Schools encourged students to borrow as absolutely much as possible. They raised tuition every year knowing that students would just borrow borrow borrow. Fast forward to 2003 and law school costs $30,000 A YEAR.

Well, those days are over. Student loans are more dififcult to obtain and private student loans are even more difficult. Who can go to school at $30k a year without loans? Not very many people at all.

Accordingly, expect us colleges and universities to be another casualty of the credit crunch. Which is a good thing because maybe they’ll start lowering tuition to attract students. People like me, 30 year old guys making $80k a year and $140k in debt should be a thing of the past.

Now that’s PRICELESS…

the UAW is just receiving a “living wage”…

geez I wish I could make as much as some jackass bolting a fender on a car but I was too lazy and incompetent so I just settled for a Master’s degree instead.

THEY EARN EVERY PENNY!!!

FYI, all this about autoworkers making $75 an hour is BS. They’re making around $40 an hour. That’s still high pay, but it’s not what the propagandists say it is.

According to the linked page, the higher figures come from combining the wages with the average pension payout to retirees. (In short, it’s BS. Imagine if someone said your wage was the sum of your hourly gross plus what the company is paying retirees.)

Also, the article says that pensions were taken away from the automakers — there was a big payout, and now the unions manage the pensions. So that number is even more BS.

Auto companies need to adapt. It’s not the UAW causing these companies to fail.

What the UAW has done, for years, that is unfair, is preserve retirement benefits by selling out the new members. They negotiate two-tier pay scales so the new people get paid less than the veteran workers. So, even those complaints about high wages is ringing hollow — as the workforce ages out, the new workers are coming in to earn less… and basically pay for the retirees.

I agree with Klesl, it doesn’t add up. I do think that bailing the auto industry is a necessary thing, or at least as necessary as the subprime/wall street bailout. Keep in mind all of this bail out stuff is a “loan”. Yeah, right.

Leave a Reply