Real Homes of Genius: The Downey Twins. Properties that Reinforce a Long and Drawn out Recession. Smallest Home Ever. 364 Square Feet.

The catchphrase of the day seems to be capitulation. Like the daily word on Sesame Street. Things have gone from bad to worse in the matter of a few short and arduous weeks. I’ve started getting messages from people that say we are nearing a bottom. That is absolutely incorrect. The worst is yet to come.

Even if certain markets are bottoming out like oil or maybe real estate in Detroit, that doesn’t mean that high flying bubble states like California are near a trough. In fact, the unemployment numbers for individual states came out last week and California is now at 8.2%, the third worst rate in the country. That is 1 of the 10 reasons why we will not even see a bottom until May of 2011. Sure, some states are bottoming out but how much lower can you go if homes are selling for $50,000 or $60,000? Or how much lower can a stock go if it is trading in the pennies? You can only go to zero which seems a common occurrence in today’s action packed market. The median price of a home in California is still $300,000 which seems a lot better than $505,000 reached during the peak but it really is only a siren call for those who want to lose some additional money. Be wary of those gorgeous and angelic voice calling you into the market.

This weekend 3 institutions failed, 2 of them being here in California. The lenders in California that failed were toxic mortgage experts and connoisseurs who specialized in the tsunami pay option ARM loans that will recast in large numbers in 2009 and 2010. Downey Savings and Loan based out of Newport Beach and PFF Bank and Trust out of Pomona. Downey Savings and Loan had nearly $13 billion in assets when the FDIC got involved. The so-called receiver and proud owner is U.S. Bank. The FDIC estimates that upfront this will cost the FDIC fund about $1.4 billion for Downey and $700 million for PFF, (these numbers are ridiculously low). These lenders are toxic supreme with all the toppings. Any models they are currently using are out the window in 2009.

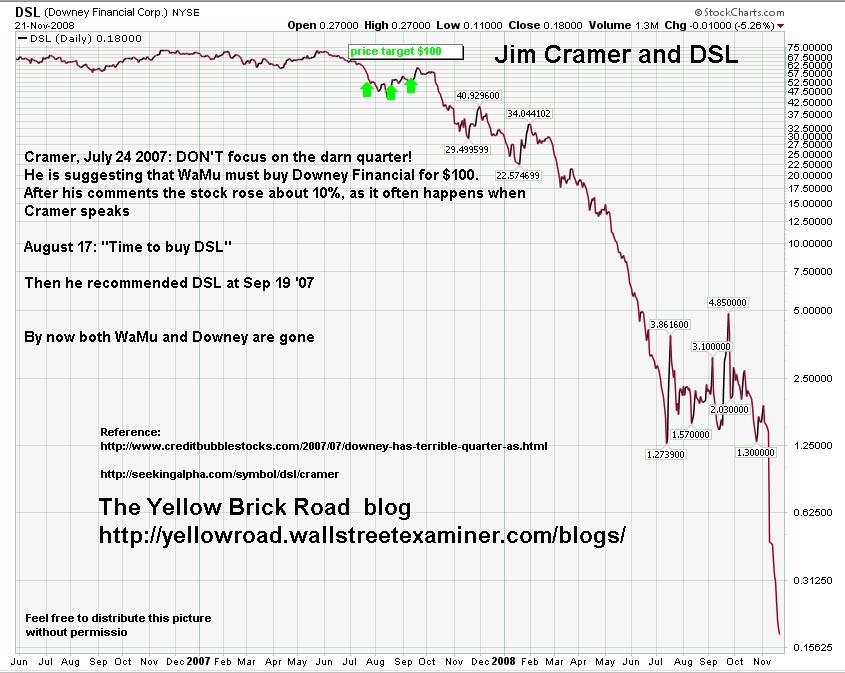

In honor of Downey, today’s Real Home of Genius Award will be given to 2 Downey homes. Before we examine the homes, let us first take a look at Jim Cramer who we talked about in a previous article critically looking at his stock picks. Cramer, at one time was pumping this horrific and toxic stock. The Wall Street Examiner has a nice chart showing Cramer’s uncanny ability to pick winners like Bear Stearns and Downey:

[click for a clearer picture]

In fact, on July 24 2007 Cramer with his psychic abilities was hinting that WaMu should buy Downey at $100 a share! Bwhahaha! Yup, the WaMu that utterly and completely failed this year. Then on August 17, he mentioned it was “time to buy DSL” which was not a good move since this is the inflexion point where California went off a cliff. On September 19 2007 he recommends the stock yet again. Great stock picking ability! That crystal ball has been spot on. Both are now gone only one year later.

But what could be the biggest news of the week is Citigroup is now trading at $3.77 a share when only a year ago it was at $35 a share. Take a look at the chart:

We’ve talked about how Citi was going to be cutting over 50,000 jobs to remain efficient (and alive). It is hard to remain efficient when you have 374,000 employees on the payroll and your company is now in the single digits and going lower each year. This is one institution that would be too big to fail. This right now should be the biggest story. All other failures including AIG, Lehman Brothers, Bear Stearns, and whatever else that has failed doesn’t even come close to this. Citi has total assets of $2 trillion on their books. They also have $1.9 trillion in liabilities. This is definitely something to keep our eyes on.

People keep pointing out similar bailouts in the past. The airlines, Chrysler, and help in Long Term Capital Management and assume that we’ve been here before. We haven’t. In those times, we had at any pressing moment maybe 1 or 2 big events happening at once. Today? We have a systemic meltdown in everything all around the world. The big 3 automakers want a bailout. We’ve already allocated $700 billion in the TARP program for banks. AIG an insurer is now partially owned by the government. We now own Fannie Mae and Freddie Mac. Major banks are failing on a weekly basis. Retail sales have fallen off a cliff. We haven’t seen stock declines like this since the Great Depression. This has no precedent because everything is falling at once. The only other precedent is the Great Depression. There was a reason that we started the Great Depression series well over a year ago. The American public is now having bailout fatigue because none of it is really working on Main Street.

Let us now go to Downey with our Real Homes of Genius Award.

Downey Love

Downey is a typical working class suburb of Los Angeles. These are the areas where most of the delusion really took place. They had the appeal of nice starter homes for working class residents but didn’t have the charisma or the zip code in Santa Monica. This home is the smallest home we have ever featured on the Real Homes of Genius series.

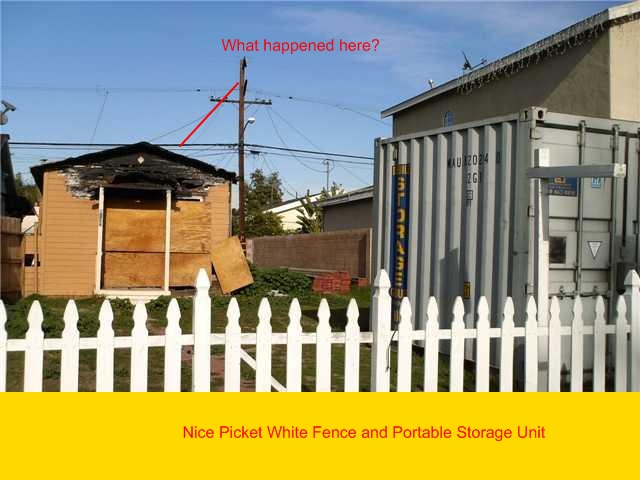

At 364 square feet with 1 bedroom and 1 bath, you’ll have a lot of fun hosting parties here. It looks like charcoal above the door with boards lying nicely next to it. We’ve seen a lot of Garbage Can 2.0 photography but this now adds a new feature. Garbage Pod 1.0 technology.

You would think that they are giving this house away. It is currently listed at $160,000 but let us look at the pricing action here which is manic and wild just like the grass in the picture:

Price Reduced: 03/08/08 — $370,000 to $240,000

Price Reduced: 07/03/08 — $240,000 to $210,000

Price Reduced: 09/29/08 — $210,000 to $189,000

Price Reduced: 10/08/08 — $189,000 to $170,000

Price Reduced: 10/27/08 — $170,000 to $160,000

Bwahaha! Someone in March of this year listed this home at $370,000! Hold on a second. Bwahahaha! You have got to be smoking peyote to think this place would have gotten that price.  Its as if someone on the street asked you, “how much do you want for that shirt?” You look down at your shirt and with a cool response say, “$5,000.” Someone should be embarrassed for asking that price. Since March, this home has quickly been falling and falling as any 364 shack should in a reality based world. What did this home once sell for?

Sale History

06/01/2005: $235,000 *

02/01/1994: $62,500 *

It looks like this home was taken back 2 times in history so it is hard to say who really owned this home. It may have been on the lenders book for sometime. Yet whoever listed that first price deserves an award in delusion.

Our next home is a nicer home that isn’t saying much compared to the above modified Doritos bag. This home was built in 1923 and has 2 bedrooms and 1 bath on 1,036 square feet. This is a short sale and the current price is $199,000. We are seeing a lot of prices like this now in Los Angeles County when only a year ago, you saw only a handful. What did this home once sell for?

Sale History

03/15/2005: $425,000

Over a 50% discount here folks. Keep in mind the lender had to approve this so you now get an idea of where they sit at the bargaining table. Why would anyone rush out and buy homes right now? They are in a corner and each day someone doesn’t buy a home like this, 2 more distressed properties come on the market. Just look at the state unemployment rate. People can’t pay for their homes with no jobs. I’m not sure what reason we have that prices will be bouncing up. The only reason I’ve heard is that prices have fallen so hard already. That is not a good enough reason.

Let us look at some of the facts for Downey and this area in particular:

Income

Median Mortgage Debt: Â Â Â Â Â Â Â $39,443

Average/Household: Â Â Â Â Â Â Â Â Â Â Â Â Â $62,665

Per Capita: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $21,518

Average household income is $62,665 which isn’t much. If you want to do a 3 times annual income ratio we get $187,995 for an upper price limit for a home. I’d be cautious about this since the number is an average and not a median which would be a better indicator. The few families that make 6 figures a year skew this data and that is why the median is a better factor. But even with the average, this home with a 50% price cut is still too expensive. The first home, with the portable pod and wild grass is too expensive even if it was being given away.

Today we salute you Downey with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

19 Responses to “Real Homes of Genius: The Downey Twins. Properties that Reinforce a Long and Drawn out Recession. Smallest Home Ever. 364 Square Feet.”

Citibank–$2×10^12…a trillion here and a trillion there and pretty soon you’re talking about real money…Forex: running to the dollar for safe haven is like running under a tall tree in a lightning storm, don’t you think? As long as my fantasy football players did well. Wonder what that Jolie girl is up to? Did you see Americans Idle (542k last week alone!)? What is this psychological trance everyone is under? Am I taking crazy pills? This is not good. Is this thing contained still? I’m thinking not…I got tickets to Planet of the Alt-Apes, but I don’t want to go.

Our living room in our tiny 2 bed/1bath apartment is about 364 square feet. Does this house have a living room?

Thanks DHB. I live in Downey and have been looking at homes here for over 2 years in Downey. The shack you have pointed out has been on the market for quite a while and the is still overpriced. What I have noticed in Downey, and in other liveable neighborhoods like the ones in La Mirada and Bellflower is that the prices for a descent 3bd 2bath 1500sqft range from the mid to high 300K. Prices are beggining to reflect the distress of the banks and I cannot wait to see what happens when unemployment cracks 10% and the Pay-Option arms begin to reset in these nicer neighborhoods. I think we still have another 2 years until the psychological effect of cheap foreclosures have an effect on non-distressed home sellers.

no no no no.

This house must have been a “scam shack”.

Who in their right mind would pay even $75K for that?

Who is making $125K a year that said, yes, that is the house for me! Do I sign on the line that is dotted?

You would think that someone that is making $100K a year or more would aspire to more than a 400 sq. ft. house.

I think this “scam shack” was simply used for mortgage fraud, maybe several times.

Of course, large portions of California may be used for mortgage fraud.

Maybe that storage bin is being touted as a “guest house”

and the back door with the arson evidence is really just the entrance to the built in smoke house where the high roller can have the help smoke hams and turkeys for the holidays.

“364 square feet” Haha haha ha ha ……my 35 ft 5th wheel RV with slideouts has more sq footage than that and has a dishwasher, washer and dryer, microwave with a full kitchen complete with a pantry, bath with a full size tub/shower & 5′ lavatory counter area, a separate bedroom with a walk-around queen and tons of closets and storage. Based upon the price of this house, I am now offerring the RV for sale at a modest $150,000. Anyone interested?

Comrade Housing Bubble,

~

So little time, so much to do! Why are you wasting it on Cramer? I stopped paying attention to that clown years ago and so should you.

~

Now, here is another yahoo that can’t see the forest for the trees, Lawrence Yun, Chief Economist of the National Association of Realtors. Here a quote from today: The Realtors said the drop was due in part to “a significant downward distortion in the current price from a large number of distress sales at discounted prices.” Obviously if you see the price action as a “distortion”, you might as well just start picking numbers out of the air.

~

There is only one credible mainstream market observer who is even close to being right and that is Harry Dent. He says that, basically, home prices have to drop by about 50% and there is nothing anyone can do to stop that.

~

Be brave Comrades!

What isn’t pointed out nearly enough is the flippant, ‘you couldn’t give this thing away’ point that was made by Dr. HB. Here’s the thing: if you gave that 1/1 to me for free, and free of any encumbrances, I wouldn’t take it. Why pay the property taxes on that in the middle of nowhere? Why worry about whether someone is turning it into a crack den? The place is a giant liability. You’d have to pay me $20,000 before I’d even consider taking title to it – and then I’d tear the whole thing down and open up the lot as a community garden.

SteveJust,

What the hell are you saying? Obviously you haven’t been to Downey. In the end that thing will have real lot value. Maybe it’s too high right now, but Downey is generally a nice place.

Oh, my. I’m thinking the bathtub must have a flush mechanism, because there’s no way a commode fits in there, too.

Correction to my previous post. I should have given props to Peter Schiff who also made the same call as Harry Dent.

It’s all location. Thing of the advantages: Paint entire interior with one gallon of paint. Vacuum whole house in a couple of minutes. Barbie furniture instead of that big, bulky stuff. Couple of tiny paintings and it would be like the National Gallery. Toaster Oven could adequately heat the whole place.

Don’t be a Bogart, Willard…pass that stuff on!

If you go to YouTube & serch for Jim Kramor meltdown, what you will find is just as disturbing as many of todays stand-up commics you find on HBO or Comedy Central. Incredible how CNBC keeps that nutjob on the payroll. Oh! that’s right, Larry the great American Cudlow is also there. I guess the inmates are running the psycho ward.

Northern Ca. isn’t doing much better.

You can get foreclosures for around 80G already in Sacramento.

Is it worth it? No. They are gutted shells with any trace of copper wiring missing.

But what is getting really scary…. CRIME.

We are now seeing more and more 24/7 operations that are being robbed.

For a measly couple of 100 bucks… they hold up convenience stores left and right. Welcome to the Christmas Season. We pay in cash that we just got from the friendly neighborhood stores’ till. Because the credit cards don’t work anymore.

I lived in downey for a year and a half –during the bubble years actually (2005-2006). It amazed me how many huge customs homes were being built there. One thing I hated about living there was the city has A LOT of heavy street traffic. Used to drive me nuts…

Yup. that’s what we had in mind for our henhouse…

Well all you cynical types need to drink a strong cup of reality check because whatever you see I see a home that went from $1000/sq.ft. to $500/sq.ft. and that to me means time to call my broker!!!

Ha ha broker that’s funny because the more business we do the broker I get

Leave a Reply