Banks save while U.S. Consumers are Expected to Spend: The Convoluted Problem of Creating a Debt based Consumption System.

I’ve read my fair share of financial books and I am certain that many of you have picked up a book regarding finances. Many times, these introductory books caution the reader that going into massive debt is a sin (or at the very least a hindrance to your financial independence). These books will usually show you the contrast between a dollar saved and compounded over time instead of someone burning that dollar on a trip to Las Vegas. The underlying premise is simple. A dollar saved is a dollar earned. This important caveat has been missing for many decades in the U.S. People sometimes forget that in order to become wealthy, you actually have to save your money instead of consuming it. Is it any wonder then, that the U.S. Treasury and Federal Reserve trying to liquefy the system with access to credit, causes extraordinary confusion with most Americans simply trying to manage their finances?

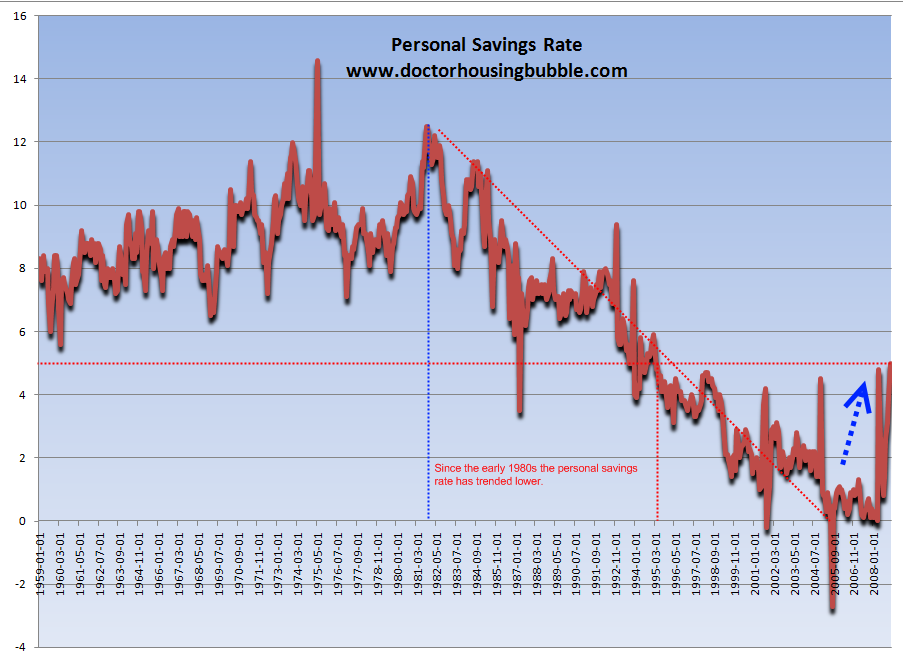

To borrow a word from a former champion of easy credit, that is the conundrum we now find ourselves in. Recent data for January showed that the personal savings rate of Americans jumped up to 5%. This is the highest rate since 1995. This should be good news right? After all, saving money is espoused as a virtue of the highest order in 90+% of most over the counter financial books. Before we argue the merits of this, let us first look at the personal savings rate over time:

*Click for sharper image

A couple of dramatic trends emerge from this chart. First, Americans have been saving less and less of their disposable income since the early 1980s. We’ve been on a 30 year debt induced buying spree. The markets during this time have witnessed two of the largest bubbles in history that with the tech bubble and now the gigantic housing bubble. As we all know, bubbles in the end do burst. So it isn’t a surprise that we are now seeing stock wealth evaporate to not only the pre-housing bubble era, but we are now squarely into the tech bubble era:

What is fascinating about the chart above besides the clear double top, is both tops were very close in peak with each bubble even though the tech bubble and housing bubble were completely different beasts. You have to ask what was the combustion that set these two bubbles off? Of course, that was access to easy credit at both the personal and corporate levels. Americans are struggling with a housing market that is showing strong indications that it will be down by 50% once the bottom sets in nationwide. Yet what we are hearing from the corporate sector and the government is to be prudent yet actions speak louder than words. That is, keep on spending ye hamsters! No wonder why Americans are confused.

Yet the troubling thing about that 5% jump is first, part of it has to do with COLA to items such as Social Security but also, over two-thirds of our economy depends on consumption. Not only does our economy, but many countries like China and Japan are heavily dependent on the U.S. consumer.   They may trying to look over at Europe for help but Europe is having deeper systemic problems which in itself is shocking. There is simply no argument left regarding the idea of decoupling. Our economic system is a global one and reminds us of the image of a butterfly fluttering its wings in Brazil and causing a chain reaction that sets off a furious storm in England.

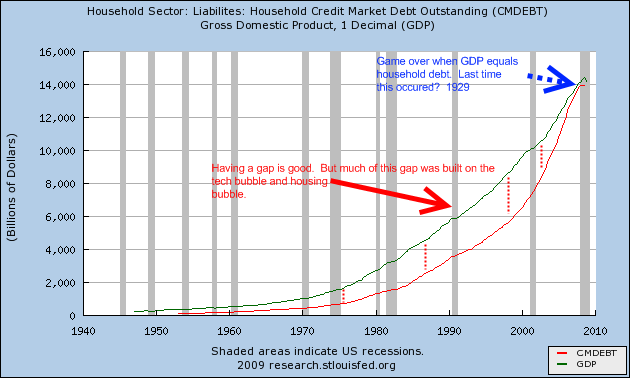

There are many reasons why this bubble burst. Credit collapsing. Psychology shifting. Yet one main catalyst was the crossing point between GDP and household debt of Americans. The number was $14 trillion:

The last time GDP equaled household debt (i.e., mortgage debt, consumer debt, etc) was in 1929 right before the epic crash preceding the Great Depression. The above chart clearly depicts this end game of the debt bubble. If you bring this down to a more understandable level it makes complete sense. Just imagine a family making $40,000 a year but having $40,000 in debt. Unless they have a sizable amount of savings (which the above charts shows they do not) then they are virtually living month to month. Any shift in home prices or stock market values is enough to make them insolvent. And this is what is happening with banks. You have banks like Citigroup with total assets of $1.9 trillion and liabilities of $1.8 trillion. That gives them a working capital buffer of roughly $100 to $150 billion depending on what sources we are looking at. And many of those so-called assets are mortgages. Let us just assume that their assets decline by 10%. A modest number since some of these assets include mortgages and mortgage backed securities. So that $1.9 trillion is now $1.71 trillion. They are now insolvent. And that is virtually what is happening in the system and why the U.S. Treasury and Federal Reserve are flooding banks with capital.

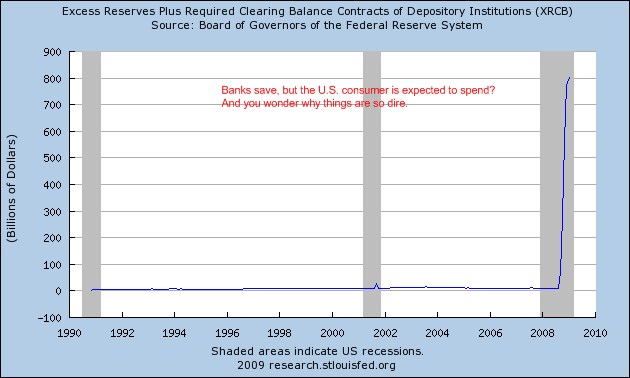

So on a micro and macro scale this is playing out thousands of times a day. Yet while the balance sheet of Americans gets pummeled, the savings of banks increases courtesy of the taxpayer:

And this is probably the biggest swindle of the entire system. These banks were given taxpayer money to ideally float through the already corrupt system and make its way into the hands of the average American family. This has not happened as the above chart will show. Why? Well taking Citigroup as only one example, banks realize that their balance sheets are not going to be getting better anytime soon. They know more write downs on their assets are imminent. In fact, I have recently started hearing from both sides of the aisle from Republicans to Democrats some idiotic notion of suspending mark to market.

Mark-to-market accounting or FAS 157 is a method of accounting that puts a market value on a financial instrument that might not be liquid or selling in the market currently. For example you might have future options that expire in one year so if you assign a value to the options, you would put a price on the asset if you were to sell them in the open market. Much of this was pushed because of the debacle and shenanigans that came from Enron. How quickly people forget. This is a reasonable rule yet the money hungry moneychangers want to put this on pause because they are in Pollyanna mode and think housing prices, which are connected to many mortgage securities, will somehow come back in the near term and thus increase the value of the assets. Yet here is the problem. The firms are bleeding money because no one really knows how long it will take for these values to come back (if they ever do). And the problem is complicated. We are talking long time horizons and many of these firms will not remain solvent before these assets regain their peak values. It is an absurd notion that comes from the school of crony capitalism. If we suspend mark-to-market, then these institutions can go back to valuing these assets at whatever they feel is the peak value or price they acquired the asset. Wouldn’t we all love this accounting for our own household? Sure, that Escalade I bought 10 years ago is still worth $50,000 because that is what my receipt has. Please. If you think it through it only perpetuates the same fraud and obscurity that we are trying to clean out of the system.

And so we are left dealing with the fall out. Most Americans by saving are doing the right thing. Yet the system is setup to reward debt and spenders but this system could only continue so long as foreigners kept propping up our debt. That game seems to be coming to an end. The fact that the markets are now at 12 year lows tells us that much of those gains were completely based on access to easy credit. The fact that the S&P 500 has come in with record low earnings tells us that companies are feeling the pain on a real level, forget the mark-to-market battle.

What needs to happen is we go back to those savings patters in the above chart of 10% or so and start producing. How can people believe that flipping homes to one another and enriching bankers was the pinnacle of success? That somehow we would become wealthy beyond our dreams by adding a Jacuzzi in the master bathroom while putting granite countertops in a kitchen. And now we get more crony capitalist calling for a suspension of mark-to-market while implementing mark-to-make believe.

Going back to that simple mantra that a dollar saved is a dollar earned, we need to realize that there is something in being prudent and responsible with our capital. This goes for people on a personal level but also as a country. Debt will always be with us but to call what we have been doing for 30 years as prudent is like believing baseball players have never used steroids.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

17 Responses to “Banks save while U.S. Consumers are Expected to Spend: The Convoluted Problem of Creating a Debt based Consumption System.”

The government attempts at reviving the “shadow banking” system of securitization is not being well received by anyone. I for one am disheartened with the entire TALF idea. Banking existed 30 years ago. A bank kept the paper on their books, they made sure the borrower was worthy and they footed the loss for a bad call.

Now, we are expected to pay the IOU’s for these gamblers. They played their cards and lost. Why is that my problem? The American people “get it” and are saving. But the government has no other plan. They seem to only know one thing. Give the banks money – my money – your money.

Why? So they can return to business as usual. No thank you.

BTW – Paragraph 5 – “right downs” should be “write downs.” We are in a big mess now and no one at the top seems to have the guts or knowledge to make the right decisions. Loved the article.

Thank you for your writings.

Hey Doc,

Great article.

A little off topic here, but I’m wondering if you’ve done an article showing how these banks only have about 1/3 of the properties on their books listed in MLS. I figure they are just waiting for the gov’t to buy these properties off their hands.

Whatever the case may be, if the 1/3 quantity is accurate then it seems we have about 3 years worth of inventory (2 years of shadow inventory).

Dr HB

If you played “beisbol”, you’d be a home-run hitter!! Your escalade anaolgy spells it out, but believe it or not, there are many dummies that actually think that way!! The struggle to inform, and then purge stupidity will go-on in vain for infinity!!

Its time to change the way bank’s asset’s are recorded. Loans outstanding are only assets when they have been paid back!

Lets call a spade a spade: loans outstanding, cash flow in etc. In my mind the only ASSET Citigroup,Chase etc have, maybe, right now is their office building, again maybe.

So the health of the banks should not be the fictional value of the security for the loan but whether the loans are current and sufficient cash is coming in to keep the lights on.

I understand that this is a radical thought, but the WSJ over the years had articles on small S&Ls that did keep their overhead in line and survived the storms.

Another home run hit out of the park by Dr. HB.

Excellent work, and thank you.

I cannot thank my depression era parents enough for how they raised me… save, save, save and always live below your means! My OC friends who have major debt and a newly adjusted $5000 mcmansion mortgage payment are no longer laughing at my frugal ways.

So, Dr HB and All…

We had the dotcom bubble burst in 2000-2001.

We just had the housing/derivative bubble burst.

What and when is the next big bubble/burst?

People will always be greedy and use a lack of common sense… so another bubble WILL happen.

Doc, in my experience a dollar saved is NOT a dollar earned. Since 1913 a dollar saved will be 50 or 60 cents earned in a very short time, thanks to the systematic inflation/currency deflation game played by central bankers.

~

This is one reason people wanted granite. Their little piece of the rock. Most people don’t have the arithmetic to calculate a 10 percent tip, but they know instinctively when they’re yoked for life to and trying to keep their footing in a power-greased system engineered by much more powerful people. As folks said throughout the tech and housing booms, get what you can while you can, because you don’t know what tomorrow will bring.

~

Progressive monetary reformers have long noted that when the only resource underpinning a fiat currency is the debtor promise to repay, the banker caste needs to be more, not less, conservative in boom times.

~

We are coming out of an era of just the opposite. Ronald Reagan pumped up the pompadoured national wang of self-regard, arrogance, and gourmet designer luxe consumption, then emptied out all regulatory oversight on the institutions that were supposed to be conservative but were in fact radical in the extreme. Banks exploited, rather than respected, debtors. Wages and the buying power of a dollar were systematically reduced.

~

Saving is a suckers’ game in this macro-monetary regime. In my household we do it because we do. We don’t seem to need the stuff others do. We get a kick out of seeing how efficiently we can do everything. Yet the more we save, the less that money is worth, and the faster it is eaten up. Compounding works on the down-side as well as the up-.

~

So who can blame the masses for wanting something solid, shiny, hard, and heavy? Their sparkly stone countertops.

~

I talked to a man in ’07 who was having his kitchen cutlery slots routed right into the granite counters of his new “custom” mini-McMansion. Why? So each time he made a sandwich, he could feel like King Arthur, “pulling a sword from a stone.” He worked in retail, so did his wife, and they were leveraged to the gills with one of those nitroglycerine loans. One jiggle, and BOOM. He had to know the chips would soon be up. But forever in his mind, he got to be a mythic fellow for a day or week or year. We haven’t really come all that far psychologically from the ancient cult of the sacred solar/vegetation king. Who cares that you’ll be flayed, flogged, hung, eaten alive, and coldly replaced in a year? For that year, you’re king!

~

rose

Check out this article in the NY times, the crony capitleists are up to there old tricks again.

March 4, 2009

Ex-Leaders of Countrywide Profit From Bad Loans

By ERIC LIPTON

CALABASAS, Calif. — Fairly or not, Countrywide Financial and its top executives would be on most lists of those who share blame for the nation’s economic crisis. After all, the banking behemoth made risky loans to tens of thousands of Americans, helping set off a chain of events that has the economy staggering.

So it may come as a surprise that a dozen former top Countrywide executives now stand to make millions from the home mortgage mess.

Stanford L. Kurland, Countrywide’s former president, and his team have been buying up delinquent home mortgages that the government took over from other failed banks, sometimes for pennies on the dollar. They get a piece of what they can collect.

“It has been very successful — very strong,†John Lawrence, the company’s head of loan servicing, told Mr. Kurland one recent morning in a glass-walled boardroom here at PennyMac’s spacious headquarters, opened last year in the same Los Angeles suburb where Countrywide once flourished.

“In fact, it’s off-the-charts good,†he told Mr. Kurland, who was leaning back comfortably in his leather boardroom chair, even as the financial markets in New York were plunging.

As hundreds of billions of dollars flow from Washington to jump-start the nation’s staggering banks, automakers and other industries, a new economy is emerging of businesses that hope to make money from the various government programs that make up the largest economic rescue in history.

They include big investors who are buying up failed banks taken over by the federal government and lobbyists. And there is PennyMac, led by Mr. Kurland, 56, once the soft-spoken No. 2 to Angelo R. Mozilo, the perpetually tanned former chief executive of Countrywide and its public face.

Mr. Kurland has raised hundreds of millions of dollars from big players like BlackRock, the investment manager, to finance his start-up. Having sold off close to $200 million in stock before leaving Countrywide, he has also put up some of his own cash.

While some critics are distressed that Mr. Kurland and his team are back in business, the executives say that PennyMac’s operations serve as a model for how the government, working with banks, can help stabilize the housing market and lead the nation out of the recession. “It is very important to the entire team here to be part of a solution,†Mr. Kurland said, standing in his office, which has views of the Santa Monica Mountains.

It is quite evident that their efforts are, in fact, helping many distressed homeowners.

“Literally, their assistance saved my family’s home,†said Robert Robinson, of Felton, Pa., whose interest rate was cut by more than half, making his mortgage affordable again.

But to some, it is disturbing to see former Countrywide executives in the industry again. “It is sort of like the arsonist who sets fire to the house and then buys up the charred remains and resells it,†said Margot Saunders, a lawyer with the National Consumer Law Center, which for years has sought to place limits on what it calls abusive lending practices by Countrywide and other companies.

More than any other major lending institution, Countrywide has become synonymous with the excesses that led to the housing bubble. The firm’s reputation has been so tarnished that Bank of America, which bought it last year at a bargain price, announced that the name and logo of Countrywide, once the biggest mortgage lender in the nation, would soon disappear.

Mr. Kurland acknowledges pushing Countrywide into the type of higher-risk loans that have since, in large numbers, gone into default. But he said that he always insisted that the loans go only to borrowers who could afford to repay them. He also said that Countrywide’s riskiest lending took place after he left the company, in late 2006, after what he said was an internal conflict with Mr. Mozilo and other executives, whom he blames for loosening loan standards.

In retrospect, Mr. Kurland said, he regrets what happened at Countrywide and in the mortgage industry nationwide, but does not believe he deserves blame. “It is horrible what transpired in the industry,†said Mr. Kurland, who has never been subject to any regulatory actions.

But lawsuits against Countrywide raise questions about Mr. Kurland’s portrayal of his role. They accuse him of being at the center of a culture shift at Countrywide that started in 2003, as the company popularized a type of loan that often came with low “teaser†interest rates and that, for some, became unaffordable when the low rate expired.

The lawsuits, including one filed by New York State’s comptroller, say Mr. Kurland was well aware of the risks, and even misled Countrywide’s investors about the precariousness of the company’s portfolio, which grew to $463 billion in loans, from $62 billion, three times faster than the market nationwide, during the final six years of his tenure.

“Kurland is seeking to capitalize on a situation that was a product of his own creation,†said Blair A. Nicholas, a lawyer representing retired Arkansas teachers who are also suing Mr. Kurland and other former Countrywide executives. “It is tragic and ironic. But then again, greed is a growth industry.â€

David K. Willingham, a lawyer representing Mr. Kurland in several of these suits, said the allegations related to Mr. Kurland were without merit, and motions had been filed to seek their dismissal.

Federal banking officials — without mentioning Mr. Kurland by name — added that just because an executive worked at an institution like Countrywide did not mean he was to blame for questionable lending practices. They said that it was important to do business with experienced mortgage operators like Mr. Kurland, who know how to creatively renegotiate delinquent loans.

PennyMac, whose full legal name is the Private National Mortgage Acceptance Company, also received backing from BlackRock and Highfields Capital, a hedge fund based in Boston. It makes its money by buying loans from struggling or failed financial institutions at such a huge discount that it stands to profit enormously even if it offers to slash interest rates or make other loan modifications to entice borrowers into resuming payments.

Its biggest deal has been with the Federal Deposit Insurance Corporation, which it paid $43.2 million for $560 million worth of mostly delinquent residential loans left over after the failure last year of the First National Bank of Nevada. Many of these loans resemble the kind that Countrywide once offered, with interest rates that can suddenly balloon. PennyMac’s payment was the equivalent of 38 cents on the dollar, according to the full terms of the agreement.

Under the initial terms of the F.D.I.C. deal, PennyMac is entitled to keep 20 cents on every dollar it can collect, with the government receiving the rest. Eventually that will rise to 40 cents.

Phone operators for PennyMac — working in shifts — spend 15 hours a day trying to reach borrowers whose loans the company now controls. In dozens of cases, after it has control of loans, it moves to initiate foreclosure proceedings, or to urge the owners to sell the house if they do not respond to calls, are not willing to start paying or cannot afford the house. In many other cases, operators offer drastic cuts in the interest rate or other deals, which PennyMac can afford, given that it paid so little for the loans.

PennyMac hopes to achieve a profit of at least 20 percent annually, and it is actively courting other investors to build its portfolio, which now consists of $800 million in loans, to as much as $15 billion in the next 18 months, executives said. For the borrowers whose loans have ended up with PennyMac, it can translate into an extraordinary deal.

The Laverdes, of Porter Ranch, Calif., had fallen three months behind on their mortgage after sales at a furniture store owned by the family dipped in the economic crisis. Margarita Laverde and her husband were fearful that they might need to move their four children, three dogs and giant saltwater aquarium into a cramped apartment, leaving behind their dream home — a five-bedroom ranch on a suburban street overlooking the San Fernando Valley.

But a PennyMac representative instead offered to cut the interest rate on their $590,000 loan to 3 percent, from 7.25 percent, cutting their monthly payments nearly in half, Ms. Laverde said.

“I kept on asking, ‘Are you sure this is correct? Are you sure?’ †Ms. Laverde said. Even with this reduction, PennyMac stands to make a profit of at least 50 percent, a company official said.

Ms. Laverde could not care less that executives at PennyMac used to work at Countrywide.

“What matters,†she said, “is that we know our house is secure and our credit is safe.â€

“””What and when is the next big bubble/burst?”””

Health “care” costs, perhaps? Is $4500 for a one night hospital stay, in Cali btw, a reasonable price? That is what I was charged in 2007, just the hospital, mind you, blood tests, emergency room staff, etc., all sent their own bills.

@Rose

I would like to counter the argument that a dollar saved is not quite a dollar earned. Yes, the printing of money and capitalist method of gouging everyone at every opportunity along with irrational demand-pull consumption has driven inflation most of the time, we have an enormous deflationary undertow going on right now: Housing is dropping, employment is dropping, bonuses for financial criminals…may drop soon, commodities are and probably will continue to drop. A dollar held may soon have more buying power than at the time that it was earned, even when earning fractional annual percentage interest, just like in the last Depression.

Even if inflation roars back with gas prices this spring, snuffing out any flicker of a recovery, saving a dollar rather than spending it(multiplied by millions of people each day) works to reduce the demand-pull driver of inflation. The other aspect is the habit: saving is a habit just like mindless consumption. People learn to enjoy having a few bucks in the bank rather than kiting checks until payday. The whole driver of inflation that we can control (demand side) is our only defense against supply-side forced inflation.

Just my thoughts–I’m obviously not an authority here.

@Sean

That is very comforting, like finding out you have six months to live…It’s incredible when your expectations are zero and you are still tremendously disappointed. What to do?…

Dr., I heart you!

Right on Dr. HB,

Yet, the government hacks will keep spinning a very complicated story to confuse the average citizen. They have to justify their useless existence.

The Treasury Secretary yesterday was whining about global warming, so he is got everything under control in his chicken little world, yikes.

Your charts are so telling. We started paying down our house in about 1997 finishing it in late last year, debt free including home. We are inching away on a retirement savings at 48 and 52. We regularly read during the last decade that we were idiots to pay down our mortgage in the hey day. But we stuck to tried and true Biblical and or old American principles, and on “a single income” have accomplished this in So Cal. It is possible for anyone!

Overheard at work today:

“OC had a record number of sales this past year.”

Awesome job! Doctor Housing Bubble…

I get that we are caught in a system of a down, and am mildly suprised that there is still people that think… we will recover soon…. Do they know how much energy and effort would be required to pull this complex system out of this negative spiral or negative feedback loop or death spiral…

My question, is that unemployment is rising, and when unemployment rises, so does the crime rate… however, what is the lag time? and what is the correlation… meaning for every 1% in unemployment the crime rate goes up x ? and again when.

Comrade Housing bubble,

Truer words were never spoken. Except of course by the grand master Peter Schiff. You’ve once again hit the nail on the head. Let’s be clear, this is a simple math problem: we spend more than we earn and we consume more than we produce. Just a question, did they stop teaching math to MBAs?

This blog site is one of the only places I’ve been able to find that speaks the unbiased truth. BTW, you absolutely must watch this clip. You’ll laugh your a$$ off:

http://www.thedailyshow.com/video/index.jhtml?videoId=220252&title=cnbc-gives-financial-advice

Leave a Reply