The Schism Between Wall Street and Main Street: Green Shoots for the Banking Oligarchy and Crap Shoots for Others.

On Wednesday we learned that GDP contracted by a stunning 6.1 percent in the first quarter of 2009. This came on top of the already large 6.3 contraction in the fourth quarter of 2008. This back to back contraction is the deepest in over 50 years when in the fourth quarter of 1957 GDP contracted by 4.2 percent followed by a 10.4 percent contraction in Q1 of 1958. Yet the market rallied on this news because of glimmers of hopes. Green shoots as some like to say. The glimmer of course comes from banks because the Federal Reserve and U.S. Treasury are doing everything in their power to destroy the U.S. dollar and keep rates artificially low so banks can keep on creating excessive debt. You may recall that it was excessive debt that got us into this mess so apparently creating more excess debt is the way out. Yet the average American household is seeing their access to debt contract while banks and Wall Street suddenly have a platinum American Express line directly linked to the Fed and U.S. Treasury.

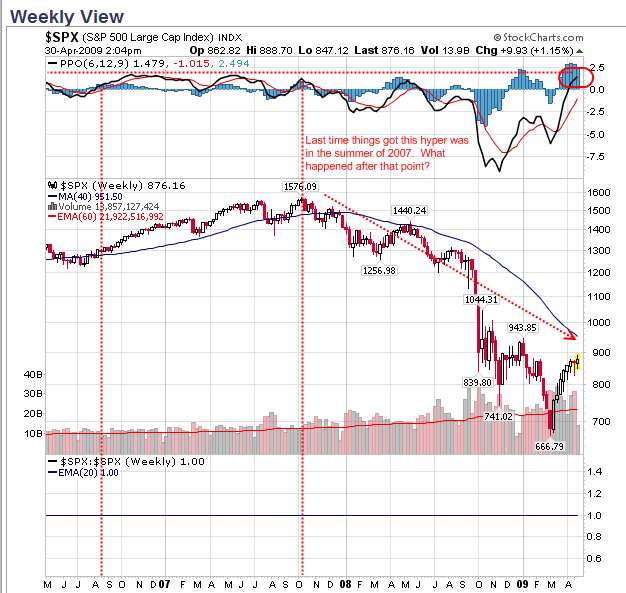

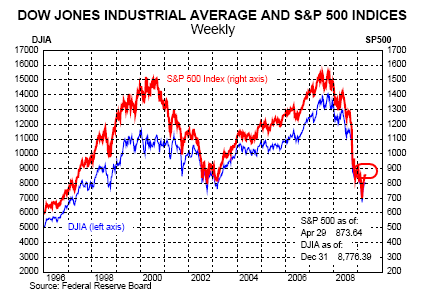

The market has been on a tear, come bad news, really bad news, or flat out horrible news:

Since the low of March 6th, the market has gone up a stunning 31%! As you can see from the chart above this increase has gone non-stop. When was the last time things were this frothy? Try the summer of 2007. Need we remind you what happened after that? The wheels of the global economy came flying off. Now of course, given the massive injections of capital into the banking sector this rally could go higher. But make no mistake, this rally is for the banks and Wall Street since the average American is seeing very little real world benefit aside from a psychological relief. If you break down the numbers, the situation is still troubling of course. 13 million Americans are unemployed. 9 million are working part-time looking for full-time employment. Another 1.9 million are not working because of other reasons including giving up. All in all we have about 24 million Americans either unemployed or underemployed. This is the Fed’s idea of green shoots.

In this article I want to look at 10 charts that clearly show we are nowhere near a bottom. These charts will also show that for trillions in bailouts, we have seen a marginal gain in the real economy.

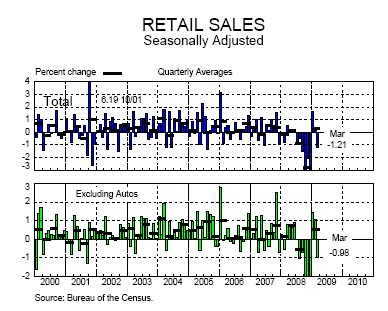

Chart 1 – Retail Sales

In the past two quarters, we have seen a strong contraction in retail sales. This is critical since two-thirds of our economy depends on consumption. And in the recent GDP report, we saw a slight improvement here but all mitigating factors point to this being a temporary jump up. Now why would something like this occur? Well think about what has occurred over the past year. Going out of business sales, gimmicks, and other cheap debt offers have brought in a few more people into the fold. Yet it has been tiny for the price we will pay. You will also see this reflected in a later chart with home sales. We have burdened ourselves with massive debt for a slight uptick in these sectors so banks and Wall Street can figure out a way of screwing the American taxpayer through their government branch offices at the U.S. Treasury and Federal Reserve. When you look at the above chart, there are no green shoots here.

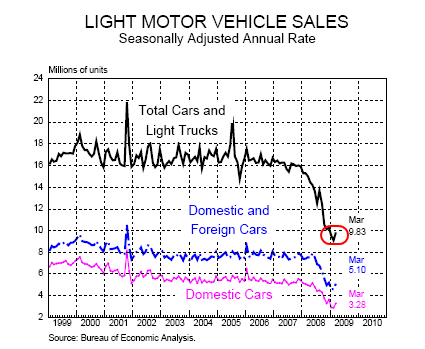

Chart 2 – Motor Vehicle Sales

The third largest American automaker Chrysler is now bankrupt. It is official. What does this mean? Job losses, product line cuts, and further restructuring. Yet the market rallies. Since when is it a good thing that a large American manufacturer goes bankrupt assuring future job losses for thousands more? If you need further proof how disconnected Wall Street is from Main Street you shouldn’t look any further. Take a look at the chart above. Auto sales have fallen off a cliff for both domestic and foreign automakers. You notice that slight uptick? All the debt and gimmicks we have thrown at the industry including fuel falling back down to record lows is not enough to get Americans to buy more cars. Why? We already have too many! Technology has made cars more resilient. If you actually treat your car well, you can easily get 10 years out of it. And more people are realizing this either out of necessity or because of a new austerity. Local auto repair shops have seen more people actually bringing in cars for repairs. Instead of trashing the car when the transmission goes out, many people would rather pay $2,500 to have it replaced instead of buying a new car. With the average new car costing $25,000 is it any wonder?

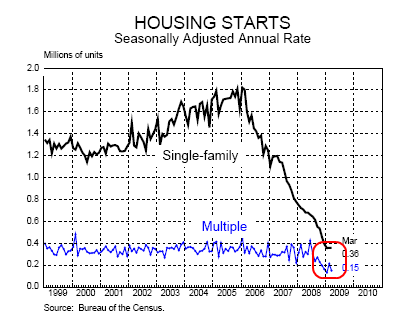

Chart 3 – Housing Starts

Housing, housing, and housing. Isn’t housing the epicenter of all of this mess supposedly? We haven’t even addressed the pay option ARM fiasco waiting for us later this year but suddenly we keep hearing that housing is shooting to the moon. Really? Sure doesn’t look like it from the chart above. In fact, the collapse in housing starts above is the steepest since the Great Depression. And as you can see from the chart above, the number isn’t bouncing back up. Meaning all those home builders and those that work in the construction industry don’t have as much work. Work is what occurs on Main Street. You wouldn’t know that by looking at Wall Street of course. The fact of the matter is we have enough inventory for a couple of years. With record foreclosures and all the building that occurred this decade, we are assured a few years of excess inventory. Bottom line? Don’t expect this to be jumping up any time soon.

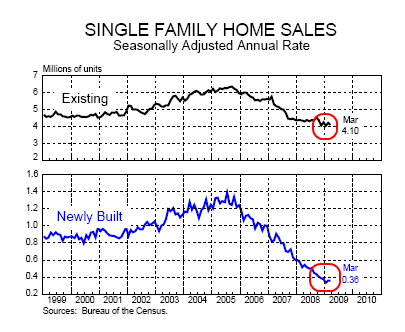

Chart 4 – Single Family Home Sales

Well look at that, home sales aren’t moving like pancakes. Yet industry insiders are telling us the bottom is in and all is well! These people either:

(a) Â Have jobs that depend on real estate going up

(b)Â Are flat out blind to the macro data

(c)Â Don’t have a clue

(d)Â All of the above

The housing market is far from a bottom. As I have discussed about the California housing market we will not see a bottom until 2011, some people think this short-term change in the trend is suddenly 2005 redux. As you can see from the chart above, that is not the case. In 2005 we had a SAAR of home sales well over 6 million. We are currently at 4.1 million. And new home sales have dropped off a cliff and are still near the trough. Although home sales may pick up or move sideways, that does not mean prices will be coming up anytime soon. Again, Wall Street is operating under a different system compared to Main Street.

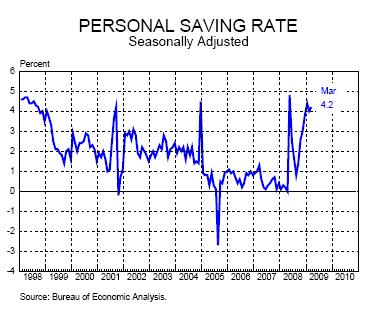

Chart 5 – Personal Savings Rate

There are two main reasons why Americans are saving more. First, they are in financial trouble and have less money. Second, they have had their access to credit limited. How so? Let me give you an over simplified example. In California if you made $40,000 a year, you probably had 10 credit card offers a week and the ability to buy a $500,000 home at the peak of the debt insanity. So let us run that math:

2005 Access to Credit:

Income:Â $40,000

Home Mortgage Credit:Â $500,000

Credit Cards:Â 4 x $10,000 each

Auto Loan:Â $30,000

Total access to credit:Â $570,000

Now fast forward to 2009. Those credit card offers don’t come in for many. You now can only borrow half of the mortgage amount. And for that car? Look at sales above. So the access to credit now looks like:

2009 Access to Credit:

Income:Â $40,000

Home Mortgage Credit:Â $250,000 (top)

Credit Cards:Â 1 x $10,000

Auto Loan:Â $20,000 (if credit good)

Total Access to Credit:Â $280,000

People mistake debt with wealth. More specifically, they confuse access to debt with wealth. So that person now has access to half of the debt they once did in 2005. Many see this as a cut but the current ratio is where it should have always been and lending terms are still generous in historical terms. Yet at this same time, banks and Wall Street now have access to trillions courtesy of the Federal Reserve and the U.S. Treasury. Once again, Wall Street is playing on a very different field from Main Street.

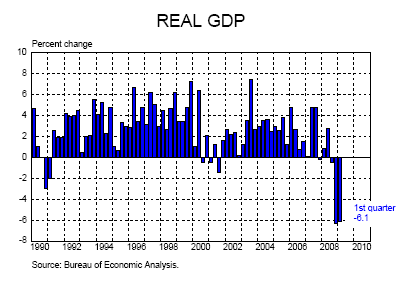

Chart 6 – Real GDP

As I pointed out earlier, GDP is contracting at the fastest pace in 50 years. The recent Q1 2009 number surprised on the downside yet the market rallied. The market is rallying because those playing the stock market are treating it as a casino. If it were an accurate reflection of the real economy with record unemployment, historically high debt ratios, crushing contractions, it would be going down further. Many pundits, those that also said there was no housing bubble, point to the stock market as a leading indicator. That is, the market recovers before Main Street does. These pundits are using out dated models. How many times have we had a Fed interest rate that is 0 (actually lower because of quantitative easing)? We haven’t and the only other experience in our history like this is the Great Depression. People point out that the stimulus plan was a big burden. Nearly half of it was tax cuts and the rest was fiscal programs and extension of benefits such as unemployment insurance. If anything, it was the only thing that actually went straight into Main Street. But this came as a diversion to the approximately $13 trillion in bailouts and commitments to banks and Wall Street. In many community colleges, 70 to 80 percent of students need remedial math. When I see people screaming about millions in executive compensation yet sitting idly by when trillions are thrown out to the most crony corporate welfare kings, it makes me wonder if there is a sinister anti-math plan to keep people in the dark. Or maybe, it is a more simple explanation like people can’t step away from America’s Got Talent?

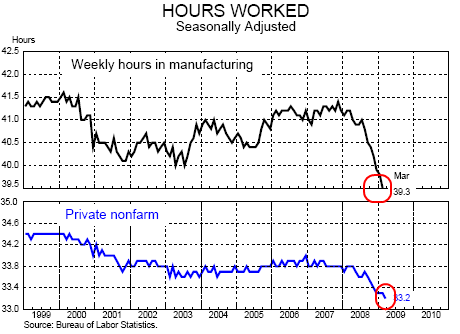

Chart 7 – Hours Worked

Back in the real world, Americans are seeing their hours cut back. Now most people that are seeing wage cuts, job losses, and less hours are probably not in the mood to buy homes even if interest rates are cheap. Employment is the key factor for the vast majority of Americans. The stock market has become more of a casino and a shattered dream of the get rich without working world. What many Americans are realizing is Wall Street never looked out for them. They tried to convince most Americans that, “just put X amount into your 401k for 30 years and you’ll be fine. Diversify and you should be okay.” As many Americans saw 40 to 50 percent of their wealth evaporate they are now told, “you are an idiot for not actively managing and keeping your asset allocation in sectors that avoided the crash. Did you actually diversify into THAT? Who told you to do that?” It is the height of hypocrisy between Wall Street and Main Street. The money from Main Street was only a shell game for the connected. In fact, some of the investment firms on Wall Street made money betting that companies would fail! How about that! If there is any clearer sign between Wall Street and Main Street it is this. Let us see who owns those profitable CDS on Chrysler. Someone made money on the failure of a large American company. And it is probably an investment firm closely connected to Washington. Want to take a wild guess who that is?

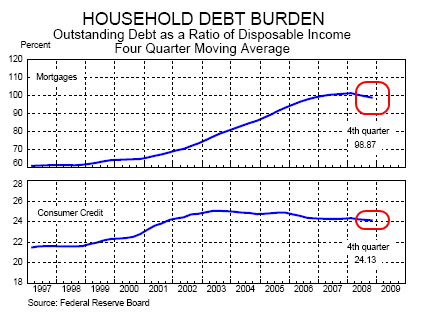

Chart 8 – Household Debt

Ironically American households have to mark to market their assets. If you paid $400,000 for your home at the peak and now can only sell it for $250,000, then to you your wealth just took a $150,000 haircut especially if you need to sell. Not so for the banks. That home is still worth $400,000. The accounting rules favor a select few and that does not include those on Main Street. The above chart shows that many Americans still have a giant debt burden. Even though this burden has decreased slightly recently, banks and credit card companies who never cared about credit ratings for this decade all of a sudden want people to pay up even if they have no job. Not having a job was no problem when they were blasting out those 20 to 40 weekly credit card offers in the mail. It wasn’t a problem that you had massive debt when they sent you those HELOC offers. All of sudden they have found religion and they are ready to collect money from bailouts and also squeezing you for everything you got. In the end game, the average American is going to lose out because:

(a)Â At a certain point the U.S. dollar will suffer

(b)Â At a certain point stocks will need to reflect reality

You cannot lend out trillions and expect nothing to happen. Sure, what is occurring is deflationary in the sense that prices are collapsing but this is only because more wealth is being destroyed than is actually being created. What is to stop the Fed and U.S. Treasury to give out more bailouts in the future? Just wait until the FDIC starts getting owned if we go with the PPIP. We are already seeing that the faux stress tests show banks are going to need more capital. Since they’re models operate in LaLa world and at a certain point they have to meet with the real world, they will have to deal with “shocking” losses.

Chart 9 – Stock Markets

The stock market has witnessed the largest wealth destruction since the Great Depression. If you look at the above chart, it is a tale of 2 bubbles. First, we had the tech bubble followed by the housing bubble. What other bubble do we have? There is no other bubble aside from the debt bubble It is time to pay the piper. Even that slight jump is all courtesy to the current disconnect between Wall Street and Main Street. It would be one thing if Wall Street was rallying because employment was healthy and companies were raking in tons of profits. Real companies. Not banks that say they have a profit because of accounting gimmicks and bailout money. Give me $25 billion and I’ll show you a $3 billion quarterly profit!

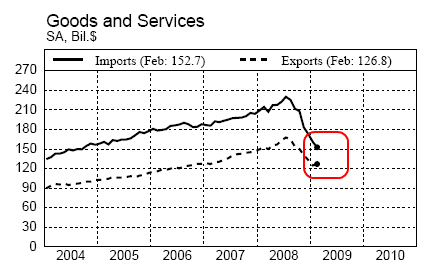

Chart 10 – Trade

Both exports and imports have fallen. Yes, our trade imbalance got a little better on the ledger but overall the reasons for this are not good. It occurred because we are buying less and selling less. This is a global recession. The challenge of global recessions is we all face falling incomes and demand together. The decoupling school is now largely running away with their tail between their legs. These were the folks who thought the U.S. having a massive recession would somehow not impact the world. Really? The U.S. who contributes about 28 to 30 percent of global GDP is not going to have an impact? What utter insanity.

So as you can see from the above charts, there is no green shoots in the Main Street economy. Sure, Wall Street is shooting to the moon but that is because the pit bosses are now trading amongst themselves fleecing the public. Recent data shows insiders actually selling into the momentum:

“(Barrons) Leading us to the question with which we began these musings: If those now infamous shoots of recovery are popping up all over, why would insiders be so aggressively dumping stocks?

Yet, they indisputably are. According to a study prepared for Bloomberg by Washington Service, a research outfit, directors, officers and the like have sold $353 million worth of stock in this fading month, or 8.3 times the total bought. As a matter of fact, according to the firm, insider purchases of $42.5 million are on track to make April the skimpiest month for such buying since July 1992.

The pace of selling in the first three weeks of this month, incidentally, was the swiftest since the market peaked and the bear came out of hibernation with a vengeance in October ’07.

We’re quite aware that insiders are not infallible. But they are, after all, in the front lines of commerce and industry and so presumably have a better fix on the economy and the prospects for recovery than analysts and economists, whether of macro or micro persuasion.”

This is the ultimate bear market rally so proceed with caution.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

13 Responses to “The Schism Between Wall Street and Main Street: Green Shoots for the Banking Oligarchy and Crap Shoots for Others.”

One thing I’ve noticed over the years is that Wall Street doesn’t like employment to be to high because the workers could demand more money. In WS lingo “Wage inflation.” So they rather keep wages as low as possible & follow the Wal-Mart moddle hoping people leave there jobs after a year or two instead of working for a company for 40 years as things use to be.

As expences for basic items increase while wages stay flat or decrease, how are americans going to be able to make ends meat without extreme levels of debt. If the average American stops shopping beyond the basics, we don’t have a viable econemy.

“……….Ironically American households have to mark to market their assets. If you paid $400,000 for your home at the peak and now can only sell it for $250,000, then to you your wealth just took a $150,000 haircut especially if you need to sell. Not so for the banks. That home is still worth $400,000…………”

Your So Right, But The Banks Are Loosing Big Money. People Are Walking Away From Their Homes.

The Smart Ones (this is what they call themselves) Saw This Coming & Refinanced Their Homes At 125% Of The Value (when times were good) & Walked Away From Them With A Pocket Full Of Money. Money They Hide In Another Family Members Name.

“……….So as you can see from the above charts, there is no green shoots in the Main Street economy. Sure, Wall Street is shooting to the moon but that is because the pit bosses are now trading amongst themselves fleecing the public. Recent data shows insiders actually selling into the momentum……………”

This I Agree With Completely.

The auto sales actually looked like it was rebounding but the numbers out today were really bad. I have a feeling some of the other charts is going to show continuous cliff diving as well.

“There is no other bubble aside from the debt bubble It is time to pay the piper.”

Dang it! There HAS to be another bubble coming, so we can make some FAST MONEY! 🙂

The only “green shots” in the metaphorical garden known as the ‘real economy’ are not grains, vegetables or even flowers – it is poison ivy aka ‘Wall St.’

Fish don’t bite the hook without bait.

The vampires drink the blood of their beast of burden in a panic. We just can’t see the big picture.

“Don’t ya get it? Potter’s not selling! Potter’s buying!”

Doc, you definitely present a strong case with facts and figures. MSM experts just say, I expect a rebound in summer of 2008 (remember that one?) without any data or arguments whatsoever, like they are Nostradamus or something. I appreciate a little light in these times of darkness.

This is all well and good. Charts and all. But you never get to the core of the problem. The Dollar is no good.

The Government via the Fed can create dollars out of thin air. Those dollars have to get into the system somehow. The Fed uses the banks to loan this fake money to borrowers. Why are you bagging on Wall Street for doing the Government’s bidding?

The Government invented the Fed. The government would have to investigate itself. Ain’t gonna happen.

Barney Frank and Chris Dodd told Fannie Mae, Freddie Mac and the large banks (the same banks that they consolidated into the behemoths they are so they could be easily controlled) to loan the money to people who could not pay it back. The banks complied.

It seems the height of hypocrisy for Government to blame the banks they created.

Wave your fist all you want.

Green shoots are good in salads. Shoots and sprouts, Very healthy and delicious. Some green shoots can even be dried and then smoked.

They should legalize green shoots, and then get us all addicted to green shoots, and then tax the hell out of the green shoots.

Oh yeah, they just did that…

I currently work for a subsidiary of one of the biggest banks. I say currently because we specialize in commercial re. It is truly astonishing how little is happening in terms of deals getting done in this market. I cant believe that they are keeping so many of their people much to their credit. I suppose they believe that foreclosures are going to start hitting the market in a couple of months, which my coworkers have been talking about for a year at least. Do you think that there will be great deals in commercial re very soon??

Comrades,

Wild gyrations in the market are to be expected since there is a total lack of confidence in what anyone says or does on Wall Street or in Washington. How do you know what fair market value is for anything? There are so many accounting tricks going on that even David Copperfield must be impressed. Here’s what Peter Schiff’s newsletter had to say:

“the level of stress in the tests was set unrealistically low. Their absolute worst case assumption was for a GDP contraction of only 3.3 percent in 2009. This comes as first quarter 2009 GDP shrank at 6.1 percent. And the economy is still slowing. To post a contraction of just 3.3 percent for the year would likely involve an immediate reversal in the rate of contraction and outright expansion by the fourth quarter.

The stress test also assumes a worst case scenario unemployment rate of 8.9 percent in 2009. This is also wildly optimistic when unemployment is already at 8.7 percent and rising at some 20,000 each day. Worse still, if calculated on a pre-Clinton basis, to include all those unable to find anything but part-time employment, the current unemployment rate is a staggering 19.2 percent, or just 0.8 percent from official depression levels! It appears that the U.S. is fast slipping from recession into depression, rendering the stress tests almost meaningless other than as a public morale boosting exercise.”

Yes, we live in the United States of Delusion. The stock market trades on expectations and momentum, not on fundamentals. The current rally is meaningless. Soon the federal bailout morphine will wear off and the patient will be sicker, not better at that point. The wild gyrations will snap back to the down side and everyone will look on in amazement (and disgust). Remember that during the Great Depression, the stock market didn’t hit its lows until 4 years in and didn’t return to break even for 25 years. Enjoy the market bounce for what it is but be ready for the downside move. Be brave Comrades!

Kudzu puts out green shoots. Covers thousands of square miles and touches none of it. Smothers/strangles all other life.

~

I was thinking about that 6.1% contraction. Ten more years of that (a Lost Decade, that is to say, another one) and the economy would be halved. That’s the magnitude of such a downturn. Not judging it, just observing. This also means that growth of 10 percent in any year would be required to get to positive growth of 4%. Which would mean a growth rate that would double the economy in seven years. Nutso way to run an economy, dood. No wonder they keep coming up with new things to count. You can run a Ponzi scheme on any one thing for only so long.

~

DHB, I agree that many people are saving more because debt is harder to get. But something else is going on as well, a cultural shift. Now it’s considered gauche to talk about house flipping, renovations, etc. Those who’ve been prudent, as well as those who cleaned up in the boom, don’t talk much about their 401(k)s anymore. Reminds me of 2001 in San Francisco. Also am observing a whole lot of silence where people used to brag about, oh, say, their house’s market value, or their CA pensions.

~

I’m seeing more and more listings locally that say “priced at $XX under assessment!” Great, so I get to buy a house that’s STILL overpriced, AND pay an inflated real estate tax on it? What a deal!

~

We’ve always used wholesale and deep discount stores as our primary ones…now those stores are packed. Good to see, except most people are shopping to big-ticket standards. E.g., a 5-ounce serving of ready-to-eat brand-name organic oatmeal for $3 (translates $9.60/lb. w/o tax–16 times what I pay for organic rolled oats). But that is CHEAP, because at the Shopping Experience stores, that same packaged product would be closer to $5-6. Thus I see far more room for contraction on the money-wasteage front.

~

I’m seeing posters and flyers all around town–workshops for “hard times skills.” Not “prudence” or “frugality” skills. The implication: if we just weather this, soon things will be back to normal. I.e., fall of 2006. This is a gale, not a sea change.

~

‘Twill be interesting to see what our overlords fund with all their public-debt bling. I predict a bunch of ill-advised, top-down, poorly thought out, but very lucrative sustainability and climate change boondoggles out of the military-industrial-university complex. For an example, see corn ethanol.

~

rose

Keep up the great work “Doctor!” Bubble troubles? What housing bubble troubles? No worries folks.

Simply “reinflate” the housing bubble as necessary using that “brand new” mortgage product (brought to market by the “fine folks” on Wall Street) available everywhere at any Bank or Savings & Loan of your choice beginning 1 May 2009.

Now introducing the “California Twister” — all inclusive problem-solving* mortgage.

* Simply “import” a Japanese-style “three-generation, 100 year” mortgage with an added California twist. Financially “reengineer” it into a “four-generation, 120 year” mortgage product to be hereafter known as the “California Twister.” (An advanced financial mortgage product developed for the new century). For truly stubborn existing foreclosure cases (or for those Californians who wish to obtain home price/income ratios mortgages of at least 20:1; as in “don’t let a mere $50K annual family income prevent you from living the life you aspire to in the $1M+ home of your dreams in Orange County”). Instead simply “step-up” and utilize the “ultimate” in currently available mortgage products: the “California Twister-II.” (A “five-generation, 150 year” “variant” to be shared with your children, grandchildren, great grandchildren, and great-great grandchildren). (Keeping it in the family as a legacy mortgage; “the family that pays together, stays together” — don’t you agree?)

All California housing bubble and mortgage-related problems promptly solved. That wasn’t so difficult to effect — now was it?

———————————————————————————————————————

Excerpt from:

New Study Shows More Than 2.1 Million California Small Business Jobs Will Be Lost Over the Next 3 to 4 Years

1.5 Million Face Immediate Risk of Job Loss as a Result of Small Business Owners Who Took out Toxic Home Mortgages according to Bornstein & Song, CPAs & Consultants Study with MerchantCircle

LOS ALTOS, Calif., April 23, 2009 /PRNewswire via COMTEX News Network/ —

Toxic Mortgage Study will Continue Nationally, Including Florida, Arizona, Michigan, and Nevada

New study results show more than one-third of all California small business owners took out risky or toxic mortgages such as Alt-A, Alt-A ARMs, Option ARMs, Interest-Only, and Subprime, etc. to get cash for business expenses during the peak of their home values from 2004 to 2007. As the first wave of mortgage resets hit, small business owners will be at-risk of “payment shock” and default as their monthly mortgage payments skyrocket. The toxic mortgage resets began in the 4th Quarter 2008 and will continue through 2012. “The resulting defaults will be the cause of the 2nd ‘Tsunami’ Wave of Foreclosures that will dwarf the subprime crisis and will take many homeowners and small business owners by surprise. In California, these inflated mortgage payments will threaten more than 2.1 million small business jobs,” said Prof. Samuel D. Bornstein.

“I purchased my home in 1999 for 235K,” says Keith Capsuto, owner KC Photography & Music in Oxnard, CA. “Within the first 3 yrs. it had a value of $650K. I did the foolish thing of buying the home with an ARM loan to save money for business expenses. Up to the turnaround in the real estate market, I had been doing a fair amount of business, but it dwindled off sharply and by 2008, I was almost bankrupt. Now in 2009, business is about gone! I am 8 months behind on my mortgage with credit cards up to the hilt from business expenses. I am attempting to work with my mortgage company and on the brink of filing for bankruptcy.”

Great Post DHB, thanks.

Gov’t is paying what they deem the dollar is worth; nothing. Why pay interest when the Treasury can print and the Fed buy all they want? Nice to talk about saving in gold or silver. Yeah, like we got extra cash laying around. Let’s face it, those of us that were prudent with our money will pay for the gamblers. Fanne and Freddie are already offering little down in an attempt to reinflate the housing bubble. People are biting too! Let the good times roll!

Leave a Reply