Deflating our way to Prosperity: Five Major Sectors of our Economy Pointing to Demand Destruction Price Deflation. Education, Wages, Housing, Stocks, and Automobiles.

The argument between deflation and inflation is still raging like a wildfire. From reading many articles and following many experts on the topic, it would seem that there is still no clear consensus as to what is going to happen long term. Just think of how many experts actually saw the housing bubble forming. Not since the Great Depression have we seen consumer prices contract so severely. Much of the argument for inflation comes from the actions taken by the U.S Treasury and Federal Reserve. Without a doubt, we have never witnessed such massive injections of liquidity and bailouts happening all at once. The argument goes that with so much money pumped into the system we must see prices rising at a certain point. Maybe but that will be for another day. Yet the current facts point to a disturbing menace that is deflation:

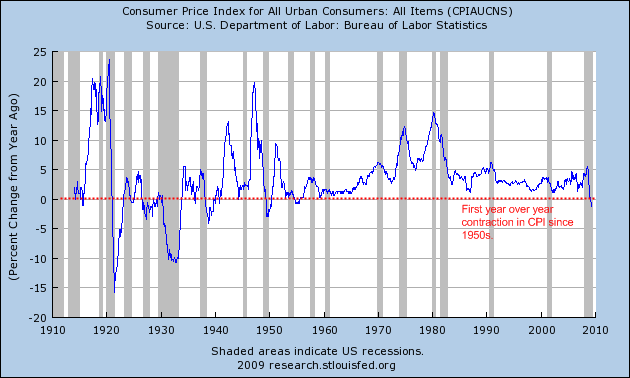

The most widely followed measure of inflation in the U.S. is the Consumer Price Index (CPI). As the chart above indicates, we have seen our first year over year decline in the CPI since the 1950s. Now keep in mind, last year we had the massive oil bubble which means we will probably have year over year declines for a few more months simply because oil nearly touched $150 per barrel last year. For our purposes we are going to look at consumer prices as our measure of inflation and deflation since this impacts most people in a more understandable way. Now before going forward, it is important to look at what areas are contracting during this recession:

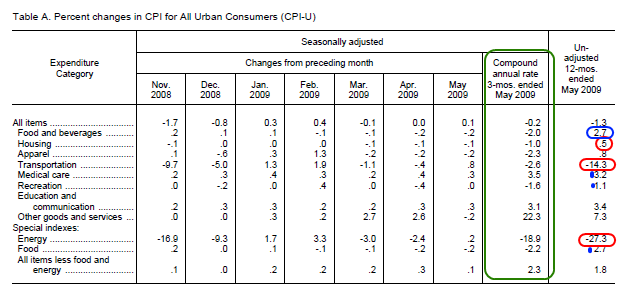

Now this is important to highlight. The 12 month adjusted data tells us the following:

Categories with decreases:

Transportation

Energy

Categories with increases:

Medical care

Education

Food

Categories neutral or slightly up:

Housing

Apparel

Recreation

Now keep in mind this is over 12 months. Yet if we look at the latest data, we start seeing that food and housing are now starting to decline. A large part of this is because of the excess housing on the market and the BLS measures owners’ equivalent of rent (OER) which has been coming down. After all, with 26 million unemployed or underemployed Americans hiking the rent may not get you new tenants in many markets. Yet you will notice that in the last 3 months, every category aside from medical care and education has come down steadily. The evidence so far is we have been experiencing deflation.

Now we are going to examine five major sectors of the economy and look deeper into the deflation and inflation debate.

Sector #1 – Housing Prices

(Deflation or Inflation) = Deflation

I’m not sure how anyone can argue that housing prices have seen any sign of inflation during the current recession. The largest line item for Americans is housing and it has been contracting at a furious pace. The reason the BLS over the past 12 months has seen a slight up tick is because of the OER measure. Initially when the bubble burst, people shifted to renting which either neutralized prices or even slightly increased rental demand. However, now that unemployment is raging and people are losing their jobs, the rental market is now being hammered which is now showing up in the CPI data.

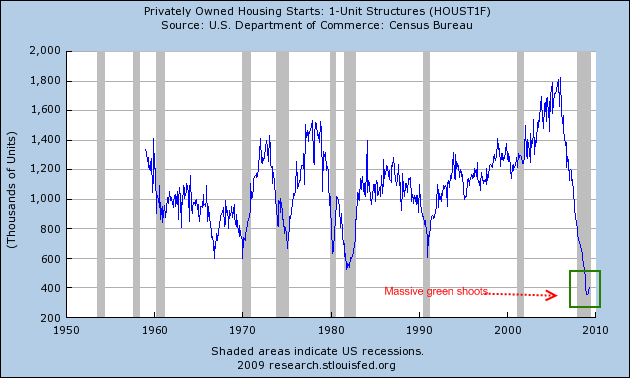

Housing bottoms normally take two forms. First, you will see a bottom in housing starts:

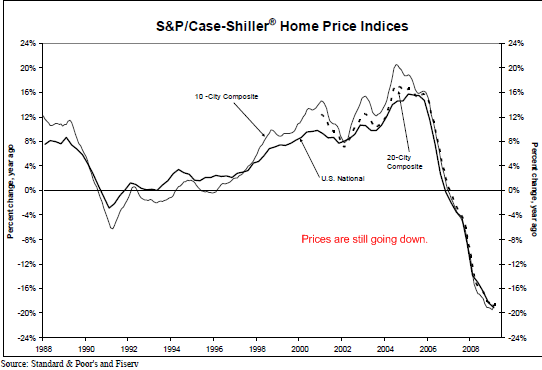

This is for 1-unit private housing starts. As you can tell, the market has completely collapsed. Yet if you squint, you can see a tiny yellow weed sprouting up. Of course, this is the non-sense of green shoots, as if superman will suddenly emerge with a construction hat and save the day by building homes again. In the case of housing starts, we may have hit a bottom but just put that into context in the chart above. We still have the Alt-A and pay Option ARM disaster waiting for us and this will assure us more cheap inventory for years to come. So in this sense, we may have already reached a bottom with housing starts but the thing many forget is we will never see peak bubble action like we did earlier in the decade. Demographics and the flood of inventory via foreclosures assure us ample supply. The second bottom takes the shape of lower prices and we are still falling in every sense of the word:

Prices are still going down. The Case-Shiller Index is the best measure since it looks at same home repeat sales. You have a few people like Jim Cramer talking about housing bottoms but they are looking at the median price. The problem with looking at the median price is that it is artificially high in the mania phase and low when a flood of distress homes hit the market. A perfect example is California where over 50 percent of homes sold are foreclosure resales. Ironically, now that you are seeing more price cuts in mid to higher priced areas you will see the median price go up or neutralize. Yet overall, prices are still heading lower. This is something that I have examined in detail when I discuss the 10 Reasons why California will not see a housing price bottom until 2011. I am looking more at the Case-Shiller data instead of the median price which can fluctuate wildly.

It is rather clear to any observer that we are seeing deflation in the housing market. There is little debate here. It is hard to envision any price pressure to the upside with such a horrible job market. In normal times, people pay for their mortgages with jobs and not high flying banana republic mortgages like pay Option ARMs and Alt-A products.

Sector #2 – Auto Sale Prices and Sales

(Deflation or Inflation) = Deflation

There is little doubt that we are seeing deflation in the automotive sector. With General Motors and Chrysler hitting rock bottom with bankruptcy, there is little pricing power here. Certainly auto workers, a large employment sector aren’t seeing wage increases. First, in 2008 the auto companies’ weak foundation was exposed with the oil bubble. After all, who wants to drive around an urban tank with a V-10 engine on the 405 freeway? It isn’t like you are driving in the Serengeti running away from rabid hyenas in treacherous terrain. I would see one person in these behemoths stuck on the freeway idling in their tank as the $4.50 gallon of oil just evaporated into the atmosphere.

Some people feel bad about what occurred but keep in mind these companies prided themselves on cheap oil fueling their tanks forever and the high profit margins on these vehicles. Even after the oil bubble imploded, the damage had already been done. There was no coming back. Now you can find many of these urban safari all-terrain vehicles on eBay and Craigslist selling for 50, 60, or 70 percent off their once MSRP. Looking for a Cadillac Escalade? You can get a 2002 with all the trimmings for a little under $17,000:

The fascinating thing that occurred during this bubble is the notion that everyone was rich and therefore should have the artifacts of the wealthy. The poor had access to middle class credit. The middle class had access to upper class wealth. The upper class spent like a new Gilded Age was here. The Escalade is a perfect example. I would drive around areas in Los Angeles County were people were living in run down apartments but out in front you would see an Escalade. Once again you can thank easy financing here. You would have people living in giant McMansions with a $700,000 mortgage when they were only pulling in $100,000. Early last year on the blog, I talked about people going broke on a $100,000 salary. At the time, people had a hard time believing this. Now, this is virtually a daily thing and many of these people are the folks living it up with the ticking Alt-A and Option ARM time bomb.

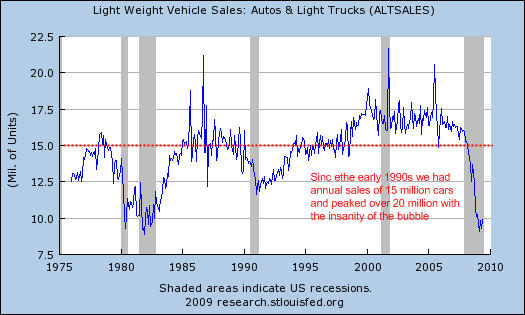

The fact of the matter is, auto sales have fallen off a cliff:

With all the attention being given to the housing bubble, we sometimes forget to mention that we also had an automotive bubble. What allowed the automotive bubble to explode? Easy and dubious financing once again. Since the early 1990s auto sales never went below the 14 and 15 million annual sale mark. This lasted well into May of 2008. Think about that. The stock market was already crashing and housing imploding yet we were still over 14 million auto sales per year! Nuts. The chart above is rather clear. Annual sales have been cut virtually in half in one year. So the dynamics in the auto industry reflect housing prices to some extent. Lower prices. What people also fail to examine is cars last much longer than they did in the past. There is no reason to replace a car every three years with a new model. A good car with proper maintenance can last you a decade. Suddenly many people have no choice but to fix and hold onto their current car.

The Federal Highway Administration lists 247,264,605 motor vehicles in the United States. From this number 134,000,000 are automobiles and 110,000,000 are trucks. As of 2000 there were 105,000,000 households. So basically we have two cars per household here and this does not include buses and public transportation. So it isn’t like many people need new cars. People are holding on to their cars more tightly and as you can see from the sales chart above, people are voting with their wallets. Easy financing built up the housing and auto industries for the past decade.

Sector #3 – Cost of Education – Higher for Public but non-Elite Private will Implode

(Deflation or Inflation) = Deflation for non-Elite private and inflation for Public

As we highlighted early in the article, only two areas are now seeing inflation. Those are medical care and education. Education I hate to say is also experiencing a bubble with easy financing. How many people do you know who went or sent their kids to a private non-elite college paying $40,000 a year in tuition to pursue a career that wouldn’t pay more than $30,000 a year? Clearly, many of these people would have never been able to afford the tuition cost if it wasn’t for easy access to student loans. That of course is now changing. The Chronicle of Higher Education had a fascinating article examining this trend:

“Is it possible that higher education might be the next bubble to burst? Some early warnings suggest that it could be.

With tuitions, fees, and room and board at dozens of colleges now reaching $50,000 a year, the ability to sustain private higher education for all but the very well-heeled is questionable. According to the National Center for Public Policy and Higher Education, over the past 25 years, average college tuition and fees have risen by 440 percent – more than four times the rate of inflation and almost twice the rate of medical care. Patrick M. Callan, the center’s president, has warned that low-income students will find college unaffordable.

Meanwhile, the middle class, which has paid for higher education in the past mainly by taking out loans, may now be precluded from doing so as the private student-loan market has all but dried up. In addition, endowment cushions that allowed colleges to engage in steep tuition discounting are gone. Declines in housing valuations are making it difficult for families to rely on home-equity loans for college financing. Even when the equity is there, parents are reluctant to further leverage themselves into a future where job security is uncertain.”

I am not surprised at all by this. It was stunning to see many people go to private schools to study a career that was fading and dishing out $50,000 a year to pursue their “dream” field. Again, this notion of having access to everything right now is the fuel that made people feel that they needed the “dream house” and the “dream car” and the “dream vacation” only to wake up in a debt induced nightmare. Few of the fields like engineering, education, or medicine appeal to Americans because why go into these fields where you have to learn “math” when you can go into selling real estate for six-figures a year with only a GED. Of course that game is now over and probably many of these private institution catering to these dream degrees will fade as well.

What we will now see is value added for certain educational fields. No longer will a B.A. in Basket Weaving land you a promising job into the middle class. I do want to make a distinction here. Private elite colleges will still have some pricing strength because of their names. And many public schools will have fierce demand because they are lower priced and offer a lucrative option to many. Take for example the University of California and California State University systems here in California. Both institutions are hiking tuition by 10 percent (again) and they are actually taking less students:

“(Daily Sundial) An even larger proposed budget cut is anticipated for the entire CSU system.

The original planned budget reductions, which would have fallen just below the $100 million mark, could now reach as high as $400 to $700 million.

For CSUN, this large discrepancy would mean cuts of up to $49 million, far from the first figures of just under $7 million.

“California is dealing with a budget shortage of more than $24 billion. A financial meltdown,” said Erik Fallis, the media relations specialist at the CSU chancellor’s office. “As a consequence, the CSU is facing an unprecedented cut in state support.”

Unprecedented is the key word in these latest figures. When Gov. Schwarzenegger announced the first proposals in 2008, CSUN had already pooled money in reserves in preparation for this type of situation, said Harry Hellenbrand, CSUN’s provost and vice president for academic affairs.

According to CSUN’s budget update web site, if the CSU budget for the upcoming year is cut by approximately $600 million, all campuses will have to reduce their incoming students by 40,000 instead of the projected 10,000.

While tuition increases and class reductions are obvious, other solutions to curtail the budget aren’t definitive.”

There you have it. We are assured that the UC and CSU will be hiking fees for the next few years because of California’s horrific budget planning and $24 billion budget deficit. And with California’s 11.5 percent unemployment rate (the highest in record keeping history) you can rest assured that many will go back to school to pursue a degree (or another one if they have fallen into a career with little viability. So in education you will see a split in the market. Public universities will accelerate tuition hikes, curtail enrollment, and become more like private elite institutions. Non-elite private colleges will have the hardest time adjusting since people will begin questioning the value of degrees and also, lack of loans will slow enrollments down.

Sector #4 – Employment – Wage Cuts – Hours, Furloughs, and Layoffs

(Deflation or Inflation) = Deflation

There are few things more deflationary than unemployment. Would you work one month for free if your employer asked you to? Well if you work for British Airways, they have already asked this question:

“(Yahoo!) British Airways is asking thousands of its staff to work for free for up to four weeks, spokeswoman Kirsten Millard said Tuesday.

In an e-mail to all its staff, the airline offered workers between one and four weeks of unpaid leave — but with the option to work during this period. British Airways employs just more than 40,000 people in the United Kingdom.

Last month, the company posted a record annual loss of £400 million ($656 million).”

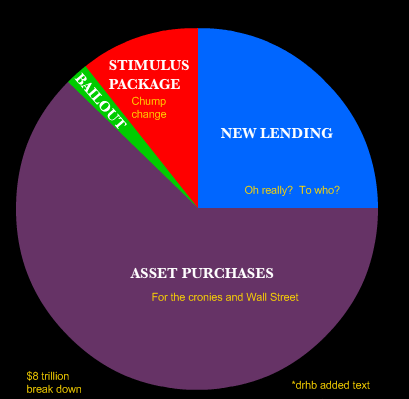

Now think about that. This only adds more pressure to prices on the downside. When you yank the pay of an employee either through cutting hours or asking them to work for free, they have less money to spend. This is also happening in the U.S. where companies are furloughing people or cutting back on overtime. In our country where nearly 70 percent of GDP is consumption based, what do you think this will do for spending? Of course people point to the trillions in bailouts but I haven’t seen any of that money rolling my way. Have you? Unless you are part of the crony banking syndicate you are basically bailing out those who created and financed this mess in the first place.

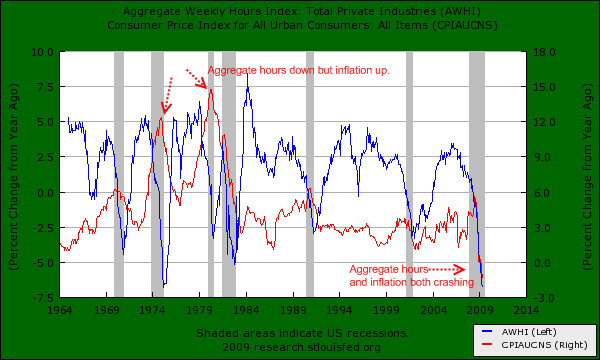

With 26,000,000 unemployed and underemployed Americans, there will be more pricing pressure on the downside. This chart below shows how weak the market is in terms of pricing power:

Some people point to the 1970s of a time where inflation raged and we had price jumping up in the face of recession. This was the so-called stagflation. Yet much of this was again based on energy but also, the nature of globalization wasn’t as big as it is now. We still had some control. Now, we have essentially out sourced our entire manufacturing base and became a service driven economy. Nothing was more prominent than when GM filed for bankruptcy, Wal-Mart announced it would be hiring 22,000 more people. Trading $20 an hour jobs for $10 an hour jobs. That is deflation in wages.

But if you notice the above chart, both aggregate hours worked and inflation are both plunging. What does this tell us? That deflation for the moment it taking hold of consumer prices and wages. Aggregate hours is a more sensitive indicator than overall employment since it looks at aggregate weekly hours worked. In fact, this may be a good indicator of when things may start turning up since companies may not be hiring people early in the recovery when it comes but instead, using the British Airways example will start paying those employees who took the month off for the month.

Even major strongholds like state governments will be cutting wages and not hiring as much:

“LOS ANGELES, June 21 (Xinhua) — In response to California’s budget crisis, more than half of the state senators have agreed to reduce their 116,208-dollar salary this year, most taking a five-percent cut starting July 1, it was reported on Sunday.

During budget negotiations last week, Senate President Pro Tem Darrell Steinberg took the lead by offering to have his salary reduced by five percent, according to the Los Angeles Tims.”

Now of course this is a joke especially here in California where we have one of the most dysfunctional politicians up in Sacramento. But tens of thousands of state workers have already been furloughed in effect taking a 10 percent pay cut. Does that sound like inflation to you? And the power of the unions which once had a say in pricing power has little clout in a global marketplace. How are you going to compete with China and India and their wages? You can’t. Plus, Americans like cheap goods. Unless we do boneheaded moves like the Smooth-Hawley Tariff Act we can expect more pricing pressure to the downside.

Sector #5 – Stock Market Losses

(Deflation or Inflation) = Deflation

The stock markets are off by 40 percent from their 2007 peak which shows the depth of the collapse since we have had a virtually non-stop rally since the March 2009 lows. I’ve been re-reading Charles Kindleberger’s The World in Depression 1929 – 1939 which is a fantastic read about the global collapse during the 1930s. It is a dense read but worth it if you really want to understand the multiple factors that led to the Great Depression. Some are arguing that the current pains we are feeling are because of the stock market crash. I tend to believe the crash of the stock market is a symptom of the global debt bubble we went through. This is what Professor Kindleberger had to say about the stock market crash during 1929:

“In the light of the sudden collapse of business, commodity prices, and imports at the end of 1929, it is difficult to maintain that the stock market was a superficial phenomenon, a signal, or a triggering, rather than part of the deflationary mechanism. One should not be dogmatic about it, but it is hard to avoid the conclusion that there is something to the conventional wisdom that characterized the crash as the start of a process. The crash led to a scramble for liquidity on the part of both lenders to the call market and owners of stocks. In the process, orders were canceled and loans called. The action of the Federal Reserve in buying securities in the open market and lowering the rediscount rate in New York brought credit markets quickly into good order. By this time, however the deflation had been communicated to fragile commodity markets and durable goods industries. The stock market crash is less interesting for the irony it permits the historian, bemused by the foibles of greedy men, than for starting a process that took on a dynamic of its own.”

In our current case, the stock market crash was merely reflecting the collapse in the credit markets and the housing bubble bursting. The stock market did not create this recession but is merely reflecting the reality on the street. When we hit the peak in 2007, it reflected the peak of euphoria. When it busted, it reflected the panic. The current jump is optimistically betting on a second half recovery which fails to adequately analyze the commercial real estate bubble bust which is going to hit us and the immense amount of toxic assets still in our system. Even if we dump all these toxic assets onto the taxpayer, they will fail and guess who will end up paying for it? In the end, prices will still need to find a bottom.

Let us take a look at the Dow World Index:

Now if we look at the Dow World Index, we see that prices nearly fell by 60 percent to the March bottom. And since that bottom, it has rallied by 47 percent but is still off by 40 percent. The bottom line is that the world is in recession. This is not isolated.

Looking at these five major sectors you realize that deflation seems to be the major issue at our door. And what people fail to realize is that American households have lost a stunning $13.87 trillion in wealth from stocks and real estate. So even though the Fed and U.S. Treasury are saving their crony banking buddies, the bottom line is the average American is still suffering. The Atlantic has a great break down why most Americans feel like they are getting shafted in the current scheme of things:

So while American households just lost $13.8 trillion only $700 billion or so will be felt by the average American. The rest of the trillions will go to bailout and patch up the Swiss cheese balance sheets of the Wall Street cronies. By this time during the Great Depression we were already marching people down to the Pecora Investigations bringing justice to those who brought the economy to a halt. Today, we are still giving more and more power to those who are largely at the helm of this mess. So for the time being, demand destruction is leading to price deflation.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

24 Responses to “Deflating our way to Prosperity: Five Major Sectors of our Economy Pointing to Demand Destruction Price Deflation. Education, Wages, Housing, Stocks, and Automobiles.”

Really nice job bringing all this information together and explaining it succinctly.

I recently started looking at rentals and have been told by more than one landlord that rents have dropped dramatically – and this is a “hot” neighborhood (Culver City) with a vibrant art and restaurant scene. One said he used to get $3900 for the house, now he’s having trouble getting $3200 – that’s a big drop! There are still a lot of “it won’t happen in this neighborhood” threads here, but I’m sticking to my guns and waiting it out.

“Renting is the new black”……………..awsome

Very good job, i am french and i do not understand why in usa people do not ask for a new pecora ?

You Amerian people are the forehood of democratie people, why don’t you complain against your governement ?

(sorry for my english…)

This is almost amounting to a crime against humanity. The money that is going to bail out the rich is needed to rebuild the country’s crumbling, long ignored infrastructure and to build new alternative energy infrastructure. The continuing failure to act on these will cause serious harm to the population not only here but across the world. If US food exports stop for one year due to scarcity of energy, 400 million Africans will die of starvation.

We no longer have the luxury of acting like these problem don’t exist. Instead of bailing out bankers and handing out unemployment for doing nothing, the government needs to directly put people to work to solve these problems – similar to work programs during the Great Depression. I really fear for the country’s future, not because the technology doesn’t exist to solve our problems but because the will to do the work needed and to pay for it is not there. Instead we’ll just let the super rich get richer while the country falls apart.

At least I’m lucky and can prepare for myself and my family. I would rather work together to solve these problems but people are so brainwashed that all government is bad and too greedy to want to help pay for it – so working together is not an option. If you plant ice, you’re going to harvest wind.

Deflation everywhere.

The major assets that make up our wealth (or is that imaginary wealth?) are falling or have already fallen dramatically. First housing, then investment portfolios of stocks and mutual funds, retirement accounts, cars, etc., now there is even a rumour of a banking holiday soon (can someone say currency devaluation or withdrawal rules a la Argentina). How do we protect our wealth?

http://www.totalinvestor.com

Doc, when you “drive around areas in Los Angeles County w[h]ere people were living in run down apartments but out in front you would see an Escalade,” they think you’re the repo man.

I am sure that you are highly amused (annoyed) by Yun’s latest bullshit. He is blaming lower than expected sales on bad appraisals, basically saying that appraisers are underestimating prices and making would-be buyers change their minds.

I want to know when Yun is going to be arrested, tried, and executed (painfully) for treason and general assholeness.

On the spot. I agree with all of your conclusions. So basically we’re getting deflated on all fronts. But I do suspect that inflation is gonna slam us in the face in a few years… those dollars have to go somewhere…

While deflation is in main street, inflation (increase in the money supply) is building up in the bailed out banks. Articles on the web show that banks are not lending preferring to park their bailout funds with the fed at a very low but very risk free interest rate. This avalanche of money sits there waiting for a trigger event for it to be spent for instance if the fed charges for the money on deposit rather than paying interest. Yes we have deflation and inflation at the same time this is why people are schitzophrenic. All you have to do is idenfify the area you are looking at: Main Street = Deflation, bank reserves = inflation. (note these bank reserves are circulating a giant black hole of derivatives but not to worry the government has a fiat printing press or a keyboard where digits and multiple zeros can be input…)

The powers that be have made it clear that inflation in Assets DO NOT COUNT. Asset inflation has never been counted in the CPI on the up side so they should not count it on the down side.

Your facts are all true but the conclusion can not be so certain.

I believe there will be mild deflation to price stability in the next couple years but then raging inflation.

If 10 million people are unemployed, they no longer produce the goods and services that people buy. Yet, those 10 million are still getting the money in the form of unemployment checks or some other subsidy to spend on the goods and services. The worse things get the more true this will be.

Then 20 million are unemployed, no longer producing and spending money on a shrinking supply of goods and services.

If the economy gets bad enough the government will extend unemployment for years. If the economy gets bad enough the government will send stimulus checks in greater amounts and greater frequency.

All of the arguments out there supporting deflation make the same claims. You can’t force people to borrow, if people don’t borrow because they can’t or wont the FED can print all they want and it won’t cause inflation. All true. But if you GIVE people money, it will get spent. As more and more people who produce nothing are given money to spend, the same amount of money is chasing fewer and fewer goods and services.

Even if a person doesn’t buy that argument there is another. If the trillions of dollars foreigners hold come back to our shores inflation will ignite from that event alone. Many things can cause this to happen, from lack of confidence to poor returns. In fact, this inflationary event could spiral out of control if foreigners simply stop buying NEW government debt.

One last argument, if you simply check out Shadowgovenment.com you will find the old CPI that was used before they manipulated it. True inflation is and has been at least 4% higher than reported.

It is simple. If a company can produce a widget for 10.00 in 1 man hour but then due to productivity improvements is able to produce that same widget in .5 man hours, wouldn’t it stand to reason the cost of the widget should decline? The answer is YES. However, instead of declining in price the CPI “captures” the productivity improvements so that 10.00 still buys only 1 widget.

Instead of productivity allowing your money to become more and more valuable, it is used to hide the real inflation rate. The fact is deflation should occur every day in things. In fact, the rate of productivity improvement is so great in some items, like TVs and computers, we actually do see declines despite the CPI siphoning off some of the benefit.

So, unless we get a new bubble to replace the old quickly, we are due for some price stability in the next couple years, and continued declines in asset prices such as real estate and stocks. After a couple years of printing trillions we don’t have we will see rapid price increases in everyday things such as food, health care and energy, the things we MUST have to survive. After a while, every category will show inflation, including housing and stocks.

We have all been screwed and it is just the beginning.

I

My God that’s depressing. Not your fault Doctor, you’re just telling the truth here.

My advice for friends and family has been to follow the lead our government and corporations…

L O O T ! !

And I practice what I preach by working as much as I; overtime, comp time. Then I turn a regular percentage of that into tangible assets.

The inflationistas are not saying there is inflation now; rather, it is always lurking beyond the horizon, ready to pounce. They purposefully forget their sunscreen because it might rain. Boy have Schiff, Rodgers, Dines, et all been burned– down 80% last year.

The gold foilers have been in this mode, and wrong, since at least 2001.

Compelling arguments, as always DHB.

My observation is simultaneous inflation and deflation: demand-pull deflation and hyper-inflated currency. It’s a deadly balancing act. If either takes hold, it could be a lost generation, and the largest generation.

Usury is the weapon of mass destruction of the money-changers. Most of us are completely underwater. We fear the third-world neighbors all around us and have seceded our cities to them. Supply and demand aren’t working with food because the largest number of folks on food stamps ever and our obesity-driven golden-corral-cattle mentality keeps food prices up. And the plastic is still out there–pay as you gorge? Not while there is tomorrow to pay.

I see another author has succumbed to reporting the obvious (seeking alpha):

“Unfortunately, the problem of negative equity is not theoretical. In the latest overview of housing and the credit crisis, T2 Partners LLC assembled an in depth, excellently documented case on why the pain in housing is not about to end quickly. One eye opener in the report is the estimate, by type of mortgage borrower, of negative equity. T2 shows the following stats: 73% of OptionARMs, 50% of subprime, 45% of Alt A and 25% of prime mortgage loans are underwater. Combine this with a weak economy, job losses and negative income growth and the potential for additional huge write-downs on residential mortgages seems inevitable.”

…Now where have I heard this before? Thanks, Doc. It’s bitter medicine, but keep giving it to me straight.

The other D-word.

Good read, but I wouldn’t consider what they are doing to the dollar to be deflation, I’d use the other D word (debasement or devaluation). Once that happens we are toast like Zombabwe’s dollar our dollar won’t be worth sh*t and everything will cost a fortune.

Inflation and deflation are not the same as prices going up and down. They actually refer to the amount of money in the economy. It’s easy to see that making more money available (inflation) can lead to higher prices as there is more money chasing after what is assumed to be a fixed supply of goods. And that deflation will drive prices down as the scarcity of money would make it more valuable. These terms don’t necessarily make much sense in our current situation. The money supply is increasing at an alarming rate, but this is in response to the availability of credit taking a dive off a cliff. What we’re seeing now is a nebulous situation in which inflation occurred very quickly without proper reporting during the series of bubbles that lit up our economy over the last 15 years or so. Then an almost instantaneous deflation occurred with the credit crunch, drastically dropping the money supply. And now with the TARP and TARF and all the federal bailouts, buyout, liquidity insertions or whatever you want to call them, massive inflation has occurred. The hope in motivation for these moves was to try to stabilize the economy by replacing the money vaporized in the credit crunch, and this illustrates another important fact: Deflation cannot occur with a fiat currency unless those controlling the currency allow it to happen. As you’ll note, the response to the credit deflation was to try to replenish the money supply that had significantly diminished. The state of the economy is one of dynamic equilibrium where the credit crunch placed massive deflation forces upon that equilibrium, pushing it to seek a new level and now the fed’s policies are pushing back against that force. The question they need to ask is how hard of a push is required. And unfortunately, they have to to rely on trailing indicators to guide their future actions. Acting fast and acting hard will almost certainly lead to oscillation in the best of circumstances and a 70’s style economic spiral at the worst.

There does appear to be deflation in prices for the above 5 sectors, especially houses and cars. However, the IMF recently said that a dollar revaluation is desireable to allow the US to increase exports. I also read about the possibility of a bank holiday for in late August, or early September, in order to reorganize banking and to devalue the US dollar. So, despite asset price and value deflation from demand destruction, it seems that a 30% percent (for example) dollar devaluation would immediately require prices to go up at least 30% to compensate for the devalued dollar value, especially on imports (like cars, car parts, clothing, and Wal-mart type imports). Yes, there is deflation possible for years; but, economists/commentators don’t seem to comment on the impact of price inflation coming with the imminent deliberate dollar devaluation. It seems that dollar devaluation would cancel price deflation, despite demand destruction.

We actually have “bothflation,” or “multiflation,” depending upon your ‘flation definition(s) and whether you appropriately account for a wide market sector spectrum. For instance, pay close attention to products you routinely buy when shopping (e.g., packaged food). Many products have been repackaged – smaller quantities of product in a given size container, but sold at a constant price. Scamflation…

“The gold foilers have been in this mode, and wrong, since at least 2001.” Really? From $255 / oz in 2001 to over $900 / oz today is a “wrong mode?” Seriously, making profits in the physical particular market hasn’t been too difficult for anyone with basic trading knowledge and some discipline. How now, down Dow…

The banks are indeed sitting on their bailout $, waiting for the “trigger.” The trigger would ideally be timed to provide maximum political benefit to the incumbent party, e.g., a fund avalanche timed to manage public perceptions as part of an election campaign. Trigger timing may be accelerated, however, by an approaching currency crisis and/or geopolitical event…

Personally I think the CPI is inaccurate or maybe completely bogus. Food prices in my area have gone up consistently since this time last year. My annual Health Net insurance premium cost increase has averaged 30% per year for the last 3 years! This year’s premium bump is 34.9%. Where is an increase like this reflected in the CPI? I also notice my credit card companies are changing from fixed rate APR’s to adjustable rates based on the Prime rate plus a margin. In my memory this behavior usually precedes interest rate increases. You can be certain that those of us who must use credit to make up the difference in lost income will be paying dearly for it. Where is that reflected in the CPI?

Doctor,

What do you think about this movie ?

http://video.google.com/videoplay?docid=7065205277695921912&ei=zypGSqfmNcSf-AbW8dT9Bg&q=zeit&hl=fr&emb=1&dur=3

Slam dunk, Doc. I was particularly interested in your deflation of education thoughts. I worked most of my career in the Ed Biz, starting in my teens (to put myself through college and grad school on my own nickel). I watched college education go from a fortunate privilege that the rich got simply for occupying their niche but the rest of us had to work hard for, to the McDonald’s model of franchising and debt-based consumerism. Pitiful.

~

In the meantime, over three decades of hiring young people, I watched them become increasingly unskilled, entitlement-minded, and clueless. I’d get resumes that were simply jaw dropping in their arrogance, cluelessness, and immaturity. Their first real challenge in life was their first real job, and most didn’t do well.

~

In the meantime, as education was cheapened into a bauble, the working class kids who’d had to battle for their education watched rich kids, whose parents bought their degrees for them, get advanced into the really interesting and challenging positions. Then go on to be incapable of doing anything but making as much money as they can before trashing everything. There in a nutshell is the story of the last two economic bubbles (tech and housing).

~

I am all over education, but not when it is a commodified substitute for learning, growing, and evolving. There IS an Ed Bubble, and it is going to deflate. Just one more reason that this whole extended period of adjustment is going to be painful, ongoing, and horrendous, even as it is utterly necessary.

~

rose

Smaller portions for the same or more money is a hallmark of inflation. Where food is concerned: previously 15 3/4 ounce cans of soup now hold 14 ounces but are 20-30% more expensive. Boxes of prepared cereal products that used to be 18 ounces, now 12 or 10.

~

But an even more vile hidden inflationary force has been the systematic substitution of fractionated agri-industrial food-derived components for actual food. For example, fractionated sugars (like high fructose corn syrup) and fats (like hydrogenated fats) substituted for actual cane sugar and butter. By substituting these nutrition-neutral, downright health-compromising industrial components for actual food ingredients, manufacturers have gleaned billions of dollars from consumers. Look at how many processed food products have just these two ingredients in the top three. And these are not foods, but byproducts of industrial processes applied to mega-farm commodities. They are placeholders for food.

~

This is related to health care inflation, because as we pack our bodies with these non-nutrients, our bodies grow weaker and more prone to acute and chronic illness. People eat themselves into obesity as their bodies are seeking missing nutrients and getting only caloric ballast.

~

This is just one more example of the crisis point we face in the mega-scale post-industrial model where everything is engineered to skim as much profit as possible off a continually growing pool of sick, miserable, confused, angry, lazy human serfs.

~

Regarding the more usual form of inflation, t the deep discount stores where we purchase food ingredients, we have observed STRONG price upturns in the past year–20-60 percent! We buy everything wholesale, in bulk quantities, and very little processed food. Our fresh food comes from a variety of sources, including barter and very small local growers. So how the CPI can claim that food isn’t going up is totally beyond me. Real food is more expensive, Frankenfood is more expensive and less nourishing…and the big agribusiness companies remain rich as Croesus.

~

rose

Inflation will take hold when nobody wants to take dollars for commodities, which are priced in dollars. Or they will demand more dollars or gold or some other currency. Then the dollar price will soar for raw materials. Meantime, the deflation in business activity, as described by the good doctor, will continue to get worse. The result will be a hyper-inflationary depression, just like Schiff et al have been warning about. The only way out will be to begin to sell off various parts of the country to satisfy the massive outstanding debts: airports, mines, mineral rights, blocks of foreclosed real estate. When that has been completed, the economy will collapse into a deflationary depression, with virtually no way out except to issue new currency based on gold or land or some other tangible asset.

Got gold?

try buying a car, keeping it and paying for the repair work when it starts breaking down in less than 3 yrs. repairs are more expensive than buying a new one every 3 years and the new one will run instead of leaving you stranded like the old one. the car problem will only improve when the manufacturers start building a quality product again. this means you too,toyota and honda. we have westernized the japanese manufacturers and they too are putting out trash. c’mon america, get right!!!-jerry

Leave a Reply