Real Homes of Genius – Santa Monica Westside Short Sale Action. How to go from $770,000 to $1,200,000 Million in 3 Years and Lose it All. The Short Sale Valentine Special with No Mortgage Payment for Nearly Two Years.

The Westside of Los Angeles is a coveted area. I’ve covered many parts of this market including Culver City. Yet even within the Westside zip codes some areas are more prized than others. Santa Monica is one of those jewels but only if you land in the right zip code. In the early days of the bubble bursting some people were still thinking that contrary to economic trends that Santa Monica would somehow stay out of the problems associated with the California housing market. Yet we now know that every area is being touched and not even the prime locations are immune from massive price corrections. It is interesting that all it took to pop the bubble was two major things. For the herd to stop believing real estate would always go up and the vaporizing of the no document and low down toxic mortgage enterprise.

If we really look at things objectively you would think that things are really good for housing. Mortgage rates are at generational lows, there is certainly plenty of inventory, and banks are willing to work with buyers. But this is all a charade. The problems we are still experiencing are that in many cities in California prices are still in actual bona fide bubbles. Would you buy a flat screen for $18,000 if your payment was $50 per month for 30 years? Santa Monica is one of the markets still in a solid bubble. Today we salute you Santa Monica with our Real Home of Genius Award.

Short Sale Valentine Special

I’ve been getting a few e-mails on how great it is that banks are now approving short sales. This is actually bogus because it is in their best interest to do this plus, as the SIGTARP report showed banks will get $1,500 for each approved short sale. Here are some of the incentives:

• Borrower Relocation Assistance — A $1,500 incentive payment to the borrower.

• Servicer Incentive — A $1,000 incentive payment for the servicer.

• Investor Reimbursement for Subordinate Lien Releases — For every $3 an investor pays to secure release of a subordinate lien, such as a second mortgage or a home equity line of credit, the investor is reimbursed $1, up to a reimbursement limit of $1,000 per transaction.

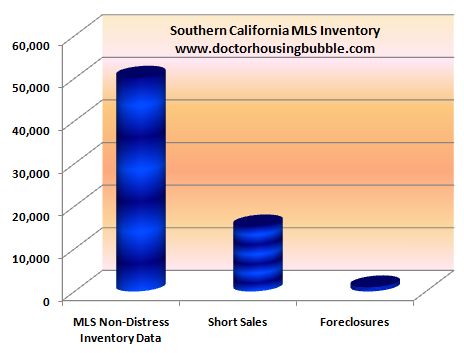

The most hypocritical can of horse manure coming out from banks is that they are now doing this as some kind of favor! They are using taxpayer money for something they should already be doing. But that is beside the point. With HAMP going down in a wave of flames, we will start seeing more short sales hitting the market. The above chart breaks down the MLS data and as you can see, short sales are a big part of the MLS while foreclosure listings are virtually non-existent even though 1 out of 7 mortgages are in default. Where are these homes then? In the shadow inventory or simply being lived in with no payment.

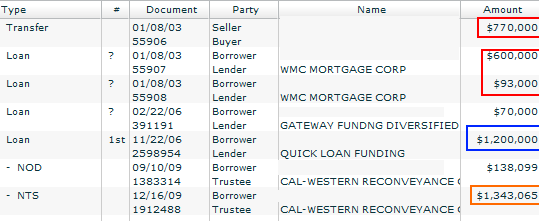

Today’s home is an interesting short sale in Santa Monica. It has only been on the MLS for a week but the story behind the home is much more interesting:

According to the ad this is a “short sale valentine special†so you might need to rethink that tired and old flower routine this weekend. Maybe a Santa Monica short sale is the aphrodisiac your relationship needs. The home is listed at 2,044 square feet with 3 bedrooms and 3 baths. It was built in 1947. I give California realtors credit for not even mowing the lawn on a listing in an expensive zip code (90405) in Santa Monica. Let us look at the pricing action:

Price Reduced: 02/05/10 — $930,000 to $899,000

Only a week on the MLS and already a $30,000 reduction. Looks like someone is looking to move this place! You might be stunned that a home listed for $900,000 doesn’t even have a manicured lawn but the path this home took to short sale land is symptomatic of the insanity of California real estate:

Let us walk through the above details. The home was purchased in 2003 for $770,000. If you do the math, a mortgage of $600,000 and $93,000 meant this buyer went in with 10 percent down ($77,000). So they definitely had some skin in the game. But then, the California housing market went into warp speed bubble mode and they managed to refinance for a stunning $1.2 million. We really don’t know what was done with that money but we do know this:

$1,200,000 – $693,000 = $507,000 cash out

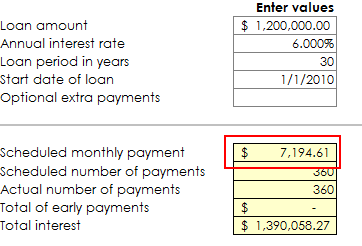

Now the above numbers are for simplicity. We don’t know what kind of loan they got but all the lenders listed about specialized in let us say, easy money financing. Also, we are using the $693,000 for ease of calculation because most of your first mortgage payments go to interest (hardly any principal is taken down). And who knows, these could be option ARMs. So now we are in 2006 with a mega mortgage but some cash as well. Let us run the numbers for a $1.2 million mortgage:

Now we are really being generous with the above data. The above only includes principal and interest. Let us include taxes and insurance and the monthly nut looks like:

PITI:Â Â Â Â Â Â $8,394

Now how much time does that $507,000 cash buy you in terms of monthly payments:

$507,000 / $8,394 = 60 months (5 years)

Well you know where this is heading. In September of 2009 a notice of default was filed. They were already behind by $138,099. Now think about this. Assuming the $7,194 payment how many months was this:

$138,099 / $7,194 = 19 months

Now this is insane of course but we know with all those Alt-A and option ARM products that this is typical with shady bank strategies. Finally the home was scheduled for auction and is now listed at $899,000. Who is going to buy this place? It doesn’t qualify for FHA insured loan financing. It would appear that the bigger your mortgage the more dubious banks will be on moving to foreclose on your home. They are happy to move quickly on homes in the Inland Empire but put a prime Westside location and banks are letting people live rent free for what would seem as ages. The fact that a listing like this doesn’t surprise me anymore shows how desensitized I am to the gaming banks have been doing.

Today we salute you Santa Monica with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

20 Responses to “Real Homes of Genius – Santa Monica Westside Short Sale Action. How to go from $770,000 to $1,200,000 Million in 3 Years and Lose it All. The Short Sale Valentine Special with No Mortgage Payment for Nearly Two Years.”

Buyers did very well on this. Walked away with $507,000.

Give these people credit. They figured out a way to become semi-rich,in a way that no MBA college program would teach you.

Send them to Sacramento to clean up the budget mess!!

$507,000 cash out, “We really don’t know what was done with that money”???

I know what was done with the money, they spent it. They bought SUV’s, and big screen TV’s, They kept the economy humming. It was great while it lasted.

Coffee thru the nostrils time…

Quick Loan Funding – ‘You can’t wait and we won’t let you”

Haha…those Quick Loan Funding loans were all sold off to the Wall Street rogues Gallery, then sliced n diced.

The basic math used is fine…some lucky “owner” robbed a Wall Street) bank aka pension funds’ Aaa CDO to the tune of $500,000

But too bad you could give a glimpse into the amount of money made by the mortgage brokers, the originator, Quick Loan Funding (snort) The Wall Street slicers n dicers, and all the other leeches on the body.

There are tens and tens of thousands of dollars that got sucked from this body like a pack of vampires.

Then you go back and look at the property itself and have to stare in shock and awe at the audacity of hope that exists in a state that believes this property can be worth more than $400,000. Big ocean close by or not.

What were (are) they thinking?

Yeah, “still” in a bubble? I’ll say.

Oh dear God, that home doesn’t even look like a $900,000 home. I remember what “a million dollar home” used to look like. Now, there are a dime a dozen.

I am starting to hear this story more and more. The borrower stops paying the mortgage and the lender does not even issue an NOD. How many out there are like this????

“I give California realtors credit for not even mowing the lawn on a listing in an expensive zip code (90405) in Santa Monica.” But they did remove the trash cans. No wonder everybody wants to live in Santa Monica.

Someone paid 8000 a month to live in that crappy little dive? Wow.

Look how far we in the “affluent” United States, and in the Golden State, that a shanty like this is considered habitable, let alone ever sold for anything like $700K. In fact, a price tag like this on a shack like this screams poverty- this is “middle class” in a third-world country such as we are quickly becoming.

The only reason the buried borrower even bought this hovel, most likely, is so he could extract equity from it to spend on other things. I wonder what those were. Could he have used the cash out to buy a nice house in a moderate-priced area of the country to retreat to when the bubble finally burst?

Wanna know what’s really gonna damage the housing? The reform bill that Obama is now rushing through.

It is Higher taxes and mandated insurance or go to jail. We’re in the middle of a Recession. Higher taxes now means more businesses will outsource themselves oversea’s, when they do that their are less jobs here. less jobs means more unemployment. if the unemployment keeps rising like it is. it will cripple the economy. all thanks to Obama’s retarded policies to pass reform now than after.

I am a huge fan Dr. Bubble! You’re doing an amazing service. This is a video that http://www.thinkbigworksmall.com/mypage/player/tbws/23088/1386032 helps to explain in essence what you are stating about short sales and the BIG advantage it has for the banks.

I think this may be the ugliest house you have ever shown on your site. I would not live in it unless I were a crack addict. I think that the rest of America should line up just east of the San Andreas Fault and start jumping up and down until California slides into the sea. They are all totally insane and useless.

With One West taking on all IndyMac’s toxic loans, how long will it take for the wave of short sales and foreclosures to start hitting the market? With a huge financial incentive to move the homes, why wait one minute to put them out on the market? One West isnt really a bank, it’s a liquidation company formed for the sole reason to sell-off all the delinquent properties ASAP. 2010 could get really ugly.

Hey now Expat, no need to tar all of CA with that broad brush. 1/2 of us in L.A. rent you know, we don’t buy million dollar crack houses. And yes this house looks terrible, even in CA it looks like it might be worth around 100 thousand, no more.

It still amazes me that no one is calling for Fitch, Moody’s and S&P, to go on trial for duping pension funds into believing these loans were considered triple A’s!

Well, they didn’t exactly pay $8,000 per month – at least not after February 2008.

They paid from the refi of November 2006 for exactly 1 year and three months, a total of approximately $120,000, so they made off with $387,000.

A legal bank robbery, much safer than a stocking mask and replica. Of course, the taxpayer has to front up for this redistribution of wealth!

WATCH:

MONEY AS DEBT !!!

Reality is hitting the Westside, slowly but surely. This clearly shows how crazy banks were able to get without any regulations. Greed at it’s best. Now the Westside has begun it’s correction and will be dramatically correct over the next 2-3 years, as toxic AltA and Prime mortgage products explode. We have already seen Double Digit drops in Price Per Square Foot over the last 1-2 years, in many neighborhoods. Inventories both shadow and listed will swell from now until 2012, putting extreme price pressure on the Westside. Malibu alone dropped almost 30% since last year! Brentwood, Santa Monica, West Hollywood, Venice, Pacific Palisades, Bel Air, Beverly Hills, Westwood, Marina del Rey are currently taking big hits.

http://www.westsideremeltdown.blogspot.com

@Edy

I understand your frustration, but do a little Fox Knews/CNBS critical thinking. Everything they say is basically to shrug all of the banking mafia’s crimes off onto the government. Obama was a politician in squeaky clean Chicago and most of congress don’t understand the complexity of banking chinanigans and thought Glass-Stegal was just unneeded red tape to keep the banks from being productive when this crap went into high-gear. And the entitled generation went along with it, thinking they have something unique to offer the world. Yes the government was ignorant and probably complicit, but the beast is the banking oligopoly, and don’t lose sight of that. And we are playing right into their hand.

I’m stunned.What if they took that 385k$ and rolled it over on down payments on 3 more homes. If they managed to pull the Fraudequity (hey I invented a new word)out in time (catholic financing) they could have rolled that 385k$ into more than a cool million.

Fraudequity – it describes the last decade to a tee.

It will be interesting to see how long these people http://beforeclosed.com string it out. They’re giving a real time account of their foreclosure as it happens on their blog. Pretty interesting…

Leave a Reply