Real Homes of Genius – Pasadena Million Dollar Home or $3,500 a Month Rental? You Decide.

The latest report from First American CoreLogic shows that 11.3 million properties with mortgages are now in a negative equity position. If we add in those “near†negative equity we find that roughly 30 percent of all homes with a mortgage balance are underwater. For California, that number is higher with 35 percent of homes with a mortgage being placed in the negative equity camp. If we ran the numbers for Alt-A and option ARM loans I wouldn’t be surprised to see that number above 70 percent. The market is clearly still in deep distress. As I have stated from the start, we will have no real recovery until job growth enters the picture. This is such an obvious statement but the banking and real estate industry seemed fixated on housing as the panacea to a full economic recovery. Housing and the banking industry led us into this mess to begin with.

I took a look at data from the Employment Development Department (EDD) of California and last year was another record year for California in terms of unemployment claims paid out:

“(EDD) A record high 1.4 million Californians were certifying for UI benefits in November 2009, according to the most recent information available. In all of 2009, EDD paid $20.2 billion in UI benefits that not only helped sustain families during this difficult time, but also helped support local communities struggling to survive the economic pressures.

The prior record of UI benefits paid in a single year was set not too long ago in 2008, when the EDD paid out $8.1 billion in UI benefits to out of work Californians.

That’s a 149 percent increase in the total UI dollars pumped into the State’s economy in 2009 at a rate of about $80 million a day.

The $20.2 billion paid in benefits in 2009 translates into an economic impact of about $32 billion dollars when you look at how UI dollars spent on basic necessities leads to further spending in the general economy. The U.S. Department of Labor estimates the economic multiplier is $1.60 for every dollar paid out in UI benefits.â€

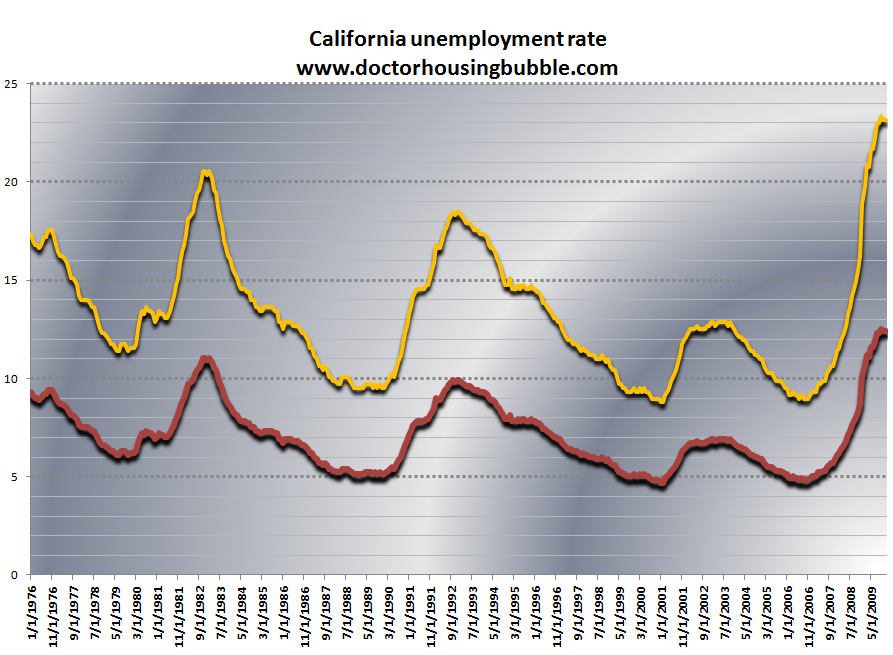

Did you get that? In 2008, an already bad year $8.1 billion in UI benefits were paid out. Last year, that number went up to $20.2 billion and we are still near the peak unemployment rate of 12.4 percent:

Source:Â BLS

I’ve had this conversation with a few colleagues in the real estate industry. Whenever they mention that California real estate is at a bottom I always ask them what industry is going to make up for the million and more jobs lost. They don’t have an answer. Heck, in the 1990s it was all about the tech sector so that was supposedly going to give every Californian with basic HTML coding abilities and a Geocities account a $60,000 a year job with no college degree. When that bubble burst, it then was every Californian was going to work for the real estate industry making $100,000 simply by popping on a suit or a skirt and pushing mortgages or property in the mania of the century. That bubble burst. So what gig is next? Can we at least get some jobs going before we start jumping on another real estate price bandwagon?

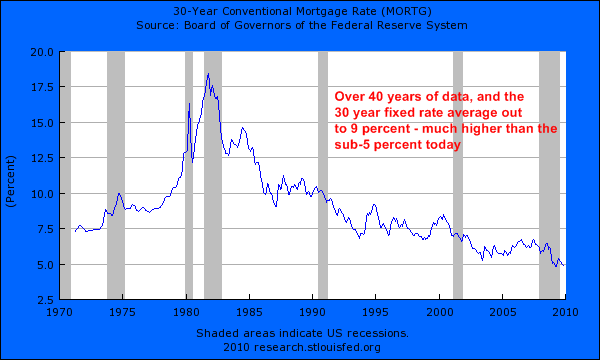

One major flaw with the current thinking in the housing market is assuming mortgage rates are somehow going to stay low forever:

Examine the above chart very carefully and enjoy that sub-5 percent rate because that is not going to last. We are at the lower bound. Even if we revert to historical averages of 9 percent, that will absolutely tank the California housing market. Keep in mind that a large part of the above is because of the Federal Reserve buying up $1.25 billion in agency mortgage backed securities debt. That game is quickly ending and this in itself has probably shaved off 100 to 200 basis points. In other words, mortgages are going to get more expensive.

But let us show this massive disconnection with another on the ground example in Pasadena. We’ll even pick a prime zip code in the area. Today we salute you Pasadena with our Real Homes of Genius Award.

Pasadena Dislocation

I decided to pull data on 91105 zip code in Pasadena. A middle class two income area where the median home price is now $657,000 (down 25 percent from last year). So certainly this area has seen a correction but is the correcting over? A good way to measure market metrics is looking at lease rates and home prices for the immediate area. First, let us look at our home for sale:

The above home is listed as a short sale which now seems to be gaining further momentum thanks to programs like HAFA. The home is a 3 bedroom and 2 baths home and is listed at 1,978 square feet. It has been on the market for over 40 days. Let us look at previous sales history:

Last Sale Info:

Sold 08/17/2006: Â Â Â Â Â Â Â Â Â Â Â Â $1,000,000

Not too long ago this was a million dollar home and the current list price is $949,000. So I went ahead and tried to search for a rental in the immediate area. These are hard to find but are extremely illuminating in giving us a sense of whether current prices are too high or low. So I found this home on the next street over:

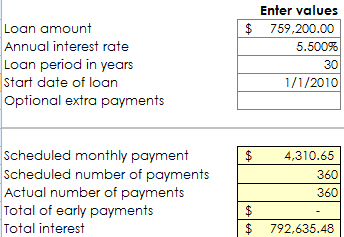

The rental is a 2 bedrooms and 2 baths home listed at 1,504 square feet. The current asking rent is $3,500. Now let us run some numbers. We’ll assume that you are putting 20 percent down for the home purchase:

20 percent down payment:Â Â Â Â Â Â Â Â $189,800

The latest tax data shows the home running $11,381 in taxes in 2009. So we’ll assume the monthly carrying costs:

$4,310 (PI) + $948 (T) + $395 (I) = $5,653 for each monthly payment

I’m assuming for the insurance that you are actually vigilant enough to get earthquake insurance in California (many homeowners don’t even have this). So this is a significant difference. But let us assume you buy this home. And rates increase modestly to 7.5 percent in five years and you plan to sell. What is the future buyer looking at?

$5,308 (PI) + $948 (T) + $395 (I) = $6,651 for each monthly payment

With a modest interest rate increase, the payment jumps up $1,000 to $6,651.  This is why we have a lot of correcting to do. Rates are artificially low and many are assuming the current environment is going to stay this way for a long time. It will not. I’ve mapped out these properties just in case you think they are miles apart:

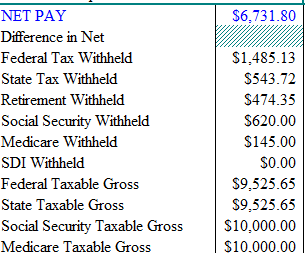

Are these homes exactly the same? Of course not. But this is as close as you are going to get to seeing the insanity in the mid-tier of the market. Now here is the reason ignoring jobs and subsequently income data will lead to additional corrections. Let us assume you gross $10,000 a month in Pasadena and want to buy this home. Can you?

Not even close. Your monthly payment is up to $5,653 and you are netting $6,731. Sure you can up your withholdings but that won’t change the numbers drastically. Your housing payment remains fixed.

When I see examples like this it tells me we still have another phase to this housing story. Today we salute you Pasadena with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

56 Responses to “Real Homes of Genius – Pasadena Million Dollar Home or $3,500 a Month Rental? You Decide.”

All of the things you say seem to come true. I heard a lengthy discussion on how much trouble FHA is in right now. One of the ways they understate the problem is how they consider the equity in an FHA loan. With 96.5% financed, the cost of transacting a sale deal immediately costs more than the 3.5 and the house is instantly underwater for 5 years (not my words, but a respected university professor) even without counting some government incentive that already puts the house on the taxpayer. The house goes down, as most real-estate is lateley, and the FHA still describes their portfolio with mark to whatever it takes and the ratio of loan to equity still sounds safe. But it is not. Viable reporting from the trenches does not match the cnbc enthusiasm.. We need a miracle, cuz nothin rational comes to mind

Regarding the comment, “we will have no real recovery until job growth enters the picture.” The jobs need to be well paying jobs,and most of the new jobs are inferior to the jobs that disappeared.

Can someone working for minimum wage afford this house? Let’s see. A minimum wage person makes about $16,000 per year. 20 people getting minimum wage make about $320,000 per year. So, if 20 people pool their money and move into this Real Home of Genius, they could barely make the payments. So, if the morning, afternoon, and weekend shifts at McDonald’s want to buy this house, I think they can do it. Look at it this way, it’s only 10 people per bedroom.

When you consider all the other monthly debt payments, the back end ration gets outta hand right away. Does anyone know what the norm is for rent vs mortgage payment delta’s?

One million dollars!

My god, we are in for the shit storm of the century.

First of all, city of Pasadena is over priced and its not even worth living there unless you really like the city. Its close to downtown Los Angeles and surrounding areas but even the economy of Pasadena sucks….Many business are closing and almost half of the city is nothing but the gangs. By the way, I don’t live in Pasadena but I use to work there back in 2006-2009. Take care & good day from Tokyo Japan 🙂

Hi i live in Holland a small country with of touch homeprices. Seeing this house

and looking at Germany prolly the only sane housing market in Europe atm.

Houses like this one cost maybe 200000 euros tops in Germany. Maybe 4 times average income.

Having worked in the prefab housing industry my self i can estimate the build cost at maybe 80 to 100k add the landcost, permits, gas and elek grid etc i doubt building a home in Europe like this is worth more then 150k. Oh and that be a better home then the crap they build in the USA. Lot of Dutch peoples go live across the border cause of this.

You can just google any real estate agency in Germany to see my point.

Ok but thats not why i post today.

I wanne warn everyone that the good times are over.

Housing is a roof over your head and thats it.

Dont treat it like its some good investment.

Its a money pit.

Dont get suxed in by sales talk.

If yu find a home and can not pay 20% upfront and have 25% max income spend to the mortgage and 5% free to keep maintenance of the home up to date,

Then DONT BUY it.

Its that simple.

This particular house is maybe worth 200k dollars worth and its a moneypit cause its build like cardboard usa style.

my 2 cents

Vince

From looking at the figures and searching Craigslist for rentals in places like Pasadena, San Diego, etc… I found even the rents extremely expensive. God knows why someone would want to spend so much of their take home pay on housing and have very little left for other expenses. I have family in New Jersey and New York and for years (I used to live in New Jersey) I told them “move somewhere else less expensive”. Finally even they are getting sick and tired of it and moving away to places like Florida, Georgia, North Carolina, Texas and South Carolina. Those states are also more business friendly. I know people whose property taxes for their businesses increased big time in New Jersey from 1999 yet prices have gone down for commercial properties by at least half! You go figure that one out.

I know California has beautiful weather. I even dreamed of moving there myself. But not until prices come down to reasonable levels where a working professional (engineer, professor, teacher, finance/accounting, small business owner, etc…) can afford an average home. Even at half off from the peak, these prices are insane!

Thanks Doc! Seems like every time my brain starts to wonder about getting a house, you knock some sense.

I agree with wheresthebeef. We are in for it.

CA has over 20% real unemployment. This thing is going to get a lot worse before it gets better. Many lay-offs are still on the horizon. The state is broke as are many cities. Raising taxes will only add downward pressure on home prices.

I agree with Vince and would encourage anyone renting right now to please wait if you live in SoCal. Take his advice. I’ve been there, having bought in 06′. House has sold at auction now. I really liked being a homeowner, but not enough to be a slave. I was tired of paying other people’s debt.

“Ok but thats not why i post today.

I wanne warn everyone that the good times are over.

Housing is a roof over your head and thats it.

Dont treat it like its some good investment.

Its a money pit.

Dont get suxed in by sales talk.

If yu find a home and can not pay 20% upfront and have 25% max income spend to the mortgage and 5% free to keep maintenance of the home up to date,

Then DONT BUY it.

Its that simple.

This particular house is maybe worth 200k dollars worth and its a moneypit cause its build like cardboard usa style.

my 2 cents

Vince”

Well of course people earning minimum wage aren’t going to be buying these houses. The point the doctor makes is that neither can people earning very good money (a person earning 120k net has to be grossing at least 150k and probably more).

Kid C—I totally agree. FHA is a piece of junk and will shortly need a bailout. It puts the houses on the taxpayer from the get-go and is more government subsidy for the banks and the real-estate industry. How about some subsidies for an industry that actually produces something?

>

>

Vince…I agree with you too. Unless this Real Home of Genius has solid gold toilets, the construction is worth around 100-150k. There would have to be a proven producing oil field or a gold mine on the property for me to pay $800k for that little lot in Pasadena.

The BEST time to buy a house is when you NEED one. I guess we can now change that to “rent.” This is not going to change until the insolvent banks are put out of their misery.

I am sure it is even harder to rent the $3500/month rental then sell the %1 000 000 short sale. They are both doomed. In the weekend I was at a local coffee shop and run on a ad on the announcement board for a rental 2/1 apartment in Redondo Beach for $1300 a month 100 yards from beach, with ocean view… Such were going for a least $1700 just a year ago. Go figure out this new price? ha-ha-ha. Rents are going down in flames and when we run completely out of fuel for the delusion the prices in the west side will follow.

Today there was very disturbing news for record low sales of new home going back to beginning of the statistic in 1963 and steep drop of application for mortgages even with prolonged incentive for the first buyers. It is getting worse, recovery is delusion. American economy will go down in flames. All that effort to start up rebuilding the house before the earthquake is over will just drain away the vital resources which was supposed to get in to play when the terrain is stable and the rebuilding make sense. It is like wasting gunshots at birds when the enemies are coming in tight rows. Instead of preserving the resources to rebuild the real economy our government (republican and democrats) have trashed that mountain of money for the most parasitic part of it – the banks, which produce nothing tangible and exist only for running the money-sucking machine in benefit of the oligarchy. Now government is getting out of ammunition and its mingling with the RE was the only reason for resent propping of the prices. Now it will all go down in flames.

Yes, property bubbles take longer to deflate than many would think. There is another leg down coming in residential real estate, I believe. There’s the obvious alt-a and option-arm resets for 2010 and 2011 as well as what I believe could be the coup de grace for the economy: further reduced bank lending and another banking crisis due to the coming commercial real estate debacle. It should coincide with increased interest rates and a FED that has no monetary maneuvers left; 2011 – 2013. This seems to fit the “hard-down” phase of the Kress Cycle: 2012 – 2014. It will be interesting to watch how this all unfolds.

I agree with the conclusion (we are in for more correction), but not the numbers on the purchase side… a house that has been on the market 40 days and listed as a short sale is unlikely to go for what is sold for in August of 2006… I would assume about 10% below list, so assume $855k selling, and more importantly, a jumbo conforming loan of $684k and a rate of 5% assuming good credit. That puts the PI payments at $3672 and tax at $890. I’m surprised you are recommending earthquake insurance as well. yes, earthquakes occur, but I have yet to see a policy that makes fiscal sense… the deductible is generally very high (as catastrophic loss insurance should be), and the limits generally come no where near covering replacement. The likelihood that an earthquake for this house does more than say $50K (a typical deductible) structural damage (remember, personal property loss is generally not covered under these policies) without completely destroying the house is extremely low. And in the event of complete loss, the limit on coverage (often as low as twice the deductible, e.g. $100k), comes nowhere near replacement cost. There is a reason most homeowners do not carry earthquake insurance, and it is not because they believe they are immune to damage, it is because the policies suck. Furthermore, even if you have a policy that provides for catastrophic loss (yet to see one with reasonable rates), widespread losses associated with such an event would yield the insurance company insolvent (and the state does NOT back this up)… the claim would never get paid. So… if we assume that the buyer DOES NOT take out earthquake insurance, the insurance bill is less than $100 per month. more reasonable tally on the buy side: $3672 +$890 +$100 = $4662 per month… lets say 25% of that $33k annual interest over the first 5 years is saved in tax deduction. that lowers the relative payment (compared to rent) another $685 per month… just under $4k per month for buying vs $3500 for renting. amortize the $8k homebuyer tax credit over that same 5 years ($133 per month) and the number is $3844/mo to buy a 2000 sqft 3/2 vs $3500 monthly rent for a 1500 sqft 2/2. IMHO, both numbers are still too high (the rent being propped up indirectly by the still inflated housing price. You are correct though that if you need to sell in the next few years when rates go up, you are in trouble if the employment picture has not changed drastically. The bigger worry is that of keeping the job you have even if you can afford the payments now… 100% on board that the focus need to be on jobs rather than housing.

This house doesn’t look like Modern American Cardboard. It looks like a beautiful, well-built American house from the 1920s when we still built beautifully here. I personally will live in or buy only a house or condo built between 1920 and 1932.

But you are correct about the price, it is NOT worth $1M. $300K is more like it,because after 85 years,it needs a few things. And $200K might really be it for a place in a deteriorating neighborhood, which Pasadena is.

We aren’t even factoring in the opportunity cost of the down payment! Putting down $200K or so as a downpayment means that the money can’t earn you interest (if you are conservative) or asset returns of 7-10% if you have it properly invested. Let’s be conservative and assume returns of 5% – that’s a $10,000 per year opportunity cost on the downpayment…

To Vince in Holland: This 1976sf house would cost $150K-$200K in most of the USA. Maybe even less in some areas. Much of California still has delusional ideas about the value of housing. I doubt the construction is as bad as you say, though.

To Jeff, who wrote “I’ve been there, having bought in 06′. House has sold at auction now. I really liked being a homeowner, but not enough to be a slave. I was tired of paying other people’s debt.”: How do you figure that debt was not yours? Was there a gun to your head when you bought in ’06? Also, you were never really a “homeowner”. More like a “loanowner”.

I’ve been going on this blog for about a year now, and most of everything the Doctor says makes sense to me. He presents facts to back up his arguments, and most of his arguments are based on logic not emotion. I’ve gotten some other friends hooked on this website. Unfortunately, others I know decided to buy even though I warned them not to. Now they are underwater.

I have noticed the Doctor often discusses the housing market in the great city of Pasadena. Pasadena is a great city indeed. I have lived there my whole life. As great as the city is, there is no reason why home prices should be at the level that they are. For one, Pasadena has a terrible school district. Ask any teacher, and they will tell you. Yes, there are some good private schools in the area, but they are very unaffordable. Pasadena has serious gang problems, and these problems not only affect the neighborhoods, but they also affect the schools. I was a student in the Pasadena Unified Scool District system, so I know. Don’t get me wrong, there are some really nice areas in Pasadena, especially around the Rose Bowl and some of the areas bordering San Marino. Yes, these houses may actually be worth a million dollars plus.

Pasadena has a very diverse demographic. There are very rich people in Pasadena, and there are poor people. There are working class, middle class, and upper class families in Pasadena. I woud like to purchase a home in Pasadena but will do so only when prices make sense economically. There was a time in Pasadena when you could buy an affordable home. Yes, it was called prior to The Great Housing Bubble that was fueled by easy credit. Pasadena is still in a bubble. Just not everyone wants to admit it.

@Laura:

Yeah I prefer homes from that era as well, but that said Vince is right. The construction on homes in the US pales in comparison to homes in Europe. Even the coasts are different. A home built in the 20s on the east coast would be heartier than ones on the west coast. Part of it is different needs dictated by climate and access to different building materials. I currently live in a duplex built in 1927. I love it, but the people who live below me don’t. They hear our every footstep as there is no cork or insulation between the floors. There is no insulation in the building at all. There are still ceramic electrical connections and in the summer one cannot run the AC and well…. anything else. It has it’s charm, and it’s not a tract home like those in Santa Clarita but it’s no Victorian row house if you know what I mean. 😉

Another reason not to buy in Calif. is that local governments treat homeowners as a bottomless money source. In a San Francisco suburb,, taxpayers approved 2 parcel taxes in the last 8 years to “save the schools”(last measure only passed by about 1%). Now, the teachers retirement fund is underwater, and in order to allow teachers to retire at age 55 with huge pensions and lifetime medical coverage, they want to pass another 10 year parcel tax, larger than any of the previous 2 taxes, on top of the 2 existing taxes.

Nearly every city in Calif. is way underfunded on employee pensions, and homeowners are expected to make up the differerence. Rather than cut pay and benefits, the answer is always a tax increase. Annual property tax bills are now around 2% of the value of the house. On a $600,000. house, that is $12,000. a year! see

pensiontsunami.com

Bob-

Have you not heard of Prop 13? If you think homeowner’s pay their fair share (or more- ROFLMAO) of taxes in California, you are out of your mind. If I remember correctly, we get something like 1/3 what the typical state gets from property tax as a percentage of total state revenue.

Logically, anyone can see that housing is overpriced and nobody should be buying. But, banks need to keep the party going to please shareholders. Interestingly enough, the areas that banks think are “bottomed out” are the areas that Dr HB says are heading down, and vice versa.

‘Jumbo mortgage market is beginning to thaw’

“In addition to lower rates, down-payment requirements are being relaxed in some cases. For example, to write a jumbo loan in coastal areas of Los Angeles and Orange counties, Wells Fargo Home Mortgage looks for a 20% down payment or that percentage of equity, down from 25% last year, said Brad Blackwell, a national mortgage sales manager at the lender.

The reason: Wells believes high-end home prices are stabilizing in those coastal counties. But the bank still requires higher down payments in the Inland Empire and other battered housing markets such as Florida, Nevada and Arizona, where prices for jumbo-size homes don’t appear to be stabilizing, he said.”

http://www.latimes.com/business/la-fi-jumbo-loans24-2010feb24,0,1111820.story

DHB, Nothing like comparing the high end of ownership expenses to the low end of rental expenses to prove our point. Apples and oranges.

on the whole that is true, but mainly because the base year valuation grows slowly over the years. recent buyers do pay their share of state taxes (and then some)… consider the inflated valuation of homes and combine that with 10% state income tax, VLF, various fees, etc… taxes are quite high in california and owning a home increases them significantly for recent buyers. Also, it is hard to compare other states’ revenue with california… such a unique beast in so many ways. True, it is not fair that someone that owns a multimillion dollar home pays peanuts in prop tax because they’ve owned since the 60s, but there is alot about taxation that is unfair. such is life.

I grew up on La Loma Road about one mile from those houses. About 4 or 5 years ago, Zillow listed my childhood home as worth over $1,100,000; it was then I really understood that housing prices were disconnected from reality. Curious about how homes were being financed, I did some reading about Alt A and option ARMs, and discovered the surreal world of home financing.

One note of irony, the University of New Hampshire is changing the name of its business school to the Peter Paul School of Business–and how did Mr. Paul make his money? Through Alt A and option ARMs! A great business model!

Even at half off from the peak, these prices are insane!

Nimesh is correct. Knock another 25-35% of today’s asking prices and we’ll be in the realm of normalcy.

I am currently renting a house in a SoCal beach community for 3,500/month. Landlord paid 1.5 Million in 2005. His mortgage payment alone is over 7,000/month. He is very wealthy and is waiting for prices to recover “in the next few years, because Obama is going to cause hyperinflation”. I did not try to explain to him that usually interest rates tend to go up in hyperinflationary environments and this may not be very helpful in terms of housing sales.

The double dip is on, folks. Check out today’s unemployment numbers and yesterdays RECORD drop in new home sales. Like, we even need any more homes built.

Don’t buy, rent. Especially a million dollar, uh, bungalow. That’s one of my favorite words – bungalow.

Seems like we’re renegotiating society-wide just what a million dollars is, and what it can buy. I personally wouldn’t live in SoCal if you paid me–I’d die of the air quality in 18 months. But many would. One of them might even make an offer in the upper 900s. Who knows.

~

But it’s pretty clear that whoever bought this for a million at peak is not terribly happy about being where the buck not only stops but stabs itself in the pyramid-eyeball with a sharp stick.

~

But hey, the thing that really caught my attention! On Doc’s unemployment chart, the official unemployment rate is now at what the U6 was in the post-9/11 recession. Startled me to hell and back, I’ll tell ya.

~

I think I have a definition of when Depression starts, DHB.

~

Look at that U6 roller coaster line–the yellow one. Eyeball across it a line representing the moving mean. Then go one standard deviation out from it. Paint that central tendency band across the U6 line.

~

When the official unemployment hits and stays in that range, we’re there. That is, when official unemployment is consistently in the range of recent-historical real unemployment.

~

Experts can play with numbers/PR till their cat farts rainbows…but that can’t hide patterns of variation around a mean. Which is precisely why governments report single numbers, and their corporate media report them. Trends is the key.

~

rose

~

PS–Doc, I thought that California was going to build its next bubble on incarcerating all Americans in a government-run “health” “care” “industry.” So my friends in the Bay Area claim, and think it’s a good thing.

PSS–Bob, we know a CA pension fund multimillionaire whom we consider the Poster Child for all this. Now, he worked all his life, and contributed, and I’d say he deserves some years of peace and freedom from worry about money. Go fishing, be old, write memoirs. Whatever.

~

But late in his work life he got the greed virus. At the peak he was flipping houses; now he’s stuck with several. He’s constantly flying back to CA to deal with problems related to these hosues.

~

The McMansion he built at peak in our working-family neighborhood has lost 25-30% in “assessed value.” (He’s been frantically tarting it the listing up on Zillow. But the thing is, much nicer houses are selling for even less now. And it was never worth a million to begin with except in his mind.)

~

Who knows what his pension fund is now worth, but if the rest of us are any indication, at least 40 percent less than when they moved here. But he still expects boom-era level of payments/material dreams.

~

He made his pile in CA and left. Now he expects to be the gentry in our community. He expects to keep mining the homeowners back in CA with property tax to prop up his incredibly inflated pension payment expectations…even as he bitches about his property tax here, and tries to get out of paying it. Says he’s looking forward to claiming disability or old age hardship as soon as possible. He’s got a fat SS benefit.

~

For all intents and purposes he has everything someone could ever have dreamed of in life–a steady job for decades, health, health insurance, pension, social security, house in a ruralish area on a huge lot. But it’s still not enough. He wanted more–house flipping, easy riches, and taxed serfs to pay for his gentry lifestyle in retirement. All this wthout contributing to the community he’s gentrifying, and expecting to bow down before him.

~

He is so surprised that things don’t always go up up up. I.e., for him, to hell with others. But that’s OK, because he’s now involved with militia guys who will go (they think) shoot anyone who tries to educate them about how arithmetic works for a whole community, a whole society. He is deaf to and furious about the message that people who try to get something they haven’t earned, and expect others to pay for it, are part of the Overlord Class.

~

rose

Predatory Lending is a major contributor to the economic turmoil we are currently experiencing.

Here is an example of what I am talking about:

Scott Veerkamp / Predatory Lending (Franklin Township School Board Member.)

Please review this information from U.S. Senator Jeff Merkley regarding deceptive lending practices:

“Steering payments were made to brokers who enticed unsuspecting homeowners into deceptive and expensive mortgages. These secret bonus payments, often called Yield Spread Premiums, turned home mortgages into a SCAM.”

The Center for Responsible Lending says YSP “steals equity from struggling families.”

1. Scott collected nearly $10,000 on two separate mortgages using YSP and junk fees. 2. This is an average of $5,000 per loan. 3. The median value of the properties was $135,000. 4. Clearly, this type of lending represents a major ripoff for consumers.

http://merkley.senate.gov/newsroom/press/release/?id=A09C6A80-537A-4EB1-83C5-31925F046B6F

The United States is now a deficit IMPORTER of food (we no longer feed ourselves). Suggest you all check out the “Survival Blog” on the right hand side of this page, to see how others are preparing for the future. They are stocking up on food, and figuring out how to defend their families from the roving hordes of the unemployed.

Just recently signed a new lease for a fab home after deciding that there was nothing worth buying. Got a call from my realtor who got a call from another broker on a house that we wrote an offer for back in early December saying that it fell through and were we interested. I told my realtor to pass the message back that it’s too late and we’re out of the market… and laugh as he was telling it! It feels great not to be looking at Redfin all of the time!!!!

The Union Tribune had that housing is on the way back up today. Maybe they should read a little of the good Dr. Maybe they have some “inside” info???

Seems like the owner is a little optomistic on the price. Zillow values the house at $825,000 and Cyberhomes puts a value of $800,000, about 16% (or $150000) below the asking price, and close to Zillow’s 2004 value. An $800k value would reduce the carrying costs to @$5000. The $3500 rent estimate seems reasonable based on comps found at Rentometer.com, although that website shows a similar sized house on the same street renting for $2100!!! Your conclusions seem to hold up.

And some are preparing for the future by reaching out and helping those who can’t feed themselves now by donating UNUSED (unowned or unwanted) fruit from local fruit trees to food pantries. And some are planting food not lawns in their front lawns and don’t even care if that means that the neighbors can see it and might even help themselves.

What does the belief system that can only treat your fellow man as a potential roving hoard get you? Maybe your fellow man is your ally in the collapse (hey at least you can barter with them right?). And anyway being a net food importer != not being unable to feed ourselves. You’d have to also subtract the amount of food that is wasted in this country to arrive at real figures (and that isn’t even taking into account all the available land that isn’t being used for food).

Anyway this is a housing blog :).

Its call coming depression of new age…… It was planned collapse and middle class will be wiped out. Owning a house won’t be a thing anymore……it will be food and job to feed the families…..Welcome to New Wolrd Order!

Pasadena Million Dollar Home or $3,500 a Month Rental? What’s my answer to this question? I would say both are overpriced.

the whole city of pasadena isn’t worth a million bucks!

Can someone please tell me how a narea where homes go for upwards of a million dollars can also be called “gang infested”.

How can gangs and their ilk afford to live in such a high cost area?

I get confused easily, sorry.

Hello BoyWonder:

Let me explain to you about the city of Pasadena: Pasadena is pretty big city divided and its like a twlightzone. One part has very expensive houses and people who are Dr’s, film directors, Jewerly business owner, high end car sales man, etc such and such. But on the other hand when you go N of Pasadena of 210 FWY, there are home of imfamous Denver Lane Blood’s, which I believe houses their worth anywhere $600,000 or more because I am pretty sure their family all divides the payments to the house or while house’s were cheap back in 1992-1998, they became owner of the house then. Back then Pasadena was cheap….cheap….. so housing have become overpriced from somehere starting 2002 to current 2010 in Pasadena…..Also, its not only the Dever Lane Bloods but the other gangs exist as well and those other gangs are growing each year making city of Pasadena obsolete in near future. For now, far as Pasadena, all I see is overpriced house but somewhere in 2020 to 2030 is not the place I want to live in. .

I live in Pasadena now so thanks for showing me something I’ve been telling all the crazy agents and sellers! OVERPRICED! The last agent told me it was stupid for me to be renting a 2 br 2.5 bth townhouse for $1900 when I can buy her 3 br 3 bth condo for…hold on…$900,000!!! This is 3 blocks over and my location is BETTER than hers cuz it’s closer to all the shops and restaurants and a better walking ratio. She tried to tell me I was throwing my money away. I asked if she did the math. She said “No, but it can’t be that bad. Just get a girlfriend that makes some money and stop throwing away your rent.” IDIOT!!!

These are the real homes of geniuses. According to the LA Times: “In the Inland Empire, an estimated 100,000 homeowners are living rent-free, according to economist John Husing, who based that number on the difference between loan delinquencies and foreclosures.”

And if there are 100,000 in the Inland Empire, than how many are there in all of California? The article is at: http://www.latimes.com/business/la-fi-squatters27-2010feb27,0,2929751,full.story

Paying a million dollars for a home in Pasadena is dumb. But, so is paying $3,500 for rent if you can live rent free for years. There is something very wrong with our economy.

BoyWonder: the part of Pasadena these homes are located in is probably not gang infested. It is probably as safe a place as you’ll find anywhere in the greater L.A. area. And many parts of L.A. are quite safe, even if it’s still not Kansas :).

Now there are parts of Pasadena (it’s a fairly large city) that are gang infested, although even they have been improving and might be a good gentrification bet, but they still aren’t very desirable right now. Either way regardless of what part of Pasadena you live in the school system is still horrendous and rivals Compton in it’s test scores, but if you can afford these house payments maybe your so loaded you can afford private school as well. Pasadena has pretty sever income polarization, maybe it’s a good symbol of the U.S. these days.

Can someone please tell me how a narea where homes go for upwards of a million dollars can also be called “gang infestedâ€.

How can gangs and their ilk afford to live in such a high cost area?

I get confused easily, sorry.

Don’t be… gangs in LA are both glorified & stereotyped. That is not to say that they don’t exist but an overabundence of time is spent in the media to turn them into legends, wich they are not.

Did some research on condos in the playhouse district area 91101, & there are only 59 listings on the MLS. I wonder how menny shaddow properties are being hidden? Most of the listings are in complexes that are relatively new or just built. these include 700 E Union Street & 860 E Green Street. Both complexes I like do to easy access to everything in & around E Colorado Blvd including transit. However I would wait to get a better value.

Reading about China’s Real-Estate bubble that will dwarf US bubble. The moral hazzard is baked in because everyone know that the government will backstop the big banks because they are just as corrupt and foolish in China as they are in any other place.

We will be lucky if this is just a Depression. I truly feel these are the opening shocks of the next Dark Ages. When China crashes, the whole game is over. I heard about the new rules suggested where no house can be foreclosed on uless it goes through HUMP, the new government program: Homeowners Underwater get Massively Punished or Hand Umpteen Millions to Politicians, I don’t know which.

Is it possible to include forecasts for Tiburon and Mill Valley in Marin County (San Francisco Bay Area).

It is impossible to get any forecast about the area. The average housing price in Tiburon is between 8.5 to 9 times the average household income, even with conservative measures, but all I can find about the housing market in this area is from real estate agents who believe the prices at the level mentioned are such bargain because they have come down about 24% since the height of the market!

Ya, I do agree Pasadena is still a nice city compare to other surrounding cities but my point was 10 to 20 years form now on, Pasadena will be nothing like today…..Just go to the end of the year New Years’s Eve party or for the Rose Parade and you know what I am talking about…….Anyhow, Pasadena is ok…..not the best.

http://articles.latimes.com/2007/dec/25/local/me-race25

http://www.streetgangs.com/hispanic/pasadena.html

http://bitterqueen.typepad.com/friends_of_ours/pasadena-denver-lanes/

Pasadena had its gang problems before The Great Housing Bubble started, and some of those years were a lot worse than now in terms of gang killings (especially in the 90s). Like I said before, there was a time when housing was affordable in Pasadena, and it was called prior to The Great Housing Bubble. Most if not all of the current listings in Pasadena are ridiculous and unrealistic. I’m seeing homes in the high crime areas of Pasadena going for $300,000 or more. You’d be lucky to get a fixer upper for $200,000 in these areas. I’m seeing some houses in Pasadena that sold for $200,000 in 1999 going for $500,000 now. Condos that sold for around $100,000 in the late 90s are now priced at $300,000 or more. Come on. Give me a break. What justifies these prices? Absolutely nothing. I love Pasadena, but I will not get sucked into buying a house that is priced at two times or more of the “real” value of the home.

@CB

Apples to Oranges? That is an ignorant statement. They are both apples, just finding someway to value them both, other than the sticker price of the RHG. If apple A is worth a million dollars, no way it will rent for 3500; thus, the house isn’t worth a million is the point. In case you haven’t noticed, the entire world economy crashed because of de-leveraging of debt, focused on the national housing bubble.

Instead of a useless statement like that, why don’t you present an argument to explain why you feel the house is worth a million, or whatever your position is.

And I don’t personally feel that someone that pays 3500/mo for rent is trailer-park trash. Can you explain that statement too please? How about a little disclosure on your interest in being a bubble-believer?

Until unemployment decreases housing prices will continue to decline in South Lake Tahoe as well. This is second home country and no one is going to lose their first home by holding on to their second home. Why buy when you can rent for far less?

The area of Pasadena in which these properties are located is called San Rafael Flats. I say flats because there is also a hilly part of San Rafael (the “Hills”) and that commands a lower price than the flats. Real estate is property to property, street to street, etc. Annandale and Glen Summer are prime streets in a prime neighborhood. Price per square foot rivals the Westside and better parts of the San Fernando Valley. These homes are only overpriced for those who can’t afford it. The market dictates (mostly) for how much a property will sell. This area has always (at least the past decade or two) and will probably always be desirable and those in the know about Pasadena who can’t afford the mansions by Cal Tech or larger homes in Linda Vista (west of the Rose Bowl) but can still afford private school. As long as someone comes in and says, “Oooh, thats less than it was four years ago.” and has the means, it will sell for at least $800K. NOT 2, 4, or 600K (unless we have a huge earthquake, speaking of). I too, wish this home was 600K but it’s not going to happen in a desireable place that is built out. Double wides in Malibu and Huntington Beach will ALWAYS be expensive. They will follow a down market but not by the same percentage as the Palmdales and the Hemets. And, they will increase at a faster rate in the good times. So, by all means keep renting. The other shoe may drop. But don’t expect prime (or relatively prime) California real estate (and that includes Marin county for the poster above) to return to the levels of affordability of the 60’s. There are still a ton of top tier income earners out there and they are still buying. I was in an open house in San Marino not too long ago and overheard a gentleman saying he just bought his son a house not too far way FOR CASH. It’s depressing, I know, because average Joe’s like we STILL can’t afford the 1800 sq ft house in our neighborhoods of choice even in this market. Hopefully that will change in a year or three but I won’t be surprised if it doesn’t.

After going on one of the MLS websites today, I see how out of wack the Pasadena housing market is. I’m seeing condos listed for $500,000 and these condos are in areas that are not all that great. I’m seeing houses listed at $500,000 that are in a “decent” area of Pasadena, but it concerns me when those houses sold for around $200,000 prior to The Great Housing Bubble. I have said before that there are some areas in Pasadena where a house is worth a million dollars. I accept that. Those areas of Pasadena have been unaffordable for the “average Joe” before The Great Housing Bubble started. Most of the other areas of Pasadena should not have houses or condos priced at $500,000. I feel like I am back in 2006 when easy credit was available for everyone and stated income loans were being given out. Anyone looking to buy in Pasadena should research the pre bubble prices of the areas they are interested in buying. Many people who buy now in Pasadena are going to take a major hit in the future. When I say major, I mean possible 50% and higher losses on the value of their properties. These homeowners are going to be very heartbroken. The house sold for $700,000 in 2006 and now it’s priced at $500,000. Is that a good bargain? No people, because that house sold for $200,000 in 1999 before The Great Housing Bubble started and got out of control. Easy credit caused this mess, and that is something that will probably not happen again. Do your research people before you buy or you will take a MAJOR hit in the future. You see everyone else underwater right? Do you want to be like them? Be informed before you buy. Buyer beware.

Leave a Reply