Real Homes of Genius – Aggressive Price Cutting in some Mid-tier California Housing Markets. La Mirada Home Selling for half-off 2006 Price. 13.2 Percent Los Angeles County Headline Unemployment rate.

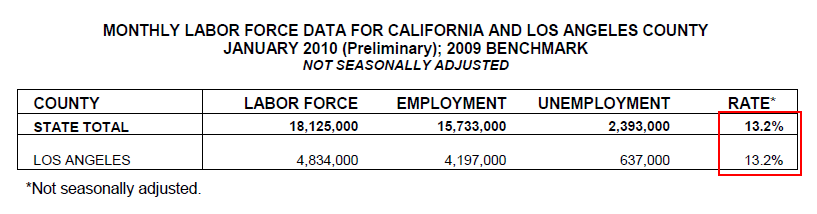

On Friday the California Employment Development Department released preliminary figures on California unemployment. As it turns out, the unemployment problem ran deeper in 2009 than many had initially thought. The current unemployment rate is 12.5 percent which means the underemployment rate for the state is probably closer to 23 percent. Mix that in with Alt-A and option ARM loans floating out in the market and you can understand why there are still problems in the California housing market. The unemployment report is in sharp contrast to what is going on in Wall Street. The stock market rallied even though we have yet to add one net job since the recession started.

The California budget is mired with systemic problems and many state and local government are going to be battling with cuts over the next couple of years even if the economy starts recovering. If we actually look at unadjusted unemployment figures, the unemployment rate for Los Angeles County and California is a stunning 13.2 percent:

Source:Â EDD

Very few of us have ever seen an unemployment rate this high for the region. And we are starting to see some aggressive price cutting from banks in some select mid-tier markets to reflect this lower wage economy. It is hard to tell what is going on internally on the balance sheet of many banks but it isn’t good.

Today we’ll look at what I would consider a mid-tier city in Los Angeles County that is starting to see some aggressive price cuts. Today we salute you La Mirada with our Real Homes of Genius Award.

Half Off From 2006

La Mirada like many cities in Los Angeles County saw a massive jump in housing prices. When prices were out of reach in other locations La Mirada was considered a good middle class place to buy a modest home. This seemed to be enough to justify massive increases in prices. The median price peak was reached late in the spring of 2007:

June 2007:Â Â Â Â Â Â Â Â Â Â $555,000 (median La Mirada home price)

In that month, 40 homes were sold in the city. Today the stats look a bit different:

January 2010:Â Â Â Â $380,000 (median La Mirada home price)

In January 25 homes sold. Now, much of this of course has to do with it being winter but a 31 percent price cut in less than three years is significant. Yet prices are still too high given the household demographics. We’ll get into that in a minute. First let us examine the home above in better detail.

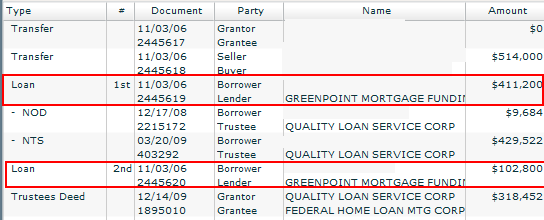

The above home is a 4 bedrooms and 1 bath home. It is listed at 1,312 square feet and was built in 1953. When I go into the history of California housing this was one of those massive building boom times. This home was purchased near the peak back in 2006. This home was financed with toxic mortgages up to the very common 100 percent mark:

Let us run the numbers. The home was purchased for $514,000 with an 80/20 setup:

1st mortgage:Â Â Â Â $411,200 (80%)

2nd mortgage:Â Â Â $102,800 (20%)

Now I know some of you are stunned about this but this was very common in California. In fact, those toxic option ARMs were being handed out like Pez candy. The notice of default was filed back in December of 2008, then in March of 2009 the NTS was filed. It took another nine months from that point for this home to go into bank owned status. The home hit the MLS on 1/19/2010.

But here is where I’m noticing some reality based pricing. Back even a few months ago, you would see bank owned homes hit the market at outrageous prices and banks simply sat back and did nothing. On some areas and some homes, pricing seems to be aggressive on the downside. Take a look at this place:

Price Reduced: 03/03/10 — $284,900 to $259,900

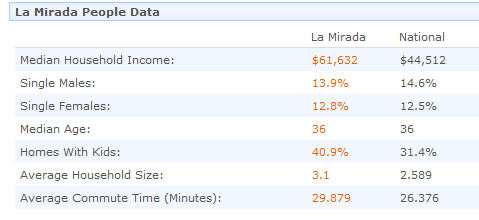

A 50 percent haircut from the 2006 peak price. Before you jump up and down this is exactly what we’ve been talking about. It seems like in some markets banks are being more realistic with their pricing. And they should be. Take a look at the household demographics for the city:

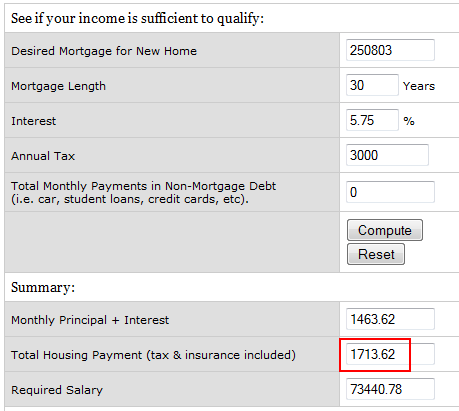

So let us run the FHA insured loan numbers here since at the current price, it clearly meets the criteria (4 out of 10 homes sold in SoCal were FHA backed last month).

3.5% down payment:Â Â Â Â $9,096

The median household family bringing $61,000 is taking home roughly $3,900 net per month. So roughly 43 percent of net pay is going to the home payment.  Does this make sense? It would seem a bit high but it is certainly more in line than other areas and certainly far from the bubble peak. And this is now the next phase and I expect to see more of this going forward. We went from areas in the Inland Empire seeing big haircuts, to lower priced L.A. County areas, and now we are seeing certain mid-tier cities cut prices aggressively. In my book, a 50 percent cut is significant.

Should you rush out and buy a home? No. If the numbers work and you find a home you like, go for it. Yet the reality is, if L.A. County has a headline unemployment rate of 13.2 percent then the unemployment and underemployment rate is closer to 24 percent. In other words, 1 out of 4 people in L.A. County are either out of work or working part-time for economic reasons. Does that really sound like a healthy market? Frankly, many people are focusing on their career and employment and are putting aside the Wall Street and real estate industry obsession with housing as the center of the universe. Without solid employment, home prices will still go lower. And keep in mind the current household income figures are based on 2008 Census figures and we won’t have more up to date data until September of 2010. In other words, the income data is much worse than it appears.

And about that shadow inventory? Let us take a quick look. The MLS currently lists the following for La Mirada:

Non-distress:Â Â Â Â 45

Short Sales:Â Â Â Â Â Â Â 28

Foreclosures:Â Â Â Â 13

And this is what is lurking on the bank balance sheet:

Pre-foreclosure (NOD):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 124

Scheduled for Auction:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 188

Bank Owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 39

Some had a question about double counting but these are all unique properties, nothing is double counted in the above data except for the 13 MLS foreclosures from the 39 bank owned properties. 86 properties on the MLS and 351 properties in distress. This above home is one of those “trickle†down homes that is supposedly going to make the market better because we won’t see a flood.  A 50 percent price cut sure doesn’t seem like prices are going to boom as some in the housing industry would like you to believe and even with a drip strategy for the shadow inventory, prices will still come down to reflect economic reality. And why would it matter how properties are released onto the market? The distress is as plain as day. Just look at the above stats. People with a NOD, auction scheduled, and losing their homes are not in a stellar financial position. People now have to go with government backed mortgages and even though these are easy to get, they are based on verifying income. And with 13.2 percent of L.A. unemployed that is proving to be a challenge in itself.

Today we salute you La Mirada with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

15 Responses to “Real Homes of Genius – Aggressive Price Cutting in some Mid-tier California Housing Markets. La Mirada Home Selling for half-off 2006 Price. 13.2 Percent Los Angeles County Headline Unemployment rate.”

As a general comment to the problems of the housing crisis, here is an article I wrote recently:

I have an answer the foreclosure crisis and a way to turn around the economy at the same time.

First, an outline of the problem: The old way of doing things with foreclosures have not changed. That’s the problem.

After a property is foreclosed, the bank lists it with (mostly) the same agents they have been working with for years. Newbies who may actually know the market are not invited…..but that’s not where I am going.

The properties are just thrown on the market no matter what shape they are in because the bank needs to get it off their books.

So, that makes the homes available to only a few buyers…investors with cash, not the ultimate home buyers. They end up paying retail after the cash investor fixes it up.

No, I am not against the investors making a profit, it’s just that there are too many homes and it makes no sense.

I know there are FHA 203k loans, but they are cumbersome, expensive and not available to all property or property types.

How about, Mr. President, making each property that is foreclosed by the banks fixed up to standards that an owner occupant can move into and finance properly.

Give income to the construction trades that are hurting and recoup the outlay when the home closes (with interest!).

What did we just accomplish? We gave people jobs, we moved property faster and for more money, we added to the number of mortgages in the system with quality property that made mortgage backed security investors happy and to top it off, we stimulated an economy with the taxpayers making money!

I know someone knows someone that that knows someone who can actually get this idea to someone at the White House to get this rocking ASAP (May 1, the day there is no tax credit would be good!).

Neither the White House or anybody can do anything to save the housing crisis! The Housing crisis will correct itself, just like any market it depends on the demand and community income.

Underlying the whole thing of fixing the economy and housing market, etc, is the redistribution of wealth. Redistribution of wealth has been the cause and result of all the uprisings in human history including the American reveloution. Whether it will end up well or badly this time, like in the past, depends on whether the redistribution is “considered fair or not” by the majority of the people.

@Fred

Lot’s of assumpitons there, but here’s a few reasons your plan won’t work:

1) There aren’t enough qualified buyers for all the houses there are

2) Most construction workers I know don’t qualify for 400k houses–they are still way too expensive.

3) There are Alt’s recasting every day and more and more foreclosures in the oven. It’s not that the homes are deficeint in quality that is the problem–there are a zillion giant mortgages that people can’t afford and they will default in time.

4) The CA unemployment is 13+. FIRE is an unsustainable economic platform, and handing caulk guns to construction workers doesn’t change that. Perhaps you are unaware of the fact that CA is 30B underwater as a state and pay bazillions a year in pensions. They will be rolling over muni’s until they default, which I think is 20?? Wait until the Chinese foreclose on the Staples Center and Jack Nicholson has front row seats to a ping-pong playoff with Taiwan…

Thank you Dr. This is very encouraging news. But La Mirada like Whittier is not that nice any more. It used to be pretty nice. Only small parts of it still are. The house is probably a fixer upper too. So there are still ways to go in the housing market. At least this is a start.

This is the first time I have posted to your site Dr. HousingBubble and I would like to state it is one of the premiere housing bubble sites I have read.

I want to thank you for your continuous coverage of the housing meltdown and its after effects.

My comments for Mr. Glick’s post-

“After a property is foreclosed, the bank lists it with (mostly) the same agents they have been working with for years.â€

Banks are not listing properties, the shadow inventories are growing, banks are letting people stay in the houses who are not making their mortgage payments rather than evict them and resell the property.

By not putting the house up for sale right away, by allowing the non-paying mortgage “owners†stay in the house, the house is treated as an asset worth the mortgage price, even if the mortgage price is inflated compared as to what the market will bear or buyers will actually pay for it.

If the banks list the house or sell it for its real price (the price a buyer will pay for it)the house would go from an asset to a loss for the bank, and banks do not want to show losses on their balance sheets.

“How about, Mr. President, making each property that is foreclosed by the banks fixed up to standards that an owner occupant can move into and finance properly.

Give income to the construction trades that are hurting and recoup the outlay when the home closes (with interest!).â€

Not all of the foreclosed properties Need fixing up, not all are in need of major repair, hence, little need for the construction trade. Also, there is a housing surplus due to all of the housing building that went on during the bubble, a large supply and a small demand does not equal more demand from builders.

From Mr. Glick’s website-

“Real Estate and Mortgage notes, thoughts and perspectives from a nationally respected, award winning real estate and mortgage professional, columnist and pundit. Fred is a frequent guest expert on media outlets such as CNBC, NPR and national publications such as The Philadelphia Inquirer, AgentGenius.com and ThinkGlick.com”

Agent genius?

It seems the 6% used house sales people view themselves as America’s Royalty and everyone else as serfs.

And they wonder why buyers dislike them so much.

The problem is that values of the house went to quick and bankers push to the limit…it is like going to Vegas and playing your favorite card game and gambling $200,000 to $500,000 with the borrow money….. Banker and wall street croonies are the one causing this freak show….. If you have the money and don’t mind losing another 20%, go ahead and buy now…..but if you know what DR HB is rest of the fellow followers & commentators, we mind as better wait until next few years….

It’s nice to see the prices come down in a mid-tier city. But, the floodgates have not opened yet. It is still just trickling.

I figured Glyck was either a SoCal Realtor or a moron, like there’s a difference.

You guys still don’t see the damage that’s been done. In the 60’s most people really didn’t personally know someone killed in Vietnam. I would venture that almost everyone knows personally someone that has lost their job and someone who has lost their home, good businesses that have failed.

The fact that anyone can make a home transaction without a realtor and you guys add no value to the deal whatsoever I’m amazed you’re still around, like Gyco cavemen. I’m sure there’ll be a fabulous open-house in Hell for all of Wall Street, Realtors, Appraisers, Bankers, Rating Agencies, and complicit officials. “Whosoever has done this to the least of them has done it to Me”

I agree with NickHandle and you, I , lot of people waking up and Dr.HB …we know the tsunami is coming…(really coming people) By the time Obama exit presidency is the time banking will release the shadow inventories….. Destruction is 2 years away people….. (they gov will do anything to destruct our attention away to our economy and housing crisis and attack Iran) that same year 2012…is the year of good bye (dollar) plunging and Gov sponcered false terrorist will hit the fan….. (The CIA is Wall Street’s finely honed tool for the neoliberal agenda of the banksters) (AL-CIA-DA) plan the housing crisis with (Bankster-Nakee) Ben Bernanke. Pretty soon IRS with change thier name to (I am Really Sorry)!

Lets get the facts straight. Wall st has hijacked

Washington. The wall st mob is in control and

always has been. Just look at who is the most

important positions.

What people don’t realize is that Greece has its

own debt issues, and Europe for that matter, but

so does the rest of the world, including US. Again

this a sovereign debt crisis, and they are using

Greece and the Europe debt issues as a scape

goat and a means to deflect the severity of what

is going on. It is not just Greece or Spain, it is the

entire global economy that this under threat here.

What we are seeing is just the merge or state

and corporate powers which I believe is called

fascism, the department of justice is there to bring

down justice to the little guys and let the big guys

get a free ride.

It sure is a crazy twisted world. When are people

going to realize what the real hard core backed up

truth is.

The whole thing is preplanned and very well orchestrated. Don’t worry ppl, the elites have your future all figured out for you and all is on track and proceeding according to their time line. In order for the elites to proceed with their NWO ‘wet-dream’ scenario where they exercise control over the whole world and its economy; they first have to destroy the United States financially and socially. They have almost suceeded. You already have your cashless society right there in your wallet; its called your Debit-Card. Soon we will all have our nifty-neeto National Identity Cards. I mean, like afterall ppl, isn’t it just logical that Big-Brother should know where each and evefy one of his children are at all times and exactly what they are doing at any given moment in time???? And if the children haven’t been up to anything ‘naughty’ ……. then why should they care???

Dr. I respect what you have to say however after 2 years of reading your blog the doom and gloom is running out of gas. I just bought 2 properties in So. Cal. and I feel real good about it. They where both 50% off peak of market prices.I don’t see that prices can drop much more. Moral hazard and government intervention will not allow it. Just my 2 cents. Your shadow inventor and option arm theory are running out of steam.

Edy this is the 3rd time you cut and pasted the same comment on other blogs. If you are going to go doom and groom be on topic. Stop slamming us with one thought.

Hey Mark, I am posting on US am time from Malasia…… I am not the doom and groom guy but seriously, Wall street has been hijacking USA……. Most my buddies work closely with investors around the world and this is the talk of the town buddy. Ya I read your post and good for you…bought 2 houses for 50% off the peak but there are millions who are suffering because of the Alt & Option Arms Recast and job loss in US. I care of USA and want America get back where it use to be, but reality is harsh and people will pay the price and more pain to come. Oh yea by the way…my other buddies are in NY Wall St guys, they even say admitting…housing will go further down…….it was well planned by wall street to main street…..(Come on Mark, even the fucking Real Estate Agents) my College buddies are telling me this when I am in Asia…..via Skype)

Leave a Reply