California Budget Details: How the Recession Will Affect Revenues for the State.

As many of you are well aware of, the California budget is facing a drastic short fall. This isn’t anything new since we as a state always seem to have very little problem spending any money that comes into the revenue base. The problem that occurs is one that involves lack of planning. During the good times, we do not save any excess and as all economic cycles end, we enter the famine stage after feasting and gorging at the buffet of revenues. The past decade has hidden a lot of wasteful spending spurred by fiction based income. What we will be facing as a state is an enormous reduction in personal tax revenues because even the 2007 tax year will not completely reflect the entire picture. The credit crunch hit us in August and many counties in California did not hit peak prices until August and even September. What this means is that we will once again not see the entire collapse that occurred in the forth quarter since the first 8 months of the year were still seeing credit bubble spending. First, it will help to take a look at revenues:

| Total Revenues and Transfers – 2008-09 | |

| *Dollars in Millions | |

| Personal Income Tax |

$58,023 |

| Sales Tax |

$35,093 |

| Corporation Tax |

$11,937 |

| Other |

$11,490 |

| Motor Vehicle Fees |

$5,966 |

| Highway Users Taxes |

$3,565 |

| Insurance Tax |

$2,276 |

| Tobacco Taxes |

$1,096 |

| Liquor Tax |

$341 |

| Total |

$129,787 |

You can already see the problem with the above projections. First, the two largest components which are personal income and sales tax, both vary greatly depending on the economic climate. We already know that unemployment particularly in California is jumping and real estate is declining at an unbelievable pace. We saw a 16 percent drop, a $92,000 nominal drop for Los Angeles County, from the $550,000 peak we reached in August of 2007. This drop is unprecedented both in speed and amount. Orange County is now off by $120,000 from its peak reached in 2007. With rising unemployment, it will be hard for people to pay income tax. And given that many of the high paying jobs in real estate and finance are now coming to a screeching halt, that means that these areas will be contracting for the foreseeable future. Also, we know that the wealth effect will take a major chunk out of the sales tax revenues because people that feel poorer because of real reasons (loss of job) or perceived reasons (less value in home) will both compound to drive revenues even lower.

Last week in Sacramento, politicians once again proposed to borrow and push the problems further into the future. It is a short term fix before the late spring budget comes out but doesn’t come close to addressing the true problems we will face. So where is all the above revenue going?

| Total Expenditures (Including Selected Bond Funds) | |

| *Dollars in Millions | |

| K-12 Education |

$43,710 |

| Health and Human Services |

$35,687 |

| Higher Education |

$14,567 |

| Business Transportation & Housing |

$13,406 |

| Corrections and Rehabilitation |

$10,290 |

| General Government |

$7,749 |

| Legislative, Judicial, Executive |

$6,358 |

| Resources |

$5,707 |

| Environmental Protection |

$1,582 |

| State and Consumer Services |

$1,555 |

| Labor and Workforce Development |

$427 |

| Total |

$141,038 |

With the above, we have an $11.25 billion budget short fall. But really look at some of those expenditures. If we think much of our problems are being caused by rising unemployment, our labor and workforce development funding allocation is pathetic. Even with higher education, you know the place we need to train our future engineers and maintain our competitiveness in the globe, that amount pales to the first top two expenditures. Some areas such as general government, legislative, judicial, and executive spend about $14.1 billion. Isn’t that the size of our current short fall? Either way, you would think that a state pulling in $129 billion a year would have enough to stay afloat but apparently this isn’t the case.

If we look back at our revenue sources, the first three top money generating areas are extremely sensitive to market changes. So the upcoming recession is going to carve into these areas significantly and we can all assume that these projections are Pollyanna given that the bursting California real estate bubble only arrived in 2007. All we need to do is look at Florida and double the impact:

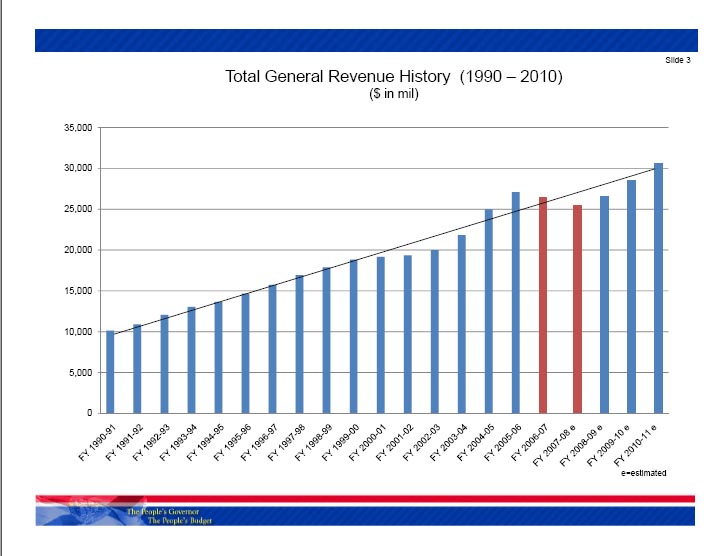

I love these charts that never show negative growth for more than one year. What is the reason for the all of sudden jump to the green in 2008-09? If we are to look at previous recessions, once the recession is official, say the first quarter of 2008, the effects of even a mild contraction will last 2 to 4 years; 2 years from the last recession in 2001 to 4 years to the one in the early 80s. This recession has the makings of something even larger than the 1980s recession so why are we to expect that we will be out of the woods this year? Again, these projections keep looking at massaged data that won’t materialize and after tax season, local municipalities will quickly realize that they are short on funds. With so many Real Homes of Genius in the state, I’m sure there won’t be many more foreclosures.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “California Budget Details: How the Recession Will Affect Revenues for the State.”

Just read on HousingWire that CA foreclosures were up 454% YOY in Jan, and 98% of foreclosure auctions are going back to the lender to help fill up the REO pool…errr, I mean lake…err, no I mean ocean

http://www.housingwire.com/2008/02/15/california-foreclosures-soar-in-january-98-percent-of-auctions-lead-to-reo/

Article also notes that a much higher percentage of NODs are going to the auction block than ever before. No way this doesn’t just decimate the CA tax base…not to mention add to the already strapped housing and HHS dept budgets.

At some point, Californians are going to have to learn to say “no” to a lot of things, like illegals getting an education and free health care on their dime, and activism-inspired environmental regulations that have choked the life out of new industry in the state for decades. Or…instead they can sell apples on the street along with their illegal amigos and Birkenstock-clad activist pals. No place in America deserves to take the brunt of this brewing economic storm more than California. After all, nothing spoeaks quite like excess…

California has a more diversified economy than most states yet it seems to have more severe budget problems than elsewhere. Perhaps it is because it has a state government where spending increases almost as fast as a ‘real home of genius’ list price. As I recall, the last big budget crisis was when Pete Wilson was governor. I think he was trying to close a 5 billion dollar shortfall in a $50 billion dollar state spending program. Things seem to have tripled since then though it was only 15 years ago. Then the state went months without a budget as the Governor and legislature battled. I think the state was even forced to issue

‘script’, funny money IOUs to keep essential services going. I suspect the coming battle will be even more intense as the ratio between taxpayers to tax recipients has tilted even further to the parasite side of the equation. I wonder if the legislature might consider lifting the ban on offshore drilling as a way to get some substantial revenue in a hurry. There is oil off the coast remember. $90 per

barrel oil. One medium sized oil field would close that budget shortfall in a hurry.

DR HB

Have you done an analysis on the effort of revoking Prop 13?

How much tax revenue will that bring to the table? It will be interesting to see if young people care enough to go to the polls and put an end to the “I won’t pay the same taxes so I can stay in my home and you don’t have one (home)” crowd.

Rick,

I THINK I see where you’re coming from regarding prop 13 and what appears to be inequities in property tax assesments.

However, I remember (guess this makes me old) my parents struggling with ever increasing assesments back in the day. I am NOT anti-tax, but I would rather treat the cause, not the symptom. As long as we have a legislature that absolutely refuses to act responsibly, we are just throwing good money after bad. Just my opinion.

I too would be interested in the Dr’s view on this…and sorry for any misspellings….eyes are blurry and I need more coffee.

Hello,

When I look at the 2008-2009 revenue chart there does not appear to be revenue from property tax. Is that considered a part of one of the segments that are listed? (If you all don;t mind I’ll skip the discussion on whether taxes are necessary, or if we are spending the tax dollars on the right thing).

By the way here is an amazing event. We sold our home in San Diego approximately 3 years ago and thought we were getting out at the peak by selling our 2600 sq ft home for $855K (Don;t worry we are not bragging .. we didn;t own the home that long before selling). We happen to be considering moving back into the area and renting until we can find a nice foreclosure that meets our needs. We looked on a Remax site and amazingly our old house just went on the market last week for $899k ! They must really be crazy, or maybe they have not heard that the spiral is now down instead of up.

Eliminating prop 13 would only work if overall property tax rates were kept reasonable.

Lots of retired people out there in CA who own their homes in full and now benefit under prop 13. This is in contrast to some states where retired people are being driven out of state by ever increasing property taxes (helped by the wonderful housing bubble).

And lots of young people out there in CA with no hope of owning anyway because of ridiculous inflated housing prices, and so who can’t be made to care about the issue regardless.

I’m sure many of you have seen this PowerPoint presentation on sub-prime loans. Absolutely hilarious (R-rated stick figure content):

http://docs.google.com/TeamPresent?docid=ddp4zq7n_0cdjsr4fn&skipauth=true

Hat tip to a reader for sending the link in.

I am glad I am posting this on the Internet because if I tell people what I really think about property taxes they will prbably never speak to me again.

They shoud just get rid of the property tax completely. When you buy a house,

pay a sales tax, but after that a person shouldn’t have to pay anything except when they buy and sell.

A friend of mine is aspecial ed school teacher. She makes over $50K a year. She said they use 3 teachers for a couple of troubled kids. Hopefully it helps the troubled kid but boy o boy…. that is way too much money spent on the school system.

My friend also wants people (especially home owners) to pay even more taxes to fund the schools even more.

I don’t know what to think anymore!?!

If we had the money I don’t mind. If we don’t have the money, they need to stop spending just like I would have to do if I were behind.

When will this madness end??

So true, js. If home prices don’t come back down, young people aren’t going to have any interest in buying a home and they’ll be stuck in the renting rut.

Steve and others,

The efficient use of taxes is another topic. If I am against the Iraq war can I refuse to pay taxes? For sure some of it is going into the war. And I am against all the porks in those legislative bills, but that is totally besides the point. If you think taxes should not be spent that way, vote it out, not vote that you don’t pay but other needs to fill your void.

The truth is, the Prop 13 people pay less taxes than people with equivalent homes, and they enjoy the same or even more benefits that the others are PAYING their taxes. We are talking about a choice here, either way it can be viewed as immoral – having the old people pay the property tax that they would’ve paid in other states, or have the younger generation pay more than their share of taxes for those that does not pay their share.

And I think we probably know that the property taxes have a lot to do with balancing the state budget: in 2003ish the state was heading for a budget deficit of a few billion dollars, but interestingly the state enjoyed a few billion dollar surplus, anyone would venture that there is part of it to do with rising RE taxes?

I’ll admit that the logic behind Prop. 13 has always baffled me although the policy purpose is quite clear which was to keep older retirees from being forced to move from their long-time homes because of the tax bills. Trouble is the way they went about it. Now here is how it works here on real estate taxes. (1) Reappraisal of properties every 2 years or when sold. Increases in appraised value are capped at not more than the rate of inflation since the last appraisal. (2) Tax rate in this little village is $40 per $1,000 of assessed value. ‘Assessed value’ is 50% of appriased value. For example, house has a $500,000 appraised or sale value. Assessed value is $250,000. At $40 per assessed value, that is $10,000 in real estate taxes. (3) Now for the deductions. (a) If it is the primary residence, there is a 50% homestead deduction. The property tax goes from $10,000 to $5000 (b) If it is the primary resident and an owner is over 65, it is reduced by another 50%. That $5,000 tax bill goes to $2,500. Real simple – if the $500,000 is owned by a 2nd home owner, investor or speculator, it is $10,000 in taxes. If it is owned and occupied as a primary residence, it is $5000 and if one of the primary residents on title is over 65, it is $2500. And that is definitely manageable at around $200 a month.

Prop 13 probably shouldn’t apply to commercial property but the reason it got passed was California home owners in the mid seventies were experiencing the same kind of real estate bubble as now. A $35,000 tract home bought in 1966 in Marin County was being assessed at 3 times that in 1978 when the measure appeared on the ballot. There were no HELOCS then so the homeowner was not realizing any of that appreciation merely being taxed on it. Imagine if you had to pay capital gains tax on stock you hadn’t sold! County governments and schools

were waxing fat on the revenue from this property appreciation but it was impoverishing those whose incomes had not trebled over the previous dozen years.

I think Prop 13 and many of the other Props just show how the proposition system is truly flawed in California. Many other States fixed the problems of having older people “taxed out” of their properties without resorting to such an unfair system. Personally, as someone under 60, I think that Prop 13 should be repealed.

The other thing that strikes me is the large share of money spent on health care in the budget. If only we could get a single payer system in place we could all save money on health care. Which would mean we would probably have more to spend and that would mean more sales taxes. The studies show that a single payer system would save a bundle on administration costs and other costs that are associated with our current system. The insurance companies are spending over 25% of our premiums on administration! Medicare only spends about 2% on admin. That is a lot of money that could be used for something more constructive!

http://en.wikipedia.org/wiki/California_Proposition_13_(1978)

The wikipedia has a pretty good article on this, especially the effects of Prop 13. I think it is very much true.

Scott,

You raised 2 very good points:

1. Prop 13 was passed when inflation was starting to get high and housing prices have sky-rocketed.

2. Prop 13 included businesses.

The 2nd point needs no argument.

The 1st point shows precisely where the flaw is. Inflation has seldom run below 2%, in fact in 70s and 80s it ran to well excess of 10%. So while keeping those already purchase a home in their home, the rest have to pony up more money to cover the costs of education/healthcare/etc. And this has gotten so much out of whack now that those enjoyed such a tax break for 20 years are still in their home while the rest can no longer have a home are still paying their taxes!

The stock appreciation argument is only true if you are require to pay annual fees proportional to the stock price, the reality is that you pay nothing, so it is fair to everybody, those who bought early and those bought recently. And remember selling a stock that has appreciatedly greatly still incurrs taxes, while selling a home that has been subsidized with other people’s money often incurrs little.

If Prop 13 is ammended with taxes that you cannot get away with $500k capital gains exemption then it makes it more fair. In bad times like now it will help to balance the deficit, in good times it should be used to rebate back the high state taxes.

My wife and I lived in California for several years. In the last year that we were in California, we were paying over $1000/month in income taxes. Yet, despite our substantial income, we could not afford to actually buy a house in California.

We left California and moved to Texas. Here we make the same income but pay no income taxes and now own a fine home. I think that we are not the only ones to do this. It seems to me, California is loosing its upper middle class and replacing it with illegal immigration. Thus, California looses tax payers and gains state service consumers. We are seeing the inevitable consequence of this.

You get less what you tax and you get more of what you subsidize.

Who is John Gault?

My mom has a California Tax Exempt income fund investment…should the state of our State prompt her to sell? Do you think the CA budget (or non budget) would have any effect on it?

They are spending more money than they are taking in in taxes. I know that that sounds simplistic but that is why not only is Cali in trouble but the US as well. The solution is cutting the huge entitlements they have in the budget.

Leave a Reply