Removing a generation of college educated graduates from purchasing homes – Higher education bubble will force many students to hold off on buying a home to service college loan debt. Renters take brunt of household correction. Demographic trends will put pressure on home and stock prices.

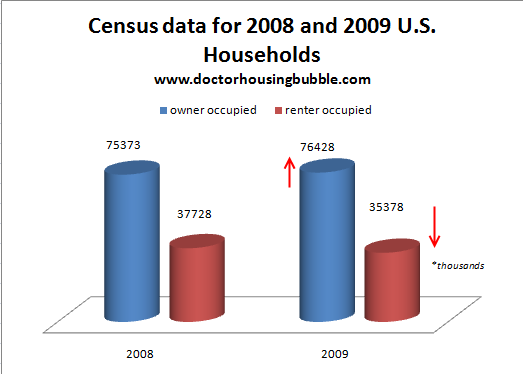

The net worth of U.S. households fell by $1.5 trillion in the second quarter of 2010. Recent data from the Fed shows that even during the recovery, U.S. households continue to move backwards in making financial progress. Who are we really kidding here? Does this feel or have the taste of a recovery to anyone? In fact, new data now coming out from the Census shows that from 2008 to 2009 the U.S. lost 1.3 million households. That’s right, because of the economy people have had to consolidate households. Yet as we will show later, much of this was shouldered by renters. Another thing that will impact the housing market going forward is the student loan bubble. That is right, higher education is in one giant inflated blue debt bubble and thankfully the mainstream media is now picking up on this. Many young potential buyers won’t be able to buy a home because theoretically they already did with the cost of their education. The numbers don’t look pretty for recent graduates with red all over their balance sheets before they even start their professional life.

New generation saddled with debt not seen in the past

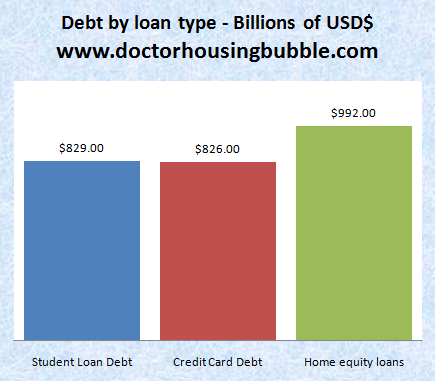

College students are facing skyrocketing college tuition that recently surpassed credit card debt:

Credit card debt has contracted down from reaching close to $1 trillion because many have filed for bankruptcy and banks have written the debt off. But with student loan debt, it just inches higher because this debt is permanent. Like the toxic mortgage debt that pushed home values higher, we now have toxic student loan debt allowing students to pursue degrees even at paper mills for $20,000 a year or more. Is it any wonder why these predatory institutions prey on students in targeted areas? And that is only one segment of this shady market. You also have people going to top ranked universities and getting degrees that provide little viable path to employment:

“(Yahoo!) Today, however, Ms. Munna, a 26-year-old graduate of New York University, has nearly $100,000 in student loan debt from her four years in college, and affording the full monthly payments would be a struggle. For much of the time since her 2005 graduation, she’s been enrolled in night school, which allows her to defer loan payments.

This is not a long-term solution, because the interest on the loans continues to pile up. So in an eerie echo of the mortgage crisis, tens of thousands of people like Ms. Munna are facing a reckoning. They and their families made borrowing decisions based more on emotion than reason, much as subprime borrowers assumed the value of their houses would always go up.

Meanwhile, universities like N.Y.U. enrolled students without asking many questions about whether they could afford a $50,000 annual tuition bill. Then the colleges introduced the students to lenders who underwrote big loans without any idea of what the students might earn someday — just like the mortgage lenders who didn’t ask borrowers to verify their incomes.â€

$100,000 in student loan debt from four years of study only! This is pure madness. Do we need to do a Real College Degrees of Genius series? Now I have heard some say, “well when I went to school, I walked through the snow in shoes made of paper bags and worked to pay for my tuition.â€Â College costs have changed since that time and just like the housing bubble at its peak, even the crappiest home in the worst part of town was selling for a premium because everyone qualified for a toxic loan. As things stand today in the student loan market, that is still the case with loans covering virtually any college. And just like Fannie Mae and Freddie Mac the government subsidizes the bulk of student loans. We even have nice old Sallie Mae.

We know student loan debt is immense. Over $829 billion in student loan debt is outstanding. The implication for housing is large. It is safe to assume that this debt isn’t with households that have paid off their mortgage long ago. These are people entering their household formation years. The average student loan debt is now the price of a brand new car:

“(Atlanta Post) According to a recent study by the College Board, I am in plenty of good – or unlucky – company as almost one-out-of-five graduates with bachelor degrees will not be able to make payments on the average undergraduate loan debt, which now stands at a whopping $30,500 (pre-interest). If that’s not disheartening enough, consider that for the first time ever, student loan debt now outranks credit card debt.â€

So right off the bat, a good portion of disposable income is going to go to servicing this debt. Unlike a bad mortgage, you can’t walk away from student loan debt. So there is a major liability already on the books for many prospective buyers. Compare this to a blue collar worker back in the 1960s with no debt purchasing a home. No need for a college degree to buy a home with one income. Today, you have this new college graduate that is probably making less on inflation adjusted terms from this blue collar worker and is unable to purchase a home without taking on more debt or combining two incomes. You have to wonder how many college graduates with large amounts of debt are unable to purchase homes because of their student loan debt? Keep in mind that 1 out of 4 Americans have a 4-year degree so this is supposedly a group that is prime for purchasing real estate.

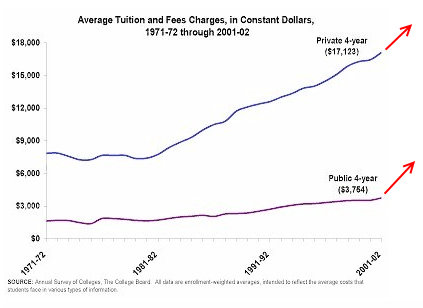

As is the case with most anything where the banking industry has gotten its crony hands on, there is definitely a major bubble in higher education. Banks are lending away because the government backs up their crappy loans with no oversight. Think of FHA insured loans or GSE backed mortgages (basically the entire mortgage market). The long-term repercussions will be felt in many different ways. Nothing is being done here so higher education costs keep growing exponentially like an expensive green pine tree:

One bubble after another and when they pop, it is usually the taxpayer that pays the bill.

Disappearance of 1,300,000 households – Renters shoulder bigger impact

From 2008 to 2009 U.S. households shrunk by 1.3 million. Yet one group took the brunt of this:

We actually added owner occupied households yet renter households declined by a stunning 2.3 million. Why did this occur? A few reasons:

-a. The long drawn out foreclosure process. With government gimmicks, banks ignoring non-payments, and other loan modifications a “home owner†can stay put for much longer than a renter that’ll be out in the street in a few weeks from their missed payment.

-b. Bias and subsidies to home buying. Tax incentives and low interest rates are subsidized by taxpayers. Banks influence legislation and they rather have a hot body in a home than another vacant property.

The decline in households is troubling and shows weaker macro trends. How many recent college graduates with massive debt unable to find jobs moved back home? This is a group that would be out getting their first apartment and creating a new household. The decline is significant and shows the real structural challenges facing our economy. It is also a reason why multi-unit commercial properties have record vacancy rates.

Poverty rate

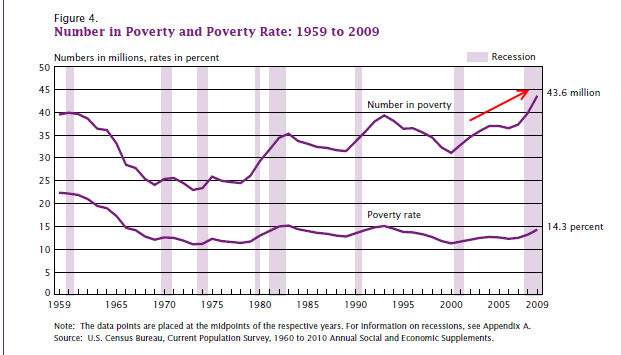

43 million Americans now fall into the poverty category:

This is horrible news on many levels. Where are these people coming from? Many are coming from the middle class. For many in this group they were part of the 1.3 million reduction in households. This housing and debt bubble has deeper societal ramifications that are now playing out. This goes beyond stabilizing home prices but reshaping what we want out of our economy. For too long the focus has been on housing and keeping prices inflated. Yet the latest household income data shows that U.S. households now make less than $50,000. With that said, home prices should be lower to reflect what people can afford.

Sadly many of the poor get sucked in the web of the for-profit education debt paper mill system. I was up late one night and saw an ad talking about a video game degree from a fly by night school. The youth was sitting on what appeared to be a La-Z-Boy playing an Xbox or Playstation. Now I’m no computer programmer but do know a few and I can tell you that you don’t program a video game by playing on a recliner the latest version of Guitar Hero. Yet it’ll cost you $20,000 a year to get this degree with debt you’ll never be able to pay off. Are we creating a new class of people that will be stuck in perpetual poverty because of debt?

Shifting demographics

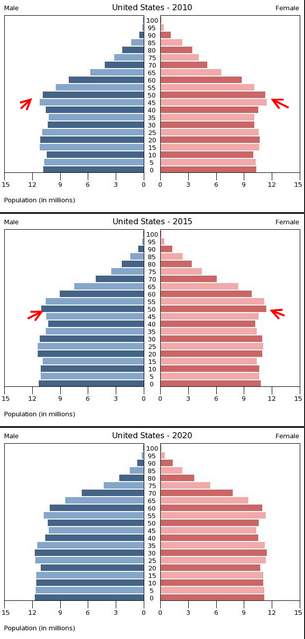

The baby boomers are coming! The shift in demographics is not pretty for the future of housing. I ran a few scenarios with Census data and what we find is a growing older population:

Talking with many baby boomers many haven’t thought about their entire stock portfolio scenario in a deep way. What is the purpose of a nest egg? To have money in retirement. But the only way to extract the money is by selling it in the market. What happens when millions of baby boomers start selling into a stock market with low volume because younger workers are flat broke or have no money to invest after servicing student loans, credit card debt, and other commitments? We already have a giant amount of property on the market plus another enormous amount in shadow inventory. Many boomers will want to downsize and sell their homes in this market.

The above scenario would work perfectly if we had a giant comparable group to the baby boomers that were affluent and giant in size. That is not the case at all. In fact, earning potential is down even with advanced credentials and we already know about the two income fallacy. There is a forced austerity built into the cards.

Summary

We are reaching peak debt with higher education. Many are catching on that simply having a 4-year degree in any major from any school will no longer be a ticket into the middle class. In fact, even going to a good school but choosing the wrong degree may leave you with a good education but no earning potential. Try explaining that to the student loan collectors. This is only another bubble but the implications are deep for housing. Without any reforms, you have a large cohort of younger Americans that will put off home buying for many years because of other debt commitments. What will this do to future projections of housing? Just like the toxic mortgage funnel, we have new factors that change the calculus of housing for the next decade. The shrinking household number is a reflection of our massive misguided bias to home buying. Who really wins here? We already pointed out that the net worth of Americans fell by $1.5 trillion in Q2 of 2010, a supposedly good time for the economy.

It is clear that massive debt pushed by the banks is the issue here. The same too big to fail banks are also the top pushers of student loan debt (and credit card debt). It would be one thing if they pumped out their own money but they are now wards of the country and have mismanaged so many things that we are setting ourselves up for another crisis soon. That is why the student loan bubble is now converging with the housing bubble. No wonder why the Federal Reserve is doing everything it can to inflate itself out of all the bubbles it has helped to create. The only problem of course is that it isn’t working as they would like and their taxpayer experiment is failing miserably for the country overall.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

96 Responses to “Removing a generation of college educated graduates from purchasing homes – Higher education bubble will force many students to hold off on buying a home to service college loan debt. Renters take brunt of household correction. Demographic trends will put pressure on home and stock prices.”

wow, doctor! i love your blog…so dead on…i hadn’t realized the connection…frightening…not only the burgeoning student debt but the prospect of baby boomers selling into a declining equities market…what should we do? Add on to this manufacturing and even service sector jobs moving overseas- I think I’m moving to Brazil….or germany, or singapore…..frightening indeed…but spot on!

I saw the article on Ms. Munna’s student loan debt a few months ago. In reading about her and her mother, one can see that they had their heart set on name brand degree from a prestigious university, even though they couldn’t afford it and it wouldn’t result in a well-paying job. If her family was in the top 3% of income earners and had $200,000 in cash lying around, then I could see it being reasonable to let the daughter study whatever and wherever she wanted. If she had gone to a community or public college to study the same thing she would have spent a fraction of the cost and gotten the same education. It’s like overpaying for a house by $150,000, and then complaining when you have to sell at a loss.

That’s not to take away from the point that tuition is out of control. Colleges charge what students will pay, and the availability of loan money only makes it worse, like the inflation of housing prices because there was so much mortgage money available. But the example of Ms. Munna and her family is a poor one; it’s a story that tells more about stupid decisions than about the student loan industry.

Another excellent post.

I want to expand briefly on the student loan piece. The bubble in student loan debt is directly correlated with the government’s insertion into student loans. Tuition costs absolutely skyrocketed with the availability of taxpayer funded loans. Prior to that, tuition and housing costs remained relatively static. Small increases occurred each year in the 70’s and 80’s. Then the government, banks, and schools made easy money and lots of easy money available.

Like all things greed, tuition costs absolutely skyrocketed from that point forward. Higher education was provided with a pot of gold with which to exploit.

The same scenario occurred with Fannie and Freddie. Let’s face it, not all people are entitled to an education nor are all people entitled to a house. Yet when all lending standards went out the window with government funding- behold what has happened.

I like to tease my pharmacist. She is a USC grad making six figs. Yet all of the work that gets done in this pharmacy is done by three pharmacy techs. Twelve buck an hour workers.

Anything that government inserts itself into is a runaway trainwreck. They have the worst resume on the planet. After examining that sometimes R and sometimes D resume’ I became a Libertarian. It is the only logical conclusion. Continuing this crony capitalism with these two idiot parties is insanity. And while I don’t want to turn this comment into a political rant, you simply cannot ignore the obvious. Government has been the problem, will always be the problem. Hacking that beast back, via Libertarians or the Tea Party Express, may be our last hope. Really.

BTW: I am a pharmacist that graduated from USC as well…

But, I agree with you 100% about the govt and anything they do, I’m libertarian all the way!

At, USC, the tuition in four years I was there went from 28000 a year to 34000 a year, I kept asking the financial aid dept, I do not feel my education getting better by that much from year to year…

The Tea Party? Are you out of your friggin’ mind?

I agree with Libertarians on many issues, but I am not a Libertarian because it is a simplistic, short-sighted ideology. The government definitely played a part in both the student loan bubble and the housing bubble, but it had plenty of help. There is plenty of blame to go around in this great recession.

I don’t recall the exact dollar amount, but I think federal student loans only cover up to 27K. Therefore, students like Ms. Munna can only amass 100K in debt by taking on private student loans. Personally, I think we need to change bankruptcy laws so that private student loans can be more easily discharged. That would prevent some of these horror stories you hear about philosophy majors graduating with 75K of debt and few employment opportunities. Regulating the for-profit higher ed industries is also an important step.

US News and World Report first published their annual “Best Schools” rankings in 1983. One could make an argument that the magazine is just as much to blame for the rise in college tuition.

The Tea Party is MAAADDD…as in Alice in Wonderland. This country really needs a third party that is more in line with liberal republicans and moderate democrats…with values similar to those of Dwight Eisenhower (pre-Reagan republicans and democrats). If some Tea Party candidate became president how would s/he handle the 46+ million people stricken with poverty (really more like 60+ million)? Forget the Constitution and focus on breaking up the giant megacorps and banks that command the government and American people. As long as they are in total power, democracy is merely a daydream. Once removed, small business (e.g. retail, industry) can find its way back to Main Street and prosperity will follow. Once the poverty level is at 5-8%, libertarian ideals might be possible to enact…but not until the majority of the country is working and doing well for themselves. Until then, we are social state where the government is the hand that feeds.

Why is it that millions of people have to be destroyed before we call a vicious fraud for what it is? Our leaders have promoted college as the ticket to good jobs and the idea that a 4-year degree in any major you chose was worth borrowing $80k or more to get because it would surely net you a lucrative career that would enable you to pay the debt back easily. Hundreds of thousands of people have run up 6-digit college loan debts just to discover that the lucrative occupations for which they thought they were qualifying themselves are not there and mostly never were. The college loan programs have not made us a better-educated or trained population. People are leaving 4-year programs with skills that they should have learned by the time they were in 10th grade. The college loan programs have only made us a more indebted population and enriched the hundreds of diploma mills that sprung up to meet the demand generated by Sallie Mae-backed college loans given to almost anyone who applied. They have also grossly inflated the tuition at all schools- college costs have inflated even faster than medical costs over the past 20 years.

For the past 40 years we have attempted to drive economic growth by debt creation as real productivity withered. We have now reached the end of that road. We can borrow no more and we’re ending up the only way that a society that lives by pyramiding debt to pay back other debt can end up, which is completely bankrupt and lacking the capital and resources to rebuild our economy on a new foundation.

Spot on Laura.

People are just beginning to understand that theoretical “money” only exists via debt instruments. You cannot create “money” without something backstopping it. Fractional banking meant that banks could loan 9x what they held in reserves. The only way to increase the money or wealth of your bank was to loan- increase debt and thus increase your capacity or margin. That was what “cash for clunkers” was all about. They didn’t give two craps about consumers- they were repairing broken balance sheets for banks- same is true for the 8k tax credit. They are trying to incentivize Americans into taking on debt. The more debt, the more margin banks have. But this zero sum game is almost over. Banks are repairing broken balance sheets with .25 overnight rates and buying treasuries paying 3 and 4% praying that they can avoid collapse. My best estimate right now is that banks owe 25 trillion. To unwind this will take a miracle. I don’t think they can do it. But that won’t stop them from trying to deceive people because if they lose their customers they lose their ability to repair themselves. Their are huge forces at work trying desperately to deceive us. They have to.

Gold at 1275 is a steal. I expect 3000 dollar gold in two years. When people finally realize that fiat currency is non existent and valueless, they will simply quit accepting it as a method of payment. I am invested 30% in physical gold and silver right now. I have no plans on adding more. I fully expect to recover my fiat losses as the world begins to realize that money does not exist. This is the dream scenario for a one world currency. The same one that whackjobs have been talking about for years. Suddenly- they don’t look so wacky to me anymore.

http://www.nysun.com/editorials/greenspans-warning-on-gold/87080

Right on the money.

Here is a recent clip of Jim Rickards on cnBS (Sep 16, 2010). I cannot believe they give him the opportunity to speak without much rebuttal.

Jim Rickards – $5,000-10,000 Gold

But the figure Jim quotes above is modified from his previous projection, Sep ’09:

Federal Reserve needs to cut US Dollar in half

I believe what most people fail to recognize or understand is that there are not enough underlying tangible assets to cover the existing paper claims against them. Interesting times.

There’s something I can’t understand about buying gold. In fact, it’s the same problem I had understanding why people were so eager to buy a $125,000 house for $500,000; who will be able to pay those inflated prices when you realize the need to sell? I keep coming up the answer; no one! You’d be better off stuffing your extra money in your mattress.

WASanford,

Oh, My!! Oh, My!!

Inflation notwithstanding, there are many reasons protecting your wealth outside of the fiat system is so important today. Remember what money is supposed to do:

1) Serve as a means of exchange

2) Serve as a store of wealth

The US$ is in danger of failing #2. There is no way to easily explain this in a few words, but you need to figure it out for yourself, anyway. Let me pose a question: What would happen if the US$ lost its status as the world reserve currency?

Be careful with that paper money in your mattress, you may end up wiping your arse with it.

Food for thought: A quote from FOA, 2001

“My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today’s dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! Worthless dollars, of course, but no deflation in dollar terms!”

If fiat currency does not really exist, then why not take out as many loans as possible to buy real assets with this make believe money?

Gold is a liability and makes you a target for scapegoating, especially during a revolution.

Invest in networking and people skills. That’s what the tea party is doing.

Boy, have you nailed it! This insanity is about to confront reality and it won’t be a happy time for any of us -rich or poor.

Off-topic: Bank Sells House Twice (San Clemente)

But the best thing about the story is the $700,000 owed on the loan when there was NO sale at that price. The sale history was:

03/11/2010 Sold $365,000

05/30/1997 Sold $168,000

If this was tapping the home ATM for $500K, the MSM missed the real story. I’d love to see the paperwork on this one.

“Renters shoulder bigger impact…took the brunt of it.”

Just wait a couple years or so – by 2014. Multi-unit housing construction has collapsed and remains in the tank, while the number of renters grows and grows. Yes, renters are doubling up but this is not sustainable. Renters will be in even worse shape in a few years than they are now, squeezed by debt, transportation and healthcare cost), and soon-to-soar rents.

Scam it is. See it for what it is, again, they have not.

Great Post! I never thought of the connection between this and housing, but it makes so much sense. People can only take on so much debt.

Here’s an interesting Frontline program on for-profit schools.

http://www.pbs.org/wgbh/pages/frontline/collegeinc/view/

I have to say, that despite the best of intentions, artificial government subsidies almost always end up hurting people. Why? Not because they are evil, but they defy free market rules and create opportunity for massive fraud. Inevitably, self-interested (as we all are), but morally bankrupt people will figure out how to game the system.

It’s odd, most people don’t seem to have any respect or concern about screwing over our country. There are TV commercials now that show people with huge smiles how they got out of paying huge amounts of tax debt. Pennies on the dollar! Hurray! Let’s all celebrate! No matter that this money doesn’t just go away, the loss is spread over all the working people out there in the form of higher taxes -for the working stiff losers who actually do pay.

I do feel bad for these students. I recall not having a clue or caring at all about my student loans when I signed for them. At eighteen years old, nobody is going to limit their dreams and be prudent.

Unfortunately, like the housing crisis, we have a financial system and society that encourages irresponsibility. It’s like we are resting on the laurels of the previous American generations. As if we as a nation feel we earned the right to be rich.

I listened to that College, Inc (podcast) several months ago –what a racket that whole private college stuff is! I’m suprised more people aren’t talking about it.

Yest but they shouldn’t have scrutinized only for-profits – the scam applies all across the board, to private colleges and State U as well.

It looks like many Boomers will be taking what retirement deals they can just because there are no jobs available for them any longer. This will put downward pressure on all the asset classes that they’ll be selling in order to retire without eating cat food.

After all the house flipping, and the speculative education costs, at the end of the day it’s the plumber that saves our asses. He fixes our pipes and unplugs our toilets. You can’t sell your flip without him. People with Masters degrees from the greatest colleges, and mighty CEO’s all need the lowly plumber, for without them, they must wallow in their own shit. Moral: people save your money on that higher education. Learn how to deal with crap, for that is America’s future, and only plumbers have the right stuff to survive this madness. And they did it with only a trade-school education.

I like to ask people “Who does society need more, plumbers or surgeons?” While a surgeon will save a life here or there, the lack of clean water and proper sewage removal will potentially and easily kill millions. Modern societies cannot exist without excellent plumbing.

Excellent point. Back when I was in college, I was a regular reader of the was but unfortunately now-retired-from-blogging Kim do Toit. While his blog was centered mostly on 2nd amendment issues (which led to some very interesting discussions on how to be prepared for disasters that might debilitate local emergency response systems), I recall quite a few threads where in addition to an education to apply toward a high qualification high paying career, that it would also behoove young Americans to learn any of the sundry trades such as a plumbing or carpentry or electronics that might allow for bartering of services in the complete economic meltdown scenarios where degrees in subjects like sociology or marketing or ancient east Asian literature probably wouldn’t amount to much.

Not forgetting, mike, that the point of a classical liberal arts education was supposedly to create a well rounded citizen capable of independent judgment and intelligent thought. Not to be cashable-in on graduation day for a particular step on the shiny escalator of consumption and class privilege.

But in general I agree. When I taught kids at an Ivy League university, and later worked for many years in the Ed Biz at public and private institutions, many students expressed disgruntlement and confusion about why they were there. I always advised them to leave and do something else until they wanted to be in college and knew why. So many had family expectations bearing down on them. And family myths. Some broke down under the weight of the latter, but some also left for something they loved, and reported back years later that they were much happier people, and more productive all around.

But since Reagan, regard for college degrees–rather than work experience and smarts–has been inflated as badly as housing and Wall St. That has gone hand in glove with the inflation of regard for consumerism.

Don’t worry. Obama took student loans away from the banks, and now it is direct from the government. This has implications for taxpayers. The stock market is international with rich people money, so the workers that retire will not affect it much. Most workers took their money out already. There are trillions on the side line.

Yep $99K in income this year, $80K in student loans, and renting. I pay about $1200 a month in student loans (which is more than my rent), I can’t imagine a mortgage on top of that.

May I ask; at your current interest rate and minimum payments how long is the payoff on this student debt? Is the $1200.00 your required payment or are you paying it down? At your payment schedule when will you be free of it?

You asked “Current interest rate and minimum payments how long is the payoff on this student debt? Is the $1200.00 your required payment or are you paying it down? At your payment schedule when will you be free of it?” I had 4 loans when I left school total of $130K. 2 paid off, 1 loan paid off after I pay $200, 6% total interest, the 2 remaining I have a 3.5% variable loan at $19K, and the rest is at a fixed 5.6% loan. For the lower interest loan I’m 2 years ahead of payment, I have 9 years more before I pay that off. The other loan, my minimum is $325, but that doesn’t pay down much principal which is why I pay more than minimum. If I keep paying as I do, I will be done in 25 years (of course would like to shorten that time by 5 years or more if possible). Sure there was the option to just put all cash to loan, and not save for retirement or emergency fund, but I didn’t choose that route.

That is why most people are investing overseas where the demographic changes are much different, not china, but other developing countries will cause demand to be increasing. Interesting times as shift of power is coming…..

Math Class!!!

1970 Tuition, Southeastern US Public Univ: $216/yr

1970 Housing, frat house: $300/yr

That’s $516/yr. In 2005, my youngest daughter cost me $8,800/yr for the same at a SE US Public Univ.

That’s a 1706% increase, which is somewhat higher than the rate of inflation during the past 40 years.

BTW, the daughter got her undergrad in Biology. No job or prospects fro 6+ mos, so she started to work as a cashier in an Atlanta Bread Company retsaurant. Two years later, she’s its asst manager and is getting her accounting degree. She loves it (ugh).

The debt is just one thing – the sense of entitlement in the 25s & under is frightening. Mine woke up, bur she had zero loan debt. I think a lot of the problem is that parents have beeen financially irresponsible and should have started that 529 or a trust to fund college tuition rather than on a leased Beemer and a McMansion.

I lived at ground zero of a nationally known university, sharing a room with recent graduates. A few found decent work at the medical facilities on campus, albeit at rather daunting hours for young folks. The rest were working retail and restaurant, and as you say, with enormous student loans for liberal arts degrees and the like. We are finding ourselves in Regean’s future, where everything is privatized and predators rule. You can even walk away from a mortgage, an agreement made by an adult; but you can’t get out from under a college loan made by a child, essentially (if you think 19 is an adult, go by a frat party on Saturday night at any university in the country). Everything from housing, schools, prisons, sports arenas: it is all spiraling out of control and unsustainable. And it’s all part of the American dream usurped by the Manhattan-Transfer nightmare. The real terrorists aren’t overseas–they’re across the Hudson River…

Your phrase Manhattan Transfer brought a smile to my face as I recalled the 60’s band of that name. I googled to find this ironic Wikipedia reference. “Manhattan Transfer is a novel by John Dos Passos published in 1925[1]. It focuses on the urban life of New York City in the Jazz Age as told through a series of overlapping individual stories.

It is considered to be one of Dos Passos’ most important works. The book attacks the consumerism and social indifference of contemporary urban life, portraying a Manhattan that is merciless yet teeming with energy and restlessness.”

More apropos than I realized. I still can’t believe that everyone has forgotten about Goldman and the cronies and think this is all about Obama.

The band is still around. I was amazed to learn this. Also, Asleep at the Wheel.

But to get back to MT’s point, I’m sorry, but if you are old enough to enlist in the military, have consensual sex, sign contracts, get married, vote, and in some states drink whiskey, you are an adult.

I’m sorry that your generation considers itself “children” at 19, and adolescents up till your 30s. But this clinging to infantile behaviors and views is another thing that has to change, and will change. We now have two or three generations who feel entitled to suckle at the teat of dependency forever, and be let off the hook for poor decisions. Sorry, sorry, sorry, but those of us who have been supporting you can’t keep lugging you like this. And if you didn’t have the basic arithmetic and thinking skills to understand what you were signing up for when you signed those loans, then how the hell did you get into college/get a degree except via a kind of age-based affirmative action?

Marge: Homer, remember your promise to the children!

Homer: Yep, when you’re 18 you’re out the door!

Well – pfffft – DON’T cosign!

I think so many of your points are valid. And yet, I wonder what you would suggest that we could do to improve the situation.

Hmmm, good point. Is there a way out of this mess? I suspect that there’s no easy way out…

I believe that the future of the USA lies not in some idealistic libertarian model but rather in a big economic about-face that addresses the counter-productive nature that lies at the very heart of our system. Changes required include tough new regulation on the casinos (Wall St) and banking systems, massive investment in targeted industries that allow us to lead in innovation and productivity and lastly, a tightening of NAFTA with Canada and Mexico. This last point is something of a dream I suppose…however we need to actually begin to produce things again (not just paper debt instruments) and adding the value that Canadian resources along with Mexican growth rates and relatively inexpensive labor brings to the table would kick start this new reality.

A pipe dream? Likely but closer to a viable solution than an Ayn Rand ‘remove the nets’ one 😉

Use an eraser.

Reverse 3 decades worth of mistaken tolerance of govmt control and “help” by eliminating the Dept of Educ – among other useless and destructive fiefdoms.

The real solutions are usually simple and elude most because it means admitting a mistake.

I would enjoy watching the entitled universities scream – as they were forced to restructure or disappear.

Our housing market depends a great deal on the first-time buyer in order for everyone else already on the ladder to become move-up buyers. Typically, college grads would be prime first-time buyers. But that’s a daunting task for them now. Who else? Maybe govt employees? But now state and local govts are starting to lay-off people due to huge imbalances in their budgets. So the housing market has another factor for downward pressure in the coming years.

How Underwater Mortgages Can Float the Economy

NY Times discovers free lunch.

Thanks Dr. Bubble. I’m fortunate to live in a state which offers a pre-paid college program. I could not afford private tuition for my daughter, but having her expenses paid as well as dormitory and meal ticket at a state university may be worth the price. That’s assuming the trust has invested wisely, which is another reason I’m kind of ambivalent about extend and pretend. The consequences of mark to market would be horrific. Now, if I can just get my daughter excited about petroleum geology.

The answer is not that students should be able to default on their bad loans (and 80K is not just one but a series of bad choices for all but a few future doctors…) I firmly believe that all loans should be recourse – if you borrow money promising you will pay it back, you need to pay it back.

The problem is that banks are lending money to very poor credit risks, whether they be 18 yr old kids wanting to study basket weaving or adults who have an irrational need for McMansions. That problem would sort itself out, with reckless banks going out of business, if it were not for our government backstopping them. This is the crux of the problem.

You cannot count on individuals (especially 18 yr olds) to be making prudent financial decisions. But, if the banks are held responsible for the loans they issue, you will see the whole system get a lot more responsible very quickly. And as the banks make fewer student loans, fraudulent “colleges” will go out of business and legitimate colleges will lower their costs.

It is obvious that fiscal responsibility is something that needs to be enforced by society. If we demand responsibility from the banks (by letting them fail) they will in turn demand responsibility from borrowers.

Bottomline is that we cannot have capitalism exist side-by-side with socialized banks.

If 18 year olds cannot be trusted to sign for loans, that argues for loan-signing ability being denied them. There is no reason to expect the usury industry to be paternalistic. In fact, I’d call that pretty naive.

patrick, with all due respect, you are coming down on the side of people who, for instance, said back in the ’70s that the national election voting age should not be reduced from 21 to 18. I don’t necessarily disagree with that perspective, even though I benefitted from it (and, I’m told by both parties, immediately abused it in 1976 by writing in Gene McCarthy for president).

The systematic infantilization of young people–did you know that social “scientists” now extend the concept of adolescence into people’s 30s?–is a big chunk of the problem. The profitable paternalism of crony finance and consumerism feeds into this, and fosters it. We are all paying the price for it.

The new model has got to involve intelligence, forward thinking, and responsibility for consequences. I’m really really tired of the constant excuses for people weakening the entire economic system by demanding their share of something for nothing.

As for choking out the Ed Biz, there are days I feel that way–30 years mostly in that industry helped.

Then I stop and reflect at how many jobs the Ed Biz created in the ’80s through Aughts. And the social services/”mental” “health” industry as well.

Before we go on slashing more jobs, we’d better have an idea of what to do with all the unemployed. Unemployed people do things like default on mortgages.

I’ve been buying gold in smaller denoms and silver.

WASanford

Eventually what will happen is that fiat currency will have no “perceived” value. Those of us who are early- already know it has no value. When people, perhaps your gold dealer quit taking fiat, the default currency will become precious metals. The only unknown is what that terminal price will be and when will this happen? I don’t know, but I suspect that the inflationary rise of fiat will be so spectacular and so fast that it might rival Zimbabwe.

All paper currencies have historically failed- all of them. In the late days of the Roman empire, precious metals were substituted for worthless pot metals. Our government has done the same thing with all of our coinage.. It is zinc. Many coins in circulation, predominantly pennies and nickels, still have valuable metals in them.

Wealth creation is still your labor. At whatever settlement price precious metals lands on- that is how you will be paid for your labor.

Around 1972 they raised the semester total fee $10 at my public state school from $60 to $70 and their was a demonstration of a couple hundred students. Now the students are paying $2200 a semester.Still a bargain but now all the students get loans for tution and living expenses instead of taking one fewer class and going to school an extra year.

Whats a little debt. It just like the credit card. Sad. But it just like the feeling for years that you bought the biggest house you could afford, not what you needed. Because prices always went up. Its only debt.

Do not forget, Congress froze the interest rates to fixed on all the government sponsored loan programs. Unsubsidized Stafford is running 6.5 and Parent Plus is 8.5, and there are the 4 percent loan fees to start borrowing. The HELOCs if competitive are a lot lower.

Citibank is selling the Student Loan Corporation…. Hmmm.

Which was NOT in the best interests of the students. This was passed to help the banks make more money. All of my student loans were taken before that passed and are at less than 2% interest rate. Wife’s are a mix and that fixed 6.5% doesn’t seem like a good deal at all.

Plus I’m willing to bet if/when interest rates go up that new ‘legislation’ will be passed to repeal the cap in the interest rate.

Golden rule – He who has the gold makes the rules.

There is trouble in the wind for these for-profit universities when even The Economist runs an article about impending US legislation on the over-the-top profit margins being earned for degrees that will earn the students wages that won’t even cover the loan payments. And the Ivy leagues? (and other prestige private universities) Their tuition levels that have soared above inflation due to adding unnecessary luxury facilities and UNREAL pay hikes for administrators (note- not for professors or instructional facilities) are also getting rebuked for allowing students to go deep into debt for degrees that will never earn their holders more than modest amounts (let’s face it, a degree in Sociology or Womens Studies will never earn more than Burger King wages unless followed by law or medical school!).

I think change is in the wind in the form of laws forcing for-profit vocational colleges to tie tuition to the latest employment/starting salary for the degree given and laws/market forces pushing Universities back to the years where they had to keep tuition down to the level that students could actually work their way through school on a mix of scholarship, work study and some savings.

I am deep in debt- but two years after graduating with a masters (in a responsibly-chosen field that actually promised to pay well before everything collapsed) there’s still no job. I am lucky, and my husband has a good job, so as soon as I DO get work, I’ll be putting at LEAST 50% of my wages into paying off my debt. But it’s going to be a long haul, and I don’t like how it feels right now.

Good luck to you.

You don’t seem to have been irresponsible. I hope things work out well for you.

But many others were quite short sighted. If schools actually gave a damn about students there might have been more warning of negative possibilities. It’s not like some version of this hasn’t happened before.

I still remember a Wall Street Journal article from, perhaps, 1992 or 93 about how some ivy league graduates of the day were stunned and angry to find that their whimsically chosen majors didn’t still entitle them to high paying jobs at First of Boston and other banks. The one I really remembered was some girl who had majored in 17th century French literature at Yale and had the nerve (and lack of perspective) to grouse to a reporter about how unfair it was that, even in a recession, this wasn’t still a glide path to a 100K job, as though the whole economy revolved around Moliere or something.

But I ask again, and with compassion, where did you get the idea that buying access to a degree was a guarantee of future income?

And I ask additionally, why did you want to believe that?

This is the mental trick that the debt industry feeds on. I’m glad that you haven’t destroyed your own and your family’s finances with your training. I’m sorry you’re surprised and unhappy that the outcome of such training can be nonexistent. I’m really really glad that it sounds like you are taking responsibility for your choices.

But just as the debt industry has been happy to pump up the market for student loans, people taking out those loans have been operating under the delusion that renting a seat in college and taking courses there somehow will translate into them graduating and getting a better standing in society than those who, say, were out working all the time they/we were in college.

What is this really saying? That in America we came to believe that class privilege was a commodity that could be bought, sold, and traded on.

And that that was more important than, say, plumbing.

Well the bloody little secret here is that most young people don’t have any friggin’ clue what they want to do with their lives, and so they play extend-and-pretend, just like the banks. And a great deal of older people view degrees as confidence-builders, when they should be out in that dreaded world, paying their dues and working their way up. School is a place to run to, when the job gets boring or rough, a place to hide while you figure out what to do. And the academic calendar..I mean, who gets that kind of regular “closure” twice a year in real life?

This is all about avoiding the Real World.

I love how the gold bug trolls find a way to convert DHB’s topic on student loan debt in to an article to comment on “buy gooooolld now”!

Don’t buy the fiat currency hype, as gold is the next bubble about to pop. Think of gold as the next housing bubble blown up by hype.

Late night infomercials on buying gold, endless adds promising riches by just buying gold now.

Don’t you see that this is just hype? Am talk radio has these gold commercials endlessly every half hour, day and night. Just like the endless housi g hacks back in the 2004-2008.

Just substitute the word “gold” with “homes” and you will see why those pumping gold are just the same SHILLS that were pumping housing in 2004-2008.

Another way to spot a gold bug shill? They try to scare you by calling the dollar, and other currencies “Fiat”.

Buy gold now or be priced out forever. Sound familiar?

Cash will be king, and gold will tank like csco in 2000 or housing in 2008, 2009.

My two cents

Don

Yes, I mean fine put some of your money in gold if you want, but also realize that gold also has no inherent value, unlike fiat it’s scarce, but like fiat it has no REAL worth.

====

But it’s shiny ooh ooh. Yea but even an overpriced house at least provides a real human need: shelter. So it does have SOME real value unlike gold (but not necessarily what you paid for it), provided there is enough infrastructure around one to make the home worth living in at all (see Detroit for homes that aren’t worth buying at any price anymore).

Don, I would think you might want to learn a bit about gold. Its the oldest money known to man. All fiat currencies have failed. Less than 2% of all Americans who could own gold, whether paper gold or bullion, do. Would that be a bubble? I don’t think so. The advertising you see is simply companies who make huge profits on people who don’t know any better. Either by selling their gold at less than 30% of its value or those selling gold to people who don’t know the difference between numismatics and bullion.

And here I thought sex, food, and influence were the oldest currencies known to man.

“Buy gold now or be priced out forever. Sound familiar?

Cash will be king, and gold will tank like csco in 2000 or housing in 2008, 2009. ”

Cash yes, but not necessarily US dollar. Fiat money means it has nothing to back it up thus it’s just a piece of pretty paper. Of course, almost every existing currency is nowadays fiat, ie. just paper. Not even suitable for wiping your rear end if something happens. Like in Zimbabwe: They had bills of billion dollars. And that bought you a bread and cup of coffee on the market.

Even if you have millions in cash, cash isn’t the king when bread costs 600 millions.

Gold is hyped and so is silver, but ‘valuables’ as a class are always worth something. It’s not a guarantee against losses (nothing is), but it’s better than pices of paper worth of nothing.

It’s not a coincidence that most currencies were based on gold, in form or another, several thousands of years. Compared to that, every fiat currency is extremely short lived, because the were designed to be such: A way of stealing citizens’ income without them to notice. Including euro.

Except maybe Swiss Franc.

It seems to me they went off the Gold standard about 40 years ago because someone wanted to spend more money than they actually had.

Gee…..I wonder what that means?

“Just substitute the word “gold†with “homes†and you will see why those pumping gold are just the same SHILLS that were pumping housing in 2004-2008. ”

As someone who was shouting housing bubble from the mountain tops beginning in 2004, I take offense to that!

I got into gold in 2002 (and out of my house mid 2004) and remain. To keep Gold mining production static, Gold needs to be at least 700.00 an ounce, provided production costs (oil, labor) do not rise. So a person can argue gold is nearly 100% over priced.

But, you forget, Gold is not reacting to what is occurring right now, it is reacting to what will occur as a result of what is happening today. In 5 to 10 years, gold at 1300 will not be overvalued at all and will probably be undervalued.

I am confident the FED will get the economy going again, they have proven they will do whatever it takes to keep the economy going and will add the fuel needed to get it firing on all cylinders.

My question to you is, when the u.s. economy begins to expand again, along with the growing demand for natural resources from Asia and South America, what do you think will happen to energy and natural resource prices? When our Federal Government needs to pay 7% on its 20 trillion in accumulated debt, what will happen?

When looking at the bigger picture, Gold is protection from what is to come, not what is here.

Everything is up 500 to 1000% (excluding electronics and computers and general Chinese Junk) in price from 1980 yet those who know nothing of the concept of money and what makes money, money are the first ones to shout ” Oh my God, Gold is up 150% from its 1980 price……..IT IS A BUBBLE!

A quick Internet search for “Alan Greenspan” and “economic freedom” will open your eyes to what Greenspan really thinks about Gold. And….with our Federal Government spending our national debt to 15 to 20 trillion within the next 5 years or so to thwart this “depression/recession”, you, me, Alan Greenspan and everyone else is going to need so serious protection and at 0% interest rates, FIAT will not give it to you.

Would a good strategy be to aquire gold using credit cards or other unsecured debt, Then just stop paying? You now have 200k in Gold (even more if you establish business credit) and seven years to wait to do it again. 🙂

Doc, I’ve been telling people for years that I already have a mortgage, its called my $1,100 student loanpayment. Luckily I’ve paid off a lot but I still owe $110,000 at 2.5% which is roughly $550 a month. And I’m a lucky one.

The student loan debt bubble will explode the worst of all the bubbles as borrowers default in mass over the course of the next decade and congress grants amensty or settlements.

Al lord should have his f-ing head put on a post at the entrance to wall street as a reminder of what happens when the serfs revolt against the Lord and take over the castle. I won’t cry for him.

Doc – another great article! I didn’t see this coming… Well done!

Can anyone tell me why I saved all this money in a trusted FDIC backed bank, with terrible interest rates @ 1% (if I’m lucky) and sit here waiting for mortgage rates to rise so our over priced mid-tier homes will drop in price? We’ve worked hard too, done everything right, have credit score well over 800 (but luckly we won’t use) Haven’t we bailed out enough to start doing more for thoose who have played it right form the start and have had to wait for more than 15 years to buy. Sorry to sound like I don’t care about folks that are down and out – I do care, but give us a break too…. Well at least the weather makes me feel better – So. California weather is hard to beat!

The very sad fact of the matter is that is seems like the responsible people will never be helped. Increasingly, our economic system is designed to help the rich and the poor at the ever increasing expense of the “ordinary” guy in the middle.

We do not put incentives in place to encourage good, honest, hard-working people and people that are smart with their money.

What’s infuriating about this is that the responsible people who decided to make good money decisions have sacrificed things in order to do that. Buying a house is a significant part of most American’s dream of a good life. The smartest people did not take interest-only loans. Often times, that meant not getting a house of their own to live in. The less responsible people, did take interest-only loans and got to live in a house. Now the government steps in and decides to make everybody pay for this crazy gambling buy using tax dollars and causing inflation. This makes it even harder for the honest, smart guy to buy.

Our system should be simple. Encourage and reward responsibility. No other system will work.

Exactly.

Personally, I think this is one of the several reasons the Gold sector is taking off. Our Government has distorted the true meaning of money to the point that it doesn’t work.

I mean really, 500K should get you your dream house in ANY coastal city in the nation! But it does not due to government intervention and manipulation (interest rates, FHA, Freddie Mac and Fannie Mae and much more). Gold is reasserting itself as money because it has always been the default money when other monetary systems fail. Our system is failing to work properly.

Did you ever think that the “right thing” to do is go by the old addage, “when in Rome do as the Romans do?” Did you ever think that being a conformist and doing “the right thing” from a 1950’s mindset, may not be the right thing to do?

I fear that previous generations were brainwashed into being compliant providers/slaves and not question authority. IMO they are the ones to blame for not nipping it in the bud. That Beaver Cleaver world is the one that’s neither real, nor sustainable. I think the Nixon/Reagan/Bush voters are really getting what the deserve. It’s just the chickens coming home. to roost.

Which reminds me of a bumper sticker I saw…”A Working Man Voting for a Republican is Like a Chicken Voting for Colonel Sanders.”

Just wow.

I know someone that is a supervisor clerical employee. She went to medical school in Grenda(?) and now the balance of here student loan is over $200K, not including any interest. She makes about $40K a year

One thing I feel needs to be added is the number of people graduating with giant amounts of student loan debt and unable to find work in their chosen fields. There are next to no teaching jobs in Southern CA these days and most people spending the 4.5 years to get a degree then teaching credential are not getting jobs. I’m fairly certain many other degrees are performing poorly as well. The whole system is a complete joke and massive transfer of wealth to the banks. They will even let you defer your loans for a few years all the while charging 8-10% interest allowing your debt to balloon that much more. I disagree with you that the situation has peaked and in in fact I think it is still getting worse. One thing I don’t understand is I graduated from college in 2003 and consolidated all my federal student loan debt at 3% interest over 20 years… I considered this to be a pretty fair deal for this type of debt. My wife graduated in 2008 and apparently George Bush passed a law in 2006 or around that time that guaranteed banks a higher interest rates on student loans. Because of this even though interest rates are insanely low right now you can no longer consolidate student loan debt to a lower rate. Its a pretty sad day when you can get a lower rate on a car loan than a student loan! What is going to happen when these people simply can’t pay and the debt gets too big from them to service on the low wages we now call the middle class.

One of the best parts about this blog is that it provides a wealth of information without the fluff. It really is one of the best sources out there for meaningful information here in California. Even the posters here are helpful, particularly to laypeople like me.

That said, I’m a bit worried partisan hackery is taking over. I know they’re intertwined, But the Doc, this site, and the comments are at their best when the usual Repub/Dem/tea party nondiscussion (it’s more talking “at,” rather than talking “with”) is left out.

I don’t know about other readers and I cannot speak for the Doc, but I don’t think partisan bickering is in the spirit of this blog. If others want to indulge, though, may I suggest Politico?

The flow and conversation on the blog has been good. That is until someone decides to appoint themselves a moderator and lecture us on what is acceptable and what is not acceptable. May I suggest practicing a little more acceptance and a little less control?

Doc, thank you for shining some light on the student loan issue. Aging boomers who can’t shake off the bubble mentality need to step back and think about the housing industry in the context of all of the other debt-fueled industries.

-Many more young people are pursuing advanced degrees today than they did 30 years ago, and most take out tens of thousands in student loans to finance it.

-I think I remember reading a while back that the average wedding costs just under 30K in recent years. Were weddings always this expensive?

-I talked to a friend recently who told me that she expects men to spend at least 10K on an engagement ring. 10K was her MINIMUM.

Toshi, women have always had their dreams. Unfortunately, reality is not the same as dreams. Now days, many young men expect the woman to support them(with affirmative action, city women now make more than men in their 20’s. Also more women graduate from college than men). Ever watch judge Judy? Apparently that is the social norm amongst some groups now days. What is this nonsense about marriage? In Europe and America, about half the children are born to parents who are not married.

My intent wasn’t to disparage women or anything like that. I was only trying to point out all of the other costs that a young couple may have. If both go to grad school, both are likely to have student loan debt. On top of that there are weddings, honey moons, two cars, engagement rings, babies… all of this stuff costs money. I just don’t understand how a young couple can afford to take on a jumbo mortgage after all that.

Any woman “demanding” that 10k be spent on her ring- is sending you a subtle message…run like the wind my son.

While I agree that any woman holding that sort of expectation is probably too full of herself to make a viable marriage partner, the number itself does not seem outrageous. If going by the old rule of thumb of two months salary, that’s like saying she wouldn’t want to end up with someone making less than $60,000 per annum. Spoiled attitude attitude notwithstanding, that’s not entirely out of line.

And of course there’s whole issue of just where the two month’s salary guideline came from, which in all likelihood traces back to the same parties that have made diamonds a requisite, and the further issue of how someone making 60 grand can hope to save up 10 amidst the current cost of living.

ACTUALLY, engagement rings are nothing but PROFIT PROFIT PROFIT for fancy jewelers. If you go to the Jewish/Hassidic (?) folk who run the NY Diamond District, you can get an AWESOME stone for, say, a couple thousand. I actually got mine FedExed to Austin by a local jeweler with Diam. District contacts. And then go to another jeweler and have it mounted. Don’t let them charge you too much for the band “because it is gold” or platinum, or whatever. A ring only uses a few GRAMS of prec metals, which isn’t too bad. Bottom line: You do the leg work: Awesome ring with large diamond for very nice price.

Uhh….my husband is making 6-figure when we got married last year. my ring only cost him $1400 while his ring is only $600. let alone that I choosed 600 dollars ring at first but he felt guilty so he suggested a $1400 ring.

Sadly, too many women are watching the “Real Housewives” on TV without realizing that there’s no actual reality in those women’s lives.

$10K for a ring is OK – as long as the guy who she loves consistently makes $200K or more every year. But the question is: Does she love a guy who just happens to make that kind of money? Or does she love the guy only BECAUSE he makes that kind of money. Because if the answer is the latter, she’ll probably end up divorced within a few years.

My wife and I got engaged when we were dirt poor. I proposed to her with a $35 silver ring. Several years later, our marriage is running strong and we have a beautiful one-year-old son who is the joy of our life. Oh, and fortunes change: I made $200K last year. Good thing my wife chose me because she loved me, rather than because of the initial payoff.

Maybe some day I’ll buy her a $10,000 ring as an anniversary gift, but thank God that we chose each other for the right reasons – money is fleeting and unpredictable.

Its easy to scold young people for taking on huge student debt, but this is the price of admission to even the lowliest entry-level job. Rather, the price of a lottery ticket — admission is far from guaranteed.

Not only do the lenders profit, but employers benefit from a desperately indebted workforce that is in no position to make demands or threaten to take their skills elsewhere.

For profit univ or not for profit – who cares. Both are in the business of education which at some point should lead to increased skills and compensation (and both have equally dubious track records at this point so I see no reason to point the finger at one without addressing both).

Government’s involvement in the student loan market was supposed to be a boon to borrowers. Rather, it’s facilitated a tuition spiral. Get government out. Educate people in high school about budgeting/career prospects and basic finance concepts (i.e. rent/buy and investment/payoff) so they can make these decisions. Watch the world change. Education is always the answer and not some paper and BS skill set, I’m talking about people who actually think for themselves here. Develop that and make the country stronger and more stable.

I totally agree.

Just like in the housing industry, the government has allowed bankers and investors to become rich through enormous education loans, while screwing the working person. These government plans always sound great when they start and I think the lawmakers do have the best of intentions, and perhaps they do work for a while, but they always seem to backfire!

What you said about finance education in high-school is spot-on. I never had a single economics or finance class, even in college. I think that hurt me quite a bit as I was generally clueless about my personal finances until about age thirty. The funny thing is, that I never knew what I was missing. This stuff is so important. It really affects your life! We have years of “health” classes in junior high and high school, but never a “financial health” class.

My real thought about education in high school – in addition to teaching people to think for themselves they get the following:

1) Finance/Budgeting Class – no matter what field you are in, your work accrues to you as money, the medium for which you will eventually exchange it. Managing that is pretty important.

2) Health/First Aid – everyone should have a basic field medic, first aid, and CPR etc… class as well as general health hygiene. Is there really anything more important to impart than the ability to save the very life of your fellow man as well as your own?

3) Farming and ecology. Teach people to pay attention to the world/environment. Treat it respectfully and not waste it. I’m not saying some insane green crap but a wholesome appreciation of the world we live in and a desire to see it thrive and take only what you need (ought to help people live within their means).

4) Firearms – teach people how to handle pistols/rifles so they don’t shoot themselves or each other. Now teach them how to fight and hunt with them. There’s a quote from a Japanese leader circa WWII “You cannot invade the United States mainland. There would be a rifle behind every blade of grass”. Issue a rifle to every civilian just like the Swiss. This will also ensure this country is kept free from the political establishment looking to steer us for their own ends and lofty goals.

Educate people, make them considerate of others and thoughtful, respectful and self sufficient. At that point they will govern themselves and the rifles are there to ensure no one can enslave them. That sounds a lot more like the Constitution than much of what I see/hear out of most politicians. As a people, I think we need to reorient to that basic framework and do some real evaluation of ourselves and our elected officials.

Slim, I agree with your high school courses, but you forgot about the mandatory Plumbing course ( everyone should learn to deal with their own sh%t).

Amen to you “T T”, Well said!

This may seem a bit simple minded but has anyone ever placed a reversed realestate Addvertisement – let’s say I want to purchase a home in a specific area. I’m willing to negociate within a price range of …. Min. To …. Max. Cash, single story, … (Including as much detail as reasonable). So please contact: House Guy at: “reversehomesaleguy@internet.Com” ( example only – not a real site ) I want to let all these Seller’s know I’m out here with Cash, can move in tomarro, … For a price that “Comps” well plus inspections that work for me. Then I’ll run this through my realtor at half thier normal fee to protect myself. Any thoughts? Or is this just Stupid? If I copied the add all over the Internet, local papers, mailers to homes that interest me. Please talk me out of this before my wife finds out I’m this desparate for us to move. Thanks all, well done, lots of great Information as usual!

Great article. I went to an above average (top-50) engineering school and graduated in 2000. Just 10 years later the current tuition is double what I paid! I wonder what the current kids are learning in class that is so much better that what I was taught?

@Dangermike – the two month “rule” was created by the advertising agency for DeBeers – N.W. Ayer. You know – MadMen.

I work at the largest community college in CA. At our opening meeting for Fall’10 the president of the college announced he will be retiring at the end of the academic year. He began his announcement with “I have been in this business for 35 years…”

LA-OC. I think it’s preferable that they be honest about it. The hacks who nevertheless identify themselves as -gasp- educators and wax poetic about how they’re only there to serve you generally should be regarded very skeptically.

Tom Lehrer started calling it the Ed Biz back in the 1960s. It was as true then as now.

I was one of those cornballs who took a bachelor’s in three years (through summer school and CLEP/AP), then did six years of graduate school (Ivy League). Total debt: about $1,500. None of it for grad school. My parents were very poor, but my parents both worked to earn $20K a year…so we didn’t qualify for student aid. The costs were indeed less then, but our household income was small, and that was the ’70s, when inflation was out of control.

The calculus of family income, expectation, costs, and all the rest were complicated for us and for me. I never expected to go to grad school, but a private scholarship from a former teacher got me started, then my department gave me a full ride the rest of the way…though I never worked less than three part time gigs while studying full time.

My point is that the government and banks colluded with higher education to make going to college easier than it should have been for most people. People do not value what is easily gained, and don’t make the most of it. College attendance became a rite of passage.

Doc, if you are arguing that student-loan-laden-or-defaulting college grads are the ones who won’t be buying houses, because college grads always were the ones who bought houses, that begs the question of just how sound college grads’ judgment about debt is. (I think the evidence is: it’s been lousy.)

Second begged question: while that 25% minority of college grads are defaulting on school and house loans, what are the productively employed non-degreed majority doing? Are they defaulting at a lower rate? I’d love to know.

You know, here is the most interesting aspect to me…

“government and banks colluded with higher education to make going to college easier than it should have been for most people”

In retrospect, it seems like that is what happened. However, I don’t think that really can be the case. Sure those were two of they participants, but what about the schools who raised tuition? I find it hard to believe there really was come kind of conscious conspiracy on anybody’s part.

I really do think government is generally clueless and easily influenced by both big donors and populist sentiment. And the bankers generally get blinded by a few things like momentum, self-delusion and simple greed. Granted, there are surely a few players that did know what they were doing was evil, but this is more of an inevitable economic result of government intervention rather than a sinister plan by anyone.

Once schools slowly realized they could raise tuition and still get the students, there was no stopping the snowball. Most schools are not in it for profit per se, but they are competing against each other for the best students and trying to keep their institutions as prestigious as possible. So they build new buildings and expensive sports facilities, etc. I think they all turned a blind eye to the rising student debt they were causing.

This is just the unintended consequence of making massive student loans easy to get. With all that access to easy money, I guess everyone just thought the only change would be that more people would be able to go to college. Just like in housing, where it was naively thought that just more people would be able to own a home, without any side effects.

It seems to be the banks, in this case, just went along for the ride because the student loans are government-backed (and not as easy to default on) and not aggressively pushing loans. I may be giving the bankers too much credit (ha!) but it’s hard for me to fathom that they would be able to plan this.

But what do I know!

TT, I’d be the last person ever to claim that this sort of thing was some sort of thought-out-beforehand scam/conspiracy. What I was pointing to–as someone more cynical than I’d like to be after 30 years mostly in the Ed Biz–was how colleges and universities stepped up for the government pork, and even public institutions handed themselves over to corporations and private foundations. Because there was bling to get/make.

Grade inflation, degree inflation, the invention of totally idiotic degrees/programs of study, the cultivation of the idea that everybody needs to go to college and that work with one’s hands or on infrastructure is not valuable, the degradation of math/science skills and education, the utter nonsense of postmodern theory applied to everything, affirmative action deployed on a culture war/victims-versus-The Man basis, the eventual creation of two- and four-year institutions that would grant degrees to anyone who could fog a mirror….

It’s been just one thing on top of another, so I think you and I agree about that. This circles back to what Doc said in his blog entry here: there are more commonalities between the housing and the education bubbles than are usually recognized. One big nexus of commonality is the attitude that “I want what I want NOW and will go into debt to get it.” And there being whole industries created both to engineer/implant that attitude, and then to service it.

However in my experience there was McEducation long before the big-loan phenomenon unfolded. Back in the ’70s my own undergrad institution went the franchise route, doing things like market researching where the new FIRE and service sector jobs would be, then quickly creating degree programs “to give you a competitive edge.” Thus, for instance, it cobbled together an associate’s degree in Food Service Science. It taught crucial, and deeply scientific, things like how to sculpt swans from butter and order lettuce from Sysco.

Did they need a college degree for this? Hell no! Would it give them a competitive edge? Maybe in getting hired at certain times in the past 30 years over the other ten gajillion Rust Belt unemployed, or recent HS grads. But it only would cost out if someone else besides the student was paying for the degree, then moving into their fabulous $18K a year job shoving plates and tables around at the Radisson.

But then here’s the kick: that one crappy little college used that program, and others, including absorbing one of the nation’s most spurious JD programs, to leverage its way to UNIVERSITY status.

The sad thing is, before that, it wasn’t at all a bad four-year school and actually had a good engineering program. But there weren’t enough US applicants qualified for the engineering program, and not enough warm bodies even globally to keep the institution solvent by teaching engineering, math, science. So they retooled the Degree Factory to sell what the public demanded. You can even take a degree in babysitting there now. Excuse me, I mean Child Care Dynamics In A Changing Society.

rose

Is it possible to purchase non-performing student loan notes?

Might be a way to prepare for the upcoming bubble!

Anytime the government tries to make it easier for people to do something or to get something it creates serious economic and ethical questions down the line.

1) Montgomery GI bill. Obviously this was to help GI’s after ww 2 as they weren’t working back home. It worked for the time…but it created a bit of a divide at least from the way how I’ve seen those in the military in college. 1/2 are extremely bright and hard working and do quite well (dean’s list etc) the other half take their time because it isn’t costing them anything. I get a sense those that have been deployed more than others take a full advantage. If someone was stationed at home or something like home then they don’t

2) Cash for clunkers. OK so they took cars that were not bad cars and had them destroyed and gave a discount. This took tons of used cars off the market. Now the rate for a used car is at least $1,500 more than last year (for a 3 year used). How was this a smart move again?

3) Student loans as was said earlier cause tuition to rise. If the demand is subsidized for anything then there’s no incentive to lower prices. Look at the Boston Red Sox. Since winning the world series Fenway sells out constantly. What incentive is there to lower prices? None…but guess what they do..expand the number of seats and it still sells out!

If they subsidized the supply and not the demand…say giving block grants to states to expand their educational systems it could create more competition and lower prices. The trouble with this though is it would mean lower salaries

——————————-

Also there’s nothing wrong with getting an education as a bachelors degree is the base line now for a fair amount of jobs out there…why? Well look at what it tells you

1) High schools are not even. It doesn’t matter about the reputation as for the most part people had no choice what school to go to if it was public. Private high schools are a waste of time since private school teachers make much less than public. So with this being the case higher educaiton at least attempt to teach more than that of high school. So someone with a 4 year degree is considered better than someone that isn’t

2) 2/3rds of the states mandate that a student has health insurance while being a full time student. Although HIPPA laws prevent an employer from asking other employers about this status it doesn’t take a rocket scientist to request a transcript and then determine if someone was full time and thus discover they have had health insurance. I say this because the presumption is that insurance = better health.