Time for Mortal Kombat Housing! The Subprime Market will face a Fatality in 2007!

Why oh why are people buying property at this time? Some people are running off to Tucson Arizona. If you want to look at Arizona here are a couple of places to look at. If anything, Tucson is a much better place than Phoneix and better priced. Take a look at our sponsor:

http://www.tucsonrealestatekraesig.com

If you want to understand the market you definitely want to submit a below market bid and make the seller work with you, you the buyer are in power. So if you decide to buy in Tucson Arizona, make sure you do your research. The market in Arizona isn’t exactly hot so proceed with caution.

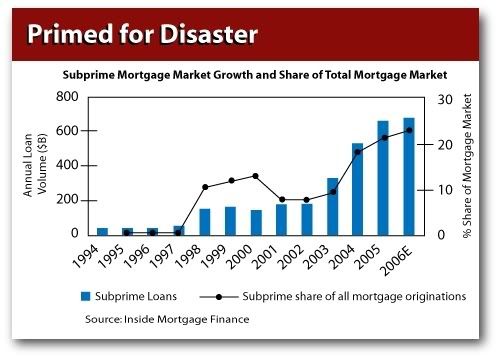

Take a long and hard look at the above chart. In the last four years we see a frightening jump in the number of subprime originations. In fact, in 2005 and 2006 over 25% of all loan originations were in the sub-prime market. You say to yourself so what? What does this have to do with the market? If you aggregate the data from 2004-2006 we are talking about $1.9 trillion subprime originations in only three years. Given that the MBA predicts that subprime borrowers will default at a ratio of 1 to 5 this puts $380 billion vaporizing into thin air in the upcoming two years. To put this into perspective this is about as much as the war in Iraq has cost the U.S. tax payer in the last three years.

Again, the point being is that a large number of these loans will reset this year and next. In addition, let us not forget the amount of money flying around in the secondary markets and easy credit markets. The California Equity Giantsâ„¢ that took out HELOC or did cash-out refinances only to blow their money on consumer goods and Chinese imported knick-knacks have kept the economy alive. How do we know this? Well another study issued by the Fed discusses that homeownership is at a historical high yet equity in homes is at a historical low. How can this be with the massive appreciation in the last few years? Again, the Metallic Home ATMâ„¢ which was slapped onto each homeowners home gave them unprecedented access to easy equity and ultimately made home owners their very own credit agency. This false sense of money in essence gave each homeowner enough rope to hang themselves yet keep the economy going; they could either enjoy the relatively nice cushion they were building up or tap into the oil well which was neatly nestled in their home equity.

Beside the CPI numbers being a hoax, we all know that prices of many things have been going up in the last decade. Regardless of what the Bureau of Labor and Statistics would lead you to believe things are more expensive, a lot more expenisve (why is there a housing bubble blog and people reading these articles if prices weren’t so ridiculous?). Just go to your local grocery store or go try and buy a new model car. Yes, 1984 is alive and well and those that point these things out are labeled conspiracy nuts and paranoid but just test the numbers in reality and you will see what is going on in Wonderland. This directly relates to housing; homeowners were given this inflated false sense of wealth and owners went out spending. It is the main reason our economy isn’t in a full fledged recession. UCLA conducted a study and found that real estate and residential housing accounted either directly or indirectly for 40% of the growth of the Californian economy in the last four years. Yes, you can say we are co-dependent on real estate.

This was all well and good but we are reaching a critical mass where the musical chairs are running out. Now, buyers are second guessing slaving themselves away for a 800 square foot box in the middle of EquityVille because these places are becoming nice boxes in dustbowl city. Before the incentive could have been a 10% increase in equity but we are trending down faster than Marion Jones so appreciation is no longer a reason to buy. No investors are purchasing residential housing in California for either rental income or appreciation because it would be a losing proposition; it is like chasing your blackjack losses in Vegas with good money. The good money is being sidelined and those shady mortgage industry syndicates are blowing up one by one Mortgage lenders implode

In a way I feel sorry for the buyers in the subprime market; many stories that I know of personally where folks are offered teaser rates and seduced into homes. Unfortunately these folks are screwed on multiple fronts. First, they are taken for a ride with a deceptive intro rate. These rates reset in one or two years giving the illusion of an affordable property. Second, the rates are astronomically high because after the rate resets these folks went stated income for the large part and then what happens? Do you remember the game Mortal Kombat where after defeating your opponent you ripped his head off or some grotesque act of kicking someone when they were down? Well this is what will happen to many subprime buyers. Only difference here is that the fatality won’t be instant but will be a death by a thousand mortgage payments.

Subscribe to feed

Subscribe to feed

3 Responses to “Time for Mortal Kombat Housing! The Subprime Market will face a Fatality in 2007!”

Mortal Kombat Housing! HAHAHA! I love your blog.

ECON – Prediction of 50% house-price drops in Orange County, Calif

http://www.timebomb2000.com/vb/showthread.php?t=237672

Does this mean that Real Homes of Genius is going away? LOL.

anon,

No way! These predictions have been out for years with no data to back them up. Now transparency is throughout the market. Rates are resetting, prices stagnating, and credit tigthening – the recipe for disaster. Real Homes of Genius is just starting because sellers still live in Wonderland thinking the summer tooth fairy will save them.

The mainstream media is finally picking up this info and the OC Register if you read them has predominantly been pro-real estate for many years; now they are changing their tune. The media heads for the most part are opportunist and not economist.

The real estate market went from hot to sub-zero.

Leave a Reply