13 of the most overpriced Los Angeles County zip codes. Housing correction shaving off $300,000 in one year for some elite zip codes. From Encino to Culver City.

The foreclosure crisis if you want to frame it differently in your mind is really a crisis of overpriced housing. The only reason we have such a large number of foreclosures flooding bank balance sheets is because the market cannot support the inflated prices that banks would like to get on foreclosed properties. It is a crisis of delusion. Foreclosure isn’t a new thing. In the past, a bank would be quick to take a home back because it was likely that they would find a willing buyer in the market at a reasonable price to mitigate a loss. It was part of the calculus of banking. However today you have banks holding onto a flood of shadow inventory while trying to gimmick the system to bolster prices. Yet even a historically low mortgage rate cannot entice buyers who are broke or unwilling to go into massive debt. Today we are going to examine 13 of the most overpriced zip codes in Los Angeles County. Some might be surprised by which zip codes pop up.

Notice of defaults and foreclosures

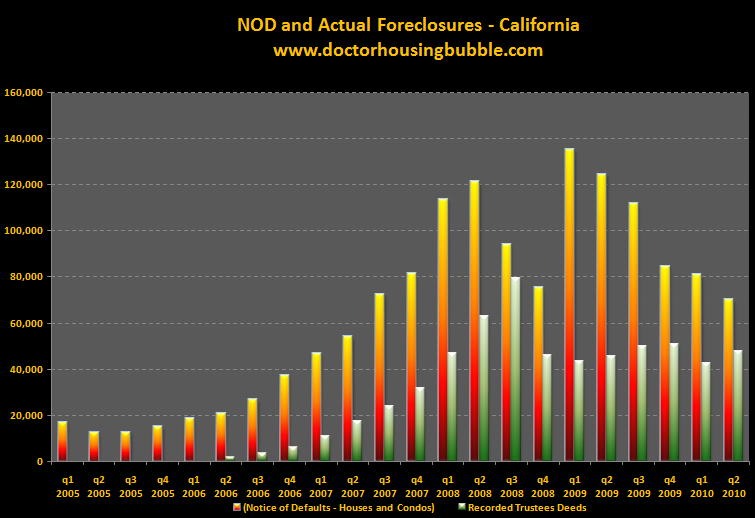

Before we examine the zip codes we should look at how the foreclosure pipeline built up in California:

Source:Â DataQuick

This is an important chart to understand. At any given point in history you will always have a number of households who are unable to pay their mortgage because of a job loss, divorce, or other financial reasons. Yet this segment of the housing market was so small, that notice of defaults didn’t always make their way through the entire process. Why? Because in a more stable market if you had problems paying your mortgage, it is likely you have 6 to 10 percent equity to sell your home and cover your costs. In essence you can sell and break even or even pocket a bit of money. So it was unusual aside from pocket regional bubbles for banks to deal with a flood of foreclosures and if they did take a home back, the losses wouldn’t be financially catastrophic. The current issue we face today is the massive amount of toxic low down to no money down mortgages that are massively underwater. Even “safe†loans like FHA insured loans are now massively underwater because people bought while home prices were still falling. There is no market to sell a home that is 20, 30, or even 40 percent underwater.

Crunch the numbers for 2006 for example at the height of the bubble. In Q2 of 2006 there were 20,752 notice of defaults filed yet only 1,936 trustee deeds recorded. If you want to conceptualize this into a ratio, in Q2 of 2006 trustee deeds were slightly over 9 percent of the notice of defaults filed in the quarter. But look at the current data:

Q2 of 2010

Notice of defaults:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 70,051Trustee deeds recorded:Â Â Â Â Â Â Â Â Â Â Â Â Â 47,669

Now what you have is an elevated amount of notice of defaults plus a large number of homes being taken back. As things stand, this number is now up to 67 percent if we use the previous ratio. But keep in mind this is merely one way of looking at this. Simply looking at the raw numbers NODs are 3.5 times higher today than they were in Q2 of 2006 and trustee deeds recorded are 24 times higher. That is the heart of the problem. Also keep in mind that this foreclosure pipeline is artificially low given that many banks have put on acme style brakes even before they file the NOD thus artificially keeping the pool lower. Like the disclaimer on your car mirror, things are worse than they appear. The housing market is in a mess because prices are still too high. Unfortunately for California this is the reality and either income needs to jump up or prices need to come down. The math is rather straight forward and the Federal Reserve would like to believe that simply having a low interest rate is the solution to the entire crisis. But would you buy a BMW for $60,000 just because the interest rate was 0 percent? Many have done this but this isn’t exactly a prudent way to live and this crisis is a symptom of this massive debt behavior and financing the present with maximum leverage on future income.

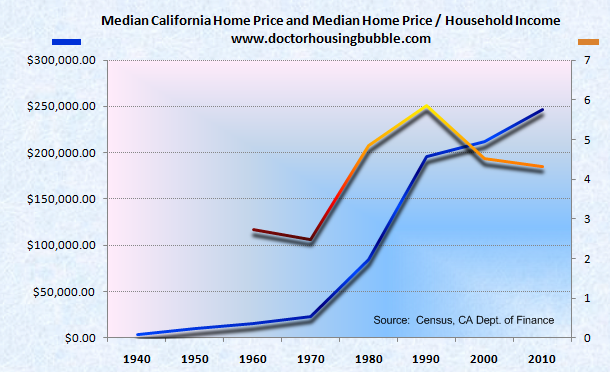

Some argue that housing in California has always been expensive. First, this is not true. Maybe in their short memory this is the case but looking at historical data doesn’t show this. Also, have they not paid attention to the state budget and the fact that 23 percent of Californians are either unemployed or underemployed? In fact, California up until the 1970s was relatively affordable. I pulled data from the 1940s to 2010:

In 1960 dividing the median California home price by the median household income gave us a number of 2.73. In 1970, this number was down to 2.48 so it actually got cheaper relative to income over an entire decade. Home prices went up but so did incomes. Interestingly enough if we merely go by decade cutoffs, 1990 turned out to be a high peak when the number hit 5.87 for California. Today that figure is at 4.33 and nationwide over the long-run the figure has been closer to 3. In other words 1960 and 1970 reflected a more sensible price of housing for California.

Some only think in short-term horizons so they tend to only look back to 2000 and start there. Keep in mind that in the 1970s the consumer debt bubble took off. Can it be that this has been a bubble in the making for multiple decades? It sure seems that way. We will reach a point in the next few years where statewide we will experience a nominal lost decade for California housing prices (this is already the case on a real inflation adjusted basis).

Every other area is in a bubble except my neighborhood

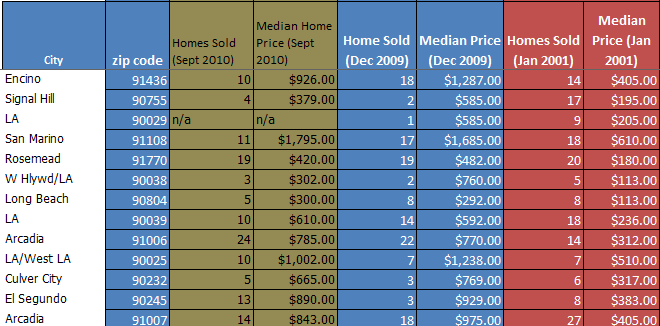

I love the anecdotal argument that many communities will never adjust because everyone makes $250,000 a year and everyone has a foreign automobile. Unfortunately the data doesn’t support this argument. You will always have hyper-elite neighborhoods like Bel-Air or La Jolla but Pasadena and Culver City although nice, do not fall in this category. Income tax data does not justify the giant leap in prices and many of these communities are very much in bubbles today. To appease those that only look to the early 2000s as the start of all things related to California housing, let us carefully parse 13 zip codes that are clearly in housing bubbles:

The winner of the most overpriced zip code in Los Angeles County at least for September of 2010 is Encino (91436). Those that argue no correction is happening simply aren’t paying attention. Encino had a median home price of $1.28 million as of December 2009. The last figure for September of 2010 shows that the median price is now down to $926,000. In less than one year prices have fallen by $361,000 (a drop of 28 percent). How can someone argue the correction isn’t hitting in these markets? But even with irrefutable data, the median home price of Encino back in January of 2001 was $405,000. So prices today are still double what they were nine years ago. Are prices cheap in Encino? The number of sales in September (10) is a big decline from those fence sitters that jumped in December of 2009 at $1.28 million and bought 18 homes in this zip code. But this is only one of the many areas facing this kind of correction.

Take a look at San Marino (91108). In January of 2001 the median price was $610,000. Today the median price is up to $1.79 million! Prices have nearly tripled in this zip code. Or take a look at Culver City (90232) which had a median home price of $317,000 back in 2001. In December 2009 that price was still up at $769,000 but last month it dropped to $665,000. I think a $100,000 cut in less than one year is significant. Look at Arcadia that has seen prices fall by $132,000 in less than one year yet is still double the price of what it was in 2001. Think the correction is done just because people have leased foreign vehicles in their driveways? The tax and income data tells us many people are living on fumes powered by debt, not real wealth.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “13 of the most overpriced Los Angeles County zip codes. Housing correction shaving off $300,000 in one year for some elite zip codes. From Encino to Culver City.”

Data and stats can be misleading. I live in the 91436 (Encino) zip code and houses range from 5 million to 500 thousand, which can really make the numbers fluctuate. Granted there has been a decline in the last two years but not nearly as severe as Riverside and San Bernardino counties. I know, the Doc. is saying big price decreases are coming…hmmm, I do believe prices ran up way too high but these “elite” zip codes have so many long term homeowners which creates a kind of built in security.

If I was selfish I would like to see prices go down another 30%. Since I owe so little on my house I would be able to buy a bigger, nicer house with a smaller mortgage and much lower property taxes. However, if this were to happen then the economy is really down the tubes and wealth preservation is severely compromised.

Prices too high? We’ll have fun fun fun until Bernake takes the punchbowl away.

Keep in mind that in the 1970s the consumer debt bubble took off. Can it be that this has been a bubble in the making for multiple decades?

What happened in 1971? Any guesses?

Nixon took the USA off the Gold standard. This was the standard whereby the World could redeem US dollars for our gold.

FOFOA just re-posted a great article on this subject, including the ensuing oil crisis.

Flow Addendum

This is also a good one:

It’s the Flow, Stupid

All of the fiat currency insanity is coming to an end. Get your gold while you still can… FreeGold approaches.

1971 was also, more significantly IMO, the time our domestic oil production peaked, and the first Oil Crisis followed shortly after. Nixon’s moves were all about disguising the damage being done to our economy on a more fundamental level by fuel prices and foreign competition- two things that were not important in the 50s and 60s.

For this also the time when we began to move manufacturing offshore AND when Japan and Germany challenged our dominance in steel and auto manufacturing.

By 1974, our economy was in the tank, and Baby Boomers just out of college were confronting the worst job market in decades, along with soaring housing, food, and fuel costs. Vietnam soldiers came home to a shrinking job market, and reduced opportunities.

By 1978, domestic auto and steel makers were losing out badly to the Japanese and Germans, and manufacturing was shrinking rapidly. The multiple oil embargos had sent our economy skittering, and inflation through the roof.

What a difference between 1970, our peak of power and prosperity, and all the times since.

Lets keep the punchbowl alive!!! Yea…..

Due to everything else that is going on in the economy, it really makes no difference how selfish you are, the economy is really down the tubes and wealth preservation is severely compromised.

Get it straight: A great part of the price appreciation in past years was the ludicrous notion that prices would continue to appreciate – that’s the bubble. That notion is diminishing, but the idea is still in too many heads that once the market falls enough, it will be new atm possibility times again. It will not be. The paradigm is shifting back to one where houses will not be seen as the speculative investments that they have been. Thus, back to the 1 to 3.5 ratio with 20% down. House prices will continue to fall relative to that new reality.

If you want to try a new bubble – get into gold or silver. Houses will be good eventually for their traditional investiment value: to keep pace with inflation. But I suspect we’re going to have to wait a few years.

Remember that old tale that California would one day fall into the ocean and end up completely underwater? MAYBE THERE WAS TRUTH TO THAT OL’ STORY AFTER ALL. Maybe they were talking about the housing market! It’s happenin’ right before our very eyes!

Boy, I’d hate to be this buyer. Bought a playa vista condo short sale for $685k in May of this year.

http://www.redfin.com/CA/Playa-Vista/5350-Playa-Vista-Dr-90094/unit-1/home/17237575

Now, another unit with pretty much the identical floorplan is on sale for $633k.

http://www.redfin.com/CA/Playa-Vista/5400-Playa-Vista-Dr-90094/unit-17/home/8180916

With playa vista’s insane melo roos, $633k is far from a good deal.

Your property just dropped $52k in 5 months. How does that knife feel??

It really hurts when it gets twisted!

I notice that the cheaper one is back on the market after “falling out of escrow.” I’m guessing an appraisal came in low…

We were been looking at Playa Vista….. not a chance ! You mentioned the melo roos, don’t forget the development is built on methaine gas too. On top of all that, these condo were all bought at the height of the market, now the sales are mostly foreclosures and short sales, so many. We sold our house in the Palisades in 2009, still leasing, will continue to do so untill the so called investors/developers/flippers get out. If they don’t, we won’t buy here, and certainly not chase homes and never get into the pathetic bidding wars.

“Keep in mind that in the 1970s the consumer debt bubble took off.

Can it be that this has been a bubble in the making for multiple decades?”

I’d say yes. Housing debt (mortgage and HELs) from 2005-2008 resembled nothing so much as unsecured/revolving consumer debt, i.e., MasterCard and Visa, dating back to the MasterCharge and Bank Americard of the 1970s. This tracks with larger consumer, cultural, advertising, political, technological and economic trends, as well as with globalization gutting well-paying and productive (rather than consumerist) jobs in the US. But the taste for debt was carefully cultivated in Americans with these early credit instruments. Oil companies also had revolving credit accounts.

It was also in the 1970s that Ginnie Mae (i.e., HUD) first securitized mortgages, wasn’t it? So the attention and energy have long been on financialization rather than wages.

The whole idea of consumer “credit” of this sort may have originated in the 1950s…but it took off in the 1970s. I’m guessing computer automation and recording had something to do with that, as well as Baby Boomers getting out of college and starting to spend.

The rise of this kind of debt also tracks precisely with the stagnation of wages. Credit became the way people could get what wages could not support–the ever-escalating American Dream, as inflated by the advertising industry and corporate media. To the Boomer culture chant of ME ME ME NOW NOW NOW, add the glitz and glam and gourmet/designer chic of Reaganismo in the ’80s, and the worship of corporate culture, then the Neo-Wall-St. religion of the boomy ’90s, and the Granite Countertop Decade….

Well, it just reminds me of that old saying about when you’re standing in a hole, the thing to do is stop digging. Not dig more, faster, with bigger shovels rained down from above. What people are calling financial meltdown is just everybody hitting the molten center of the earth at the same time.

California had its hands all over the birth of the credit card. Remember, Doc, BoA’s Bank Americard started in Fresno in the late 1950s. Its founder handed out something like 150,000 cards IN THE MAIL. Not ads or applications, the actual cards. I believe it was in the late ’60s or so that Bank of America started licensing the card program out.

Then in the mid-70s the aptly named Dee Hock created the badjillion-dollar global industry, Visa International. Headquartered in SF, though I believe originally chartered in Delaware.

His fabuloso ability to use computers, globalization, and quant savvy to get Baby Boomers worldwide to get themselves in hock led him to become a guru in the ’90s on “chaordic” organizations that will altruistically save the world somehow. And also the whales. Or something. He was such a visionary, he couldn’t foresee that the inevitable outcome of his invention would be enslaving the masses with debt, and making them think it’s normal.

Nothing wrong with his invention. Visa makes money on the transaction fees. It is the banks that are willing to loan people money because they can make 25% interest, the regulations that allow the 1/10 capital ratio, and the loose credit system. It is too easy for everyone to get a whole of debt.

Rose, that also dovetails with a conversation I heard on the radio today recalling 1971 when Nixon and his cronies realized we were broke and could not keep up our end of the Bretton Woods agreement. Since then, we have been 100% fiat–take the Federal Perverse notes or go to jail, regime change, whatever it takes. It’s all part of the great disconnect and the begginning of the Manhattan Transfer.

This is great doc, I see that my home town of toontown, Burbank is not listed. Roger Rabbit is still hopping around the streets at night here.

Burbank isn’t on there? Well that’s because the Dr. chose 13 highly desirable zip codes, not a post war working class shoebox shithole of a suburb of L.A., built on top of God-only-knows how much toxic waste dumped mainly by the aerospace and defense industries over the course of a few decades.

Sure, Burbank might be desirable, relative to most of the rest of the armpit sewer known as the San Fernando valley (although ask any resident of Toluca Lake, Studio City, Sherman Oaks, Encino, and the rest of the south-of-the-boulevard and western edges of the valley, if Burbank is desirable and they will laugh in your face, just as we all in LA proper laugh in theirs), but the rest of us recognize it for what it is – an exceptionally overpriced little clown town with no character in its 50 year old 1,000-1,200 (or even less) sq. ft. stucco little hovels.

The Culver City 90232 zip code is an interesting one to see in this list, as the area is definitely not the same neighborhood as it was in 2001. 10 years ago, the downtown Culver City district (upon which 90232 is centered), was sleepy, with a few diners and mom and pop shops. Now there are easily two dozen unique restaurants and bars, a new stadium-seating movie theater complex, a Trader Joe’s, massive public parking structures, and it has become a nightlife and dining destination for the westside. Additionally, the Expo line will open it’s west-most station for public rail to downtown there in the next 18 months. I don’t deny that there is still a bubble in 90232, but how do you factor the significant change in neighborhood lifestyle into these numbers?

Joel, the outward appearance of improved “neighborhood lifestyle” in Culver City is of little importance unless it translates into improved neighborhood “median household income”. I suggest it does not. Statistical information linking the two would be interesting.

The basic fundamental is: Income drives rents and rents drive property values. Lower incomes mean lower property values.

Incomes are based on adding value to something. The greater the value added, the greater the income. Los Angeles County used to do that. Not any more. Name the businesses that created wealth around LAX in the 1950’s to 1970’s. Hughes, TRW, Douglas Aircraft, there were many, many more, even Mattel Toys. All gone. The only jobs left are a little design and marketing. They have been largely outsourced too.

I’m sorry to see the standard WalMart package these days. “Designed in California, Made in China.” That provides few jobs to underpin Culver City real estate values.

It’s amazing that WalMart got so good at outsourcing that they have now unemployed their customers.

Let’s keep our eyes on value-adding jobs. Incomes and real estate prices will follow that.

LL:

1970 peak of prosperity? Depends upon how you measure it. We were still riding single fins, Todos and Mavericks had yet to have been surfed. You might be right, some say the 70 chevelle, or 70 hemi Cuda were the epitome/peak of the msuclecar. Some wouyld argue a new viper or 996 Turbo are superior to the old american iron. Then you have the fools that think a harley is better than a GSXR. I could argue the peak was sometime in the first 100 years after the American revolution when our govenrment was smallest, and we the people were the freeist. I dont believe in peak oil. Maybe you think we need to return to burning whale blubber??

“Chandler, you still have a single fin mentality.” – figured you might recall the quote given name/post.

On the subject of peak oil, necessity is the mother of invention. People seem to behave and prognosticate as if oil is binary, either there or not (also keep in mind that many are talking their book). The majority of oil found is still in the ground, it is all about cost of extraction and technology to make it economic. Look at natural gas, where there was none, there is now the Marcellus Shale. Even assuming no technology change, the amount of oil that is economic to extract at $200 is many multiples the amount at $100 – supply is not fixed nor is it a linear equation. That said, my hope is to get a lot more efficient with our use of these fuels and focus use of them where most appropriate rather than throwing oil at everything.

Funny, ive been throwing around the idea (in my head) of purchasing a new VW diesel instead of continuing driving my 60 year old car whose carbon footprint was expended decades ago when first manufactured. I just cant get past the math of spending $30,000 to save a few hundred $$ in improved fuel efficiency.

Funny, but all the alternatives to various functions of oil, particularly fuel, when priced in $/tera-joule or some such are always in lock-step with oil. Reality is if oil truly does become scarce, alternatives will step in. Oil futures are driven by speculation right now–not peak oil. Some day, probably, but not today.

Housing is also driven by speculation, no matter who has a book or article to the contrary.

Why can’t I divorce the housing meltdown from TBTF banks, the government, and the mood of the country. Or California. It may be that I am simply too stupid to understand.

The short bus stops here.

http://thecivillibertarian.blogspot.com/

“Data and stats can be misleading. I live in the 91436 (Encino) zip code and houses range from 5 million to 500 thousand, which can really make the numbers fluctuate”

There’s the money quote. IF the few homes that are being sold are at the lower end of the spectrum, it will “drop” the median price. If they are at the high level of the spectrum, they will show “increases”. It’s the mix… nothing more. This same phenomena was evident during the blowing of the bubble as well, but no one was holding onto it like it was the holy grail.

It’s simply math.

Median income faces the same issues. Unemployed people make nothing. It pulls down the “median”. An influx of low paid immigrants into a community also erodes the “median”. Again, it’s math.

We are in a depression, folks. Unemployment in CA is @ 22%. Unemployment, nationally, is @ 19%. The “99 weekers” are nearing the end of the line. just in time for the holidays.

That’s why people who like to play with statistics for their own purpose fluctuate between median and average. Whichever datapoint tells the story that they’re trying to spin is the one they pick.

Yeah EL, that is the same phenomenon that I also see in today’s politics. You can always came into a debate armed with your facts (that are not based on reality) or better still damn the statistics if they do not conform (or cannot be bent) to your world view.

I don’t understand Katz. The media tells me that things are not so bad, just vote for Obama and keep the (Dem) party going. Apparently, you don’t watch TV and read the Times.

Ed, spot on, now factor in those of us that sold while we still had some kind cash in it.

Then we had to buy in one of those low income immigrant hoods, because you have to live somewhere.

Should get interesting , seems many middle class Americans are taking back these areas as an attempt to survive with some retirement money still intact.

I feel sorry for those that loaned the kids money to buy via a second, we are going to see many that can not live above the poverty level soon. talk about Americans being displaced. Not sure why no ones calling for the bankers heads like we did with the saving and loans mess in the 1980s ? Washington is beyond corruption.

I would have thought Santa Monica would have been on this list. Does Doc consider that to be an elite zip code a-la Bel Air?

“Some argue that housing in California has always been expensive.” And then you counter with data from the 1940’s-70’s!

Did you take into account the cost of moving to CA in the 1940’s before national highways? CA was expensive then because it was difficult to get her and there was little infrastructure. Once that was built the prices climbed.

Even if it does cycle I don’t have another 40 years to wait – I would like to enjoy a home in MY lifetime. And we live in the bubble years so we have limited options as long as there is another buyer willing to pay the high price.

And I have been hearing the banks are going to relax lending soon – as they need to make money. That will lead to more people willing to pay a higher price.

“Some argue that housing in California has always been expensive.†And then you counter with data from the 1940′s-70′s!”

I think that is the point the Doc is making. Housing during that time was priced at a good level so there was a time in history, not too long ago when housing was cheap relatively speaking to income levels.

“Also if you read the news you will see that corporate America is doing VERY WELL! Businesses are profitable although unemployment is 10-20% depending on what number you trust. Exploiting the poor is very profitable last time I checked.”

That might hold water in San Marino but in many other cities it won’t. Corporations are doing well because of the ability to keep labor costs low so for the majority of areas, there is little price pressure on rising incomes.

Your arguments seen to hinge on you buying and trying to justify high prices that clearly are off the beaten path in terms of historical data. Just go ahead and buy, no one is stopping you but there is little doubt that many areas are clearly in housing bubbles.

Well we can go back to a point in history where CA wasn’t a state too and see how much land we could have bought for $1000. But we don’t have these type of time frames. If not to long ago is 40 years for you? That’s a very LONG time for me.

Would I like to buy a home, yes. Can I justify the prices, actually NO. I think they are out of line. But I also don’t think they are going to be in the line I would like to see them. (cheap)

But these sales numbers seem hard to trust with such a small sample. To really dig in you need to put the home into a quality category (Crap, Good, New) and see what is sells for per sq ft and lot size.

Also, is something really overpriced when it sells? Depends who you ask.

Sean,

Let me ask you a question. Why would a zombie bank, already insolvent, make home loans at 4.5 % when they can make a guaranteed 3.5% in treasuries. Not only do they risk lowered prices and another round of housing deflation, but now they have to risk mortgage gate and all of those implications? Not to mention the overhead costs.

Since lax accounting rules allow banks to essentially value their assets anyway they choose- they create the illusion of solvency. Once that curtain gets yanked, the party starts.

Don’t worry…when the SHTF…and it will…things are going to get interesting fast. California RE prices need to get chopped in half. Demand creation means moving to a completely bankrupt state, the highest tax, insurance, and infrastructure costs in the nation. I am just not seeing demand picking up. No demand? Supply rises. Keep your powder dry. The party hasn’t even started yet.

Oh yeah 2nd bubble! thats the plan tighten supplyso to increase demand lend again!

San Marino – Not for the middle class anymore.

Yep, the prices are crazy high! Totally agree. But the homes keep selling at high prices! Why? Maybe, because San Marino is “Asian Beverly Hills” and the money is not coming from a 9-5 job. It’s family wealth, business wealth, and the desire to show off your wealth among your rich friends.

Will the prices drop to 2001 levels to match income. Highly doubt it. These properties are purchased with money from running a business – not just an average Joe income. (BTW – Average income in the area is 150K and I think that stat is from 2000.)

Also if you read the news you will see that corporate America is doing VERY WELL! Businesses are profitable although unemployment is 10-20% depending on what number you trust. Exploiting the poor is very profitable last time I checked. And all of them manufacturing jobs we sent to China in the past 20 years made someone rich. When those rich people come to the USA, many move to SoCal – aka San Marino.

Remember there are very few homes in San Marino – Zero condos – Zero apartments.

This is an area for the elite – and the last time I checked the rich are getting richer and the poorer getting poorer. Keeping the prices high is what they want as it keeps the working class out of the area – which is just fine with them.

Sean, Income in San Marino is not that high!

According to zipskinny.com : “Median Household Income: $119,147” – see info at http://www.zipskinny.com/index.php?zip=91108

I’m assuming that data is from either 2008 since it is pulled from the Bureau of Labor Statistics and they are usually a year behind.

You are right that it is a demographically Asian community (47.6% Asian vs. 45.3% Caucasian). Not sure why you thought Asians were more able to afford high prices… they seem to be getting foreclosed along with everyone else.

Link to 149K Median Income. (I mistyped average before.)

This is why I don’t trust stats, who can you trust. It pays to do some legwork as ask around which is what I always do.

FLOL, as if the income stats for San Marino are legit. As you stated, nearly half the population is Asian (of that no doubt 90% is Chinese – either Chinese American, Taiwanese, or Chinese from HK or the mainland). I guarantee the vast majority of their income is from cash businesses or overseas and very little of it is declared/taxed.

Couldn’t agree more. Most of these properties were purchased with funds from the Far East that transfer their wealth which was created with loss of jobs here in America. And to keep working folks off the other “Berverly”!

Median prices are important, but not as much as the monthly volume. Banks are not lending and sales volume has slowed to a crawl. Throw in the latest mortgage mess and people are scared to get into a transaction these days. I would stay far away from any transaction right now, until the banksters straighten things out.

Latest reports show housing dropped 6% in the last 2 months nationwide, as sales have shriveled up. And now, Gary Shilling believes there is another 20% drop coming in order to revert back to historical norms. History just repeats itself, whether you like it or not.

http://www.westsideremeltdown.blogspot.com

Sean, most of the people living in San Marino’s are rich white folks who own the house from early 70’s to late 80’s……All the Chinese lives in Arcadia, Temple City, Alhambra and surrounding areas but this Chinese people are not from China…they are Chinese Americans and yes…many Asians owns the small business……

Edy – sorry but you are really out of touch with 2010.

If you see the post above San Marino is now an Asian community (47.6% Asian vs. 45.3% Caucasian). And every year that percentage grows.

When those rich white folk who bought in the 70/80’s you talk about move out (or pass away) the homes are selling to rich Asians.

And YES, the Chinese lives in Arcadia, Temple City, Alhambra and surrounding areas ARE mostly from China, Taiwan, HK. People who own the homes may live here, but the people living in the extra room, garage, and back house are often foreign born. I live in that area and I know who my neighbors are. Almost ZERO white people and very few who have an excellent grasp of the US language. (Only there kids speak well.)

Not sure why anyone thinks Asians can hold anything up in So Cal. The majority of my friends, yes Asians, still live at home in multigenerational households, making it seem like there is an abundance of wealth (well that is true to an extent). That’s the only trend that will prop up housing – college grads moving home, making $40-50k a year, helping parents with rent while saving up for their own homes down the line.

I had to think about your comment while, Concerned, because you make a thoughtful point here. These multigenerational, mutually supporting, savings-focused family units just may create a deeply needed form of sustainability and economic health *down the pike.* Even though they don’t resemble “the American Dream” as Visa and MasterCard’s been pumping it these past 40 years.

For four decades our economy has been geared to everybody spending 150-300% of what they earn, each and every month.

DHB has talked repeatedly about how “new household formation” has become a crucial measure of economic health. Never mind that many new households formed–and the crap bought to fill those houses–has been, for the past 20 years at least, out of the wage-related reach of the occupants.

An economy based on inflating expectations, expressed as consumption based on debt, is what we’ve had. That’s got to change. It’s going to be painful as it changes a lot of suppositions and expectations that people have learned to have (such as, if you can’t afford it, buy it anyway, NOW). Worst of all the economic and policy powers that be do not distinguish between truly needed things (basic health care) and inflated expectations (boob jobs and boner pills).

The pun was unintentional, but I’ll leave it. Heh.

Let’s put Doc’s main point another way.

If the median house price is $1M in an area, then it is a nice prudent 3:1 relative to SOMEBODY’S income. Probably not just you and me.

Or most of us.

Exactly. At 3:1 hell, let’s make it 4:1. At $250K a year income, according to all the stats I’ve seen so take it for what it’s worth, that’s less than 1% of the population of the country…probably around 1% of working people make that much or more annually (I believe it’s 2% of HOUSEHOLDS make $250K per year or more).

Although it’s obviously skewed higher in “highly desirable, world class cities” like Los Angeles and the southland in general.

I’ve been hearing about this theory that much of the inflation in housing prices in SoCal is caused by the influx of rich Asians. Can anyone lay out this argument coherently and provide stats/sources/graphs to back it up? I agree that there is a large immigrant Asian population in many cities with high housing prices (Arcadia, San Marino, etc.), but the Asian population boom didn’t happen overnight, whereas much of the housing bubble occurred during the last 10 years. Was it because the Asians who bought houses in the last 10 years were different from the Asians who bought houses in the 1980s and 1990s? If so, how? How do you know the housing inflation was due to rich Asians? Could it simply be the result of the housing bubble in general, which happened in areas both with and without large Asian populations? I’d like to see the evidence.

Leave a Reply