Housing Bubble Blog News on the Decline Year-on-Year? What is Going On?

There was a post on a housing blog recently talking about the decrease in those searching for the illustrious “housing bubble†we all know is here. The way the article was written, they were trying to point toward a decrease in housing bubble blog news with the implication that housing bubble heads like myself are on their way out. Are you kidding me? The fun is just beginning and I’m not sure the breadth of their research but I’ll like to point something out and show the shift in housing energy.

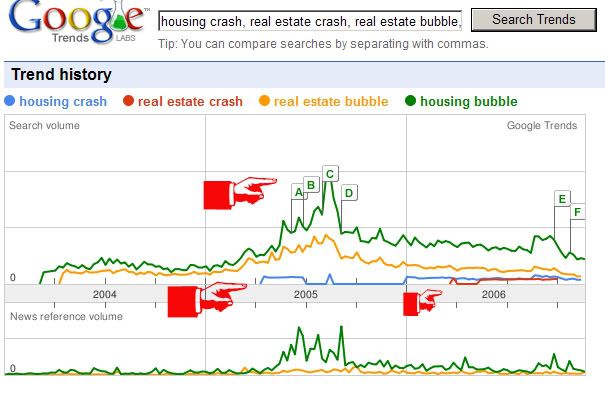

As you can see from the above Google Trends picture that I queried, yes those searching for “housing bubble†or “real estate bubble†information did decrease. The peak was in Q2 and Q3 of 2005. Yet we notice a new birth at this time as well. Like the sun peaking with orange and yellow rays over the horizon we begin to see the emergence of a new trend; we see the dreaded words of crash appearing. Interestingly enough we see this trend sprout up about the same time that the other “bubble†trend peaked. Now we are seeing the word “crash†appearing in a significant amount to be spotted on the Google radar.

I have no patience for those saying “yes, we just had our correction and now it is time to jump back on the housing appreciation bandwagon.†There was no correction! I almost feel like someone is trying to convince us still that there are WMD in some part of the world. Do your own research and crunch your own numbers. The conclusion should be rather obvious.

Subscribe to feed

Subscribe to feed

10 Responses to “Housing Bubble Blog News on the Decline Year-on-Year? What is Going On?”

Having just started daily reading housing bubble blogs I find that’s a little odd. Perhaps it’s that now the bubble is being “covered” by mainstream media some folks think they don’t need to do their own research – oh the poor sheep.

For me, the incentive to wait on purchasing a home grows with each line and paragraph I read. Keep up the good work!

Has anyone started talking about what the end of the burst will look like? Either right before or right after is when I want to buy – this much to the despair of local realtors.

Tom:

Welcome to the bubble world! Where down is up and realtors are kings in a land of renter peasants.

Joking aside, sometimes the best way to find out about the future is to look at the past:

History of a Housing Bubble

Great aggregate of housing news clippings spanning numerous years. History never repeats itself but it rhymes as Mark Twain once said. And no one predicted 100 to 150% appreciation in 1999 or 2000 so I would be hard pressed to find articles describing how this thing will play out in the theater of real life.

That History of a Housing Bubble link was very interesting.

If history rhymes and if 2007 is similar to the 1990 situation then we’re in for another 6 or 7 years.

Seems like this bubble got larger than the one in the late eighties though.

Hey there! I couldn’t find your email to ask for a link from your blog. I’m a Realtor. Wait! A Realtor telling people NOT to buy.

Blog.FranklyRealty.com

Love to see your comments over there.

Speculative Bubble:

If you look at the parallels we are somewhere between 1989 and 1990. In addition, we notice that the bottom happens somewhere in 1993-1995. Again, price differences in these years are probably very similar since many buyers can negotiate if they are in good standing (i.e., good credit, 20 percent down, good income). I suspect that we will have one dead cat bounce before things really hit the road. Expect 2009 to 2010 to be a true buyers market; unlike the NAR saying it is a buyers market right now. Not until prices adjust downward will that be the case.

Frank,

Glad to hear that you are taking the high road. Again, realtors serve a purpose and in probably 40 states bubble-mania has not infected the market to the extent of certain coastal regions; we happen to live in two that fall into this category.

Again, referring back to housing cycles I think we’re barely on the down trend of a coming housing bear market.

We would be curious to hear what your prediction for the upcoming year is?

dr.HB, finally got my act together and added you to my links. great site!

HI Dr.B, what needs to be taken into account is the leverage between now and 1989-90 – this is huge and a lot bigger than that piddly downturn, prepare for the worst case scenario, also the trade deficit is enormous compared with back then, nice blog BTW

http://forum.globalhousepricecrash.com

ocrenter:

Thanks for the add. I just saw that Phx. Arizona went over 51,500 today on your site. Every market has inventory going through the roof. Any guesses where we will be in December of 2007?

consa:

Not only the leverage but also the amount of sub-prime originations. If anything, I think this will be the first thing that will derail the market. The reason being is that this group is the least likely to handle any adjustments to their monthly payments. Not only that, but their loans have the highest rates and worst terms.

Leave a Reply