Financial contradictions with banks chasing profits in other markets – 2010 year of two financial worlds. Stocks in many sectors improve while unemployment increases, home prices fall, condo values in Los Angeles decline, and option ARMs worst performing loan product.

2010 was a year of economic contradictions. The stock market had a solid rally yet the headline unemployment rate moved from 9.7 to 9.8 percent. Many sectors had double digit gains yet the nationwide housing market declined and shows additional price weakness moving forward. In the non-bubble past housing has typically been one of the strong sectors leading the economy out of a recession or financial funk. That is not likely in this market with banks hoarding millions of homes in shadow inventory and aiming for a slow leaking out of properties. The banking industry was aiming for a bounce in home prices but did not get it. Yet the investment banking world has found other stock market sectors to make money on with bailout funds. More and more, at least when it comes to real estate, it looks like a Japan lost decade of deflation in real estate is occurring. According to Case Shiller data home prices are back to 2003 levels already. In many areas a lost decade has already occurred yet banks continue to make solid profits when real estate used to be a stalwart of profits for commercial banking. It is a year full of financial contradictions and 2011 is lining up for a set of unique challenges.

Best performing sectors

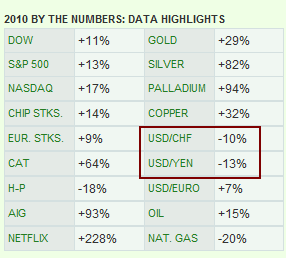

I always find it helpful to do a recap on where we started and where we ended up once a year comes to a close. Let us look at a handful of sectors:

Source:Â MarketWatch

The DOW ended the year up by 11 percent followed by the S&P 500 being up 13 percent. At the same time the US dollar declined 13 percent against the Japanese Yen. Oil was up 15 percent yet headline inflation gives us a year with no price movement. Netflix had a 228 percent gain as many people seek out cheaper sources of entertainment. Gold went up 28 percent and silver went up 94 percent as investors seek out safe havens in a market where central banks like the Federal Reserve can jump into billions of dollars of quantitative easing without the will of the people for purposefully currency devaluation. Virtually every sector went up except housing and the US dollar. This is essentially what the Fed wants but with home values going up. This is a systematic inflation as investment banks chase profits with bailout dollars yet a slow crushing vice goes around the wages of Americans and home values decline. Home values are declining because Americans pay for their mortgage with a W2 job typically. Since both are incompatible, that is higher home prices with lower wages, the Fed is happy with allowing investment banks to return to their massive bailout sponsored profits.

The fact that the headline unemployment rate went from 9.7 to 9.8 percent in 2010 does not tell the entire story. Many people are taking new jobs for much lower wages. My hunch especially in housing bubble states is that many high paying jobs tied to real estate disappeared and many of those workers have jumped into other sectors but at much lower pay. This hunch was correct:

“(NY Times) Some of these may have been workers who retrained for new fields they wished to enter, but many seem to have taken their new jobs out of desperation. Only a minority of those displaced workers changing careers — 22 percent — said they had taken a class or a training course before finding their new job.

Look, I am really happy to have a job — that’s the main thing,†said Sue Bires, 60, who was laid off from a job managing homeowners’ associations in Orlando, Fla., in September 2008. She initially had another job lined up with a different realty association in Orlando, but when that fell through, she moved to Austin, Tex., to stay with a friend. She filed for bankruptcy and took a job at a call center.

But she now earns $30,000, far below the $45,000 she was paid when she was managing properties.

“It’s competitive out there, even for the lower paying jobs, especially when you’re 60 looking for a job in a young town,†Ms. Bires said. “So I’m grateful to have a job where the people are nice and I have a little bit of flexibility in my hours. That’s especially important now, since retirement is looking like a long way off.â€

The study found many cases like this. Here you have someone that worked in the housing industry earning more than her current new job. She is one of the fully employed today. Yet the housing market for 2010 performed poorly:

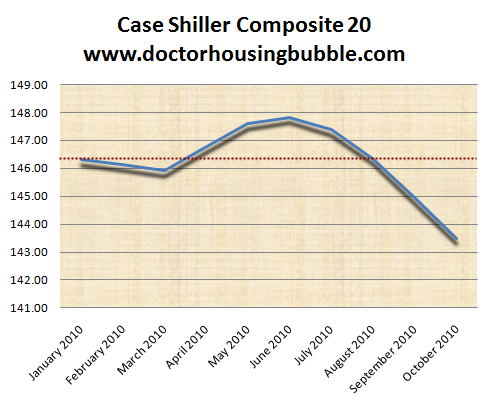

Here is a clear examination of what happened last year. The year started out with the typical slow winter but picked up nicely for the summer. At this point, the Federal Reserve and the banking industry must have thought that they were going to be able to will housing values back up merely by massive bailouts and artificially low interest rates that punish prudent savers. Yet the main thing to remember is without exotic financing home prices need to reflect local area incomes. Bottom line is families need to have home prices that fall within their budgets or people cannot buy. We are seeing this in California where home prices in many markets are still inflated. So what you see is inventory increasing and sales imploding.

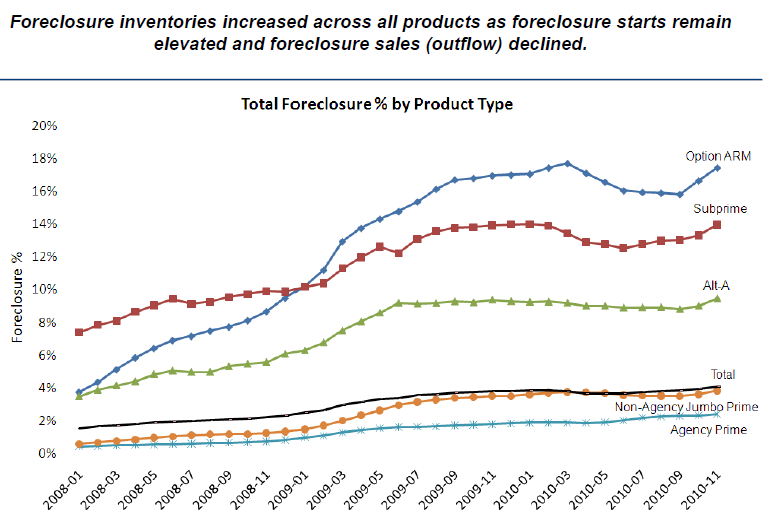

Loan foreclosure by type

Not much is said or discussed about option ARMs anymore. This does not make for a good nationwide story since most of the loans are in bubble states like California and Florida. California has 50 percent of all option ARMs in terms of nominal value. As it turns out comparing option ARMs to subprime mortgages gave subprime mortgages a bad name:

Source:Â Lender Processing Services

Option ARMs win the award for the most toxic mortgage product out in the market. Option ARMs were generally made on higher priced properties. Half are in California and many are in middle tier markets. Many of these loans have imploded yet banks have moved slowly on them to try to beef up their balance sheets with accounting chicanery. Alt-A with no-doc or low-doc scrutiny is still a large mortgage product lingering in California.  The market is not making any more of these loans but the financial sins of the bubble still stubbornly remain.

If we look at California’s unemployment rate over the last year not much has changed for the better:

January 2010:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 12.5

December 2010:Â Â Â Â Â Â Â Â Â Â Â Â Â 12.4

What I would argue is that California like the New York Times article has had thousands of people shift from high paying real estate related jobs and are now working for much less (or not working). The pool of buyers for expensive homes continues to shrink yet the inventory is still elevated as we have seen with the above toxic mortgage chart.

Some markets take it on the chin quicker than others. Let us look at the Los Angeles condo market next.

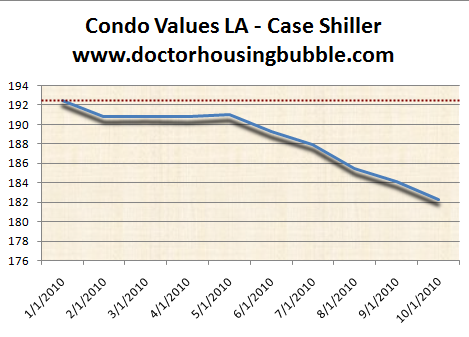

Condo values in LA

It is interesting to note that condo values did not have the mini bump seen in nationwide real estate during the winter. Condo values have fallen directly lower in Los Angeles:

Condo values fell over 5 percent for the year in Los Angeles and the trend looks to push prices even lower. Condos are usually seen as stepping stones into residential housing yet lower condo values would tell you that the equity build up in condos is also dwindling. That is more future home buyers have less and less pull for more expensive homes. Areas like Culver City and Pasadena are already seeing cracks in their markets. With the current Congress it is likely there will be little sympathy for areas with $500,000+ homes when the median home price nationwide is closer to $170,000 and moving lower.

If 2010 was a year of financial contradictions 2011 may be a year of reckoning. In fact these are the words of the incoming California governor. The reality is many states face troubling budget deficits and a housing market that is now in a double-dip. With so much information flying around you need to remember that home prices eventually can only reflect the incomes of families in an area. You will always have tiny markets where home prices are too expensive for most people. Yet these are a handful of areas and even there, prices have adjusted. However 99 percent of the housing market caters to the average American and not the top tiny percent of wealthy Americans. Looking forward it almost seems impossible that home prices will move anywhere but down in 2011.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

29 Responses to “Financial contradictions with banks chasing profits in other markets – 2010 year of two financial worlds. Stocks in many sectors improve while unemployment increases, home prices fall, condo values in Los Angeles decline, and option ARMs worst performing loan product.”

10% drop for 2011? Quite possible.

It is not just real estate jobs that have disappeared. The IT sector that was huge in CA-especially the Bay Area has been decimated by offshoring. Entire companies workforces have been shifted offshore -very similar to what happened to the rust belt. The rust belt never recovered and it is now possible to buy a house in Detroit for a 1000 dollars.

CA does have weather and a diversified economy-but fundamentals have shifted and nobody seems to acknowledge that. The repubs seem to think tax cuts will solve everything and the dems -I don’t know what they think anymore? I have not heard a single policymaker even address what they are going to do to address main street?

You can buy a cheap house in Detroit–but the taxes are off the charts. $1000 house might be $6000 a year in property taxes. This is not encouraging to buyers.

LOL… while I could probably look up the taxes online, I’ll take your word for it, MI being a known high-tax Nanny State, desperate to paper over the long term damage of UNsustainable fiscal practices by their incestuous political machine.

That said, I’m thinking the bigger turnoff to buyers than prop. taxes would be the POST-APOCALYPTIC Third World condition of said ‘hoods, which renders a house and *LAND* worth only $1,000… or less, FAR LESS. Ammo is expensive, and so is hiring a Blackwater merc to stay home while you’re out earning the W2. =:O

Will you provide an on-line source for just one verified example of a house that it taxed at 6 times its sale price?

Perhaps a Detroit tax assessment database and a single house property listing/last-sale price?

Happy New Year to everyone and thanks to Dr. HB for his great insights. Alt-A and Option ARMs alone will bring down mid and high priced CA homes. We have 58% of these loans in CA and there is no escaping them. Look at the charts and you’ll see that most of these are due to reset in the next 1.5 years. Give them another 6-12 months and you’ve got the makings of a huge foreclosure pipeline on top of the growing foreclosure inventory that banks are already hording.

Dr. HB is correct – it’s very difficult to imagine prices going anywhere but lower in 2011. Supply/demand is way out of whack and demand has been heading down – not up. It’s simple math.

Between State/Local budget deficits, Federal deficit, high unemployment, GDP that is being artificially propped up by stimulus, Alt-A / Option ARM resets, EU issues, China cooling its economy due to inflation concerns, and a long list of other major issues, the reality of 2011 / 2012 looks quite bleak. And for those of you have are convinced that these headwinds are too powerful to be overcome, be sure to read Dr. HB’s article on deflation in Japan. We’re mirroring their stock market performance so far and history tells us that we will have another crash in 2011 or 2012 due to one or many of the forces that I mentioned above. Deflation is here so be sure to lock in your income stream…

Good to luck to everyone.

Agreed. Like a philandering spouse, the housing industry has been making up stories for so long they were starting to believe them as well. Stock market peaks and investors move to commodities. Gas goes to $3 and the recession flares up again–not that it ever stopped, just that it was declared over. There is no rosie scenario, long-term.

So prices don’t rise to justify investing and don’t fall enough to make ownership practical for any but the foolish. US and China keep raising the stakes, but we both got nothing…China called our bluff and the Fed stepped in at the Treasury auctions. Everyman knows this is insane, but Wall Street just writes themselves bigger bonuses. The only question is which storm blows down the house of cards.

Zombie banks? Lost decades? We got everything Japan had, except savings, work-ethic, positive trade balances, growth industries, leading technologies, shame in failure…but there’s always hope.

“Stock market peaks and investors move to commodities. Gas goes to $3 and the recession flares up again–not that it ever stopped, just that it was declared over.”

–

It does seem there is some built in almost homeostatic feedback system here that just maintains the status quo. The Fed pumps and claims it does so in hopes of stimulating the economy. Fearing inflation investors run to commodities, therefore gas prices increase, this hampers the recovery. I guess the Fed would like to debase the currency to such a degree that they reach escape velocity but …

–

I’m not sure Kensianism actually knows how to deal with a global asset market.

You hit the nail on the head. Supply/demand fundamentals simply do not match up for commodities. The irony here is that by telling everyone that things are perfect/fine and then providing tons of stimulus to try to make it so, the people that believed you run and bid up essentials/commodities which in turn hurts the chances of a robust recovery and commodities ever sustainably reaching those prices. Bottom line, the world is largely riding off US and China stimulus – endogenous demand has not recovered and cannot weather uber high commodity pricing as it will cripple demand and confidence.

How much longer can banks afford to let people stay in their homes without paying the mortgage? Two years? Three years? What business school teaches this kind of money management? I guess the bankers just get their million dollar bonuses, and don’t worry about the future when most assuredly the chickens are going to come home to roost. Or, maybe they think they can hoodwink the government to bail them out forever.

When the foreclosures start flooding the market, the prices will drop to affordable levels in the mid to high tear areas. Time will tell.

I have a question for the good Doctor and the other knowledgeable posters here.

It seems like the intense deflationary pressures of the declining housing market, unemployment, and lower wages are battling with the Fed’s attempts to stoke inflation. It seems like the Fed is actually suceeding in inflating the stock market, commodity prices, and thereby decreasing the value of the dollar.

My question is: It can’t go both ways, right? If we’re really trapped in a deflationary cycle, soon the stock market will drop, commodity prices will drop, and the value of the dollar will go back up. Or, alternatively, the Fed will succeed, and inflated stock values and a lowered dollar will eventually lead to increased wages and higher home prices (at least in dollar-denominated, if not real terms).

I am not an economics expert, so I was just wondering if there’s something I’m missing here. Lately I’ve read a lot on the Internet that seems to say the equivalent of “the fed is debasing the dollar until it’s worth nothing, increasing the price of commodities, even though housing is going to continue to tank.” And my brain wonders… “Well, ok, if the fed is debasing the value of the dollar until it’s worth nothing, won’t house prices denominated in dollars go up?”

Please, I’m eager to hear your thoughts. Will inflation or deflation win in 2011-2012?

I think we will see both. Credit based markets (like homes) will continue towards their deflationary trends while prices for everyday goods (especially those that are imported) go up.

In the global scope, more dollars = less value. But in the local scope, people don’t really see that money because the extra supply isn’t distributed to them. They can only access them via debt (credit cards, loans, etc). The result is a squeeze with rising prices of foreign goods/services and deflationary trends for goods/services that can only be acquired by debt.

The thing to keep in mind is that prices are not purely inflation driven. Demand, or lack thereof, will also factor in the price of a home. Less demand (due to lack of credit/income) will usually provide stronger downward pressure than the upward pressure of inflation.

There is absolutely no way to know where the stock market is going. Flip a coin and you will have as good of an ideas as a guy making 1MM on Wall St. (He would like to think he knows, but in reality most are only right 50% of the time.)

Something to think about, the start market is about business profit. Businesses are very global today, so don’t only focus on the US economy. Also, when there is 10-20% unemployment who benefits? Big Business as they get labor cheaper. When resources are cheap who benefits? Big Business as they stock up on the commodities. This market is great for the stock market the get good cheap, labor cheap, and the smaller competition is going out of business. So my money is on Big Business and that’s why stocks might not crash as everyone expects.

“Or, alternatively, the Fed will succeed, and inflated stock values and a lowered dollar will eventually lead to increased wages and higher home prices (at least in dollar-denominated, if not real terms).”

–

Yes if it actually leads to increased wages (in a global market this is questionable).

–

Without increased wages the hiccup here is interest rates. Real inflation would lead to increased interest rates (at lest it has historically) especially long term interest rates (and the Fed can’t suppress these forever). Higher interest rates will lead to lower housing costs to keep housing at all affordable without increased wages.

Great question. All you need to do is look back at Japan to see the answer. The “CPI” actually remained at “normal” levels, meaning that you saw some slight inflation, on average, over 20 years. At the same time, land/RE prices + stock prices plummeted, leading to 80% declines for each. I don’t know what was part of the CPI calculation but it’s likely that some items had a lot of inflation, while others had some deflation, and the average CPI looked great. As others mentioned, I wouldn’t expect everything to move in sync, as evidenced by the historic data in Japan.

I apologize that it’s not a simpler answer but I would say that an investor has a pretty clear cut path during inflation. Try to lock-in the longest constant payments possible, such as is common with long-term leases (ie. industrial, large retail, large office properties), while avoiding short-term leases that will erode in price very quickly (ie. self-storage, multifamily, homes, etc). Inflation is pretty much the reverse. Ultimately, there are ways to navigate both environments, depending on you how you invest.

I hope this helps…

Charts are always fascinating. In 1900 a house (or similar dwelling) cost less then in 1800 (considering the dollar was stronger in 1900). Does this mean the economy completely tanked in the 19th century…NO. Sirs, when dealing with hyper complex monetary and fiscal theory on a mature economy there is no right or simple answer. As silly as it might sound, it comes down to confidence and belief.

Believing to buy — buy

Believing to rent –rent

BofA Resolves Fannie Mae, Freddie Mac Loan Dispute.

Bank of America Corp., the biggest U.S. lender by assets, paid $2.8 billion to Freddie Mac and Fannie Mae after the U.S.-owned firms demanded the company buy back mortgages they said were based on faulty data. The bank rose as much as 5.6 percent in New York trading.

Resolving the disputes cost Bank of America about $3 billion in the fourth quarter, including additions to loss reserves for loans that weren’t a part of the deals announced today, the Charlotte, North Carolina-based lender said in a statement. The agreements “largely addressed†liabilities from Fannie Mae and Freddie Mac, Bank of America Chief Financial Officer Charles H. Noski said on a conference call.

Mortgage buyers including McLean, Virginia-based Freddie Mac and Washington-based Fannie Mae are trying to force lenders to repurchase loans that may have been made with incorrect data on income and home values. Before today’s announcement, Bank of America faced $12.9 billion in unresolved putback demands, with about half related to government-sponsored entities, according to an Oct. 19 presentation. The company said in October it had reserved $4.4 billion for costs related to the problem.

Can’t *WAIT* for the WikiLeaks beans to spill on the global super-criminals at BofA… hopefully Wells Fargo will follow about 2 weeks later.

Shame on the knee-jerk reactionary nutjobs calling for Mr. Assange’s assassination, and other extremist nonsense, simply for shining the sunlight on the obviously out-of-control megalomaniacs who running humanity into the ground.

The following are 30 reasons why 2011 is going to be another crappy year for America’s middle class

#1 We are bleeding middle class jobs at a pace that is staggering. Since the year 2000, the United States has lost 10% of its middle class jobs. In the year 2000 there were about 72 million middle class jobs in the United States but today there are only about 65 million middle class jobs.

#2 In particular, the United States is absolutely hemorrhaging manufacturing jobs. Back in 1970, 25 percent of all jobs in the United States were manufacturing jobs. Today, only 9 percent of the jobs in the United States are manufacturing jobs.

#3 The decline of manufacturing in America has only accelerated over the past decade. The United States has lost a staggering 32 percent of its manufacturing jobs since the year 2000.

#4 Deindustrialization is creating ghost towns in some areas of the United States. Even some of America’s biggest cities are now only a shadow of what they used to be. Since 1950, the population of Pittsburgh, Pennsylvania has declined by more than 50 percent. In Dayton, Ohio 18.9 percent of all houses now stand empty.

#5 We have literally seen tens of thousands of American factories close down permanently over the past decade. Since 2001, over 42,000 U.S. factories have closed down for good.

#6 U.S. companies now create more jobs overseas than they do in the United States. Over the past year, American companies have created 1.4 million jobs overseas but less than a million jobs here at home.

#7 When Americans lose their jobs these days they typically end up having to take new jobs that do not pay as much. According to one recent study, the majority of unemployed Americans that have been able to find new jobs during this economic downturn have been forced to accept a cut in pay.

#8 The overwhelming majority of the jobs that the U.S. economy is creating now are low paying jobs. In fact, more than 40% of Americans who actually are employed are now working in service jobs, which are often very low paying.

#9 The number of long-term unemployed continues to skyrocket in this country. As 2007 began, there were just over 1 million Americans that had been unemployed for half a year or longer. Today, there are over 6 million Americans that have been unemployed for half a year or longer.

#10 For those who are out of work, the wait can be excruciating. It now takes the average unemployed American over 33 weeks to find a job.

#11 Millions of Americans have become extremely depressed as they have discovered that they simply cannot find any work at all. In August 2009, only 10 percent of the unemployed had been out of work for 2 years or longer. Today that number is up to 35 percent.

#12 Meanwhile, the gap between the wealthy and the poor continues to grow. According to one recent report, the wealthiest one percent of all U.S. households have an average of approximately $14 million in assets, while the average U.S. household has assets that total about $62,000.

#13 In fact, those at the very top of the income scale seem to be doing better than ever. Between 1950 and 1989, the top 1% usually earned around 7 or 8 percent of all national income. Today that figure is getting very close to 20 percent.

#14 Some of the income inequality statistics are almost too outrageous to believe. For example, the top 20 percent of U.S. working families take home approximately 47 percent of all income and earn about 10 times the amount that low-income working families bring in.

#15 Sadly, most American families are now living week to week. According to a survey released very close to the end of 2010, 55 percent of all Americans are now living paycheck to paycheck.

#16 The U.S. real estate market continues to stagnate. During the third quarter of 2010, 67 percent of all mortgages in Nevada were “underwaterâ€, 49 percent of all mortgages in Arizona were “underwater†and 46 percent of all mortgages in Florida were “underwaterâ€. So what happens if home prices go down even more?

#17 For millions upon millions of middle class families, their number one financial asset is their house. Unfortunately, many analysts are now projecting that U.S. housing prices will fall much lower than they are now. For example, Peter Schiff of Euro Pacific Capital says that home prices in the United States are going to decline at least 20 percent and possibly even more.

#18 But even though home prices have declined significantly, the truth is that they are still too high for most American families. Only the top 5 percent of U.S. households have earned enough additional income to match the rise in housing costs since 1975.

#19 Most American families have found that their economic situations have significantly deteriorated over the last several years. In fact, 55 percent of the U.S. labor force has “suffered a spell of unemployment, a cut in pay, a reduction in hours or have become involuntary part-time workers†since December 2007.

#20 As tens of millions of Americans barely scrape by, saving for retirement has become an afterthought. Today, 36 percent of Americans say that they don’t contribute anything to retirement savings.

#21 The truth is that incomes all across America are going down. In 2009, total wages, median wages, and average wages all declined in the United States.

#22 So is anyone doing better? Well, one group is. In 2009, the only group that saw their household incomes increase was those making $180,000 or more.

#23 Most Americans are scratching and clawing and doing whatever they can to make a living these days. Half of all American workers now earn $505 or less per week.

#24 Millions of Americans have been forced to take part-time jobs because that is all that they could get. The number of Americans working part-time jobs “for economic reasons†is now the highest it has been in at least five decades.

#25 Some of the people that have been hit the hardest by all this have been children. According to one recent study, approximately 21 percent of all children in the United States are living below the poverty line in 2010 – the highest rate in 20 years.

#26 If all of the above was not bad enough, now we are not even living as long. According to one recent report, the United States has dropped to 49th place in the world in overall life expectancy.

#27 The sad truth is that our country is in decline and it is getting poorer. Ten years ago, the United States was ranked number one in average wealth per adult. In 2010, the United States has fallen to seventh.

#28 Our young people are supposed to be the hope of the future, but most of them are up to their eyeballs in student loan debt. Americans now owe more than $875 billion on student loans, which is more than the total amount that Americans owe on their credit cards.

#29 Life is getting harder and harder for those on the low end of the income scale. The bottom 40 percent of income earners in the United States now collectively own less than 1 percent of the nation’s wealth.

#30 On top of everything else, the price of oil is skyrocketing again. John Hofmeister, the former president of Shell Oil, believes that American consumers could be shelling out 5 dollars for a gallon of gas by 2012. If that actually happens, it is going to absolutely devastate millions of middle class American families.

Good Luck 2011!

Why don’t we have a National Home Foreclosure Clock adding up the totals so we can see in real time Americans becoming homeless on the continent their forefathers conquered?

Come on now… where’s that good ol’ American blind faith in the Fed and other PTBs? They “maneuvered” us out of the Tech Bubble/Crash in a right royal fashion, did they not? Surely they have Yet Another bubble up their sleeve, oui/non? WHAT will that be, and how soon can I “get in on it”?? ;’)

Seriously though, on the one hand, honest markets require the price discovery of unleashing all those REO props (shadow and acknowledged) from Duh Banks, but OTOH, what happens to the “recovering” consumer economy when all those NOD squatter-deadbeats finally get the boot, and have to stop paying Macy’s and start paying RENT, which is straight from the pocket, without Alt-A fiction?

What happens here is cash for keys,then welfair if they have little gold mines,then rent with section 8, all good for the tax payers. no middle class ony hoods.

buy amo seeds and water.

Ok, so why does Zillow show a price rebound in Silicon Valley? Prices for homes that should be naturals for a guy like me, with solid engineering job, have marched upwards. since last Spring.

I know – different market from SoCal. But why are is the NorCal market stablizing?

It’s all in the data. More high-end homes are selling, which essentially raises both the “average selling price” and “median selling price”. The media conveniently calls it a price “rebound” when, in fact, all that is happening is that there is a higher mix of the high end selling (at lower prices), which cause the average or median price to rise. It’s unbelievable irresponsible for the media to make it sound like there is a price “recovery” or “bounce” when it couldn’t be farther from the truth. But, then again, it’s no surprise – the trick is to get out of the weeds of the media so you can understand what’s really going on and this is a classic example…

I hope this helps.

The “Great Depression II” continues. The disconnect between Main Street and Wall Street is getting bigger every day. It is apparent, the govt is willing to sacrifice whatever it has too, in order to keep the American Business Machine (Banks) alive. That means falling house prices and wages for 98% of the people. Anyone who doesn’t see this is just uninformed. Unfortunately, that’s a vast majority of the American Public. “Ignorance is Bliss” I suppose. Buying a home in this environment is practically suicidal, as your equity will be gobbled up over the next 5 years at least. Conserve your cash and don’t commit 30 years of slavery to a non-performing asset (house).

On the Westside of Los Angeles, real estate agents are now racing to the bottom by undercutting prices, in order to get anything sold. Desperate times make for desperate measures. Throw in all the excess shadow inventory and 2011 could be an interesting year.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

@Whitehall

The number of homes repossessed by banks dropped off pretty dramatically at the end of 2010, partly because of the robo-signing foreclosure freezes, and partly because the average time between initial mortgage default and foreclosure has stretched out to as long as 16 months in some states, 22 months in others.

Strained States Turning to Laws to Curb Labor Unions

Faced with growing budget deficits and restive taxpayers, elected officials from Maine to Alabama, Ohio to Arizona, are pushing new legislation to limit the power of labor unions, particularly those representing government workers, in collective bargaining and politics.

Some new governors, most notably Scott Walker of Wisconsin, are even threatening to take away government workers’ right to form unions and bargain contracts.

“We can no longer live in a society where the public employees are the haves and taxpayers who foot the bills are the have-notsâ€

MPatton said…

“Will you provide an on-line source for just one verified example of a house that it taxed at 6 times its sale price?

Perhaps a Detroit tax assessment database and a single house property listing/last-sale price?”

Zillow.

There are plenty of homes that sell for anywhere between $1 and $200.

But since you asked for just ONE. Here you go…

http://www.zillow.com/homedetails/6025-Cecil-St-Detroit-MI-48210/88435315_zpid/

Paid $200 Taxes $1808

You lose.

one difference between housing and other commodities is that it costs you to keep up a house; taxes, maintenance, etc.

true for gold, too, but authorities can tax properties more easily, i think

Leave a Reply