Four financial corners of California – real estate and broker licensees continue to decline, banks extend average foreclosure to 285 days, underemployment surges to 19.9 percent nationwide, and Federal Reserve now largest U.S. debt holder.

California home prices continue on a downward and inevitable trend lower reflecting an underlying weak economy brought on by lower paying jobs and gobs of debt that cling to the state like an albatross. We are seeing promising early reports regarding nationwide job hiring but little of that is being reflected in California. Even as the job report comes out we are realizing that we are entering an era of low wage capitalism. The new added jobs don’t come from the six-figure real estate agent and mortgage broker crowd but come in lower paying employment sectors. Because of this and other reasons it is likely that California home prices will not see any significant gains for the rest of the decade. Focusing on a market bottom clouds the more important fact that is rarely highlighted in the media and that is the fact that housing has collapsed because of massive leverage that masked weak income gains for over a decade. The housing crisis is largely a crisis of the middle class loss of income in the United States. Now that the toxic mortgages have shut down the leverage game we are left dealing with real income figures and the steady decline of home values is merely an adjustment to this new economic climate.

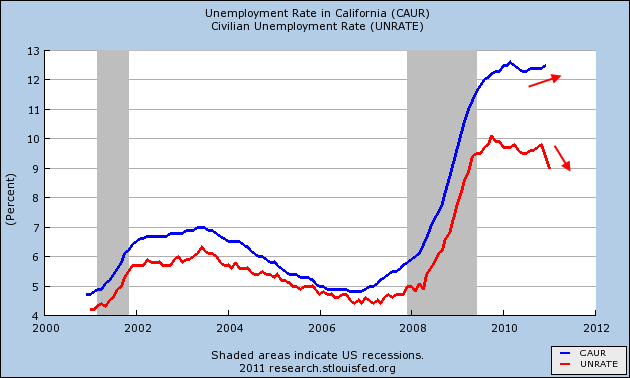

Follow the real estate agents

Source:Â DRE

I casually track the number of licensees in California that hold either a broker or real estate agent designation. From 1995 to 2002 the state had roughly 300,000 agents and brokers at any given point. At the peak in 2008 nearly 550,000 Californians had either a broker or agent license. This was an increase of 83 percent from 2002 to 2008. During this same time the population increased by 5 percent. This was the modern day California gold rush. The above chart shows what we all know and why all of us knew at least one family member that suddenly was a “real estate professional.â€Â Many agents and brokers have dropped out of the field and are letting their licenses expire. If the market was so healthy, don’t you think these numbers would be going up as people enter the field?

I tend to believe that there are many fewer people that have their active license but have completely left the field. For mortgage brokers, especially with only government backed loans in many cases there are slim pickings and the days of large option ARM commissions are more of a dream. These were good paying jobs that only existed because of the housing bubble similar to tulip dealers hundreds of years ago. According to many agents it is always a good time to buy or sell a home (otherwise they don’t get paid). Yet many are leaving the field and this is largely due to the continually weak California housing market.

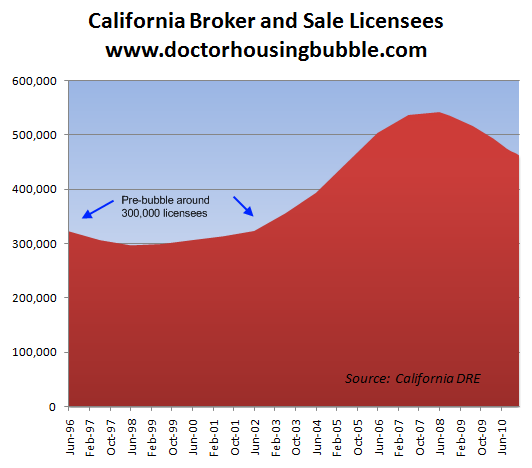

Shadow inventory delaying tactics

I love this chart because it really highlights the insanity of the market. Today it takes an average of 285 days for a home in California to foreclose! Last year it was 235 days. Foreclosure is a typically straight forward process. You miss three payments, you get a notice of default filed. After that the auction date and process to bank owned should be rather quick. In a healthy market this would typically happen in a steady stream. Why? Because people actually had large down payments and homes had equity. A bank would be glad to take the home back since they would then be able to sell it back on market. The owner in many cases had the option of selling because of equity. The incentives pushed the process to be quicker. Today with falling home prices and the incredible shadow inventory in California banks are dragging this process out as long as possible. We’ve recently seen indications that banks are now moving on releasing some of the shadow inventory to market so it’ll be interesting to see how this plays out in 2011. Yet I have a hard time understanding how any of the above indicators are somehow good for home values? The one important metric of household income is going sideways or down depending on what county we look at.

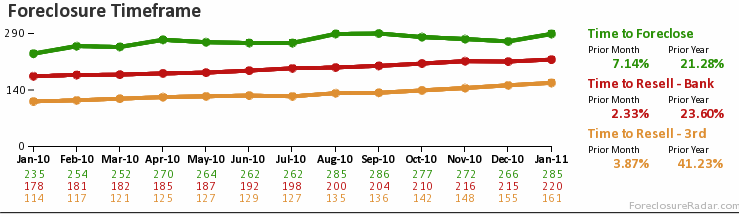

Real unemployment and underemployment

Source:Â Gallup

Gallup tracks the underemployment rate which is a better indicator of the health of the U.S. economy. The most recent data shows that 19.9 percent of Americans are underemployed. If we look at the recent job additions these are coming from lower paying sectors and keep in mind that if you land a job at the 99 Cent Store for 15 hours a week you are now considered employed in the headline BLS figures even if you want a full-time gig. How does this warrant sky high California home prices? The only way California home prices remain inflated at today’s levels is if we have another bubble similar to the technology or real estate boom and hundreds of thousands of high paying jobs are created. So far there is no indication of that so I’m not sure why some people think prices will be going up anytime soon.

Although the unemployment rate seems to be edging lower nationwide California is going in the opposite direction:

I think some people must think high unemployment and low wages are somehow good for housing prices. The large amount of shadow inventory and currently falling prices are an indication that they are not.

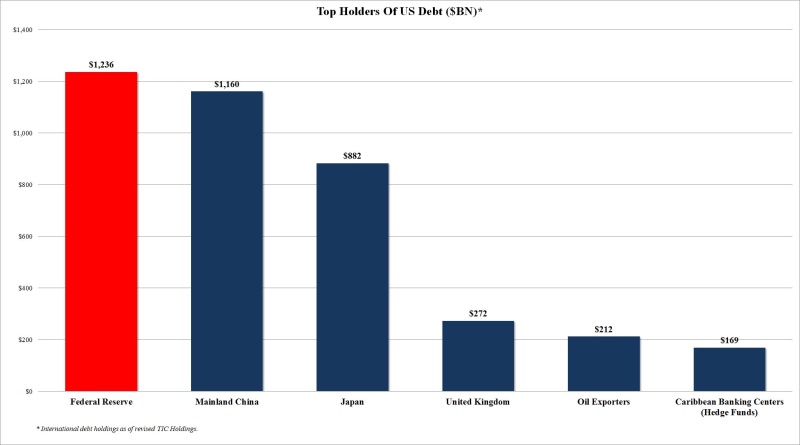

Top holders of U.S. debt

Source:Â Zero Hedge

The Federal Reserve is now the single biggest U.S. debt holder thanks to their absurd quantitative easing and mortgage buyback programs which basically did a clandestine banking bailout at the expense of the U.S. taxpayer. Those that point at the low cost of the bailout usually look at only TARP or some smoke and mirrors program when the true cost is hidden through artificially low rates, banking bailouts, and the fact that the Fed now owns the most debt as a single entity, even surpassing Mainland China. Of course the quality of life of most Americans will diminish because of this because it devalues the worth of your money. Keeping mortgage rates artificially low inflates housing values which actually hurts most Americans. This is money that can be used to pay for increasing college costs, energy bills, or rising medical care. High home values are only a way the Fed is trying to bailout the banking industry through more subtle ways. Look at the above chart and you realize we are merely going into debt to sustain the appearance of recovery.

By definition that which is unsustainable will eventually collapse or reverse course. Home prices need to reflect the household incomes of those in the immediate area. This applies for California just like it does in Canada or Australia. California faces severe price corrections ahead unless a giant new segment of the economy rises from the ashes and begins hiring people in droves and pays them excellent wages. Until we see that prices will keep moving lower.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “Four financial corners of California – real estate and broker licensees continue to decline, banks extend average foreclosure to 285 days, underemployment surges to 19.9 percent nationwide, and Federal Reserve now largest U.S. debt holder.”

Unless the unemployment rate drops below 8% in CA., Obama will not win CA. in 2012.

Without the massive number of electoral votes in CA., he can not win re election.

Expect all kinds of give away programs from Washington in the next 2 years, trying depirately to keep the state in the blue camp.

Wishful thinking.

As long as social conservatives remain a faction within the Republican party, California will NEVER go Republican for president. Even if you don’t think the government should be a vehicle for the advancement of your particularly narrow interpretation of the Bible, you cannot get elected as a Republican without the support of those who do.

Home-grown Republicans can get elected, and often be quite effective, at the state level when they are economically conservative, but socially liberal- people like my father and a good friend of over 30 years.

These are folks who don’t care about abortion (or are even pro-choice), don’t care who you have sex with, etc, and just think the government needs to stay out of peoples’ lives. Perhaps they’re even agnostic or atheist, like my father.

Unfortunately, it doesn’t translate well, if at all, to the national theater, and it’s a shame. I would vote for one of these people.

I agree, if the Republicans would just keep their hands out of everyone’s pants (metaphorically of course), they’d have a good chance to win in CA. As it stands now, the Republicans don’t appear to be any more fiscally conservative than the Democrats, and they are obsessed with people’s private bodily functions. Don’t tread on me indeed. Phew, now back to real estate.

Well said. A fiscal conservative and social liberal would WORK the system. Instead we get conservative and liberal, but never the twain. If Reagan was alive today he would be considered a “moderate”. That’s how far the repugnantcan party has fallen into fascism. The defacrats were already head first in the dumpster with all the special interest lazy people who want something for nothing.

The country is going to sh1t, and I blame you all who vote for the two major parties. The Tea Party started good, but will be hijacked just like what happened to the Independant party after Ross Perot. After Perot won, the Independant Party was rightfully allowed a portion of the pie that YOU check on your taxes ($3 to the Presidential Election Fund) then Pat Buchanan got control and raided all the cash and effectively KILLED the Independant Party chances because America DOES NOT WANT a religious fanatic as President.

BTW, after Perot, the Preseidential Debate Commission was taken from the Women League of Voters and is now controlled by 1 defacrat and 1 repugnantcan, NOW you understand why Ron Paul was never, ever allowed to speak to the american people in debates.

America is rotten to the core and it is my firm belief our government is corrupt and bought and sold by the “secret societies” which aren’t so secret anymore.

One major question everyone should ask, if the entire f’ing world is in debt, to WHOM is it owed? Yup, it’s nothing but bullsh1t…it’s all about control, power, and the corrupt organizations that hold the world as their puppets.

Me too!

California numbers tell it all. The Boom and Bust state is still falling down the rabbit hole. With the illusionary FIRE economy sinking fast we still have yet to reach bottom. In higher-end areas, a good 20% correction is still in the works. We are nowhere near capitulation yet. Buyers need to wait it ou,t until NOBODY is buying any more. Nothing but bottom fishing investors right now. Soon, even they will be washed out.

http://www.westsideremeltdown.blogspot.com

Rick, I’m sure you paid attention to the elections last November. Despite record low approval ratings, the Democrats made a clean sweep of Californnia. I wouldn’t expect anything else come next November. This state is a Democrat stronghold and won’t change anytime soon.

Anyone who thinks this state will go Republican is smoking that green leafy stuff along with a great deal of the electorate here. I’ve been here all my life and watched a center right state fall off the cliff to the left. Socially liberal is fine, but it has to be accompanied with some sense of responsibility. As a government employee myself for 30 years, I’ve seen the entitlements go from reasonable to incredibly lucrative sums of money. Believe me, these people aren’t going to give up one penny without a huge fight and them some. The Governor of Wisconsin is extremely courageous, but in the end he too will lose. People want entitlements and they really don’t care how they are paid for. Its estimated that $8000 is spent on each student in California’s public schools. The unions and teachers claim that more money is needed. How much will be enough? All you hear from these unions and public employees is “More Money, More Money”. Once a great many people or a majority vote for their own interests only representative government is lost. This state sorely needs some balance in government.

Curt,

Labor (and therefore unions) part of economic policy, not social policy, so an economic conservative would probably not be in favor of overly powerful public unions.

By social conservatism, I’m referring specifically to those who think that their own particularly narrow interpretation of morality ought to be legislated into law.

I consider myself economically conservative, but cannot vote for a social conservative. And because Republican presidential cannot win a nomination without the support of the religious nuts, I will, unfortunately, probably never vote for a Republican for president. There are a lot of people out there like me. What I do within the walls of my own home is my own business and not the government’s.

CA will vote for O no matter what…

Great job doctor, read regularly.

Moved to TO in 2005, did not buy, wife went along, renting a condo , thw owner bought for 465K, i rent for 1700(it was 1850 in 2005)

a condo in the same development , same size, BR etc, listed for 245K.

Thinking of pulling the plug.

There is another foreclosure near by, also a condo 299999 for 2000 sq ft.

i’ve more options now, lot more will be there in next 3 months

Even if a giant new section of the economy emerges, headquarters will be here in CA for over-paid executives, the holding company will be in a combination of Ireland and Grand Cayman for tax avoidance purposes and all the assembly (soon to be design) jobs will be shipped to the far east. Baddah-Bing!

You’re right. I notice many in many layoff announcements of California jobs, headquarters and the hired help goes to the MidWest/overseas, a satellite office for the executives remains in California; fun to read the absurd reasons given why the execs can’t/won’t relocate with the rest of the team (just remodeled kitchen, kid started kindergarten, etc).

I swear I must write this blog in my sleep when my IQ is much higher.

Hoo boy. That was a good one, T. Paine. I laughed out loud when I read your comment. Very witty!

I don’t get it? can you explain why the comment was so witty?

Please elaborate. are you criticising the Doctor? Care to substantiate your post? I admire the blog and trust the data in it. The conclusions make perfect sense and we now have the benefit of 20 / 20 hindsight with regards to previous blogs.

I *think* he means he so thoroughly agrees with the subject material that it might as well be that the ideas on the page might be from his own, though tempers that claim with the counterclaim that he lacks the proficiency in waking life to do so (accepting a possibility akin to sleep-walking in light of having no memory of writing it all down).

It appears to have been meant as a compliment.

I believe he is saying the Doctor is basically saying what he thinks, but in a more intelligent way than he can parse… a complement on the quality of the article.

We are in a ‘correction’. A ‘recovery’ means something or someone is getting better. Returning to and/or continuing manipulated, fraudulant, missallocations of capital and criminal asset stripping does not constitute a ‘recovery’ unless you’re one of the perps.

Nicely clarified and wouldn’t it be nice to see those perps get their correction. I vote for it happening in the well run strong unionized California penal system. Perhaps they can invite Scot Walker to visit. He should have free time pretty soon.

The bottom is still at least a year away….if not a few.

Does anyone else see this article as a collection of correlations that the author is trying to pass off as causation? Just because the number of agents has dropped while the market has collapsed, doesn’t mean we can use the number of agents in the field to predict the health of the market. How do we know there isn’t some third variable (or a combination of variables) controlling both the housing market and the number of agents?

C – He is not using it as a predictor of the future, he is using as an indicator of the present. The indicator of the future (per the article) is: 1. unemployment is high 2. high paying jobs are getting replaced with low paying jobs. 3. shadow inventory is going to be coming onto the market and it will cause prices to fall. 4. You can’t get adjustable rate mortgages anymore, and the cheap interest rates were allowing people to get more house than they could really afford.

You need money to buy an expensive house, or a cheap mortgage. Californians increasingly don’t have either so house prices have no where to go but down.

Don’t think he is doing what you assert.

As Tim states the Dr is pretty clear on his causation. Honestly, whether in his sleep or awake in his writing, bankers of a generation ago (prior to payment mania, first rolled out in the auto industry, non-secured credit given to an essentially debt styled slice of the populace (college students) and mortgages bundled into derivatives for Wall St wolves) would smartly concur with DR HB. Because that is exactly the way they ran their business; on sound financial principles that included healthy down payments, income ratios to plan for life’s expenses and a clear awareness of the trend for housing prices to track inflation because that correlated to sound money management that meant the loans got paid back. Upon those principles a society with a median income of $50,000.00 cannot afford a median priced home of $580,000.00. That is well out of the principle of a mortgage that is 33% of income is a safe loan to make. Perhaps you doubt that the industry made unsafe loans for the majority of the last decade. If you do and if you doubt the employment numbers, or the cut backs on govt as well as private sector good jobs – you will need to get out more and read more.

The number of agents is decreasing because many agents dont have the chops for waiting months on end to close a short sale. Try working for months to never get paid when it falls through. If they are working on foreclosure it can equally be tuff, most reos are in awful shape and cant meet lender/buyer inspections.

I am watching one right now that the broker took money out of pocket to clean up and tear off the no code add on. sitting for 7 months priced 40k lower than last years comps.

but this is in the central coast ca. not la.Where the pressure comes in is when the rents stay high while the investors struggle to make a buck. they will pack em in anyway they can, 6-8 to a 3 bedroom home is what we are seeing alot of.

Agreed. Even the good ol Irvine Company (which pretty much owns all RE in Irvine) started packing em in to the apartment complex where we lived until recently. At the end of 2010 there was a family of six illegally stuffed into the 2br townhome that shared a wall with ours. They lied on their rental app– the leasing office believed that there were only 5 people living there. What an awful 5 months for us. But, it motivated us to get out of there and into a great rented house in a very nice little neighborhood nearby, paying in rent a fraction of what we’d be paying to own. Gotta love the free gardener, water, & association fees!

Don’t forget the federal reserve is creating money out of thin air to buy the debt. The dollar is eroding because of this scheme. That very debt is rolling over and then the Federal Reserve buys more of the debt. It is a house of cards and charade.

Meanwhile the Republicans cut the budget for the poor and Obama signs an extension of Bush era tax cuts for the rich of $700 billion. Go figure. Rich get richer and poor get poorer.

Back when I was fortunate to have a higher income than I needed to live, I put everything extra into Gold and Silver and also my 401k into mining stocks.

I have recently been thinking things are getting toppy, I mean, after all, 1430 for an ounce of gold? That is a lot, or at least I thought it was.

My cat was not acting well so I took him into the Veterinary Hospital. 24 hours later and 2300.00 later, I was told he had cancer. 2300.00 just to give me the diagnosis? Yeah, they had to do several procedures but 2300?

I no longer think 1430 is toppy for Gold, not when 1K dollars is as insignificant as it is these days. Yeah, I know, I can get a lot of electronics or junk made in China for 1k, but I can’t get squat as far as necessities of life for that 1K.

Martin wrote “Yeah, I know, I can get a lot of electronics or junk made in China for 1k, but I can’t get squat as far as necessities of life for that 1K.”

Now that I understand!

I get so mad when I read (or hear) any talk of a recovery in the news. Often the reported says something like “…this or that is slowing the recovery.” When I hear this mumbo jumbo, smoke starts coming out of my ears. Horns pop out of my head.

Listen up, people……there ain’t no frickin recovery.

Honestly, I’m shocked that housing has stayed so high for so long. This will come to an end. They have many tools (interest rate being one of them) to manipulate housing. I think that much of the overpriced housing in California will be like a hot potato being passed from person to person (even if it is being passed slowly). A person who holds onto an overpriced home will end up getting burned.

Soon it will cost a “house” to pay for a tank of Gas.

Doctor Housing Bubble! Well said! You have 2 great lines above – ” Even as the job report comes out we are realizing that we are entering an era of low wage capitalism .” Maybe that would be low wage serfdom! Or maybe, ball and chain capitalism!

Your next insightful sentence is this one: “Because of this and other reasons it is likely that California home prices will not see any significant gains for the rest of the decade. ” Well said! I believe you are right on this one. To be honest, no one knows how long it will take for housing to bottom and then start rebounding. It could be decades! No one knows for sure.

That being said, I did read this about housing – housing really isn’t an “investment.” It’s a fricking place to live! Why should the price of a house increase? Unless a building (a business, for example) is a money maker and has a good location, the price should not be increasing by any substantial measure. Sure, if you do a major remodel, that is different. But in this fairytale capitalism called the U.S., the PTB invented this phony housing economy based on easy credit. It was doomed to failure from the beginning. It was a fake out economy, in place of a sound, manufacturing economy…. people taking magic wands and making their houses increase in value. What a complete, sick joke.

A house is a place to live. There is no logical reason the price should be increasing. That, my friends, is a fairy tale.

Exactly! Exclusive of new jobs in your area, or other external reason to make the house MORE desirable, then the price should not rise.

The nonsense of “A house is a place to live” is a myth put out by Real Estate Agents trying to make a buck off of suckers. It’s only a place to live if you own it outright. If you’re using leverage (as in a typical mortgage) it’s an investment. A speculative one at that.

About 25% of those with mortgages got confused about this, speculated, and are now underwater. They have gone from being “home owners” into renters from the Bank. Sucks for them, but that’s what happens when you don’t understand what you’re gambling on. And using leverage is always gambling.

The amazing thing is that many people out there still haven’t gotten a clue. I see people still trying to leverage to the hilt. I look at those fools, and know that they are going to get an expensive education in a few years.

Don’t forget property taxes: Even without a mortgage I have to pay the government for the priviledge of living there>>FOREVER!! The American dream of private property ended decades ago!!

Most right wing social conservatives I know are angry, judgemental, crazy, and

misinformed (Fox News) individuals. Oh, and they think Rush Limbaugh speaks the truth. Haha.

California does have a massive deficit. Some folks think that we need higher taxes so government employees can keep their jobs. Others want to keep the money that they earned and spend it buying something from a private business who will in turn hire people to produce the good or to sell and service the item. If this choice appears on the ballot(this is not a social issue, but an economic issue) you will have a choice.

I had an interesting conversation with the Association Exec Joel Singer at CAR in San Diego in January on just this subject. I said that I thought there were two reasons we did not see the dramatic drop off of members as we did in the last down turn. 1. There are no “real jobs” for the part time agents to go back to in CA and 2. Most of them are over 50 and are not qualified to do anything else, so they will hang on taking a transaction here and another there which is why we see the average CA Real Estate Agent closing less than 1/2 of one transaction per Quarter on average when sales are divided by membership.

There are some good points made by the readers about the politics that goes on today and how we the people get lied to and screwed by the “man.”

Awhile back I watched the movie, Bury My Heart At Wounded Knee, after remember reading it as a kid, about our government falling back on treaties with the Indians. Taking their land putting them on a reservation, and than moving them again because gold was found, or they wanted the land for a railroad to go thru.

It reminded me of how the government skews things for their own interests, and contributors. Tarp, and everything else that the Dr. has informed us about.

I can’t believe as the Dr. mentioned, they consider 15 hours of work employed. But than again that’s probably what these shitheads work a week, while we do our 40,

so it’s justified in their data.

I’ve seen the word sock puppets mentioned in here now and than and I got a good laugh. But more and more I think these politicans think we are the sock puppets.

I’m not sweating anything, like are we at the bottom yet, It remined me of Shreik, with Donkey when he kept asking, “Are We There Yet?”

No I’m learning to take it day by day, and as I mentioned before, anymore the American Dream seems just to be happy to have a job, whether 15 hours or 40!!!

This site has the best info on the net.

The Dr. speaks the truth.

Truly hilarious comments to start the thread:

Liberal politics, policies, “education” and welfare statism have brought California to it’s knees, and the insight to be gained?

Blame Conservatives!

Only when Curt chimes in with insight from inside the system, does sanity re-enter the discussion.

—

Two Californias

In two supermarkets 50 miles apart, I was the only one in line who did not pay with a social-service plastic card (gone are the days when “food stamps†were embarrassing bulky coupons). But I did not see any relationship between the use of the card and poverty as we once knew it: The electrical appurtenances owned by the user and the car into which the groceries were loaded were indistinguishable from those of the upper middle class.

By that I mean that most consumers drove late-model Camrys, Accords, or Tauruses, had iPhones, Bluetooths, or BlackBerries, and bought everything in the store with public-assistance credit. This seemed a world apart from the trailers I had just ridden by the day before. I don’t editorialize here on the logic or morality of any of this, but I note only that there are vast numbers of people who apparently are not working, are on public food assistance, and enjoy the technological veneer of the middle class.

California has a consumer market surely, but often no apparent source of income. Does the $40 million a day supplement to unemployment benefits from Washington explain some of this?

Do diversity concerns, as in lack of diversity, work both ways?

Over a hundred-mile stretch, when I stopped in San Joaquin for a bottled water, or drove through Orange Cove, or got gas in Parlier, or went to a corner market in southwestern Selma, my home town, I was the only non-Hispanic — there were no Asians, no blacks, no other whites. We may speak of the richness of “diversity,†but those who cherish that ideal simply have no idea that there are now countless inland communities that have become near-apartheid societies, where Spanish is the first language, the schools are not at all diverse, and the federal and state governments are either the main employers or at least the chief sources of income — whether through emergency rooms, rural health clinics, public schools, or social-service offices.

An observer from Mars might conclude that our elites and masses have given up on the ideal of integration and assimilation, perhaps in the wake of the arrival of 11 to 15 million illegal aliens.

We hear about the tough small-business regulations that have driven residents out of the state, at the rate of 2,000 to 3,000 a week. But from my unscientific observations these past weeks, it seems rather easy to open a small business in California without any oversight at all, or at least what I might call a “counter business.â€

I counted eleven mobile hot-kitchen trucks that simply park by the side of the road, spread about some plastic chairs, pull down a tarp canopy, and, presto, become mini-restaurants. There are no “facilities†such as toilets or washrooms. But I do frequently see lard trails on the isolated roads I bike on, where trucks apparently have simply opened their draining tanks and sped on, leaving a slick of cooking fats and oils. Crows and ground squirrels love them; they can be seen from a distance mysteriously occupied in the middle of the road.

In fact, trash piles are commonplace out here — composed of everything from half-empty paint cans and children’s plastic toys to diapers and moldy food.

I have never seen a rural sheriff cite a litterer, or witnessed state EPA workers cleaning up these unauthorized wastelands. So I would suggest to Bay Area scientists that the environment is taking a much harder beating down here in central California than it is in the Delta. Perhaps before we cut off more irrigation water to the west side of the valley, we might invest some green dollars into cleaning up the unsightly and sometimes dangerous garbage that now litters the outskirts of our rural communities.

Great post Doug N.

This is a great example of why I like this site so much.

Doug> You got a bone to pick with the roach-coaches? While pedalling, Did you get road-rash after a wipe-out in your lycra-spandex bicycle shorts which offer Zero protection? I know the san jaquin is too HOT for full roadrace leathers, but I’d suggest wearing them in your future traverses of grease patches.

Just wanted to update the status on this home that I posted a couple days ago. They had the first open house this past Sunday that I went to. I drove by last night and there is a Sale Pending sign on it already…

http://www.redfin.com/CA/South-Pasadena/1511-Marengo-Ave-91030/home/7007773

Doug N…really now, you’re kidding …right?

Clean communities are only for the priviledged few such as the Marin Headlands or Santa Monica.

Yes, I agree. The Dr. does speak the truth.

Some people think the financial fraud ended with the housing bubble but that chart showing the Federal Reserve with almost $1.25 trillion in US Treasury debt shows it just moved to Washington and New York and is even more bizarre than any Wachovia “pick a payment’ mortgage loan.

Here we enter a true financial twilight zone. Through ZIRP the Fed enables the Wall St. banks to borrow at essentially zero percent and buy US treasury debt. The Fed next creates digital money to buy the debt back from the banks under the POMO/Quantitative

Easing program. The interest on those bonds, instead of becoming an expense the US government must pay to the holders of the debt now becomes ‘revenue’ the Fed can return to finance government operations! Billions of dollars in interest payments magically become billions of dollars of revenue with a little baksheesh to the Wall St banks for playing along with the incredible fraud.

Of course such chicanery cannot last forever and its starting to unravel now. Those 44 million Food Stamp recipients had better watch out. Their benefits are fixed but food prices are not. When all the montly allotment will buy is a couple of loaves of bread or bags of rice there is going to be real hunger in America to go along with the out of gas cars and foreclosed homes they once drove and lived in.

I should have bought a McMansion, with a 5 year arm, and paid the Intrest only, then get a quick HELOC, bought a BMW cash, stopped making payments when the rate adjusted, played the Hamp game to drag it out longer, then squated in the place for a year or so, while banking the cash, mail in the keys, and drove my BMW into the California sunset.

Oh why must I be so damn responsible!

No matter what site I go to there is always someone who says they regret being responsible…. Well CC……… First of all, if you buy a house you most likely have to put money down. McMansions are too expensive to do ZERO down, so you will loose your downpayment. In California, which is a non-recourse state, you are protected when facing foreclosure for your original purchase money but not for your HELOC. The HELOC become a personal judgement on you, which could be chasing you around for 20 years if the creditor chooses to renew the judgement after 10 years. Many people do not know that a personal money judgement can also revoke your drivers license. Not fun trying to drive your dreamy BMW without a license unless you plan to go totally criminal and start of life breaking all the rules. Not to mention the IRS views the HELOC as a gain and you would be taxed on it as income, which is why many people are forced to file BK for insolvency. Hard to drive off into the sunset with a judgement, tax lien or a bankruptcy trailing behind, not to mention the legal costs $$$ to try to minimize the damage.

unit472, continued:

The Home Affordable Modification Program (HAMP), was a fraud from Day One:

It is designed to do nothing but camouflage the effects of the housing meltdown. It is based on bribery — paying the banks to modify (or pretend to consider modifying) mortgages that they really had no business or interest in modifying.

And administration of the program was entrusted to Financial Public Enemy No. 1: Fannie Mae, the government-sponsored enterprise that did so much to inflate the housing bubble in the first place while enriching its politically connected executives and committing a sustained campaign of outright financial fraud. An economically meretricious bank-bribery scheme run by a known criminal organization –

HAMP often is criticized for the fact that the great majority of the people who receive temporary (“trialâ€) modifications under the program ultimately are rejected, receiving no permanent modification of their mortgages. The critics suggest that this is a shortcoming of the program, the effect of bureaucratic ineptitude and governmental inertia.

That is poppycock:

The fact that most of the temporary modifications will never become permanent modifications is a built-in feature of the program, the economic incentives of which all but guarantee that outcome. The program is, to be blunt, a scam.

Here’s how it works: Fannie Mae gets paid a certain amount of money to administer the program, and its payments are structured in such a way that it has an incentive to push more people through the application process.

A former Fannie Mae insider charges in a whistle-blower lawsuit that Fannie’s main concern in administering HAMP was maximizing its own fees. (Surprise.)

The banks and “mortgage servicers†get paid to put people into modification trials, and their incentives are structured in such a way that if it makes sense to go ahead and foreclose anyway after the trial, then they make money doing that, too.

But not until they’ve extended the trial to whatever point maximizes their financial return.

I met a lady

Doug N

Ahmen!!

What is it with Americans I just can’t figure it out. We have 25 million unemployed in the united states and the Federal government keeps importing over a million immigrants ( who need jobs) every year. Add to that around 1 million illegal aliens hop over the border each year, and take more jobs. The government dosn’t want more Americans employed, judging from it’s immigration and border enforcement program it wants cheaper labor.

Oh yeh did anyone hear about the LAPD and La firedept. “Dropp” retirement program where over two thousand “retired” cops and firemen received checks between $200,000k – $900,000k and then continue to work another 5 years and recieve their average annual sallery of $175,000. Do the math that little program costs the city of LA 1 billion per year. and everyone wonders why the gov. is broke.

California logic is “blame conservatives”.

If only the country wasn’t insane.

If you’re looking for the next Black Swan to trigger the next leg down, you should be looking at the Comex. A default there will trigger the equivalent of a Bank run, and right now it looks like the Comex is out of the silver it has to deliver this month. It might squeak by this month, but May and July will be looking more dubious, as people realize they can make a huge amount of money by standing for the delivery of their Silver contracts, but get paid a huge amount in cash instead of taking the Silver.

It’s a losing game for the Bankers, and it looks like they are getting caught with their shorts down.

Here’s an amusing video about it:

http://www.youtube.com/watch?v=Et02g9OQ-LM

And if you’ve wondered why the price of Silver has shot up 30% these past couple of months, I encourage you to follow this blog:

http://tfmetalsreport.blogspot.com/

and this one:

http://harveyorgan.blogspot.com/

Good luck. And be grateful you don’t have a mortgage when this scam comes crashing down.

First of all CA is paying close to 40 billion in taxes in the federal govt than we get back. If we had our money, we would be running in surplus.

That bastion of conservatism-Texas is running bigger deficits than CA proportionally-despite getting more or less all their money back from the FEDS. That other bastion of conservatism AZ is very close to us. So what’s their problem?

My former neighbor in California finally sold her house after 12 months on the market. It was identical to the one I used to own in layout, design and location. Except she paid 20,000 more than I did, and did a lot of remodeling and upgrades that I did not do.

Hers sold last month for 40,000 less than mine did 18 months ago. Things are getting uglier out there.

I moved back to NYC after I sold my place in Northern California, and I am happily renting and commuting to work on the train.

Four-dollar gas will completely derail even the shadow recovery. Unless this time it’s different. The hyperinflation/demand-deflation two-headed monster on the loose now will drive the nations to fight for commodities and the territory they are in (as all wars have been). After WW III, there will be massive employment to replace global infrustructure destroyed. Depending on how many people survive, all debts will be erased as the remnants of civilization put the pieces back together again. That’s about the only scenario I see for a revitalized housing industry. Or perhaps the thousands of college grads saddled with binding loans will be able to afford inflated housing with their jobs at Staples and Old Navy.

@ Native Pasadenan

That house is way overpriced. Amazing. Maybe the buyer is some multi-millionaire and $850,000 is chump change for him or her. If that’s not the case, the buyer is making a serious mistake.

Leave a Reply