Rancho Palos Verdes and Palos Verdes Estates welcome the California housing crash – From $1.75 million to $1 million in an elite market. MLS has 1 listed foreclosure yet 200 homes are in some stage of foreclosure in Rancho Palos Verdes. A $4.7 million loan made on a $1.5 million home sale in 2003.

The correction in prime California cities continues. There seems to be a unique trend in 2011 for California real estate. First, there is a large amount of all cash buyers buying low priced properties as investments. We are seeing this in places like the Inland Empire. The next significant trend is the fact that banks are releasing shadow inventory via short sales or REOs even in mid-tier to prime locations. That in itself may not be the biggest change but the pricing of these properties signifies that some banks are getting serious about moving real estate in California. Today we are going to examine the prime market of Rancho Palos Verdes, a city that has one of the best views of the Pacific Ocean and of Catalina Island. But a good view doesn’t pay the mortgage and it certainly will not keep reality from hitting even in prime real estate markets.

Rancho Palos Verdes short sale

2621 VIA VALDEZ, Palos Verdes Estates, CA 90274

| BEDS: | 5 |

| BATHS: | 3.5 |

| SQ. FT.: | 3,357 |

| $/SQ. FT.: | $298 |

| LOT SIZE: | 8,450 Sq. Ft. |

| PROPERTY TYPE: | Residential, Single Family |

| STYLE: | Two Level, Other |

| VIEW: | Ocean |

| YEAR BUILT: | 1973 |

| COMMUNITY: | Lunada Bay/Margate |

Rancho Palos Verdes has two zip codes in 90274 and 90275. 90274 falls under Rancho Palos Verdes Estates and has a median price of $1.5 million. 90275 is RPV and has a median price of $828,000. These are prime areas in Southern California yet they are not immune to the housing correction. The above in Palos Verdes Estates was listed less than three weeks ago as a short sale. Let us first look at the sales history here:

Sold:Â June 27, 2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,725,000

This home sold near the peak of the California housing market. Someone is now trying to unload the property and keep in mind the bank has to approve a short sale here. The home was only listed on February 15, 2011 for:

Listed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,000,000

On the same day it was delisted. It is now relisted as of February 26, 2011. This is a 42 percent reduction in one of the more exclusive areas of Southern California. Rancho Palos Verdes Estates with a median price of $1.5 million is now trying to move a short sale at $1 million. This is the new reality with banks trying to unload shadow inventory at discounted prices.

The MLS has the latest figures for RPV:

Palos Verdes Estates:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 82 listings

Rancho Palos Verdes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 167 listings

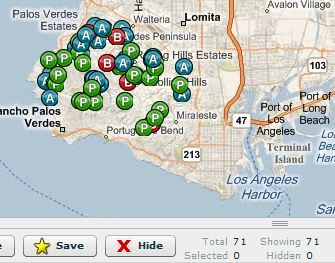

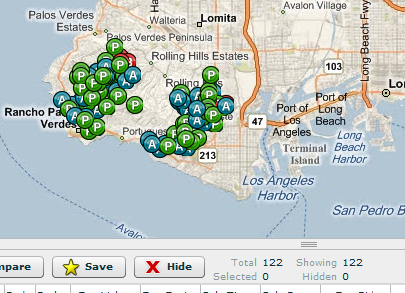

Only 1 MLS foreclosure is listed and ten short sales. As we all know the shadow inventory is much more problematic even for this market:

Palos Verdes Estates

Rancho Palos Verdes

Now remember that only 1 foreclosure is listed on the MLS while nearly 200 properties are in some stage of foreclosure in 90274 and 90275. Some people have made comments that areas with great schools would not face price corrections. This area has some of the best schools in the entire state and to me, cutting a home price from $1,750,000 to $1,000,000 is a decent sized reduction.

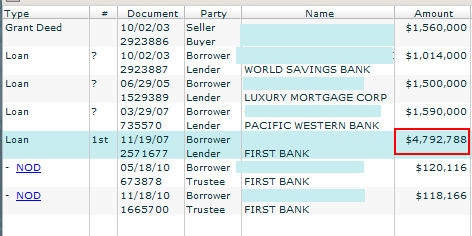

If you want to see an epic refinance take a look at this place for examples of shadow inventory in the area:

There is no going back on this one. This home was purchased in 2003 for $1,560,000. First Bank thought it would be a good idea to make a $4.7 million dollar loan on this place at the absolute peak of the market. This home now has two notice of defaults filed. This is a mega foreclosure in the making. Here is an aerial view of the place:

The current Zestimate is $1.9 million. Good luck on getting that money back. Even though we have this kind of view:

A mortgage still needs constant love and attention from a thing known as income. Obviously even in elite areas like Rancho Palos Verdes foreclosures are a large part of the market even though they are kept away in the shadow inventory like a dark secret.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

65 Responses to “Rancho Palos Verdes and Palos Verdes Estates welcome the California housing crash – From $1.75 million to $1 million in an elite market. MLS has 1 listed foreclosure yet 200 homes are in some stage of foreclosure in Rancho Palos Verdes. A $4.7 million loan made on a $1.5 million home sale in 2003.”

Wow. It’s about time that the meltdown started hitting the high end. Up in the SF Bay area, we’re just now starting to see prices dipping again a little. A lot of people are still very much in denial. Just today my barber was telling me he thought prices had bottomed. I had to disagree.

One trend has me puzzled though. On Craigslist, in some areas, I see a lot of REO’s which are billed as “Not on MLS”. One would think that if the Banks were serious, they’d be putting them on the MLS.

Is anyone else seeing this? And any idea why?

The only explanation that I can think of is the old trick that Developers use when they have a hard time selling. Namely, keep the low prices off the MLS so that it doesn’t affect the prices on the rest of the sales in the Development. But I really don’t know, or know if this is perhaps a localized phenomena.

I live in Chicago and the same old tired arguments were made when the real estate bubble went “pop”- “oh it can’t happen here”, “my neighborhood is exclusive and it’s different”, etc…..

Even in my hometown of Chicago exclusive and high income areas have seen price drops of 50% to 60%. The same common theme applies; people living beyond their means.

Then they act surprised when the law of supply and demand prevails!!! What a surprise. LOL

The Presidents Chicago home is underwater ?

In 2006 the future leader of the Free World made a bum deal on his own home .

Ronnie, President Obama’s home is in a nice neighborhood called Hyde Park. It’s in the South side of Chicago. Very close to the University of Chicago. Even in Hyde Park, home prices are down big time. Like I mentioned before, prices are down in high income areas and in areas that were thought to be immune from the real estate downturn.

Hey Doc, now you are talking, this is what we are waiting for the good stuff to correct.

So far its been the bank investors junk to hit the market. Soon we can buy Cash

in a decent hood as this global correction continues.

I watch a sweet little know country club area here on the central coast. looking at nod s I see a fair amount coming down the pike. This is typically not the bought too high peak stuff but more so, the let’s borrow for the motor home, college for Johnny, boat, beammer and need that vacation folks. You know the ones that thought it can only got up up up.

Doc, I think the dribble of news about the states wanting to able to use gold and silver as legal tender is the real news. Utah and 11 other states have bills to do this now. As the buck sucks the life out of us hedging this way I expect to see the banksters ask for metals as cash payment soon. Think global meltdown , china wants no more dollar as the world currency ect.

Where did the $3.2 million go? Does anybody care about that $3.2 million?

If nobody cares then this was bank robbery of the safest kind. Buy a jumbo loan house, borrow million$$$ against it, vanish with the million$$$.

I take it that the ‘borrowed’/absconded million$$$ never even had income tax paid on them.

Explain more please.

Yeah, I’d be very curious about this too.

This kind of money seems worth hiring a collections firm to pursue them for if they didn’t blow it all in Vegas (and even if they did, it seems worth finding out for sure).

School teachers in this district make an average of $90,000. to $100,000. per year.

How much money does someone else have to make to “fit in” here?

Manny, you are so very wrong about how much teachers in PV make, so very wrong. The average salary is around $52,000. And so what if they did make $90,000 a year? They teach our kids 7 hours a day, 10 months a year plus summer school for those who want to teach then. The schools are very good here in RPV, PV and Rolling Hills because the parents (both single and coupled, BoyWonder) demand it. As a community we have filled in the shortfall in money ourselves. Culturally, we are a mixed community as well.

GoodNews, if you are going to post your ridiculous theories about public schools, at least learn how to spell. There are not busing laws in California. Schools here have been losing money since Prop 13 and that’s the reason they are in such a poor state–there is a lack of funds.

Also Dr. Housing Bubble it isn’t Rancho Palos Verdes Estates, the name is correctly Palos Verdes Estates with the 90274 zip code. Rancho Palos Verdes has the 90275 zip code.

Thank you, Joanne. I was hoping someone would reply to the asinine comment. I am so sick of teacher bashing. It’s tough to live on the amount of money most teachers make, especially here in L.A. Teachers bring their work home with them; the work day does not end at 3 p.m.!

If you count the astronomical cost of benefits, teachers make more than many doctors and lawyers. All California taxpayers (not just PV and RPV taxpayers) pay for these heavy salaries and our state budgets show the ramifications of these compensation decisions. Additionally, if you divide annual pay by actual hours worked, these employees make much more than most people, even without the unreal benefits package.

You’re right, professional brainwashing is expensive, I’m for trippling their pay!! they are SO good at what they do, I have to spend most of my evenings de-programming my 3 children!! Somebody is teaching them that life is fair, there is free lunch, taxes are too low, schools are underfunded, everybody gets summers off (3 mos NOT 2), competition is bad, …stop me if this sounds familiar….

Here in Indiana, teachers get about 9 weeks off during the summer. My wife works from 7:00 till 5:00. Kindergarten teachers spend more time after school than any other teachers.

This is a Real Estate blog… I wish everyone with an axe to grind would go elsewhere. All you show is that poisonous political atmosphere fostered by the media and politicians is truly out-of-hand. We need to stop throwing bricks at each other and start discussing solutions like adults. BTW – There have been interesting articles about “Robo” commenters funded by some think tank. Take the political comments with a grain of salt. Apparently, a small number of paid staffers can manufacture “opinion” with multiple profiles on one thumb drive.

When I lived there, 90274 was Ranch Palos Verdes. Was just Palos Verdes Peninsula in the early 70’s until incorporated in the 80’s.

Teacher Salaries for 12 years of Service run from $54K to $75,000 for Base Pay – if you are a coach or other duties that adds to your Pay

Here is the Pay Schedule for PVPUS district

http://www.pvpusd.k12.ca.us/eecore/images/uploads/certificated_schedule_A_2010_11.pdf

not true, but let’s try this on for size, since so many of you think teachers are just glorifed babysitters, let’s pay them minimum wage, or less even!

7.00 an hour x 6 hours per day x 30 kids would be 1260.00 per day x 180 days per year would work out to an annual salary of 226800.00 per year.

Oh, those greedy teachers………………..

Alright you kiddies you have disrupted class. ChirsOC does have a point, this is a real estate blog but unfortunately between that scum Wagner in WI and your ignorance I have to defend the teachers. Disclosure: I am not a teacher and yes I was raised in private schools (Ah Catholicism) by teachers who taught in public schools. It was the family business with Aunts, siblings and nieces also in the profession.

Goodnews: Your mistakes are clearly not typos. I suggest you call a teacher – you need help. Chris sadly also needs a teacher. The salary is not multiplied by the number of students.

Surfadidict: You need to wear earplugs. The water has rotted your brains. Yup, it sounds familiar, like the propaganda coming out of WI and Fux News. Did you ever stop to think that the teachers have the same complaint, they have to set your kids straight on the facts – global warming is science you know or perhaps you like DDT. They fought that one too.

BoyWonder: You are off the tracks. As I said my parents were teachers. Mom had a Masters. Wait actually two and Dad besides teaching coached and ran the extracurricular Drama dept. He was pretty good. They named the new theater after him 20 years after he left. Neither of them together made near what docs do.

KI: you are way off center, best if you change your handle. What you have claimed is flat false. Please if you are all so smart do some fact checking. I was good friends with a doctor, he was my climbing partner. He went $300,000 in debt when he left med school. In several years he was divorced and remarried paying for two homes. He had no complaints on money, did some treatment for me gratis ( no insurance at the time) and went on to buy and build airplanes. More recently I dated a teacher. Got an e-mail from her because I sent the link about Jon Stewart’s satire of fux news on teachers. She is spending 100 a month on class supplies. She works 10-12 hours a day, six and sometimes seven days a week (class room and lesson prep as well as grading. It is not just what happens during class. Heck, I helped grade papers as a high schooler). This teacher makes 60K plus. but she is furloughed and has her benefits cut. She is not the high paid teacher. That goes to my retired sister who taught in the Calif corrections system. She was close to 100K a year. 5 days a week and easy grading, no class room prep for the incarcerated.

Ironically no one is making a whimper these days about the largest and highest paid union workers in our fair state – the guards in the prisons. Where are there pay cuts and layoffs?

My teacher ex-girlfriend. She cannot afford to buy a decent home, thanks to idiots drinking koolaid liar loans and liar bankers. So finally we are back to the blogs focus – making homes truly affordable for decent honest working people.

Oh how can I not comment on this. The teachers have been pampered AND abused. Both by the bloated corpse called “Union”. The unions lobby for a lot of things, but first and foremost is keeping the “union” itself alive. Teachers DO NOT make too much money, they are just useless because the system ties their hands, controls the curriculum and uses FEAR to bully teachers into using “the system”.

The problem with our education is the upper management and government. Both WASTE untold billions of dollars while providing little to nothing to help further educate our kids (yes, I have 2 boys, 17 and 16 atm).

I agree with surfaddict that schools brainwash our kids, again, this is the *system* and not the teachers. Telling my kids in 6th grade that smoking marijuana can KILL you. Teaching LIES is not good education and is HUGELY responsible for our younger generation to scoff at the wisdom, or supposed wisdom, of the elder generation…and you know what? I do not blame them, most of the people in “the system” are filled with propaganda and untruth. They teach patriotism to American government and not to truth, justice, and the REAL american way….freedom.

Escape from the fascism that America has slowly become entangled in. Enough is enough and if the laws don’t change, just ignore them like the FEDS do on border control or paying for illegal aliens, or for that matter, any State rights.

Hear hear. I spoke with my Mom about these posts on education. She’s the retired teacher with the Masters Degree in my above post. She pretty much agreed with you on govt interference in education. Of course in our conversation she was agitated by Obama resurrecting Dubya’s no child left behind program. She considered it a complete waste and interference in the work of teaching. Her pension as an aside on the discussion is only 800 dollars a month. Yup, teachers are killin’ us. Not one schmuck bashing teachers could get a job without having had a teacher. Kind of ironic.

There’s still a lot of “investors” with cash for good deals. I’d say the market needs at least another year to exhaust this group

Yes, I do see some good deals at the trustee sales, but with the need for a down payment and verifiable income, who are you going to sell it to? Other “investors”? If you buy, you had better plan on holding for a while.

I have only a comment regarding this myth of “good schools”.

First of all, if we are speaking of “government schools”, it is only relative.

By and large, the government run schools and their layers upon layers of administration can barely teach a chimp to eat a banana.

It is a wonder this institution of government run schools still exists in the 21st centruy.

But I digress.

This notion of “good schools” is strictly a function of good parents.

By and large, the kids from good parents are good students.

I am sure the RPV area, like so many other affluent areas, is populated by driven, responsble, highly educated adults.

Their offsping tend to be high acheivers.

Their TWO parents probably spend more time and effort in ensuring they apply themselves academically.

Interpet this any way you choose.

In my area of Atlanta, our schools are consistantly ranked among the highest scoring in the state.

It is an area that was formerly a bunch of cow pastures until all the affluent whites fled for the proverbial greener pasture.

But to hear the principal tell it, that is why everyone moves there.

Asi f there was this miracle school in the middle of the cow pasture, and everyone flocked there to enroll their child.

They even give each other awards proclaiming thier ..acheivments with “their” children.

What a bunch of hooey.

The schools in any given area are strictly a function of the socio-economic status of the parents/children.

Of course they’re good in RPV.

The people living there probably don’t spend alot of time with their pants down around their butt cheeks or hypnotized breathing through their mouths while watching Dancing with the ..ahem…Stars.

First you say…….”By and large, the government run schools and their layers upon layers of administration can barely teach a chimp to eat a banana”

Then you say…..”This notion of “good schools†is strictly a function of good parents.

By and large, the kids from good parents are good students.”

I absolutely agree with your second statement. Your first statement however seems right out of the God loving, War mongering, saviour of over taxed millionaires, working class hating Republican Handbook.

Schools and teachers are for the most part the same that educated the boomers. What has changed is the type of student, their attitudes and the attitudes of the parents, just as you state.

Most middle class neighborhood schools these days are victem to the busing laws and illegal alien entitlements.

So you end up with the ESL offspring types using the resources that would be a disadvantage in the classroom for native english speakers.

This is why most upper middle class send their children to private schools.

As they become poor (middle class) and can’t send them to the private schools all hell is breaking loose. this is one of the reasons people are tired of paying for public schools.Why pay when it only serves those that are costing us from welfair to grave . Here illegally.

Like DougN posted , two californias but now its getting blaringly worst in every city.

All one has to do is look at the debt we have from this invasion.

Sad days for california and every border state.

The problems of inequity in schools could easily be solved- just allow kids to use vouchers, to attend any school that they want.

Unfortunately, this will never happen. Every place where this is proposed, it is heavily opposed by the teacher’s union. By forcing you to attend bad schools,

they keep poor teachers in place, and keep the union rolls large, with more dues to spend on candidates that support their union.

Young teachers really get shafted- they pay into unions for 3 or 4 years, then are the first laid off. So much for “money well spent”

Good students are a function of good parents to a large extent. Another important factor is that the teachers that get assigned to the better classes are of a higher quality and also are more motivated due to the simple fact that the kids are there to learn. Many of the teachers that deal with the screw-ups eventually burn out. The thing to watch with the upper demographic schools is the kids have more cash and many find their way to harder drugs. Los Alamitos is a good example of kids with too much money and two parents working.

Funny thing happened when shopping for a house. My realtor tried to get information from the listing agent on a short sale and never heard back from her. I called the listing agent and received a phone call back within 5 minutes. When I told the agent I would work directly with her she told me that I just moved up the list. Greed is a great motivator.

Real-tards cutting each other out of REO deals… LOL!… now THAT is a good sign that the dam of of shadow backlog is about to break!

Here it Miami-FtLaud, I’d heard that banks have been playing hardball with listing agents, saying to hell with the 6% scam, and forcing total commissions down into the 2.5-3.5% range–and that on a greatly reduced price. Plus, out of that, the agents are having to reach into their own pockets to have the electricity restored, green pools de-gunked, and yards spruced up… heh, heh, heh…

In most inner cities, 80% of children are born out of wedlock. There are no

“Parents”- usually only one adult per household.

Fine and virtuous behavior, guaranteed to produce a class of civic-minded high achievers… 🙄

While I agree that good parenting is one of the most important factors in educating children, you have to realize kids are not raised in a vaccum. Our government provides public schools and our Corporations provides advertising, entertainment, food, clothing, toys, electronics, transportation, and a majority of the things older children are socialized to through peer pressure.

You complain about Dancing with the Stars and kids wearing pants hanging of their butts. But, who is broadcasting Dancing with the Stars to the nation’s population? Some Corporation. Who in mass producing pants that hang off your butt? Some Corporation. Why are they doing it? To make money. Well, if our society is set up to value making money over education, this is what you get. This is also what “good parents” are up against in raising their children.

So BoyWonder, what do we do? Well, obviously we, through our government, have not decided to force corporations that lease our public airways to educate people rather than pander to our baser nature. We, though our goverment, have not said, maybe a Carl’s Jr. six dollar burger with nearly all the calories you need in a day (before the fries and drink) might need some regulation. Instead, the past 30 years has been about deregulating so that Corporations could make as much money as they possibly can without worrying about silly little concepts as decency, patriotism, health and education. Then we blame parents for “bad parenting.” Even better we take money away from public schools, claim the middle class, taxpaying teachers are making too much because of their unions, and complain the schools now can “barely teach a chimp to eat a banana.”

Two lessons about life from my grandmother for you:

1) You reap what you sow. You allow Corporations to fill the airwaves with garbage (every reality tv show I know of), you better expect your kids’ minds to be filled with that garbage.

2) You get what you pay for. If you take money away from the public schools, you can expect less learning in school.

Eureka!! The enemy is “corporations” I love this faceless strawman which fools tout as the “problem” I think ignorance is the problem, always has been.

+1 Ryan. To deny the control of Corporations over the government is, ahem, rather ignorant.

Hardly faceless corporations and definitely not a strawman. Surfaddict, it takes simple research come upt with the names. I’ll go through some examples:

1) Program- Skins. Aired by- MTV. Airway lessor Corporation- Viacom. Problem- little educational value, sexually graphic portrail of teenagers, targeted audience children and teen agers. Contribution to society? You figure it out.

2) Food- Six dollar burger. Maker- Carl’s Jr. Resturant owner Corporation- CKE Resturants. Problem- Unhealthy. Calories 1080 (without the fries and drink) while recommended intake per day is 1800 for men and 1300 for women. Targets primarily men and children. Contribution to society? Making the population obese, increasing healthcare costs, but makes money.

Again…”You reap what you sow.” You allow your children to be bombarded with this crap, you better believe they are going to mimic what they see on TV and eat unhealthy food to “be more like a man” or just for the toy. In addition they will learn that it’s ok play on these human weaknesses if you are making money at it.

Doc, Good Read.

I live in the South Bay and went to a real estate seminar the other day and the realtor said that over 50% of the homes in Torrance that were sold last month were in some sort of distress. I was surprised and told him I look at the MLS for that area and do not see nearly that many distressed properties on the market. He told me a lot of homes in the South Bay that are listed on the market are actually distress properties but they are not showing up on the MLS as distress but as normal sales. Can this be true.

My realtor called on a property in the 90277 and it showed as a normal sale and when my realtor spoke to the listing agent, they said it was bank owned. Nowhere on the MLS listing did it say it was bank owned. This is the property –

http://www.redfin.com/CA/Redondo-Beach/521-N-Gertruda-Ave-90277/home/7700470

Could it be that the MLS has distressed properties listed on but that they are showing up is normal listings?

Tim, sounds ENTIRELY plausible–more of the “pretend” factor, the all-important drive to “keep up appearances”, i.e. prop up PRICES. Think about it–there’s NOTHING official about the MLS–it’s purely a RealTOR construct, every bit as fictitious as the pronouncements of their former Chief Economist, David “Boom-Can’t-Bust” Lereah!

Gads, think of the huge DISadvantage a clueless buyer has if they do NOT know the prop is “distressed” or REO! That’s the Real-tards, “serving” the public! 🙄

Don’t know about Cali, but here in So-Fla, I can easily check the online databases of both the County Tax Collector and Clerk of Courts to get the real background on any listing.

I’ve been looking for a “bubble-built” townhouse in the 90278 zip code (North Redondo Beach area of the south bay) since May of 2010. By bubble-built I mean homes built new from 2002 – 2008. By definition, most of these homes have to be underwater, even with a 20% down payment. So many of them are empty, yet listed as standard sales, that this is clearly the shadow inventory. At least half of the newer built homes on the MLS are empty or staged, yet agents come up with laughable excuses as to why the homeowner moved out, yet supposedly these homes have current mortgages on them. One agent staged a home and hung some clothes in a bedroom closet to show that someone was living there. Yet there was no fridge in the kitchen. The agent claimed that the seller moved out because she had 4 dogs, and “do you know how hard it is to show a house with 4 dogs in it? LOL. This same agent claimed that there are little to no foreclosures or short sales in Redondo, but she can’t explain why all these homes are empty other than to say “people get relocated”. A “real-tard” if I ever met one!

I have no pity for any of these roulette players who lost in the housing house of cards. This idea of entitlement that’s ingrained in Americans is disgusting. The idea of get rich quick without producing anything but flipping a house after fogging a mirror to get the loan is equally appalling. Anyone with one iota of common sense knew the numbers didn’t make sense. To heck with them!

We all know the housing bubble resulted from criminal behavior, but it’s interesting to view it as though it were an economic stimulus. (That $700,000+ on the first home and the $2 mil+ on the 2nd home is as good as lost; ultimately taxpayers are going to foot that, so we may as well start viewing this as a stimulus.)

Anyway, Housing Stimulus 1 started in the early 2000’s, when the govt took a huge chunk of taxpayer money (trillions, I suspect, when all the dust has cleared), and injected it into housing, in the same way that Obama’s stimulus was injected into local govts for building projects. This enabled all housing-related business to roar like gangbusters from 2000-2008. Of course the banks, realtors, house flippers made insane money, but it also helped regular people like tile installers, plumbers, etc to make good, consistent income, along with businesses as big as Home Depot all the way down to the small carpet store on the corner. (I’m trying to see this from a pro-business perspective.) In terms of helping the economy during those 8 years, it worked fantastically. However, from a long-term perspective, Housing Stimulus 1 didn’t create a solid platform going into the next 50 years, and that’s where I see its biggest weakness. Its most pathetically wasteful result is the overabundance of unused housing that is actually being torn down in some places.

Again, using a pro-business perspective, what would’ve been a better use of that Housing Stimulus 1 money? Brazil, for example, made a wise push in 1976 to wean itself off of petroleum, and as Wikipedia mentions in the article about ethanol fuel in Brazil, “there are no longer any light vehicles in Brazil running on pure gasoline. Since 1976 the government made it mandatory to blend anhydrous ethanol with gasoline.” One big argument in the US against moving away from petroleum is that we lack the “infrastructure”, which really means we have a gas station on every corner for gasoline, but we don’t have a good system in place for alternatives. However, the (possible) trillions that were put into Housing Stimulus 1 could’ve probably started us pretty solidly in building that infrastructure, whether it’s the swappable car batteries concept being tested in Israel and Japan or something similar.

That’s just one suggestion, of course, but it sure seems like that money would’ve been better spent giving us a solid platform for better long-term business benefit. It reminds me of how Miracle-Gro gives your plants a great pick-me-up for about a week. They really flourish, but the effect is so short-lived. Housing Stimulus 1 gave everyone connected to housing a great boost, but it didn’t leave anything behind to keep the momentum going.

Interesting take on the macro-economics, and how, like all central gov’t economic “steering”, it resulted (as always), in Potemkin Village Syndrome (see brand new empty cities in China… or Las Vegas).

BTW, though Brazil has been admirably progressive in its ethanol initiative, while the US PTBs have been shamefully negligent on alternative energy during the same 4 decades, Brazil has the advantage of lying on the equator, thus being able to implement a SUGAR CANE based ethanol system, with a net energy GAIN. USA, OTOH, has very little land area tropical enough for sugar cane… our CORN BASED ethanol bogosity is a net energy LOSER, a true “Potemkin Village”, and must be ended ASAP. It is nothing but corporate welfare for Archer-Daniels-Midland and related Midwest Farm Lobbies.

It’s been my opinion that Ethanol is not a wise use of resources .

This post just today ” US farmers fear the return of the Dust Bowl “.

http://www.telegraph.co.uk/earth/8359076/US-farmers-fear-the-return-of-the-Dust-Bowl.html

I’d like to mention that this idea we will win the future with methane power is a mouth full of horse shit.

http://www.nrdc.org/water/pollution/ffarms.asp

The parks department puts diapers on pack horses in our National Parks yet the meadow muffins praise methane power and the call for even more stockyards ?

And when in the Hell did nuclear power become clean and green ? Was I asleep when this happened ?

What next ? ” Clean Green Nuclear Power For Alaska NOW ” I’m sure that mouth full is right around the next bend

What is a dollar worth?

A million dollar home – give me a break. When homes are worth a mllion dollars, a dollar is worth TOILET PAPER.

I live in a Central California coastal town right next to Pebble Beach. I remember about 12-14 years ago, you could have bought a house in Pebble Beach for $350K. No kidding! Of course $350K was a lot of money at that time.

When the housing bubble came along, every donkey had “money” (a bank loan) to buy a home. It made everything go ape-schitt. Prices went statospheric. Before you knew it, everyone had $500,000 to $1 million homes.

The correction continues, and continues, and… All I can say is this ain’t gonna end pretty!

Doctor – after reading the following 2 bits, I was thinking you need to be enlightened a little bit….

“This area has some of the best schools in the entire state and to me, cutting a home price from $1,750,000 to $1,000,000 is a decent sized reduction.”

“There is no going back on this one. This home was purchased in 2003 for $1,560,000. First Bank thought it would be a good idea to make a $4.7 million dollar loan on this place at the absolute peak of the market. ”

This was all confetti money, invented by bankers with 24/7 “printing presses” and pumped up on psych meds, weed, and crystal meth.

However, you redeem yourself with this classic line….

“A mortgage still needs constant love and attention from a thing known as income. Obviously even in elite areas like Rancho Palos Verdes foreclosures are a large part of the market even though…” Income? You mean, I need a job? It’s time to wake up and smell the coffee folks!!!

This is great to see. I live around the corner from the house you mentioned above. It’s true that there is no market that is “safe” from this downturn. On the positive note, every market has ups and downs. We’re not going up too far any time soon, but it will happen eventually. This post shows that there are good deals even in your backyard, just have to keep your eyes open! Thanks

Keep hearing the media say how the economy has improved exept house prices. As if housing has to go up to have a full “recovery”. These idiots think housing is undervalued. To heck with them. Let’s start the “Housing is too damn high” party.

A number of years ago my wife wife was a high paid oil co exec. I talked her into resigning To look for a different place to spend the rest of our life. 4 years and several places later we ended up in nowhere Arkansas. We bought 50 beautiful acres with a 3 acre lake, fenced with a three bedroom house. It also included a 400 ft deep well and a 1345 foot driveway. It cost us 75000.00$ and the property taxes are 47.00$ a year. Utilities run about 115.00 a month. There is no mortgage. We can’t see any neighbors and Walmart is only 8 miles away. This all happened in 2002. The wife is now a real-estate broker and is doing OK but we live better and happier than we ever have. Nobody is super glued to California.

Howz da surf there in Arkansas? Did you get all your friends and family to move there too?

When I think Ar Kansas I think bad teeth, illiteracy, racial apartheid, incest, bad roads, bars that mask as volunteer fire departments,speed traps, opossum stew, dry counties, KKK, Baptists…in fact I don’t think it, I know it. I seen it wit me own eyes. GAWD…you can have your $47/property tax…you get exactly that in return. From somebody’s cousin.

But you are right about things going bad out here on the left coast. They’ll get worse before they’ll get better. Ar Kansas will remain the same.

But, but… they’ve got Duh Clintons (who vamoosed the second it became politically feasible), Mike Huckabee… and let’s not forget that shining beacon of Truth & Justice For The Common Man–The Rose Law Firm! 😆

REO HOMES NOT ON THE MLS:

Typically REO agents get an assignment when a F/C sale takes place; the lender assigns an agent and the agent goes to the property to establish occupancy by knocking on the door and saying sorry it didn’t work out.

More often than not the occupant, having become completely addicted to living free, not making a mortgage or property tax payment for several years does not want to leave the golden goose behind and slams the door. This leads to an eviction.

The post above is correct in that banks are cutting commissions to REO agents but only on the listing side, they still pay a full commission to buyer’s agents so any REO agent with a brain tries to self sell the property and places ads on Craigslist-and everywhere else- hoping to get enough interest so when the property does get listed they have the winning buyer.

EVERY property that goes REO is listed, many of the large lenders and GSEs will not even counter an offer till the property have been on the MLS (agent must submit proof) for at least 3 days and in some cases up to a week. If an agent has not listed the property in the MLS and is submitting offers you should report them to the lender and the local DRE.

The main issue and greatest confusion in the market is that while we see so many homes IN foreclosure we do not see many homes GO to foreclosure, they just sit in limbo being postponed every month for no real reason other than the lenders do not want them all back at once.

The market cannot and will not bottom until the lenders flush the toilet and get rid of the HUGE shadow inventory which will take about 3-5 years. The market also cannot improve unless unemployment drops to %5 and I mean good jobs, not the kind you get for 3 days a week helping folks out to the car with their groceries.

But we as a nation are chasing our tails: instead of systematically prosecuting the bankers that created this mess and the borrowers who lied (under penalty of perjury) on loan apps we are letting politicians set the agenda and they have demonstrated over and over again they are unable to organize a bachelor party at a brewery. This is why folks who put zero down, pulled out $150k in a refi tax free now need our help?

Let’s have a show of hands; of the hundreds of thousands of folks who have not made a mortgage payment in over 2 years, how many are paying their property taxes?

So, Moratorium? Loan mod? Principal cram down? Sure, just show us the cancelled check to the local Tax Assessor for your taxes because if you think letting go teachers and fireman, closing parks and libraries so you can stay in a home while paying utilities only, you need to have a brain scan because yours is not functioning.

Good post Christian.

Ditto. Many thanks for explaining that, Christian. That also might explain the F/C sales that appear briefly on the MLS and then go immediately pending.

Biggest problem with California? Seems daily the local paper reports layoffs, usually over a hundred middle class jobs; the only reports about companies who hiring involve retail, fast food type gigs. Hard to afford a 400K house flipping burgers or doing crowd control. If you have a good job and lose it, good luck finding something in here with comparable duties/pay.

Please ignore the good surf in the last photo, there’s nothing to see here.

But San Marino is still going strong.

As long as money keeps flowing from China to California, there will be no collapse.

Bottom fishing cash investors are the last to get wiped out, once prices drop another 25%. Just what the banks want. They will take their money and the property, no sweat. No mark to market, just a great trap for foolish investors thinking the market has bottomed.

Keep piling up your cash and wait until NOBODY is buying…. It’s coming.

http://www.westsideremeltdown.blogspot.com

Yes, DHB, it is nice to dump on the rich in affluent areas–plays to the populists, many of whom are your fans.

The pure unfettered reality is that the banks will not EVER dump their inventory on the market unless forced to do so–and that is highly unlikely due to their lobbying.

Why?

-Take your example of the $4.7 mil. that the bank holds on the property in this posting.

-If the bank sells the property for $1.0 mil, that means that it now has $3.7 million less in assets than is currently on its balance sheet.

-FDIC laws require the bank to therefore increase its reserves by ~$1.2 mil.

-Ergo, gives up the opportunity cost of that $1.2 mil., which invested in T-bills is ~$50K per year–or in consumer interest on a credit card can be as much as $190K per year.

This is pure simple business logic by the bank management. I don’t blame them, they are trying to keep their jobs, just like everyone else. If their earnings take a hit, they will be fired–and by the way, everyone’s 401K’s will take a huge hit as their share prices decline.

These are the decisions that are driving the market cycle.

Better schools?

Own or rent?

Teacher salaries?

All of that is just noise.

Looking in Bay area now and for several months. Palo Alto is the strongest area and yet is dead above $1.5 … almost nothing happening. At or around $1 m still getting multiple bids on most. Los Altos is ok but not as strong.

Nice neighborhoods like Los Gatos are dropping monthly. Going down to $400 per sq foot which sells yet there are still listings at $500 or $600.

watch corelogic, data quick , case shiller and the realtor.org data … it is moving down … the question is How Much Dr. Housing Bubble?

strategic defaults coming to the valley from the financially well-off.

I met an associate of mine this weekend. Here is his story.

He bought a condo at peak of market in 2006 in studio city, for $1 million. His mortgage is now $950k

his place is now worth $500k

His solution to his problem?

1) he is in the processes of buying his neighbors condo which is slightly better than his, for $475k cash (he has lots of cash).

2) he will rent out his old unit for 2 years until it forecloses, giving him approx another $50 000+ in cash (will not pay mortgage in this time).

So at the end of 2 years, he will own his new condo with no mortgage for $425k, with a credit ding on the foreclosure.

VS

continue pay his existing mortgage which with interest will end up costing him like $1.3 million dollars if he pays it over say 10 years.

so basically he just saved himself $900 000

and that is why this real estate market is going to get worse the lower prices go, because those with means are going to just say screw it.

Yes, I’m feeling that TSUNAMI of strategic defaults building too… a year ago, before Dylan Ratigan’s pro-walkaway-from-the-banksters screed, it was an unknown option to most plebes, the phrase ‘strategic default’ was not even part of the lexicon… now it is, and the last thin veil of moral prohibition is melting away… it’s going to be an exponential function, like our national debt! 😮

was quite interesting, I spoke to him on the moral aspect of defaulting. He explained it like this:

if he had loaned the money from his father at zero int rate, (father had paid for the house cash), then it would be a transaction where the loan’s primary purpose would have been for him to have a better life. Thats a moral obligation to keep paying.

The loan from the bank from their side is purely a business transaction. They don’t care if his life is any better, they care he pays the mortgage. Its purely business to a bank. Therefore him defaulting is purely business as well, as it has now become a bad business transaction for him.

He said even fiscally conservative financial planners were urging him to default at the end.

Doc – Great information, once again! Thanks for helping us filter through the maze of opinion and predictions. Folks, it’s a tough time for many – why feed the Beast? Let’s find more appropriate sites to post negative Rants. We need to keep the Posts & Reponses on track and helpfull. Follow the Doc’s example. We can make a difference…

Housing Doc…

What does one do when a higher paying position and great career move is offered that requires relocation to an area where housing costs are still too high to buy? Rent out your house and wait for the market to go up? Or sell now? Either way I’d still have to rent a place.

Sorry partial OT but similarities are painfully obvious:

“global warming is science you know”

Unfortunately it’s not science by any measurement, but a belief system.

Science has measurements, a hypothesis to explain those measurements in theory, then using that _theory_ to predict the future. Anything that doesn’t fit into theory blows the theory. Clear so far?

“Global warming” is a scam that has a numerical model carefully fitted to cover past measurements in years 1980-2000. I.e. no hypothesis, no theory, no predictions based on theory, thus not science. Just a numerical model: I can do one, it takes a couple of days.

Just like “Real estate values goes only up” and we have material from 1994-2004. Lo and behold, that’s truth! In 2004. Is it the whole truth? No. Is it science? No, no that either.

Even IPCC (a _political body_, not scientific) is finally admitting this as their predictions are bad even for guesses. And more so year by year. Also their model (so called theory) can’t explain why every planet in Solar system is/was warming. Including Earth. That’s a final nail on the coffin of any explanation relying on human made causes or CO2.

Also the hypocrisy is very visible, see Al Gores own house. Does he do what he preaches? Or _any_ IPCC member, who fly(!) into very distant places to hold their conferences in thousands. That alone should tell anybody: It’s all about money, hypocrisy at highest level.

_Just_ like real estate agents.

Leave a Reply