Pasadena $2.4 million short sale and the Dual Income, No Kids growth from 2000. Have younger professionals shifted housing priorities because of the economy and inflated home prices?

Pasadena is a great city in Los Angeles County. One of the older more established big cities within the county, there is definitely demand for this area with personality. Driving and walking in this city recently you realize that many would still overpay today if toxic mortgages were still floating in the market. You can almost smell it in the air on Colorado Blvd. Yet the market is now such that families have to demonstrate adequate income to purchase a SoCal home, even in prime locations in Pasadena. Like all bigger cities, Pasadena has prime and not less than prime areas. Yet people forget that back in 2006 at the height of the bubble home prices in every section of town were at ludicrous levels. Today we will cover the city’s current housing data and try to focus on a prime California city that is creeping into a much needed correction. We’ll also look at a very expensive short-sale in the city associated with some very famous California families.

Pasadena growing DINKs and income fantasy

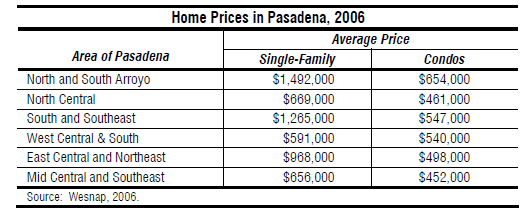

First I want to take a trip down delusional lane for a moment because it helps to understand history for the context of what is happening. In recent months when I cover the city advocates usually counter with “that home is in the wrong part of town†but back in 2006 it seemed like every area of the city was doing well and many of these advocates remained silent during this time:

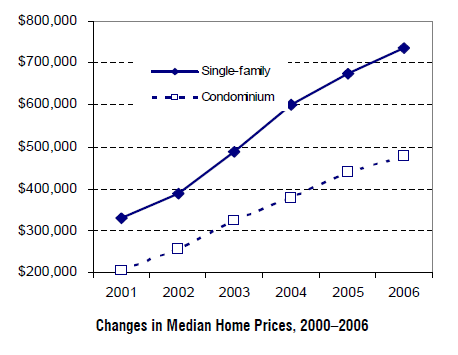

The lowest priced region was located in the West Central and South part of the city with an average price of $591,000. This isn’t exactly a prime part of the city for those familiar with the area.  Pasadena has low priced areas all the way to multi-million dollar neighborhoods. The important thing to realize is that all the above areas have come down in price, some dramatically especially in the lower income parts of town. The change in median price was dramatic:

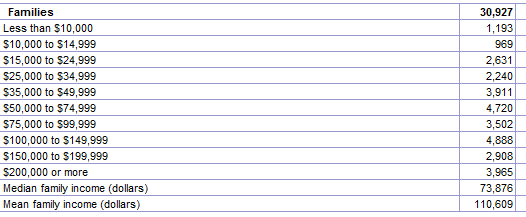

Home prices from 2001 to 2006 doubled yet incomes only went up by modest amounts. This is where the major disconnect still remains. Let us now fast forward to the present. What is the income break down of families in Pasadena?

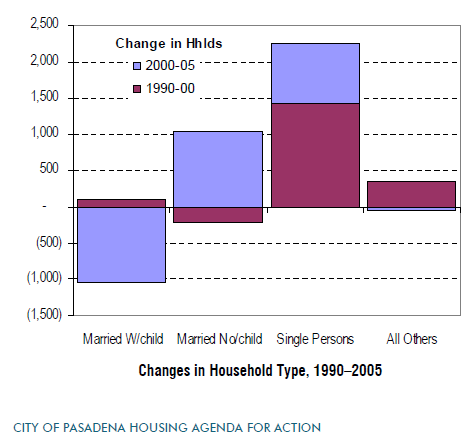

The median household income for the entire city is $73,876 which is a solid showing for the city. But it certainly does not support those 2006 prices, not even close. In fact for all regions you would need to make at least $200,000+ a year as a family for housing to be affordable and only 3,900 families made this in the entire city! Now as I have discussed many newer families are holding off on having kids because of the economy and also the cost of housing. I found it interesting that the biggest growing group in Pasadena came from DINKs (dual income, no kids):

From 2000 to 2005 the biggest jump came from DINKs with singles also making up a good portion of the population increase. Now it may be the case this group moved to the area because of the bubble with the anticipation that they were going to buy a home and have a child. This is very likely. Yet plans have changed for many in California. I couldn’t find any new data showing what has happened from 2005 to 2010 but I’m sure many of the DINKs did have kids but probably not as many to soak up all the excess housing. Many in this group did buy from 2005 to 2007 and probably leveraged up with toxic mortgages. Pasadena currently has 600 homes in some stage of foreclosure so problems are happening even in a market with relatively good incomes.

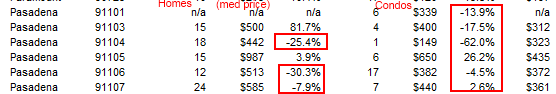

If we take a quick glance at where prices stand today you can see that overall, prices are coming down and condos are taking a beating:

Compare the above prices to those of 2006 discussed earlier. Overall I expect this trend to continue well into 2012. If families are reluctant and have shifted their expectations (i.e., instead of buying a home maybe a condo or renting for DINKs) then demand will pull back yet again. But more importantly and fundamentally prices are still inflated relative to incomes. This is precisely why home prices continue to go down overall for the city. There is definitely a desire to live here yet these desires are not supported with actual incomes on a broader level. I’m sure everyone would love to drive a foreign import of the year but it is likely that high enough incomes are in shorter supply than the desire to buy. No need to guess, the data is above.

Pasadena multi-million dollar short sale

Let us now focus on a short-sale in the city in a very prime location:

494 BRADFORD ST, Pasadena, CA 91105

Listed   09/22/10

Beds     5

Full Baths            3

Partial Baths      2

Property Type  SFR

Sq. Ft.  4,648

$/Sq. Ft.              $525

Lot Size 37,150 Sq. Ft.

Year Built            1928

This home is in the prime South Arroyo neighborhood and is certainly not a home you would expect to see as a short sale. Let us look at the description here:

“Historical landmark (with the mills act) once owned by harriet doerr-‘the doerr house'(huntington family) located in pasadena’s sought after neighborhood of arroyo seco. Secluded sprawling estate on a double lot of approximately 37,000 square feet. This master piece created by roland coate includes original florence yoch gardens. One of the few properties remaining completely in tact with original rooms and features and an original representation of ms. Yoch’s work. Historical status entitles buyer to a huge property tax deduction. Interior appointments include; elegant foyer, library/office, spacious formal living room w/beautiful fireplace, formal dining room w/built-in cabinets, five bedrooms, original hardwood floors and much more! Amazing landscaping includes oak trees, fruit/citrus trees, rose garden, ‘summerhouse’ (gazebo), water pond and stone walls. This is a rare find of art and history.â€

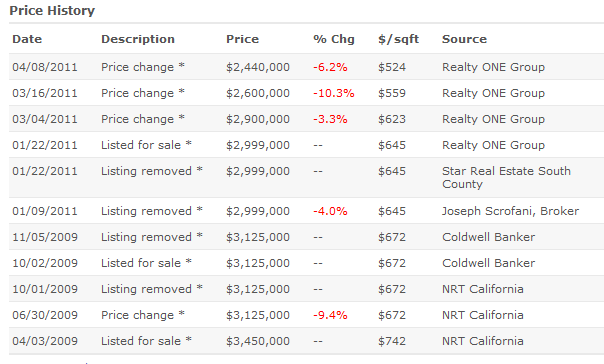

We can also see that this home has been chasing the market lower for some time now:

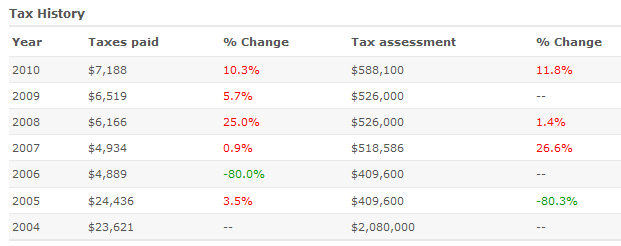

At one point they were trying to get $3,450,000 for this place. Today it is now listed at $2,440,000 and is categorized as a short sale. What is the Mills Act? It basically is major tax relief for the restoration of older homes or landmarks. Let us try an exercise and see if you can spot when this occurred:

This is big difference here. Of course folks in multi-million dollar homes need major tax breaks especially when more normal folks are being gouged left and right because of our troubled state finances. Even with the tax savings, someone is going to need deep pockets for this place. From $2.4 million short sales to lower-end $100k condos Pasadena is now fully engaged in the correction.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “Pasadena $2.4 million short sale and the Dual Income, No Kids growth from 2000. Have younger professionals shifted housing priorities because of the economy and inflated home prices?”

If you are a young couple who wants to buy their first house, a word of advice-

Wait 3 years after marriage to have your first child. You can save up for that down payment, you will be comfortable with each other, and you will know the marriage is going to last (or not). More divorces occurr in year number 4 of a marriage, than any other year.

Um…Roger, if that’s true, wouldn’t it be best to wait four years so you don’t have your divorce occur the year your child is born? Or is it that the stress of that kid causes everyone to get divorced? I say this mostly in jest…I’m just not sure it’s very practical to use aggregated statistics to guide one’s own life. But sure, it’s probably a recipe for stress if not divorce to get married have a kid and buy a house all in the same year.

Better yet, hold off on marriage until after the children are born and raised to adulthood. If you still voluntarily remain together once the parental obligation is fulfilled and you’ve gone through all those many years of good times and bad times together, then you’re probably safe from the prospect of divorce. AND if you can hold off buying a house at at all throughout those years, you will have a much wider array of home choices at retirement (and likely a different set of preferences than you might have had when planning your family) plus will likely be able to get a much better deal once the market approaches a real bottom, say 20 years or so from now.

This short sale, just a few blocks from the Bradford house, has been on the market well over a year, not 12 days as the ad says.

http://www.redfin.com/CA/Pasadena/650-W-California-Blvd-91105/home/7187242

SURELY you are not implying any chicanery, fraud, or deception on the part of the aptly-acronymed FIRE industry? Say it ain’t so!

Seriously, please track this prop for us, and report back. We appreciate your “on the ground” reporting.

??

One other aspect of the housing bubble is that is diverted talent from some industries to a component of the housing industry. I’m involved with AudioVisual work for corporate, educational (sort of the same things), and government (sort of the same thing). Many were lured away making double and triple the pay with the Home Theatre bubble. They all had their BMW’s and such to go to training while we took the hotel shuttle. Then, that industry collapsed, and now most of them are upset that they have to work for the meager pittance the rest of us do, rather than their world-traveler, nouveau riche lifestyle they were used to.

I’m sure it’s that same for many others. How many dropped out of school when someone with a GED pulled up in their Mercedes and told them how much they were making in surreal estate. As if American’s didn’t feel entitled enough already…

Even is Pasadena, every rose has its thorn…

Too true. Here in the So-Fla Bubble/BUST Zone, we have a group of late 20s/early 30s RE “professionals” who are literally crippled because they started their careers during the frenzy, thought it was the NORM, ergo, spent it ALL, saved NOTHING, and are now squatting in a defaulted condo w/ the aging Beamer, FICO 400, food stamps, and a long spiel of BS cover stories…

Whew, flashbacks to the tech bubble of the ’90s in NoCal and Silly Valley. When any midwest college graduate would show up in the Financial District of SF, expecting a six-figure salary for playing hackysack, sucking bong, and doing rudimentary HTML coding for NutmegGratersOnline.com

And then complain because transit workers putting in 70 hours a week were earning $110,000.

Real life came as quite a shock in 2001.

Either California has a lot of trust fund babies or a lot of people are living way beyond their means. A job loss, missed paycheck, disabled spouse and they are toast.

We have both, but most are in the category of living beyond their means.

You obviously don’t live in SoCal. These people never planned to make these properties their homes. Rather they were a short term investment designed to make them six figures in “profit” with nothing down on an interest-only, liar loan. They would “buy” the house, put in granite counters, stainless steel appliances, update the fixtures and the bathrooms, refinish (or install) wood floors, slap a coat of paint on everything, throw some plants from Home Depot in the yard and unload it. It’s a slam dunk! Then they’d do it all over again.

Anyone who didn’t go along with the program was looked upon as a “loser” by the real estate wizards. You were someone who wasn’t smart enough to see the guaranteed success of this method.

Turns out the real estate wizards were the losers.

I still can’t believe that the market is putting forth these insane prices, and there must be a few knuckleheads nibbling on the bait to let them keep prices so inflated. When is the true capitulation going to happen?

Two incomes and a kid, then you need $1000 a month for day care. Better make a hell of a lot of money to consider a mortgage at those prices. Need a car? Forget adding car payments. Better eat rice and beans. Oh wait we live in Los Angeles. I can be a movie star and make millions. Then I can buy that Pasadena house.

Movie stars aren’t happy with a $2 million house – try $14 million.

HAHAHA, so true Tim. That $2 home wouldn’t be anywhere near good enough for any of the west coast Masters of the Universe. Maybe an art director or fancy interior designer or lower level corporate exec. But no self respecting movie star (total oxymoron, I know) would be caught dead in that place.

Can’t let the market just work–it’d be like flying a plane that hasn’t been flown in 20 years. Lot’s of unintended consequences. The Fed only has one way out of the debt death spiral–inflate everything else until the nominal debt size is manageable. Only the very wealthy will be able afford to maintain their lifestyle. The rest of us will be slaves to Manhattan, trying to outbid rich foreigners for the scraps. Does every one here know that the Fed and the banks that are required to buy bonds are the only thing holding up the debt charade? How long can they spend at this rate and also monetize the debt? With the Fed buying bonds to the tune of over a trillion now, all hell will break lose if they stop.

1 acre = 43,560 square feet. This place is 37,150 square feet or 0.85 acre. What a complete rip off. This house is a dinosuar built in 1926! What fool is going to shell out $2.44 million for a house that probably should be demolished and would need a fortune to fix up?

These banks are outrageous. $2.4 million? Bulldoze this old shithole house. Start again. Hell no to $2.4 million for this haunted mansion.

I’m not defending the cost as being justified but I’m curious why you automatically deride a house because it was built in 1926. One could form the exact opposite opinion that it was probably made with much better materials and that nobody was trying to see if they could minimize the amount of wood used in the frame.

Just curious.

Gotta ask. How much in Pasadena for a house with a pretty, little flowerbed of white gardenias and a rickety old garage (that would fit a brand new super-stock Dodge)?

Re: The 494 BRADFORD ST house… while it’s architecturally sad that such a “Virginia” house exists anywhere in the unique and decidedly NON-Virginia environs of So-Cal, I’m guessing 0.85 acres is considered a VERY large SFR lot, just about anywhere in LA County. And yet… the market refuses to cough up the “asking” price… go market forces!… work your “invisible hand”… hurry, before the NAR throws more bribes, err, I mean lobbyist fees, around DC and Sacramento. ;’)

It is interesting to note that the folks with kids packed up and left town and moved to Texas(or back to old Mexico, depending upon the situation). Texas is the promised land for families with children. SoCal is too expensive to raise children and the lifestyle is not conducive to the folks who like “traditional family values.” America is a big country for all types of folks(but apparently, just not living on the same block). I think that the good areas in Los Angeles county will be primarily people with few or no children. I know that the young folks in Japan when they get married ,do not have children(a few apparently do). They look at children as a drag on having fun. Japan has no “Texas” for the young couples to move to if they are so inclined to replicate themselves.

Wow, I’d like to see the numbers you’re basing your Go Down Moses assertion on. TEXAS is the promised land for families with children? According to the US Census:

It’s in the bottom 2/5 of the nation for expenditures on schooling.

Its average public school teacher makes $6,000-10,000 below the median income.

It’s right in there with Arkansas, Idaho, Massachusetts, and Washington state for unemployment.

It’s #14 in the nation for violent crime.

It’s #41 in the nation for number of doctors per 100,000 people.

It leads the nation in population inflow, meaning that once the conservatives are finished drowning government in a bathtub, it’ll be up to corporations to fill the gap (for a price, Ugarte, for a price).

It ranks 8th in the nation for # of people living below poverty level.

And it’s #5 in the nation for energy consumption per capita.

Add to that the tornadoes, drought, air pollution, and leather-skinned ladies with big hair who drive Escalades like tank gunners…and all this heah stuff from still other data sets…

http://shapleigh.org/system/reporting_document/file/255/Texas_on_the_Brink_2009_website_final.pdf

That’s a real garden spot for children alright. I mean, like, if you secretly hate your progeny and want to see them wander in the desert for 40 years till the whole Golden Calf generation is consumed.

This recession is going to leave profound changes to this country. I’m not positive on how all this is going to shake out, but states in dire trouble like CA are headed for probable collapse. My wife and I are in our mid-30’s, with 2 young kids, and live in NoCal. We collectively bring home 350k+ per year. I’d say we’re lucky, but we’ve worked hard, saved, and prepared ourselves to be in the situation we are today. With that said, we close on a house in Charlotte, NC next month. Cost is less than 1.5x yearly income. Equivalent house in the Bay Area would be in excess of 2.5mil. My wife and I are born and raised in California. I would estimate 75% of our friends and family (same income demographic) are seriously considering a move to a lower cost state.

DHB, I greatly appreciate the posts about Pasadena. From working and renting here for the past 5 years… the market still seems artificially high and is just very recently seeing much price correction.

The condo market is extremely soft and will continue to take a pounding. Most if not all of them charge outrageous $300+ monthly association fees (decreasing affordability). And not many of them will quality for FHA financing either (further decreasing the pool of buyers). Still a ways to go on the downside.

I’ve been following the Dr. now for about 3 years and I appreciate his take on things. I sometimes wonder why our gov’t or private enterprise hasn’t started up a housing tracker that would compile and anaylize data, i.e.distress status, house history, locational demographics, etc. with a premis based on the Dr.’s ideas? I beleive most of us know something is being hidden. I’m just surprised that it’s really disgised in plain site when it’s such a serious issue. Behind the scenes I’ve a feeling that individuals are working the system, such as it is, to make their next bundle while the average home buyer will never see the true market prices of these houses we would really like to buy. I think we, as a group are just another factor in some slick financial investors calculations.

Something else for the buyers of historic homes with big tax reductions – those benefits usually expire in 15 years. I’m not familiar with the Mills law, but in Oregon, taxes on historic designation places revert to normal taxes at the end of 15 years. There was an extension of that 15 year limit some time ago, but the property tax break will eventually expire. Imagine the surprise of the new owner when that happens!

Another thing to consider is, the caveat of many of these historic preservation tax relief laws is that the dwellings/structures on the property must be maintained and kept in their original state for the most part. Virtually impossible to get approval to tear down and rebuild, or add on, or even update/modernize. Especially in LA City’s HPOZ (Historic Preservation Overlay Zones) you can’t do a damn thing to change the exterior appearance/structure of a home that falls unto the HPOZ.

Have fun getting stuck with a 100 year old shitbox!

“Have fun getting stuck with a 100 year old shitbox!”

There’s always someone who wants that kind of house so they aren’t exactly “stuck” with them. It also shows in asking price that it’s old: Try to get even 10th of that area from a modern house and see what it costs.

I’d like to have one but I can’t afford those mansions. And, btw, 100 years isn’t even old, here in Europe we have thousands of castles from middle ages, those are more than 500 years old. And still used for housing. Not always very practical but on the other hand you have a lot of room and a house nobody else has.

So it’s all relative: I’d trade my modern house for a castle any day. Unfortunately I’d get a room or two from a castle with the price of the house.

1500-1600 square foot homes in central Santa Ana sold $170-200K in 1999. People bought them like hot cakes at $500-$550 up until 2006-2007. Needless to say the loan faker lost their plots and banks let the land lay fallow until cash buyers came in and snapped up some in the $300k range. Many of the said properties and gone from liveable to graffiti tagged overgrown eyesores. My guess is that the newly purchased and rehabed properties in this area will not produce the cash flows the investor/landloards had speculated on unless they are renting to several families per home at a time.

Like Dr. HB. I think that all home prices for properties outside of coastal OC and the exclusive enclaves for the Uber Rich will revert to the mean and then dip below it before an annual 3% a year recovery.

Please help out on this one. House bought for 685,000.00. Owe 590,000. Worth 400,000 Maybe and I do mean maybe. Stay or Walk ??? Does anyone think I would break even in 4 yrs ? Opinions would be greatly appreciated.

Break even? What the hell do you mean “break even in 4 years”? Do you mean “will it be worth the $590K I owe” or “will it be worth the $685K I paid” in 4 years? I say NO CHANCE IN HELL to either. Even if the dollar gets hyperinflated, it will probably be worth substantially less than the $400K you think it is worth today, in 4 years.

I shoiuld have been more clear..I know there is no way I will ever re-coup my money I just trying to figure out if I am dumping money into a black hole with no chance in hell of ever getting out from under this wet blanket…I was just trying to figure out how much more the prices are going to tank…Thanks for responding it is appreciated.

Hi Hill. No one can say for sure. On the one hand, market cycles have been the norm and just as there have been at least two I know about, there should be more. On the other hand we have leaders, in my opinion, who don’t know how to run CA or the country economically.

No one can say. I would say if you like the home and enjoy living there and feel you can live there for many years happily (minus the being underwater) and you can pay your mortgage…then stay. Otherwise, pick up and leave.

I bought property in 1995 when real estate was cryptonite and there was a 25% vacanc y rate in my city (Long Beach). That turned out to be a great time to buy and it has gone up substantially. Well, now real estate is cryptonite now…hard to tell if that means we are the bottom, destined to go up…or not.

Sorry, that is the best advice I can give. Good luck.

You are in the same situation exactly as a couple of friends of mine, who made substantial down payments, and in one case a lot of additional investment, in improvements and renovations, and are now underwater all the same.

Speaking only for myself, if I had invested nearly $100K in the down payment alone, and then, as a friend did, spent an additional $20K on improvements and $8000 for special condo assessments, I would be loathe to walk away from all that, especially if the place were in any sense unique, like a house or building with exceptional architecture or location that you waited for some time to become available. .. especially if I were having no trouble paying my mortgage. I’d certainly be hesitant to destroy a good credit rating if there were no need to, and I’d be careful about that, because as more foreclosures happen, credit is going to become even tighter than it is now.

If you’re thinking of your house as an investment, or something to “break even” with, you are probably in too big a hole for anyone to dig you out of, never mind commenters on a housing blog.

Sounds like you want an easy answer to a complicated situation your choices have led to. I don’t think here is the place to seek that.

Thank you for those who responded. It is greatly appreciated. Compass rose you are correct. I am in hole because of a choice…With no excuses I did not think the choice would turn out in this manner. But it is what is. The loss of a significant amount of earned income has placed me in this situation and provides few options. If I walk or stay.. it is not not a good situation with either decision..

Leave a Reply