You Can Kiss $2.84 Trillion in Housing Equity Goodbye: The Continued Decline in Real Estate.

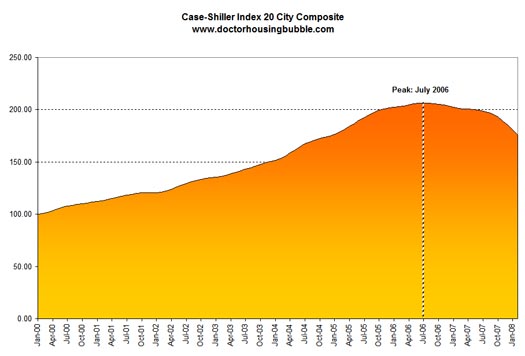

It is hard to wrap your mind around the size of the American housing market. Today’s Case-Shiller Index reported a further deterioration in the housing market. The difficulty in determining what real estate was valued at the absolute peak is somewhat hard to determine since many regions hit peaks at various different times. The one major thing that we can do however is take a look at the composite of the 20 cities used in the Case-Shiller Index and see when the peak was reached. Why use the Case-Shiller Index? It is generally seen as the most reliable source of price changes since it uses a repeat sales pricing technique. What we can then do to get a general estimate of the total housing value is use the Federal Flow of Funds Account and take a look at the value of homeowner equity near the peak, followed by looking at mortgage debt to get a general idea of the size of the United State residential real estate market. First let us look at the Case-Shiller chart:

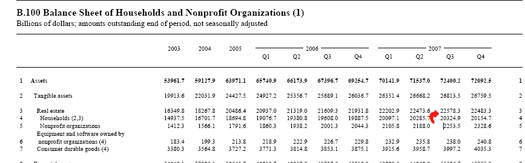

As you can see from the chart, the peak was reached in July of 2006 for the 20 composite index. The next step we’ll look at is from the Federal Flow of Funds Account which looks to show real estate peaking at least in value in the third quarter of 2007:

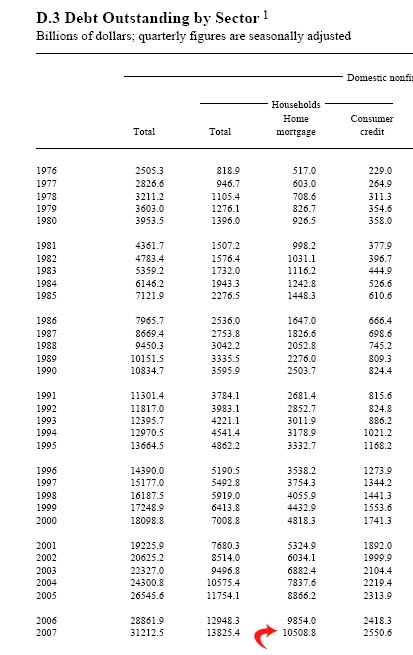

The next step of course will be to look at total mortgage debt during this time to see how much equity was flying around out there:

So let us use the $22.2 trillion of real estate wealth that was achieved in the first quarter of 2007. Next, we will subtract the total mortgage debt of $9.854 trillion that was reached by the end of 2006.

$22.2 trillion – $9.854 trillion = $12.346 trillion in equity (55 percent equity)

Of course we can trust these numbers only so far as we believe the Fed didn’t see a housing bubble but what else do we have to work off of? So let us now fast forward and use the same data but for the current environment:

$22.48 trillion – $10.5 trillion = $11.98 trillion in equity (53 percent equity)

Well of course, this is a load of crap assuming that only $366 billion was lost as of the end of the forth quarter in 2007. I rather we use our own measurement and apply the current Case-Shiller Index drop to the $22.4 trillion total real estate wealth which seems to be as accurate as we are ever going to get in trying to assess a bubble. The recent report with 20 cities has a 12.7 percent drop. Let us run this more realistic scenario:

$22.4 trillion x 12.7% = $2.84 trillion in equity gone

Of course, this should be the bigger story as opposed to folks going insane and begging for an 18-cent tax moratorium on gas. I’m starting to realize that a vast amount of people are financially penny wise and pound foolish. Let us run a quick calculation why the so-called gas tax moratorium is a bunch of crap. We’ll even assume you drive a massive gas guzzling H2 Hummer for the sake of argument:

“Forbes notes “H2 gets a paltry 13 mpg on the highway and 10 mpg in the city” Motortrend observed 12 mpg. Car and Driver observed 10 mpg. A reviewer at about.com got 8.6 mpg. Edmunds got 9.2 mpg. Four Wheeler magazine observed 10.8 mpg in their final long term report of an H2 SUT. Their worst tank was 7.2 mpg and best tank was 15.3 mpg, pretty high for an enormous SUV.”

Okay, we’ll say that the Hummer gets 11 mpg just to be generous here. So what is the grand plan?

“NEW YORK (CNNMoney.com) — Amid record gas prices and a faltering economy, Sen. John McCain called for suspending the federal gas tax Tuesday – a call that was met with skepticism from many experts.

In a wide ranging economic speech at Carnegie Mellon University in Pittsburgh, the presumptive Republican presidential nominee called for a hiatus in the 18.4 cent-a-gallon federal gas tax from Memorial Day until Labor Day – the period when vacationing Americans spend the most time on the road.

“The effect will be an immediate economic stimulus – taking a few dollars off the price of a tank of gas every time a family, a farmer, or trucker stops to fill up,” said McCain.”

“Most of the money is used to fund highway projects. Suspending the gas tax during the summer would leave a funding gap of about $10 billion.”

More deficits! Are these people really serious? Okay, from Memorial Day until Labor Day, we have roughly 4 months of driving. Let us assume you are typical and drive around 15,000 miles per year, which works out to be 1,250 miles per month. So over a 4 month period we’ll be driving our H2 for 5,000 miles. At 11 mpg let us run the numbers to see how much we’ll save:

6,000 miles / 11 mpg = 545 gallons needed

545 x 18.4 cents = $100.28 grand total saved!

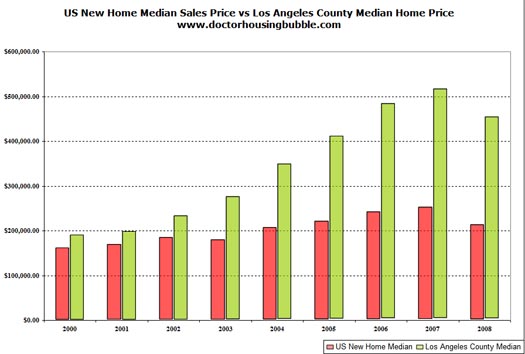

Bwahahaha! Holy crap we are so screwed. All this insanity over a freaking $100 bucks? And guess how much money the average American just lost in home equity? Let us take a look at the median new home price for the United States and the median price for a home in Los Angeles:

And the trend is heading lower. Instead of focusing on how in one year we have lost nearly $3 trillion in real estate equity (which of course it really wasn’t lost since it was all a mega bubble mirage) we are fighting over chump change with gas at the pump. I do believe that higher fuel costs do make their way into higher consumer inflation on goods and services but to argue about a moratorium on the tax and putting us into a further hole is flat out disturbing. But clearly math isn’t the forte of our California government either:

“April 29 (Bloomberg) — California’s deficit could reach as high as $20 billion, nearly one-fifth of the state’s budget, by July because of a slumping economy and required spending, Governor Arnold Schwarzenegger’s office said.

Schwarzenegger’s spokesman Aaron McLear says the gap could grow by $10 billion on top of $7.4 billion already expected for the fiscal year that begins July 1. The creation of a rainy day fund Schwarzenegger proposed in January would add another $2.8 billion to the gap.

The ballooning deficit comes amid release today of the S&P/Case-Shiller composite home-price index for January, covering 10 cities nationwide, which fell the most in its 21- year history and left California among the hardest-hit states. Schwarzenegger, a 60-year-old Republican, has touted the budget crisis in a push to get lawmakers to consider a constitutional amendment limiting future spending.”

Early in the year, it was $14.5 billion. Then it jumped to $16 billion. Now we’re at $20 billion? Talk about having no idea where money is going.

“Schwarzenegger in January proposed a budget with a 10 percent, across-the-board spending cut. McLear said the amount may grow. Schwarzenegger in February ordered state agencies to stop hiring and scrap new equipment purchases as part of a plan to save $100 million this year.

The Legislature on Feb. 15 passed a series of bills to eliminate $3.3 billion from the budget gap for the current fiscal year by cutting spending and deferring payments until next year. Also in February, the state sold $3 billion in deficit bonds to help close the gap this year.”

Now tell me, what other industries are going to start hiring to boost the so-called phantom housing bottom especially here in California? Never mind the astounding fact that according to the California Association of Realtors the median price statewide is now off by a stunning 30 percent.

It only logically follows that real estate declining will hurt a state that is utterly dependent and obsessed with all things real estate. My calculations above may be off by a few billion since the data itself is based on bubble prices and assessments but hey, I’m in good company with our Governator. As long as we come in near $3 trillion we’re doing okay based on government math.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

26 Responses to “You Can Kiss $2.84 Trillion in Housing Equity Goodbye: The Continued Decline in Real Estate.”

Please correct me if I am wrong, but……

1. Doesn’t the Case-Shiller Index measures the total value of ALL residential Real Estate?

2. Roughly 38% of U.S. Real Estate is owned free and clear – NO mortgage.

If you reperform the above calculations using Total Mortgage Debt against 62% of the value of U.S. Residential Real Estate, things get much much scarier.

Your thoughts would be appreciated…….

Lee

Dr. HB. Always a pleasure to read your analysis. By any chance have you written anything on what the effects will be if credit card and car loan defaults are added to the mortgage mess?

I came up with roughly $6 trillion in losses back in 07 using a 20% decline across all120m residences and average value of roughly $230k.

$2.8 Trillion/303m americans equals $9,200 paper losses per person. Helps to normalize it for the average person.

On the gas tax. Many Europeans lead happy and fulfilled lives with far higher gas taxes. Americans will adjust and thrive, it just takes time. We now have the longest commute times in the world. Are we winning yet?

Housing bubble gains were never real. Counting them is fun, but useless. It’s like counting the money you “lost” after you confirm the numbers on a losing Lottery ticket. Did I lose $1 or $1MILLION. I’m so confused.

It is amusing how those responsible for solving problems will quibble over details. Of course, there is no real solution. A price will be paid for allowing the economy to evolve into a freak show. We may have some control over how it’s paid, but pay it we will.

And of course your calculation assumes the price at the pump drops the full 18.4 cents, which I think is unlikely. The lower price will stimulate more demand, causing the price to come back up a bit…so the big winners would be the oil companies, most likely.

So I have a question…

So we have huge wave of foreclosures happening and coming, a record high of vacancies, and a rapidly decling housing price index. I get that… I understand that, but…

My first question is people have to live somewhere, correct? So if I read between the lines, and educated guess would be, that we massively overbuilt during the bubble. How much of an overbuild? or no overbuild at all, people are moving in together, or a little of both.

My second, question is assuming the people have to live somewhere? and assuming that banks will eventually have to unload properties to shore up the 10% reserve status, etc. So based on average rent etc… what would be the median home price (How far would it have to fall) before it made sense for a real estate investor who rents properties to start buying to get a 5 to 10% ROI.

Looking for ball park figures here, and methodology.

Governator’s platform has always been cut spending & reduce taxes, its what he has preached all along. Probelm is he has to FIGHT with legislature, and VOTERS to make that happen!! I am sickened the masses arent out-crying for the same nationally as well. REDUCE govt expenditures PLEASE!!!

Something I’ve wondered, as an ex-Floridian, did the Windstorm Insurance hikes resulting from the crazy 2005 hurricane season (Katrina, Wilma, etc.) cause the “first” domino to fall? When the premiums were sent out following that 2005 Hurricane season, there was much discussion of homeowners not being able to stay in their current houses due to insurance costs. It certainly accelerated my timetable to move away and sell my house (short sale 12/07).

Another great article doc; way to go.

It is really insane they way people perform this crazy dance in their heads, I really wonder what they think and even if they think.

So let me get this straight: the state of California and the country have become so dependent on driving that now – after sitting idly by and watching as the Fed does everything in its power (and some things outside its power) to drive the dollar lower and lower, and thereby making the cost of oil soar – the politicians want to fix the problem by what? Making gas cheaper by socializing the loss people are feeling at the pump.

Bought a Geo that gets 50 mpg? Too bad, you get to pay for this 10B shortfall we are going to create.

Take the bus to work? Tough, you too get to subsidize some jerk in a Hummer.

Is it just me or is the world really going crazy?

Matt: I sometimes think the people are too uneducated to even know what is going on. And I don’t *fully* understand it all either …. but … sheesh, the level of supidity in the proposals our politicians make …

–

You hear all these statistics that people don’t read books (you’d hope that if they won’t read books they at least find Dr HB’s blog :)).

–

Do people really think the education they received in grade school (or even that they received in college!) is enough and that they don’t have to learn anything anymore? Sigh – I don’t know anymore ….

You guys are maybe optimistic at $2.84 trillion…the LATimes blog has it at $6Trillion!

Ooops almost forgot the link:

http://latimesblogs.latimes.com/laland/2008/04/disappearing-no.html

-DaveP in Pittsburgh

Some good points. However, IMO you haven’t lost or made anything until you sell. So if people stopped obessing about phantom gains and losses we wouldn’t have this problem. All those gains in the bubble were phantom (unless you sold) and so are all these losses. If people stayed focused on the fundementals like wages etc, and stopped thinking their home was an ATM machine we would be on the right track

Gasoline prices are highly visible. What other product has its daily price posted alongside our highways? So naturally politicians like to posture with symbolic gestures, haul oil company executives before Congress to testify, propose punitive tax legislation and, in general, demogogue the issue. If gasoline prices are very visible, natural gas and coal prices are not but these have been soaring too. These two other fossil fuels account for about 2/3’s of American electric power generation. If you can’t afford to go out and drive much this summer you may not find it all that cheap to sit at home either if you need airconditioning. People may not ‘see’ natural gas and electricity prices posted alongside the road on their way to and from work but they are going to feel it when their utility bills arrive in the mail. $11 natural gas and $80-90/megawatt spring electricity prices

to not bode well for what could happen this summer. If I was the Governator I wouldn’t become so focused on the budget deficit that another electricity crunch

catches him by surprise. He only need remember what happened to Grey Davis to understand people can stomach high gas prices but not brownouts and $1000 per megawatt electricity prices!

The gas tax reprieve is ridiculous, do we really want to starve the pot of money for road and bridge repair? Do we really want to risk more bridges collapsing just to save less then $100 for the average person? I don’t mind paying my taxes if they are used well, so instead of cutting me a “break” by cutting the funding for something I want, why don’t we worry about something useful.

And on the topic of cutting, one easy way for the local and state governments to save money is really simple, turn off the street lamps! Oakland for example spends about $3million alone. And there isn’t much that says street lamps do anything more then make people feel good. They turn them off in Germany after 10 p.m. if I remember correctly. No point lighting everything up if most people are at home.

An excerpt from a report on crime and street lighting.

“The research presented here, which was carried out in the London

Borough of Wandsworth, deals with the criminological impact of some 3,500

brighter street lights. The timeframe for ‘before’ and ‘after’ comparison was a full

twelve months in each case, while the total database comprised over 100,000 crimes reported to the police.

The team from the University of Southampton who carried out this research

concluded that, as deployed on a broad scale, better street lighting has had little

or no effect on crime. In their words, “the dominant overall conclusion … was of

no significant changeâ€

I think the solution to many of our problems lies in thinking differently and not just assuming that what we are doing actually makes rational since.

RE:Street Lighting

Oh we did turn off the lights, and they have been turned off since around September, 2001!

Lets use the average car is really 24mpg. So we will just use 22 instead. So instead of saving $100 for 11 mpg. At 22 mile per gallon saving is $50. I can’t even fill my tank.

What they ought to do is double the tax and build more freeway to eliminate the wasted gasoline in gridlocks.

The only thing I know is that nothing will be solved with government action, including the price of gas!

IMO,

The US is ready for some drastic measures, and when I say drastic I mean drastic!

First, the United States needs to cut down on its consumption of Oil. This would have political, economic and environmental impacts, and would create massive change.

Here comes the crazy part, I would more then double the federal tax on Gas, Cigarettes and Booze. The fed tax on gas right now is 18 cents a gallon, I would raise it to .50 cents a gallon, and then in one year raise it .25 and every year after that raise it by .25. All proceeds over the .18 would go to paying down the federal deficit.

Secondly, I would drastically cut the federal budget anyway humanly possible, and cut corporate tax loop holes. All cuts, and extra money would go to paying down the federal deficit.

This probably would shake things up dramatically, cause unemployment, crush the GDP, etc..

After 4 years, walk away…

You’re also assuming the oil companies will let the stations sell for 18.4 cents less. That’ll get rounded off to 15 cents (if we’re lucky), and then the price will creep back up with an additional 18.4 cents profit!

Check out Exxon/Mobiles 1st quarter Profit Statement…

Once again a record profit in the billions…

With one gripe from Exxon… because of the high crude oil prices

it wasn’t very profitable to produce gasoline in it’s refineries…

so they cut back production. Which of course makes the Supply

go down and the demand go up…. and the price go up.

Exxon couldn’t take a loss in refining (which was only one small part

of their operation) therefore it cut back and got their profits anyway

from the higher prices it could charge claiming that the “supply” was low.

Cutting out the gas taxes this summer will not change the picture but

will lead to an even higher budget deficit. And don’t be fooled, not every

penny of those taxes are really used to fix our roads and bridges.

Alot of it goes for who knows what… 18.7 cents per gallon of gasoline sold

in the United States is a huge amount of money – those roads would have to be

gold plated by now. (Add to it your DMV fees, registration, etc…

And to tell us that we should be using the Bus to get to work…l

I have news for you… unless you live downtown Sacto. most of our cities

don’t even have sidewalks to walk on. Most European countries have

a public transportation system that puts you anywhere in town with a bus

running every 10 minutes from bus stops that you can reach on foot within

10 minutes (and yes, you will be walking on a regular maintained sidewalk)

even in very small communities. Matter of fact most European’s don’t need

a car to get to work. (Trust me, I grew up over there… I could make it to work

within less than 30 minutes using a bus that took me to the Tram station and the trains were running every 10 minutes… We don’t even have school busses because our (european) public transportation system is so advanced that all school children can make it to school on time even when they live 15 to 20 miles away from their school.

Our american public transportation system is literally non-existent when compared to European standards and this makes us so vulnerable. Most of us simply can’t leave the car parked and take the bus. So to demand from us to cut back on driving is ridiculous. We still need to get to work. There are people that drive hours every day just to commute to work. There is no alternative…

we may be able to cut out the vacation traveling but we need to get to the store

and we need to get our kids to school and we need to get to work! And we can’t do it on foot!!! I have to be at work by 6 a.m. … guess what , the nearest bus station is 3 miles from my house, the busses don’t start running until 8 a.m. and the 11 mile trip to where I need to be would take in average 2 1/2 hours because

the bus doesn’t just go there straight but has numerous other places to visit first.

This situation is so frightening… we can’t function on any alternative right

now. The goods have to be delivered to the stores by Truck and people

need to get to work to make a living.

We don’t need to feel threatened by terrorist attacks – just mess with our fuel supply and watch what happens…

Reena

Reena,

you are right on. We have absolutely BLOWN our public transit in most cases. I would not be opposed to using PT at all for lots of stuff like airport transit. I travel 20 to 30 weeks/year and just getting to the airport in LA is a mess. We have a train (green line?) that when I first heard was going to run from ‘near’ OC to LAX. unfortunately instead of going directly to lax, it veers to El Segundo where you have to schlep bags to a shuttle bus to the airport. I realize that there are factors that I am unaware of as to WHY this was designed this way, but pretty much everyone I know avoids using this because of this pain/hassle alone. So we drive to the airport, creating more congestion, using more fuel wasting more money, resources etc. Ifwe build a solid, CONVENIENT transit system, we will use it.

Reena:

Are you bitter that you haven’t purchased any stock in oil companies, hence havent shared in the profits?

Go back to Europe if its so great.

missedthebubble :

Great ideas, lets increase taxes on things that will be paid by poor people. Your a genius. Don’t tell me, lets also cut capital gains taxes. Everybody knows that the rich don’t have enough money to re-invest.

How about debtors prisons? We can use the people imprisoned to create low cost goods for export. Man once I get started I can come up with all kinds of good ideas. I know, we can wall of inner cities and force them off of welfare and then bus them to the suburbs to work menial labor jobs. Oh, we already did that.

The crisis we are facing is because nobody listened to Jimmy Carter in 1980. He had solid ideas on reducing oil dependency, remember (55 mph speed limit) and the Great U.S. elected a ponzi scheme fool instead. Trickle down my leg economics and Free-Trade are the problems.

Ronald Ponzi Reagan.”Hey lets increase spending and decrease taxes” sounds like a ponzi scheme to me. The chickens are coming home roost.

Very funny “surfaddict” – I run a gas station.

No I am not bitter for not owning any stock in ExxonMobil, etc.

I have only been here since 1986… just a very spoiled european

kid that was taught that the world is one’s playground.

And so I decided to play for a while.

I love California and settled here around 1989.

Born “workaholic” and there is no place like “America” to

make a workaholic feel at home.

Reena 🙂

Let’s all hold our breath until US Congress and State legislatures reduce spending… How I wish.

Reena, I’m pretty sure you haven’t looked at the profits made on gasoline sales by the federal government during that same time period. You should befour you whack the oil companies; what if they stop producing, will that make your life better?

Leave a Reply