A mortgage with every college graduation – Student debt to stifle home buying prospects of younger Americans – In 2000 student debt made up 2 percent of all household debt. Today student debt is up to 7 percent of all household debt and growing.

In order to have a healthy housing market you need to have a steady employment base and also a low level of distressed properties. Both of these prerequisites unfortunately are not applicable to the current economy. One albatross of future buyers is the now increasing burden of student loan debt. While virtually every other debt sector has contracted since the recession hit student loan debt is the only segment that has increased dramatically. It is understandable since many unemployed and the steady stream of high school graduates are still demanding a college education. What is incredible is the amount of debt students are taking on. Most are coming out with the debt of a brand new car while many others, are exiting school with what amounts to a mortgage with no home. Just look at the data; in 2000 student loan debt was roughly 2 percent of all household debt. Today student loan debt makes up over 7 percent of total household debt. Many future buyers are going to have their purchasing power curtailed by the amount of debt they are carrying with student loans.

What long-term impact will rising tuition have on other sectors like housing?

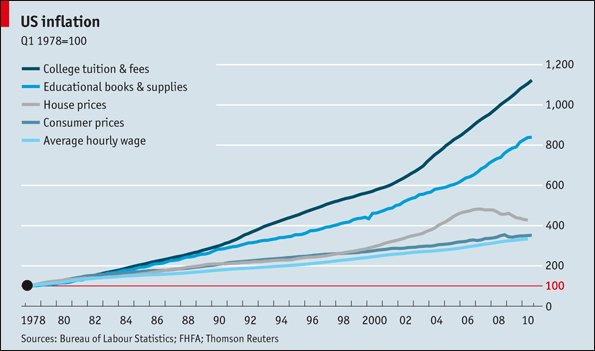

We’ve covered the housing bubble extensively on this site and the underlying argument has always been that home prices increased because of a mania produced by an economic bubble. Incomes never justified housing values and so we are here with the repercussions of a bubble bursting and with 6 million distressed properties still waiting on the sidelines five years after the music stopped playing. Yet as out of touch with reality that home prices became with household incomes student tuition saw an even more astronomical bubble:

Since 1978 home prices tracked the general rate of inflation until the late 1990s. At that point you can see the housing bubble emerge. But look at fees associated with college. This is where the next bubble exists and with nearly $1 trillion in outstanding student loans, this will put a clamp on how much future buyers can afford when purchasing other items like automobiles and more importantly homes.

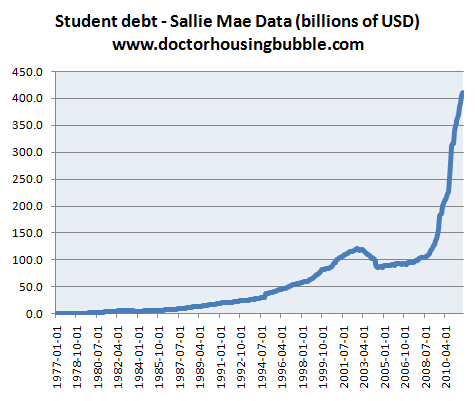

The Federal Reserve now publishes data for student debt from Sallie Mae. This is only one component of the student debt market but nonetheless the chart is incredible:

Source:Â Federal Reserve

This is not a healthy trend. More importantly the long-term impacts of student debt are only now starting to filter down into the overall economy. You think a recent graduate with an entry level job and $100,000 in debt is going to buy a home? A decade ago this scenario was rare with 2 percent of all household debt being in the form of student loans. Today it is over 7 percent and this debt is largely held by a group of potential future home buyers, not current owners.

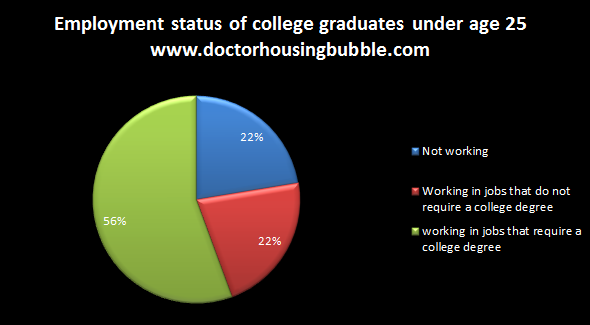

Recent data shows that many graduates are working in fields that don’t even require their college degree:

Source:Â John J. Heldrich Center for Workforce Development at Rutgers University

The good news for recent graduates is that 56 percent are working in fields that require a college degree. The bad news is that 22 percent are not working while another 22 percent are working in fields that don’t require a college degree. With this group, you probably have many that simply accepted whatever job they were able to find in this ongoing recession. The above data is for the class of 2010 and I’m sure we are going to get more information soon on the class of 2011.

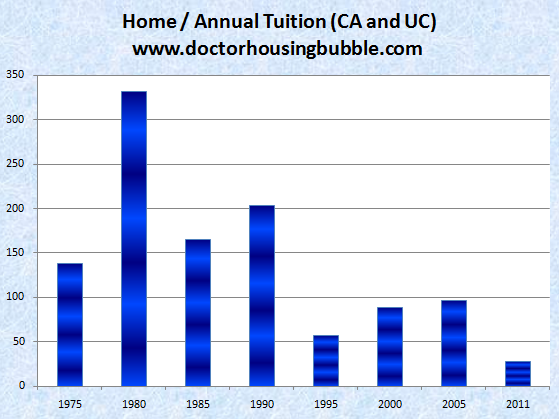

Home prices versus college costs

In relation to a public education even here in California, the cost of higher education has become more expensive in relation to home prices:

“The cost of an UC degree was cheapest in 1980 in relation to housing prices. For example, for the cost of the median home in California in 1980 you would have been able to purchase over 330 years of education at the UC. Today the cost of a median priced California home will only get you 22 years of college education.â€

In other words, even measured against another bubble asset category in housing the cost of higher education is in a deeper bubble. None of this has kept people from enrolling and much of the growth has occurred with for-profit institutions but public and private institutions have also been increasing their fees:

Source:Â Â Pope Center

The patterns seem extremely similar to the housing bubble with certain segments taking up the roll of subprime lenders and the entire industry getting excited by easy finance and an unrelenting line of demand. The only problem of courses is the debt is being backed by the U.S. government (i.e., taxpayers) and we all know what happens when the bubble pops.

You then have many thinking that graduate school is the answer and going deeper into debt:

“(Bloomberg) Gerrald Ellis, 28, took about $160,000 in federal loans to attend Fordham Law School, and then spent a year searching for a job. He eventually found work at a four-lawyer firm in White Plains, New York, doing consumer protection work.

Because his student debt is so high compared to his salary, Ellis said he expects to qualify for a plan that would let him pay 15 percent of his salary for 25 years, and whatever debt is left after that is forgiven.

“I’m trapped for at least two decades,†said Ellis, who lives in Harlem with a classmate who also borrowed more than $100,000. “The debt has an impact on everything, where I decide to live, what job I take. I can’t even imagine having kids with this kind of debt burden. Multiply that by a whole generation.â€

Or what about this case:

“Laura Sayer, unsure of what she wanted to do after graduating from college in 2006, figured a master’s degree was “a safe bet.â€

With $5,000 in undergraduate loans from her time at the University of Cincinnati, Sayer was set back $50,000 more after completing the Interdisciplinary Master’s Program in Humanities and Social Thought at New York University. The 27-year-old now makes about $45,000 a year as an administrative assistant for a nonprofit group, a job that didn’t require her advanced degree.â€

A large part of this growth has come from the government working with banks to back up these loans:

“After a change in federal law in 2006, graduate students became eligible to borrow federally backed loans that covered the full cost to complete their degrees, while undergraduates are limited to $27,000 over four years, according to Kantrowitz.

The number of students enrolled in graduate schools, excluding law and medicine, totaled 1.7 million last year, a 33 percent jump from 2000, according to data from the Council of Graduate Schools, which represents more than 500 universities.â€

Do you notice a pattern here? The combination of banks and our government seems to produce bubbles that sprout up like weeds in a garden. Only difference is there will be no investors to purchase distressed college degrees.

Tying it together with housing

Today more of the high paying jobs however do require a college degree. Growth industries like engineering, health care, computer science, and applied sciences require four year degrees. The problem comes when you have many entering for-profits and coming out with tremendous debt but very little job prospects. With student debt not being discharged in bankruptcy, you lock in millions of potential future buyers from buying a home. First, the debt burden is high and second you have a more reluctant group of people that may develop risk aversion.

Banks are no longer lending money out like candy during Halloween so income is important and debt-to-income ratios are now part of the lending lexicon. Given that the student debt bubble keeps on growing and good paying jobs are yet to be found in mass, the justification for higher home prices seems to be a wishful fantasy. The shadow inventory is still immense and the reality that home prices are making post-bubble lows is a reflection of this confluence of forces. People are doubling up, don’t qualify even for FHA insured loans, demand is muted even with artificially low rates, and are simply burdened by weak household wage growth. Certainly the millions who have moved back home because of the recession are putting a plug into the future buying pool and hierarchy of the old buying process:

-Go off to school

-Rent once you graduate

-Find a partner and purchase a home

-Build equity and move up

This has been the pattern for decades but this entire ecosystem of buying is no longer applicable. Not at least in this current climate with distressed properties being the bulk of sales and home prices moving lower.

With every incentive in the world being thrown at home buying little can be done without a healthy economic jobs machine. Those that understood this were able to see through the housing bubble rhetoric. I wonder how many can understand this argument with the student debt machine going at full speed today and the future implications on other segments of the economy including housing.

Have any stories about student debt and housing?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “A mortgage with every college graduation – Student debt to stifle home buying prospects of younger Americans – In 2000 student debt made up 2 percent of all household debt. Today student debt is up to 7 percent of all household debt and growing.”

I wonder if the housing ATM that was going on during the early 2000s caused rich-feeling parents to bid up the cost of education. The HELOCs felt like free money, so they could “afford” to send their kids to any school at any cost.

In the initial phases, perhaps that simultaneously bid up education prices, while keeping the (education) loan balances low. Then, when the housing ATM broke in the late 2000s, the desire to go to school had to be financed by college loans directly (rather than the housing ATM).

Could that be one of the reasons the college loans jumped 4x in just a few years?

Sounds good to me. I’ve always thought that the education industry benefitted greatly from the housing bubble, as billions were extracted from accepted home values using HELOCs to fund thousands of new libraries and student centers and a sabbatical every five years for the tenured.

Student loan availability increased education demand in a very unsustainable way! As the Feds were throwing money out the door, all sorts of people were getting loans that should not have. Many of the largest loans were given to those pursuing low value degrees! We don’t even hear about the millions of students that owe but didn’t receive a degree. Thats why they had to pass the indenture servitude laws to insure that those loans would be paid. Don’t have to read history any more, it’s happening right here right now!!

Denninger also posts about the unsustainable student loan debt. He hit the same article:

Wake Up And Smell The Espresso (Education)

…the financial industry bribed, cajoled and scammed its way into turning that debt into something that Laura could not discharge in bankruptcy. As such there was no risk for the lender in making the loan and they didn’t give a damn that there was no reasonable expectation that Laura would find a job that paid at least $10,000 a year more with her Masters than she had before it — a job that in addition would actually require the Masters to obtain.

The situation is much more dire than this. Many middle class and upper middle class parents are paying and borrowing for these ultracost college degrees and taking out, still, first and second mortgages (note the refi boomlet still going on, that’s where some of the money goes). Their own later life financial security is knocked down and this is part of the reason total middle class net worth has plummeted.

Note that of the places that, as the article says, have jobs, namely health care and so forth, every single one gets government support and overspending; any reigning in of these costs by governments will put an end to those jobs pronto, even IT jobs. The bubble starts and ends with government overspending its income; note the layoffs the states have made, as they aren’t supposed to do unbalanced budgets (they do have unbalanced budgets, but that has lead to a doubling of muni bond debt in ten years, if no one noticed). We are no where near out of trouble and the leadership nationwide has been zero to even begin to fix the systemic problems. “Tax the rich” won’t do it either: either the rich change their behavior or cheat to cut that tax down, or the overspending doesn’t stop anyway. NOW let me see the students graduate to jobs and pay down debt with utterly no jobs even in these touted employment areas, it will be like Greece or Spain, huge jobless among those under 30 and still massive deficit spending. If we balance the US budget tomorrow all by cuts, about ten million jobs would end, perhaps fifteen million. Balancing it by all tax, leads also to cuts of five to ten million jobs as the disposable income plummets.

Most student loans are GSL’s. You can’t get these dismissed like a mortgage. You’ve got to pay them off. Ouch.

“Most student loans are GSL’s. You can’t get these dismissed like a mortgage.”

Why do we think Obama took over the student loan program from the private sector?

So he could lend more to stupid kids and have the taxpayers pay for it all?

I know a guy who can be counted on to fall for almost every gimmick out there. He’s managed to accumulate something like 200K in student debt and has no job. Strangely enough, he’s otherwise very smart. I think he’s just very optimistic and assumes things will turn out OK. Hey, after all, this is America!

A smart sucker is still a sucker?

Intelligence and wisdom are two entirely separate qualities. People tend to accumulate wisdom from experience as they age. Some learn quicker than others, and with less pain being applied, but older people tend to be a bit more conservative. The reason is experience leading to wisdom. As time passes the chances increase that at some point, no matter how lucky or fortunate you are, you’ve been kicked in the sack hard and likely you want to avoid that experience if possible. Some can learn with a slight graze, others need repeated applications. All eventually learn from life’s stick.

There are many different forms of intelligence. Your friend is obviously lacking in some of those forms.

A large part of the reason college tuition has gone up so much is because all large and most medium-sized 4-year universities have become primarily research institutions. The second side of the coin is that the great majority of that research was paid for by the Federal and State governments, but is now mostly funded through tuition payments.

This is not a terrible thing if we assume that much of that research will result in new technology and future economic growth. My current position puts me fairly close to the engineering and science side of all that research. I can tell you this…nearly half of it is geared toward cleaning up environmental toxins from soil, streams, and groundwater. You wouldn’t believe how many are out there and how high some of those concentrations have gotten.

The sciences are the way to go for the future, this coming from a graphic artist! Those who understand molecules and can develop ways of fixing the planet, not just the ground issues you spoke of but manipulating the atmosphere, breaking down waste, cleaning and repairing the oceans. All of us will eventually side with the planet, since we can’t buy another one. Most of these loans are sadly for degrees that no longer hold relevance. I don’t know what the solution is but going to grad school is and has been a waste of money even since I was in school a decade ago. Sadly my husband parents had to die for us to end up with a paid off house, otherwise we would be the poster children for this lost generation of home buyers.

Is the planet broken? Can humans fix it? Are humans the “problem”? Not everyone smokes that stuff. I believe Mother nature is stronger than us. If we don’t kill each other first, some disease will, or old-age > which isnt very old compared to our planets life. Nature is very similar to the market. It strives for equilibrium, in spite of dumb human intervention.

Hopefully this doesn’t really need to be explained, but once more for posterity so that the alien archeologists will know that we did get it before the end: We won’t make the Earth uninhabitable. There have been worse things that triggered mass die offs at the end of most major ages and life will eventually rebound after a few hundred millennia. We will merely make the Earth uninhabitable for 6 billion humans. So rest assured that life will continue, just not probably your life.

Have a nice day.

I work at one of the largest research universities in America and I can tell you that tuition is NOT being used to fund research.

It is being used to fund the creation of a vast bureaucracy of do-nothings and know-nothings however, faux administrators whose numbers are legion and whose compensation is often better than most professors.

Also the state governments are cutting their direct support to their public universities. At this point calling such and such a school a state university means very little. They’re only getting a small amount of funding from the state, about 15% last time I heard, though I’m sure it depends on the state.

Also the costs of attending non-research universities have also gone up and are generally equal to that of other universities.

The higher education market was profoundly distorted when the federal government made it so easy to take on student loan debt. The artificial supply of money for school meant that the prices went up. If everyone has a million dollars, then a million dollars isn’t worth much. If everyone has 50,000 for school, then 50,000 won’t get you very far.

Nowhere is this more evident than in the insane prices for textbooks and other materials, which have gone up at almost the same rate as tuition. If devotion to research were the culprit, that $20 textbook wouldn’t cost $165.

The biggest problem is not the ever-increasing price of a degree, but the way in which colleges and universities are watering down their curriculum to accommodate students who in years past would never have attended college. Used to be that going to college meant you were bright and knowledgeable. Today there are entire degree programs, particularly in the humanities, for students who come to college but aren’t expected to learn much. They spend 4 or 5 years here and leave with a liberal arts degree of some sort, often in something that until a few years ago didn’t even exist as a supposed field of study. Employers have gotten wise to this and have stopped hiring them into real positions, which is why some of them are camped out among the Occupy idiots whining about how their imaginary studies degree didn’t qualify them for a career.

This is why I firmly believe that student loans should vary with the degree program and to that student’s projected future income. The schools themselves should also be on the hook for some of that money, essentially as a co-signer. When a school is betting its own money that its graduates will find gainful employments, the practice of graduating people with nonsense degrees will come to an end.

I agree and I’m one of the crazy people that got a “nonsense” degree (Film Tv Studies Major). BUT with a little luck, hard work and some innate skills. I established a career in the film industry and am very happy.

College for me was more of a social awakening… I was an introverted high school student addicted to video games who rarely did much else. College at least introduced me to a world and new paths in my life I might not have found otherwise. Is that experience worth $50K ? Who knows… the debt is long paid off and I’m making more than twice that a year doing something i enjoy.

If my future child were in the same position as me.. I’m not sure what advice I’d give him. I’ll probably make the mistake of pushing him into being a doctor or engineer instead.. unlike my parents who supported whatever I chose to do. I do believe in doing what your good at or enjoy… or are passionate about. Success will usually follow…

@ OC Surfer. So many profound off-topic questions and statements! Let’s take them one by one!

Q. Is the planet broken?

A. You mean is there a crack that’s going to split it in half? Of course not, rhetorical OC Surfer. But there are 6 billion omnivores whoring for more and more of earth’s finite resources every day. And, there are 1 billion more coming every 12 years or sooner. And natural habitat and non surfing animal species are declining at a rate never before seen outside of natural cataclysmic events. And the climate is warming due to man’s activities. But not to worry, says OC surfer!

Q. Can humans fix it?

A. Can humans fix human exponential proliferation and racacious resource consumption? Of course not, OC surfer! We’re only human (all 6 billion of us and ramping)!

Q. Are humans the “problem�

A. No, OC surfer, just the Obama human.

Statement: Not everyone smokes that stuff.

Observation: haha!

Statement: I believe Mother nature is stronger than us.

Observation: BRILLIANT!

Statement: If we don’t kill each other first, some disease will, or old-age > which isnt very old compared to our planets life. Nature is very similar to the market. It strives for equilibrium, in spite of dumb human intervention.

Observation: This one speaks for itself

Hi, Lee. I appreciate your response. I am also with a very large research university; one of the ten largest universities overall in the United States.

You can make a case that tuition doesn’t go to research, but it doesn’t take very much scraping to get beneath that paint, at least at mine. One example–new professors are given “seed money” to construct a lab, with that seed money amounting well into the six figure range. There are several buildings built and under construction now that are designated solely for research. The grants acquired for research do virtually nothing to defray the costs of construction and maintenance. It all amounts to billions over the life of those programs. Billions.

On the wastage of money by administration, I agree, because that is the nature of large organizations. I’ve worked for several large corporations and they definitely have a logic of their own as well. Anybody who thinks large, for-profit companies are fundamentally different from government agencies just needs to go work for one a little while.

As for humanities degrees being abused by the university as pass-throughs for poorly educated people, trust me, it’s no different in the sciences or engineering. I can’t even begin to count all the know-nothings I’ve seen pass classes with curves so steep a 40% is an A-grade. It’s ridiculous. Students either need to know the material or they don’t. I’ve seen courses at the 400-level where students who hadn’t even mastered basic grammar, 6th-grade stuff, were passed along. Abuse of the system is rampant, and let’s be serious–every department is urged by the office of the university president to increase enrollment and to pass students.

You’re also correct that the university is not accountable for money lost to bad student loans. In fact, there is no accountability for the university beyond the first year. There is an entire wing of the financial aid office of undergraduate students calling already delinquent new grads, reminding them to make their loan payments. Once the accountability window closes, the calls stop.

As a society we are in denial about the real costs of education and the real costs of uneducation. Educating children starts at age three, and for people going into fields like medicine or advanced physics, doesn’t end until thirty-three. As a society, we have decided that we are not willing to pay for it. We will get what we have paid for.

I was shocked to learn recently that Social Security income can be garnished to pay for these loans. And, it sure looks like that will happen, if some 30 year olds are walking around with 200000 debt and lousy job prospects.

Can estates be hit for payment of these loans? In other words, will some people pay off these loans after they’re dead? (if there is anything left)

Yes, the holders of student loans, like any other creditor, can be repaid out of the estate. Heirs, however, cannot be pursued for payment of the deceased’s debts.

As Myth Buster pointed out, yes, student loan lenders will ultimately go after the debtors’ estates. However, creditors seeking payment of debts from an estate are ranked similarly to creditors in bankruptcy proceedings. Student loan companies will have to stand in line behind the estate attorney, the gov’t, a mortgage company (if the debtor owns a house) and possibly other higher-ranked creditors. *If* there is anything left after those creditors are paid, then they’ll fight over those scraps.

That said, it is likely most of these people will die indigent; even an attorney will end up doing the estate for no cost, as part of their local Bar Association’s requirement for pro bono work. (I once worked for an attorney who did the estate of a homeless drug addict who had died of AIDS; this is why he ended up with the case. There wasn’t even enough $$ to cremate this guy.) Then the creditors end up writing off the debt, because the heirs cannot be held responsible unless they are co-signers to the loans.

the old buying process:

-Go off to school

-Rent once you graduate

-Find a partner and purchase a home

-Build equity and move up

The New Process

-Graduate from college

-Move back home with parents (perhaps never moved out).

-Refuse any job that involves relocation, can’t leave friends or deal with snow, heat, rain.

-Land $10 job close to home, redecorate childhood bedroom for long term residency.

Actually, the reality is “refuse any job that requires relocation because it costs A LOT of money to move, the applicant doesn’t even have enough money to move down the street, let alone hundreds or thousands of miles away, and almost no employers pay for relocation these days.”

I really love the “just move” people, who act like moving cross-country is easy and cheap. I can tell they’ve never actually gone through such a move themselves, OR they did it while in the military (where the military took care of everything) OR they did it when they were children and were therefore not involved in the process other than helping Mom and Dad pack a few boxes.

In addition, I know more than a few people who maxed out all of their credit cards and/or drained their savings to move hundreds or thousands of miles away for a job…only to be laid off six months later. Then they are stuck in a city where they know *no one,* have *zero* job contacts, have *zero* support network (by “support,” I’m not just talking financially)…and have no money or credit to move back home, because they spent it all on the initial move and didn’t even have time to earn it back before they were laid off.

Actually, our family has done the cross country move multiple times. Used UBF, cost around $1200 for a 1600 mile move, family of four, packed/unpacked the van ourselves. Is it better to stay in an area with poor FT job prospects and high cost of living?

Recent college grads don’t have houses full of furniture…a U-Haul would suffice, however that involves going out of a comfort zone, most seem to have a tough time w/ change.

Some stories from recent grads I know…one offered a 3 month paid internship in a tough to get into, lucrative field…internship was in South Dakota, likely would have led to FT position. He turned it down because of weather, now works as a cashier, living w/parents. Another recent grad with degree in History; no job prospects, is going for Masters Degree, applying for more student loans. Another rejected FT job in his field of study because position was seventy miles away; he didn’t want to leave the beach close neighborhood he grew up in. He’s still unemployed, lives with GF who pays the bills. Another recently took state exams for his profession…says future job prospects in CA are terrible, but he would prefer to continue working his job in a stockroom indefinitely than apply for jobs that would use his college degree if the job involved relocating out of LA.

Perhaps my observations are unique, and LA is truly filled with 20 somethings making $100K+ a year, living with parents, feverishly saving up for that California starter home.

Yes Nightcrawler moving can be expensive. I want to hear the rest of the story though. The story about the more than a few who relocated for jobs and ended up in a strange town jobless and broke.

The few who called home to ask for another $500 only to be told that the folks had lent you the last $500 they had ? What the hell did the more than a few do then ? Did they lay down and die ?

I know these more than a few are most likely here with us today. So it is proven that you can relocate with nothing.

One factor is that jobs are so unstable, and the treatment of non-executive employees in the corporate world so demeaning, and advancement so difficult to come by now, that a job is no longer worth upending your life for.

It’s one thing to move to Social Siberia to land a “dream job”, or even an entry-level job with a good probability of turning into a semi-enjoyable, good career as in the old days. It’s another to relocate and find yourself toiling in a micromanaged, soul-crushing corporate environment, for a good probability of being laid off or stagnating indefinitely in a menial position with no growth path, in a place where you have no social support network.

If any job you can get will suck, why give up your support structure, your social life and the comforts of your hometown to get it?

“Interdisciplinary Master’s Program in Humanities and Social Thought at New York University.”

The mere possession of such a degree hurts her job prospects. Education is supposed to show that you are intelligent and knowledgeable. A degree like that shows the opposite.

I suspect that there are jobs she would have gotten that were given to others because those doing the hiring were troubled by her choice of masters degree.

A degree in Nothing is worth less than nothing because people question why you didn’t get a degree in Something.

The key difference between the housing bubble and credential bubble is that a house isn’t just debt, but where someone lives. Stuck in a house that they cannot sell in an economically devastated area, people drown. Being up to your eyeballs in student loan debt does not generally prevent someone from moving to greener pastures. They drag that debt behind them like a ball and chain, but it does not force them to live in a particular place.

Another key difference is that real estate doesn’t go away. No matter what happens in the market, the asset doesn’t just evaporate. A worthless degree is an abstraction. It is tied to the person who possesses it. If my neighbor has a worthless degree, it does not drag down the value of my worthwhile degree. If anything it makes mine more valuable by removing competition from the labor market. Meanwhile a house next door whose value plummets means my house is now worth less.

We are now going to see a drop in kids turning 18 for the next decade, this should help to keep the pressure off of tuition hikes as demand slows.

They are going after the folks with Bachelor’s Degrees, who are already currently working. They delude you into getting an additional degree – usually an MBA – so you can earn the bucko bucks. I went to college well over a decade ago when it was (compared to today) a bargain. Now everyone’s (peers) telling me that I should get yet another degree.

Thank you again, DHB, for reminding us not only how we arrived at this point in time, but where it appears we are going. I feel like I have been watching a grade B horror movie that has gone on way too long. What is the next plot point? Are we going to continue to languish slowly, watching from the sidelines as home prices slowly melt down the like the Wicked Witch from the East? Or is there going to be some dramatic car crash scene where it will all be over and done with? The suspense is killing me.

It’s the wicked witch of the west, actually… 🙂

Yes, but in our story it is the wicked wizards of Washington and Wall St.

From CNBC, the NAR has admitted to overstating existing home sales for 5 YEARS !

http://www.cnbc.com/id/45659547

Yes, the warlocks of the east…

No worries. They are moving back home. Say goodby to the entitlement attitude. Now if they bust their buns and kick in to pay off the mortgages, the system works, the extended family is restored, and they might get the home in 30 years.

It gets somewhat overlooked that endowment dollars are coveted dumb money for the shadow banking industry. The input into the ponzi is the college tuition dollars to the non-profit institution such as Harvard. The boards of all of the schools are populated with finance professionals so the tuition dollars go to the endowment where they are then invested in various hedge fund and private equity investments where 2 and 20 are siphoned off by recent graduates of the business schools. And the people at the endowments beseach the finance professionals on the boards to demand more tuition so they can funnel more money to the hedge funds and private equity partnerships where the endowment workers will go on to make their real money before becoming board members of the non-profit colleges.

So the kid that comes out of the liberal arts not for profit school with $150k in debt will be paying student loans monthly and may be living in an apartment and paying monthly rent to a joint-venture partnership funded by a hedge fund whose money is from the endowment of the liberal arts school . . . in essence the kid is then paying rent to his alma mater. And why are these schemes not for profit?

In classic misdirection, the media points to the teachers and the tenured. What about the bloated administration who don’t even teach? Why all the buildings going up instead of tuition decreases (see finance professionals on the boards – schools partner with finance/developers to get these projects done)? What about the huge endowments? Why doesn’t anyone audit the investments in the shadow banking industry?

Why doesn’t anyone question why tuition goes up when schools have such large endowments taking risky bets in financial markets and serving as incestuous honey troves for the finance/real estate sector?

Don’t blame the professor making 150k w/tenure – at least he teaches, maybe it’s a useless subject, but at least he furthers the true purpose of the university. Blame those that do nothing but control everything.

You are absolutely correct. Take a look below and see how a real “financial wizzard” works. Of course, he was of Obama’s first hires… Now he is back screwing up Harvard, again.

http://blogs.reuters.com/felix-salmon/2009/11/29/how-larry-summers-lost-harvard-18-billion/

Yes, the home meltdown will continue until inventory vs. wages balances out. This could take 10-20 years folks. No college degree is going to ensure that you get hired – especially when many of the degrees don’t offer much – liberal arts for example, film production for example, I could keep naming them. Many of these degreed people don’t know what its like to work a full day or work overtime….judging from the 20 and 30-sometimes I work with, we are going to be in the long haul for staffing people who WILL work. Unfortunately if you drank the Kool-aid and went into debt on the promise of future earnings, the game has now changed and you are stuck as badly as if you bought a house on the high side of the market and its now worth 40% less.

It’s quite a show: http://www.archive.org/details/TheBrotherhoodOfTheBell

Most college student I know couldn’t care less about home ownership. Who wants to be tied down when they are so young?

#OWS

*that should read “students.”

They’ll want to when they hit 30. And they still won’t be able to.

Ironically, when this mess corrects, it might be the (more or less) legit colleges and universities that get hit the hardest. The fly-by-night, for profit places can just turn off a couple of computer servers at crunch time.

But what about all the public and private universities? These places have a lot of fixed costs that aren’t going to go away, just because enrollment drops. For one thing, half the faculty is tenured, and they can’t be fired unless they commit some really heinous act.

Another point, which is somewhat related to the posts on research, is the huge number of buildings that have been built or are under construction. These will have to be maintained, whether there is any teaching or research going on inside.

Also, to echo some other posters, eventually the federal budget will do one of two things. The size of the deficit, which has held fairly stable in the $1.4 trillion range for four years now, will eventually contract, heading towards a balanced budget. Odds of that are one in 20. College enrollment, as well as university employment both contract quickly in this scenario.

More likely, they keep spending, with the deficit financed by money printing, the dollar loses its buying power, and tuition gets so expensive only the top 1% can afford a private college. In this scenario, student debt actually increases for a brief period, but gets so absurdly high that an ’emperor has no clothes’ situation manifests itself, and enrollment drops even faster than the other scenario.

I also believe that student loans going forward should depend on the degree being taken… We should subsidize those going into Engineering/Scientific degrees…

Look at the big picture.. What does a current society need most of…. Then subsidize that… Every year assess what is good for our society as a whole and subsidize it.

You won’t see many students going to school for liberal arts if you have to pay twice as much for that degree than an engineering degree.

Those who pursued degrees in engineering and science over the past twenty years ended up in finance. You want to finance more of that?

No, no. You aren’t going to get away with that. That line of reasoning leads to no loans for anyone because they might go into finance. (Shudder!). Cogent arguements only, please!

Drat. That reply ended up out of sequence. I was responding to Gael, who said:

“Those who pursued degrees in engineering and science over the past twenty years ended up in finance. You want to finance more of that?”

Gael, that’s a ridiculous oversimplification. Only a very tiny fraction of engineers ever went into finance.

We shouldn’t subsidize any degrees, and especially not with loans, that is the lesson. Whenever the government or society decides to subsidize something, not only does it create social and economic imbalances, but it’s just one more issue that can be turned into a political mess of entitlements and pandering.

Agreed.We’re already subsidizing higher education with grants, federal and state monies given to universities, etc. Also, I believe that contributions to scholarship funds are tax deductible, as are gifts to the endowments and general funds of universities.

It might vary from state to state, but I believe university property is exempt from real estate taxes, another subsidy. And, eventually, a trillion worth of student loan debt will be forgiven. Throw another trillion on the fire. As the ‘Talking Heads’ sang, ‘burning down the house’, lol.

@ CaliOwner –

So you propose that we get a bunch of well-meaning smart people in a room in Sacramento, and then let them use this Centralized Command to try and control economic outcomes. oh my….

Unintended consequences will abound, even if the process if not corrupted to begin with….

The unfettered market, with freely informed people making borrowing decisions for themselves is a much better route.

We are in for a HUGE mess if something isn’t done to innovate us out. Bankrupting multiple generations of home buyers and students is not going to be a pretty situation.

Congress will do everything possible to keep people in homes happy and content.

Look at the OWS movement… Most are poor students, homeless, people kicked out of their homes.. ect. Multiply that by millions!

The government doesn’t want angry mobs… Another 40% drop in home prices would cause civil unrest….

CaliOwner/Kevin:

40% drop? Depends on what city we are talking about. This will not happen nationwide but some areas are still in bubbles.

By the way, it looks like your Woodland Hills area is seeing a bit more crime:

http://latimesblogs.latimes.com/lanow/2011/12/la-crime-alerts-437.html

Any idea why this is happening?

Sarah – “By the way, it looks like your Woodland Hills area is seeing a bit more crime:

http://latimesblogs.latimes.com/lanow/2011/12/la-crime-alerts-437.html

Any idea why this is happening?”

I’m in the SF Bay Area & have been noticing the same kind of trend here. My guess is with 23% real unemployment (U6), desperation is setting in for some who feel like they have nothing to lose. They get away with it and make a few bucks, or get caught & get shelter & 3 squares.

Might cause some of the young people that saved some cash to come out and actually buy a house.

we/the government/taxpayers should be subsidizing nothing. this is how we get into these messes. the government should get out of the way of the free market with the exception of prosecuting mischief. instead the goverment is causing problems funded with our tax money and prosecuting no one.

Higher education is turning out a lot of people that will never get the jobs they thought existed for them. It won’t take too many years before kids and parents start to realize that unless the kid wants to be an engineer or chemist, they should probably learn a trade.

It used to be possible to be a chemist without having a chemistry degree. Now you’ll probably end up having to do post-doc work.

Has anyone found a leveraged inverse student loan portfolio ETF?

Are those graphs in constant dollars?

For the dollar has depreciated, in case nobody has noticed.

(Interdisciplinary Master’s Program in Humanities and Social Thought at New York University.) if you actually have an education in something somebody will pay for, you can make some money. i watched CNN with michael moore and the OWS bunch. A lady was complaining she can’t find a job as a “journalist” because the economic situation “caused by the big banks” has made it impossible to find work. In the end, you get paid what your worth, even in a tough economy. Relevant is the key word…

Heh. The demise of journalism isn’t the banks’ fault. You can blame the engineers for that one. Journalism is a casualty of the Internet.

Hey–I got a journalism degree in 1998 and immediately got a job as a proofreader right out of college (for 6 months) then got hired by a publishing company (with benefits and 401k), and at age 28 moved to NYC to further my career. I make great money now.

BUT I am sad for our interns lately; I interned in college and had lots of great job prospects. A few years ago, we could barely keep our interns for their full internship because they got hired away from us. Now? Not so much. They are super smart and network like crazy and there just aren’t enough jobs out there for all of them. So don’t be too quick to dismiss this girl’s complaint. It IS harder now, and these kids are graduating with real debt now. (I worked through college and graduated with virtually zero debt, even without my parents’ help with tuition. Try doing that today. Not possible.)

That being said, I went to a local university, lived with my parents the first couple years to save money, worked two or three jobs at a time, and when I moved to NYC for my new job, I slept on an air mattress (for a few months until I could afford a proper mattress) with 2 roommates (for 5 years until I could afford studio apartment rent on my own) and worked 60 hour weeks for the first 4 years or so. But I love what I do and where I live, and I wouldn’t trade it for anything.

That being said, I doubt kids graduating from college today have the same job opportunities I did or are able to graduate with no debt, even if they choose a local university. They aren’t lazy; it’s just a different world 13 years later. I know my own strategy wouldn’t work as effectively today. I graduated with $1000 of credit card debt with a 0% APR, and I paid it off in one year before that rate expired. Try paying off even $5000 of credit card debt with the 29.99% APRs you see today. Much, much harder.

Just think about it. It’s easier to think that because you worked hard and it paid off for you, anyone can do it. But seriously, a lot has changed over the past decade, and not in a good way for our young people.

It is still worth it to go to a top school in fields that pay. Business, Science, Law, etc. The more degree mills out there, the more respect carrying the nameplate of a “real school” has . . .

But yes, we need more skilled plumbers and mechanics at this point. Workman with any level of skill can command $45 an hour now becasue of all of the kids who went to college rather than where they should have been: trade school.

It seems unfair to rag on the liberal arts when most of our economic troubles have been caused by the technocrats and much of our environmental damage is the result of policies of corporations employing all those engineers and scientists.

A recent look at the salary schedule for one campus of the U of Illinois (I can’t remember where I saw it, so no link) reveals that the highest paid employee is the football coach, followed by the basketball coach and the school president. Several engineering professors are paid more than 200k, and at least six campus cops pull down more than 150k (pepper spray training deserves compensation, I suppose). One, exactly one, liberal arts professor makes more than 100k.

Academic careers for scientists are not all gravy, either. After being awarded a doctorate, the new PhD can look forward to years of journeying from one postdoc to another, receiving a pittance from all those fabulous grants that professors are supposedly getting. Don’t forget that schools take half or more of scientists’ grants as “overhead.”

I do agree with the doctor that the for-profit institutions are the most egregious abusers of student loan programs, offering substandard technical training in exchange for outrageous tuition and vague promises of great jobs to come.

I’d love to see a comparison of Australia’s real estate bubble compared to the U.S… It appears there 2007 is 2011… crazy how residents of Melbourne all saw the US real estate market crashing, yet still continued to bid up properties for 4 more years.. all while repeating the mantra.. “It’s different in Australia”

Ok, who hijacked CaliOwner’s handle??? Is that you Questor??? 🙂

I attended my local community college (OCC), and I received my A.S. degree in Early Childhood Education: School-Age. Then I had my new degree “certified” before transferring on to CSUF where I earned a “B.S degree”.LOL I was not required to take any additional “lower division” units like all of my fellow non-certified “transfer” classmates. We all took the very same coursework at OCC, but I intentionally “certified” my degree so as to save money by bypassing the additional lower division req’s which added the extra year’s tuition. And I didn’t have to waste any time on expensive SAT prep courses or the stressful all-day tests either!

Also, I participated in the CA Teaching Consortium program which reimbursed my tuition and books. So I basically was paid to go to college. All I had to do was pass my classes (with at least a “C” which btw, wasn’t too difficult to do!) and I graduated debt free. But most of my “non-certified” transfer classmates graduated more than a year later, b/c they couldn’t get all their classes due to budget cuts causing them to aquire more SL’s.

I knew that I chose a very low paying career: Pre-K. So there was no way I was going to rack up a ridiculous amount of unnecessary college-loan debt that I would never be able to pay back. I have, and I will always live debt free. Unfortunately, most young people today cover their wants, and not their needs….

On a completely different topic, from USA Today online “The National Association of Realtors said Monday it will release the downward revisions for previously occupied homes on Dec. 21â€, “CoreLogic estimated that the Realtors group overstated sales in 2010 by at least 15%â€.

Wow! I think something is really amiss when NAR is admitting that their numbers have nothing to do with reality/realty. I think “at least 15%†will win the understatement of the year award…

Actually the NAR overstated sales for 2007-present, they say by no more than 20%. I say BS. 20% is more likely the floor than the ceiling. See link to article posted by ZigZag above.

Yet more off topic, school loan discussions really bore the hell out of me… Sorry Dr.

We always hear how the average salary in bubble cities cannot buy the average home.

Check out the following link:

http://www.simplyhired.com/a/local-jobs/city/l-Santa+Monica%2C+CA

If my math is correct the top 17% of Santa Monica residents has a household income above $150,000. The median house price in Santa Monica is $853,400. I am not convinced that a household income of $150,000 can support a mortgage on an $853,400 median/average house. The top 11% of Santa Monica residents has a household income above $200,000. This is closer to affordability with the median/average house in Santa Monica. So, are we saying that only the top 11% can afford the average house in Santa Monica? How can this be sustained if 30% of these wage earners own a home in Santa Monica. I smell a bubble….

But what about the year that they made 500K from that movie deal? What about the inheritances? What about the family assistance? What about the fact the house was purchased 20 years ago? What about the great number of renters in Santa Monica? Foreign buyers?

I mean please, there are so many variables aside from bubbliciousness that impact Santa Monica real estate. It is not a normal, predictable market. It actually is a unique place.

A couple of comments Jay, I agree that there are a number of other factors that play into Santa Monica housing costs including rent control. However, I believe that there are some obvious issues with the math. It is true that there is trust fund money, money from parents and inheritance. But I would argue that the same could be said for most of the west side. The question really is what percentage of the homeowners made $500k on a movie deal or fit into your other categories. I think there are many folks on the Westside who appear to be more successful than they really are. I would wager that it is a 1 out of 10 ratio of rich with the other 9 falling in the category of “pretendanaireâ€. I believe this perception along with the banks not foreclosing is what is really holding up all of the Westside.

what about the lottery winners? what about the guy that bought a storage unit and found $500k worth of gold & silver? blah-blah-blah. who cares? once in a lifetime occurences do not make up an entire market. all of california is a unique place and it’s all going down. sit back and enjoy the show.

Just a fyi, turns out NAR has double counted sales for the last 5 years:

“All the sales and inventory data that have been reported since January 2007 are being downwardly revised. Sales were weaker than people thought,” NAR spokesman Walter Malony told Reuters.

You know it’s a sad state of affairs when the cheerleaders of an industry are saying its much worse then people think.

I wonder what was the motivation for them to come clean… well come cleaner…

It appears that they deceived the public in order to lessen the severity of the housing collapse. I don’t think it was an honest mistake. The Federal government does the same thing by revising GDP to much lower numbers later. Also they report years later that the recessions of 2001 and 2008 were much worse than originally reported.

You have to realize that the media and government have been engaging in a systematic propaganda campaign to give the impression that things are much better than what everyone believes with the economy. Also they love to focus on Europe’s troubles rather than our own problems which are much worse. The austerity occuring in this country is greater than Europes. At least in Europe, the working folks will riot and protest while us Americans sit down and take it.

DHB — “Only difference is there will be no investors to purchase distressed college degrees.”

I’m sure there will be investors looking to purchase distressed college *loans* though.

I went back to school at 30. Went to community college for the gen-ed’s and paid cash. Transferred to a 4 year state University in Chicago which the degree program needs all 4 years anyways. So, I’ll have 6 years of school and $30k+ in debt and a Bachelor’s. I worked the first two years, but as the course loads become more complex, working isn’t possible during the semester if I want to create good work and keep my sanity. The 15hr a week @ $8/hr PT job won’t make a dent anyways, so why waste my time. Now the state is trimming money off grants it has already awarded because they are broke.

Glad I passed up that private school in LA that would have cost about $180k by the time I was done….that’s a 500 sq ft house in Compton!

I have a high school junior that I am encouraging to seriously consider the Service Academies. I do not want my child saddled with school loans for years to come. The Academies offer predominantly an engineering focus with other desirable private market concentrations. Five years commitment after graduation is a blessing. You will be given a job full of responsibility, with a top end salary while you grow and mature. 90% of graduates are given their first or second choice of career fields and assignment location. If you choose to leave the service after 5 years at age 27 you are a very marketable commodity able to choose your career options vs. an age 23 college grad that may have move through many menial jobs or require additional education.

At age 42 (20 years of service) you can retire from the service and start a second career. Having a retirement income at such a young age gives you such financial freedom to choose your second career. The future employer will receive your best managerial years of service (42-62) and you can gain a second retirement.

The child has to be on board with the grades, leadership qualities and the passion to serve the country of course.

For families that are financial stressed (ours), and in a very uncertain economy for years to come, this is a career path option my children are seriously exploring.

Not too many people want to comment about the so-called “Exchange Students” who help to raise college tuition.

They come mostly from wealthier people in Asia, and don’t really care for paying $50k+ per year since an “American Education” is worth something back there.

They overcrowd some colleges, which love them because they don’t have to give financial aids to foreigners.

IMHO, foreign students should not take more than 2% of a univ population ; they should stay where they were born.

Cenk Uygur had a pretty good segment on the student loan bubble recently. Had some pretty devastating graphics to help illustrate it. Scary!

The higher education establishment is more concerned with its own interests than in the interests of students. How can universities accept students into graduate programs knowing that those students are already deep in debt, and that grad school will only sink them deeper into debt?

At what point will students figure out that this is a bad idea? Not surprisingly, reason #1 on the “100 reasons NOT to go to grad school” is debt: http://100rsns.blogspot.com/

Yet universities continue to take in new grad students by the tens of thousands every year. Their priority is to keep enrollments up, and even public universities advertise their grad programs like consumer goods. Admittedly, the consequences of borrowing $50,000 for an “Interdisciplinary Master’s in the Humanities” should dawn on people before they enroll in such programs, but the universities are (ironically) encouraging ignorance of those consequences.

“Those who pursued degrees in engineering and science over the past twenty years ended up in finance.”

I call BS. Those who are in finance, are targeting to finance, i.e. legal robbery.

Economics and law, those are the degrees for financing.

An engineering degree in financing is as useful as liberal arts: you don’t see many of those either in there. As a mechanical engineer I should know: financing is seen as stealing among engineers: when an engineer sells you something, you get something useful with your money while “financing” is essentially stealing: You pay for nothing.

The value of college education in Amerika is still in a huge bubble. Most of those universities are suspended 20th.Century animations formerly serving the needs of real productive American corporations gone overseas.An inert bureaucracies, packed with overpaid baby-boomer tutors, with vastly overvalued research centers with huge maintenance costs, and annual budget rigged staff needs paradoxically conveniently positioned to answer the cry of every local politician how much they care to educate your kids.

Anyone stupid enough to borrow 50 grand to get an underwater basket weaving graduate degree like “Humanities and Social Thought” deserves to be a debt slave for the rest of their life!

You needed 3 classes of Calc before Diff EQ’s to pass P Chem which was needed for my major in Chem minor Bio before med school. I washed dishes in High School, stacked hay bales, painted houses etc to save $ for college. Sold encyclopedias door to door during summers as undergraduate to pay for school.

Did I like it? No, but I was able to pay my own way w/o borrowing.

I have never seen such a bunch of whining babies as on this site. Everybody complains about boomers. Well, I was not born with a silver spoon but managed to make it. Try getting up off your hands & knees for a change and actually working and it will do wonders!!

Leave a Reply