Expensive homes and food stamps – While California home prices went up 8 percent in the last year 13 percent of California households are on food stamps. How low interest rates help Californians more than other states.

It is now almost a universal mainstream headline that housing has reached a bottom. Of course little is mentioned about the ridiculously low mortgage rates that have aided in covering up stagnant incomes to accomplish this task. Yet a nationwide bottom should not be confused with regional troughs. The summer selling season has been hot for California. Home prices are now at two year highs coming in at a median price of $274,000 (still far from the $484,000 peak reached in 2007). Yet is this positive with California facing a 20 percent underemployment rate and massive budget deficits? There is no doubt that the recent push has come from two sources; low interest rates and controlled inventory. Roughly 30 percent of California home owners are underwater. This works out to be 1.5+ million households. Yet California only has about 170,000 homes for sale on the MLS! You have nearly 10 times the number of underwater homeowners compared to the homes listed on the MLS.

When did people buy?

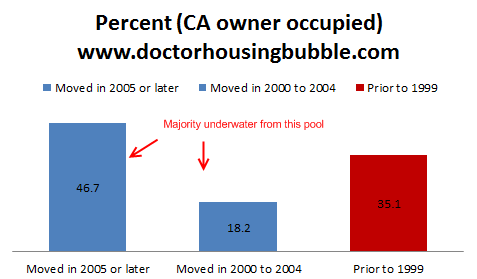

With many baby boomers heading into older age, it is important to note when people purchased their home. Many in California do have equity and can sell. I thought it would be interesting to pull this data:

Most of those who “own†their home moved in after 2000. A large portion, nearly half moved in after 2005. But you have 35 percent that bought prior to 1999 that are likely to have a good amount of equity in their properties whether they sold for $600,000 or $300,000. This is another interesting part of the housing market that is unfolding. The transition in demographics between an older more affluent population that bought when home prices were affordable relative to incomes versus a now upcoming younger and less affluent population that is still facing sticker shock.

The impact of interest rates

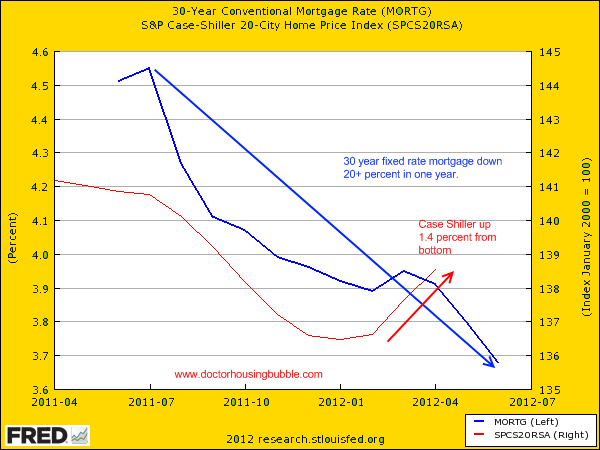

There is a false sense of charm in low interest rates. For example, in Laguna Woods, an older community you have cheap property prices but HOAs that can run $500 to $1,000 per month! That is only the HOA and not including property taxes. People seem to think that once you pay off your mortgage, you are living with zero payments. If you want to see the impact of low interest rates just look at the action in the last year:

Keep in mind interest rates were already historically low just one year ago. In the last year, the 30-year conventional fixed mortgage saw rates fall by a stunning 20 percent. For most of this time, home prices fell. Starting this year home prices are now up 1.4 percent. In California, and here is the kicker, home prices are up 8.3 percent year-over-year. So you begin to realize that lower interest rates are largely a boon for high priced metro areas.

Compare a $150,000 loan that will get you a home in most states versus say a $400,000 loan for a starter shack in California:

20% drop in interest rate for a $150,000 = $87 monthly savings in Principal and Interest

20% drop in interest rate for a $400,000 = $232 monthly savings in Principal and Interest

And this is an important point. Why should a California home buyer get a subsidized monthly savings that is nearly three times that of most home buyers in other states?

Home bottom difference between US and California

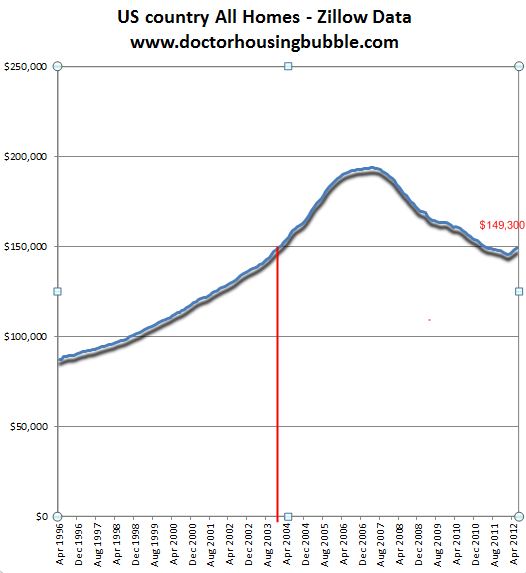

Home prices nationwide do seem to be hitting a bottom:

According to the Zillow Home Value Index prices rose to $149,300 (compared to the NAR figure of $189,000 for existing home sales). Now this is important to examine in light that California has a 20 percent underemployment rate and the median home price is $274,000. The median California home is valued at 80+ percent higher than the nationwide priced home using the Zillow figure. With major factors lined up to hit the market it is too early to call a bottom for a place like California especially in overpriced markets. Even close to us, in San Bernardino and Riverside good deals can be found. Yet LA and OC still look to have pocket bubbles.

California tax revenues

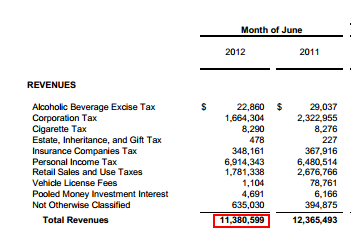

You would think with prices rising by over 8 percent in California in one year that the economy is now booming:

For the month of June revenues are down nearly 8 percent from last year. A big part of this comes from the fall in corporate taxes which really isn’t a good sign. California has 12.4 million occupied housing units and roughly 1.7 million households are collecting food stamps (nearly 13 percent of all households). Median household income for the state is $57,000 (according to the ACS 2010 survey nationwide household incomes are up to $60,000). Over 3 million Californians are already drawing Social Security. So of course, this is simply more reason to celebrate with high home prices.

It should be abundantly clear that the recent rise in home prices is being driven purely by controlled inventory and the insanely low interest rate. Those that are obsessed only with their backyard and rudimentary calculations need to pay attention to what is going on in the world (or in the state for that matter) with bigger macro issues. The economy is slowing down and storm clouds are brewing in Europe. China is now looking like it will have a tougher landing (keep an eye on the ridiculous Canadian housing bubble to see the impact). It would be one thing if jobs were being added and wages for households were holding up and improving but that is simply not the case.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “Expensive homes and food stamps – While California home prices went up 8 percent in the last year 13 percent of California households are on food stamps. How low interest rates help Californians more than other states.”

Californians ( and New Yorkers too) often have complained how they pay more into the Federal government than they get back and, in terms of income and corporate tax, this is true. However, as shown here high cost states get back benefits that are not as visible such as the effect of lowering mortgage rates not to mention the mortgage interest deduction. Then there are wages. A job in California that pays $15 per hour might only pay $10 in Florida or Texas but Social Security benefits are not indexed according to cost of living so Californian doing the same job as a Texan will, upon retirement, receive a larger Social Security check than the Texan. The Californian can then take that pension check and any equity they acquired in their more expensive California home and retire more comfortably in a low cost state and live better than the locals who worked their entire lives in a low cost/wage state.

I can GUARANTEE you the higher wage in CA still doesn’t make up for the cost of living, stress, commute, and other anxieties that come with CA. Especially the cost of living part.

I have friends in the Midwest living better on $17/hr that I do in CA for $35/hr. That’s fact.

Agree with you here Papa. Price/income ratios in CA are way off base. Just like tulips and tech stocks and every other mania out there, prices will always reflect the ability to afford certain goods and services. There is some sort of “location” factor for places like Laguna Beach, but it probably should not be 4X-7X anywhere else. That is Irrational Exuberance.

This is very true. But there’s more to it than meets the eye on this situation.

For example, someone may be living paycheck to paycheck in California. But when retirement comes they can move to a state with a much lesser cost of living, and live BETTER than someone with the same profession in that particular state, who perhaps also lived paycheck to paycheck with less.

So cost of living is of course relative.

But in the long-term, making more money is perhaps usually better than making less?

$15 vs $10 per hour. They’re both still both pay an equal percentage benefits tax(same rate). Thus, Californians may get more ss benefits but they paid in more. As my wife often says, “Why it’s just economics, honey, what’s yours is mine and what’s mine is mine”.

You want to talk about fairness and California? My aunt bought a house in San Francisco in 1965 for $60,000, sold it in 1995 for a million. My father, her brother, bought a house in Brownsville, Texas in 1957 for $21,000, sold it in 1985 for $40,000. There is your fairness. It all has to do with government spending and rip-off FIRE “industry”driving up prices. DC and NY are the same way. So, when Californians bitch about inequity, they have a lot of nerve. However, the chickens are coming home. Take a look at Anaheim and see your future. What goes around, comes around.

By the way, 7 million Californias are either on Social Security and/or food stamps. That is roughly 20% of the population. In South Africa they had special term for it, apartheid.

Gee Manny maybe it’s because Brownsville Texas is an armpit with no people lined up to live there unlike coastal ca. where the demand far exceeds any supply. That’s just the way it is. You sound like a left winger demanding that everyone have the same outcome. Life does not work that way except for immature people who think like Marxists.

Manny, with all due respect, you need to adjust your thinking.

Government food programs are not apartheid. They are welfare for agrobusiness. “Food stamps” allow consumers to purchase inflated-price food-ish products that have been marked up for profit but whose contents contain very little actual nutrition.

http://www.ers.usda.gov/media/131096/err114_reportsummary.pdf

This is why we should be investing in community gardening and local food systems much more heavily. The heavy concentration of fossil energy in the industrial food system itself guarantees these systems can only be sustained by, basically, driving food sector workers’ salaries into the dust. Energy costs alone have increased by some 80 percent in the past 12-15 years.

Californians take “food stamps” because California is and always has been the nation’s laboratory of sucking up public money and rebranding it as private profit. Between dollars and water, most of CA’s economy is, and always has been, imported. And always, ALWAYS, based on bubble pipe dreams.

The median price went up because the mix of homes sold has changed. The cheap REO’s have gone, now the mid range homes are selling. This is different than any particular home in your neighborhood increasing in price. It hasn’t.

There are more cash purchasers who do not need a FHA appraisal. The sells that go through FHA or a bank are appraised cheap, hence the lower prices of those sells.

The banks are selling at auction and avoiding the MLS now.

You hit the nail on the head. I have been telling people for years that the “mirage” of increased pricing would results once the banks shifted from lower-end to mid and high priced homes, regardless of the volume. The banks knew that strategy would create the appearance of increased pricing, as has now happened. If you’re reading this and you don’t understand the concept of the median house pricing being higher now because higher priced homes are selling more then I would honestly suggest you do some research, as understanding this fundamental principle is critical to getting out of the weeds of the media and understanding what is going on.

Speaking of which, not only do we have the median price going up due to the mix of sales, but inventory is WAY down for 2 obvious reasons:

1) Election Year – The banks are helping to paint a “better” picture for the elections.

2) Large funds buying the properties instead – I know people at the largest of Funds that, for the first year, are buying HUGE pools of properties this year to buy and hold them to rent. One of the funds is targeting the purchase of 10,000 SFRs this year alone (that is not a typo). So the mirage of “lower inventory” is simply inventory that has been redirected by the gov’t and banks to these funds to create the illusion of lower supply when, in fact, it’s just investors buying the difference. This might be an election year ploy or it might be the beginning of a multi-year trend. Either way the 1% wins because they’re the investors getting the pooled discounts – lovely…

I hope this helps everyone to get a bit more understanding of what is going on beyond what the media is reporting!

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

Median prices are very misleading…especially in areas like LA where prices are all over the map. Back in 2009 it was the low end driving the median home sale price, now it seems like it is the mid tier.

I generally don’t bother paying attention to median. Look at price/sq ft, this is much more telling and that number ain’t going anywhere!

Question for you or anyone that might know – will the homes being sold in the bulk sales have these sales prices recorded in their sales history?

In other words, if you look at the sales history on zillow or redfin, will the price the home sold for show up in the property history?

If so, I’d guess this would make a huge impact in valuations by appraisers when looking at comps.

Dom, it is my understanding that distressed sales are not included in an appraisal’s comps. I would assume that the transfer of ownership/deed would be recorded but price might be a little iffy. I have seen property sale valuations that included total values of a multiple property deal. I am not sure if that was a mistake or if this is normal procedure with multi property deals…

The county property tax accessor will certainly value the investor purchased property at “fair market value” which may be more than the “fire sale” purchase price.

Bill – here’s a round of applause for you:

http://www.youtube.com/watch?v=qLezXLuvNgc

You are so right…I can’t believe for one second that “California home prices went up 8 percent in the last year.” It’s probably more like the median price of homes sold. We (the United States) are on the verge on a depression. The real estate situation in California HAS ME REALLY PISSED OFF! Home prices are still way to high – thanks to ultra low interest rates, held down artificially low by the Federal Reserve. If interest rates were to rise to market rates, the housing market would come crashing down. Home prices would be much more reasonable, not artificially high like they are now. The real estate market is nothing but a circus in this country. Nothing but a circus.

Why would the real estate situation in Ca. piss you off? Unless you are looking to be able to steal a home why should it bother you at all unless you yourself are looking to buy. Prices have indeed come way back up in the last year with bidding wars now underway especially for non foreclosure homes. You should have made your move two yaers ago when chaos was still in charge.

It wouldn’t surprise me if housing prices have bottomed. You never know about things like this, except in hindsight, but a bottom appears to be forming.

The problem is, what if house prices drift sideways while the price of most other stuff zooms higher? Real estate has historically been a great inflation hedge. That was always the advantage of home ownership. You need a down payment, and you are stuck in one place until you sell, but you always were protected from the ravages of inflation.

If real estate under performs inflation going forward, which seems likely, than it is a hollow victory if it goes up a bit, but not enough to match the increases in food, fuel, tuition, health care, etc.

Ironically, it probably doesn’t matter what the fed does with rates. As inflation continues to push up prices far faster than government doctored statistics indicate, the fed’s zero interest rate policy (ZIRP) will be like pouring gasoline on the fire. Housing might go up a little, but with wages stagnant, they can’t possibly go up as fast as food and other essentials.

If the fed raises rates to try to contain inflation, house prices are doa.

There’s no way we are at a bottom with 3.75% mortgage rates and the huge shadow inventory. Even if all goes according to the FEd’s plan and they stretch this for 2 more years or so prices will drift downward during that time in real and nominal dollars.

Might want to take a look at what is happening to the price of food, especially corn, wheat, rice and soybeans. No amount of FED “tightening” can bring down prices based on scarcity. On the contrary, it will thinks worse.

What corn? I live right in the middle of corn country in North Central, Iowa, and most of it’s dead or dying. I’m at my farmer Father-in-laws (O’Brien County North western, Iowa) right now and I walked out into his field to see how it’s doing. The corn plant started the ear of corn, made corn about 1/4th of the way up the cob and then quit, because the bottom of the plant fried (meaning it’s brown not green) and when that happens it’s done making corn so what’s there now is what’s going to be there in the fall. It’s not even worth combining, and this is on a farm that usually makes 220 bushel corn, and the whole state; except for pockets of course, looks the same way. Anyways, either buy corn futures, or stock up on any kind of food (that’s just about everything by the way) because it’s all gonna go through the roof and then some.

Is there a source anybody knows of that describes the controlled inventory issue, and the banks’ exit strategy re the same?

I can’t give you any sources but I will give you an example of the ludicrous inventory. I track Huntington Beach 92647 Zip. Almost one year ago today there were 137 properties for sale…today there are 37 properties for sale! That’s right a 73% reduction in inventory in one year.

With only 37 homes for sale, you won’t get whopping sales numbers. In 60 to 90 days we will be seeing this and the sales numbers will be absolutely abysmal. I wonder how they are going to spin this one.

Dr. Housingbubble is right. Big, dark storm clouds are on the horizon and you can almost hear the thunder rumble in the background. I have a feeling the next year is going to be quite ugly from an economic standpoint. Batten down the hatches! 🙂

Inventory is way down in most desirable locations. And mortgage interest rates are way down as well. Cheap money and low supply is creating an upswing in the markets here in CA. This ‘market’ is so messed-up and non-normal that making any kind of prediction to its course is futile.

Much of the inventory has been sold on the sly to connected insiders and other favored people. Most times the banks severly limited who could even bid on a home. Of course these same banks had already had their loses covered by we the sheeple. I believe that Buffet ststed he would be buying around 200,000 homes in the mass sale program for use as rentals. We are now officially an oligarchy.

The hoarding of property by the financial system. Sort of like bringing back the divine right of kings. You might get a land grant for serving them at their pleasure.

Controlled inventory? This is how it works. ZIRP (zero interest rate policy) by the Federal Reserve allows banks to borrow money at close to zero percent interest. Banks can then use these ZIRP funds to cover the delinquent monthly mortgages. This keeps the bond holders of the underlying mortgage note happy because they continue to receive their payments.

Using this technique, banks can withhold foreclosed properties from the market for as long as ZIRP is in effect. If interest rates were to go back to their historic levels of +7%, banks would be forced to liquidate foreclosed properties at market value (i.e. prices in SoCal would be closer to the national average versus the current Case-Shiller bubble levels of 160).

Very informed regarding our taxpayer supported banks. Also would like to mention the same banks are utilizing large investors/LLCs to purchase distressed properties, and are acquiring cheap real estate thru various tax default sales. I think their long term objective is to make most of us all renters.

Nothing to worry about, everyone will follow the City of El Monte and tax soda cans @ a penny an ounce. See all is fixed. They are going to make up the shortfalls with $7 million in soda sin taxes. Now they just have to sit and wait while the 1,341 permitted retail sales establishments in El Monte crank out annual sales of 58.3 million cans at 120 cans of pop a day per store.

I am going to patent coin operated soda fountains. Obviously they are going to have to tax refills at the fast food joints. Maybe make them look like little gas station pumps. Sell adds on the TV screen while you refill. It will only cost the fast food chain a couple of grand per store to put in the metered soda fountains.

What was that saying about picking up pennies in front of a steam roller?

Good one Potus, I often wonder when walking into a small mom & pop place if they even bothered to research how many of whatever they are selling would it take to sell just to break even. Some places would not be able to even handle the volume of what the need to sell.

I’m a little confused by the mom and pop comment. They would not pay the taxes out of their pocket, as taxes are always passed on and paid by the consumer. Then the store gives the money to the Gov.

I wonder how many mom and pops avoid taxes anyway though by keeping things off the books.

WF REO FEES trial business model

$12,000 and $195 to have the pleasure

to buy a “as is†pos.

We passed due to soil conditions of area among

other issues.

The few REOs coming to market are about to be fee heavy

if this pilot program goes viral.

CAE

I agree, we’re in unchartered waters and all crystal balls are foggy.

In my wildest dreams would I think we’d be in bidding wars over

plain jane 1970-1980 ranchers. It is surreal. TPTB have won for a long

time. Reason/Logic/Reality is out the window again, and when Jan 1st, 2012 rolls around, inventory will be few and far between. We’re come to terms with reality, and it is ugly.

Someone help me out on this….

That last graph starts in 1996. From there the graph rockets upward. It has come back down some, but still much higher than 1996.

So my question is, what evidence shows we’re at a bottom, and what should justify the much higher current price than 1996? Do wages and inflation justify the increase from 1996 to now, or are things still in a bubble?

I think getting down to around 1998 levels would be just about right and a healthy level, have thought this for the past four years – we’ll see.

I have two comments.

First, is that any housing index worth its salt would be in real numbers (inflation adjusted).

Second, is that any graph worth its salt would start at least prior to 1987 which is really the beginning of the housing bubble.

I am not convinced that we are in a bottom given that the current graph\analysis does not include both of these parameters. I believe that we will not know when we have hit a bottom until many years after.

This is like predicting an earthquake. If you predict that there will be an earthquake every day, you will eventually be correct…

@Shellz – I somewhat agree with you, but believe the year we’re heading back to is 1997, and I have thought this to be the case since 1997. I purchased my first home in early 1997. Looking around in late 1996, the market was dead. There were very few shoppers. Then after closing on that home, I watched in amazement as prices started climbing rapidly and shoppers were everywhere. Not sure what caused the market to heat up. Maybe the goofy loans were starting to appear. I remember them being available when I purchased that home but couldn’t imagine putting my signature on a contract where the payment could start to climb.

Just for historic purposes, and to show how out of control everything is in the taxation of individuals, I pulled up the June 2003 report. It is written not in chart form, but in confusing summary form. http://www.dof.ca.gov/html/finbull/july03.htm The big thing to see is how high the median home price is claimed to be 369,000 for 2003 versus 274,000 in the Zillow report for 2012. The huge difference that caught my attention is the bleeding of personal income tax; California has almost the same number of workers at each wage point over $30,000 (2012) as 2003 (approximately, that is population growth less unemployment high in 2012) yet the personal income tax collections in 2012 seem massively bigger. Is this an historic anomaly, or are Californians getting bled in personal income and other taxes while receiving not much more in total state personal income? This can’t be right, but even if it is approximately indicating tax trends as worsening on private workers with any income, then where is all the spending growth of government (ie, government expenses as taxation per state non-government worker would seem much, much higher in 2012 despite all the statements of “austerity”). NOTE: two things are keeping total disaster from California, one being a trillion dollar federal deficit, the other being artificial and long term, unsustainable lower and lower home interest rates with near-zero down loans; eventually, some other currency or even the Euro will emerge with stability and higher rates and that’s that, especially given US money printing and inflation. Inflation of money does not automatically lead to equal inflation of homes, so don’t think buying a home in a low interest environment is some kind of “inflation shelter”; sometimes it is, sometimes very much it is not as interest rates rise and unemployment skyrockets in recession.

“some other currency …. will emerge with stability”

IndyLew if you want an answer to your question, you just answered it yourself.

There is no other currency with any chance of stability. None, not Japan, not the Swiss and most definitively not the Euro. The reason being is that they do not share the same advantage as Ben’s Fed. All the other fiats on the planet are at risk of the people rising up and making things anything but stable. It took years to even get Occupy started and it disappeared in no time. The passivity of the US populace is the best guarantee of continued global dollar hegemony. You will never get a Hollande elected here, you won’t get massive protests. What you will get in the near future is about 10 million filthy rich folks all over the planet very concerned about what to do with there wealth WTSHTF. Are the rich elsewhere going to sleep well at night not knowing if parliament will be stormed tomorrow morning? I am fairly certain a significant portion of that wealth will willingly find it’s way to very low interest US bonds, for a very long time to come. Because you can sleep well knowing that the 2 party-one owner system of government in the US is working hard to keep your money safe.

It amazes me to see booze tax revenue so far down? I thought people drank more in a recession.But maybe there’s a work-around I don’t know about?

Historically, interest rates are always way down in a great recession. So these rates could be very low for a long time yet.

Alcohol isn’t getting it done LOL! People are so down they are turning to the “other” forms of self medication that are only sold on the black market…

The same thing here in florida where we our .IMOP ONLY FOOLS RUSH IN .!!!

Thanks for the reality check Dr. HB. Impatience and MSM headlines are fooling peple once again. But, nobody is forcing them to buy. If they don’t take the time to analyze all the data and they run with the herd, then they will get slaughtered. Just like the last time. Nothing has been resolved since 2007, just govt trickery trying to keep the game going. On the Westside of LA, we still haven’t seen the stage where people give up hope and all the crap is washed out. Keep piling up cash folks and wait, your patience will be rewarded.

http://Www.westsideremeltdown.blogspot.com

The tax table is very telling. Vehicle lic. fees plummeted. Folks are still smoking & income taxes are holding strong…

The barn is burnt down. Who knows if the horse made it out, does it matter? The barn is burnt.

“Last train to Auschwitz! Kiss those calories goodbye!”

It is a given that lower interest rates make homes more affordable throughout the price spectrum. However, visible and available supply is the driving factor in determining home prices. Whether one believes supply is being constricted by banks, a low level of new housing starts, sellers waiting for higher prices to list their homes, or whatever is immaterial. This inventory is on the sidelines and is not available to buyers.

Stagnant/contracting salaries, distressed property overhang, student debt and demographics have all been discussed by the good Dr as factors that may/will influence the supply balance going forward. These are all well documented and reasonable theories and in aggragate suggest that prices will continue to slowly decline and the housing market will be in the bottoming process for many years.

Emperical evidence seems to suggest otherwise, and outside economic collapse, there does not seem to be any major near term changes that are going to have a substantive effect on housing market supply or prices.

As the last bubble clearly indicated, supply and demand had very little to do with house prices. The availability of credit is the driving force affecting house prices. In Nevada and Florida, supply and demand had absolutely nothing to do with the bubble. Making loans to people who had no possibility of paying them back certainly sent prices over the top.

I did a refi recently, and one page of the paperwork had to do with lying about one’s personal income. Apparently it’s a Federal crime to misrepresent your income on a mortgage application. I wonder if that is something new, or it’s always been like that? If it’s always been like that, then there is a pretty clear breach of duty that present homeowners could claim against people that lied, then went belly-up. It would be awesome to nail each faker here in LA for 100 to 1000 bucks a pop to compensate those folks who bought responsibly (as in ‘didn’t go overboard in debt to income’) but who have now lost equity. Make ’em wait a whole month before starting that Mercedes lease payment or upgrading that iPhone.

aaaaah… cheap money created an increase in demand (houses) which increased price which signaled to the market to create more supply (build and they will come). Sounds like supply and demand to me. Further, lower price of money created higher demand for money which signaled the market (Fed/banks in this case) to make more money to keep the supply in line with the demand. Supply and demand is not something that goes away because of bad policy. ARTIFICIALLY cheap money over a long period of time used as a lever to control the economy had an artificial impact on the supply and demand of many things leading to mal-investment.

@ a fez

I think the answer to your question was that NO, liars loans pre-2009 were NOT breaking federal law, and therefore would not technically be considered a crime at that time.

I’m not an expert on this, but this is how I understand it. (Perhaps someone else can clarify or it would do well to research this more if you have the time & interest).

I think the way they got around the mortgage fraud thing was that the federal law only referred to banks, not mortgage lenders.

Thus, lying on a mortgage app with a mortgage lender wasn’t covered under that lying on a mortgage application law.

The reason I believe this is the case is because the law that was passed in 2009 in response to this mortgage debacle, extended that federal law to include mortgage brokers or mortgage lenders in with the definition of “financial institutions”.

One assumes that this new law added this because in the previous mortgage laws, it was not a crime to lie to a mortgage broker, only if you lied directly to a bank.

?

At least that’s what I’m seeing.

So once again, there’s no way to “blame” people for lying on their mortgage apps, because well, they were legally allowed to do so!

(At least that’s how I imagine people justified it at the time at these mortgage brokers.)

But affordability doesn’t always represent good value — unusually low interest rates over such a protracted time frame grossly distorts prices and price discovery. I can afford to pay 50 dollars per gallon of gas, too — ever more if I use my credit card. That doesn’t mean that’s what the actual gas is worth and certainly doesn’t mean that the utility I get from it is reasonable. It simply means I can afford it.

Once the assets are stripped from the old work force by the financial system they will be offered to a new generation of debt slaves who have clean an insurable credit reports. A young and eager work force. Wages even go up a little to match inflating prices near where the money is first dispensed into society. Sorry to say it but they don’t care one bit if you ever actually can pay off your mortgage.

Having been following this blog for more than four years, I can’t agree more with the Dr. Analysis, logic all make sense. Socal or westside of LA are overpriced related to income or… However for me, I just can’t wait any longer for the price to go down. I thought there would be time I could pick up a property reasonably priced with cash. It may or may not happen. I just don’t know anymore. With all the programs, interventions out there; it seems that the climate is all about keeping things going the bubble way. Instead of seeing my savings shrinking due to inflation and cramped into a 2 bedrooms apartment, I bought a nice piece of property in one of these beach cities on the westside. I don’t know what a ‘hot’ market is. Boy, the several properties I made offers on all went to other bids. These are 800k houses. Finally I’ve got one after getting beaten many times. From the date of listing to closing, property including mine, it takes just about 45 days. Anything decent, it’ll be pending after a week of listing. Wow or f**k is all I can say. I put 50% down and got things going… Like the neighborhood and the house of mine. Looking back, it’s really some experience of buying in LA that I’d like to share with you.

This is what I predict: most if not all of the windfalls made in housing will wind-up sunk back into the very asset class which produced said wealth, and ultimately, be destroyed or almost entirely lost again.

I think there was this idea when people were selling their overpriced houses back in ’04-’05 and walking away with their OMG-I’m-gonna-travel-the-world money that they would slum it for a year or two or three and then jump back in and buy a beach side mansion or some other residential edifice to gratify their egos. The reality is that the market has these windfalls priced in and this is reflected in the asking prices and manipulated inventory you see in many of the more insane of the bubble markets.

I predict the lucky ones will either get tired of the staring contest with the fed and capitulate and overpay, thereby wiping out the better part of their windfalls, or they will try to buy up rental properties — an over-played, over-saturated strategy/market — and lose it that way. But sure as anything, unless you sold for a ton in the bubble years and downgraded or downsized dramatically, 9 times out of 10, you will lose those winnings back to real estate.

Hamsun

Well stated. We sold years ago. We are older, and we have missed out on a quality of life we can’t make up for. Multiple rents (office, storage units, apt) is part of the issue, and you don’t get hit the time rewind button. We had hoped the prices would revert back to 2002 sanity, but tbtp won. With the goal of the US becoming a rental market, we have got to jump back in. All the REOs that are going to come back as rentals (and I wish this fails terribly, trust me) will keep SFH purchases a wealthy person’s game. I don’t think it will improve in the 35+ years I have left.They broke the business cycle of housing for good, imho.

None of what you describe can be applied here. Being a renter for 20+years and having opportunities of living in some of the most beautiful cities in the world; I remember back then in the later part of 90s while living in the bay areas, I thought it’s too expensive to buy. That was when houses selling mostly in the high 300 in the city. Went through all those bubbles and couldn’t justify of buying. Now I need a place for my baby to grow.

Funny that life is way complex and hard to predict. One thing I’ve learnt is that the ‘free market’ is a relative term. One needs to take it in, digest it and make the best of situation for oneself and loving ones.

gulpher

Congrats on the new home. Health and Happy Memories to you and your family.

Yeah, when you lose in a bidding war, it is not only surreal and it stings, you start to wonder how much CASH you have to flush down the toilet. Interest rates are at zero, and our money is losing purchasing power as well. We decided to also look beyond the retail market, but you become a Paralegal and the risks are scary. Nevertheless, we are branching out. The amt of BKs are blowing our minds. Extend & Pretend is alive and well, but at least the BK Attorneys are making money.

Congrats on finally getting a deal.You’ll have to share some learning curve lessons. Dying to hear your journey.

Mad As Heck,

Thanks for the wishes. I’m happy to see my boy running around. It looks like he likes it here too. Like your name, mad as heck, that is how I feel sometime. There are so much acts of market manipulation which is really causing more problems… Man, it’s tough out there if you are interested in buying in a decent neighborhood. Get a very good rate of 2.875 for 15 years. Good luck to you and everyone else who is looking into buying.

gulpher

We’re a cash & close as well, but in east ventura county. Bidding tomorrow on a home. I’ll fill you in after the courthouse step experience. BTW, you can get title insurance on a TS. The policy is called a “Trustee Sale Guarantee”and it is pricey with many “carveouts”.

It’s amazing to see that 65% of homeowners moved to CA after 2000. I’ve long believed that our State was a huge benefactor from the War Economy. If the Defense cuts actually happen and our Government can’t start another war, look out below…

James, I don’t think these people “moved” to CA. The 65% is the amount of homes in CA purchased after 2000. Many of these people have little if any equity; however, they have been lucky to get bailed out by the Fed’s perpetual lowering of interest rates.

I cringe when I hear the stupid remark “home affordability in CA is at its highest level in 20 years.” I would have much rather bought a place in the mid 1990s at a 8 or 9% interest rate. Rates could always go down (as they did) and prices would likely go up (as they did). I doubt rates will go much lower than 3.5% 30 year money…maybe a half a percent or so? And prices will likely be stagnant for YEARS to come unless we have some miraculous economic turnaround that boosts salaries. The low interest rates have also been a boon for local governments (more of a backdoor bailout)…keeping property tax values high. I’d rather have a mid 90s Prop 13 protected tax basis.

Live and learn. Maybe rent control should be instituted at a national level. The government controls all facets of the housing market, they might as well do the same for the rental market. Only fair right?

Thanks Lord. Considering we’re off the Gold Standard, it’s looks like we’re in for a long run of low interest rates. The 30 year may go even lower and possibly break the 3% handle.

“Affordability” Is realtor code for a “Lousy market”

CAE, I am going to steal that one from you!

“With the goal of the US becoming a rental market…”

I think most investors can see, from the decoupling of the S&P500 Index (which relies on >50% overseas revenue) from the other major overseas indexes (U.S. equities are in ‘ignore and pretend’ mode, floating way, way above such), that there will be blood regarding U.S. equities at some point (though perhaps not as bad as Europe) in the short to mid range.

Therefore, a good hedge against that junk is to go cheap and buy in bulk, regarding rental property.

This has the smell of biotech replacing the lost income in silly clown valley. I am not convinced that this whole rental market thing is really going to pay off. We are in a race to devalue our currency which makes things that we bid for on the world market much more costly like food and fuel. These expenses will most likely crowd out housing. I think a better “investment” would be in food and fuel which most likely will keep up with price inflation. I am not convinced that we will have much wage inflation given the large slack in the labor market. In other words we are F’ed in macroeconomic terms!

What

Great post and insight. NPR just had a segment on the increase in food prices, and we are just feeling last year’s drought, let alone this years drought. They expect some hefty inflation in food prices this year and next. I see it in not only the prices, but the decline in ozs. We don’t eat much processed foods, red meats, dairy, but we feel it as well in healthy choices.

Deflation in salaries, increase in funny money, equals the smell of stagflation in the air. I am in the inflation camp. This “aint” going to be much fun to live through. QE3 to come is not stimulus, it’s a BAIL OUT cycle imho.

Food prices will double (adjusted for inflation) by 2030, secondary to climate change, using crops for biofuels, population growth, etc. Oil prices will continue to rise as well secondary to growth in China and India, possible peaking, etc. If there is a long term investment play on this stuff that I, the under informed and amateur investor (and my amateur brethren) can understand then……

I own Exxon just because I think once oil prices get crazy, they’ll be taking full advantage of it. I own BP, because I think they have a strong understanding of the explosion of renewable energy growth that will happen in the coming decades, but 90% of their revenues have nothing to do with drilling oil. I own GE because wind energy is growing at 25% per year, and the Lazzard Levelized Cost of Energy 2011 paper shows wind energy to be cheaper than more conventional sources (when considering the advancement in technology in the short to mid term; look at Iowa, who has managed to keep the cost of energy below the US average using 20% wind in their grid, and also has managed to keep the rate at which energy cost increases well below average).

As far as a long term play on food prices, the only thing i know to do is rent out my CA place, buy a cheap place in a small east coast town, where prices are affordable, make sure it comes with some land, and start organic gardening, as my father has done these last 40 years. Even if the price of my place out here (in CA) doesn’t increase for 10 years, at least the rent money will pay down the mortgage and I’ll be gaining equity the old fashion way. I’m only a couple years away from the point where each mortgage payment will contain more principal reduction than interest.

Speaking of food prices, there is a family in my neighborhood in Pasadena and they converted their front and backyard into gardens and grow just about all they need for food except for meats and dairy.

Myself, built a 4×8 foot planter box and at least no longer need to buy tomatoes or squash… its quite amazing what a few planter boxes can yield. (cost to build a planter box $60).

It’s strange how this is *just* now catching on. My old man kept a veritable farm in his backyard all his life, complete with cornstalks. He kept chicken coops and used the chickensh*t to fertilize the garden, which is maybe the GREATEST fertilizer I have ever seen. He had tremendous yields each year with tomatoes the size of small pumpkins. He was looked at like a hill billy by most of his neighbors, but suddenly, it’s not only fashionable, but utterly necessary.

“You want to talk about fairness and California? My aunt bought a house in San Francisco in 1965 for $60,000, sold it in 1995 for a million. My father, her brother, bought a house in Brownsville, Texas in 1957 for $21,000, sold it in 1985 for $40,000. There is your fairness. ”

Really? You are going to compare Brownsville to San Francisco? Let alone the intrinsic weather and access to the ocean and mountains, how much growth and wealth has from out of Brownsville vs Silicon Valley ( hint hint, you are posting on a website that has much of its technological underpinnings on what has been developed in SV. ) I certainly don’t think that these 3 bedroom ranch shacks are worth what people are willing to pay for them in California, but there is absolutely something to be said for location, location, location.

Looks like another bubble is being created. So when rates go up, and they will, that 600k home in OC is going to cost the new buyer a lot more monthly.

Artificial is just that.

Leave a Reply