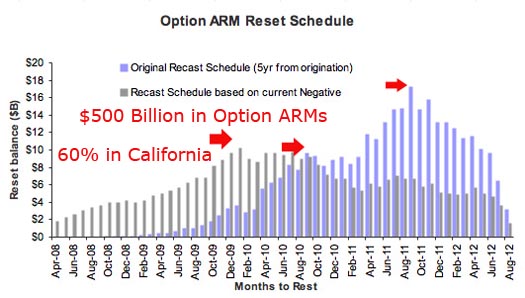

Stage Two of the Mortgage Collapse: $500 Billion in Pay Option ARMs Meet the Piper in 2008 with 60 Percent Being in California.

The next stage of the mortgage debacle is only starting to rear its ugly head and all early signs tell us that this is going to be even worse than the subprime mortgage collapse. We need to remember that the subprime mortgage debacle was only one facet of a global debt boom that has taken a stranglehold over the industrialized world. The United Kingdom is now starting to realize that even they are going to face a housing meltdown. Yet there is still a perception out there from pundits and those in the media that this housing meltdown was caused purely by subprime loans, which could not be anything further from the truth.

Many understand that this is a debt bubble and not only a collapse fueled by the subprime market in which low-income people bought overpriced homes. That in fact is a big player in this mess but many who once thought they were “prime” are going to be realizing there is nothing prime about them. Welcome to the even uglier side of things which is only in stage one at the moment. We now enter the Pay Option ARM debacle:

The most ominous sign of the above chart is the following:

-$500 Billion in total Pay Option ARMs outstanding in the U.S.

-60 Percent of these issued to folks in California

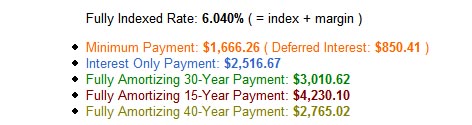

The Pay Option ARM is one of the most poorly construed mortgage product ever to face this planet. It was a pathetic attempt to allow a larger majority of Americans to have a piece of the great American credit ponzi scheme. Many of these loans give you the following pay options on a mortgage:

–Fully Amortizing 30-year payment – you pay both principal and interest on a 30-year schedule

–Fully Amortizing 15-Year Payment – you pay both principal and interest on a 15-year schedule

–Interest-Only payment – covers only the interest portion of the mortgage and does not pay down principal

-Minimum Payment – the most widely picked option in which your payment is set for 12 months at an introductory rate (remember those absurd intro rates?). After that, payment changes are made annually and a payment cap limits how much it can increase or decrease each year.

Just to show you how financially destructive these mortgage products will be let us look at a $500,000 loan with a teaser 1.25% intro rate:

*Source: http://mortgage-x.com

The loan if it were to be paid in 30-years carries a $3,010 monthly principal and interest payment while the intro teaser rate only required the owner to pay $1,666 per month deferring a large amount of the payment to a later date. You may be wondering, “well I’m sure only a handful of people opted to pay the minimum payment right?” Wrong.

“(Businessweek 2006)Now the signs of excess are crystal clear. Up to 80% of all option ARM borrowers make only the minimum payment each month, according to Fitch Ratings. The rest of the money gets added to the balance of the mortgage, a situation known as negative amortization. And once balances grow to a certain amount, the loans automatically reset at far higher payments. Most of these borrowers aren’t paying down their loans; they’re underpaying them up.

Yet the banking system has insulated itself reasonably well from the thousands of personal catastrophes to come. For one thing, banks can sell some of their option ARMs off to Wall Street, where they’re packaged with other, better loans and re-sold in chunks to investors. Some $182 billion of the option ARMs written in 2004 and 2005 and an additional $83 billion this year have been sold, repackaged, rated by debt-rating agencies, and marketed to investors as mortgage-backed securities, says Bear, Stearns & Co. (BSC )Banks also sell an unknown amount of them directly to hedge funds and other big investors with appetites for risk.

The rest of the option ARMs remain on lenders’ books, where for now they’re generating huge phantom profits for some lenders. That’s because, according to generally accepted accounting principles, or GAAP, banks can count as revenue the highest amount of an option ARM payment — the so-called fully amortized amount — even when borrowers make only the minimum payment. In other words, banks can claim future revenue now, inflating earnings per share.”

And for those of you who say we didn’t see this coming, that paragraph was pulled from a Businessweek article in 2006 title “nightmare mortgages.” Of course, Wall Street is no longer buying this crap so that $500 billion is going to implode and no one is going to stop it. Also, you need to remember that 60 percent of that mortgage portfolio of Pay Option ARMs is here in sunny California making us confront a $300 billion time bomb.

80% only made the minimum payment on these toxic waste products. I’ll draw your attention once again to that new chart recently released by Businessweek. What you’ll notice is that the gray bars are a better indicator of how quickly we will face this implosion since only a small minority were actually paying either the interest only or the 30-year options. California as a state is now down 30 percent in one-year and many niche markets are going to face 40 or even 50 percent drops. This will prove to be a bigger hit on the California housing market as we will see in the upcoming months.

Many of these mortgages now have larger balances! That is the absurdity of these mortgage products. If you really think about it, the minimum payment will actually increase the underlying amount you owe almost assuming your home will appreciate in the Wonderland reality of many homeowners and lenders. Now we have a somewhat cruel fate in which California median prices are crashing while many of these option ARM products have been slowly growing in the past few years. That is why lenders such as WaMu, Wachovia, and Countrywide who specialized in these toxic waste products are down by:

WM: down 84% from 6/14/2007

CFC: down 87% from 6/14/2007

WB: down 65% from 6/14/2007

Why do you think these companies are down so much? Aside from the subprime collapse they have seen nothing in regards to the option ARM debacle that is squarely facing them. $300 billion in mortgages alone in California that are worth so much less! Let us assume that these products are now only worth half of that $300 billion. That means California alone, not even counting the other $200 billion out there is going to hurt many direct lenders or Wall Street firms via writedowns by $150 billion with an almost guarantee given the 30 percent market decline. Let us do a quick market cap calculation of these 3 sample companies:

Marketcap as of 6/14/2008:

WM: $7.02 billion

CFC: $2.82 billion

WB: $38.89 billion

Total: $48.73 billion

Bwahaha! There combined marketcap is only about a third of the losses of pay Option ARMs which one state (California) will be facing! What if we factor that other $200 billion which undoubtedly will be facing losses as well given the nationwide scope of this housing debacle? Of course there are other lenders out there who dished out these toxic products but the above 3 were major players. Now you know why these institutions are off by ridiculous amounts. If you simply do the basic accounting and take the pulse of the market, you know that this has the potential of flooding lenders with a stream of losses for a few more years or until they go under. Take a look at the distress numbers for California last month:

May 2008:

NODs: 41,965

NTS: 9,728

REOs: 20,237

Total for California: 71,930

Nationwide total: 261,255

California makes up 27.5% of all foreclosure filings in May of 2008. Just to give you an idea how bad things are getting in California let us look at the stats for May of 2006:

May 2006:

NODs: 7,794

NTS: 804

REOs: 138

Total for California: 8,736

Nationwide total: 92,746

*Source: Realtytrac

So only two years ago, California made up 9.4% of all nationwide foreclosure filings and now we stand at 27.5%. This is how quickly things are coming apart at the seams and we haven’t even seen the first peak of option ARM recasts which should occur in October through December of this year. If you don’t think that $500 billion is a lot just wait until this summer selling season falls flat on its face for California. Fall and winter are going to be brutal.

Many of these owners are going to be highly tempted to moonwalk away from their mortgages. Does Bank of American really want to assume this option ARM time bomb? They are scheduled to close their deal with Countrywide sometime in the third quarter yet I simply do not see how they avoid astronomical losses on the current mortgage portfolios and REO properties. Unless California suddenly goes into another bubble and prices start going up, we are in for a tough few years and the current California multi-billion dollar budget short fall isn’t pretty either. Keep in mind the California budget which has now been revised to a $17 billion short fall is going to force us to make some hard decisions. Either raise taxes to plug budget gaps or cut spending (aka jobs) and only increase the unemployment numbers and thus depress the economy further.

No matter how you slice it, California housing is going lower and pay Option ARMs will be the next crisis that will send the credit markets stumbling. You can bank on that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

35 Responses to “Stage Two of the Mortgage Collapse: $500 Billion in Pay Option ARMs Meet the Piper in 2008 with 60 Percent Being in California.”

While WAMU, WB and CFC maybe in a class of their own with option ARM loans the worrying thing is that other sizable banks with no major exposure to these loans or California are also in trouble. Banks that operate in the Southeast

like SunTrust or the South, like Regions are tanking. OK Florida isn’t doing well

but these and other banks are hurting because of construction loans as much as their retail loans. Need I say that Lehmans was the investment banker that handled Wachovia’s acquisition of Golden West and is now tanking because of its own portfolio of unknowns. Those banks like National City, Citi and Wamu that have been raising capital either under the orders or requests of banking regulators have done so and burned their new investors in the process. WAMU sold shares for $8.50 when the market prices was $10-11 but did the investors get a deal? NO! They are underwater now too with WAMU at $6.50. Ditto for CITI

and National City which has fallen below the $5 danger threshold. Yet these and other banks still need to raise capital. From where will it come? If the pioneers in the recapitalization process have seen their investments sour within months of their investing billions who is going to follow especially as the drumbeat of writedowns shows no sign of abating. Without fresh capital banks have to shrink

their lending levels down to what their remaining capital can support. The Fed can temporize by exchanging its assets for bank debt but bad debt doesn’t go away in this process and the Fed, so far, has insisted it be made whole if the debt it takes as collateral goes south. At the other end of the credit bubble are the GSE’s who are taking on the vast majority of new mortgage lending made possible by the FED’s largesse. So, at either end of the credit bubble we are being backstopped by quasi governmental institutions assuming the credit risks of a banking industry no longer sufficiently capitalized to this itself. The bubble bursts when the first of these quangoes goes to the Congress for an appropriation to cover losses it has sustained propping the banking system up. I don’t see any other way out and given the stress on the consumer and business

by rising ‘non core inflation’, aka as the ‘real world’, can there be any doubt that either the FED or the GSEs are going to be taking some serious hits by holding or underwrting all this private debt

Scott:

Your points are well taken. I also think that we are only entering the first stage regarding the commercial real estate decline. This is where most of the bank failures expected by the FDIC will hit. The overarching problem of this all is that the entire system was predicated on a market where housing prices not only went up but went up substantially. Many of these institutions are only trying to bide time, shift assets all over the books, and borrow from any source to maintain a façade of solvency. This will end and I think we will have a major crisis again sometime in the fall or winter.

It may hit sooner given the ancillary market triggers like high energy but either way, there isn’t much that can be done here. The markets are now forcing Bernanke into a corner and there is even dissention within the Fed ranks. Take a look at the 10 year note. It is already pricing in a rate hike this year. Raise rates = destroy the housing market further. Lower rates = dollar gets creamed and consumer inflation goes through the roof even more. He is screwed. We are quickly approaching an end game scenario.

We’ll survive this. This isn’t the end of the world. But if your life is tied to an old finance and real estate paradigm, you are going to feel like your world was turned on its head.

Let me add something to my gloomy prior post. There is a possibility we could salvage our banking system IF we made it profitable for people to save again. Banks lend depositors money and guarantee its safety with their capital. The ‘Its

a Wonderful Life” school of banking. If Congress would make interest earned in savings accounts tax free it might cause a flood of deposits to hit the US banking system and obviate the need for all the machinations of the FED and Barney Frank to rescue a failed system. Banks could even offer part of their interest on savings deposits in equity. Sound banks would attract more deposits than risky ones and sanity might once again reign in our capital markets. Of course this would take all the fun and power out of being a Wall St. hustler, Central Banker or Congress banking committee member as well as provoke the class warriors who would resent allowing savers to keep the interest on their money but it is just a thought.

Scott; There are ways of saving tax free, plus reducing your taxable income.

1) max out your 401K. The money you put in a 401K is not taxed from your paycheck, thus reducing your taxable income. Also, If your employer matches any amount of your 401k, that is FREE money.

2) If you have a high deductible health insurance payment, you can open a Health savings account, which again reduces your taxable income and can accumulate interest tax free. Plus you are not required to pay medical expenses from the HSA.

What I would like to see is a chart (graph) that adds the Subprime to the revised Opton Arm numbers. That way you could get a pretty decent handle on the peak of foreclosures and by adding 1 year to that peak, a good idea when the bidding at the courthouse steps will be the most intense and provide for the better deals there or at the bank REO offices. Does anybody have the data base and desire to tackle this?

Dr. Housing Bubble–

Your post is somewhat misleading because you are relying on RealtyTrac for foreclosure stats on “Houses” only. The actual foreclosure numbers for home is significantly lower than what RealtyTrac protrays. RealtyTrac is not a very reliable indicator for residential home foreclosure numbers.

The reason why is that RealtyTrac’s numbers are distorted. They count Automobiles, Boats, Motorcycles, 2nd mortgages, and other items in their numbers. For example if a buyer purchased a house using a first mortgage, second mortgage, and lets say he bought a boat. If the buyer defaults on all three then RealtyTrac’s counts that as three separate foreclosures NOT one. The problem that RealtyTracs has is that the information it gives the public is very distorted because it gives the illusion that in one neighborhoold they had 5 different foreclosures but in reality we had one household foreclosure event.

If RealtyTracs actually broke down their data the numbers would actually be significantly lower in the residential housing market than what is percieved. Now that’s not to say that the residential housing market is all rosy–its not–but its no where as bad as the data they provide is with respect to the RealtyTrac numbers.

Think of all the option arms on ATV, Boats, Automobiles, Private Planes, etc that are in the numbers and once you look into it you will quickly realize that you have distorted the residential housing market. Its not your fault because you relied on RealtyTrac for guidance so I ask you to keep that in mind when you write an article on residential housing with using these numbers.

Most of these numbers need to be discounted somewhere in the 70% range. The big numbers I see posted represent the total book value of the loans and does not take in to consideration the collateral behind it. I know, i know, the value of the collateral has declined and there will be losses. However, most of these loans required a minimum 10% and a lot required a 20% or better down payment.

So if you had a 500K loan that was on a $600K house, the loan on the books is $500K plus whatever negative amm add on there was but that will only complicate the calculation and is irrelevant because it will just entail the reversal of previously recognized revenues.

About the biggest market value declines I have seen have been in the 40% range, so that $600K house is now worth $360K in a worst case scenario resulting in a $140K loss to the bank.

Knock the $500 Billion number down to about $150 Billion for a more realistic forecast. Still a big number, bad for the banks and a sad ending to the dumb people who signed up for the loans, but not the end of the world. California Real Estate will be screwed up for 10 years, worse if the Obama tax policy occurs.

Great idea, it just wouldn’t work.You’re forgetting that the biggest debtor is not the guy who bought a $700K home with an income of $50K. No amigo, the biggest debtor is our uncle Sam. You forget that he’s got to borrow Billions of dollars just to stay afloat and maintain our illusion of prosperity. Barnanke does not have the luxury of doing a Volker-style interest rate hike in order to kill inflation, no we’re too far gone for that. Remember that back in the 70’s we were still an industrial nation with a large manufacturing base and we were also the largest creditor nation as well. Any substantial increase in interest rates would not only kill the banks but the Federal Government also, that is the reason they refuse to let the stock market tank, which would happen if they were to increase interest rates by any substantial amount because money would flow from the stock market to fixed income vehicles overnight. They prefer to let people think inflation is under control (core rate) in order to keep interest rates low and people dependent on the market for any chance to stay above water inflation-wise. How much longer can this go on? Dunno but I have a feeling the gig is coming to an end soon and when it does G.D #2

Turn the system on it’s head !

take every mortgage holder that lives in their primary residence and make the mortgage simple interest 10- 15 year pay off.

make it applicable to every open morgage in the country yes the banks would take a hit mun not as bad as loosing the entire bag as that is where the curent system is going now. After all the system now is a 100% markup or more on a 30 year compound interest note,second homes or mcmasions over say 500000 k let them pay the usery of compound intrest or pay cash deposit to bring the morgage down to the 200k range

Another “IT CAN’T HAPPEN HERE” town meets the GRIM REALTOR. Was only a few months ago Richmond, Virginia was congratulating itself on its still rising property values. No more. http://www.inrich.com/cva/ric/news.apx.-content-articles-RTD-2008-06-15-0060.html

*- snicker -*

Welcome to the Blue States Revenge! (wherein we buy like flaming fools and the Red States bail us out)

Go Barney, Go Chris D — save our bacon from our big appetites.

and buy our book, Hard Assets for Deadbeats

Trucker, 401(k)s are fine, but you MUST be sure your portfolio doesn’t have any financials or any businesses that have invested heavily in financials (for example, a couple pharmaceutical companies were hurt big by the subprime mess)–if your retirement fund is invested in anything like that, the losses you’ll see this year and next will make paying taxes seem like nothing.

It is important to remember that when a home loses 20 to 50% of it’s value, it matters very little if the mortgage is a 30 year FRM or a 30 year ARM, of any ilk.

In my opinion, the World Savings-side of Wachovia Bank will be hurt the least of all the banks that originated option ARMs. It appears to me that the default rate on the portfolio side will be less than on the secondary side.

1) The overwhelming majority of World option ARMs were 80% LTV or less. The entire portfolio was less than 80% LTV. Yes, loans were offered up to 90% LTV, stated, with a 75% LTV 1st and a 15% LTV 2nd. The bank just did not lend much money at high LTV/CLTV as did WAMU, Downey, CW, etc.

2) The World product has a 10 year timeframe for the 1st recast date, not 60 months like most other option ARMs. This needs to be considered when looking at the chart above. While this is good, it doesn’t mean a lot when your home loses 20 to 50% of it’s value.

3) The World product allowed up to a 125% limit of principal balance. Again, doesn’t matter much when values are plummeting. Nevertheless, it is a cushion for some.

4) There is a significant difference between the indicies used by various lenders to calculate the fully-indexed interest rate. The indexes that fluctuate the least are COSI, COFI, CODI. and MTA. I know borrowers who are thrilled with their World option ARMs because the COSI index is falling, their interest rates between 6-7%. BUT, they did not have “jacked up” margins either!

Note: I remember telling brokers in early 2004 that they were virtually guaranteeing their customers would default in the 2nd to 4th year of the loan based on the fact that they were selling the Downey option ARM with an LIBOR index value of 1.000, there was a 60 month recast date, and they were jacking up the margin to take the fattest rebate they could get away with, therefore giving the borrower the highest possible note rate and therefore the greatest amount of “unpaid interest” (deferred interest).

5) World never allowed the lowest minimum payment rates that many banks did, to at least make an effort to slow that rate of accumulation of “unpaid-interest.”

One last question: Who in their right mind would build a MBS in which the underlying debt was based on a loan with a 2-year fixed term (2/28) and made at 95-100% to a borrower with bad credit? THAT always seeming incredible!

Anyway, this is one of the better blogs and I look forward to reading more informed opinions and articles in the future.

holy crap… …whoever is walking into the Jan 09 presidency is going to have to deal with a serious economic shitstorm.

Great post. Thanks for sharing this!

Why does it not surprise me that the majority of Option ARM signees chose the “minimum payment option”? It’s textbook American financial moron idiot thinking. “Why pay more now when you can..blah…blah..blah” .

Reminds me of a dorm roomate of mine when I was just freshmen in college. He received a new Gold VISA credit card in the mail, unsolicited. He was amazed. Bought a CD-player, new color TV, new microwave, refrigerator. Didn’t have a job. Didn’t have much money. Just paid the minimum monthly payment of $20.00 per month to keep the gravy flowing. Eventually his parents bailed him out, and made him stay at home (no more dorm life). Today he’s either 100% clean after debt counseling, or a holder of one of those ridiculous Option ARM loans!

Mommy!

Dr. H.B., thank you for your work. Enlightening and frightening.

Why else did the Fed push rates down other than to stop the 1st wave of Sub-Prime mortgage resets from hitting. Had they not done this, most SP loans would have adjusted into the 9s rather than the 6’s. Since this also has debased the dollar and created massive (and underreported) inflation, the ECB will raise rates, followed by the Fed which in turn will push LIBOR up. These ARMS are tied to LIBOR so expect to see some incredible problems as an unintended consequence of bad policies piled on to worse. Think of it in another way: Countrywide will be gone, WAMU will be gone, Wachovia will also fall and with BofA absorbing CW they too are at risk. We don’t have anymore shotgun marriage parters like the JPMorgan Chase/Bear deal. Who then will be the ones to try and save these banks? You already know the answer.

Need investment suggestions for 2009: Guns, Gold, and Ammunition.

JW

So… to a first-time home buyer who’s thinking about buying a house in the next two years, what would your advice be?

Not exactly true Brad as I was underwriting these loans. Countrywide and others where allowing piggyback HELOC 2nds to 100% CLTV (combined loan to value) so the losses will be greater than your estimates.

The hunting & fishing was good. The living was soslow & easy that living was almost timeless. Everything was free. Then the white man came.

YOU TOTAL EMBICILES!!!

YOu have been had by the system ONCE AGAIN. I was one of the ones that TOOK you. I was ….WAS ..a commodities broker and a trader as well. We took you investors for EVERY penny we could get out of you. Before you judge/cuss me, know this!!

I was in the market on 9/11 to the tune of 22k!! I had put options in “MONTHS” before all this US government op came about. I couldn’t get out of my positions ..with a profit.. (460k profit) cause they closed the market down.

Some assholes out there made “millions” and they can’t tell ya who they are…

My records are still at the brokerage for the IRS and anyone else to view.

Imagine that!!!!

You have been blinded by the trees and you cannot see the forest.

please go to google videos and watch the 75 minute video by “Lindsey Williams” and educate yourself.

You may be 30 with an mba and a college education and a fine home in the burbs and think ya know about the world….you are mistaken. look at the video and protect your family.

seeya

You listen to people that are..(a) younger than you…{first

ROBERT,

TURN OFF THE TV AND START LIVING!!!!

Trucker I ahve to disagree with you about 401ks. I have done a lot of research on prospectuses and mutual funds that are in these. Wall Street puts most of there garbage in 401k’s because the worker like lemmings is decieved when told they will recieive 80 cents on the dollar on what they put in(which there are limits by the way), in turn religiously makes contributions and never really makes returns that keep up with inflation. Historically mutual funds do not make you a lot of money. You are way better off researching a good company and buying the stock on your owm. The match never adds up to anything significant. Start your own IRA and choose individual stocks is my suggestion and you can still do that tax deferred or if at a young age it would be wise to open a ROTH.

BC save your money and wait. If you must buy something that a lot of people are needing right now a small 2 br condo in a nice area. Temporarily stay there for two years and then rent it and move to another similar house. Continue to monitor the housing market as prices will for surely continue to plummet as credit is hard to find. Maybe in time you will find your dream house. Housing is very costly at this time. Energy is rising and so is material cost for fixer uppers. So be careful. Very careful.

My advice for 1st time home buyer: Raw land with good water, arable soil, decent wind, trees for shade & firewood; conducive to easy security thru parcel plot layout. Avoid urban areas and municipal utility service. Prepare for solar & wind power off the grid. Invest in bicycle parts & PV electric panels. Plan for geodesic design, buy materials now cheaply and store them. Build halfway into ground for geothermal advantage. Think Mad Max Beyond Thunderdome. Civilization is coming to an end.

The housing crisis, the energy crisis, the immigration crisis, and all the “homeland security” BS is a deliberate attempt to facilitate the liquidation of all national assets. Even before Clinton gave the deeds to our national parks & natural resources to the UN as collateral, we have been engaged in the largest bankrupcy reorginization in history.

One angle is the North American Union situation. We know that many laws are being commonized for Mexico, Canada, and the US to ultimately remove borders in an EU sense. We will see the US and Canadian dollars reach a 1:1 ration and the dollar/peso relationship will move to 1:10 (these are pretty much there now.) That will allow a currency conversion to the Amero for the entire continent in a smooth manner. But before the new money is in our pockets, the bad guys need to make sure they are handing out the least amount possible to the peons, thus the crap happening now. It is all designed to drain your savings to zero and suck up all of your disposible income so there will be a less complicated “conversion” to the new system.

The other angle is that the the poor shape of the dollar is increasing all costs, yet the value of assets is falling. This will be perfect for China (or whoever) to come over and buy up everything of value (at a fraction of the traditional/historic value) with our own dollars! Land, corporations, water treatment facilities, roads, whatever — they are all for sale, and they will not be bought by Americans…

When Obama offers the grand solution of wealth redistribution via a new currency and other bells and whistles, remember that all this stuff was put in place to get you to ENTHUSIASTICALLY accept the premeditated solution.

You’re on FIRE.

I suggest(humbly) the Rumple Stiltskin and D-liberate get the last two Nobel prizes that will ever be given before the rest are melted down for bullets.

Arnold may have to break out the exoskeletons just to restore order if you’re right–and you probably are.

I’m outside the US reading this right now–good luck, and get to work on those Mandarin&Cantonese lessons.

We deal with this housing catastrophi every day from every part of the country and it’s quite a puzzle. We audit loan documents for borrowers and in almost all cases the income on the original application is fraudulent (inflated). The borrowers say they have no idea of it, the lender says the borrower signed attesting to it and the broker (who in many cases is no where to be found) is always the perpetrator. Many, particularly in the Malibu and other high priced areas of CA believed they’d become wealthy by “buying” multiple properties w/ NegAm loans, they are now losing them all.Other’s worked w/ the broker to scam the lender for origination fees. All involved, including the original architects “gov’t.” are now trying to figure out an “out”. The fun is just beginning!

Hello,

I am not knowledgeable about refinancing. I am currently in the exact arm loan, in the above article, from Wachovia. One thing that was not mentioned is that many of these loans have a $200.00 option to go to a fixed loan with no other costs.

How do I know when I should do this? I don’t even really understand the math behind the index and my rate. I also have a large non-conforming amount.

Wachovia is advertising values based on the $417,000 conforming, but was that

recently changed to a much higher value? Shouldn’t they be advertising based on that value?

Thanks,

David

This bailout will go down in history as the last act of Congress in a Free America – they will not be coming back into session – stock up on the essentials: beans, rice, gold, ammo.

http://tinyurl.com/4zygyh

Hello Fascism!

I think we as brokers, originators, loan officers whatever you call yourselves all got duped by the creators of sub-prime products who never did their homework. They sent their wholesale reps around armed with large expense accounts who trained the newbies on how to peddle this garbage. In my view those who created the programs and peddled them stole our industry out from under us. World savings (to name just the obvious) trained loan officers to become unlicensed ‘Financial Planners’ who sold a new ‘financial instrument’ designed to help borrowers take charge of their finances. (You can find the training video’s all over Google etc.) I say, the broker community should have risen up and filed a class action suit against them all. Hmmm, maybe it’s not too late. 🙂

Well, I was one of the idiots…I should have known better. I have regretted my decision to refinance into one of these stupid loans pretty much since the day I did it. I made an emotional decision based on trying to find a way to stay home with my daughter after I quit my full time job. I feel like I’ve signed a “deal with the devil”. I do not have an option to pay a fee and refinance. My home is worth less than half of what I originally borrowed…I have no one else to blame, but myself.

Truthfully there is no stage 2. Stage 2 has well mostly happened. Pay Options true if the rates increase will have even more foreclosures. Stage 1 was bullshit. Sub-prime loans did not cause this. Anyone that knows anything about mortgages knows this including the lying press that is owned by the lying mortgage lender. It was so-called cheap money. Which really is a misnomer for giving away money to anyone that looked like he could possibly be a human being. Trying to dig their way out of 9/11 and a war. Hey this sounds harsh. But you know what I didn’t cause all this. The half wits that run all of this did.

“Thanks for the Great Blog post! I found your post very interesting, your a great writer. I’ll make sure to bookmark your blog and return in the future. Keep up the great work, I found you on Bing. Thanks for now, Have a great day.

Everyone wants the best deal when it comes to buying a car.

Many people are unaware of what is required of them if they

are going to get that job done. Some people even think they got the best deal when they actually are mistaken.

Consider the following helpful advice when learning more about finding the best deals.

Leave a Reply