Baby booming into real estate investing – 8 Charts Highlighting the Real Estate Plans of Baby Boomers. Will Older Americans Venture into Real Estate Investing?

The rush into investment real estate has largely been dominated by big pools of money and foreign investment. I’m intrigued by seeing the Wall Street machine suddenly finding blue collar rental real estate as an attractive investment. However there has been another group of potential real estate investors that has largely been hidden from view. Are baby boomers diving into the real estate investment game? The prospect of buying investment real estate has never been a popular one. Most Americans own their own home but that is largely it. Real estate in the form of investment properties is largely an active venture. Sure, some can pay a property manager to manage their asset but this will then require a diligent process in selecting a trustworthy team. The big dive by Wall Street funds into residential real estate is interesting because this is not a quick buck industry. Baby boomers with low yields on fixed income might be looking into buying other real estate as an investment or hedge. Instead of speculating on this I decided to dig deep on what baby boomers are doing when it comes to other real estate outside of their primary residence.

Owning other property

One study that I found was conducted by the National Association of Realtors. We will also compare this data with a more comprehensive survey conducted by the Fed. The NAR survey contacted 2,000 Americans born between 1946 and 1964 regarding their real estate plans (not exactly a giant pool but we will measure this with other data):

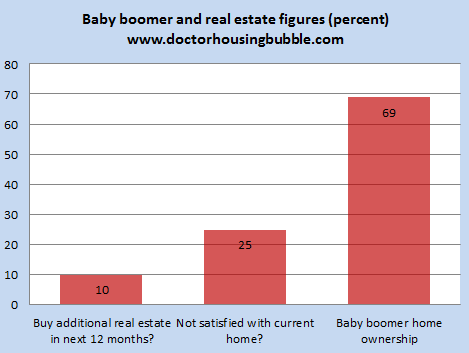

One of the first items that came out was that baby boomers have a much higher home ownership rate than the overall figure. Baby boomer home ownership is close to 70 percent. Another item that came out in the survey was that 10 percent were planning on buying real estate in the next 12 months. This isn’t exactly what some were saying that a large number of boomers were going to shift the investment market game. One interesting figure is the satisfaction with current home. This figure will likely push more homes onto the market as many will sell to move to a more desirable place.

Baby boomer and ownership rates

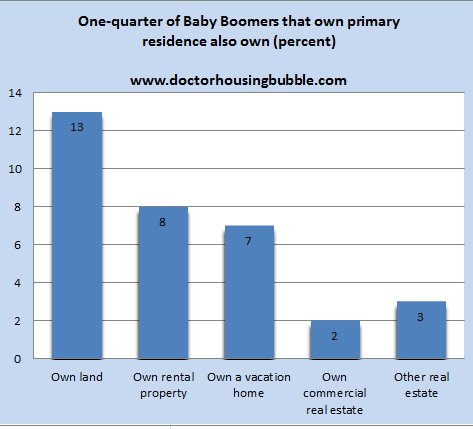

So how many baby boomers own other real estate outside of their primary residence? The survey found that 25 percent of baby boomers that own their primary residence own other real estate:

The largest segment came from land. Rental investments are at 8 percent and vacation homes came in at 7 percent. In other words, this is a small segment of the market. It is hard to see how baby boomers will suddenly find a desire later in life to dive into the landlord game. These figures have been steady over the past decade. Given the volatility in the housing market will baby boomers be lured back in once again to risk their money at a time when time is not on their side?

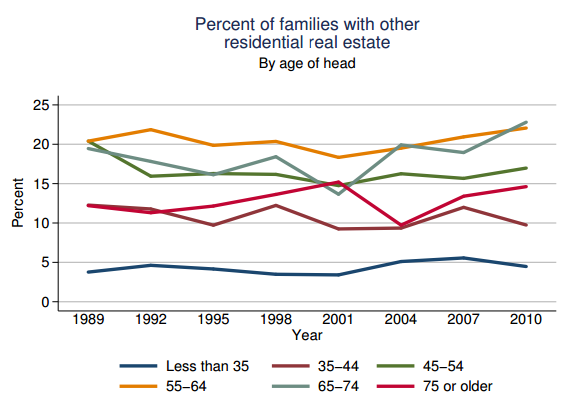

Comprehensive Fed Survey – Percent of Families with Other Real Estate

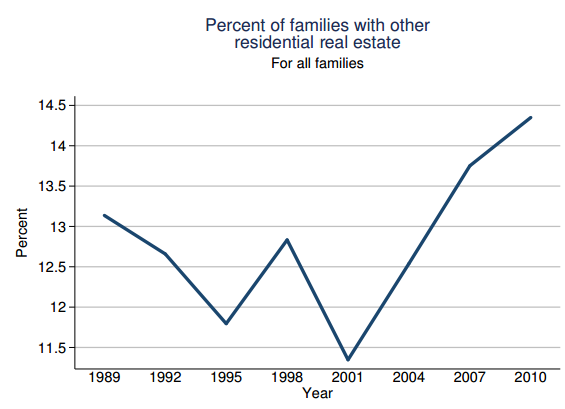

One of the more comprehensive surveys on household financial health comes from the Fed’s Consumer Survey. This survey comes out every three years and has some interesting data. First, let us see how many families actually own other real estate outside their primary residence:

This is interesting. There was a jump from 2001 to 2010 in terms of how many families own real estate outside of their primary residence. From 1989 to 2000 the figure ranged from 11.5 to 13 percent. In 2010 it went above 14 percent. Much of this was pulled in from the mania and easy money but from the more recent survey we examined, it looks like baby boomers in terms of rental real estate didn’t dive in fully.

Real Estate by Age

The best way to look at this is to pull data on other real estate by head of household:

From 2000, it does look like baby boomers increased their holding in other real estate yet it doesn’t seem like it was in the form of rental property. Maybe it came from land and also vacation homes yet that isn’t necessarily an investment more than a luxury purchase. Short of renting the vacation home out, this is like adding a spa to your home expecting it to yield a net-net return on investment.

Younger Americans, those less than 35 do not have a big holding in other real estate and that is to be expected.  The pent up flood of baby boomers isn’t likely to be in the form of rental real estate buying but more on them selling their current homes to move up or to move out.

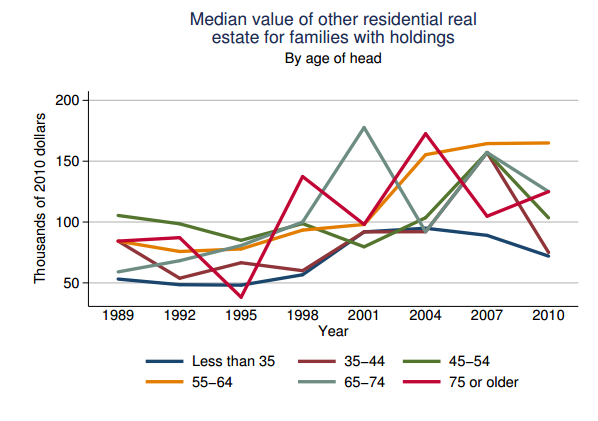

Investment Property Data – Value

The one group that seemed to ride out the real estate bubble in a better position is the 55 to 64 age group:

Every other category saw the median value of their other real estate holdings fall except the 55 to 64 age group. This could be that this group did not heavily invest during the boom times and probably bought before the bubble ran up. Those in the 45 to 54 range saw a dip from over $150,000 to nearly $100,000. Those less than 35 saw virtually no gain dating back to the early 2000s. Those claiming that a flood of investors will come from the boomer ranks are simply speculating since the data does not back this up. The current investment demand is coming from big money and foreign funds. The action is also coming from flippers in boom and bust markets looking for a quick profit. I’m not sure if I see boomers rushing in to suddenly become flippers at this stage in their lives.

Families Owning Stocks

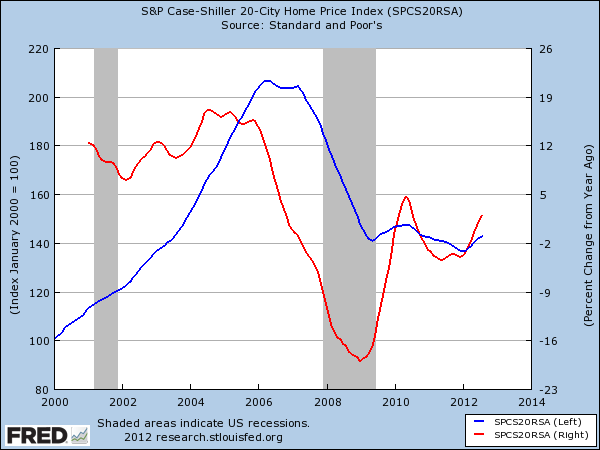

Americans have been hit hard in this real estate bust because most derive their wealth from real estate holdings largely from their primary residence. Home prices although moving up when looked at the median price, largely distort the current trend. What is happening is that the mix of distressed properties is falling in terms of the number of sales. If we look at the Case Shiller home prices are up but maybe not to the levels being reflected in median home prices:

The current standing? Home prices are still off by 30 percent from the peak and are now up by 4 percent from the trough. So households have a long way to go when it comes to repairing the damage from the bust. Yet the stock market is now getting close to the previous peak. Why are households not benefitting from this?

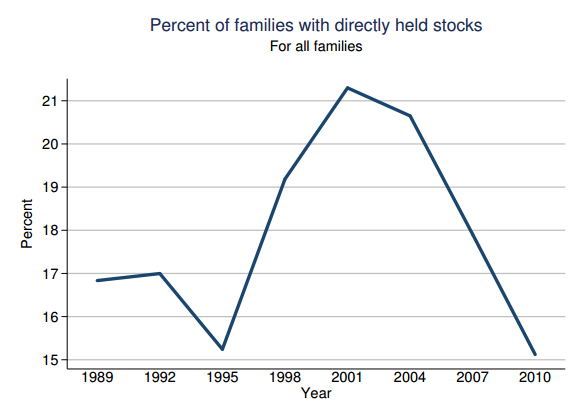

I’ve discussed this before and US households do not hold stocks in large numbers. Those that do, may hold them through pensions (a dwindling segment) and it is nothing in comparison to the amount held in residential real estate. That is why the recent stock market recovery has done very little for US households. Only about 15 percent of Americans have direct investments with stocks (off from 21 percent in 2001).

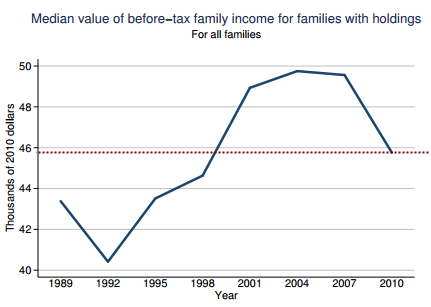

Household Income

Yet the most important figure to look at is household income. This is important whether we are looking at California housing or nationwide housing. Household income adjusted for inflation is back to levels last seen in the 1990s. So with less discretionary funds, will more baby boomers dive into investment real estate especially seeing how volatile real estate can be? I’m sure many realize that rental property is largely an active investment. Do boomers have the desire to take on this new avenue of investing? It doesn’t seem like this is happening in large numbers. One thing that can change the market dynamics is if boomers begin selling their homes to move out and transition. This will likely add more inventory to the market and is a more likely scenario that lies ahead.

From the overall data it doesn’t seem like boomers are going full force into the investment property market. Even if they enter in today, they are competing with big pocket Wall Street and foreign money that is willing to over pay. With 10,000 hitting retirement age per day, this is a segment we need to keep our eyes on.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

20 Responses to “Baby booming into real estate investing – 8 Charts Highlighting the Real Estate Plans of Baby Boomers. Will Older Americans Venture into Real Estate Investing?”

One thing that is often left out of the picture with regard to the income drop is that this is combined with a large increase in household DEBT, especially negative equity. It is this whipsaw effect that is killing consumption and guarantees little or no growth for decades. See Japan.

The mortgage interest rate in Japan is about 1.5%. I wonder what ours will be next year?

Household debt is/has been falling. It would be a LOT lower if student debt were not rising sharply.

http://www.calculatedriskblog.com/2012/08/fed-consumer-deleveraging-continued-in.html

@ Dave Barnes

Slightly in my book is not much. When one defaults, debt FALLS.

“Aggregate consumer debt fell slightly in the first quarter. As of March 31, 2012, total consumer indebtedness was $11.44 trillion, a reduction of $100 billion (0.9%) from its December 31, 2011 level.”

Details: http://data.newyorkfed.org/research/national_economy/householdcredit/DistrictReport_Q12012.pdf

“Outstanding household debt has decreased $1.3 trillion since its peak in Q3 2008. The reduction was led by a decline in real estate-related debt like mortgages and HELOC.”

And how was this real estate-related debt reduced? I am sure it was all paid off with cash and there were thousands of mortgage burning parties all over Las Vegas.

I think you are in the same boat as President Cristina down in Buenos Aires. Argentina’s debt will be REDUCED dramatically next month on December 15th when they default.

Household income? Bah, that’s just another anachronism that has no real factor in today’s RE market. Just listen to the hot money guys, they always know what’s best for all of us – and that’s to buy now, whatever the price.

go ahead if you dare, been there done that got the t-shirt

Just get ready your 20% cash down payment and we will get you pre-approved in no time….The mere thought of buying any real estate on a 15/30 years mortgage is laughable now days.Will the mortgagee’s have a job to support its home loan in the next 5 years,1 year, 6 months,1 month, next week,tomorrow???

I think the hedge funds that are busy buying up homes for rentals will be folding them into RIETs so they can cash out. How will this end? Well, look at all the other things they’d gotten into and then out of.

Dogbert hedge fund:”It’s simple. I take your money and then use math to turn it into my money while destroying the overall economy.” Q: “Is that legal” Dogbert: “More so than you’d think.” Q: “What’s in it for me?” Dogbert: “My inflated claims will give you false hope. That way you won’t stress out until after you retire and discover you’re penniless.”

Once the third quarter has reached us in 2013 anyone who has not purchased at these more than reasonable prices will miss this ship!

Rob,

If your real estate advice is as good as your idiomatic skill then it should be avoided at all cost. Think boat next time.

I think he meant to use a t where he used a p.

That reminds me of what Steve Jobs said once: ‘Apple is like a ship with a hole in the bottom, leaking water. It’s my job to get that ship pointed in the right direction’.

http://www.latimes.com/business/realestate/la-fi-luxury-flipping-20121123,0,6397390.story

To me this quote says it all:

“Elevators are in high demand in big houses, as are land, privacy and views. Must-have amenities include dual bathrooms off the master bedroom, spa tubs and showers with rain heads and multiple body sprays.”

I agree that the govt may keep this bubble inflated for a long time (and if so I suspect it’s because disaster looms if they don’t), but really ponder this article for a moment and think back to 2003 (and 1989 if you remember that bubble as clearly as I do), and remember how amidst the bubble you thought, “wow, I guess this market is for bigger players than I’ll ever be. Elevators in homes, too cool! oh well.”, and then after the bubble popped you said, “what was I thinking? It was so ridiculous in retrospect! Homes are for resting your weary head, not lounging in pharoah-quality luxury.” I’m getting that Groundhog Day, this TV show’s a repeat feeling. Go to the library and read some LA Times archived archived just like this one and think, is this REALLY uniquely different than all those other times?

are you being ironic or do you honestly believe that, Rob?

Love all the charts that stop in 2010.

Landlording can be a nightmare and is a VERY active business. If you get one nasty tenant, you can not only lose all your profits for the year, but also sustain huge losses when damage is done to the property.

@German Daddy not only is it a very active business but the IRS has lots of traps to deem it your passive business and thereby severely limit your deductions.

I am a baby boomer that owns other RE. However this other RE are orange ranches. Housing is dead money. Own producing farmland. Best RE in the world.

Leave a Reply