How Fannie met Freddie: The True Hollywood Story of Fannie Mae and Freddie Mac.

In order to understand the current market turmoil it is important to look at the history behind the two largest government sponsored entities (GSEs), the Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac). Fannie Mae was founded as a government agency, part of FDR’s New Deal in 1938 during the Great Depression to provide a secondary market for mortgages and to also provide liquidity to the mortgage market. The longer term fully amortized loan products were an innovation at the time.

The birth of Fannie Mae came at a time that was riddled with bank failures. During the 1930s bank after bank failed on bad loans and foreclosures skyrocketed. As documented by painful stories of people losing their homes during the Great Depression, this was the climate that bred Fannie Mae. The essence of Fannie Mae was to provide a larger incentive for homeownership. Keep in mind that in 1940 the homeownership rate was 44 percent. Measure that up with the peak of 69 percent in 2004.

As it turned out, the idea of a longer term fixed mortgage took hold and Fannie Mae served its purpose of providing liquidity for the next 30 long years. In fact, Fannie Mae held monopoly status on the secondary mortgage market all the way up until 1968. In 1968 Fannie Mae was converted into a private corporation. This is where I think much confusion lies in whether these are government agencies or private enterprises. Well, for 30 long years Fannie Mae was a government agency.

Fannie Mae’s primary method of making money is by charging a guarantee fee on loans it securitizes into MBS bonds. Investors assume that Fannie Mae takes on the risk and they get to keep this fee. The underlying assumption, at least from investors in these bonds, is that the principal and interest on the mortgages will be paid regardless of whether the actual homeowner pays.

In 1970 to expand the secondary mortgage market and end Fannie Mae’s monopoly on the secondary mortgage market, Congress chartered Freddie Mac as a private corporation to provide competition. Freddie Mac’s primary revenue stream and business model is nearly identical to that of Fannie Mae. Both GSE’s are only allowed to purchase conforming loans which is a reason why the current legislation battle and lifting of caps has been such a big issue over the past few years. During the boom, that is where other institutions jumped in with non-conforming loans such as Pay Option ARMs and jumbo loans that did not find a market and created a speculative fever. In fact, during the past decade Fannie Mae and Freddie Mac started losing a significant share of the mortgage market.

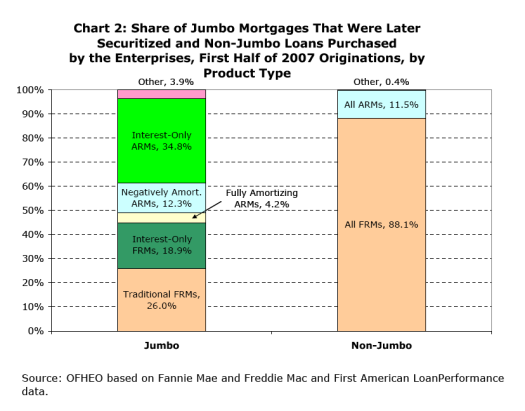

If you are curious to see how this market dislocation occurred, here is a snapshot of how the jumbo market for the first half of 2007:

As you can see, the non-jumbo market was rather bland and vanilla looking while the non-jumbo market is where much of the problems occurred. The push right now and the overwhelming mantra is to provide further liquidity. The market is in need of credit Drano and even with the current housing bailout bill which looks like it will pass, the idea was that Fannie Mae and Freddie Mac would be ready to saddle up to increase liquidity in the secondary market. The only problem is, Fannie Mae and Freddie Mac both may be the one’s in need of liquidity:

What would cause such a market punishment for these two government sponsored entities? Well earlier in the week it was thrown out by former St. Louis Federal Reserve President William Poole that these two may actually be insolvent:

“(Reuters) Congress ought to recognize that these firms are insolvent, that it is allowing these firms to continue to exist as bastions of privilege, financed by the taxpayer,” Poole was quoted as saying in an interview held on Wednesday.

Chances are increasing that the government may need to bail out the two mortgage companies, Poole was quoted as saying.

Shares of the two companies have taken a beating recently on worries about whether they can withstand more losses and support housing as well as concerns that they may need to raise massive amounts of new capital.”

The problem with this sent many official including U.S. Treasury Secretary Hank Paulson to say that a government takeover of Fannie Mae and Freddie Mac would not be necessary. As the market kept pummeling shares of Fannie Mae and Freddie Mac, Ben Bernanke stepped in and did the following:

“(MarketWatch) Typically, the Fed has acted as a lender of last resort only for commercial banks. But the Fed has authority to lend to almost anyone, if the Fed Board of Governors agrees that conditions are dire enough.

Earlier this year, the Fed board voted to open up its discount window (where it makes cheap loans to banks) to the investment banks. The Fed even created a special entity to hold the especially toxic assets from the Bear Stearns fire sale.

Under Fed regulations, regional Fed banks can offer loans to any “individual, partnership, or corporation” under “unusual and exigent circumstances” but only “if, in the judgment of the Federal Reserve Bank, credit is not available from other sources and failure to obtain such credit would adversely affect the economy.”

There’s no indication that Fannie or Freddie have asked to borrow money from the Fed, or that the Fed board has voted to authorize any loans.

Bernanke’s statement isn’t an indication that Fannie or Freddie will be going to the discount window any time soon. It’s really more like a letter from the fire department saying that of course they’d come if there were a fire.

Arsonists, take note.”

This action sent stocks from being down over 240 points to actually bringing them in the positive! Yet as the day went on, the market ended lower by 128 points and Fannie Mae and Freddie Mac still got hammered, just not as bad. This kind of volatility is similar to what occurred in October of 1929 with big figures launching out last minute efforts:

“At about half-past one o’clock Richard Whitney, vice-president of the Exchange who usually acted as floor broker for the Morgan interests, went into the “steel crowd” and put in a bid of 205 — the price of the last previous sale — for 10,000 shares of Steel. He bought only 200 shares and left the remainder of the order with the specialist. Mr. Whitney then went to various other points on the floor, and offered the price of the last previous sale for 10,000 shares of each of fifteen or twenty other stocks, reporting what was sold to him at that price and leaving the remainder of the order with the specialist. In short the space of a few minutes Mr. Whitney offered to purchase something in the neighborhood of twenty or thirty million dollars’ worth of stock. Purchases of this magnitude are not undertaken by Tom, Dick, and Harry; it was clear Mr. Whitney represented the bankers’ pool.

The desperate remedy worked. The semblance of confidence returned. Prices held steady for a while; and though many of them slid off once more in the final hour, the net results for the day might well have been worse. Steel actually closed two points higher than on Wednesday, and the net losses of most of the other leading securities amounted to less than ten points apiece for the whole day’s trading.”

We don’t have mighty men like a Whitney or Morgan on Wall Street today. Buffet carries the same power but he isn’t planning on stepping in given that his Berkshire Hathaway is down a stunning 17% for the year (for forty years, his worst yearly return was -6.2% in 2001). This action stunted the market for a bit but the implicit guarantee of the GSEs will now be put to the test.

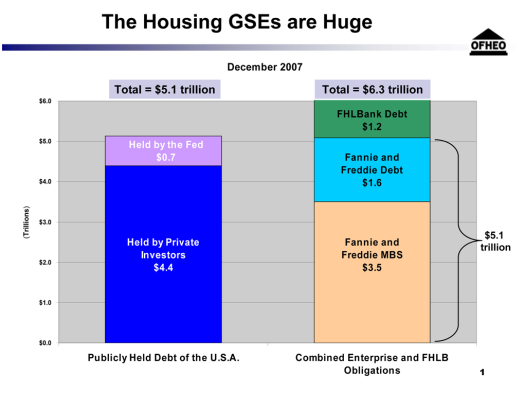

The sheer size of the GSEs is daunting. Combined, Fannie Mae and Freddie Mac have over $5.1 trillion in debt through MBS and debt:

This is larger than the size of the United States publicly held debt. If the government were to take on the GSEs this would not only jeopardize our financial security, it may damage our country’s credit rating (what is left of it)!

Given that the secondary market has frozen over the past year, there has been a push to increase the size and scope of the GSEs but the problem is that they are already way too big. Increasing them will only further create the problem that got us here. They are no longer solvent. Their combined market cap is $15 billion and they are linked to $5.1 trillion in debt. The Case-Shiller index already shows that the United States is down over 15% on a year over year basis. Given that the market real estate peak was somewhere at $23 trillion, $3.45 trillion in equity has evaporated! Estimates tell us that housing nationwide will fall an additional 10 to 15 percent meaning $2 to $3 trillion more in equity is going to vanish.

That is why this story is so perilous. If you think Bear Stearns was a big deal you have seen nothing should Fannie Mae and Freddie Mac continue on this path. Unless housing miraculously goes positive, I simply do not see how the government doesn’t nationalize these two. The fact that the Fed has already opened the door to the credit swap meet tells us there are major problems here. There is a fantastic article in Vanity Fair talking about the entire Bear Stearns boondoggle:

“(Vanity Fair) The first team of Morgan executives reached Bear’s sixth-floor executive suite around 11 that night. It didn’t take long for them to realize the danger in what they were being asked to do. If Dimon lent Bear $15 billion or so and the firm imploded the next day, they could lose it all. A little after midnight Dimon told Schwartz in a phone call, “We’ve got to get the Fed in on this.”

Downtown, Tim Geithner was waiting when Dimon telephoned. Any bailout, Dimon reiterated, was too big, too risky, for Morgan to handle alone. Both men knew that meant only one thing: somehow Bear had to be given access to the Fed “window,” that is, the spigot of cash that was available to the nation’s commercial banks, but not its investment banks. The only way for the Fed to help, to give Bear access to the “window,” was to lend Morgan the money, allowing the bank to act as a bridge across which the Fed cash could stream into Bear’s vaults.

Geithner, quickly grasping the wisdom of the move, got on the phone with Washington, going through the details with the Fed’s chairman, Ben Bernanke, and the Treasury secretary, Hank Paulson, and his counterparts at the S.E.C. If they could just get Bear through the next day, perhaps a bigger and better deal could be forged over the weekend. By two a.m. teams from the Fed and the S.E.C. had joined the Morgan bankers at Bear, poring over the numbers. In Molinaro’s conference room, Schwartz and Molinaro paced, occasionally taking bites of cold pizza; their fate, they now realized, was largely out of their hands.”

Now how much did that Bear Stearns bailout help our economy? It didn’t. If anything it allowed Wall Street firms to off load toxic waste onto the public while a few Wall Street firms lived to see another day. Now, they want to shovel more toxic waste onto the government via Fannie Mae and Freddie Mac through the new housing bailout but the only problem is, Fannie and Freddie already have a ton of toxicity in their folders! The end game is quickly approaching and the volatility of today should make you keep your powder try. Bernanke allowing Fannie and Freddie to come to the window is like calling out, “5,000,000 shares of GM at $20.” Alas there are no giants in our current economy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

16 Responses to “How Fannie met Freddie: The True Hollywood Story of Fannie Mae and Freddie Mac.”

Don’t worry the housing market and Fannie/Freddie are all saved. Our working mind trust in Washington just passed a housing bill in the senate. All of this jumbo junk will be converted into conventional mortgages backed by the tax dollars of renters and people who pay their mortgage on time. Oh yeah and disregard the facts above. According to the senate their are only 400,000 houses in trouble and the most it could ever cost to fix is 300 Billion.

http://www.fdic.gov/bank/individual/failed/IndyMac.html

Revolution, anyone?

I’m not talking about Ron Paul’s bloodless one either. I think Pennsylvania Avenue has enough lamp posts to enable us to play Mussolini with our so called elected representatives, heads of our corporatocracy, and bureaucrats.

The only thing is, will we have enough rope? It costs between 1.5 and 2 million bucks to fuel a cargo ship coming from China. Hopefully it all gets here before we run out of oil.

Oh, I am looking forward to the IndyMac posting.

I don’t suppose that we could rally enough troops to make a noise through a protest at Indymac while the government and news stations are focusing attention there?

I would be up for a little march at their headquarters. Maybe a phone call to all of the local TV news stations? They seem to like chaos and negativity.

I say we all get up and spend an hour or two venting our anger and contempt for government and greedy banks.

AnnScott: I cannot belive that seemingly one of the most intelligent poster is acting like the world owns her something. Opinions are to be said, even if it sounds like hate and a cliche. If you don’t like it just post someplace else. As a lifelong republican since Nixon, all I can think of nowadays, that the GOP, Bush and all Neo Cons should be just lined up against the wall for Chauchescu like execution. They don’t represent anything other than hate and greed.

In meeting with a local stock broker, a true bear, he gave me the following wisdom, that has been posted here over and over and over……

They have found a way to “privatize profits, and socialize losses.” Basically, savers and the fiscally responsible get screwed by the fiscally irresponsible risks taken by others.

I do find it amusing when the extreme ends of the political spectrum argue about what is best for the whole….. “Progressives” try to pass the blame on to the “Neocons” and visa versa. Believe me, there is plenty of blame to pass around to both sides.

Extremely wealthy progressives claim to represent “the common good” and want to throw cash at every problem…. While the extremely wealthy Neocons want to prove they are compassionate and outspend the progressives. UGH Both now represent irresponsible spending of tax dollars, then want to increase taxes to cover their irresponsible spending!!!!!

What about us that fall somewhere in between and are fiscally responsible?

With this upcoming election, vote them all out of office, as they are no longer representing the people, just their own special interests.

Any guesses who will go insolvent next? Fannie? Freddie? Lehmans? Next week is earnings(losses) and it will be ugly.

I just got the lovely news that my IRA lost another $2000.

Crap! And I am actually pretty good at picking a diversified portfolio.

Have never seen losses like this. No matter which fund you pick you can’t

win any more.

About had it – probably will convert the remainder to 6 month CD’s and

keep it there until this blows over.

My bank teller just informed me that they have this terrific Credit Card Offer

for me… I am disgusted… I have banked with them for over 10 years and they

should KNOW BETTER than to push a Credit Card on me. It’s no secret what

I think about credit cards. Why pay interst and fees when I can just use my

Check Card and pay cash?

Even if you pay them off every month… you will get nailed sooner or later with a

fee for some stupid reason or other.

Right now we are cutting back on spending money on things that we don’t absolutely need. My job is safe and my goal is to save as much as I can

for the next couple of years. With any luck we will have enough for a down payment when the market truly hits bottom. I just wonder what will happen when

Fannie Mae and Freddie Mac actually go down?

Will the housing market completely crash and reset back to what normal people can afford? With a median income around $40K this would bring the price of a median home to $120K? Or will it go even lower because the existing inventories are just sitting on the market with no financing available from anywhere?

Let’s face it – not many people buy houses and pay cash for them. What will we do when the banks won’t be able to lend?

Yikes… I am having a financial nightmare…

America has succeeded, with full complicity on its own part, in debauching its currency. Free market capitalism, promised by America’s plutocracy as a more elightened form of economic democracy, has failed spectacularly.

This will not come as a surprise to some but for many, who have put their faith in “those who know better,” it will give much reason to consider carefully what is still yet unfolding. The evidence does indeed point to a prolonged economic downturn that will become a depression.

Those old enough to remember the last major free market debacle, knew what the ’30s were like and what the average person suffered. The reforms brought about on FDR’s watch were resisted by the American plutocracy, almost to the point of staging a coup d’etat, but the war generation and the baby boomers enjoyed those reforms in the 50’s and 60’s.

America’s plutocracy will not give up their power readily. I believe that any future economic direction the U.S. will take, will not be based upon free market capitalism. I suspect that Keynesian economics could be revisited, but probably not in the same form as used by FDR to fix the last depression.

“Comment by AnnScott

All you “neocon†‘haters’ need to keep your opinions to yourself. (Theres enough “Bushies†telling us what to do alreddy.)

****Don’t tell us what you think WE need.

****You dont have the answeres.

****Neocon-Bushie-Haters caused these problems”

_____________________________

I DID NOT WIRTE THIS!!!

I WAS AT THE BEACH ALL THAT DAY.

SOME WEIRDO HAS APPROPRIATED MY ID!!!!!!!!!

BETTER CHECK THE EMAIL ADDRESS COMING IN WITH POSTS DOC!!!!

Um, I’m having a hard time believing the ‘real’ AnnScott posted that.

For one, she posts long comments. For two, when she expresses an opinion, she cites figures and sources. And for three, she responds to other posters by name when she ‘calls someone out’. If I’m wrong, so be it… but that would surprise me.

Phew! That didn’t seem like AnnScott.

Anyone see this article?

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4322440.ece

Uh, how is 15 billion dollars going to help two troubled possible insolvent companies fix a problem estimated to cost 300 billion? Are they expecting other bill spenders to throw more money into the pile? Cause if not, isnt it the same as just throwing that money away?

Is this being done with the idea that these efforts will prop up home prices? If home prices continue to fall aren’t more losses guaranteed? If home prices don’t fall won’t the real estate market still be locked up since most people don’t have the salary to afford homes at today’s prices without creative loans like ARMs and such? What do you think?

Gael I think you’ve summarized the situation very nicely. There is no ‘solution’. Now to add another problem for Mr. Bernanke I read that Indymac’s collapse will consume 10% of the FDIC’s insurance reserve. Indymac was just a middling sized bank. Wachovia, to name just one and one that is offering even higher CD rates than Indymac did to attract deposits and whose share price is crumbling, is something on the order of 20 times the size of Indymac. The FDIC only had a little over $50 billion in reserves. You have a Wamu or Wachovia fail and those reserves are gone. It would appear the FDIC never envisaged anything more than some small to middling sized bank failures and if those are coming so too is the very real danger of huge regional banks and even the mega banks crumbling.

Concentrating profits and socializing costs has ALWAYS been the basis of market economies. What do you think “profit” and “growth” are? They are the cream, and they are skimmed, and many get the whey so some can get the good stuff.

We’re all implicated in this, and judging by how many people will stint their kids on good food rather than changing their fossil energy consumption, most of us choose to remain implicated. You don’t think you pay full cost for every mile you drive in your car, do you? Of course you don’t. Everyone in the world pays so the few can drive (and fly, and develop land, and go on cruises, and so on).

Storming the Capitol and hanging bankers from lamp posts I suppose meets the criterion of a good fantasy wankaroo for some. But the fact is, a much larger redefining is needed. Before I retired I spent 30 years working for organizations doing that thinking and trying to build mechanisms for it. Suffice it to say, I don’t have a lot of hope it can happen here in the US, where saving, working, investing (in something real), and taking responsibility for one’s actions are considered the activities of suckers and chumps.

mik

Are Freddie and Fannie doomed to got he way of Indy mac or not?

I see a bunch of conflicting stories about it, and am interested in what is going to occur with the common stock.

i think that the stock will recover. the government will not let these companies fail and eventually, once the bad loan losses and what not are off their books, i think they will return to profitability. it will never be like before, where the stock will probably never excedd 4-5 dollars (once these traded over 60), but i do think that the government will be able to exit from this – but maybe not for 4-5 years. this is def. a long term investment if you were to buy the shares.

i don’t think the common shares are going anywhere.

Leave a Reply