The bubble that is California: A flood of rentals in lower priced markets, inventory creeping back up, and investors appetites waning.

California can be viewed as a microcosm of what is occurring across the United States. Few markets are propped up by a smaller affluent population while most, are pushed outward or to rentals as incomes go stagnant. People for the most part only pay attention to what is immediately around them. When the crisis hit in 2007 many were caught off guard although the warning signs were all over the place. As 2014 starts, we are now seeing a definite slowdown in housing even in higher priced areas. Inventory appears to be coming back online but sales are very weak since people are asking for peak prices and drinking the housing Kool-Aid with gusto. The median sales price in SoCal has stayed put since June but sales have fallen steadily. Across the state, with more rentals from investors prices are soft and unlikely to rise given that many Californians have not seen any real income gains over the last decade. For the most part, many are stuck in a bubble thinking things will remain the way they are simply by sheer momentum.

Where the bubble begins

When you look at California home prices and compare them with incomes, you realize that we did indeed live through a bubble. Of course many of the critics that now acknowledge the previous bubble give multiple justifications as to why it is nearly impossible to have another bubble today. Bubbles by default are guided by manic behavior detached from underlying economic fundamentals. Today, the market is driven up by investors and speculation being driven by large pools of money flooding into certain areas from Wall Street and abroad.

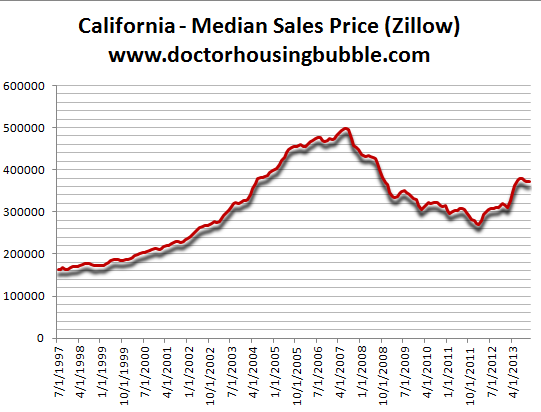

With that said, let us look at where prices stand today:

At the peak in the market in 2007 a median priced California home was fetching slightly over $500,000. Today, the price is at $370,000 after bouncing off the bottom of $270,000 according to Zillow data. As we have discussed, this current price makes housing unaffordable to 2 out of 3 families in the state based on current incomes and mortgage rates. More households in California are now renters because of this boom and bust. A large part of investors have put their properties back on the market as rentals:

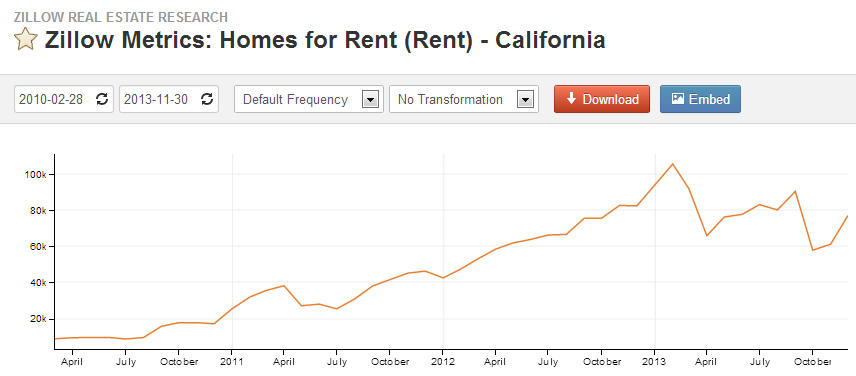

Source: Quandl    Â

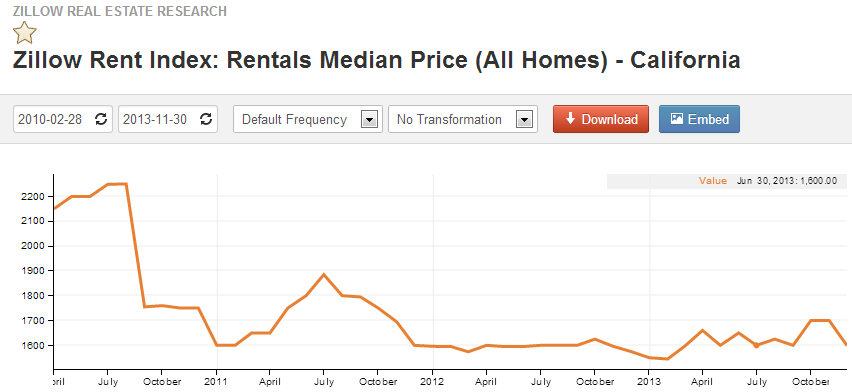

The number of rentals has gone up dramatically since April of 2011. In April of 2011 something like 15,000 homes were available for rent. The peak was reached early in 2013 at nearly 100,000 and is now hovering around 80,000. Of course, this has to do with the incredibly high number of investors buying up single family homes and now putting them back onto the market for rent. California is a big state and many investors bought in more affordable areas. This is why the median rent across the state has also fallen with the new added supply:

The above data I find interesting but I think the explanation is rather straightforward. Investors have been dominant in areas like the Inland Empire and Central Valley. In previous years, most of these areas were filled with people actually buying homes since prices were modest compared to incomes. As investors sucked up a large part of the inventory, a bigger portion of this market turned into rentals. Given lower incomes, when these homes hit the market as rentals, they depressed the overall state median price of rent. Typically a good portion of rentals are in the form of apartments but suddenly we have a large segment being allocated to single family homes from big investors. Does the above rent trend look lucrative to investors?

It is too soon to tell but looking at the MLS there has been a steady stream of new inventory across California. This is typical for the winter and spring. Usually, you will see inventory tick up in winter and spring with sales picking up in spring and summer. The inventory portion is happening on schedule but we’ll have to see how those sales numbers look. Will we still have over 30 percent of investors diving into this inflated market?

Here is the data on owners and renters for California

2007 Census

Owner-occupied             7,076,972            (58%)

Renter-occupied             5,123,700            (42%)

2012 Census

Owner-occupied             6,781,817           (54%)   -295,155 from 2007

Renter-occupied             5,770,841           (46%)   +647,141 from 2007

Keep in mind this trend change to renters has occurred during a recovery period (the recession officially ended in the summer of 2009).

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

118 Responses to “The bubble that is California: A flood of rentals in lower priced markets, inventory creeping back up, and investors appetites waning.”

Housing To Tank Hard in 2014~!

Housing to remain flat all year.

Keep hoping Jim

It deserves to tank! The rise in prices throughout California is purely artificial.

Jim is correct, it already is tanking. Median number is a fantasy. You have ZERO volume and slowly increasing inventory. You have a FED that is perfectly fine stoking inflation which (along with Obamacare premium rises) is going to destroy family budgets and force even more multi generational co-habitation in CA.

So to recap…

Shrinking disposable income due to inflation increases vacancies, destroys cap rates and the institutional investors returns along with it. FED either loses control of the bond market and treasuries rise OR inflation runs higher (it has to be one or the other) and either one is bad for residential RE. RE tanks hard in 2014 no matter what the rainbows and unicorns median price is reported as.

JK-Row: “…purely artificial.”

A rather curious assertion, given the high percentage of *all-cash* buyers, and lack of liar loans. All-cash is as real as it gets… normally. Now if you’re saying that the banksters are laundering their ill-gotten ZIRP “recovery” (and Fed MBS “repurchase”) funds through their hedge fund cronies, in a Bernanke-Blankfein-Sharon-engineered shell game, well, then… I get what you’re saying. ;’)

This economy is artificial. The FED screws with rates and prices adjust. When they decide rates are not going to be low anymore. I remember 1981-82 When the prime was 21%.

Los Angeles inventory is at MULTI-YEAR LOWS, and its only January. Housing to up again this year. The ship left the dock without you long ago.

http://www.deptofnumbers.com/asking-prices/california/los-angeles/

Ship left dock without you? That doesn’t happen. The ship leaves dock for a while then it comes back. Centuries of data on that one. Don’t get caught up in that mentality. It leads to making bad buying decisions.

Cities will always need more plots and parcels for property tax payers to move into. It sometimes just takes time.

I am very disappointed that someone cool enough to have Heisenburg as their profile pic would have such an unscientific comment. Research please! That’s like telling people that had not bought yet in 2006 missed the boat but as we all know waiting a few more months would get them the same house they missed the boat on at 50 year lows. Have to say if they missed the boat, just wait, another will come along soon.

Except in 2006 there was 3 times the inventory we have now. I would be worried right now if inventory was 3 times what it is now. Some people don’t learn even when facts are staring them straight in the face. Another up year, but don’t mean much to me since I already bought and locked in <4% rate.

Ah, so you bought your house at top dollar because money was artificially dirt cheap. Good luck selling your stucco to the next guy making what you’re making today as incomes stagnate and interest rates go back to 7%, making money much more expensive for him to spend.

“don’t mean much to me”

Of course it means much to you. It means a ton to you. That’s why you’re here. If you were confident that it didn’t mean much, you wouldn’t be here trying to convince us that it doesn’t.

You’re just like all of the others that come on here to regale us with tales of their currently ongoing boat ride that started in a past housing market. You’re chips on the table and the tell is obvious. Anyone who’s not a fool knows you don’t count ’em until the game is done.

“Except in 2006 there was 3 times the inventory we have now”

And there were WAY MORE than 3 times the amount of qualified buyers! You’ve got affordability at its lowest in recorded history. No more NINJA loans available for the proles. As soon as the rentier class moves on to the next bubble much of your “equity” will be disappearing. Maybe not a depressing amount if you truly live in a prime area, but even then unless you put 20% down you’ll likely be underwater. I would wish you luck, but I’d be insincere…

He’s right. This market isn’t tied to economic principles. Investors are in it for the long haul. It’s the regular buyers from 2010-2012 who are trying to unload their houses for a quick profit if they can, hoping the market being hot will fetch them a deal they might not get for a while.

Only way market tanks is if investors flood the market, which isn’t going to happen, I think. Depressed inventory, 40% cash buyers the last 3 years, and we’ll have a market that will flat line or slightly increase for the year.

Buying now is not going to get you a net equity in 18 months like the last 2-3 years (and I wouldn’t recommend buying FHA at this point in time), but with 20% down I don’t think it’s that risky. If you’re in it for the long haul, can afford the payments, and it’s at or less than what rent will cost you for the same house, it’s still the prudent thing to do. I was an FHA buyer, so I”m out

Housing is going to crash? Keep wishing. Slow down to where the double digit appreciation rates are over? More then likely.

Inventory might be up but there are a ton of sellers that are being greedy and no shortage of real estate agents that will take overpriced listings right now — resulting in a decrease in closed sales.

Homes priced right are still selling and there’s absolutely no shortage of buyers looking for decent deals.

ding ding ding! We have a winner – that’s exactly what’s going on

Housing tanking in 2014? Only if interest rates continue to climb. Most “all-cash” buyers are technically using borrowed money to finance their “all-cash” purchase. Therefore flat interest rates means flat home selling prices. Rising interest rates mean falling home selling prices.

The only caveat is: Recession

If the economy goes into a recession in 2014, then home prices will tank in 2015 or 2016, but not 2014 as selling prices tend to be somewhat sticky.

I think the biggest red herring is the discussion of interest rates going up versus staying flat being the factor. The real factor is the rate of change of the interest rates. You cannot support an asset bubble with fixed public debt/income; you need increasing public debt/income. Blert’s friend Steve Keen describes this as the rate of change in the change of debt. Flat interest rates will not give the asset bubble the necessary fuel to support current state. The most important point about asset bubbles is that they are unstable by nature. We would need ever decreasing interest rates to sustain the current bubble economy and that is not likely…

@What?

Another point to take in is that when the mortgage rates when up by 100 basis points in 2013, this effective locked a whole bunch of people out of the housing markets. The month-to-month decline in sales since the rates went up is a sign that the supply of potential buyers at current prices is being depleted.

Example:

Super Prime areas: unaffected by mortgage rate changes

Prime areas: largely unaffected

upper mid-tier areas: declining sales, number of potential buyers is diminishing

middle mid-tier areas: heavily impacted, number of potential buyers is being rapidly depleted

lower mid-tier areas: heavily impacted…running out of potential buyers

working class areas: severely impacted, pretty much no more potential buyers at the current price/interest rates. mostly investors in this area.

poor areas: forget it. only investors are going into these areas.

Sorry people, you may see price reductions, but another collapse or so called bubble, not going to happen in your lifetime.

If you are the market to buy do it in the next 5 months because interest rates will be at 5.5%. Sellers are in a much better position to hold on now, especially good property in good locations, waiting will only cause you lower inventory to pick from and stable to higher pricing.

Well considering we’re focused on SoCall their have already been 3 bubbles collapses in my lifetime, the early 80’s, the early 90’s and late 2000’s. You present no compelling argument in the face of the facts pointing to a fourth crash in less than 40 years.

You know the bubble is already bursting when real estate shrills reappear on the bubble blogs. They have so much spare time that they visit blogs versus open houses… Hmmm… Robert is the best evidence that the market is already crashing…

Jim, I do not see any rapid moves in housing in the next 12 months. If anything the feds will continue to attempt to support the bad bank loans by pumping housing prices. If anything it will be a slow drip as investors slow down and try to off load to the poor individuals desperate to own a home.

“Jim, I do not see any rapid moves in housing in the next 12 months.”

Jim, I see a beautiful woman coming into your life. I see new opportunities at work. I see the return of an old friend…

History has proven one thing. You really can’t predict the future even with a crystal ball. Our economic modeling has been wrong 10 times out of 10. That means that our “understanding†of economics is generally wrong. So Jim’s guess is as good as your guess. BTW – my guess is that you both are wrong…

Doctor, oh dear Doctor, you forget that in our current environment, the banks and the hedge funds run the country. Free markets work well for them. You see, when the free market works in their favor, they cash in the check. When the free market works against them, they simply manipulate the system outright. They have no shame in doing it and no one will stop them. The electorate cares about other more important matters that are related to pop culture. If things appear to fall apart, they simply will manipulate the system. No one should dream that prices will tank.

“Bubbles by default are guided by manic behavior detached from underlying economic fundamentals” Correct. The average person is no where near the real estate market.

50% of transactions being all cash/investor deals highlights the lack of main stream participation in the housing “recovery”.

Worse as you pointed out on January 7th, 2014 “Failure to launch generation: “Why household formation for younger Americans continues to lag while home prices soar. 46 percent of younger Americans living with older family members”, millennials are even more shut off from homeownership than their elders due to rising home prices and their own lack of proper employment and because many also hold crushing amounts of student loan debt.

Only a real collapse that the Fed can’t bailout holds any hope for GEN Y as QE has enshrined losers. Unfortunately millennials aren’t part of that “losers” club. http://smaulgld.com/millennials-not-part-of-the-club-yet/

I have been watching condos in one South Bay community! and the buyers are having to twist themselves in knots to close deals. Lots of sales above list price, which suggests to me that he seller has to pay the closing costs. It seems that the average buyer is still willing to push themselves to financial extremes in order to buy at the top of the market.

There will be demand for all those rentals–from the undocumented hordes who will be flooding into California to join the millions of other undocumented immigrants already here. Why wouldn’t they come to California when Democrats in the state legislature cater to them by passing legislation allowing illegal aliens to obtain driver’s licenses, become lawyers, and qualify for in-state tuition at California’s university and college systems?

Now, Democrat State Sen. Ricardo Lara has said that immigration status should be irrelevant if the goal of the federal healthcare law is to provide coverage to the uninsured so he will introduce legislation to involve the state in providing coverage to those in the country illegally.

http://www.latimes.com/local/la-me-healthcare-immigration-20140111,0,7582750.story#axzz2qEkFUYCC

Illegal immigration isn’t as big an obstacle as its made out to be. If the Gov’t wanted to crack down on it, it would. And it would be easy. Just like drugs though, there is money to be made in it. Not to mention the small businesses that would suffer because they can’t handle employing people legitimately.

First of all all your troubles will NOT be over if we deported every single immigrants. Second the corporations want them here and there is nothing anyone can do about that. So let’s try to be human beings and treat everyone fairly as we can. If they don’t have medical care it ends up costing the state even more and your taxes go up not down. We live with and around these people all the time. Most of them are wonderful people so just let up. Your bigotry has no place here.

Bobi, I fail to see the “bigotry” in Fastrack’s comment. Do you believe that there is such a thing as “illegal immigration”? I do. And I wish the government would put a stop to it.

But businesses and their owners that can leverage cheap labor will continue to get their way at the expense of the rest of the people living legally in the US and paying taxes.

I hope that isn’t too bigoted a comment.

well said – thank you Bobi

First of all, Bobi needs to know that every country in the world controls their borders and limits illegal immigration–even Mexico. You can read

how badly Mexico treats treats their illegal aliens at this link:

http://www.nationalreview.com/articles/344042/reminder-how-mexico-treats-undesirable-foreigners-michelle-malkin

Secondly, why do you expect California taxpayers who already pay the highest taxes in the nation to pay extra taxes to provide healthcare for millions of illegal aliens who were so selfish that they came to this country illegally ahead of people who are trying to immigrate to this country legally?

Since Bobi and shellz think that undocumented immigrants (aka illegal aliens) are such wonderful people, why don’t you both open up your homes to them? Why don’t you both volunteer to pay extra taxes to feed, clothe, educate and pay for their medical care? Better yet, why don’t you buy several homes for them to live in?

So Bobi and shellz , if you aren’t prepared to completely open up your wallets for your wonderful undocumented friends, your liberal hypocritical bigotry has no place here.

I really can’t understand why so many people think that the illegals are the problem for higher taxes, when in reality they make way less then any American and use dead ssn#’s which is banked and never given back in retirement. Also If you really think this is the issue then you miss the bigger issue you’re miss informed. Most illegals live in a apt that is meant for 2 by the 10’s 3-4 in the living room families in the rooms and pay cash for everything. Who your paying higher taxes for is the stupid Americans that can’t make good investments and never pay their bills CC, house, or car loans even student loads. On top of all the politicians that find loop holes. Stop complaining about it this is so old already and as for food stamps they don’t even get it they don’t qualify, they are illegal. So if your mad moved to Mexico and get a life.

It’s complete BS with the illegals. Now they can get a driver’s license. The only motivation can’t be to get votes (they already have them) — it’s because hit helps the economy. More illegals driving legally = more people playing taxes, car registrations etc

The intention is to bill the illegals for bad driving (traffic citations) rather than having to arrest them and pay for their three-hots and a cot.

As the law currently stands, driving without a license means ‘bracelets.’

It’s that transparent.

Sacramento: the best politicians that money can buy.

I think there is no housing bubble in So Cal beach cities. And I think there never was a housing bubble in So Cal beach cities. Most So Cal beach cities are now at or above the previous peak prices even though the subprime mortgages and negative am products are gone. These big prices in beach cities are supported by incomes and standard mortgage products. It is possible renters made a huge mistake not purchasing a home in a beach city when the prices dipped in 2009 – 2011 … that dip was a temporary blip that is long gone.

Jimmy, I’m sure you’ll get lots of responses from the angry bears here. What we have learned is that these ultra prime socal beach cities really ARE different. Many people who currently own in these spots likely couldn’t afford to buy their house today if they had to, but that’s all irrelevant. Today’s buyers are highly qualified, that’s all that matters. You have many market forces at play: supply and demand 101, LA is truly an international city, money of all sorts (domestic, foreign, inherited, ill gotten, etc) want a piece of the action. And with central banks creating money out of thin air, prime RE in the good old US of A is one of the safest bets going. Owning RE in a desirable socal beach city is one of the best tangible assets you can add to your portfolio.

Not an angry bear here, LB; I enjoy your posts although I don’t always agree with your viewpoint. That said, agreed that small slice of SoCal ultraprime properties will likely hold their value and be desirable. People will likely always want to buy beachfront, Beverly Hills and on the Bird Streets. However, this sentence might be a bit chilling…

“Many people who currently own in these spots likely couldn’t afford to buy their house today if they had to, but that’s all irrelevant”

This could prove to be a fatal flaw in your argument, as it also applies to huge portions of SoCal RE that are “desirable” but hardly “superprime”. Will their always be qualified buyers lining up for 70’s era houses in Torrance at current prices? 80’s era condos in Huntington Beach? Millenials who in the past were first time buyers on the RE the food chain…they’re leaving CA or back living with Mom/Dad/Grandma working low wage jobs. CA Middle class mostly treading water, fretting about job loss, putting kids through college, supporting said kids when many boomerang home with limited job prospects, caring for aging parents, etc. They’re renting or hunkered down in a house bought pre-2000; I doubt few plan on “moving on up”.

I’m looking at retail earnings and many are coming in with some startling misses. I’m wondering if the middle class family is running out of gas.

Just my humble opinion.

“Today’s buyers are highly qualified” – Don’t quite understand this.

Aren’t most buyers today investors and/or FHA 3% down folks? Neither are the organic traditional “highly qualified” buyer that the market needs to sustain itself.

Agreed on Torrance, there are neighborhoods in South Torrance that will likely never drop much, but I wonder if parts of the city are overpriced. Who will replace the long time owners in the ‘so so’ areas that border Gardena, Lomita, etc? These are VERY middle class areas that are currently selling for 10 times the median income. Will there be enough wealthy professionals waiting to move in ?

You keep touting that El Segundo, Manhattan Beach, Redondo beach (South Bay) area as if its bullet proof to a downturn. I work for one of its biggest employers in that area(Raytheon), and they are slowly packing their bags and will eventually move their entire operation to Texas, taking with them around 10K jobs. When they move more defense(aerospace) contractors will follow them. When that happens(not if), we will see then if COASTAL California homes (south bay) can continue to hold their price.

@ Drinks, unfortunately I think people will always stretch themselves to get into the “nice” but not “ultra prime” locations. A buyer who would stretch themselves with a 600K Torrance place would never dream about living in MB. The alternative for them is much worse, Gardena, Hawthorne, Lawndale, etc. People will pay the Torrance premium to avoid those lesser areas mentioned. Factors such as safety, schools, quality of life all come to play here.

@ Joe Average, the beach cities are seeing “highly qualified” buyers. Cash, large downs, documented incomes and emergency reserves are totally normal. The investors or 3.5% FHAs aren’t buying in the desirable areas.

@ Bubblicious, the South Bay was dominated by the aerospace industry back in the day. It’s slowly declining and will likely continue to. Other money is coming into the area. Look at Manhattan Beach to see what the future holds for the South Bay. The rich are colonizing the desirable parts of coastal CA. MB is done, Hermosa is in full swing, Redondo will likely follow. The days of young engineers moving here from the Midwest and living the dream by buying that sweet South Bay house is pretty much over. This is happening in many places of California, not saying it’s right…it’s just reality!

“@ Drinks, unfortunately I think people will always stretch themselves to get into the “nice†but not “ultra prime†locations.”

LB, there is a very limited number of “entry level” buyers now compared to the past. Many recent college grads have low wage jobs, are living with Mom/Pop, or roommates. They will “stretch themselves” to make next months car or rent payment. Most won’t be buying SoCal RE anytime soon.

Move up buyers? Mom/Dad are worried about keeping their jobs. Maybe Grandma will move in to cut expenses; or Junior has moved back home with a pregnant girlfriend with no exit strategy and limited job prospects. Most Boomers aren’t “moving up” the RE chain “stretching” to buy bigger/better homes, quitting jobs to to buy vineyards and “find themselves”, etc. That was 2005. In 2014 they’re struggling to pay their bills and worried about the future.

Hope that pool of “investors” and “foreign cash buyers” is mighty big, because the pool of SoCal homeowners in “desirable” areas who couldn’t qualify to buy their own homes now is mighty big as well. Is this “irrelevant”? Time will tell.

All good points Drinks. However I think you are underestimating the number of potential “Torrance type” buyers today. The LA basin has almost 20M people. There is only so much turnover creating available housing in the Torrance type areas. So it’s back to supply and demand 101. I have been tracking sales in Torrance, it seems like almost anything priced accordingly sells quick…even today.

I agree that your average Joe is totally screwed going forward. Anybody buying a 600K socal house today is definitely above average. I guess time will tell and give us the final answer.

“@ Joe Average, the beach cities are seeing “highly qualified†buyers. Cash, large downs, documented incomes and emergency reserves are totally normal. The investors or 3.5% FHAs aren’t buying in the desirable areas.”

Where is that cash and those large downs coming from, savings or other forms of leverage?

Can you produce any evidence to backup your assertions?

If the desirable areas are such a sure bet, why wouldn’t an investor want the presumed safety that would come with one of those assets?

I agree with you, Jimmy. We live in Texas. We purchased a house in a California central coast beach town last year to use as a second home. Between interest rates as low as they were, prices being much lower than a few years ago, and putting 40% down, the monthly payment is surprisingly small. Add to that the low property taxes and low utility bills and our little (1100 sf) beach house is very affordable — even more affordable than our house in Texas, where our property tax is 2.5% and the summer electric bill often exceeds $300.

Chasing yield, I’m still building rentals at the beach, but if 10-year Treasuries get to 4%, then my money goes into Treasuries instead of rental properties. If other RE investors feel the same way I do, then cap rate on rentals will be destroyed.

Why even bother with 4% rental yield? Too much work and risk to justify 4% cap rate. 6% is minimum for me.

Break out an economics history text: 1970s America.

Bonds and real estate usually trade INVERSELY.

Bonds will only fade in value — in a time of absurd money-printing — hyper-inflation of the currency.

Real estate, at least for a time, will hold its own. It won’t take off; it won’t implode.

Rents can be adjusted UPward. Cap rates can move all over the place — when both rents and prices jockey all over the market. They are NOT the key metric to use when making a purchase decision.

(I know that’s a radical thought. But there are other cosmic issues that now loom large: like just where else can one SAFELY invest wealth? ZIRP has shut down most normal options. You’re not only not in Kansas — you’re not even in 1985. That confetti at your feet is the rule book.)

US Treasury bond coupons cannot!!!! So rising long term rates cause seasoned paper to crater.

So, you’re reasoning is errant.

You seriously need to study up on the zany antics of the markets in Argentina and Russia. (circa 1998)

I must also recommend studying up on American economic disruptions: the end of the Confederacy and the post-Revolutionary economy during the Articles of Confederation.

(Taken together, it’s enough to put one off of ‘confedera…’ as a term of structure.)

“Break out an economics history text”…

Gotta say it Blert, love your zesty writing style…

As I have said before. California is made up of a number of different areas, each with its own dynamics. The Bay Area is different than Sacramento and the Inland Empire. Same for the “Westside” and the San Fernando valley and etc. Each area is different, like the different states. The Bay Area is very different than SoCal as any resident of The City knows. Which California are you talking about? Be specific. What applies to the Inland Empire does not apply to San Jose or The City.

Probably housing too remain slightly up all year.rents too go flat.long term trends too continue

I am buying this year, like it or not. I’ve been looking in the area I want for about three years and seen some deals come and go. I think that will be key for anybody hoping/waiting to buy: know your market area and keep your eyes open for the deals. Anyway, that’s about the only thing I can do.

Everyone should now understand why the big investors in the CA housing market are rushing to securitize their rental revenue streams. It’s time to off-load these dwindling revenues to the uneducated masses who are dumb enough to buy these securities.

Can you spell “Srewed Again By Wall Street”?

It’s happening already. Beginning sometime in 2013, I began hearing these radio commercials on KFI-AM’s Tim Conway Jr. Show.

Some company is buying houses, refurbishing them, filling them with “great” tenants, THEN selling the houses to YOU!

“They do all the work!” Tim Conway Jr. says. “You buy a fully refurbished house, WITH a tenant, and begin collecting that monthly rent check IMMEDIATELY!”

Someone should ask Conway, if owning a rental house was such a great deal, why is the company off-loading these houses to buyers>

That’s because lenders will only lend them so much and the more debt u own the less u can borrow. So they have to sell and realize their gains so they can refurbish a larger property. Hopefully move up to multi unit complexes.

“That’s because lenders will only lend them so much and the more debt u own the less u can borrow. So they have to sell and realize their gains so they can refurbish a larger property.”

Those rental properties are collateral that could be used to leverage even further. Also, the rents provide additional capital with which to invest. They know that you have to sell to lock in the profit. That’s what’s really going on.

“Can you spell “Srewed Again By Wall Streetâ€?”

Was that intended ironically?

More than 11 million Americans spend more than half their income on rent….

http://www.zerohedge.com/news/2014-01-13/welcome-blackrock-recovery-over-11-million-americans-spent-more-half-their-income-re

Stagnant incomes and increased demand for cheap apartments spurred the rise. Between 2007 and 2012, real median renter incomes fell by 7.6 percent, based on Census data compiled by the Joint Center. The number of renters climbed 11 percent between 2007 and 2011, U.S. Department of Housing and Urban Development data show. A Census report released this month found that 31.6 percent of Americans lived in poverty for at least two months between 2009 and 2011, an increase from 27.1 percent over the 2005 to 2007 period. And the nail in the coffin: the annual rate of change in real disposable income per capita just went negative.

The rest of the story is well-known. Wall Street landlords, who have access to cheap funding, demand a high cap rate, and as a result rents keep going higher and higher, and since the cost of capital is still sufficiently low to where even a less than fully rented out complex will generate a positive return, there is no impetus to lower prices in order to generate more demand (well, everywhere except perhaps in New York of all places, where rents continue to decline). Alas, for others this dynamics means being forced to move out (and not being able to squat in a house in which the mortgage has not been paid for years).

QE A, constantly rising rent was a factor that got me off the fence. Landlords have/had an immense advantage over the past few years due to the manipulated market. Many people who wanted to buy couldn’t so they are stuck in their rental and at the mercy of the landlord. The thought of finding another rental and moving and going through all the headaches to save $100/month just isn’t worth it so they begrudgingly signed another lease.

When I closed on my house back in 2012 and essentially told my landlord to go eff himself was truly a great day. I was the perfect renter and was constantly hit with rent increases. I got the “it’s only business” reply back after complaining many times. I locked in a sweet place with a monthly payment less than my 1 bedroom apartment…it’s only business as they say!

It is, ultimately, only business. So, no need for hostility toward your “landlord”. Actually, they took the “lord” out of “landlord” a long time ago. You did what was in your best interests in the marketplace, the owner of the property did also. No need for hostility either way.

@ Lord B. I rented a 1 bedroom apt in Santa Monica for 10 years before buying in 2012. In the 10 years living as a renter, the 11-unit apt bldg changed ownership 3 times. The 1st and 2nd owners were docile – hardly ever heard from them. However, the 3rd owner, was a young guy who perhaps thought he could make more money than his rent roll indicated. He attempted to send us bills for his sewer line, trash and water. He had some property management firm send us these allocations for water, sewer and trash fees on official looking letterhead, hoping us the dumb tenants would pay it. I faxed all his letters to the Rent Control Board in Santa Monica – and they were more than happy to send him registered letters and carbon copied all tenants that he was in violation of rent control laws and instructed to stop his attempts to collect fees for these things. [the law stipulates that tenants do not need to pay for those items unless specifically called out in the rental agreement, which they weren’t]. It was fun busting the landlord on his greedy tactics.

Stan, I generally agree that people do what’s in their best interests. These rent increases weren’t a by product of a booming economy and big salary increases every year. It was solely based on fucked up Fed/government/bankster/PTB policy that overwhelming favored owners and utterly screwed over renters. Some people obviously had no shame in profiting from others during difficult times while they were indirectly receiving favorable treatment.

Trust me, I learned a lot from the past decade. Look out after number one. Real simple!

O/T

As a blog courtesy:

http://www.oftwominds.com/blogjan14/7-lean-years1-14.html

The harsh math that awaits the average Joe.

…

More generally, it has been an EPIC error for the PTB to carry on with 360 month, fully amortized, mortgages.

A shift over to 180 month amortization should have been made when it was possible.

This transition would’ve solved the back-end duration nightmare initiated all the way back in the Roosevelt maladministation.

Put simply, the credit markets do not want thirty-year paper.

No-one can see that far into the future. (Unless you’re Hari Seldon.)

Now that careers are being delayed an extra decade (thank you, 0-care) the average Joe needs to have his mortgage killed off before he’s knocking on MediCare’s door.

A 180 month amortization provides a window for the homemakers to endow their progeny with some college support before they, themselves, have to pile it on for retirement.

Now that modern production methods make the purchase of all consumer goods so low, it’s good policy to refresh the capital markets with debt paydowns.

Further, in an era of rising interest rates, no-one is going to line up to extend long-term credit. Even the government is going to be “challenged” in this regard. (Hence, the preference for direct money-printing.)

As any 12-stepper can tell you, shaking addiction is pure hell. This goes triple when everyone is condemned to the same 12-step half-way nation, sinners and saints, alike.

“Now that careers are being delayed an extra decade (thank you, 0-care)…”

That’s some red herring-alicious, nonsensical, unsubstantiated, hyperbolic gold!

To witness the past is to see the future…

In Europe, unless you’ve got ‘juice’, careers don’t get started until you’re in your late twenties. (Juice in this case means connections — typically, family.)

In Europe, (and Japan — AND Hawaii) it’s as common as dust for young adults to stay living at home — even to the age of thirty-five. This reality is so typical there — and so shocking in Mainland America — that we get postings like DFresh.

In extreme cases, twenty-somethings in Europe stay un-hired for years on end. Mandated benefits (central government do-gooderism) price their labor entirely out of the market. This is why Spain and Greece has mind-blowing youth unemployment. Indeed, it started from a very high base, to begin with.

The fantastically flat economic growth of Europe has meant that the young must simply wait for their elders to retire. This pressure is so intense that Mitterand lowered the retirement age in the 1980’s to keep the Left happy.

(Ultimately he had to reverse course, entirely, on his rampant socialist impulses. The French economy was buckling.)

%%%%

0-care destroys the initiation of careers by causing economic disruption. The deciding players merely postpone their impulses to expand/ establish new firms.

That has a lasting impact on those entering the labor force. For those in the wrong birth cohort, they never get their careers on track. Big business ONLY hires college graduates. They shun anyone in a class-year that was skipped over — even if the general economy was a disaster that season.

This time around, what might have been a one or two-year hurt — has morphed into a retrenchment that seems without end.

0-care magnifies the situation.

By your posting, I can take it that you’re young. After the decades roll by, you’ll come to understand: life is not only unfair — if you were born in a bad year — you don’t even get your shot.

(The inverse of this was the West Point class of 1915 — the year the stars fell… and the Harvard class of 1947 — the class of the CEOs. Those graduating just a year earlier were shut out, as a practical matter. Graduating even three-years later had drastically different outcomes. WHEN you were born was far more important than even who you were and what you could achieve.)

0-care is so EPIC that historians will cast their eyes back and declare it the next big American event — after the end of WWIII/ aka the Cold War.

It’s much, much, bigger than 9-11. No-one will escape its reach. You not only will see this happen, you’ll feel this happen.

I’m a doctor, own my own practice, and employ 5 people. Blert is 100% correct on this one. Ocare is destroying the economy on multiple different levels (macro/micro/etc)

What blert says is 100% spot on. Actually, I am a (very) fortunate exception to his rule that you need a college degree to start a white collar job at a Fortune 500, but that was back in 1994 in Silicon Valley, not the world we live in today.

For whatever reason–and even through today–Obama refuses to focus on growth in response to the Great Recession. Maybe he doesn’t understand the private sector. But focusing on Obamacare and wasting money on a “stimulus” that was nothing more than crony capitalism doesn’t help. You may hate the private sector, but that is where the jobs come from.

As for my own biz, it is going to be pretty much what blert describes in Europe, et al. I will probably just hire family and other “connected” ones, and that’s it.

I agree that O-Care (aka R-Care) is not a good thing but this did not cause the debt crisis. I would argue that it is a symptom of the crisis. Rahm “You never let a serious crisis go to waste†Emanuel used the crisis to get the ACA passed but that is the only real connection. This is where I have to agree with DFresh that this is a Red herring. The real issue is that we are in the throws of debt crisis and there is really no way out. I am not sure how to “grow our way outâ€. Real income has been declining for decades and we hit a private debt max in 2007 at 300% of GDP. That is the main cause of the crisis. It was not caused by illegal Mexican’s or Red Chinese or Obama’s grandmother or evil Cheney etc. The US private debt is maxed out and we can not find growth other than removing the debt one way or another.

This is not the first financial crisis in our history. Actually our history is littered with financial crisis and this is no different than the sea of past crisis other than the government is trying to make it not hurt this time…

What, it’s true that we can’t “grow our way” out of our national debt.

More likely, the government will try to “inflate our way” out of our debt.

Which is why I’m always worrying about, and expecting, hyper-inflation just around the corner.

Blert,

It seems you and Paul Krugman both were inspired by Asimov’s psychohistorians. Great minds think alike, eh?

Somewhere mid last year, search for housing for me changed. It was even before the taper tantrum. It just seemed like there were too many crappy houses where too many people were in a buying frenzy to buy. It seemed off.

Another thing was that it really reminded me of 2006 where the average price of a house was way above the median income.

I can afford a house, even in this over-priced market. There are even deals that go by that seem pretty good. Yet, it still seems these prices are not based in reality.

To everyone that says real estate is local, they are absolutely right. No two markets behave the same. But looking at things here in Pasadena, what seems to come to mind is _who will buy all these houses in the future at this price_? Investors? Doubtful. Foreigners? Maybe a couple percent. The vast majority will have to go to real, regular people with regular jobs. The simple truth is neither the income, nor tricky leveraging is there for people to afford these prices.

Current prices depend on passing on a purchase to the next bigger fool. Unfortunately, we are running out of fools that can afford these prices.

You know I have really been struggling with the majority belief that housing will “level off†in 2014. We all know that incomes for the bottom 90% have been declining for the past 20 – 40 years. I have even read that the bottom 9% of the top 10% (top 10% minus the 1%ers) has been flat over the past 5 to 10 years. We hit a private debt max somewhere in 2007 at 300% GDP so there is really no more debt growth to offset the lack of income growth. This would then suggest that the world’s consumer is out of gas. There may be a small offset by foreign wealth as well as “investor†purchases but we all know that this cannot support the US housing market long term. The “investor†purchases will boomerang back to the bottom 90% via pension funds and 401k fund purchases of rental property “income streamsâ€.

So, how can we get to a “leveling off†of the housing market? I believe in asset bubbles so I think there is a case where the 2014 housing market as a whole could appear to “level off†when it is really in the beginnings of a crash. Let’s assume that specific bubble areas mentioned many times on this blog continue with double digit growth which would support the local bubbles while at the same time many other areas start a major crash. The average of this would appear to be a “leveling off†housing market. The media will report this as a success of the housing recovery and that we are back in equilibrium…

“Current prices depend on passing on a purchase to the next bigger fool. Unfortunately, we are running out of fools that can afford these prices”

Yes, I agree.

Unfortunately for LB; fortunately for me.

Yep. It is totally unsustainable short of a black-swan event like the Antichrist ushering us into the New World Order. I’m not kidding about that.

Whether or not housing tanks in 2014, it’s going to tank, short of the aforementioned black-swan event. Maybe the government and banks can prop things up for a little while, sort of like someone with a giant brain tumor can still get around for a couple months. But ultimately, he has a giant brain tumor. When jobs are more and more difficult to come by, there is real inflation in the prices of many goods, wages are decreasing, and there is no hope on the horizon for any of this to turn around; wouldn’t you say the writing is on the wall? Many people will crack and go into delusionland, simply because they won’t face how bad things truly are. But even that is not going to stop reality.

Sure, certain places will last longer than others. But to say they will ALWAYS be desirable is sheer nonsense. These elite are creating a world ghetto. They are polluting and poisoning their own environment with policies that will absolutely ensure a downward spiral of poverty for the masses, and more money for them. Now, how long do you think your gated communities are going to last in this situation? All it will take is some roving gangs from Lawndale to start coming to Manhattan Beach, for the police force to get scared and crack, which I doubt would be too difficult, and it’s all over for that place.

Not that there is no hope — there is, but most people don’t yet see it, that the only hope is a restoration of the true Catholic Church ( not to be confused with the Vatican II impostor ). It’s just like in the Bible, people rebel against God, everything crumbles, then they cry out for Him again. The only difference is that this time it’s happening on a massive worldwide scale. I know people here are generally not spiritually inclined, most likely, but for those who want the truth, to understand what’s happening, how huge it really is, now you know. This is about a rebellion against Catholic rule that started with the French Revolution. If you think we have “progressed” since the time of kings, think again. We are regressing to utter barbarism.

I can appreciate that prices in So Cal are much higher than when I bought our home and rentals 20+ years ago. Thank god my primary home is paid off and the rentals will be paid off in 5 more years as like many, my income has taken a huge hit in the last 5 years.

I would encourage people in their early working years to buy a home as soon as they can afford it, as continually increasing rent (our rents have doubled in 20 years) is not a great way to go into your retired years.

Ah, but there’s the rub; who in their early working years can afford these bloated prices?

In 20 years, your rents have doubled in real or nominal terms?

Much of my work life (unfortunately) centers arounds high-end attorneys (top 200 law firms worldwide) and lawyers and business participants at fortune 1000 companies, banks, hedge funds, PE shops and other financial instiutions. Basically the ‘best’ (credentialed at least on paper) folks in these fields. I began this career (unfortunately) in the early 2000s so I’ve seen the ebb and flow in these markets. In 2005, 2006 and 2007 corp and real estate lawyers were in demand like gangbusters. 200k+ jobs were growing on trees. Maybe end of 2007/early 2008 things started getting bad when structured finance/securitization (cdos, clos, rmbs. cmbs etc) tanked and pretty big firms like McKee Nelson and thatcher profitt went the way of the dodo. Then came broader layoffs at all big firms when things went beyond CDOs/MBS and the broader economy tanked. Since 2008 its really been flat and then gradually moving up in 2013 for the hiring of high end attorneys in the lateral market (although leveraged finance and other corp work has been very busy at select shops). Then bang. The past few months and especially the past few weeks have seen a sharp increase in the number of available job openings as well as hires. Banks are back at hiring JDs as bankers (no MBA required) and things are busy not just in NY and No Cal, but Denver, Seattle, parts if Texas, Phoenix and a few other big cities. Corp and now real estate hiring both increasing. Doesn’t feel natural and the attorneys (over 200 a month) I speak with mainly think/fear its all artificial too. I can’t say it feels quite like right before the last crash exactly, but it all of a sudden feels frothy and like its not going to be a smooth down. Not sure if its 06 or 07, but i think its one of em. I think we’re due for just a good ol fashioned nasty recession regardless of housing and then housing will follow. If we don’t go down by end of 2014, its coming 2015. All my opinions of course.

Lastly, Lord B and others with all this prime area love, people either stretch or they don’t stretch into homes/lifetsyles they can afford as a species. Can’t have it both ways. Can’t say some people stretch into one area but not other. That makes no sense. We’re all equally idiotic n insecure besides a few good apples. Next you’ll tell me people in prime areas don’t masturbate.

Huh, people have stretched and will continue to stretch to get into certain areas in socal. Unlike many other cities in this country, LA is such a unique housing case study. Within a few mile radius, you have ultra rich and ultra poor, ultra safe and ultra dangerous, top notch schools and ghetto schools, multi million dollar homes and housing projects, etc. People will go to extraordinary lengths to give themselves the best leg up they can. Unless you live here and have experienced it, it’s hard to comprehend.

LB – I am not sure how long you have lived in the LA area but I agree it is a very interesting case study indeed. I have seen good neighborhoods turn really bad and back again. There was a time where LA was so infested with gangs that all the smart money was moving way out to escape the crime. Places like Rancho Cucamonga and Valencia come to mind. Many years back when I was at one of the big consulting firms, I was being pressured to buy a house in Valencia because many of the managers and partners lived there. The big firms want you to be a debt slave. No one in their right mind would buy a house in Mar Vista, Venice or God forbid Culver City at this time. You couldn’t have paid me enough to live there but now I can’t afford to live there. Back then LA was a giant ghetto with small patches of money. This lead to all three strike like anti crime legislation. I think the point is that all we need is for the jails to be cleared and we will start all over again…

LordB-you wrote above that people will always stretch themselves to get into nice but not ultra prime locations. That is where is I call bs. Someone in a real nice location wants that ultra prime and will stretch themselves. (Most) people strive up for their entire lives (I mean the real estate depends on people upgrading no?). In fact usually top 2 and 3%s stretch themselves to the limits of their curent salaries and beyond striving to look like 1%ers. 1%s wanna be .1%s. .1% wants to be .01%. And so on and so on.

Each week a shttier home comes out somehow on a smaller piece of property for more money. Cannot and will not continue. There is a sucker born every minute but not one who can keep affording CA real estate at ever increasing prices (or one that even cares about CA whatsoever-go figure there is a whole world outside of CA). The market needs lower lending standards, lower interest rates, higher wages, worldwide demand for goods and services to continue, and a lack of investment alternatives worldwide to continue. That sounds plausible.

FTB great analysis as always. i am seeing similar indicators and thinking from people I interact with. Love the quote too “Next you’ll tell me people in prime areas don’t masturbate.” LOL that’s a good one there 🙂

A friend who bought at the bottom of the housing crash by dumb luck now suddenly talks like he is a real estat tycoon. Ready to buy more properties to flip and rent. He is not a big money person either just works a normal 9-5 job and got lucky on his timing of his first home purchase. He says his grand plan will be to quit his job and a landlord flipper full time.

I was told years ago by a former options trader, “when your barber is asking you what are some good stocks to buy it is time to sell everything!”

I feel we are at that mark. Prices in stocks continue to hit new highs with 0 volatility. VIX index continues to drop. Yet there are major geopolitical events contantly shrugged off. I think the entire investing community has finally become numb to risk. At that moment we have the greatest risk of a colossal collapse.

“I think the entire investing community has finally become numb to risk.”

Risk? What risk? I was told in my investor seminar that you buy, paint, rent and become an overnight millionaire with no money down. They never mentioned risk…

Back during the Rodney King Riots, there was a guy going around our Orange County neighborhood saying that the Mexicans (and Central Americans) living in the apartments about a half mile north were all going to come down to our neighborhood (modest one story tract houses on 8000 sq ft lots) and start “lootin’ & shootin”! I was on a road trip looking for work, but my Wife was home and she told everyone not to worry. She was right and he was wrong. I don’t see any violent social upheaval coming this year. Manhattan Beach can rest easy for another year. Let’s all go back to predicting the housing market for 2014.

Joe R.

PS My prediction: “Hell, I dunno… but people will continue to live in SoCal houses, apartments, trailers and camper vans”.

Maybe home prices will remain high in Manhattan Beach but crime is also skyrocketing! There have been a lot of news articles about the increase in home burglaries and other crime in Manhattan Beach. We have family and friends who live in Manhattan beach and they are always telling us about the latest crimes that they hear about. Here’s some news links about crime in Manhattan Beach:

http://www.easyreadernews.com/79035/2013-newsmaker-burglary-city/

http://losangeles.cbslocal.com/2013/10/23/police-warn-south-bay-home-burglaries-on-the-rise/

http://manhattanbeach.patch.com/groups/police-and-fire/p/police-chief-to-give-crime-presentation-wednesday-night

http://www.easyreadernews.com/74134/manhattan-beach-residents-police-chief-respond-recent-rash-home-break-ins/

http://www.easyreadernews.com/79214/manhattan-beach-police-seek-purse-snatching-suspects/

The ghetto people that live in Inglewood, Lawndale, Gardena, Lomita, etc. are 1. Bored with their typical hangouts. 2. Desirous of being “fabulous” like Kim K. #3. Discovering that it’s relatively cheap to drive down to the beach cities and pretend to be rich for a while. So yes, the riff-raff will be (and are) bringing their element to the nicer South Bay Cities slowly but surely. That’s why Newport Beach and Irvine will always remain so high, you don’t have to worry about a random Black or Mexican showing up and ruining your lovely So Cal day there.

Data from http://www.neighborhoodscout.com

MB violent= 1.74/1000 property 23.94/1000

Fullerton violent = 3.34/1000 property = 30.7/1000

Villa Park violent= 0.34/1000 property= 14.61/1000

Tustin violent = 1.47/1000 property = 21.36/1000

So MB is somewhat similar to Tustin, safer than Fullerton and way less safe than Villa Park… no surprise there! Ever been to Villa Park, CA?

Maybe a better one to compare to MB is our own NB… Newport Beach.

http://www.neighborhoodscout.com

violent 1.16/1000 property 24.64/1000

NB a bit less violent, a little more theft/vandalism etc prone. Lots of out of town visitors there,too.

For LA County safety, try Agoura Hills

violent = 0.58/1000 property 11.42/1000

2014 will be the year of the amateur investor. They’ll show up late to the party after all the hotties have left and will overpay for passed-over dumps with dreams of making their fortunes from flipping. They’re gonna have one helluva hangover come later this year/early next!

This falls in line with what i’ve been seeing in the San Diego area. The only inventory left are passed over single family/condos either beyond repair or massively overpriced. Meanwhile i’m standing by with a $100k downpayment and very secure job waiting for the house of cards to once again crumble. Too bad i missed the boat last time due to being too young! (25 y/o m)

California pricing can’t ever be in the equation of thought to someone who lives in lets say Atlanta or Denver? Every house should be judged on its location, condition, local market, and economy except California.

California real estate is a ballgame so different, so diverse, it plays by it owns rules and real estate codes. The cartel of real estate agents and brokers can make or break a perceive home value. Look at Beverly Hills, the Mongols of Hollywood created a niche year ago that this area was the big get? Lets see, no ocean front property, beautiful pristine country side as you drive around? (hardly, lots of heavy traffic for sure and many drawback’s.)

California is perception, and it has made many middle to upper middle class investors very comfortable over the years in selling over valued property.

California, the motto “you must pay the price to live there” you know folks world wide still believe the hype, they always will? Only mother nature can stop the craziness of that state.

Eventually the youth will yell out “the emperor has no clothesâ€. This too will end my friend. Nothing lasts forever. Nothing…

BTW – Aren’t you late for your open house?

But California is the best! Haven’t you seen my Facebook post about the AWESOME weather, which naturally makes Californians superior and cool as well?! Those “sunshine dollars” are making me feel wealthy already. California is above those pedestrian ideas of supply and demand that other regions must adhere to.

This just in – perceptions change.

http://www.dailynews.com/business/20140114/la-film-production-dropped-by-50-since-1996

Just because the market feels frothy, doesn’t necessarily mean the bubble will burst tomorrow. It felt frothy back in 2003, but my home doubled in value from 2003-2007. Of course, there is no guarantee that this bubble will burst in exactly the same way as the last. But the moral of the story is…timing is everything. IMO, the Jim “the Tank” Taylors of the world are leaving a lot of money on the table by selling right now.

This is why the average man eventually loses everything. The idea that you are leaving money on the table because the market may continue to rise is the worse way to look at an investment. I have been selling stock into this bull market for the past 3 years. No regrets! I made a good deal of money and have no desire to “time” the market because I know that I am not that smart. The real problem is that everyone appears to be a genius during rising bubble markets. But it is a different story during the crash…

Not sure why TJ is spending time spreading the good word here when Jim Taylor’s money is sitting out on the table for the taking, lest someone else get to it first.

When the music stops in the end, it’s better to be left with a seat than without.

@ What?, If the market goes up, I potentially realize a large cap gain. If the market crashes, I’m “stuck” with my 2% mortgage (which is cheaper than renting an apartment.) I wouldn’t exactly call that “losing everything.”

I can imagine there are a lot of people like me in the same boat…that is why sellers aren’t selling yet, which is why inventories are low, which is why prices are not going to crash anytime soon.

As for your claims to not be a market timer or a prognosticator, it seems you are bit disingenuous. Most of your posts hint at the fact that a crash may be just around the corner. Let’s face it, you have biases just like everyone else, whether you like to admit it or not.

@Anon, the reason i am “spending time” responding to Jim “The Tank” Taylor’s posts, is probably the same reason you are responding to mine….to discuss the real estate market. No??

You’re a better man than I am, What. I too rode out the 2008-09 crash and then slowly started reallocating out of the stock market after the S&P gained back its first 100%. However that was about 500 points ago. While I’m in a much more crash proof position than I was 6 years ago I figure that by reducing my stock allocation down to 50% I’ve reduced my net worth by a couple of healthy SFH down payments (compared to where I’d be if I’d stayed all in).

It is better to be able to sleep at night, but I do often question my strategy. In both financial and residential decisions an overabundance of pessimism can be almost costly as the irrational optimism of bubble fever.

Prices are maxxed out unless banks bring back creative lending. If they do, expect another rise in prices but like my 80 year old grandma said…creative lending wlways fails. It did in the 1920’s, the 2000’s, and will happen again. I stick to my theory that current prices are 15% over valued. I don’t know when they will fall, but they will.

Simple economics. When demand falls, prices fall…

http://blogs.marketwatch.com/capitolreport/2014/01/15/worst-of-all-worlds-for-mortgage-lending-in-fourth-quarter/

Such stats are to be expected when massive non-traditional buyers show up.

The hedge fund play is a multi-year bet. They are being financed by the very same crowd that used to park liquidity into conventional mortgage debt.

Such an arrangement could prove to be very, very, long term… and in size.

The hedge fund management can no longer be embarrassed by short term swings in the market. Neither can the pension trustees.

Even 50 basis points as a management fee would be fat — considering the scale of the play and the time horizon.

There is every prospect that the big boys can roll over rent backed debt to great advantage. Now it’s being tranched — just like sub prime paper. The route to the courthouse looks much shorter and sweeter, though.

This may be the new normal.

In which case, real estate turnover — and mortgage refi’s — will proceed at a drastically lower tempo… as far as the mind can see.

Actual price drops in the market will not be permitted to happen.

This type of market is what typified old England — going back centuries. You couldn’t buy land at any price. The lairds were not for selling, period.

(Famously, one little burg in England manufactured ALL of her leather shoes. It was a very stinky, very profitable, trade, ALL of the land surrounding the town was held by a mere four lords. They held the shoe manufacturing crowd in extreme disdain. They mutually agreed to never sell another square foot of land to them. This situation held on for quite a few years. It resulted in a bizarre manufacturing high-rise surrounded by a bucolic countryside. Eventually, the trade secrets leaked out, and leather shoes were manufactured elsewhere. And, eventually, heirs to the lords needed the money. This episode shows just how long economically strange and strained relations can go on.)

I’ve been tracking this building for several. Prices here tanked hard during the bust. New condos that sold for over $1.1M dropped to between $700-$800k until 2013. This one just came on the market at almost peak price http://www.redfin.com/CA/West-Hollywood/118-S-Clark-Dr-90048/unit-PH2/home/12285076. PH1, right next door, just sold for $725k, after a 13 month short sale escrow. Whoever bought that will have almost $400k equity if this unit sells for or near asking. I’ve seen a lot of sales close for peak or above peak prices in the Westside area, so it could happen. This area is a mixed bag. I see a lot of properties that sell for peak prices, but there are also plenty that need major prices reductions before selling. Either way, I don’t see a crash in this area happening anytime soon. Too many well qualified buyers and lots lots of foreign/inherited money.

I am confused. Its not bhills, but west hollywood is a pretty prime area in LA. I was told on this blog that prime areas can barely go down. Wouldn’t $1.1 million to $700k-$800k be an approx 30% drop in price? Kinda weird to cite an example of a home cratering like that and then concluding it cant happen again less than 10 years later when nothing fundamentally is better with the world and affordability with little room to go down with i-rates, etc. Was there not foreign and inherited money ten years ago when then stock market was raging and everyone was making cash? QE….QE…..QE….QE…stop forgetting its been in the background distorting the world.

FTB, stop it. Even the most prime areas (W. Hollywood not in that category) went down by about 20% during the collapse. Relative to the utter carnage in many other areas (60 to 70% drops in value), that was getting off easy. Not surprising that this was a distressed sale. The details behind many distressed sales were very shady (trust me on that). The average buyer generally did NOT have access to many of the deals. People with RE connections made out like bandits during that period.

Regarding QE, it sure as hell has distorted things. You either play the game or you get left behind. Anybody who bet against the Fed for the last 5 years got slaughtered.

LB. why don’t you spend five minutes on Redfin, look at the current home prices in west Hollywood and tell me its not prime. Search by under a million in west hollywood and there is one house total for sale (this 1250 sq ft gem):

http://www.zillow.com/homedetails/7242-Fountain-Ave-West-Hollywood-CA-90046/20788763_zpid/

Search by under 1.5mil and its three homes total (including the one above) and there are 6 homes listed for 1.5-2 mil.

West Hollywood and fairfax village have exploded. Even like your precious beach towns, some tear downs/6000sq ft ish lots are now going for over a mil. I know this bc I lived there and was in that real estate market from 2007-2013. I saw the bubble burst and real estate climb back in that area. 20% down is bs. If I doesnt meet your definition of prime somehow, fine; I guess its just bev hills and right by where you bought. If you’d like, each post I will tell you probably made a good home purchase decision….due to intelligence but really due to luck (sorry; you had no clue that QE would continue when you bought regardless of your affordability calculations (you could have got smoked if rates went up right after you bought). Its what you really want to hear anyway.

FTB, I will be the first to admit that I do not follow W. Hollywood RE. From your comment I assume you do. Then I guess we can both agree that W. Hollywood is undergoing massive gentrification just like my precious beach cities. My whole point was that the details behind many distressed sales were shady. Be very careful using these as the “latest comps.” Like I said, if you had RE connections you made out like a bandit during that period.

I had several reasons for buying. Most importantly for me was that I was buying below rental parity in an area that weathered the housing bubble storm quite well. I have lived in this area for decades and rents generally remain very stable, nothing like wild house price gyrations we saw. Based on that, I knew buying was still the right move even if future home price declines occurred. I have went on record many times here claiming I am not expecting any home appreciation for this whole decade, it’s just gravy if I get some. I agree that buying in socal is all about timing, but everybody could have agreed that buying in 2011 was much better than in 2006 based on some very simple calculations (affordability, rental parity, etc). And I have never claimed once that prime socal areas will be immune to future declines, they will just weather the storm better than others.

You bought an expensive Texas mansion yourself. While Austin is considered prime TX RE, it is not immune to declines either. A year from now, both of our homes could easily be worth 20% less than today. I’m OK with that. My monthly payment will still be less than a 1 bedroom apartment, I immensely enjoy living in my home and all the tangible/intangible benefits it brings and I can get my property tax bill lowered also.

Why don’t we just leave it at that. I’m not here to pick fights with anybody.

Apparently rents move in two directions, even in prime locations:

http://www.businessweek.com/news/2014-01-09/manhattan-apartment-rents-decline-as-landlords-offer-more-breaks

“Only way market tanks is if investors flood the market, which isn’t going to happen, I think.”

When their cash flow runs negative (after debt servicing) what else can they do but flood the market with properties??? The cash buyer is a myth. All these wannabe rentiers are playing with house money and they will exit the market as soon as they are at risk of losing their gains. This is the same it’s diffrent this time bullshit we heard from 2005-2006. Then 2007 brought the market to a standstill before the 08 crash. This market is Wile E Coyote hovering over the canyon. The drop is imminent…

“The cash buyer is a myth”….not to all the sellers taking their real cash.

The sellers are taking cash, but the buyer did not “own” the cash, they borrowed the cash before the purchase. It gets logged as an all cash purchase but most of the “all cash purchases” are simply purchases that take place in which a loan is not needed for teh sale to take place, they borrowed the money before hand…can we get the idea out of our heads that there are people falling all over themselves with actual cash paying for these properties…most are probably about as highly leveraged as you can get, you are telling me that when the market turns or they don’t get the returns they expected they will not only want to, but be able to stick it out until the boom times return again? I am not so sure about that…the people who missed the boat are the people who are buying right now…I have actually developed a term for them which I am quite happy with, I am going to call them an “all-crash buyer” because they are about to buy into one of the biggest market crashes in history, this thing is litterally the car tilting on the side of the cliff, it just cant be righted until a true fundamental shift occurs.

For some hedge funds, the better part of their funding does not come from borrowing, per se. Instead, they’re operating with, de facto, passive partners: the pension fund crowd.

The IRS ruins the tax status of any pension fund that actively manages leveraged assets — actively manages assets in most contexts.

This has kept the big boys away from real estate ownership for decades.

It now appears that some of the hedge funds have been able to tap “tax qualified monies” by crafty language in their structure.

The IRS has long permitted Limited Partners to hold passive interests without ruining a “tax qualified status.”

I must surmise that at least some of the big boys have figured out that mega-limited partnerships — across a huge swath of the American market — replicate the risk dynamics previously known for straight mortgage debt.

Owning even a passive interest in rental property HAS to be attractive to anyone who comprehends that the national government is profoundly debasing the currency.

In such an environment, the better part of discretion is to hold real assets. The fund management is structuring these deals to provide high levels of security for the big money — while positioning themselves for super-leveraged returns as the bet pays off.

Since the Fed has ruined the ‘cap rate’ of US Treasury bonds, money can be lured from the Moon for even humble current returns.

%%%

ZeroHedge is reporting that bearish sentiment versus US Treasuries is now epic. They are not falling because the Fed has moved essentially all of the trading float onto its balance sheet.

Most of Uncle Sam’s debt is short term — less than three-years. The amount of T-bills out there is astounding.

Hence, it’s easy for Operation Twist to devour the ‘duration’ without moving the bills market. Indeed, there have been auctions bid all the way to 0.00% on bills. (!) What’s normal about that?

It also shows what the big money boys are facing: no return on their assets. This in a time of rampant hyper-inflation: shrinking foodstuffs per box/ wrapper/ bag/ and product substitutions at every turn.

Markers Mark even attempted to bleed down the quality of their bourbon. No price concession was contemplated, of course.

Mild hyper-inflation can accelerate like crazy — once mass psychology changes.

Agree w AK. I live in the southbay. Prices are higher than the last bubble. I can stretch to afford to buy but I refuse to. Watching the frenzy of people over-bidding to buy something in crap condition (or a super cheap flip) priced at $150k over 2005-2007 prices. Only a select few can really afford this. My husband bought a place for $510 3 years ago that we could sell for $700k. It’s a piece of crap.

I have $20% down easily ($ set aside specificaly for the down) and am buying without my husband. However I can only qualify for $750k, and that buys you a hunk of crap. Since when is $750k nothing. RE agents try to push you into something way higher or tell you what a great deal the house is. My favorite is when I see someone try to flip something in 2 months for $200k profit w the cheapest fix you’ll ever see.

Leave a Reply