Do banks sense a change in the California housing market? California foreclosure starts up 57 percent last month. Typical California foreclosure process lasts nearly one year and the misconception of middle class.

It is common knowledge that banks have metered troubled real estate inventory out into the market in a slow drip fashion. This practice over the years has caused an artificially low supply to be present in the market. Add into the mix a low rate environment and years of investors buying up properties and you get our current stalemate of a market. Virtually no one in the press with a voice is even expressing a possibility that prices may sway lower. The only options making the rounds involve a couple of scenarios where prices will go up slowly in 2014 or prices will move sideways. No option for a decrease. This lack of perspective is odd given the resurgence of interest only loans and the fact that a well known bank is dipping back into the subprime market. One surprising statistic that I did see was the resurgence of foreclosure starts in California.

Why the sudden jump in foreclosure starts?

I fully agree with readers that we are dealing with a pseudo-market here. How is it feasible to have double-digit price increases, low supply, and then last month a surge in foreclosure starts of 57 percent? You would expect that in a market with rising prices that this would be a sign of underlying economic health. This isn’t exactly the case given that a large portion of purchases are coming from hot money rather than individual families signing on to purchase with conventional 30-year fixed rate mortgage. This isn’t only the case in California but nationwide. The latest monthly sales figures show that 32 percent of purchases came from buyers using no traditional mortgage product (aka investors).

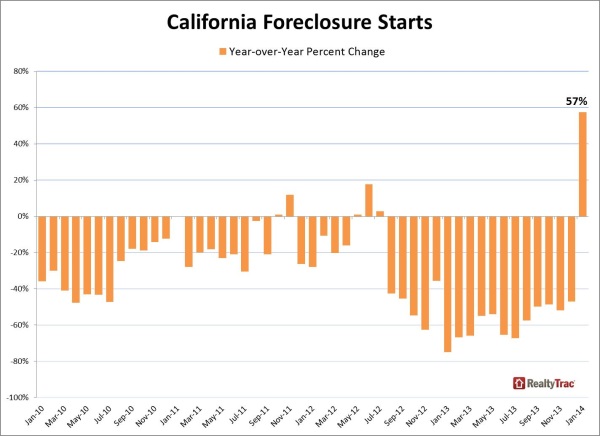

Many readers sent this chart over from RealtyTrac and even mentioned it in a previous post but it is worth analyzing here:

After 17 months of consecutive annual decreases we see foreclosure starts up by 57 percent in January. It is interesting that banks suddenly decided to move on the foreclosure process this year. Given the timeline of foreclosures this is perfect timing to unload homes late in spring or early in summer:

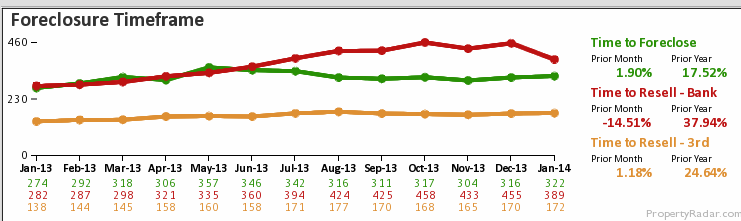

A foreclosure start merely means the bank is starting the process with a notice of default. As you can see from the timeline above, the process can take four months if the bank is really motivated to unload. This hasn’t been the case in California so it makes you wonder why the sudden surge in foreclosure starts. In fact the average time to foreclose in California is 322 days:

What is interesting is that you will see that banks are getting quicker at selling distressed inventory. This makes sense given the massive jump in prices in 2013. This jump does highlight that yes, banks do have some shadow inventory available but probably not as much as you would expect from back in 2008 and 2009. It also reflects that you still have a good number of California homeowners in trouble with their mortgages.

Underwater in California

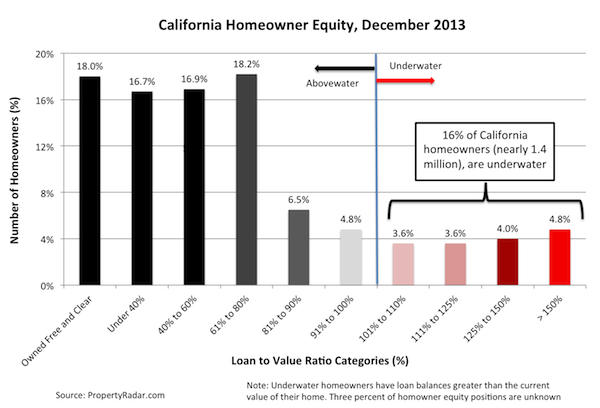

It is hard to believe but we still have a large number of Californians underwater in spite of the massive jump in prices in 2013:

16 percent of California homeowners are underwater. Throw in those with less than 10 percent equity and you have over 20 percent of the market at or near negative equity. That is a large pool of the market. Given the jump in foreclosure starts, you still have a good number of delinquent homeowners. Banks are now moving probably because they are acting rationally and want to lock in some gains by selling to investors or highly leveraged buyers. 2013 was a damn good year. A smart gambler knows when to walk away.

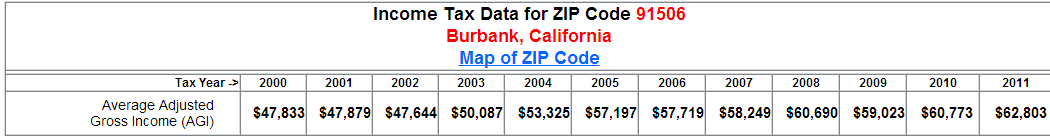

I know some think income is irrelevant in the current housing market but long-term this does matter. For example, let us look at a couple of zip codes in Burbank:

Zip:Â Â Â Â Â Â Â Â 91506

Median Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $625,000 (up 42% year-over-year)

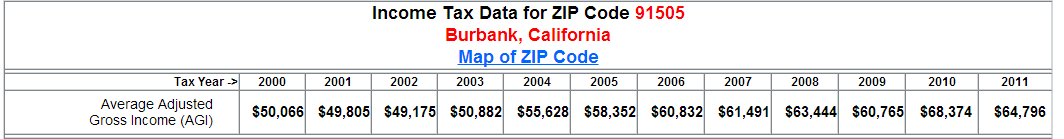

Zip:Â Â Â Â Â Â Â Â 91505

Median Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $566,000 (up 25% year-over-year)

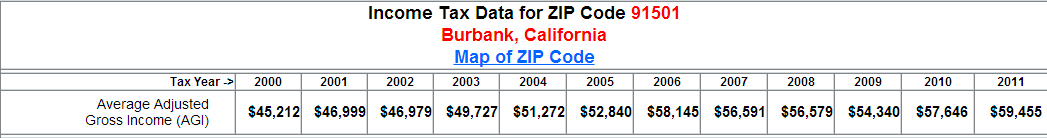

Zip:Â Â Â Â Â Â Â Â 91501

Median Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $788,000 (up 35.8% year-over-year)

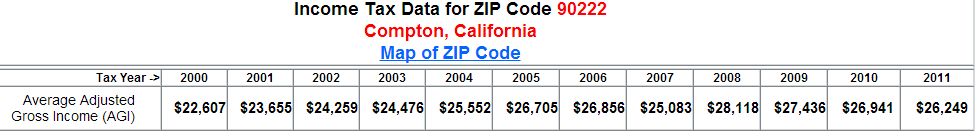

Or take a look at Compton for example:

Zip:Â Â Â Â Â Â Â Â 90222

Median Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $230,000 (up 24.3% year-over-year)

Does any of this seem rational or more like a mania? I also believe that foreclosure starts are up because millions of Californians are living precariously close to the financial edge. Leased cars, massive mortgages, big student debt, and living high on the hog.

People seem to get frustrated especially when six-figures doesn’t do much when starring at a $600,000 fixer-upper to move into. They may have $120,000 saved up ready to bounce yet don’t pull the trigger because logic tugs at their practical side. Because a 10 or 20 percent move down is very possible (we saw prices in California move up 20 to 30 percent in some markets last year!). Well there goes that down payment if this happens. So it does pay to run the numbers and of course incomes matter. The doctor making $1 million a year is probably not sweating buying that beach front condo. Yet this is a small portion of the market. And even in this case, income does matter in the sense that overall monthly outlays are tiny in proportion to what is coming in. The reason this is a tough decision is because housing is so expensive in California, even in non-prime areas.

Middle class in California

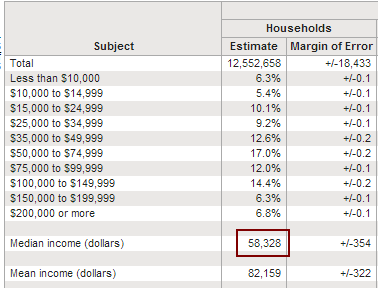

Ultimately the middle class is being squeezed out. This isn’t to start some insane conspiracy debate, it is merely facts and is not only happening in California but nationwide. People change definitions all the time. If we mean “middle class†as is dictated by the English language, we mean the middle of where half of the families make more and half make less. This figure is easy to find for California:

Source:Â US Census

The median income in California is $58,000. We don’t get many comments from people going into bidding wars for homes in Compton, Pacomia, or Lynwood – this wasn’t the case in 2005, 2006, or 2007 either yet prices are up everywhere. The same target markets are on the list once again yet someone is bidding these areas up. It certainly isn’t the income of local households. 27 percent of households make more than $100,000 which is the absolute minimum to start bidding in select areas. I would actually say you would need $150,000 or more for the more prime areas that blog readers seemed to be focused on. When we go this far, we have 13 percent of California households. Then you throw in the 30 percent of money coming in from investors, low supply, and you can see why we go from boom to bust. Many are now using ARMs to stretch their budgets to the absolute max to get into a home. Yet volume is extremely low because of the few households that can actually compete at this price point and the fact that investors are having a tougher time making out with good buys.

People want a definite answer as to when to buy. It is hard to give an answer to this given the multiple factors to consider. Throw into the mix that this is no free market and that only makes it tougher. Yet those thinking that prices will never drop (again) fail to understand history.  Heck, in California we had a few bubbles within our lifetimes yet the sun seems to cause some kind of financial amnesia. People also buy for emotional reasons. Unfortunately the current market has made everyone into a speculator. No one is going to care as much about your financial situation as you do. Do you think the market cares if you take on a $3,000 or $4,000 monthly mortgage for 30 years? I think one good rule of thumb is to try to keep housing costs to one-third or less of your gross income. That is, if you make $10,000 per month (gross) $3,333 should be the higher end of what you spend on housing. Given the Census data, that is speaking to 13 to 20 percent of all California households. Given that every other car on the freeway is a BMW, Audi, Mercedes, Lexus, Acura, or Infiniti something tells me people are up to their eyeballs in debt once again.

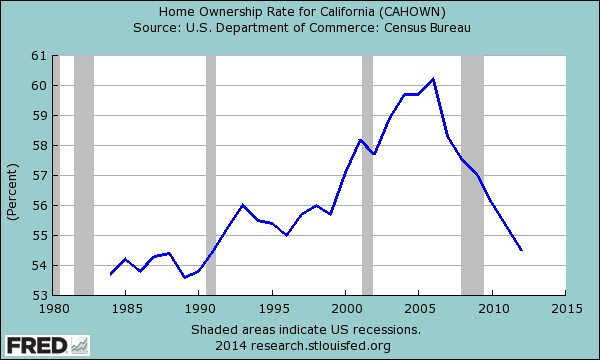

One thing is certain and that is the California homeownership has taken a big hit since the bust hit:

To highlight the full circle here, take a look at this:

“(Reuters) - Wells Fargo & Co, the largest U.S. mortgage lender, is tiptoeing back into subprime home loans again.

The bank is looking for opportunities to stem its revenue decline as overall mortgage lending volume plunges. It believes it has worked through enough of its crisis-era mortgage problems, particularly with U.S. home loan agencies, to be comfortable extending credit to some borrowers with higher credit risks.â€

ARMs, interest only loans, jumbo loans, massive investor buying, low inventory, stagnant prices, a surge in foreclosure starts, and now subprime loans. Sure sounds like all is great on the housing front!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

112 Responses to “Do banks sense a change in the California housing market? California foreclosure starts up 57 percent last month. Typical California foreclosure process lasts nearly one year and the misconception of middle class.”

As California goes, so goes the nation in this abnormal, synthetically contrived ‘recovery’:

“Short sales & foreclosure sales rose to a three year high of 16.2% of all U.S. residential sales, up from 14.5% in 2012. Distressed home sales account for 1 out of 6 all home sales or 500% higher than normal. This is not a normal housing market.

All-cash purchases accounted for 42% of all U.S. residential sales in December, up from 38% in November, and up from 18% in December 2012. Before 2008, all-cash sales NEVER accounted for more than 10% of all home sales. This is not a normal housing market.

Mortgage applications languishing at 1997 levels, down 65% from the 2005 highs. If mortgage applications are near 16 year lows, how could home prices be ascending as if there is a frenzy of demand? This is not a normal housing market.

First time home buyers account for a record low percentage of 27%. In a normal non-manipulated market, first time home buyers account for 40% of home purchases. This is not a normal housing market.”

The Fed is sitting on well over a trillion dollars worth of impaired mortgages collateralized by future foreclosing houses.

A massive amount of baby boomers will be looking to dump their homes on the market, and the generation of future buyers, many living in their parents’ basements, are strapped with over a trillion dollars in student loan debts.

A record number and a record percentage of working age males are no longer in the workforce.

Most jobs being created are part-time jobs, so who qualifies for a mortgage?

2014, at the least, is going to be a real challenge for real estate sales, especially now that the Dodd-Frank QM and the Biggert Waters Act have kicked in.

“The Mortgage Forgiveness Debt Relief Act’s (MFDRA) expiration may lead to negative pressure on liquidation timelines and recoveries for legacy U.S. mortgage investors if the act is not renewed, according to Fitch Ratings.

Recently expired as of January 1, the MFDRA was signed into law December 2007 with the purpose of aiding underwater mortgage holders. Fitch Ratings projects a negative effect from the MFDRA’s expiration.

The act was designed to provide tax relief by allowing certain borrowers to exclude mortgage debt that was cancelled or forgiven by the lender through a foreclosure, short sale, or loan modification—debt that would normally be considered income for tax purposes.

Without this relief, Fitch expects a decline in the volume of short sales and principal forgiveness modifications. The agency cites three reasons for its projection:

Without the tax exemption, there is less incentive for distressed borrowers to agree to a voluntary property sale that will not pay the loan off in full, likely increasing the number of involuntary foreclosure sales.

The MFDRA’s expiration provides less incentive for servicers to offer principal forgiveness modifications. The tax burden on the borrower increases the likelihood of redefault.

Servicers may increasingly opt for principal forbearance, which requires the borrower to repay the reduced principal amount at the end of the loan term.”

With the prices of food, fuel and health care rising against stagnant wages, where will the average American find the money to buy a house? Watch the short CBS video.

http://www.cbsnews.com/news/food-prices-soar-as-incomes-stand-still/

I think it’s more regional than anything else, look at Williston, ND. They can’t find enough ways to spend all their money up there. I know it’s a nice town with niche work but I’m making a point.

Not every American is hurting, or will hurt. It all centers around how those bottom 20% are doing that puts a perception on the economy as a whole. “What are you talking about Papa?” I’m talking about the good ol 90’s for example. There was so much tech work and internet bubble, that no people were left for fast food joints and telephone call centers. Thus, “now hiring” signs were plentiful, jobs of all kinds were plentiful, and life was good.

Now that there are not enough jobs to go around, teens are broke, and 60 year olds are checkers at Stater Bros, life is not so good. But move to a state where the economy is good like Iowa for example, and life is better. Except it’s damn cold out.

“Most jobs being created are part-time jobs, so who qualifies for a mortgage?”

This is the key. Yes, SoCal like every place else will have ups and downs but in addition to it’s own long-term decline related to the decline in the entertainment and aerospace industries, along with other factors, the changes happening that our economy overall are surely going to be at the core of the looming price crash.

I would be scared — very scared — if I were sitting on a large mortgage anywhere in So Cal. Or anywhere in CA for that matter.

But Doctor I have been in LA for a whole ten minutes now and “prime” areas have never gone down since I have been here. I know I have a pretty good handle on how things work here now that I am a “localâ€. The real amnesia is most likely due to the fact that 75% of those who call themselves “locals” were not in California during the last major earthquake. The amnesia is a lack of the perspective that only time can build. Remember the majority of the Wall Street geniuses that created the MBS catastrophe had never seen an economic downturn in their adult life. They thought it could go on forever! It is easy for the FOB ten minute “local†to cast away 2008 as an anomaly and justify to themselves that this time is different. My family were land speculators as far back as the late 1800’s. My wife’s father was a big land speculator in the 70’s and 80’s. California real estate has boomed and bust since the beginning. It takes time for someone to get perspective on what can and can not happen. Give them a couple of generations and maybe their offspring will have a better understanding of CA real estate…

Given a commenter’s response in a prior email I think it is important to understand the definition of native. The definition of Native: “a person born in a specified place or associated with a place by birth, whether subsequently resident there or not.” So logic tells you that if you were not born in Southern California you will NEVER be a native.

Now “local” has a different connotation due to surf culture. If you had any understanding of the term “local” in this context you would know that you never call yourself “the local†to someone who was there before you. I can see the confusion from the outside on this. This is similar to someone from NYC moving to Texas and calling them self a Texan to a native Texan. New Yorkers may never understand this but I assure you Texans know exactly what I am talking about…

Sorry prior post not email…

” The definition of Native: “a person born in a specified place or associated with a place by birth, whether subsequently resident there or not.†So logic tells you that if you were not born in Southern California you will NEVER be a native. ”

Wrong again, you bitter man. I was born in Nevada but do not consider myself a native because I did not grow up there. I know very little about it except what I have gotten in my vacations there. And what does any of this have to do with the pending housing bubble?

Really. Please see my other reply to you in the last post that I hope the good Dr. has not censored. I have actually agreed with a lot of your points but you are coming across as such a flaming jerk it really does ruin everything else you write.

SOHF – It is not my definition.

http://www.merriam-webster.com/dictionary/native

What?, do us all a favor and stop while you’re ahead. You are starting to sound like a Mel Gibson incoherent drunken rant session.

I really don’t care what your definitions are for native or local. And I could really care less if you think transplants have ruined “your” home town. A transplant has just as much right to living here as your fifth generation family…get over it.

As I said before, I was not born here but have lived in socal for three decades. I went to college here, have worked here professionally, have owned multiple homes, paid plenty of local taxes, supported many local businesses and charities. I enjoy living here and plan on retiring here. If anybody ever approaches me tells me I’m not a “local”, I will kindly tell them to eff off!

Native is not my definition it is Webster’s…

It is interesting that you bring up Mel Gibson. I find it very interesting that the pretending to be a native is mainly a California phenomenon. I have traveled quite extensively throughout the states in my prior two jobs and I noticed that most people you meet will say that they are from the place that they were born and raised in. For example, when I was in Minnesota people there would tell me that they were from Iowa or Chicago or Wisconsin, etc. They would never say that they were from Minnesota if they were not born and raised. My experience is that this is by far the norm for every place I worked, lived or visited with the exception of LA. I find it absolutely fascinating that in the land of make believe that so many even make believe where they are from. And now for the Mel Gibson connection, it appears to be somewhat of a religion for these folks. And to criticize their God is the most offensive act. But in reality the whole thing is a myth. I am not sure what the attraction of LAanity is but I can tell you that I don’t subscribe to the myth.

Some free advice to the followers…

Now if you really want to come off as a native the biggest giveaway is talking about the weather. A real native would never talk about the weather because there is no weather in the mind of a native. I had to move to MA to comprehend the concept of weather.

Now how does this “rant†relate to the housing bubble? First the So-Cal housing bubble is impacted by the religion/myth of LAanity. Given that LAanity is a founded religion it survives based on finding new followers. As long as the religion/myth is strong the housing bubble will continue to feed off of the fuel of the new followers. Second, a native has a perspective that LAanitians don’t have. I have seen so many speculators lose their shirt in CA real estate over the past 50 years that I know that it always falls and it is never different this time. The California bubble always wins in the end and there are few survivors in the long term.

No believer so devout as the convert.

No atheist so strident as the apostate.

Guess it applies to the California religion too (spoken as a convert slowly drifting towards apostasy).

ap – it is not that I left my religion, it is that my religion left me…

Well, I am both a native and a local, so y’all can shut up now.

And yes, I do talk about the weather (generally to the tune of “man, I’m so glad I live in LA.”)

I smell a shill/shril.

How do you know when a real estate agent is lying? His/her lips are moving…

What – never underestimate the power of cognitive dissonance which exists in our human nature. It’s obvious that some folks are trying really hard when they come on a housing bear (their label) site to spread the “gospel” to non-believers or the questioning. I always submit that if some particular thing is so great, you can let that thing speak for itself. Then there’s the obvious tell that instead of spending as much time as they can enjoying said thing, they are choosing to spend time preaching to the uninitiated.

I think that this is a problem exclusive to such areas as Southern California. Note that median home prices are now around 9x median incomes in the examples cited. That simply isn’t the case nationally. Somebody will have to dig up the precise statistics, but as an anecdote, folks don’t spend more than 3x their income on housing purchases here in Florida.

Actually, Nor-Cal is just as bad. This might be an all of CA anomaly.

I think it’s really prime areas of CA, not just all of CA, that are ridiculously inflated. Surely houses in Bakersfiled, Fresno, Visalia, etc. are not 9x median income. But they are still inflated and more than the price in FL for sure. And there are plenty of places in Nor Cal that are not as bad, but that doesn’t include prime areas like Palo Alto, Marin, Oakland hills, etc. Places like Fremont, Milpitas, Hayward, etc. are inflated but not 9 x median income inflated.

BAR – agreed. I would guess perception is playing a part at this point. I remember a long time ago reading how the banks were “attacking” one area at a time and they never really got to the “prime” areas as far as I can tell. That might explain some of the disparity as well.

I’m not sure how relevant this is, but median income in one coastal so called prime area of LA is ~$147K. The median price of homes that sold recently according to Zillow is $2.4MM. That’s 16x. Are these the types of numbers folks use for comparison? If so, this is clearly insanity, right?

El Monkey, I’ve seen those stats and they are really misleading. Take the median income of TODAY’S buyers in those prime areas and they will be multiples of what is shown for the overall median income of the entire city. I recently read something that stated Manhattan Beach’s median income was ~120K yet tear downs nowhere close to the beach go for 1M plus…and they sell like hotcakes. When you don’t include renters, long time owners, part time working adult childrent living at home and you’ll likely have a median income much higher than 120K. This is not abnormal for many prime CA cities.

15 years ago that $2.4mm home was $7-900k, which was “doable” on a $150k salary (considering there actually used to be such a thing as a “move-up” buyer and also buyers of that ilk [prime coastal] have parental help with the DP). And, there are plenty of retirees ($0 income) enjoying their 5x return since buying in prime areas during the 80’s or 90’s. Those buying @ $2.4mm are uber-wealthy, strong-hands, guar-an-teed.

@KR – I’m not sure where you’re getting data suggesting people in FL are holding to 3x income. In most markets in FL I’ve looked at the rates of median home sales price to median household income in metro markets is in the realm of 6:1. And the only thing keeping it even that low is the number of 1 BR condos that sell “cheap” (coincidentally enough, around 3x median income).

FL may not be 9 or 10:1 like CA, but it still seems out of whack, imo. If you do have a data citation I’d be curious to see it.

Oh Doctor, I did read an article on the sudden increase in foreclosure starts and one of the reasons they gave was that the banks’ legal teams have finally learned how to foreclose while adhering to all the new foreclosure regulation. I am not sure that this is the reason but I think it is at least a factor…

Once a bank forecloses on a property that starts the clock on when the bank must unload the property. Federal law allows banks to hold on to foreclosures for 5 years with a second 5 year extension if selling would do them harm. And since mark-to-market was suspended in 2007, the banks do not have to take an unrealized loss at the moment of foreclosure. The realized loss would only occur when they sell the foreclosure. Therefore the banks can game the foreclosure process to keep their balance sheets pretty.

But as you say, they now get ten years on those properties…at some point they will have to sell. They have started the countdown. If they can muddle along for ten more years, all will be well for the fat cats at the top, who will keep churning profits and start planning their exit now (which will be, not surprisingly, in about ten years…they won’t be stuck holding the bag, they will be “retired” so they can then call themselves “investors” and “philanthropists,” busying themselves with very important things like by naming buildings after themselves at their alma maters).

Do you really believe that the rules will not be changed to allow the banks to hold the properties for quite some time if it is to their advantage? My understanding is that at least three rules have been changed in this area that favor banks.

– Suspension of mark to market

– Relaxing the maximum percentage of real estate a bank can hold on their portfolio

– Extending the amount of time a property can remain on a bank’s portfolio

The only changes left if they haven’t already happened would be to make banks not responsible to pay property tax or HOA fees. It wouldn’t shook me if there isn’t already ways around this for banks…

@What?

Actually, the banks don’t need to have Federal law changed regarding the 5 year + 5 holding period for foreclosures. This is where Quantitative Easing comes in. The banks can flip their defective mortgage/mbs’ to the Federal Reserve without having to foreclose. The Fed, owning the keys to the money printing press, can then monetize the bad debt and make whole the lending bank at the press of a keystroke.

QE enables the Federal Reserve to act as the defacto bad bank ala Reconstruction Finance Corporation (RFC) and Resolution Trust Corporation (RTC). The official dialog about QE keeping down interest rates, stimulating the economy, helping unemployment is blatantly untrue.

Excellent article, thank you Dr. HB.

Housing To TANK Hard in 2014@~

Thanks for checking in Jim…

How does one the percentage of all cash sales in other places. I live in Boulder, CO. That information seems to be hidden? I am suspicious of the housing market here. Prices just head up but all the national data shows high all cash buyers. People in Boulder have a crazy idea that Boulder is exceptional. It’s not so can anyone help me find this bit of data?

That dramatic shift in foreclosure starts in California is ominous. If we have reached a peak, the banks are the first ones trying to get out.

Guess who the last ones will be?

http://www.westsideremeltdown.blogspot.com

I’m still seeing homes selling pretty fast once they hit the MLS. And there are not too many of them. This trend does not look to be changing.

It’s a completely un-normal market, but I think it can last a while longer. Maybe another year or so.

I believe someone is forgetting to account for the 2014 elections. I think the democrats may use this increase in foreclosure activity to “blame, yet again, those rascally republicans” for causing the people who are in the foreclosure process for taking on loans they could not pay back… Sound familiar? Just another tactic to keeping poor people poor and eliminating the “middle (income) class” over the next couple of decades.

No-one’s gone public, but the timing indicates that this surge is quite likely linked to the settlements that the mega-banks made INRE defrauding Freddie and Fannie.

As long as those torts hung over the system, the assets at issue were being rolled forward.

If the mega-banks had broken the market, then their prompt hit to the bottom line — the settlement terms — would’ve been brutal, perhaps even terminal.

By getting their good ol’ buddy BS Bernanke to juice the mortgage market and ZIRP the pension fund crowd, the mega-banks trimmed the apparent losses of Freddie and Fannie to the point that closure could be obtained.

Now that these State Sponsored Enterprises are no longer in the fray, the mega-banks are in a position to unload in quantity.

I further surmise that Wall Street has ALREADY syndicated pools ready to take this surge off their hands. De facto, the market is being re-structured towards professional asset management. Seventy-five years of housing policy is going out the window.

Because the mega-banks are hip deep in both commercial lending and investment syndications, you just have to assume that one hand is washing the other.

For obvious legal reasons, the liquidations will move the assets into the arms of mega hedge funds. By doing so, the players can meet all regulatory requirements for ‘arms-length’ negotiations.

Also, do keep in mind that YOY stats are wickedly skewed when they represent the tail of the dog. It’s in their character.

Blert .. Can I email you, or you me ?

petalumahouse@yahoo.com

I’m new here. This blog and subsequent commentary (with links to further reading) have been very valuable and I appreciate the input and insights of the good Dr. and lots of you commenters. It has really helped me ramp up from knowing nothing about buying a house (because it never crossed my mind) to finally beginning to understand what has been going on with the boom/bust/bail out/bubble/ pump and dump. Thanks to all the folks who have had something to add. Maybe my little bit of experience will add a some color from the mean streets of LA’s so-called “prime areas”. I guess I just feel like I finally get it.

For 10 years I lived 50 steps from the sand on a walk street in the Marina. I lived in an owner occupied 3 unit “high end” building and though my place was 600 square feet, it was new, well built, top notch and yet only cost $1650/month in rent. I had it made and it was as much as I needed since I was only home to relax and sleep. It felt practically like I was living for free on one of the best streets in LA. I’m a fairly minimalist person and don’t need a lot of possessions or opulent junk. My motto is experience over things any day. Because I didn’t want a mill stone around my neck, and like being unencumbered and flexible, buying never crossed my mind even though I could have readily afforded it.

Now married and with a new baby, we decided to check out another area to see if we would like it and would consider staying there. We are living in a prime area between SM pier and the Getty Villa (guess which one). Rent here is ridiculous, but not nearly as ridiculous as home prices. For a decent house, rent is about $6000. An ‘entry level’ home here is about $1.8MM. $1.5MM for a 1943 bungalow that is “original” (AKA fucking shitty and in disrepair) and with quote “serious geological challenges”. I laugh my ass off when I hear what people pay for this garbage.

People here rhapsodize about how this place is like Nirvana. Wonderful neighbors, great life, just decent folks making a community. I call bullshit. Sure there are some nice people (no monopoly on that) but it’s also become a celebrity and privilege ghetto. I am a self made man who is sitting on a decent amount of cash from the sale of a company I helped build. I have been around the world and lived in many situations and it’s amazing to me what a reality-challenged insanity dome people live in here. I mean, all you need is a tiny bit of imagination to realize that there are so many other situations that are better.

Here’s another one…a friend’s friend is a realtor, so he’s been sending me “helpful” info which I take with a grain of salt. (Isn’t it great when “friends” willfully supply you with bullshit info for their own advantage?) I was sent one listing that was labelled a “game changer” It was $1.7M for a crappy cramped bungalow on an average street. It’s one of those houses that are perched above the street. 22 shitty home depot ‘wrought iron’ hand railed steps straight up hill to the door. The ‘veranda’ is a deck above the garage conveniently looking out on to the drive way and the street below. Awesome.

You may say, well hey that’s the price to pay for glorious living in coastal LA. But I say,even though I could afford that house there’s no way in hell I would saddle myself with that pile at these prices. Prices have shot up over the last year and it’s completely picked over crap. Good news is that I have started to see stubborn prices start to drop this week. I also have new found confidence in firmly stating that this Alice in Wonderland insanity is ridiculous and untenable. I mean, I “knew” it before which is why I wondered allowed, “are these people insane”? I mean I have friends here who can’t afford a vacation but live in a $1.5MM home!

Now with all your helpful input I am really starting to get it.

By 2015/2016 I’d guess that prices will come down and it will be possible to buy a decent if comparatively modest house at a more reasonable price in cash – don’t care where interest rates are. They will at least be more rational. Not that I’d ever ridiculously over extend myself for some bullshit prestige place, but I don’t think I’d have the conviction along these lines without the insights of this blog.

So I guess, in summary. Thanks folks.

“I guess I just feel like I finally get it.”

Congratulations! You really do get it.

Yep…I thought this price history was quite hilarious. Take a look farther down the page.

http://www.zillow.com/homedetails/1049-Glenhaven-Dr-Pacific-Palisades-CA-90272/20543299_zpid/

From: 07/28/13 Listed for sale $2,099,000

To: 10/15/13 Listed for sale $3,795,000 +80.8%

To: 01/04/14 Price change $2,099,000 -36.3%

WTF? Hey, let’s see if some idiot will bite 😉

El Monkey, have you thought about looking in other areas in this city or do you have your heart set on that area? 1.5M can get you some really nice houses in some really nice areas in this city. Spending that much coin and buying an old fixer shitbox sounds like a bad idea unless there is future potential for building your dream home on the lot. Sounds like you were really happy in the Marina, what about looking back in that area?

The RE mindset in the city really is something else. Life could definitely be better just about anywhere else, there is no denying this area has a certain draw to it.

@Lord Blankfein

Yes, I’m with you. Not only am I not set on the area, I’m not really dead set on the city or So. Cal in general though I do like it. The area here is nice, but there are many options in my opinion. Right now, I’m less concerned about “I have to buy a house” than I am at just understanding the dynamics at play and understanding the data behind the feeling I’ve had that this is simply insanity. It’s obvious to most all the posters here, but I’m just catching up. I feel like Neo in the movie “The Matrix” where my sense that there’s something really wrong here is being confirmed and I’m understanding how and why. 🙂 A better understanding of what is happening is powerful because it can help you make better decisions even if it doesn’t change the conditions. And the situation when you start thinking about buying a house conspires to skew the info and or keep it from you.

Right before we had a baby, we went on a 2,000 mile road trip around CA. I could have imagined a great life in many places we went. Marin county, Sonoma Coast, Central Coast, Sierra etc. I liked the Marina a lot. My wife likes it a little less. It isn’t cheap either, but that’s definitely an option and somewhat likely one. We’re not really sure if we want to settle yet. Because of mobile work options, I don’t really need to be stable somewhere until the kid is ready to enter school. And then, you can rent a great house near the school you want for a much better deal. Basically if you don’t believe the hype, and don’t get caught in the mania, there are many many more options that open up. I think more people will start thinking along those lines.

An example that had me intrigued….In Central Coast wine country for 1/2 the cost of the shitty tear down you can get 60 acres of glorious mountain top with house and guest house within 15 minutes of a great elementary school, a trader joe’s, and restaurants and vineyards. Not bad – a mini Hearst Castle for the rest of us. (If $850K is the rest of us). Not sure, that’s the solution, but just a comparison.

@Chris

Something is amiss when the only shops in town are a cupcake place, an ‘anti aging place’, a Jack Lalane era ‘nutrition store’, 2 lingerie stores, a stationary store, a deluxe pilates studio, but you can’t get a cocktail or chinese food delivered 😉

@ernst blofeld

I agree. I don’t know how pessimistic I feel about things. I mean I see opportunity ahead. I remember in 2008 some people I knew were salivating at the opportunities opening up and some were mourning the fact that businesses were shuttering and store fronts were going vacant. Not sure who was ‘right’.

El Monkey what part of Central Cali was that? Email me.

No.. thank you for the term “Privilege Ghetto”. I’ve been dancing around that one for a while now.

@El Monkey, what you are seeing is the trailing end of most recent major debt super cycle.

The first (major) debt super cycle was in the late 1980s (popped by the 1990 recession). The next (minor) debt cycle was year 2000 (popped by the 2001 recession). The next (major) debt cycle was 2007 (popped by the 2008 recession).

This is really something you only see in the megalopolises of SoCal, NorCal, the Northeast (Washington D.C. through Boston). The “wealth” is all borrowed money fueled by massive debt consumption. In the fly-over regions of the U.S. people actually live within their means, pay cash and avoid credit like the plague. Whereas in the megalopolises it’s all credit, borrowing, leasing and massive leverage.

The year 2014 looks somewhat like 2000, and a lot like 1989 and 2007 before the economy collapsed.

New construction (tear down/rebuild) in Normal Heights (north of Adams; preferred area) advertised for >700k (~1500 sq ft 3/2 no yard sm lot) had much traffic this weekend! Homes in the area went for 400k 2.5 yrs ago. My thoughts… Tipping Point coming but not there yet. Won’t Tank Hard (Jim), but will relax gradually. Market fundamentals (deflation- NOT inflation, poor US GDP, stagnant international commerce/trade, currency devaluation- relative to fixed assets… etc etc etc) are far more complex than the laymen know and can comprehend…. What we do know is this market is NOT impacted by you and I, rather, by individuals we do not know because they remain behind the curtain and assure their wealth is not negatively affected. Will be an interesting 12-18 months, plus, election season winding up.

@DrHB “Why the sudden jump in foreclosure starts…”

Two words: recession, employment

SoCal and California continue to have the highest U-3 and U-6 unemployment and underemployment rates in the U.S. Recessions since WW2 happen every 5 years. The last recession ended in 2009. Congress just voted to cut food stamp benefits and not extend unemployment benefits. And let us not forget the current drought in the western half of the U.S. Food prices are going to be spiking later this year due to this. The banks see the writing on the wall and are moving now before GDP goes negative.

One needs to remember that home prices in the desirable areas of SoCal tanked with the recessions of 1980, 1982, 1990 and 2008. The only recession where home prices did not get crushed in the desirable SoCal areas was 2001.

Blert, what you say makes the most sense. The things I think they are missing- unless they only want to play musical chairs with decaying housing and steal the pension funds, is no one will be able to afford rents high enough to both repair and make a profit off many of these houses. Many have windows punched out, copper piping stripped, roofs leaking for years… Even in once nice homes. In 2011 and 2012 I looked at well over 100 of them. Some of them being consistently vandalized by previous owner’s friends.

The other thing is you have is a large proportion of 2 or 3 generations of people after the baby boomers who feel they’ve gotten burned financially. It’s not that they don’t want to buy- it’s that they have given up hope of ever being able to afford it and are somewhat enraged about that. They hold no loyalty to employers or landlords. Even less to corporations. There will be more unpaid rents in the future and also less care of rentals = more upkeep expenditures. Corporate landlords are more susceptible to squatters, even with property management. False ID’s are readily available on the black market for a price, so those enterprising enough won’t worry about credit ratings as a consequence of their actions. Especially if dealing with a faceless investment firm rather than a mom and pop.

So, maybe at some point the cycle will burn itself out and first time buyers can buy a house to live in… If there were actually loans given on those houses in 2011 – 2012 many working people could have bought a house. That’s no secret to people who wanted one. Which is just about every one.

The other thing is you have is a large proportion of 2 or 3 generations of people after the baby boomers who feel they’ve gotten burned financially. It’s not that they don’t want to buy- it’s that they have given up hope of ever being able to afford it and are somewhat enraged about that.

Even us tail end boomers born in the early 60s are “enraged” if you will. I make a lot of effort to shop and get good deals on everything, clip coupons, keep cars for 10 years plus, etc. and I make a nice six-figure income. Very secure job. Yet I agree with the general rules about borrowing…not more that 3x or thereabouts income. I won’t pay more than that. Or much more than that, to stay in CA (where I was born…”native!” But not a “local” to Nor Cal, having only lived here maybe 10 years of my life total, in different areas of Nor Cal). So I rent, hoping to buy some day. Owned a house back east and made a tidy profit. But with the volatility in price fluctuations here, it’s not worth risking my financial future unless I can buy in that “range of fundamentals.” I wonder what the next couple years will bring, I can’t read the tea leaves as well as some claim they can, but I just hope it will be more sane in a couple of years…

I experienced all that as a native San Franciscan…growing up the town had a good mix of people and blue collar workers could buy, raise a family, etc.. but by the time I was an adult in the 80’s buying was out of the question for me. Eventually moved 100 miles north and was able to buy a place for less than 3x income etc., sold in 2007 for a nice profit etc.

Tried to buy again in 2011 and thought it would be easy as I had lotsa cash for a down payment, great credit, preapproved loan, good job etc. but none of that mattered as I was competing w/ 100% cash buyers…that was actually waaay more frustrating than my youth in S.F., I had the money but no one would take it.

It will be interesting to see how this all shakes out and if I’m finally in a position to buy at 3x income after bubble 2.0 pops will maybe think about doing t again

“Also, do keep in mind that YOY stats are wickedly skewed when they represent the tail of the dog. It’s in their character.”

Blert, could you please expand on that? How does that work?

In a boom, the price ramp is so strong that essentially nothing goes to foreclosure. The ruinously leveraged owner is able to sell out, pay the broker and retire the debt.

The obvious exception being a player who re-leveraged in a mania and walked away. In a true mania, the typical player just won’t let go. He’s making more on his real estate position than anything else in his life.

Hence, you end up with astonishingly low REO stats … and all the rest.

After the boom has crested, there is a delay… the home owner/ ower has to go into blatant default — typically ninety-days — before the bank gets itchy.

After a super-boom, the bank officers are so swamped that they — for institutional reasons — try and paper over their crisis. For many, their own career is on the line — at least at that bank.

(Never mentioned, many an ex-banker lost his career during the last debacle.)

Then, when the nightmare can no longer be denied, the system — as a whole — goes into crisis mode. This is typically orchestrated by the Federal Reserve Bank.

[ Side note: my sister is a retired Federal Reserve Bank examiner. ]

It’s this orchestration that’s behind the ‘sudden shift’ in banking honesty/ reality recognition.

[ Banking is a cartel — and always has been. It can’t function any other way. Naive economists never plug that into their models, never admit so to their students.]

Consequently, the stats VAULT higher — especially in a YOY context.

Unlike many financial stats, because of this dynamic, the urge to purge causes all published statistics to whip around like an excited dog’s tail.

As you review post-war banking, you’ll note that bankers move as a flock, going into and flowing out of, one mania after another.

Florida land

Spec REITs

Oil patch and associated real estate (Texas, esp.)

Hawaiian real estate (circa 1960s)

So burn this into your brain: bankers run with the pack AND commercial banking is a cartel. Bankers CAN’T differentiate on pricing. Lock-step pricing = cartel economics.

As for service: every innovation is impossible to patent — and so replicated by all peers in short order.

This makes banking a lot more like farming. One ‘competes’ by the amount of turf one controls. Whereas farmers covet ever more acreage — bankers covet size.

The result is a nation of mega-farmers and mega-bankers.

(You’ll note that farmers WANT Federal interventions, too. And they’re constantly suffering crazed swings in farm income. Like bankers, they’re riding an implicitly passive position. They can’t influence their fates — except as a collective — and that takes the form of central government interventions, rigging and cash outs.)

As they grow, both sectors shed jobs. You can read that as a labor surplus — or as a vector of unemployment. Take your pick.

Those Burbank zip codes with the low income doesn’t tell the whole story. There are many immigrants who show little taxable income and get all the taxpayer benefits that California gives. In reality, their income is very large, buy expensive homes and drive BMW 7 series and MB 600.

Don’t be misled by reported taxable income and the prices of homes. If there is a substantial immigrant population, e.g. Glendale, then you understand what is going on. Thank you taxpayers of California for giving us such a great life in so many ways. P.S. Run your money through a Corporation and you will not get a 1099, that is your free tax tip for the day. There are many others as well.

Yes I’ve seen many Armos with Coach purses and Mercedes using EBT cards (food stamps) to buy their food. Please elaborate how they are able to pull this off, and why I as a real American have to pay for it?

Hey Papa, I am Armenian/American(also live in Glendale) and not all of us are that bad. I have a corporate career at an aerospace company and my finance also has a corporate career. I am disgusted like you and others when I see people abusing and taking advantage of the system. It is pitiful that people work cash, hide money and do everything possible to game the system(work under the table and receiave EBT support, run money threw a corporation so they pay the least amount of taxes. My fiance and I make close to 200K ( not bragging showing example) and we are still priced out of purchasing a house in Glendale/Burbank/Pasadena due to people gaming the system. From Short sale fraud(selling your home to relatives or friends at discounted prices happens all the time in Glendale/Burbank). the house that dont sell and are on the market are either extremely overpriced or just shakes that need a tear down. What i have found true in this country is, the savers, hard working people who do it the right way ultimately get screwed and that is a shame. One thing i have learned though is that one day the chickens will come home to roost.

As an Armenian American, i can say I think it is less likely the money came from the six digit taxes I paid rather than from you. Please keep ethnic insults to yourself.

I blame 75 years of communist rule throughout the world for most of this. If you look around carefully at who’s bucking the system, you’ll see a large majority are coming from former communist nations. Government was the enemy, period. Everyone’s goal was to keep as much money as they could be circumventing and beating the system whenever they could. If you’ve done it as long as some of them have, it’s hard to change ways.

Don’t mean to specify any ethnic group, it is the system that allows people to take advantage. Tea Party anybody? I understand the feeling. I know people with W-2 and 1099 income and they are jealous of those who have their own business and etc. The government does not effectively enforce the tax laws or the taxpayer benefit laws, so, of course, human nature being what it is, people take advantage. May be the problem is with the welfare system. In “old country” the welfare system was the family and the church and you could not take advantage of them, because they knew you. In this country the government is impersonal and they are easy to take advantage of. Famous American said, “Don’t give a sucker an even break.” Don’t blame us, blame your stupid government. You voted for them, I didn’t because I operate below the radar.

You’ve got some zany ideas.

Let’s start with the presumption that filing an 1120 or 1120S means that the IRS gives you a pass — let alone the Franchise Tax Board.

Quite the reverse is true. And the FTB is much worse than the IRS.

1120S and all the rest are where the big money is. They get audited drastically more often than a mere 1040 — let alone a 1040A.

The stuff of legend: leasing expensive cars and taking a full deduction is dead going back almost thirty-years.

The only angle that can work is out-and-out cheating. This means running a cash receiving business that doesn’t attract scrutiny, that runs double and triple books. Jerry’s sales tax collections has him going overdrive to nab those frauds.

****

BTW, it IS true that the IRS and FTB are enthnically biased. Despite knowing that immigrants — especially Indians, Chinese and Armenians — but not limited to them — are wildly over represented as tax cheats.

Such a truth is Politically Incorrect.

In as much as the IRS is a Democrat bastion, they ride as easy as they can on constituencies favored by the The Party. So these players get a soft ride. The more recent the immigrant, the higher the odds that they are pocketing all taxes. (Bringing their home town ethics with them.)

Whereas, for the IRS, it’s open season on the Koch brothers and Tea Party non-profits. (So much for tax collection! The IRS has much bigger fish to fry.)

(“Patriot” is a flagged title word — which shows you where the tax machine’s head is at.)

The form that hides income the best is 1040 Schedule E. (RENTS)

Not surprisingly, Indians, Chinese and Armenians are wildly over represented as cash-collecting landlords. This impulse has proved doubly fortuitous because of the systemic debasement of the American currency. This means that tight-fisted no-talents shoot straight to the top of the assets sweepstakes as they vector all of their purchasing power to the rest of the clan. There is no chance that any outsider can compete for their business, get serious.

I know of one immigrant clan that is worth Big Bucks that still manages to qualify for SBA subsidized loans for real estate purchases for de facto millionaires fresh off the boat/ jet.

That same agency gives the stiff arm to poor white men. Ike, its founder, is spinning in his grave. The SBA was supposed to be a counter to the MIC. Today its number one purpose is to work against native White American men.

Don’t think that I’m singling out just the above three.

In my daze in the Islands, I noted that EVERY recent immigrant class was over run with tax cheats. Many of these players were so nasty that they’d been run out of town — back home. (Tax cheats will be dead beats, too. Call the trait: financial narcissism.

(Famously, the Japanese Yakuza regarded Hawaii as their ‘Switzerland.’ Hence they spent large on every manner of insane development projects. Who else would build a golf course on a mountainside — $100,000,000 — and then run out of money?)

(And you wonder why Japanese banks ran into some heavy weather?)

Yes Armen, you Armenians have become quite skilled at fleecing the system for every welfare entitlement, all the while you conduct business in cash and pretend to be legitimately successful.

You wrote ..”Thank you taxpayers of California for giving us such a great life in so many ways.”

You’re NOT welcome, and I hope we Californian’s can provide you with a vacation behind bars too.

Don’t get your feathers all a-fluffle, Pet. “Armen” is “Maria” is “Lee” and any number of other false-identity pseudonyms that some poster (or posters) periodically use on this board to be “ironic” by glorifying negative racial stereotypes.

“Armen” is not real, and he won’t be here long, though his cowardly bigotry will surface again under different cover to bait and enrage the uninitiated.

P.S., I do understand that all stereotypes are based on agreed-upon perceptions (simplified “truths”, if you will)

P.P.S. I also realized Pet is for Petaluma

P.P.P.S. I’m a closet blert fan

I dunno what happened the last few months, but redfin’ing my zip code, asking prices have literally dropped from the low 300’s into the high 200’s. All in accord and unison, I’m perplexed.

I also see a lot of short sales again, I haven’t seen a short sale on the market in at least 9 months.

Did the short sale taxable gain tax relief rule get extended? This might be a factor in the growth of short sales. It might be the last chance to get out for some of these folks…

Yup. I’ve been seeing a lot of price drops as of late in various locations of L.A. where prices had formerly skyrocketed from 2nd half of 2012 to mid 2013. As for prices “moving sideways” or remaining “flat” in 2014 – we will find out soon enough. If what I’m seeing keeps going into and through the Spring, things should get really interesting.

Here is more insight for those who wish to be pretend natives/locals. This could save your life (not really anymore) … :-)ïŠ

“Regular surfers who live around a desirable surf break may often guard it jealously, hence the expression “locals only.”

“Some locals have been known to form loose gangs that surf in a certain break or beach and fiercely protect their “territory” from outsiders.â€

“In Southern California, at the Venice and Santa Monica beaches, local surfers are especially hostile to the surfers from the San Fernando Valley whom they dub “vallies” or “valley kooks”. “

“The “locals only” attitude and protectionism of the Santa Monica surf spots in the early 1970s was depicted in the movie Lords of Dogtown, which was based on actual events.†(This is a must watch for all those who wish to pretend to be locals)

Link to the source even though I don’t really need a source because I was there…

http://en.wikipedia.org/wiki/Surf_culture

I never saw surf Nazi in my area probably because of the locals of Jewish/Mexican/African decent would never tolerate it. I do remember someone coming to our beach with a swastika and I can only say it did not end well for him and I never saw him again.

Surf punk was very prevalent as many surfers including Tony Alva (Lords of Dogtown) became musicians in punk rock bands in the late 70’s and early 80’s. I played in a number of these early bands.

This is why someone using the term local has an irrational impact on me to this day. Unfortunately this was going on when my brain was still pretty malleable so it is really hard to let it go. This is also the case for most of my friends…

I was in the Marines from 88-94, out in 29 Palms and then at Camp Pendleton 92-94. I then lived in Studio City from June 94-Jan 95. I visit the South Bay at least once a year. I was an instructor for Marines right out of boot camp and had the same crew of them for 3 months straight during the time at Pendleton.

I saw 2 things towards the end of my time: Surf Nazi’s and gangbangers.

The Surf Nazi’s were all white kids from Newport and Huntington or the South Bay. They were the first Marines to keep a shaved head after boot camp, at a time when all ethnicities in the Corps avoided having a shaved head. They made no bones about being ‘Locals’ and there was a lot of tension between them and Mexican American guys, particularly from around Santa Ana and Anaheim. I saw Swastika tats and they even mocked other ‘Californians’, considering themselves to be the only true representation of CA life. These kids were going active duty (24/7/365).

The gangbangers were black and Mexican CA natives who were joining to ‘learn weapons’ for the gang. They joined the reserves and would carry themselves completely differently than east coast blacks or hispanics. They would go home every weekend and didn’t hang with other ‘classmates’ on weekends.

The California you describe as a 4th generation native IS exactly what I saw during my 6 1/2 years there. Bumper stickers mocked all of us ‘interlopers’, radio DJ’s ragged on new arrivals, we in the military were belittled, harassed and generally looked down on from the border to the Valley and all the way to the river.

I went 9 years without going back, when I did I didn’t recognize LA. Places that had been ghetto were top dollar, places that were beach bums were beyond expensive, places that were more white than not were 100% spanish, everyone white had tats all over themselves, the guys I rode motorcycles with would’ve been amazed that there is a whole ‘Hell’s Angel’s knock off culture for 25-35 year olds and the Hell’s Angels I used to see would’ve beat down all of those new hipster guys…… I have yet to meet a transplant since going back (and having lifelong friends from here in NY who’ve lived there since 2001-ish) who has been in a decent sized earthquake. I was in the Landers and Northridge, plus all of those aftershocks. Everyone I know out there freaks over a little shimmy here and there. Drought? I caught the last one. The folks I know with pools don’t believe me when I tell them they might be banned from topping them off. They don’t know what Foster’s Freeze was like before El Pollo Loco, they don’t know Huell Howzer, they don’t know riots, fires, the LA Weekly exposing the LAPD every 3rd issue, they don’t know Poorman, that Loveline was a radio show….. they don’t know Speed was filmed on the 105….. because the 105 was open when they moved there!

I only spent 6 1/2 years there, but I think I caught the tail end of the post- World War 2 CA that is the one people everywhere else always imagine CA is like. I’ll take your word as gospel on here when it comes to ‘locals’.

>> I have yet to meet a transplant since going back (and having lifelong friends from here in NY who’ve lived there since 2001-ish) who has been in a decent sized earthquake. <<

Is being in a large earthquake how a transplant "loses their virginity" and becomes accepted as a local?

I'm a native New Yorker, but I've lived in Santa Monica since 1987. Yes, I experienced the 1994 earthquake. Do I now qualify as a local, it not a native?

No, my point was they are ignorant of what others their age (mid-40’s) who are true natives have experienced as ‘SoCal’ during the last 40 or so years. They (my childhood friends) think the last 10 or so years are the norm, they are wrong. As this blog explains, CA is a boom/bust cycle kind of place. They think the housing bubble (that they all cleaned up in flipping btw) is the worst thing to happen and get all uptight over the occasional smoke from wildfires. When I ask them if they have even thought about where they would get food or water after a quake they just laugh. My girlfriend and many friends lied 5 miles from Northridge. Fellow Marines I served with fought wildfires and patrolled the streets post riots and military bases were locked down. The topography of Camp Pendleton, including the routing of an entire river, was changed in one weekend by floods in 93. None of them or any other transplant I meet in the South Bay thinks any of that will happen again and they never hear about it because nobody they hang with was around for it.

So to answer your question:

You are not a local. If you’ve been there since 87 you would know this….. unless you have spent the last 25+ years surrounded by other interlopers who call themselves locals. Which I believe is the point ‘What’ was making.

I believe most people now coming to CA and settling are immigrants from other countries, many who continue to speak native languages (even second generation), especially in social settings, and are content within their cultures. I’d guess most of these folks are oblivious to the concept of CA surf n sun “natives”,”locals” etc. CA is a completely different place than it was twenty, thirty years ago. I doubt few people even think about the concept of “locals” or “natives” anymore except for maybe age 40+ folks getting nostalgic, talking about seeing TSOL or Iron Maiden on the Sunset Strip “back in the day”, maybe sporting a Dead Kennedys T shirt around the cul de sac/at the mall on Saturday to show the populace just how rebellious/cool Mom/Dad/Grandma/Grandpa was/can still be, etc.

Drinks, thanks for bringing back some good memories. LA back in the 80s was really something special. Other things I remember: original taco Tuesday at El Torito in Fashion Island, KNAC night at Live Bait in Long Beach (yes, I had a sticker on my car), Studio Café in Newport/Huntington (adios mother drinks), the sleazy Red Onion, going to the Forum to watch your favorite bands, all the great sports memories (84 Olympics, Lakers dynasty, 88 Dodgers and LA Raiders).

There is no doubt socal has changed and I don’t think the 80s are coming back. What we have seen the last 10 years is likely the norm going forward.

FTB, your view of local is exactly what I thought. You don’t have to be a dictionary definition of a native to be a local, but elementary school is where locals are formed. By the time you get to high school you might be in a class with people from the same city who had absolutely zero of the same hang out’s, activities, etc. Anyone claiming to be a local who didn’t even graduate from the nearby high school is a poser. If you answer the question by saying what year you arrived ‘there’, you aren’t a local. “I moved here in 3rd grade” is a world away from “I came out here in 1987”. I am not a native, I will never be a local, but I was lucky enough to have many SoCal locals as friends from age 18 going forward and spent time off duty in places as varied as Wilmington, Torrance, Downey, the Valley, Upland, Riverside, Hollywood, most of San Diego County, and on and on. I was immersed in CA culture from day 1. That is why I’m bummed that SoCal is exactly as described above; an area of non-assimilating immigrants and out of state migrants who want things to be like ‘home’ but with better weather. I still laugh when I hear it called Los AnG-a-Leez in old movies. How many wannabe ‘locals’ know that there was an actual campaign to change the pronunciation to Los Angeles?

Who am I kidding….. my friends don’t even know who Cal Worthington was……..

I get the whole native definition…born here. Local is highly subjective. All the people I know do NOT associate with people who are territorial in some way or another. Maybe you guys did and that is the difference. Most kids today in any decent area are completely sheltered, they aren’t trying to “represent” their city. They are driven to school, picked up from school, driven to activities, etc…hardly ever out of adult supervision. If I showed up here a few years ago and claimed to be a local, people might have some heartburn. I’ve lived the good and bad of this city for three decades…sooner or later you get to join the “local” club. I’ve seen it all, both good and bad.

I have tried to stop myself from fueling this fire further but I guess I just can’t help myself. I am quite frankly very perplexed how someone who doesn’t even live in LA and admits to only spending 6+ years in the area knows more about the area than folks claiming to have spent “decades†in the area. I choose to take these folks at their word (except RE agents) so it is absolutely confusing to me how this could happen. I would think that in 30 plus years you would run into some locals if not natives and listen to them and learn what justagauy apparently did in 20% of the time. I fear that so many natives/locals have moved out/on that we now have no historical reference. I read an article where the writer called Venice Dogtown. Anyone with a historical reference would know that Dogtown is Santa Monica and Venice and Santa Monica were rivals when the term was coined. This then brings us full circle; LA has been redefined into a caricature of itself like a bad movie. It is really sad to witness the death of a loved one.

What, I kind of miss the old grungy socal beach towns from the past. They have been or are in process of being gentrified. I haven’t been to Santa Monica/Venice in ages, but I’m pretty sure it isn’t Dogtown anymore. I did however love hanging out at the old Oarhouse back in the day. Hermosa back in the early 90s was completely different than today. You could park your car on the pier promenade. It’s gotten completely commercialized…good for the city and their tax coffers but it’s definitely lost some charm. The Redondo Beach pier is still a bit crusty which is nice to see, there are plans of completely revitalizing it. Downtown Long Beach was a total ghetto back in the day, it looks like a carnival zone now. Downtown Huntington near the pier in the late 80s/early 90s was definitely dumpy too…big time commercialization happened. San Clemente is still holding true to its roots, love going to the pier and eating at the Fisherman. As time goes on, it will likely go the way of the other socal beach cities too.

Strolling down memory lane is always fun.

LB – Help me understand the need to be considered a local. I am a transplant and will never be a local in Santa Cruz CA. I love the place and would love to retire their but I know that I will always be a transplant. My mother moved to LA in 1962 in her early 20’s and died a transplant. There is no shame in being a transplant. People love the palm trees in LA and they are transplants. There was a mystic about LA many years ago so I sort of get the desire to think of yourself as part of the mystic but the mystic has been replaced with a cartoon character. The mystic is why I always question those desperate to consider themselves a local. I think both FTB and justaguy conveyed the real sense of developing a mindset that makes you a part of a place and this seems to happen in the early years of development. My mother was very different from the other people I knew and I never understood her until I moved to her home town. The way I saw her changed dramatically after my stint in the north east. I realized that she was normal for the area that she grew up in. This is really the reason that transplants will always be transplants. This is not a bad thing. I am cool with the idea of being from LA and living in SC…

What, I don’t clamour to be a “local” and sure don’t go out of my way to advertise myself as one. The formitive years are great buy you don’t have a say in where you live, you are essentially along for the ride. As an adult, you choose where you live. I choose to live here, build a life, be part of the community here. I guess our definitions will be different, let’s just leave it at that.

What?,

I live in San Pedro. Maybe I’m just aging (43) and mellowing, but doesn’t it seem like localism (surfing-wise) has chilled considerably over the last 25 years?

Seems like its time for cash-strapped municipals to raise taxes on second homes, rental props etc

Raise it to 10% and well see how long this bubble keeps up

One of the unintended consequences of 0-care is to achieve exactly that.

0-care deems out of area (the 2nd home, vacation spot) as NOT COVERED. Citizens will have to pay the cash-in-hand rate. Yikes.

Middle class vacations will never be cheap again.

This will absolutely crush the desire for distant vacations for anyone who has any kind of health concern at all.

Weird things are going to happen to small time firms with travelling employees, too.

One by one, all of the old plans/ schemes are being zeroed down.

It never occurred to Pelosi and Company that active Americans need care on the road, too.

Blert – You at times make absolutely no sense and I read and reread your post to see WTF I am missing. Sometimes I can discern from your ramblings what your point is but this one escapes me. How do you get from ACA (which I agree is an abomination) to raising taxes on second homes? Connect the dots for me because I see absolutely no connection…

Blert–I’m not sure Ocare’s outside the territory cash on the barrel head is unintended. Constricting socialist governments seek to restrict mobility of the populace. Its nice to keep them within reach. With Californians its going to be a challenge for the beltway crowd to slow them down and limit their desire to go where they want when they want. OCare is the first speed bump–more are coming.

What?…

The post begged the question: increasing taxes upon 2nd homes/ vacation homes to pop the real estate mania.

I had to pipe up with our living reality: Straight out of Left field, 0-care has managed — indirectly — to impute a cost burden that can’t be avoided — aka a government imposition — a tax.

In sum: The very properties cited are sailing straight into heavy weather.

Like 0-care itself, Barry’s re-rigging of the modern American economy to suit his tastes is too complicated to pull off. Even the whiz kids are forever running into unanticipated realities.

BTW, Barry is not a man alone. All of his zany nostrums are/ were considered absolutely correct and brilliant — righteous, even — by the Punahou set on Oahu 30-35 years ago. They graduated and hooked up with similar brainiacs while at Ivy.

This mindset runs amok through British and American elites at this time. This global group-think cabal is destroying the developed world — with high minded intentions.

They have succumbed to the narcosis of fiat. Its mechanics permit these players to tax the polity without comment or restraint.

Even now, were I to poll the savvy set, most would NOT acknowledge that hyper inflation of the money supply is even occurring… would not admit that such a process functions as a wealth tax that destroys working capital… which, in turn, is the rate limiting factor in jobs creation.

This is because, like Communists and Socialists, they have an alternate myth to ‘explain everything.’

Myth/ faith/ hope is required because the reality is too complicated.

You still have endless commentaries from prestige names who think that the governments books can ever be run according to GAAP.

They further assume that governments — in a fiat system — actually borrow money.

They further assume that today’s follies fall upon their grandchildren. While true to a point — it’s a totally mistaken notion when applied to government accounting. Our progeny suffer when we screw up society… Fiat abuse occurs in the PRESENT.

Just as Argentina how that works.

Of course, if Barry’s adjustments are reversed, Carte II will be followed by Reagan II.

Mourning in America will be followed by morning in America.

@ blert

Obamacare? Really? Do you honestly believe your own malarky? Citations please.

How come we haven’t heard this elsewhere….. now let’s see….hmmnnn… maybe because the only places this claim is made don’t cite actual statutory citations and quotes.

But you might start with this article:

http://www.forbes.com/sites/beltway/2012/04/02/there-is-no-obamacare-tax-on-most-home-sales-really/

Realtor.org is also a good source. Stay away from those toxic, negative, paranoid fantasy places on the Internet and you’ll fell better about life. Really.

And don’t forget, blert, money doth not make the man.

I’m a tad hungover and sleepy and said I couldnt add anything else to this site….so I thought I’d chime in and I think help Blert get from point A to B out. Sorry, cant help myself as regardless of one’s stance on the subject, at the very least facts should be known. Please turn to page 1,847 of the “Affordable Care Act” (hint: when they give them names like this, its often then opposite) for reference…or was that 1,487. Not sure. All I know is that it was written by lawyers for the insurance companies pushed through by lobbyists for said insurance companies with a 3 year guarantee on profits, so as a consumer, taxpayer and lawyer who knows how important it is to know which side “controls/drafts the documents” I feel good. Like christmas morning good.

I don’t think Blert was commenting on the tax that could come on the sale of the home. I think he was talking about a waterfall effect that starts with “0-care deems out of area (the 2nd home, vacation spot) as NOT COVERED. Citizens will have to pay the cash-in-hand rate. Yikes.”

Basically, most people with insurance pre-O care had clauses in their insurance that allowed them either bigger, included out-of-state networks (national care) that was included at the exact same rate everywhere. I had this (I could see a doctor in NY, CA, wherever as long as they were in-network). Others had insurance where you could only see doctors in your local network (say CA), but if you went on vacation to say NY or had a second home there, you could see an out of network doctor and your insurance company would still pay a large % of that bill.

The Affordable Care Act just added more risk to the equation bc ocare is about small doctor networks and you it doesnt pay a dime outside that network nor count it towards your deductibles (I believe this is correct, but in 100% fairness I, an no one besides some lawyers and 4 people in the media (who really didnt) read the thing still). So basically what Blert is saying and that risk will change behavior. If you are ill or a family member is ill or just maybe you are a worry wart or just don’t think the risk of having to spend cash on doctors is worth taking that vaca or buying that second home out of network. So if there is less demand for second homes, the prices should (conceivably) go down.

Getting to higher property taxes if thats the goal of what blert is saying is a little trickier. Maybe since (most) municipalities really have fixed (and growing) costs, to make up for the shortfall in property tax revenue due to lower home values, property taxes need to be raised? Note, this one issue could (conceivably) effect other things in the economy like the travel/leisure and transportation industries. It could also do horrible things at the local, small business level (or I guess good things) depending on which states are the winners or losers of the decrease in mobility for select, not all, people.

In the end, its all just another (intended or unintended, I have no idea) consequence of the ACA that I doubt 3/4 of congress knew about when they signed it. Can’t wait to see what else lies ahead. Regardless of what you think of the ACA, politics, the role of govt in providing healthcare to everyone, etc, the changes that arise from this will be EPIC over time.

PS: other thread on natives v local: native has a dictionary definition. Can’t really dispute that one. If you do, see your own brain for psychological deficiency as you are just trying to impress others by saying your from X over Y in almost every case. Local maybe has more wiggle room. Personally, I think you can’t be local unless you experienced things there in your youth/formative years. College/work is not local. Even if you move in junior high, I would say not local in most cases, but perhaps a case by case basis there. 🙂 Birth through maybe you moved their during elementary school is local, IMO. Really exploring every inch of your local spot on a bicycle or skateboard (or surfboard) is EXACTLY what it means to be local. Lords of Dogtown was a great movie, but I think I actually liked Dogtown and Z Boys better.

Scarlett…

Even Forbes publishes analysis spewed forth by shills.

FTB has elucidated my point: the cost of a vacation home/ winter home are shooting up — very indirectly.

This has to hit home for Phoenix. Scottsdale is over-run with snowbirds — in their retirement years.

My own parents absolutely refuse to leave California for ONE reason: they are obsessed with maintaining their health plans and medical continuity.

They are scarcely alone. THIS and nothing else explains why the elderly do not move on and out — if they can afford to sit tight. California’s elderly don’t have a harsh winter climate — unless they’re in the Sierras.

This epic erosion in the viability of winter homes will take a while to hit the news. Then it will be everywhere all at once.

For most, they’ll assume that nothing’s changed until they get the bad news.