Does housing policy amount to price fixing from banks? Negative equity, accounting standards, and control of supply. 1.3 million homes in California still underwater.

Housing is an industry made and broken at the margins. This is why in areas like Beverly Hills or Newport Coast, a small number of sales can skew prices dramatically. Housing prices in more homogenous markets where many homes are built in cookie cutter fashion provide a better metric of future appraisal values. How so? If you have a builder building 1,000 identical homes in Las Vegas, it is hard to justify that your 3 bedroom 2 baths home at 1,500 square feet is valued more than an identical one next door even though you might think it is worth more. Also, housing is the biggest purchase for most Americans. You may buy multiple cars over your life but not many homes. This is why the measures to control inventory by banks and the flood of investors has tilted this market into unfamiliar waters. High prices in the face of very low inventory. People struggling to pay mortgages yet banks having no issue buying up a large portion of single family inventory. Given that the Fed is the mortgage market, are we seeing a minor (or major) portion of price fixing in housing?

Price fixing in real estate

First it may be useful to give a standard definition of price fixing:

“Price fixing is an agreement between participants on the same side in a market to buy or sell a product, service, or commodity only at a fixed price, or maintain the market conditions such that the price is maintained at a given level by controlling supply and demand.â€

For housing, most of the definition is met. Banks fully control distressed inventory and the Fed essentially owns the mortgage market. Since real estate is not standard like say a farm product, there is little ability to set prices in a uniform way however by controlling inventory via stunted accounting rules and slowing down on foreclosures over the years, slowly real estate has moved from weak hands (i.e., American consumers) to stronger hands (i.e., Fed backed banks). The main mission of the Fed was to protect member banks (many that owned overvalued real estate and derivatives). All other economic results have been a consequence of this primary mission.

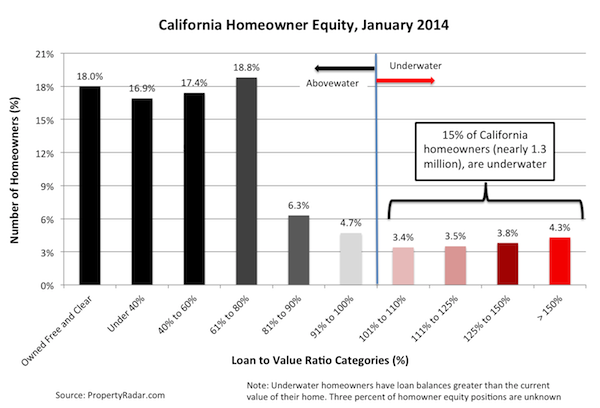

One of the most obvious ways this is revealed is through the number of properties that are still underwater across the nation. First, take a look at how many properties remain underwater in California where home prices jumped last year in a way we have not seen since the last housing bubble:

15 percent of California homeowners are still underwater despite the dramatic jump in prices last year. Throw in those with less than 10 percent equity and you have nearly 20 percent of all homeowners underwater or near underwater. A massive amount of California homeowners have no equity in their homes even though prices surged last year by 20 to 30 percent in some areas.

Yet price gains are tapering off. Investors have lost some of their appetite in the market. Investors buy with the intention of making money off rental incomes or flipping in an ever increasing market. Prices today are stuck where they were back in the summer of 2013. The ability for households to buy is constrained by weak income growth. In California, only 1 out of 3 households can actually purchase a home today at current prices and with their actual earned income.

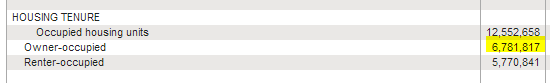

In California, we have a total pool of housing units of 12,552,658:

Of these 6,781,817 are occupied by “owners†although you will see from the previous chart that 1.3 million of these owners are fully underwater. They are paying more on their asset than it is currently worth. This is typical for a depreciating asset like a car but not a home. Many of these people bought during the last bubble that ended more than half a decade ago!

Banking policy has worked well for banks and investors have done very well over the last few years. Peppered throughout the mainstream press is the grim reality that over 5,000,000 households have lost their mortgaged properties via foreclosure. Many of these homes simply shifted hands to Wall Street, hedge funds, and investors. The single family home market has become a speculative vehicle once again simply in a different form.

We’ve already noted how many homes are “owner occupied†so it might be useful to see how many homes sold in the latest month of data:

January home sales for California:Â Â Â Â Â Â Â Â Â Â 25,832

Last month, only 0.38 percent of all properties in the owner occupied category shifted hands. If demand, supply, interest rates, and emotions are playing into the trend then these few properties will set the market. The average January sales volume is 31,393 dating back to 1988 in California so demand was much lower (despite more inventory and a much bigger population) yet prices were higher because of heavy investor buying. Investors seem to be pulling back a bit and that is why we are seeing some more inventory creep in and sales inching back. Price gains are also moderating.

It is safe to say that the current housing market has many forms of price fixing through a connection of government policy, banking regulation, and Fed monetary policy. At the moment, this may not be in favor of future homebuyers but it certainly is in favor of current owners and banks. The dialogue now seems to revolve around “do I speculate and jump in?†or “will market forces break through the control and shift prices?â€Â This of course assumes you want to “own†although many are opting to rent now. I don’t buy the arguments from people saying that they simply want to buy for security and then whine how they “missed†the last opportunity and are now locked out forever. If you really believe that thesis, why not buy today? If you are buying for the “long run†meaning 30 years or so this minor jump up is nothing in the full scheme of things. Similar to dollar cost averaging, if you have a long horizon why does the short-term matter? Many however are speculating but don’t want to call it that.

This is fascinating from an economic stand point because we have never been in a situation like this especially with so much riding on housing. Price fixing is not a dirty word necessarily but this is definitely going on to a certain degree.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

78 Responses to “Does housing policy amount to price fixing from banks? Negative equity, accounting standards, and control of supply. 1.3 million homes in California still underwater.”

This article says nothing that we don’t already know. Yes, the banks run the country when it comes to protecting their interest. Throughout history this has been the situation. The past is the past. Don’t be re fighting the battles of the past, as Heinz Wilhelm Guderian would say.

So everything is the same, until it’s different? Much like the individual in a previous article who stated to the effect “I wouldn’t bet against 100 years of dollar devaluation/worth destruction i.e. fiat currency inflation” – to that I say PAST PERFORMANCE RESULTS ARE NO GUARANTEE OF FUTURE RESULTS.

Particularly when you consider how much of a “brave new world” of uncharted territory we are really in now, and how much has been done to fight the dreaded deflation and collapse of the banking cartel yet we BARELY are seeing any inflation at this point outside of the inflated equity and real estate bubbles (take a look at natural resource and raw material prices, precious and semi precious metals prices, coal, and most fuels). Commodity prices are shit outside of oil, and that demand is sure to collapse as the developing world continues to fall apart.

Due to the new global economy we live in forcing wages down, the deflationary pressure of this on commodities and core essentials will continue to erode and counter inflation. We are rapidly chasing every other economy down the spiral of deflation fighting tooth and nail to stop it. We need credit/debt destruction…

What’s really sad is that here in SW Ohio, people still have the blinders on about home pricing – especially the Cincinnati market. In some areas, there is still a rush to buy with many of the less desirable neighborhoods literally rotting away. And those in homes trying to re-fi are running up against a whole plethora of hurdles put up by the lending institutions while trying to get there. Price fixing can be in more than one fashion – either artificially inflated values as you describe, or artificially inflated down payments and escrow to get into a home in the first place. I see both in action here.

O Comptroller of the Currency Administrator of National Banks

Interpretive Letter #950

12USC 29B

12 USC 84(a)(1)

12 USC 371D banks only investment in “real estate†lease

1 Under 12 U.S.C. § 29(First), a national bank may invest in real estate that is necessary for the transaction of its business. Twelve C.F.R. § 7.1000(a)(2)(i) provides that this real estate includes “[p]remises that are owned and occupied (or to be occupied, if under construction) by the bank …†(emphasis added). Section 7.1000(a)(3) further provides that national banks may acquire and hold such real estate by means of a leasehold estate

Banks can extend credit to member banks worded as ‘home mortgage loanâ€, based on pledge of “stocks or bonds†of member banks.

TITLE 12 – BANKS AND BANKING

CHAPTER 11 – FEDERAL HOME LOAN BANKS

http://lr-n-r.org/b&cindex.htm

-HEAD-

Sec. 1422. Definitions

(4) The term ”member” means any institution which has subscribed for the stock of a Federal Home Loan Bank.

(5) The term ”home mortgage loan” means a loan made by a member upon the security of a home mortgage.

(6) The term ”home mortgage” means a mortgage upon real estate, in fee simple, or on a leasehold (1) under a lease for not less than ninety-nine years which is renewable or (2) under a lease having a period of not less than fifty years to run from the date the mortgage was executed

(7) The term ”unpaid principal,” when used in respect of a loan secured by a home mortgage means the principal thereof less the sum of (1) payments made on such principal, and (2) in cases

where shares or stock are pledged as security for the loan, the payments made on such shares or stock plus earnings or dividends apportioned or credited thereon.

(8) An ”amortized” or ”installment” home mortgage loan shall, for the purposes of this chapter, be a home mortgage loan to be repaid or liquidated in not less than eight years by means

of regular weekly, monthly, or quarterly payments made directly in reduction of the debt or upon stock or shares pledged as collateral for the repayment of such loan…

Since no bank can “hold†or own real property, and the definition of real estate eliminate “residential real property, all “private loans based on credit †documents are void and unenforceable. That’s why the “foreclosures code in California is for personal property.

See California Code of civil procedure section 726. judicial Foreclosure only

See “unjust enrichment†title 18 U.S.C Crimes and Penalties .for fines and jail time for bankers that violate the law.

If a house jumped up $150,000 and interest rates went up a full point is this really “nothing” over 30 years? Maybe so, math is not my strength.

I think you are missing the point. Do you believe housing will stay high? If so you might as well buy since wages will go up and your housing price is fixed. Or do you think housing will crash and you are waiting to buy? Either way you are a speculator.

30 year mortgages are about 4.5%. Affordability is in the 30% range. I am seeing homes sell within 30 days of listing on a regular basis. With inventory at a trickle, this means home prices will continue to rise this year. Albeit, not like last year, but still it will rise.

Real asset deflation on uber-leveraged real estate is the #1 Black Swan circling overhead. Buyers need lower prices that the Fed and its affiliated banks will fight to the death to keep artificially elevated. The ten year Treasury is the Alamo for the Fed and will be defended at < 3% at whatever cost. This is going to be the future for many years ( see Japan ). I don't agree with it. I don't like it. But that is the corner these so-called "moneymasters" have painted themselves into.

In fact, ALL asset classes are being manipulated. Newly found fraud in spot gold pricing was disclosed just last week. More so than any time in the past…. Buyer beware !

But does the FED really give a shit about home values, or is their primary concern merely the health and profitability of its TBTF member banks? The two do not necessarily go hand in hand. Just as the FED put out all stops to save the TBTF set in the last round, it didn’t really do a damn thing to prevent the housing bubble 1.0 burst or maintain price levels. Its actions have obviously been responsible for reinflating the bubble, but that was after the huge shakedown and massive wealth transfer from weak hands to so called strong hands.

Wait until the economy do actually recover. We will have higher housing prices if interest rates is decent which it is now. Also prime areas will command prime prices since the municipalities have less chance to go bust once the economy turns down. Housing is yet another wealth transfer scheme from those that rents to the upper class since the barrier to buying a home is now very high. With the stock market at this valuation, investors are more likely to buy RE than stocks as it still less overvalued in the grand scheme of thing. Problem is there will always be a price floor for prime areas coming from international capital buying the dip so your downside is limited. For people with large equity in the first home and 401k’s, they can always use those funds to buy a second home as well, if the price is right plus institutional investors. If housing dip again, these will be a flood of professional buyers ready to scoop it from under and the little man will loose again since he will, more likely, won’t qualify for the loans or have too little money for down payment.

It is a joke to call this a bubble when prices in many areas are still more than 20% down from the 2006 peak while the dollars is being devalued by at least 20% in the last 8+ years so prices is still down 40% in nominal terms with lower interest rates (than 2006) to boot. I’m no housing shill, but housing in general is fairly to slightly over priced at this point depending on the areas. Areas where price have gone past 2006 mark might stagnate or drop but there’s still some price gains left in areas that haven’t been over bid by the “hot” money. Cities like Hong Kong, New York and London have been living with overpriced RE for decades and that has become the norm. LA will soon experience some of this and high prices will eventually become the norms.

Baloney.

The “peak” was made up of fraudulent loans that people should have went to prison over.

J6P is the one buying most homes in America, outside “prime coastal areas”. So as far as that goes, are you saying that big raises for everyone are right around the corner, when “the economy recovers”? My company in the Southbay makes billions a year, and the stock is at an all time high. But raises are 2.5% a year, always have been, always will be. Even on $100k/yr, you can’t buy a home west of the 57 fwy. Oh yeah, I forgot, you are supposed to save up a downpayment for 10 years, then embark on the great 30 year journey. But I digress…

Homes are 10% overvalued as we speak, and that is conservative. A healthy economy is home prices @ 3X median income, and we are far from that. The IE, Vegas, Phoenix, etc all need to be 3X income before I believe any malarky you throw out.

The norm in Hawaii, going back two generations, was that only those who’ve got old money — that is parental backing — can buy a home in their youth.

You see this across the board in Red China and modern Japan.

Because of the Keynesian faith, saving can’t work.

I’m leaning toward calling out Ben as a troll. An articulate one, but a troll none the less…

A personal story to share from So Cal RE…

A client of mine who is in property management is about to shutdown his 20 year old company. Compressed cap rates due to vacancies killing many of the properties he managed. Way to many liabilities for him as property manager (rents ain’t as stable of a revenue stream as Ben Shalom above has intimated) vis-a-vis the profits for his business. 20 years in business and he saw no growth prospects in this environment.

While we’ve been arguing over AHFR biz model and portfolio of a few thousand homes, Dr Housing was kind enough to remind us that California still has 1.3 million underwater home debtors. 2014/15 is going to be ugly in RE. Luckily a RE crash is the ONLY thing that can give consumers the disposable income to spend and get our local economies moving again. Notice that the Ukraine situation has the Russian CB raising rates to protect the Ruble. With the taper complete by 2015 and other nations raising to protect their currencies the FED will be forced to raise rates. They’ve already admitted as much. Those 5.5-6% mortgages will mark the deathblow for Housing Bubble 2.0.

100k is a decent salary and if you can’t buy a 400-500k house in an okay area than there’s something wrong with your spending. Housing is also partially to the FED QE and you can be sure more is coming once the stock market is in trouble. I was in the camp that housing would crash and stay down until 2013. However, with open ended QE, your money will continue to be debased at rates faster than your annual raises, you can thanks the FED for that. I just bought a home for 460k with 90k income. I don’t look to flip but it make sense for me to buy and the payment is affordable with future raises and promotions coming. Sure, I cannot be a free spender now but that’s fine knowing that I can be a free spender after the 15 year mortgage is done or should I choose buy a second home. Wait until the US raises the minimum wages (thanks to the FED) than you will see rents+everything jump causing RE prices to bump up as well.

Brilliant,

Yes the last peak was a total fraud, homes were 10x the median income and then some in CA……wages have not gone up that much since then either.

If someone has left your workplace that position was probably divided up and spread out to whoever was left…oh yes and the cost of living….lets not forget about that, have you filled up your gas tank up this week?

I smell a quote of the week…

“I don’t look to flip but it make sense for me to buy and the payment is affordable with future raises and promotions coming.”

I am not sure which is more funny, the grammar or the delusion…

>>> The dialogue now seems to revolve around “do I speculate and jump in?†or “will market forces break through the control and shift prices?†This of course assumes you want to “own†although many are opting to rent now. <<>> Home ownership in Greece ‘a sick joke’ as property market collapses / Houses Seen As Millstones

… Vergos prefers to focus on another figure. “Last year, there were just 3,600 sales in all of Athens – I repeat, all of Athens.” <<<

http://www.theguardian.com/world/2014/feb/28/home-ownership-greece-property-market

Thanks for calling BS! I agree. Housing can and will rise and fall, and the “my coastal house is more specialer” is a total crock. I have seen plenty of coastal, even so-called “prime” coastal, go up and down like the rest of the state. Even places like Newport Beach, when finance takes a hit (OC has a big finance industry), prices around NB and Irvine plummet. They also overshoot high too, quite often, when inventory is low. People need income increases and not the phony stock market kind to be able to buy expensive real estate. If incomes don’t rise, no amount of the proverbial “deep pocket foreign investors” will push prices that much higher. The main problem in housing affordability is manipulation by the Fed, pure and simple. It is no more complex than that. Will it end? Doubtful, unless a good-sized black swan appears. We are overdue. Who knows what it will be but lookout below!

460k home on 90k income and a 15 year mortgage?

Even assuming you can drop a full 20% down (92k – which most Americans don’t have sitting around liquid) to avoid PMI and higher principal, that still shakes out to close to 4k a month/48k a year.

A salary of 90k after tax nets around 5500 per month. Assuming your story is real, there’s a key figure you’re leaving out of this story (your trust fund, perhaps).

” I just bought a home for 460k with 90k income. ”

Come on. Unless your down payment was very large and you have a 3% interest rate or something, you are going to be having a hard time in life with a $90K income. So where did you get the down payment and how is your credit so stellar? Are you one of those with move-up equity that you were actually able to realize? Did parents give you a chunk of change?

If not, then we should assume you put 20% down — $86K or so — which, at a 5% interest rate, would leave you with mortgage and tax payments of at least $2,500 or so. That does not even include other costs. That’s way too much money for someone making $90K. I realize real estate agents will be quick to say, “But that’s just 1/3 of the monthly $7,500 gross income of someone making $90K, which is within lending guidelines”.

Dude, your housing is going to be consuming more than HALF of your monthly take home. Sorry, but I would be frightened to take on that kind of debt earning $90K.

Would your opinion change is someone was already paying $2500+ in rent? In LA, $2500/mo doesn’t go very far.

Saving 80k on a 90k/year salary isn’t as hard as you make it sound. If they could save 15k/year, they’ll get there in 5 years or so. If they invested 15k/year in DJIA 5 years ago, they’d probably have a $120k downpayment.

@BenShalomBernanke wrote:

“…international capital buying the dip…”

The mythical foreign buyer, kind of like Unicorns, the Tooth Fairy, the Easter Bunny and Santa Claus. No foreign buyers in my area (walking distance to the beach, great views of Malibu/Santa Monica to the north and Rancho Palos Verdes to the south). Maybe you have international buyers in Beverly Hills or San Marino but not where I live.

“…It is a joke to call this a bubble…”

The Case-Shiller index has SoCal at 215 in December 2013. A CS index of over 135 is very much foaming and frothing. A CS of 215 for SoCal is in nosebleed territory.

“A CS index of over 135 is very much foaming and frothing”

Why 135? That seems arbitrary. Should one adjust for inflation first? That 215 number for LA isn’t inflation adjusted, right?

If Detroit has a CS index of below 95 does that mean it’s oversold and is automatically a great buy? Can you predict the direction of the market by simply looking at chart?

CS *IS* adjusted for inflation, though. I would speculate he threw 135 up there to account for the “global cache” and demand of LA/SoCal over the 100 baseline. It’s generally averaged around 135 post WW2 IIRC…

Beware the Ides of March ………………………………………….

Thanks for checking in Jim.

So are you saying housing won’t tank hard until after the Ides?

Based on history, when housing bubbles come to an end, they end with a wimper not a big bang.

1990 SoCal housing bubble did not bottom out until 1996

1980 SoCal housing bubble did not bottom out until 1984

1987 NYC housing bubble (and stock market crash) did not bottom out until 1993-95

1990 Japanese housing bubble, still searching for a bottom

It’s hard to argue that the housing bubble of 1998-2006 didn’t end with a “bang” (Global liquidity crises/asset crash that started the Great Recession). That is, if you still don’t think we ever ended that bubble.

But, that would be hard to argue, too, given the massive rise last year, wouldn’t it (which would presume a new bubble had begun)?

“That is, if you still don’t think we ever ended that bubble. But, that would be hard to argue, too, given the massive rise last year, wouldn’t it (which would presume a new bubble had begun)”

The 2006/2007 RE asset bubble pop/deflation was stymied by the concerted efforts of the bailouts and QE shenanegans, thus it was merely delayed and even allowed to become exacerbated by its re-inflation. At some point though, inevitably, the debt has to be paid. How though – given the global economic meltdown forming and taking shape all around us, we truly are in uncharted and unprecedented territory…I really would love to hear from individuals such as Ernst Blofeld, Nihilist Zero, blert, and what? as to where they see profitability moving forward. Blert states he’s called many massive market shifts both to the positive and negative previously, one example being the early 80’s shift out of the bear market doldrums to the multidecade uber bear market. Well I want to know where to park what meager wealth I have now where it will be protected or even better yet explode in value…

Hey Jim, good to see ya, are we still on for that tanking to begin sometime this month?

Just like to know because I got my eye on this California dream…

http://www.redfin.com/CA/Los-Angeles/1832-Alder-Dr-90065/home/7075163

Just kidding, hopefully you’re right ’cause this bullshit is way past old.

Must see in street view to appreciate. Pride of ownership. Palm tree and storage container with cheetah mural not included in sale…

The seller should have Californian Dreaming play in the background when you open that page because I think daddy finally found his dream house. Wifey and I have been looking for a broken down pile of sticks and stones with a plywood drawbridge that we can buy without inspection. Where’s little ‘r’ Robert when you need him!

On a sidenote, most obvious quote in the world ‘the us housing market is rigged in favor of banks.’ I mean duh. Does anyone really need any further explanation at this point?! Every single market where bankers or traders touch is rigged. Thats what a ‘free market’ is at the end of the day-free to manipulate by stronger hands and weaker hands are along for the ride, sometimes getting lucky n other times not, usually at the whim of the stronger hand. If you want to learn how to really rig a market go watch Enron: smartest guys in the room. The second half is about how Enron fought to deregulate the Cali energy market, on,y then to rig it against california citizens by purposefully causing blackouts, etc so their traders could make more fees.

Sorry, hit stupid submit button. Meant to just add that the Enron movie and dogtown and the z boys (a sick history of skating and surfing in the santa monica-ish area in the 70s) movies are both currently on Netflix streaming.

I love that kitchen! But I would be cautious and get a home inspection first, I see some Drano on the back of the counter by the sink and you wouldn’t want to have plumbing issues taint your new purchase excitement.

Plumbing issues, what plumbing issues? What do you think the moat is for? Just empty the bucket when full (or bend over the side of the drawbridge with your pants down for number 2, just unzip and let er rip off the drawbridge for number 1) and viola! You’ll soon have a moat to keep the undesirables away…

“It is safe to say that the current housing market has many forms of price fixing through a connection of government policy, banking regulation, and Fed monetary policy.”

Couldn’t you make that claim in _all_ housing markets, whether the market is in boom, bubble or bust?

Story for you Dr.H.B. I got it in my inbox via Digg yesterday. New York Times supplement article.

It begins_: SAN FRANCISCO — Not long ago the pink house at 1829 Church Street, in the Glen Park neighborhood here, hit the market for $895,000. It sold for $1.425 million — $530,000 over the asking price — in less than two weeks.

Linky: http://bits.blogs.nytimes.com/2014/03/02/the-housing-market-with-nowhere-to-go-but-up/?_php=true&_type=blogs&_r=0

I live in the SF Bay Area, East Bay. Long-time lurker and avid reader. My family and I have been waiting out the bubble, watched it pop, and then reflate. Since then we have saved a sizeable down payment. We live in a crapper rental (but it is clean and cheap). Very frustrating to watch the market players collude to keep RE out of reach for many young families. We finally decided to go house hunting this spring and were shocked over the frenzy. We have seen houses in the Richmond hills (yes, that Richmond of eminent domain notoriety) go for $150,000-165,000 OVER asking price. That’s right…we’re talking pre-war bungalows, no upgrades, hitting the mid $550k sales range…and this particular house we were interested in just closed this week. It had 29 offers. If that is not evidence of a price-fixed bubble, I don’t know what is.

Something interesting we have noticed lately…a swath of REO homes have been sold by the banks to hedge funds or LLC companies in the past month. They are all in a 5 mile radius of us and they sold between $250-400k @ auction. Nothing over that amount. We have seen a strong uptick in MLS inventory over the last 2 weeks of some of these flips by said LLC’s with prices in the $400-525k range. Andectotal rinse-wash-and repeat. This is how they are dealing with some of the “lower” priced inventory in my area.

I think we will be waiting much longer…or relocating to another state.

Very smart you are! We have been in the same boat for years. We have a nice rental but it is overpriced. My wife and I can’t bring ourselves to think about moving out of state but at some point, if the affordability dam doesn’t break here, we will just have to consider it. No way am I risking my financial future for some crapshack!

I feel rather foolish for missing the low prices in 2010-2011….however, at that time, in our immediate area, what was for sale was in pretty bad shape and usually went for all cash. I remember viewing a SFR that had been operating as an illegal elderly care home…there were brightly lit EXIT signs over every door of the home. I feel your pain about not wanting to leave the state. We have family here and it would deeply pain us to move our child away from his grandparents. Yet, at some point reality is what it is and if we can’t make it work in a financially sane manner (as you suggested) we will have to look at plan B. So sad to see the area turn into a banana republic. Hang in there fellow renter!

You may not have missed out on anything but extreme frustration in 2010/2011….I wasted a year trying to buy near you in Sonoma Co., in 2011/2012 made several offers on 3/2 houses and all were ignored as I was competing with 100% cash flippers and speculators…had up to 50% cash down, great job and credit, preaproved loan etc. and none of that mattered, finally gave up.

FWIW another thing that keeps me in the area is Kaiser health care, has worked really well for me and my GF (and I do know some have Kaiser horror stories but we have only had good care in Santa Rosa)…we are both 50 something so health care is a much higher priority than it was in years past.

I did buy once before in a normal market in 1997 and it was simple…looked at about 10 houses, made two offers, one was rejected and the other was accepted. Sold that place in spring 2007 thanks to following blogs like this.

Similar experience past 6 months in East Bay:

[copied from earlier post]

In the Bay Area, I am almost convinced there is collusion between Buyers’ agents and Sellers’ agents. My BA has never recommended less than a bid of $100K over ask. He hasn’t been wrong. The eventual sales prices have been from $200K to $700K (not a typo) over bid. Just learned that a 4/2 home sold for $550K end of Oct. At same time, a smaller home 1 block away (almost across the street) went for $850K (ask was $650K). But first house now back on market w/ ask of 700K. It’s a flip and my BA expects it to go for $800K or more. (Probably will. Work done inside is impressive.)

But how did flipper get it for $550K back in Oct.?

I don’t know how, but it should be illegal to set an asking price $100-500K lower than you expect. It’s almost a bait-and-switch. Or maybe sellers should have to pay an excess profits tax. I know it won’t happen, but there is something seriously wrong with this market. And it is more than having more buyers than sellers.

I figure it’s a combination of low inventory plus:

1. buyers’ agents’ commissions based on sale price and they also either sell real estate or work in firms that buy and sell.

2. setting below-market ask prices brings in lots of lookers who

3. are told by their buyers’ agents that house is underpriced, bid $100-$200K+ over ask (no kidding. My agent does this. He thinks money grows on trees and has never seen a house he didn’t think was worth $100-200K more.)

4. closed bidding. Bidders have no idea what others are willing to pay. First house I saw had 2 bidders (5 declined). Sold for $200K over ask. Nice house, nice neighborhood but nothing special. And needed some upgrades. What if each bidder’s agent gave same recommendation: offer $100K plus? What if bidders had known what each thought house was truly worth (i.e., open bid/auction)?

5. Ca. banks give out jumbo loans, interest only loans, etc. Without these kinds of loans, even two-income families couldn’t buy these homes.

Of course the govt./fed/banks/wall street price fixed the market. If things are rosy, reinstate FASB 157-8

4 trillion in market distortions with policy never used before. They will continue to prop housing somewhat, its the internal carry trade….how can a countrywide thief get to run a pennymac and buy same properties they wrote bad loans on for penny on the dollars…

Home prices are inflated to bubble over other bubbles….

Housing prices will plunge when interest rates rise. Also, millions of Baby Boomers are downsizing and getting rid of their large houses. This lowers prices. The hedge funds have already stopped buying for rentals. It doesn’t look rosy.

“Housing prices will plunge when interest rates rise.”

Housing will absolutely become less affordable for those using a mortgage when interest rates rise. The question is will inventory continue to be tight enough to squeeze out just enough buyers to satisfy the strong demand.

“Also, millions of Baby Boomers are downsizing and getting rid of their large houses.”

Google “doctor housing bubble golden sarcophagus”

“The hedge funds have already stopped buying for rentals.”

Have they? Is this permanent? Will they sell? If so, will these “smartest guys in the room” sell in such a fashion to hurt their own self interests?

“It doesn’t look rosy.”

I agree.

The huge institutional investors like BlackStone, BlackRock, black tar heroin etc. are going after nonperforming loans now, because the potential profit margins are much better than regular old REOs and properties on the market which have reinflated so much. There was an article on this recently, I’ll try to track down the link…

All this bellyaching about price fixing, collusion, the Fed, suspending/changing accounting laws, etc. I warned everybody here that these things simply won’t change over night. The Fed and other PTBs will simply outlast you. This crap will likely go on for years.

Since Jim Taylor made his prediction. Here is mine: as long as interest rates stay “low”…and they are still super low, there is NO way housing is going to tank hard.

Regardless if you or Jim are correct about tanking hard or not, is it plausible that housing still decreases due to less overall demand at these price levels? Then regardless of rates, what about a chance of further decreases due to a blackswan event, stock market correction, etc? You could be right bc SO FAR central banks have puppet mastered this thing to a tee, but you assume they can continue to do so under any circumstance that arises as well as that they want to. Valid opinion, but nothing more.

Can we get over this “Valid opinion, but nothing more” commentary? Any prediction about the future is speculation/opinion.

Everyone here talking about the future is guessing. And, everyone’s prognostications on DHB (even good Dr. himself) have been 100% wrong over the past 5 years!

I can’t agree more regarding opinions, they are nothing more than pure speculation at this point…no matter how much data you have to back up your case.

Based on the last five years, the Fed and PTBs have proven that they can do “what it takes” to get any outcome they desire. I would be willing to “speculate” that they can keep this charade going longer than any angry renter is willing to stay put in their rental. If we enter another crisis of some sort, I will “speculate” that the Fed will come to the rescue once again…and the results will be the same as befofe (savers, renters, cash holders will get demolished). Until proven otherwise, that is the current status quo!

i’m one of the guys who has commented the most that its all just guessing at the end of the day and geniuses are annoited after the fact. That wasnt my point here. I was trying to comment (not as eloquently as i liked apparantly) more specifically on LordB’s assertion that housing can not tank as long as rates were low (which he also seems to infer by now that are under complete control of the fed forever going forward). That’s why I said things like ‘regardless of rates’ and started off with talking about another important component of housing-demand. Interest rates are just one part of the equation as they influence price, but that’s part of the reason things are so scary. If prices do start to fall just to organic demand not being able to replace institutional investors at these price levels and a black swan event happens or the stock market corrects (or does that just part of the this time is different meme too) or whatever, how much lower can the fed take rates to revive things if we’re only at 4.5% today? Can rates be driven that low if things do snowball down? Will banks give out low interest mortgages in a market with crumbling home prices where they cant trust appraisals or people’s future income (basically get paid a little interest for a lot of risk)?

LordB-a lot of your comments seem to infer central planning can and will forever support housing specifically based on the last 5 years and that’s why housing is kinda safe. I think that’s where me and the rest of the ‘bears’ here disagree. We believe eventually fundamentals matter the fed will eventually find other things to deal with or will lose control of housing and this time is not different.

FTB, nowhere did I say “forever.” I just said longer than most people are willing to wait. Most normal people have a finite time horizon for buying a house. Sooner or later, their hand is forced to buy by one event or another (angry wife, kids, lousy landlord, crappy rentals, the search for stability, etc). We even have people on this blog on stayed out of housing bubble 1 and are still on the sidelines. I can only imagine the frustration when the future of one of the biggest components of your life (your home) is totally up in the air.

LordB-it ain’t just frustration over losing homes to all cash offers keeping everyone on the sidelines. Thats a part of the market, but not THE market. Its the current prices that are keeping many people out of the market and frustrated. You seem to infer that everyone is dying to buy any house today regardless of cost and its just frustration stopping them. Might it also be their income doesn’t buy what they want so they’d rather wait?

Check out this report by the Demand Institute, page 17. California isn’t anywhere near the top of their list for appreciation over the next four years. Sure are a lot of those “miserable” “fly-over” states at the top of that list.

Hey Papa, check out what they’re predicting for STL on the pages that follow (18-19).

“The MSAs likely to see the strongest median

increase in the price of a single-family home

between 2012 and 2018 will be Memphis

(33 percent), Tampa (33 percent), Jacksonville

(32 percent), Milwaukee (30 percent), and

St. Louis (30 percent). Those with the lowest

projected price appreciation over the same

time period will be Washington, D.C. (7 percent),

Oklahoma City (10 percent), Denver (11 percent),

Minneapolis (12 percent), and Phoenix (13 percent).”

They predict LA to be + 13% in 2018.

I think many housing bulls and investors would be satisfied with that, and many housing bulls would still be posting about the impending crash.

You guys realize the report is not from 2014 forward, its predicting increases from 2012 forward. Therefore, unless i am reading it wrong (which could be) if it says a home will increase 20% by say 2015 or 2018 it ain’t good if that home has already increased 30% from 2012-early 2014 as there are no more gains to be had. In fact, wouldn’t the home now have to go down to only be up 13%+ by 2018? Its early so maybe I’m missing something, but that’s how I read the columns with tired eyes.

Yes FTB, the report was published last month and the price increase projections date from 2012 through 2018. I suppose they are including what’s happened the past two years but don’t really make note of it in the report. Perhaps it’s noted somewhere in the methodology, which on it’s face appears to be rather complex.

The link http://demandinstitute.org/2000cities/report

It looks like a fascinating report. Thanks for the link.

Have to disagree with the Doc on one point…I’m one of those who would like to buy today, but simply can’t afford the prices after the recent jump. I don’t want to try to flip the home… I plan to stay in it long term, but I sure as hell can’t afford 30 years of payments at such inflated prices. Those price jumps driven by speculators DO make a difference to those of us who have to finance long term.

You cannot expect to buy in an established neighborhood for a reasonable price in So Cal. It has always been that way. Think outside the box. Don’t go after what everyone else has and wants. Property on the coast in California should not and will not ever be cheap and affordable. I still read this blog, after buying at the end of 2012. I have not regretted it for a second. Quite the contrary.

Then what would be the point in reading, yet alone commenting on a housing bubble blog?

Are we supposed to believe that you’re here simply for the amusement and missing time spent enjoying your new home?

No regrets? Who are you trying to convince – strangers on the Internet or yourself?

Candace, your straw man argument reeks of confirmation bias. Housing in MOST established neighborhoods has been reasonable outside of the Banker Bubbles of the late 80’s (S&L crisis) the mid 2000’s (Housing Bubble 1.0) and now (Housing Bubble 2.0). At all other times prices, while at a premium to be sure, made sense compared to incomes. Even the 2009-10 dip was not incredibly out of whack. The ONLY thing that has ever taken SoCal RE to irrational levels is Banker malfeasance.

If you’re happy with your property, great. Just don’t sing the blues when you lose the gains of 2013 and possibly more. As I’ve said before the FED cares about one thing, petro-dollar hegemony. If supporting your asset helps that cause you’re in luck. The moment it doesn’t you can scream to the heavens and Aunt Janet won’t hear you. Rates are rising due to the problems in South America and now the Ukraine. THE FED DOES NOT CONTROL THE WORLDWIDE BOND MARKET, so to maintain petro-dollar dominance they WILL RAISE RATES and (as much as it’s in their power to do so) allow a controlled rise in treasury yields.

The FED gives fuck all about you or your house value. The tide of 1.3 million underwater homes, whether they crash ashore slowly or in a tide, bodes ill for your assets value. Of course if you’re happy in your job and payment it shouldn’t matter. But don’t waste your breath preaching to the prudent among us of your grand foresight. Broken clock twice a day and all…

+1

Petro-dollar is a snazzy term of art — that means nothing.

KSA, and the rest of OPEC are no longer accumulating serious US dollar (financial) assets.

The relevant term you’re hunting for exists: International Money aka the Reserve Currency of the World.

That term really means something. It’s what the Fed is really concerned about.

&&&

For all of the Fedsury’s insanity, it has turned out that Beijing has trumped the follies of the West. Her liquidity engine has created such epic distortions that new metrics are required.

For, on the whole, Beijing has managed to blow their wad — and did so without a war!

At this time it’s reasonable to assume that some fantastic retrenchment is due in commodities demand.

The ‘tell’ for this swing are the astounding revelations pouring forth from the coal fields of Red China. Apparently, monster monies have been spent building out new coal properties — which need firm or rising prices. Instead, electric power demand is soft to declining. And so, the coal producers are discovering that they are facing monopsony conditions. The CCP has put a lid on power rates… which puts a lid on BTU value… which is cramming down mining revenue.

And so we have a critical sector of the Red Chinese industrial economy sent to the hurt locker. Some can-kicking has rolled this debacle into the future… the near future, I fear.

Beijing has reached the end of her exponential.

Japan, Korea, et. al. found that Asian economics go splat when the ride ends.

&&&

To compound matters, all too many Renminbi have been created — and invested in wholly unprofitable speculations.

And corporate Red China has been scoring too many Renminbi profits by way of speculating in yet other listed corporations. In this fashion, they’ve become as much hedge fund as an industrial.

So the operating profits are actually not so hot.

Wall Street dittos this folly. It’s getting too much GAAP profit by way of interest rate arbitrage. Thank you Mr. Fed.

This means that both Shanghai and New York are trading at P/Es far above appearances; probably a P/E of 28+ for the NYSE. I can’t hazard a guess as to how zany the Chinese equities are priced. BTW, they sure don’t look like they’re in a bull market.

And then, note how the biggest money is fleeing the corporate world to take up residence in the real estate market. This is happening across all major markets: London, New York, Shanghai, Beijing, California,…

Humanity has reached the point of synchronizing our follies and panics.

I give you the Crimea and Putin’s climbdown. He gave a war… and no-one financed it.

WORD, NZ. Sorry, Candace, but you dun got served.

We are going to be fine because the “rich Chinese” are buying up Detroit…

http://www.forbes.com/sites/gordonchang/2013/12/08/chinas-newest-city-we-call-it-detroit/

False alarm. They are waiting on the sidelines… Yea… that’s it!!! Pent up rich Chinese demand…

http://www.npr.org/2014/03/04/285711091/chinese-investors-arent-snatching-up-detroit-property-yet

What is your favorite flavor of Kool-Aid?

The What? doth protest too much, me thinks.

Both articles are positive towards heavy interest from Chinese for investments outside their own country. Detroit is a highly speculative RE play, so you’d expect some trepidation when it comes to actually pulling the trigger.

Are you denying that there are rich Chinese looking to park their money outside of China?

Are you denying that one destination is the familiar confines of SoCal and that hard assets are appealing on many levels (place to house kin, residence for children to attend universities, built-in ethno-environments, etc.)?

Is the Chinese buy-side story the ONLY story? Of course not. But to deny that Chinese factor isn’t in play in our current SoCal RE market is unsubstantiated.

Me thinks Red China is the second comming…

So, what’s your favorite flavor of Koooooool-Aid?

I made this exact same argument in this blog a few weeks ago. The gist of my argument was that the Fed, the government, the big banks, wall street, etc. will do whatever it takes to support higher prices. Whatever it takes. The free market works when it works in their favor, they keep the gains. When the free market works against them they will do whatever it takes to make sure they don’t lose money. Even if it means the public shares the losses while the profits are privatized. This is playing straight into the hands of the Left that wants to destroy capitalism.

There is a huge divergence in our economy between the fundamentals and the reinflation of the stock market and now the real estate bubbles. Look, if you want to buy at these lofty valuations then more power to you. I choose not to buy (either stocks or a home).

I passed on a home that I wasn’t in love with and my realtor responded by reaming me a new one. Apparently he’s hard up and needs the sale.

WOW. I would have fired him on the spot. Is he Suzanne’s hubby?!?

Here’s a blast from the past, lest we forget!!!

https://www.youtube.com/watch?v=20n-cD8ERgs

As the great Jim Taylor so eloquently states, HOUSING TO CRASH HARD IN 2014!!!

SUCK IT, FED!!!

Is there any truth to the rumor that Putin stopped up short after Tartars blew up Russia’s largest oil refining complex — in Tatarstan?

Where is the love?

This would go a LONG way towards explaining the crash in Moscow’s equities market.

IIRC, Putin’s best friend owns the missing refinery complex.

Housing to tank in 2014!!!!

What happened to the “HARD” Jim 😉

Seriously though. That story I shared about my longtime client in property management was no bullshit. People who actually manage and deal with the business of rentals in SoCal see the storm off shore and are acting accordingly.

I remember how quickly the Perma Bulls fled sites like Housing Panic back in 2007-2008. Wonder if they’ll stay and take their medicine this time? Probably not…

Thanks…

In the Bay Area, I am almost convinced there is collusion between Buyers’ agents and Sellers’ agents. My BA has never recommended less than a bid of $100K over ask. He hasn’t been wrong. The eventual sales prices have been from $200K to $700K (not a typo) over bid. Just learned that a 4/2 home sold for $550K end of Oct. At same time, a smaller home 1 block away (almost across the street) went for $850K (ask was $650K). But first house now back on market w/ ask of 700K. It’s a flip and my BA expects it to go for $800K

But how did flipper get it for $550K back in Oct.?

I don’t know how, but it should be illegal to set an asking price $100-500K lower than you expect. It’s almost a bait-and-switch. Or maybe sellers should have to pay an excess profits tax. I know it won’t happen, but there is something seriously wrong with this market. And it is more than having more buyers than sellers.

Leave a Reply