Baby boomers value real estate much higher than their offspring: 6 ways traditional buyers are entering high priced markets with the assistance of baby boomer parents.

Baby boomers are one of the largest home owners in California. They are also the largest mortgage holders since Californians love using their properties as a virtual ATM.  As time is moving by we are seeing a clash of generations when it comes to buying a home. The days of working at one company for 30 or more years is really a relic of the baby boomer past. Many baby boomers are also seeing their offspring coming back home with student loan debt that already rivals that of a mortgage in other parts of the country. Yet in many cases, their kids are happy and well rounded. I know many offspring of baby boomers and many have no intention of buying. They place a higher value on location, mobility, and having free cash to travel with close friends. The data also shows that the family unit is becoming much smaller and many are opting to have one or no kids. Why the need for a 3/2 then? This isn’t the 1960s where bigger households were common and one income was enough to live a middle class lifestyle. Yet some boomers are trying to assist their kids in buying their first home and in expensive areas, the passing of wealth is occurring in ways that may not be typical.

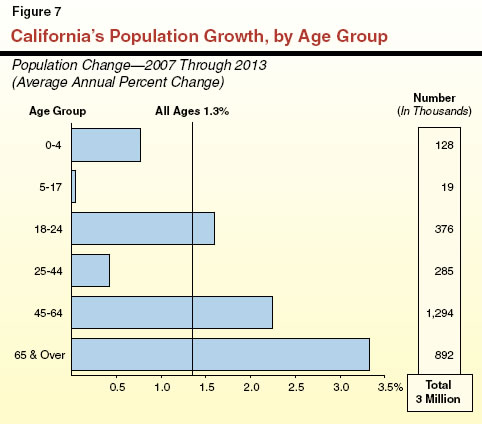

California’s aging population

For many baby boomers, they came of age when the dollar had maximum power and for the most part, housing was affordable across the state. Keep in mind that the California Association of Realtors has an affordability metric that now shows that only one out of three families in the state can actually afford to buy a home at current income and price levels. They factor in mortgage rates into their equation and it isn’t like the C.A.R. is anti-housing.

The fastest growing age group in California is coming from baby boomers:

Many are living in their retirement fund. Whatever is left over, many are finding it necessary to gift over to their cash strapped young so they can make the down payment. From everyone in the industry that I’m talking to, the least likely way to save for a down payment in SoCal is to diligently sock away $200,000 or $300,000 just to purchase a “starter†home. They laugh when this is brought up. A reader actively searching to buy in “prime†West L.A. mentioned six ways people are buying from an agent with high volume in a selective market. I thought it would be interesting to share:

-1. Those with all cash

-2. Boomers funneling money to kids

-3. East Coast folks shifting to L.A.

-4. Stock market euphoria and wealth effect

-5. Foreign money especially from China

-6. Big money from entertainment industry

Now this is an interesting perspective and all the above tends to favor those buying and staying put instead of flipping and investors. The volume of sales is very low so those trying to be a traditional sale need to boost the process with helping out their kids. Baby boomers that are under the illusion of buying a home similar to their time really are missing the global picture here. Take a look at the list above and ask yourself if boomers had to deal with such a tight market when they bought? Contending with Wall Street money? Foreign money? Giant down payment transfers? I can tell you this was not the case. This is a new beast of a market. Many boomers I talk to are playing old records on real estate tactics and don’t fully grasp the changing dynamics of this global market. They are house rich and cash poor. The little cash they have they are throwing it at their offspring to buy high priced housing. Otherwise, they have their kid living back home with them. The volume of sales is also low because the big money is pulling back.

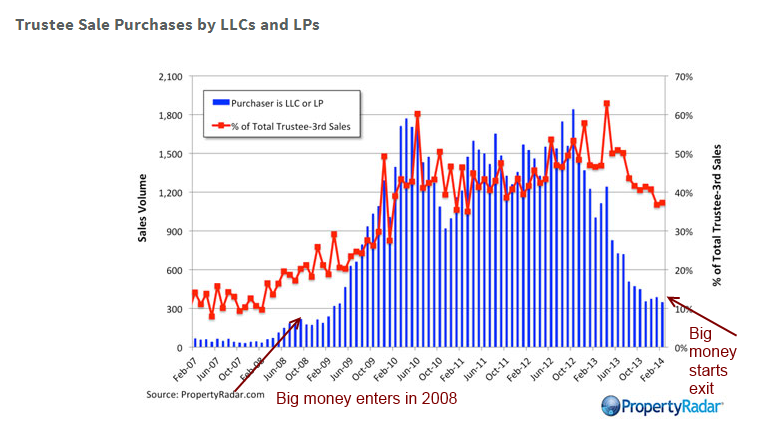

Big money moving out of California

The bigger cash buyers are slowly stepping away from California:

Some have argued that you should follow Wall Street. This would have been a good move if you followed their movements starting in 2008 up through 2013. The above chart shows the number of big buyers (i.e., those buying via LLC or LP). You’ll also notice how quickly they are pulling back.

Someone asked about the benefits of buying real estate with all cash. Frankly, big money is more interested in solid yields instead of being mega landlords. Why would you deploy $500,000 for $2,500 a month in rent (after all expenses are factored in you are looking at yields that rival bonds). Better to make bets in a hot market on more proven dividend yielding stocks instead of becoming a landlord. Plus, dividends provide better tax breaks than rental income with less of a hassle.

Many mom and pop investors dive into real estate because of leverage. You are able to control a $500,000 home with 25 percent down ($125,000). If the market goes up, you leverage your gains but if the market goes down, your losses take a bigger hit as well. Big money is not stupid and the fact they are pulling back dramatically should tell you something.

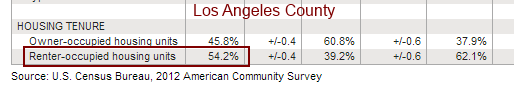

Renters dominate California’s biggest county

I’m always surprised how off some people view income in L.A. County, the biggest in the state. L.A. County is largely dominated by rental households:

Over 54 percent of households rent in L.A. The trend has only increased so you have to wonder how people will be voting when owning a home is part of the minority. You will get no sympathy from the public when you talk about how “poor†you are sitting in a $1 million home being assessed at $250,000.

The boomers gifting money to their offspring

In housing, generational transfers are a big deal. Boomers are already unprepared for the most part for retirement based on market data yet will need to aid their offspring if they want to make an entrance into this market:

It is interesting to see the e-mails I get about people being outbid by “all cash†buyers in prime markets. This is simply the new game at play here. As I mentioned, you probably won’t be hearing much from those 7,000,000 foreclosures in the graveyard. California is infected with financial and real estate amnesia.

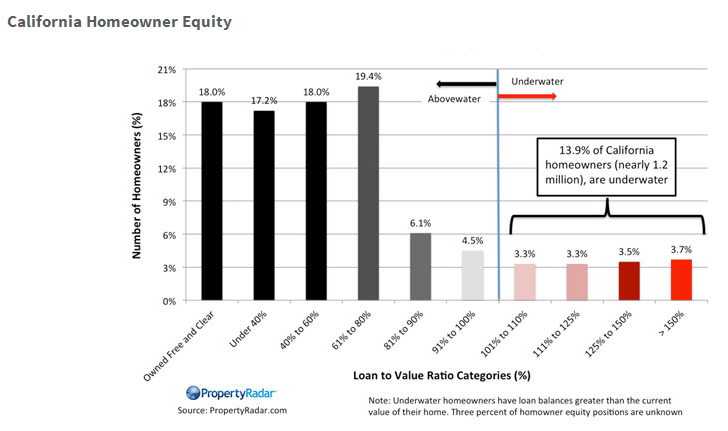

Negative equity still an issue

While prices are up dramatically, negative equity is still an issue:

We still have over 1.2 million home owners underwater. Many of these are boomers. I can’t tell you how many boomers took on HELOCs and upgraded their homes and cars and are still paying that debt today. Are they in a position to make that $200,000 gift to their young ones for a down payment? For most, this will be a hit to their retirement plans and as we mentioned, that million dollar sarcophagus is not going to throw off cash like a job, dividend, rental, business, or other cash flow source. This is the mistake of treating your residential home like an investment. Unless you have it as a rental, it is not an investment (that is unless you flip or sell the cash is locked). Otherwise you are merely a speculator.

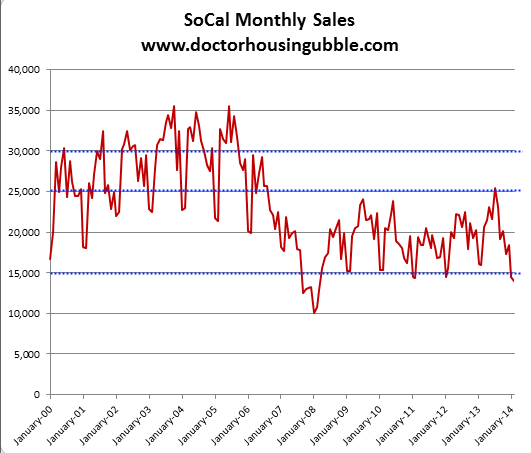

Sales volume still at record low levels

What is interesting is the perception of real estate for those in their late 20s and 30s. These are the kids of the boomers and many are not buying the simple arguments from the past. Sure, in many cases it may make sense to buy. Incomes may be so high that housing is a trivial amount of what they spend. But for most, this is not the case and you see from the data that many purchases are coming from non-traditional sources. These are fickle groups and that is why sales are hitting multi-year lows:

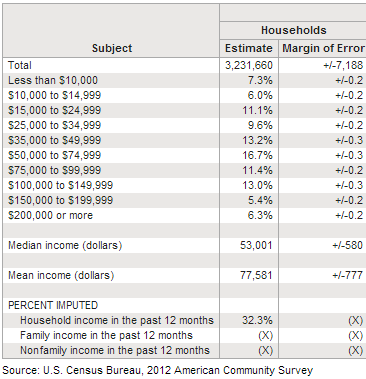

I see people speculating about income for L.A. County. Why speculate for those living here? We can find this real data easily:

The median income for a household in L.A. County is $53,001. Is it any wonder why this is a big renting area? For current prices in prime areas, I would argue a household would need an income of $150,000+ a year. Only about 11 percent of current households meet this threshold. And how many of these households actually already own?

I think boomers feel that their kids value real estate in the same fashion. But they don’t. And why would they? One company working careers are gone. Benefits are getting radically chopped for younger workers. In the early 1980s something like 60 percent of all workers had a pension. Today it is around 10 percent. Young people also know that Social Security is not going to be as “great†as it is today when it comes to their retirement. You see these generational hits taking place in Japan as well where the older generation just doesn’t get the younger generation. This is common across time but with real estate, there is truly something different here across generations.

When people ask about buying today I always say they need to run the numbers but underlying their question is the desire to be part of the hot money crowd of California. You don’t want to miss out on the next Malibu or Newport Coast. Some areas that people mention as new enclaves of wealth are flat out comical. The one percent is not chasing properties in the South Bay short of Manhattan Beach and no, Garden Grove or Fountain Valley is not the next Irvine. I think the ridiculously low sales volume tells you something else is going on. Those buying today seem to be part of the fickle investor cohort and when prices stall or go negative year-over-year, let us see if things will continue. The Fed now seems to be on it for tapering and if you think they care about SoCal real estate you are incredibly mistaken.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

89 Responses to “Baby boomers value real estate much higher than their offspring: 6 ways traditional buyers are entering high priced markets with the assistance of baby boomer parents.”

http://www.babyboomersruinedamerica.com

Oh my, somebody has issues with their parents, I see.

The “youth” will write the history books one day. I sense this will be a recurring theme…

Oh, no. The winners write the history books. Always have, always will. So, the young better get off their butts and start taking the powers down, or they’ll be lost to history.

It’s true that Winners write history.

And EVERY generation has its share of Winners and Losers. Xers and Millennials have, and will have, their own set of Winners — and their view of history won’t be that of Losers who put up whiny websites, whining about other whiners.

Sorry, but the Boomers blame it all on Reagan.

Pay attention.

Good news for Boomers, there’s a great promo going on right now for free pet food for new customers only:

$12 Off Pet Food Coupons (New Customers Only) for Natural Balance, Pro Plan, Go & Now Brand = Free Pet Food + $4.99 Flat Rate Shipping

http://slickdeals.net/f/6812142-12-off-pet-food-coupons-new-customers-only-for-natural-balance-pro-plan-go-now-brand-free-pet-food-4-99-flat-rate-shipping?src=pdw

Nothing like Alpo stuffed breakfast burritos and Purina soft and hard tacos for lunch and dinner while enjoying that golden handcuff, million dollar sarcophagus.

Housing To Tank Hard in 2014!!!

Freebird!!!

First off, most Boomers that I know, are going to spend the money on themselves, and not on their spoiled children who never call or visit. The stats are that half the boomers are going to give their wealth to charity when they die, and not to their spoiled children. “You see these generational hits taking place in Japan as well where the older generation just doesn’t get the younger generation. ” You are right about the generational divide. Harsh words have been spoken.

Second, not every kid goes to college and has monster student loans. Some are good at the trades(customers pay cash) and are doing fine. Don’t be misled about “income figures”. Remember, liars can figure and figures can lie.

Oxnard is beach front property. Someday it will go for a lot. Ventura is already great beach property.

You’re right that most Boomers will spend the money on themselves, but not because their kids don’t call, write, or visit. Boomers use that as an excuse and “justification” for their selfish behavior but the reality and fact of the matter is, THEY ARE FOR THE MOST PART SELFISH, SELF CENTERED, SELF OBSESSED AND SELF ABSORBED ASSHOLES.

And their kids don’t call, write or visit because they know *exactly* what sort of people their boomer parents are (see above), and don’t want to waste their time dealing with said selfish, self centered, self obsessed and self absorbed assholes.

Oh my. Somebody got kicked out of the basement and had to find a job, I see. Real life is nasty, isn’t it?

I can see that you are really in touch with your emotions. No, we don’t eat shit or animal food. With a million or two, we eat “high on the hog” as my uncle used to say. We enjoy the good life with vacations, cruises, and so forth. I got my inheritance because I played the game and learned to bite my tongue and also plenty of flattery. After they are dead, of course I trash talk my parents. That is the time for trash talk, not while they are alive and can cut you out of the will and spend all your money. You are such a fool. You pay a million dollar price to “keep it real.”

People who complain about “those selfish [fill in the blank]” are HYPOCRITES.

What they really mean is “those selfish [fill in the blank]” won’t give more money to ME!

Million or two? BWAHAHAHA, the median Boomer household has a net worth of $200K.

Average baby boomer is poorer in old age than their parents. And this assclown is talking about eating “high on the hog” directly due to his inheritance and kissing his parents ass in life then pissing on their grave in death. Talking shit about their parents, particularly after they are dead, is a sure sign of a fucking life loser. Better or worse I won’t talk shit about my parents PERIOD, because they weren’t spoiled lazy entitled losers like the average boomer but rather members of the last generation of real Americans that built and rebuilt the entire modern civilized world that you squandered – the G.I. generation and the silent generation. And I will gladly put my boot through the useless skull of any worthless coward hippy baby boomer scum that mouths off on them.

But don’t worry, sooner or later you’ll be fucked like the rest of your generation and the hog will be eating you. It’s only a matter of time before some scary third world slave wage healthcare worker will be robbing your house and accounts blind, beating you, and leaving you to sit in your shit crusted Depends while watching telenovelas on your giant flat screen and raiding your fridge while feeding you dog and cat chow. Can you smell and taste the Alpo and the fear yet? And you should fear that inevitable day because it will on you before you know it. By that point you’ll be wishing for death to take you.

http://www.zerohedge.com/news/2013-07-12/guest-post-10-things-baby-boomers-wont-tell-you

“Boomers can eat shit and die”, it is clear, that we are of a different class and I can not relate to your class. Never had, never will. I am a retired attorney-CPA. Usually, I don’t associate or speak with poor folk who don’t have a million.

Yes, we are of a different class. You are of the class that put their hand out saying GIMME GIMME GIMME and took every handout offered or presented as appeasement, then spit on the back of those that gave it to you. All the while proclaiming to be “self made”, despite the truth of the matter – “I got my inheritance because I played the game and learned to bite my tongue and also plenty of flattery.”

That speaks volumes as to your character, or lack thereof.

“Usually, I don’t associate or speak with poor folk who don’t have a million.” You can have that etched on your tombstone, assuming you get one and don’t just get dumped in a ditch somewhere. Perhaps in the many years you will spend under the care of poor folk who don’t have a million i.e. your future healthcare providers, you will learn humility and a humbling of that arrogance. That elder abuse can be truly brutal, particularly to one with an attitude such as yours.

Boomer handouts, DINKs, and high powered careers at google or in Hollywood are the only young bucks out buying. If you just move here to work, and your wife don’t make much, its tough. I’ve seen many a kid in the south bay blow more on cars and beer and women than anything else. Then they hit 30 and leave cuz it costs too much to live here. I know there are responsible, focused people out there but many aren’t. I wasn’t. Its hard to save for years then get a 30 year note. Easier to live in another state.

no problem kids no nagging wife just chill

sooo, common wisdom these days is that rates will continue to rise as the fed tapers. This should create some downward pressure on prices. Also, big money is pulling out,contributing to falling sales stats YOY. Are we ripe for the long-awaited second leg down?? I feel like I missed the boat after the crash– most everyone here with a few exceptions said , wait wait wait, prices still have a long way to fall before they are back in line with historical norms. But this didn’t happen. There was a bounce back up 20% last year alone. Based on what? not on fundamentals, thats for sure. Based on the items in that list above in the article. Who predicted that??

So is it finally time for another leg down, will that 20% be a dead cat bounce? Will Hot Asian Money and Big Money demand falling, combined with rising rates finally push prices in line?

@Dasher the period of 2010 – 2012 was generally speaking a great time to buy a home (low prices and low interest). It will happen again, but remember it took a couple years for prices to unwind last time i.e. – early 2008 downward until 2010 when prices about bottomed in in many places. During the period of 2010-2012 there were many armchair economists on this site claiming: ‘get out your popcorn and watch prices drop another 20%’ or ‘sit back and watch prices will be half what they are today’… and other arrogant comments from people who really had no real estate economic experience except to hope for lower prices. I think most of them are still on this site, with similar claims ‘wait until…’ and of course since california real estate goes through boom or bust cycles, they will be right someday. But how much rent will they have burned through from their chance to buy in 2010, 2011?

Is that you QE?

I was one of those cheering the fall and expecting it to bottom out a little deeper ~(10-20%) than it did (outside of the backroom cash buys). \

The knowledge to predict the bounce had nothing to do with RE economic experience, but rather insight into hedge fund portfolio allocations and timelines and prediction of the FED rate policies.

RE economic experience would not have led you to knowledge in hedge fund investment strategies for cash flow, cap gains, and exit nor into predicting the unprecedented period of historically low FED rates.

In most cases these days, “burning through rent” is better than burning through interest.

“… site claiming: ‘get out your popcorn and watch prices drop another 20%”

20% is and was very conservative estimation, I’d go with 30-50%. On normal markets, of course. But not even you could predict QE abyss: At that point all bets are off.

FED could and did change whole game with unlimited money to banks to spend on housing. That’s not a normal market and it’s questionable if it’s even market, when one player (FED) dictates everything to maximize profits for their owners.

Conventional wisdom @ 2009 here was, “busts always blow past the mean.” Never happened.

“The Fed now seems to be on it for tapering and if you think they care about SoCal real estate you are incredibly mistaken.”

This pretty much sums up everything. It is a 100% true statement. The FED cares less about the CA real estate. They are working 100% for the interest of their shareholders – the few largest banks in the nation. That is 100% ONLY mission they have. Everything else is pure propaganda and smoke screen.

In the past, because of cold war and threat of communism, many times there was some overlap of interests, hence the notion that the FED cares about the CA real estate. If the real estate benefits, it is pure coincidence.

These days, due to globalization and financial wars, the picture is far too complex. Past performance DEFINITELY is not guarantee of future success. If the dollar is threaten to be dethroned as reserve currency the FED will raise the rates, or the international bond market will force their hand to raise the rates regardless of what is happening to the CA real estate.

Remember, the FED first mission is to protect the interest of the largest banks and second to keep the dollar as reserve currency. All the wars derive from this mission. If the CA real estate benefits or looses when these 2 goals are pursued, so be it (from FED perspective, not mine). I wished it wouldn’t be so but that is not going to change the reality, the 100% truth stated by the doctor in conclusion.

Very true. They make a feeble nod towards unemployment, which is supposedly a “mandate”, but they’re smart people, and know that they can’t have much power over hitting and firing, especially in the new global economy.

Note that when Yellin was asked about emerging market turmoil when she was testifying in font of congress recently about the taper threat, her response was a polite “not my problem”, to paraphrase.

What Yellen said it is true. On the FED list of priorities, what the emerging markets are doing it is at the bottom. They care less.

This is a link to an article which explains in details what everybody is feeling and why:

http://www.financialsense.com/contributors/daniel-amerman/why-federal-deficit-falling

Everybody knows and feels that the economy is sick, it is in a bubble and the government is crowding out the private sector through taxes. It explains in details what is happening and why there are no good jobs for the young people. People’s opinions are meaningless. They are affected equally regardless of their opinion. For those with less time, you may read the conclusions of the article and if you don’t agree with the conclusions, you may read the explanations. For reasons explained, the real estate is going to be affected in a negative way really soon.

Awesome realtor-speak for a house in my hood on the market for $1.4 million… Love how half-assed sellers can be even when trying to get this kind of cash. Pure. Insanity.

GOLD MINE !!!, A MAZAL!!!! UNIQUE MEDITERRANEAN STYLE ONE STORY IN BEVERLY HILLS ADJACENT. A FABULOUS HOME!!! R2 ZONING!!!! 4+2+fireplace A/C HEATING remodeled and playroom (guest room)has a income great for 3 family & LIFE TIME INCOME FROM PACIFIC COST ENERGY . new electrical copper pluming hardwood floors, crown molding, light and bright, hi ceiling, remodel chefs kitchen with large breakfast room, granite counter top, laundry inside and brand new, this home features an open floor plan including formal living and dinning room , large windows allow for great natural lighting. double door entry. PERFECT FOR ENTERTAINING AND ENJOYING!!!!

Housing To Tank Hard in 2014!!

Capital “I” and two exclamation points “!!” gave you away as a fraud…

Doctor HB wrote: “The Fed now seems to be on it for tapering and if you think they care about SoCal real estate you are incredibly mistaken.”

This dovetails nicely into a point that QE3 was never about the job market. QE3 was always about the Federal Reserve acting as a “bad bank”. Once the Fed got enough of the garbage mortgages (i.e. the zero down payment mortgages, FICO scores under 700, rotten credit, stated income loans, no mortgage payments in years, etc) off of the balance sheets of the banks, the Federal Reserve was going to phase out QE3.

FED is telegraphing a 2.25% interest rate by the end of 2016. Reserve currency status is under fire from the Russian/Chinese bro’mance. World is sinking into Cold War 2.0…

And people think that the FED givez fuck all about SoCal RE? The dead cat bounced, but he’s still dead. I admit to completely misjudging the height of the bounce, but I knew the cat was still dead. 2015 lows minus 10-15% depending on interest rates. No QE plus no specuvestor momentum means new bottom by 2016.

As an aside, I’m curious to see how this deflationary period affects .gov spending in real terms. Considering Team Red and Blue usually swap the presidency every 8 years I expect a Republican White House to push through budget cuts that could have a “neutral” effect on services provided as I expect a much stronger dollar by that time. If food costs adjust downward 20% is a 20% cut in food stamps really a cut?

I think a lot of what you say has a lot of merit. However, I’m not so sure the US dollar is under as much pressure as you appear to think from losing status the worlds reserve currency. You still need a replacement currency and I don’t know how quicky everyone is trusting china with the task. Maybe a basket of currencies is what youre thinking, but thats not happening now either. You think china is doing well? EU? Japan? Russia? its ALL a shtshow. A bunch of countries teetering on social unrest bc they are all really broke if the curtain comes off (it aint just us). You’re on zerohedge too so I’m sure for every article that says china is gonna be this new great thing, there’s another saying china is a bigger ponzi than the US and is near collapse. Not saying QE doesn’t end as scheduled bc I’m not in the club, but if it ends it doesn’t mean that reason it ended either. None of us know sht folks. That’s what smart people know and they know that’s all they know-jack sht. Once again, I like what you have to say, I’m just not so sure the rest if the world offers attractive alternatives at the moment.

RE: FTB

“However, I’m not so sure the US dollar is under as much pressure as you appear to think from losing status the worlds reserve currency. You still need a replacement currency and I don’t know how quicky everyone is trusting china with the task.”

I agree that no other currency is ready for the dollar’s role. i would speculate the danger is more to the traditional role of a reserve currency as much as to the dollar “as” the reserve currency. If Russia and China start trading energy and commodities directly (perhaps along with the other BRIC nations) I think we could be on the move to commodity backed trade markets using each nations local currency pegged at agreed to rates of exchange. It seems to me (admittedly a layman who loves yucking it up about this stuff on the internetz) that the time of a reserve currency may be passing. The time of the FIAT dollar and free trade globalization seems to be turning towards a more protectionist period that is bordering on Clod War 2.0 as we speak.

Most of the young,middle class,college graduates that I know are not having ANY kids.The only people that seem to have them are where the woman is the youngest in the family, or an only child. They want the “experience” of being around small children, something they experience in their own family,at home. It has nothing to do with finances.

A lot of middle aged people that I talked to about kids, will admit, that if they had it to do over, they would not have kids. The media has a drum beat of how fullfilling children are. But younger people have decided it is one of life’s “experiences” that they can skip with no future regrets.

There are other people in SoCal besides “young, middle class, college graduates.” Governments have affirmative action and they are hiring people who speak Spanish. People from traditional cultures believe in having extended families in one house. We are the future in more ways than one. Nick, you speak of the past. I speak of the future.

NO doubt that past and future population growth in SoCal is due to people with “traditional” cultures. This does not necessarily solve the housing problem. 1) The TFR of the most fecund population group is only at replacement rate and won’t contribute population growth (http://www.scpr.org/blogs/multiamerican/2014/01/21/15642/california-s-shifting-population-latino-plurality/.

2) More people in one house only further reduces housing demand.

3) People without a college degree are impacted to a greater extent in the recession than those that have one.

4) Non college graduates likely have no access to the investment tools needed to benefit from fed policies.

5) Most of the young, middle class college graduates grew up in traditional backgrounds and reject children for numerous reasons. This will happen to most of the children of “traditional” groups. In my own opinion primarily the problem is the poor economy that contributes to our national nihilism and the continuance of policies that support malinvestment.

Maria: “People from traditional cultures believe in having extended families in one house. We are the future in more ways than one. Nick, you speak of the past. I speak of the future.”

No, you don’t. Not really.

From what I’ve read, Mexican immigrants assimilate very quickly. They come here with traditional family values. But by the first and second generations, they have far fewer children, and far more out-of-wedlock births.

IOW, some Mexican immigrants move up into the middle class, securing professional jobs, and forming nuclear families with few or even no children. Intermarriage with white professionals is very common.

Other Mexican immigrants descend into the white trash/ghetto black lower class, with broken families, substance abuse, and public entitlement money.

Either way, up or down, Mexicans assimilate far more rapidly than some people think. Their kids learn English. Their grandkids often don’t even know Spanish.

The only reason for all those Spanish language signs and electronic media is because new immigrants keep entering the U.S.

If you want to know the future of all those extended Mexican families, look at the white nuclear family. That’s what Mexican-Americans will look like in a generation or two.

SOL – completely agree. The 10 kid Mexican family died sometime in the late 70’s early 80’s. My mother was a bilingual school teacher near LA high and she stated that the majority of parents were only having 1 or 2 kids because it was too expensive to raise kids. I am not sure why we continue to hear about this dated stereotype.

Funny, my experience is exactly the opposite. Most of the “young” I know want kids, and the “middle aged” -if anything- wish they had more.

I guess a lot of people think “the grass is greener” had they done it differently.

Middle-aged and elderly folks without kids fantasize about their perfect imaginary children, hanging out with them, helping them as they get older, bringing the beautiful imaginary grandkids for a visit.

Middle-aged and elderly folks with kids fantasize about the amazing careers and foreign travels they’d have done had they the free time, and more money.

My late-Boomer wife and I have learned to utter fake noises of regret when friends burdened with children express their sympathies regarding our “sadly” child-free state. It keeps them from getting too envious about all the travel and free time we have. Mostly, though, we look on the endless succession of squalling brats growing up into whiny boomerang money pits with a mixture of horror and utter relief that we avoided that particular trap.

Plenty of kids in the world – we didn’t need to make our own. Many of our closest Boomer friends feel exactly the same way.

I think you nailed it with this one Doc. I know it is anecdotal, but I have a family member who is a Boomer in the D.C. area and has a house she has to commute over an hour for. Recently I had an interesting conversation with her and I feel she clearly does not get the current generation (future buyers).

For one thing she popped off she only has 3 million dollars for retirement not including social security and could sell her $850,000 house at any time. People of GenX/Y do not really think of this as a sad story. I know no GenX/Y person who would want to live that far out from a city. Doesn’t mean the house is valueless but you would pay less for a house that you don’t really want right?

She clearly sees housing as an investment and has helped her son buy. I can tell you that he appreciated it as much as one who expects to be handed nice things to crap on. He now loves buying and wants to buy another house so he can rent out the place he was helped to buy. I mentioned to him, “Enjoy the asset bubble.” He replied: “What is an asset bubble?”

She “only” has $3M in cash and owns a house worth $850K outright? I don’t think her story is sad, either. I wish I had $3M in assets- I would consider myself well-set with a good deal less than that. Nothing “sad” about this woman’s story at all.

She sounds like she’s living well below her means and should have no trouble either paying the expenses on that house, or leaving a nice nest egg to her kids.

All of these things happened during the 1926 (Florida real estate scam madness) – 1946 WWII and aftermath. Every last thing. Housing collapse, QE, decimation of small biz, concentration into behemoth corps. Shortages of rental housing, huge increases in local etc taxes, repeal of prohibition to allow reinstatement of “sin taxes” – now being done with Marijuana. There are changes though. Automation is more powerful at eliminating jobs, telework and internet speeds are disintermediating, concentrating and obviating industry after industry while making borders more and more moot while…nuclear weapons and aircraft carriers are preventing global war so far. We live in tectonically dangerous times. Real estate is the least of our worries. Also, I like my kids – they can live with me any time they want. Omnia Vincit Amor

With the rise in interest rates which must accompany tapering of QE3 by the FED and the withdrawal of the all cash investor from the California market the resulting softening of the real estate market will play out across 2014. When the last of the foreclosures are disposed by the banks, coupled by the significant number of homes still under water, are factored in the size of the California housing market correction may be significant (20-30%). Neither the FED or the rest of the country will care. Although California is a significant fraction of the national housing market, and a California correction which will stall or even pull down the national market, they are focused on a bigger picture.

With the 25-45 year olds not moving into California, where is the long term housing market going? When the baby boomers reach the point where them must sell their homes to fund retirement, who is there to purchase?

“When the last of the foreclosures are disposed by the banks, coupled by the significant number of homes still under water, are factored in the size of the California housing market correction may be significant (20-30%). Neither the FED or the rest of the country will care. ”

True, but with new ARMs being originated, that may be a while. Let hope those ARMs had tighter underwriting.

The biggest problem with this post is:

$200,000 or more 6.3%

This is a problem because I would argue that this income could not support a new house payment in Lord Blankfien’s prime neighborhood’s like Culver City. I think we are in for a hella hurt with this simple statistic. Everything else is a smokescreen to explain away a full blown asset bubble…

Agreed. And on top of it is that no one I know that makes 200k has any interest in living in Culver City (I know thats anecdotal, but most people I know with that salary want a little “better” area and will rent/wait). On a sidenote, I know someone that bought in silverlake for over $800k and sold after 4 months after spending money to fix it bc he had homeless people knocking on his door at random hours (he lost on closing costs). Also my wife got a new job recently and now her new commute is awful. If I didnt own I’d move closer for her. Mobility is key, IMO. I hang with tons of people in their low 20s to low 30s and I think they are smarter then people give them credit for. Maybe they like to spend money on gourmet burgers and drinks (and a nice communication device-I mean isnt that OK considering a phone is a lot more than just dialing people these days), but theyd rather live 6 people in 4 bedrooms splitting rent with a dog in the backyard then own a house (or have kids) and deal with all the headaches that come with it. I wouldn’t call that stupid or lazy. Seems smart and thrifty to me and logical based on their circumstance..and a lot of fun.

“no one I know that makes 200k has any interest in living in Culver City”

Isn’t this part of the problem?

People who have a HHI of $100k don’t want to buy in Riverside or Mid-City LA

People who have a HHI of $150k don’t want to buy in Alhambra or Eagle Rock

People who have a HHI of $200k don’t want to buy in Culver City or Redondo Beach

…

They say it’s because the schools are poor or the neighborhoods are “poor”

If EVERYBODY who made $200k “settled” for Culver City, how long would it take for the schools to turnaround and neighborhood to gentrify?

“If EVERYBODY who made $200k “settled†for Culver City, how long would it take for the schools to turnaround and neighborhood to gentrify?”\

Why should they overpay based on future gentrification. that’s beyond stupid and counter intuitive. You UNDERPAY when speculating on future gentrification. Fucking FED bubbles of the last 14 years have killed financial reason. Let’s all buy P/E overpriced stocks so that they’ll go higher and maybe someday the companies will actually make money. Jesus Christ…

Housing to Stay Flat in 2014!!

Dr. HB, dropping the hammer of truth and reality on the heads of bubble brained fools drunk off the RE Koolaid for a decade now.

like watching a frat party over spring break..by day 5 it looks like this market today … Barfing over the side of the houseboat while nursing the swollen crotch..5 more days of partying anyone?

Starting to see some flippers out this way, one recent house at the beach bought in september for 219k now asking 369k, the 6 month flip! But it still hasn’t sold. But at the low interest rate they got they can sit a long time. It might be better than money in the bank!

Life-long South Bay resident in early 30’s. ARM’s + gift from boomer parents is how everyone of the first time home buyers in the South Bay go. A couple of poster are correct even $200k of income doesnt support purchase in prime, beach communities here. Really need to be closer to $300k.

I’m not saying it will happen or not, but its called QE3, not QE, so to say that there can’t be QE4 is a tad presumptive unfortunately. I agree with a lot of the logic of why there is more of a need now to end QE (never wanted it started personally), but if stocks and the US starts collapsing, ya think Yellen et al just lay down? Maybe, but lock? Go ask Duke about locks. Will QE4 work if it does kick back in? Maybe not. I’m in bear land for sure, but timing is a motherfcker. Patience is gonna be the name of the game for those planning to buy later.

‘For most, this will be a hit to their retirement plans and as we mentioned, that million dollar sarcophagus is not going to throw off cash like a job, dividend, rental, business, or other cash flow source. This is the mistake of treating your residential home like an investment.’

THE NEW BOOMER REALITY

The retirement vehicle being used today by ‘Boomers’ is a Reverse Mortgage. It allows them to tap revenue for several years until its time to turn off the lights. The transfer of wealth to kids is not a major concern. The ‘Boomers’ that I know have already explored the reverse mortgage option and have NO intention of selling their pricey prime Orange County primary residence. Instead, live the high life $$$, travel the world and hand the keys over to the Bank… instead of Jr. The price of prime SoCal housing is not going to tank anytime soon, that ship sailed between 2010-2013.

Dude you just contradicted yourself Banks holding properties is what WILL tank the market. You’ve got a generational declination in workers AND wages and reverse mortgages only put MORE inventory on the market. Besides reverse mortgages are a small fraction of the market available to those with good equity. Now that the market is back on the downswing that group is smaller and smaller. The FED is taking away the punch bowl and as I noted in an earlier post the world has bigger problems than SoCal RE. The markets are shutting themselves at anything other than ZIRP. FED is in a corner and has no choice but to pop these bubbles lest China and Russia kill the petrodollar sooner than later. Keep waving you Reverse Mortgage Magic Wand at the Macro Economic tidal wave thinking you won’t get wet…

NihilistZero,

Dude, Banks withholding properties from the market via ‘Reverse mortgage magic’ is exactly what will reduce inventory from the market. I’ll try to break in down in simple terms. The 65 yr old boomer that is ready to retire, will instead remain in the house via RM, until he or she checks out someday… this will defer bank sale inventory for an average of 10-12 years. Yes, someday it will add inventory from the banks. However, not occur anytime soon. Check out RMs… you will be surprised how much volume is actually taking place in SoCal. The guy with ultra low prop 13 taxes from 30 years ago, no pension and very little ss benefits is now turning to plan B… Reverse Mortgage. The prime areas of OC will offer Boomers a very comfortable retirement supplement. Sorry if its not what you wanted to hear… just the facts. Keep talking about Russia and China RE and I’ll check back later.

“While some people may raise their eyebrows at people who give out their money to charities instead of their children, others also applaud those who do. They see the act as a selfless way to enable their children to grow and stand on their own feet. A new study from U.S. Trust says that only half of millionaire baby boomers think it’s important to leave money to their kids. A third of them said they would rather leave the money to charity rather than their kids.

There are two explanations for their stinginess.

The kind explanation is that today’s boomers want their kids to grow up with the same middle-class values they had. They want their offspring to learn struggle and hard work and failure and the joys of earned success and all the other lessons that helped the boomers become successful (those, along with 30 years of bull markets and strong economic growth).

The second and perhaps more realistic explanation is that boomers don’t think their kids can handle all that money. Only 32 percent of baby boomers are confident their children will be prepared emotionally and financially to receive a financial legacy.”

“They see the act as a selfless way to enable their children to grow and stand on their own feet”

Yeah, right, just more bullshit, hypocritical “do as I say not as I do” life lessons from the ME ME ME Baby Boomer generation. Give it all to charity (but make sure the attention whores get the self aggrandizing accolades for doing so), after they themselves received and inherited all of what they have from their own parents. Selfless?!? The boomers wouldn’t know the meaning of the word.

“The kind explanation is that today’s boomers want their kids to grow up with the same middle-class values they had. They want their offspring to learn struggle and hard work and failure and the joys of earned success and all the other lessons that helped the boomers become successful (those, along with 30 years of bull markets and strong economic growth).”

So the boomers want their offspring to learn struggle, hard work, and the joy of earned success, all the lessons which the boomers’ parents attempted to instill in them but were never learned let alone mastered? A boomer, working a day, A SINGLE DAY of hard work in their life? Bitch please.

These are all the lessons which the boomers’ parents attempted to instill in them which were blown off so the boomer bums could go get stoned and high and fuck their lazy worthless brains out. “Sure I had it easy and reaped the benefits from the REAL hard workers that built the foundation for everything, but YOU kids will have to learn the value of hard work.”

“Boomers Can Eat Shit And Die “,why the hate?

Hmmm, I’m never selling my house in California. In a few years it will be paid off. I’m under 40.

I got it for a great price and the money in it is making me money tax free because I don’t pay rent. The amount of money someone would need to pay me to make me sell would be staggering. I know many people like me.

If you have a house and the price was right, then California is a wonderful place to be. If you are slaving away and renting. . . Well, I felt that rage too. Don’t be blinded by it.

The more confirmation bias posts I read like this the more I know the bubble has already popped 🙂

So tell us Sak do your wise and well of friends out number the MILLIONS of underwater fucked borrowers and those just barely making their monthly nut? How about those who have the house close to paid off but are old and must fund their retirement? If you truly did BuyTheDip then good on you. I plan to do the same in 2015 or 2016. Hope I don’t sound like such a smug prick when I do 😉

Great comments Zero, I was thinking exactly the same thing. Most of my 50+ friends are not in much better shape than I am, and we all have had stable careers at lawyers, businessmen, etc. some of them have debt issues, divorce issues, etc. and some of us have no debt, steady 150K-200K income yet we aren’t able to buy houses where we thought we would at this stage of our lives (and some would rather rent in a ‘hood we can’t afford to buy in, rather than buy in a “lesser” area). I am not going to overpay no matter what the ‘hood is. Right now, the music is playing and the chairs are disappearing. I can smell the fear of those looking for a greater fool to offload their overpriced house to…it sure isn’t going to be me. I might take a chance on a very cheap place in Oregon or maybe Wyoming but I looked at coastal OR recently and it is way overpriced. Middle of nowhere, no services, and they are pricing a little less than comparable So Cal. Talk about an overreach! Bubbleicious. I agree with you that it is going to take more time and patience is needed.

Not Smug, just stating the facts. Based on your simple analysis I predict that you won’t buy the dip “next time” either. Why? I’m not going to explain it to you because you didn’t listen to the right things last time, and droves of people were saying it.

Sakman,

I agree with you 100%. I have a few SoCal properties and will never sell as well. Why in hell would anyone sell with the lowest interest rates in recent history and Prop 13 taxes. Socal will truly become a region of owners and renters. The volume of Socal residential rental properties will exponentially increase over the next 10-15 years. I believe most of the folks on this site are disgruntled and I totally understand the frustration.

after WWII,winning a war that would of changed history as we know it today,they came back home to live free lives,buying homes to live in not knowing that the homes they where buying would be worth what they do today.nothing came easy. hard work and a government that actually helped its citizens to improved their lives is the payoff for what they have today.now,what do we have today and how did it get that way? “ooh, i don’t know” so what makes you think you deserve the same or better?

I am in my early 40s. My generation got off it’s tail and purchased real estate it could afford. That meant fixer homes … old stuff with termites. After 20 years, I have made a lot of money, and I did not complain about those older than me who own the good real estate.

But, it appears the next generation after me do not have thick enough skin to play the game. Instead, they complain about others that have more. If this is what the next generation is made of, then this country is in big trouble.

“I did not complain about those older than me who own the good real estate.”

Somehow that doesn’t stop you from coming here to complain about those younger than you who don’t own the “good real estate.”

The castigation of boomers is the least fruitful discussion on this otherwise useful blog. We should be angry at the boomers for borrowing into oblivion and “stealing” from later generations but sympathetic to millennials who have gotten themselves laden with student debt.

>> We should be angry at the boomers for borrowing into oblivion and “stealing†from later generations but sympathetic to millennials who have gotten themselves laden with student debt. <<

Why? Why should I be sympathetic to Millienials who wasted their time and money on useless college degrees?

When I attended college in the 1980s, it was still reasonable to believe the myth that "everyone should go to college." Yet my first job, in a Manhattan office cubicle, was totally unrelated to my degree.

But by the 2000s, young people should have realized that college is often a scam, especially if you major in "gender studies" or something equally vapid.

So, no. I give no sympathy to Millennials burdened with college debt. If they majored in something useful, they'll have no trouble paying it off. If they majored in something ridiculous, then they'll just have to work double shifts flipping those burgers.

This post is old now, but I meant to put a question mark at the end of the above. Both generations are responsible for their sins–I meant to imply. My generation had a big hand in the last bubble. Later generations will point the finger at all of us for QE and the corporate takeover of housing. Not sure where all the finger pointing gets us though, which was my overarching point above.

30 yr up 55 basis points in the last couple of days… ut-oh!

http://www.bankrate.com/funnel/graph/default.aspx?cat=2&ids=1,-1&state=zz&d=180&t=MSLine&eco=-1

Doc, I sure wish you’d bring back the real homes of genius because I got a good one for ya.

How nice of the flipper to paint the neighbors’ walls.

Check out the satellite view on this beauty!

http://www.redfin.com/CA/Inglewood/1206-N-La-Brea-Ave-90302/home/6407248

How about this 64-year-old, $949,000 home in Mar Vista: http://www.redfin.com/CA/Los-Angeles/12110-Sardis-Ave-90064/home/6754842

Located just a half block from the foot of an airport runway — directly under the flight path.

At least it provides “easy access to airport travel.”

But…but…but, SoaL, it’s in such a !!!HAWT!!! neighborhood! Silicon AND Silicone Beach adjacent! Perfect for some google, facebook, MSFT, snapchat, assbook, facespace, whatever.com exec! They can just walk across the street to hop on board the company or chartered private jet to fly anywhere along the Pacific Rim, east coast, Eurasia etc. Compared to a similar home by San Jose or Palo Alto airports THIS IS CHEAP CHEAP CHEAP!!! (end sarcasm/realtor-speak)

As an aside, I’m curious to see how this deflationary period affects .gov spending in real terms. Considering Team Red and Blue usually swap the presidency every 8 years I expect a Republican White House to push through budget cuts that could have a “neutral†effect on services provided as I expect a much stronger dollar by that time. If food costs adjust downward 20% is a 20% cut in food stamps really a cut?

Forget a Republican winning the white House. They can’t win Virginia, Florida or Oh which means they just can’t win. The problem with the Republicans they don’t understand the high unemployment has little to do with taxes but a lot to do with automation and robots that will even kill thousands of service jobs in the next decade.

So Cynthia did your Crystal ball envision Al Gore losing following one of the (for some stupid reason only idiots know) most popular presidents in history? i don’t support either team but Obama is at just over 40% and only once since Roosevelt has the same party held the Oval Office for 12 years straight. Check your facts before you debate honey.

Cynthia: “I’m curious to see how this deflationary period affects .gov spending in real terms”

Here is a good explanation/answer to your question:

http://www.financialsense.com/contributors/daniel-amerman/why-federal-deficit-falling

BUT HOME SALES ARE UP! http://new-homes.lennar.com/promotion/?utm_source=eblast&utm_medium=email&utm_campaign=corp%20nl_tod_32514

BUY NOW! BEFORE YOU MISS OUT!

Buy now or be priced out forever! We’re having such a hard time keeping these things from flying off the shelves, that we’ve got some spare time to try to get even moar demand for the things we don’t already have enough supply of! You know, we’re running a sale because we don’t need to.

OK, young couples don’t want to have children. They should rent. Houses are for families. The lifestyle in SoCal is too expensive for most families. Stop the whining and come to Texas, otherwise accept the situation, it will not change.

I hear too many people on this site whining about how bad life is in SoCal because they can not buy a house in a district that they can not afford. Do you see me whining that my ranch is not as big as the King Ranch? No life is what it is. Have lemons, make lemonade.

“Houses are for families.”

Next thing ya know, this guy is gonna tell us that cars are for families.

The only whining here is your whining about people supposedly whining. There are complaints about a system that is not working for people. It comes to a cumulative head at some point and complaints are an effect of that. While rolling over and playing apathy to bullshit might be fine for you, there will continue be those of us who will call it out, regardless of how you try to reframe such actions as “whining.” These are the agents of change. Stick that in your lemon pail.

“Talking shit about their parents, particularly after they are dead, is a sure sign of a fucking life loser”

Or abused kid or equivalent. This idiot is basically claiming that all parents are saints who have never done anything wrong and are honest and fair to kids they have created.

Most peolple have fortunately brains to see that this is bullshit and some parents are shit and there’s no way around it. Them being dead or not is irrelevant.

“First off, most Boomers that I know, are going to spend the money on themselves, and not on their spoiled children who never call or visit.”

So punish the kids being spoiled after you did the spoiling. This is Boomer logic allright: No matter what, you haven’t done anything wrong. Ever.

Leave a Reply