The showdown in housing: Inventory increasing in California as sellers drink the Kool-Aid of housing mania 2.0. $769,000 and you get one bathroom. Low volume and cooler heads starting to rationalize the biggest purchase of their lives.

Welcome to the summer SoCal housing season! This is typically the house horniest time of the year and real estate agents are getting ready for all the open houses they will be hosting for future big eyed buyers. Last year, housing lust was reaching fever levels and people were diving into bidding wars just to get into a house. The biggest purchase of your life and people were making offers sight unseen. The grunt crowd seeing investors pony up big money simply tried to follow the larger players at the table. Those larger players are exiting stage left in 2014. This summer has a different tone from the summer of 2013. Inventory is higher and slowly, buyers are starting to question current prices. Sellers are drinking their own Kool-Aid and think that a home with a hardwood floor and granite countertop suddenly adds $100,000 to the value of a place. Like purchasing a new car, the novelty of owning real estate wears off after you go through a few years of mortgage payments, maintenance, and other costs of daily living. It is interesting to hear from a few condo owners or those with very closely built homes that bought and are unhappy with their neighbors. Some are unhappy that their new neighbor has a place with multiple generations living under one roof! You make the biggest buying decision of your life and don’t vet your neighbors? Hope you enjoy that place because when you buy, you lock in for a good amount of time. The honeymoon wears off quickly but there is still plenty of “buy now or be priced out forever†perfume stinking up the atmosphere. The showdown in housing is here and as we highlighted before, like a giant ship, housing markets turn at very slow speeds.

House hunting in Pasadena, Culver City, and Torrance

People seem to enjoy looking at real world examples. For those in SoCal, these prices are simply par for the course and don’t shock us beyond our already high tolerance state. However, for readers outside of California it gives you a taste of what it is to live in a boom and bust housing market.

Since real estate either in mortgage payments or rents consumes a high portion of your income, it is usually a very important sector of the economy to look at. It is so important that the very secretive Fed is actually buying up practically every mortgage-backed security in the market in the hope of keeping people in the game to buy (although what has happened is that big investors have used low rates on borrowing to leverage up in real assets).

Let us first take a look at a property in Pasadena:

787 N Wilson Ave, Pasadena, CA 91104

3 beds, 1 bath listed at 984 square feet

Built in 1905

The adjusted gross income for a household in the 91104 zip code is $58,610. Just keep that in mind when you realize that this tiny place is selling for $549,500. I love this line in the ad:

“The entire home is glowing with natural lightâ€

This home would likely rent for $2,000 a month. A 3 bed and 1 bath home is much too small for a couple planning on having a family unless you want everyone sharing the bathroom at the same time. Oh, and this place still costs $549,500! The place was built in 1905 (if you are keeping score that is 109 years ago). Say you buy this place and plan on staying put for 30 years. After 30 years, you own this place but then what? You still have taxes, maintenance, and insurance. What are your plans for that future income stream? Will you be a cat food eating baby boomer living in a $1 million golden granite countertop laden sarcophagus? Of course house horny buyers view this place as a stepping stone into their dreams of property laddering their way into greatness.

The next property we will look at is in Culver City.

10925 Wagner St, Culver City, CA 90230

3 beds, 1 bath listed at 1,165 square feet

Built in 1941

A slightly bigger home and this place is currently listed at $769,000. This place would likely rent for $2,900. Household income for this zip code? $67,470. Of course incomes don’t matter so don’t you worry about that data. This is a great line in the ad:

“You’re going to be pleasantly surprised when you visit this house!â€

Now isn’t that great? You’ll be paying $769,000 and maybe, just maybe you’ll be pleasantly surprised. Now I don’t know about you, but when I pay a nice amount for a good steak I want my socks to be knocked off right through my beat up shoes. I don’t want to be “pleasantly†surprised otherwise I’ll head on down to Jack in the Box. The only difference of course is that buying a burger isn’t going to be a 30 year albatross.

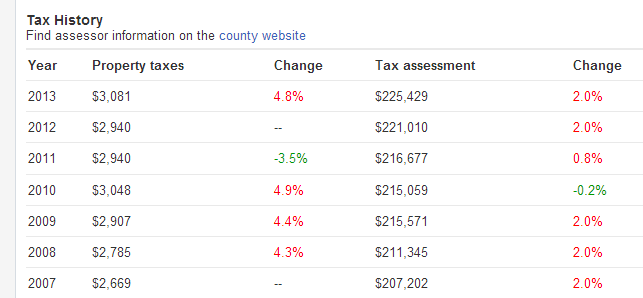

And of course, someone is going to make the tax system happy:

Someone right now is paying taxes on this place as if it were worth $225,000. If this sells at $769,000 someone is going to find themselves eating a tax bill 3 times the current amount for the same public services unless I’m going to be pleasantly surprised by 3 times the services once I buy this place. When you see things like this you can easily understand why investors are pulling back. And do you see a professional couple with the income to support this mortgage moving into a place like this with only one bathroom? Apartments and condos have more bathrooms!

Finally, let us end the examples with the South Bay in Torrance.

4603 Narrot St, Torrance, CA 90503

3 beds, 1 bath listed at 1,112 square feet

Built in 1984

Another 1 bathroom place. This place is listed at $699,000 just so all those house horny buyers looking for homes “< $700,000†find this popping up in their queries. $100 will go a long way since you’ll only be able to afford Taco Tuesdays trying to cover the mortgage. Household income for this zip code? $71,640. Of course this also explains why investors have been the only actual players in the game over the last few years as middle class California families are priced out or you have adults living at home with mom and dad.

Welcome to the summer of 2014 in SoCal housing! The showdown is here but you still have plenty of house lusting buyers ready to dive into the market and sellers willing to justify current prices. Heck, you might even be pleasantly surprised by paying $700,000 for a home built during the Great Depression or World War II and your parting gift will be one bathroom giving a more vibrant definition to what it is to live in a crap shack.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

99 Responses to “The showdown in housing: Inventory increasing in California as sellers drink the Kool-Aid of housing mania 2.0. $769,000 and you get one bathroom. Low volume and cooler heads starting to rationalize the biggest purchase of their lives.”

It’s the school district

Ha ha ha, I couldn’t help not to post for the first time. Double income couple here 160k/yr, bought in 2005 4 bedroom 2 bath 1913 Crapsman house in need of ALOT of work. Purchase price at the time was under-valued due to the house’s condition a mere 635,000.00 (GULP). Well needless to say we were both EXTREMLEY house horny and dove right in. Fast foreward 9 years and 1 refi (rates were rising circa 2007) which included pre-payment penalty and i modification(the recession pretty much closed my store so my income was halved) Here we have arrived at a whopping 40,000 in equity which if we sold a used cars salesperson…err Realtwhore would pretty much take care of the proceeds…………..

Good article Doc. “You’re going to be pleasantly surprised when you visit this house!â€

How can anyone still be in a pleasant mood after just looking at the asking price on the listing on the web? One day I hope the actual visitors to such homes, with such asking prices, will dwindle away to nothing.

To: “Trapped in San Diego” – it doesn’t surprise me that you have still have little equity position after all those years of ownership. However the risks are, in my opinion, much more severe for buyers of today, at current asking prices. The math involved.

Although horny housebuyers pushing and falling over one another to pay such prices; have been for past few years, crunch/money problems forgotten. I’m not US located, and 30 year fixed mortgages I’ve never heard of here, but these 2 anecdotes I keep close to mind (for the math). Short term 2 year fixes on teaser rates for those able to put down 40% deposit are still allowing buyers to set high prices (but bank got 40% to play with in a crash), but going to see some action when those deals run out and people revert to lenders higher SVR.

______

1) I stick to the Lionel Ritchie rule, the once, twice, three times a lady rule. Its a rule of thumb rather than an article of faith so you’ll have to excuse the broad generalization.

Borrow $15,000 (once) results in a typical repayment of $30,000 (twice) which for a typical basic rate taxpayer means earning $45,000 (three times). Or, to put it in plainer terms, an additional $15,000 offered is equivalent to a years work at average salary and even better offer $15,000 less and you could retire a year earlier. Instead we fixate on lending multiples at gross earnings which neglects tax and interest.

_______

2) Well, based on the loan value for standard SVR (standard variable rate) mortgage I’ve just looked at on my Banks website, you would actually be looking at $400k interest on a $400k loan over the next 25 years (that’s if interest rates stay as low as they currently are – which I don’t think anyone believes will happen.)

Now, look at some of the daft $450k terraced houses on the property-websites. I can easily see those dropping by at least 10-20% in value over the next 5 years; maybe much more. But even at just over a 10% fall and no rises in interest rates, that’s your $50k deposit gone (plus the loss of the interest it could have earned in savings account etc..) And in the first 5 years of mortgage payments, at $2.6-2.7k per month? Well, you’ve only paid off $26k of your house. But remember the interest on the loan? That’s cost you another $121k in just the first 5 years. So, after 5 years, you are ~$180k down on a $450k house – if interest rates don’t go up at all and your house only drops in value by about 12%. The reality is likely to be something much more severe, IMHO – a 30% fall in prices and interest rates at just 2% higher than today gives a loss of over $300k on a $450k house in just five years. And what have you got for that $180k-$300k of investment? Just $26k worth of equity in a house (and minus all your other costs for 5 years – moving costs, taxes, insurance, maintenance, etc., you don’t even have that!)

So that, to me at least, is what is so frightening about buying in the current market. Not a single young person under the age of 35 I speak to can afford to buy at current prices. And for those that do, the doubling and trebling of houses prices needed to wipe out the enormous amount of interest they’d paid in the first 5-10 years of ownership is just not going to happen. Scary stuff indeed. Hence why I rent cheaply and push cash onto the “buy-outright when prices fall-back” fund.

“plus the loss of the interest it could have earned in savings account”

Lets ponder. Were do i put my money? Bonds are at almost record highs. Stocks are at record highs. CDs are 1% at best. Saving accounts are 0.1%. Commodities are high by historic standards.

How can the S+P keep going up? At 10% growth, in 7 years the S+P would be at 4000. Does anyone think that is remotely possible? Apparently valuations by price/earning are already at record highs.

I made the decision that a house has some tangible benefit now rather than in the future.

I think we will have low interest rates for a long time. I am looking at Japan style 20 years of low rates. And Japan used to be ‘normal’ like the US.

I am also looking at 10 year yields being higher in the US than Ireland or Spain! Does anyone seriously think Ireland or Spain is safer than the US!?

Also, rental prices are big feature no one talks about. We just bought. We wanted a 3/2 and were looking for rentals in our area. First, there is zero rental inventory. Second, the few available houses were minimum $2300/month. Our old 2/1 house had 17 people apply within an hour of the ad being on Craigslist. People sent nasty emails to the landlord when they were not chosen. The landlord thinks that he should have charged a lot more rent but more than $1850 for a 2bed/1bath?!

I used this tool

http://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

If you are going to stay in the house for more than 5 years buying is a no brainer. Rents are sure as hell not going to go down. Even in the crisis they did not go down.

I lost friends that year trying to give the advice “don’t buy. It is going to implode! It has to.’ Excuse me but when I saw my craftsman (pd 173,000 circa 2000) double then triple thorn quadruple, I knew that some weird was going in and with bushy as the leader…well he made his history.

I’m thinking of taking a long term rental in one of the tourist hot-spots of Southern Spain; Marbella. (probably the most elite tourist area for holiday-makers). Some really really good long-term rental deals.

(I still think purchase values are set to soften more – especially as it looks like Gov of Spain might crack down on owners offering short-term rentals… 100Ks of such owners, with suggestions stronger legislation is coming in requiring licence/regulation/tax, and fines for non compliance.). Also on the Costas (Spain tourist areas), just been reading about a couple who’ve recently bought an apartment to retire to for €40,000 in same block as their friends who paid €120,000 TEN years ago!

I don’t mind low interest rates on my savings, when I think opportunity will come for better value for those who still have capital to take advantage of opportunity. (at lower prices – example above)

And incredibly there is also ski-ing in Southern Spain, a good resort in the Sierra Nevada mountain range. Europe’s most southern ski resort. 2.5 hours drive away from Marbella.

Anyway, I’m not going to question your view on rentals and rents but: “If you are going to stay in the house for more than 5 years buying is a no brainer. Rents are sure as hell not going to go down. Even in the crisis they did not go down.”

I’d like to run your mortgage numbers through Karl’s mortgage calculator to see if this no-brainer is as good as you believe. I’m not used to running the numbers from a US perspective (so feel free to check my figures), but let’s take a 30yr fixed rate for fair-case scenario of 4.25% for someone buying today.

For example, say buy at $500,000 but contributing $100,000 of your own money, with a $400,000 mortgage.

Property value: $500,000

Downpayment: $100,000

Principal: $400,000

Payments: $1967.76 pm

Start date: June 2014

End date: May 2044

Total interest: $308,393.44

Total interest %: 43.53%

Total payments: $708,393.44

Looking at the Amortization Graph.. well run the numbers for yourself. I think you pay the bank a lot of dead-money rent as well, via interest. http://www.drcalculator.com/mortgage/

The best thing about the ‘real homes of genius’ isn’t that they put a real face on the abstract numbers, though that’s certainly nice, it’s that it gives the Doc a chance to add humor to the mix.

And as Shakespeare would note, even the most tense drama is well-served with the addition of a Falstaff or jocular grave digger.

Throw out everything you heard about appraisal of a home. At one time a 1 bath home, suspect location, and over 50 years old was as death nail in making a dime on that type of property.

I can’t imagine anyone even considering such homes at these prices, apparently it is par for the course in CA.

viewed that wilson house! total shack! way overpriced

Ooh, major nostalgia rush… while in college back in the (gulp) ’70s I rented a similar 3 + 1 house just a few blocks away from that one on Wilson. The houses in that neighborhood were indeed crapshacks even 40 years ago – suitable for a bunch of grungy college kids dragging in their ratty old furniture, but I’d run screaming before actually investing any real money into one of those places.

I wouldn’t mind buying the Wilson house; I could win a Nobel Prize if I can figure out how they bent space-time to cram 3 bedrooms into a 984 sq ft. crapbox.

I could call it the “Pasadena Tardis House”

> I could win a Nobel Prize if I can figure out how they bent space-time to cram 3

> bedrooms into a 984 sq ft. crapbox.

Easy: 2 tiny 10 x 10 bedrooms, 1 laughable 12 x12 “master” bedroom, 15 x 15 living room, 10 x 15 combo kitchen/dining room, 6 x 10 bathroom – add in some miscellaneous dingy corridors and a couple of closets and there you go – instant student flophouse. No Tardis necessary (though we would have certainly appreciated one to get out of there sooner).

The Pasadena home has a nice sized lot for the area at 7500 ft. There is plenty of room to add on to it. If the lot was 4000 square ft like many others in the area, than it would be way overpriced. I suspect this will sell within 30 days to someone looking at expansion. The square footage and bed/bath count is not where the value is at this location.

@KC2, people look at the monthly nut when determining whether to buy. Term (30 years), lot size, etc. really do not factor into the purchasing decision.

People look at the lot size when considering an addition to the property. The only way this home makes sense is a remodel and addition.

Housing TO Tank Hard in 2014!!

Housing to go up 30% in 2014!!!

GDP for Q2 to be 7%!!!

BTW – I think the real Jim Taylor would have a lower case “O” in “TO” and would have at least one more exclamation point!!!

What?, I miss the real you. May I suggest a return to fact based posts and a second username for the “other guy”… Perhaps “What? on FED Meth” ???

Do a line and buy a McMansion 😉

Really though, the bulls are grasping at straws. Anything they cheer means a larger crash. Touting the return of HELOCs and lower lending standards does not support a price plateau, it ensures a crash of the over leveraged assets. It’s laughable they think the FED has there back. They have the banks interests, and those interests only at heart. Juicing housing any further this cycle would destroy the economy and the dollar system. They know it and everyone but Yellen (who conveniently aren’t covered hymn the mass media) has said so publicly. 2015 spring selling season will be ugly, REITs should start liquidating by then and I’d expect much greater price velocity than 2008-10. We’re not talking about individual home owners defaulting but REITs controlling swaths of homes running for the exits to cover debt. The guy who first coined “Housing Bubble 2.0” in print predicted this in early 2013. I’ve seen nothing to disprove, and much to confirm his thesis in the last year and a half.

“What?, I miss the real you. May I suggest a return to fact based posts and a second username for the “other guyâ€â€¦ Perhaps “What? on FED Meth†???”

Nil – It is way too frustrating to do battle with the NAR shills using the antiquated tools of math, data and logic. It is so much easier to use NAR talking points to argue with bears especially since the bears have been beaten down so decisively by the “new” reality.

I think I have said it time and time again in my comments, predicting in today’s “economy” is like playing a made up game with a 4 year old who keeps changing the rules of the game to make it go their way. How can you predict that?

Can this go forever? NOPE! But can it go on way longer than any bear can fathom? YUP!!! I have simply adjusted to the new, new, new, new reality. I will stick to it until it changes and not a moment before… 🙂

Titanic appears to be slowly turning…inventory is FINALLY starting to creep up in my market.

You have no proof!!!

@ What?

I am happy to see that others are also asking you to revert to honest discussion. The sarcasm has become beyond lame and entered the realm of annoying, especially since you post so often. You cannot be gainfully employed and still have time to faithfully troll this site on an hourly basis.

RE: proof, I’ll take the bait. Pulling only for SFR’s MLS shows May 2013 Culver City had 2.5 months of inventory available. May 2014 shows 1 month of inventory. This actually shows the opposite of my post that you responded to. However, same parameters for Walnut (extremely popular among Asians), inventory is from just over 3 months to just over 4 months. Surrounding cities bordering Walnut show similar inventory increases.

More evidence for bifurcation? Asian all cash slowing down? Not seeing it as far as the boots on the ground, but who knows?

CAB – well logic would state that neither of us are “gainfully employed” from your comment…

Really? You outpost me by about 20 – 1.

Posts or words? You definitely have me on word count!

I wouldn’t live in these places on any terms, rental or purchase…. and I have nowhere NEAR $600K to spend on a place.

Cali is a lovely place… spectacular scenery, lovely year-round weather, and some great architecture & vibrant cities (the places shown here excluded).

But I paid less than a fifth as much for a drop-dead beautiful old condo on Chicago’s north side and it even has more space than these sad places, and I could score a lovely, small masonry home for less than half what these poor little houses are offered at.

The saddest part is that I am old enough to remember when SoCal was cheap, and in far better economic condition than it or any other place in this country is now. Northern CA has been expensive as long as I can remember, but back in the days of aerospace and ship-building, there were great jobs for almost anyone willing to work in SoCal, and the houses were cheap relative to incomes. Even the Malibu coast was not outrageous.

How far have we “progressed” since the 60s. Tragic.

Laura…Drop dead? Don’t use that term when speaking of Chicago, again over the weekend 29 more people shot including to police officers.

Most of those shootings happened, as usual, at the opposite end of town in the same small pockets on the southeast and west sides where they always happen, perpetrated by the crowds that have always perpetrated them. They mostly took place within blocks of each other. And they took place a good 20 miles from where I live.

One in a nasty pocket on my far north side. Outsiders do not know it, but this is a huge city stuffed with neighborhoods where you can safely walk anytime of the day or night you please. I’m in one of them. Sure, I have some neighbors I could do without (will the horn-blatter in the bldg across the street please lay off after 10PM!), but, for the most part, our tree-lined streets with their fine old buildings are populated with civilized people.

There are no $600k+ SFR’s in the areas where most of the homicides occur. You could probably buy the entire block for that. Chicago is still highly segregated and knowing which areas to avoid is pretty easy. The media makes it sound like the entire city os one big war zone, which it is not. Mind your own business, stay out of the bad neighborhoods and your chances of getting murdered are rather low.

@robert, Laura is right. The north side of Chicago is quite nice especially Skokie and Northbrook, and arguably better than about 90% of SoCal.

Laura and others….I was born in Chicago, my family own many business in the city North side and North Ave near Maywood Race track. So I’m well verse in the town and should have quaify my statement.

Certaiinly Like any other big town there is dangerous locations. That is why it bothers me that folks trash CA as everybody is broke and house poor?

I no longer live in CA, we were never broke or house poor, what we did was take advantage of a very large and diverse state and pick and choose where to buy and sell, no place is like CA to make real estate money, there is always someone who wants the dream of living there. We sought those people and they paid the price for it.

Chicago as a whole is a nice town, but as I can attest to, my realitives and friends stay there, today many years later they to the person said,wish we had the guts to move West,to a more progressive life and climate.

What, you must be kidding, right….AND Jim Taylor is right…..only stupid will buy house right now…

karian…many stupid people still exist, case in point.

Couple buys a home for 989k, the owner was mad that they didn’t get more so they trash the house during the pending period. The couple returns to the home before closing, they see that the house has sustained about 10k in damage.

They are so worried to back out these brilliant folks close on it. I wanted to ring the doorbell just to see what really stupid people look like. They put the trash out, they look very human, they just think stupid?

Robert: ” I wanted to ring the doorbell just to see what really stupid people look like.”

I see dumb people… they’re everywhere. They walk around like everyone else. They don’t even know that they’re dumb.

Except there may be fewer of them in a position to buy now – the market can’t crash until it’s just about pulled in everyone who can buy. Even these so called love letters to owners to beg them to sell (presumably at lower prices), may be a trigger for a crash.

i wish i knew how to post a youtube video. What? can you help? youtube “stupid people” by george carlin. thanks

George Carlins’ “Stupid People”. Also recommend searching You Tube for George Carlins “it’s all bullshit and it’s all bad for ya”.

https://www.youtube.com/watch?v=8rh6qqsmxNs … hope this works

@karian galustyan wrote: “…only stupid will buy house right now…”

The correct term is: Minsky Moment

Minsky Moment: “When a market fails or falls into crisis after an extended period of market speculation or unsustainable growth. A Minsky moment is based on the idea that periods of speculation, if they last long enough, will eventually lead to crises; the longer speculation occurs the worse the crisis will be.”

1.) Housing in SoCal, especially mid-tier areas, are approaching a Minsky Moment.

2.) Wall Street and the Stock Markets are approaching a Minsky Moment.

3.) Margin debt, (stocks/commodities) are approaching a Minsky Moment.

4.) Household debt (student loans, credit cards, auto loans, home equity loans, second mortgages) are approaching a Minsky Moment.

2014 resembles 1987 (stock market), 1990 (housing bubble), 2000 (stock market) and 2007 (stock market / household debt / housing bubble) all rolled into one big clusterf@ck.

Inventory may be going up, but we are not even close to the amount from several years ago.

http://www.deptofnumbers.com/asking-prices/california/los-angeles/

Could be underwater homeowners not being able to sell, but could also be homeowners waiting for prices to rise even further before cashing in.

We don’t really need inventory/supply on market to hit any great heights; nothing like 2006/07 imo, to have a real effect.

We just enough to quench frenzied demand, and enough of a tick up to provoke uncertainty in other owners. Some of who may come to market and have more willingness to accept a (still very good) but lower than peak price in order to sell. And then wobble this market and provoke more of the same. Market prices are set at the margin, between buyers and sellers, and the prices they agree set the values for all of the other assets, including ones not even up for sale on the market.

Elliottwave: Only a very few owners of a collapsing financial asset trade it for money at 90 percent of peak value. Some others may get out at 80 percent, 50 percent or 30 percent of peak value. In each case, sellers are simply transforming the remaining future value losses to someone else. In a bear market, the vast, vast majority does nothing and gets stuck holding assets with low or non-existent valuations.

“We just enough to quench frenzied demand, and enough of a tick up to provoke uncertainty in other owners. Some of who may come to market and have more willingness to accept a (still very good) but lower than peak price in order to sell. And then wobble this market and provoke more of the same. Market prices are set at the margin, between buyers and sellers, and the prices they agree set the values for all of the other assets, including ones not even up for sale on the market.”

This may be the case but how is this different than the bond market where the fed buys up any surplus debt to control the price of money or the stock market where the companies buy back shares to control the EPS? Why not have the fund managers buy up stagnating inventory to control price of housing? The fringe is really a lever that can be used to control the whole market as we have seen. The other problem is that your “math” assumes a positive cost of debt and we all know that debt has a negative cost. We are truly in new and strange world now that we have entered into the world of NIRP. My new google glass will help you understand once we get enough facebook likes, twitter followers and pintrest re-pins…

What?: “This may be the case but how is this different than the bond market where the fed buys up any surplus debt to control the price of money or the stock market where the companies buy back shares to control the EPS? Why not have the fund managers buy up stagnating inventory to control price of housing? The fringe is really a lever that can be used to control the whole market as we have seen. The other problem is that your “math†assumes a positive cost of debt and we all know that debt has a negative cost. We are truly in new and strange world now that we have entered into the world of NIRP. My new google glass will help you understand once we get enough facebook likes, twitter followers and pintrest re-pins…”

_____

What a headache this market is. The shoe-shine boys with big mortgages have bought housing than I, and happily tell me what it’s worth. Authorities cuddled them through it. Their shoe-shine parents, and shoe-shine grandparents… smiling throughout this without any concern and all able to brag what their houses are worth.

You’re correct as I understand it. The fringe/margin can be overridden by vested-interests, when enough money is pumped their way (or debt bought by central banks); and reality shaped to meet their ends. Surely there has to be a limit though?

It ‘appears’ like it could be an inflationary remedy for forces of deflationary depression, and backing vested-interests in the process (which is horrible – and makes me feel lost in the market, as well as denying what my family have saved towards… improving our situation) but I can only hope it’s a temporary phenomenon which allows a correction to play out, and allow younger and smarter entrants to have opportunity at some point. With banks better positioned to lend on lower asset values (in huge volume).

This insanity is a direct consequence of ZIRP.

In London the insanity is epic… for the same reason.

Prices don’t actually decline so much as simply stall out — like an aircraft entering unstable flight.

Air France flight 447 — and its death agonies — figures to be translated to real estate pricing — on a global basis.

The marginal (yet totally crazed) buyer is coming from afar.

Uniquely for our times, the top tier players are not using conventional mortgages at all.

The liquidity is coming from every other asset class.

But the turn must eventually come — unless the powers that be re-pump the fiat currency with more spew.

BTW, a firm an rising US dollar merely causes alien buyers to lust for California even more.

&&&

To a certain extent, the foreigners are returning US dollars — to swap for real assets. It’s the lack of alternative assets that has Red Chinese investors going crazy buying real estate. Don’t forget that by Beijing standards, LA is going for a pittance.

&&&

A global contraction appears to have started during the 1Q2014.

I have put it down to 0-care. I still do. No matter how the President dances around it, the roll out of 0-care is destined to hit the voters every October from here on out. We’re still seeing but the beginning of the tsunami.

The ratchet and pawl nature of the regulations and paperwork mean that backing up is brutally impossible to do.

Interesting points blert–some you’ve made before. Though, I’d like to hear more about Obamacare can spark a global contraction. It’s not that I’m one way or the other. I’m mostly 50/50 on Obamacare. Just curious as to how you trace the line from A to B.

Per supreme court O-care is a tax, the most regressive tax. It is the ONLY leg to make the stealing of money from middle class legal. What Bert is saying is very logical and 100% accurate.

For the very rich people, the impact of O-care is almost zero. If you increase taxes on middle class, you decrease the aggregate demand for most people – that simply translates in economic contraction big time for various reasons:

1. the obvious is less money for people to spend

2. there is less disposable income left to save for a downpayment (or no disposable income, depending on the household)

3. Less money for downpayment or none, means less mortgages (less qualifications) – this is already obvious for all DHB blogger and all loan officers. DHB already had many articles to confirm less % of buyers with mortgages

4. Less mortgages means the money supply does not increase fast enough to grow the economy

Therefore, Bert, without stating the obvious in terms of details is 100% correct. Where I have doubts is this: where the politicians who brought O-care completely illiterate in terms of economics or they knew what was going to happen and they were just evil. Regardless of the reason, the end result stated by Bert is accurate.

Fly – “Less mortgages means the money supply does not increase fast enough to grow the economy”

I think this is an “bass ackward” statement if I ever saw one. I agree that the Fed pretends that this is a true statement but I seriously doubt that even John Maynard Keynes would buy that. It is true that a growing economy may require a growing money supply to keep up with growing “transactions” but there is no evidence that increasing money supply increases transactions(economic activity) directly. This is why velocity is part of the mathematical equation. You can shove more money in a system but if it isn’t growing it will just sit as we are currently seeing. A growing economy may require a growing money supply but a growing money supply does not crate a growing economy. We have plenty of examples of this before our very eyes…

What?

I agree with you with how the economy should be run for the benefit of all citizens. However, given the system we live in where every single dollar is created through debt, every time a bank gives a mortgage or commercial loan, the money supply increases.

I also agree with you that money have to circulate to create an impact on the economy. The increase in money supply is just one step in the right direction. It is true that for the economy to run at its potential we need more steps than one.

My reply, briefly, was addressed to Chris so he can connect the dots in Blert’s argument, because Blert was just presenting the conclusion without going step by step.

“I agree with you with how the economy should be run for the benefit of all citizens.”

Aaaah…. I don’t remember saying that in my comment.

“I also agree with you that money have to circulate to create an impact on the economy.”

Aaaah…. I don’t remember saying that in my comment.

“However, given the system we live in where every single dollar is created through debt, every time a bank gives a mortgage or commercial loan, the money supply increases.â€

Not clear how this makes your point but I agree with this.

“The increase in money supply is just one step in the right direction.”

This is where you fall apart. You are assuming that the problem in the current economy is a lack/shortage of money/debt. That is the backwards thinking that is the source of the problem and not the solution. There comes a time when increasing total debt/money actually slows economic growth. I think it is around 250% to 300% of GDP. I believe we are somewhere in that neighborhood now. There have been studies on how a shortage of money supply relative to demand caused an economic slowdown. I would argue we do NOT have a shortage of money/debt in our current economy. We have a shortage of demand for goods and services. Throwing more money at our current economy is not and will not create economic growth.

“It is true that for the economy to run at its potential we need more steps than one.â€

In actuality our economy has been running PAST its potential because of artificial price signals for the past 30 years. Eventually we will feel the pain of the funny money experiment…

“Prices don’t actually decline so much as simply stall out — like an aircraft entering unstable flight.

Air France flight 447 — and its death agonies — figures to be translated to real estate pricing — on a global basis.”

I think this comparison is deeper than you imply. The sensors on the A330 had frozen giving the pilots false readings. Eventually the auto pilot shut down and all computer flight systems failed. The pilots were controlling the plane but were unaware of the pitch and airspeed of the plane. The plane fell from 35,000 feet to the Atlantic Ocean with the engines at full thrust and the airplane at a 30 degree angle of attack. The pilot could have saved the plane if he only pushed the stick forward and leveled out the airplane. Given the false readings and lack of understanding they never had a chance…

I have neighbors on either side of me who make my life Hell. Neighbors are the biggest wild card in this mess, but if I was looking for a home and I found a home on a piece of land where there was room between houses, so that neighbors with their loud music and their barking dogs and the parties would not affect me, that would be worth an extra 100K, easily.

One of the intangibles of renting. Your financial position isn’t tied to some a-hole neighbors and it’s easier to move away from them.

… Well it looks like the ‘stupid money’ money is slowly DWINDLING …..the sobs and tears we will soon be hearing are from the poor naive folks who just could NOT WAIT….got to have it …got to buy it … can’t lose that deal … “now I’m stuck with it? … Help….

DRB you can’t have it both ways…catfood-eating retired boomers in their prop 13 lottery homes dramatically depress the median income figures for these areas. Plus, CC has huge number of apartments and condo’s, whose inhabitants also depress median wages.

You keep repeating and I’ll keep rebutting….median incomes don’t matter re: the relative “affordability” of SFR’s in gentrifying or prime areas such as Pasadena, Torrance and Culver City.

My hunch is people paying $700k for these SFR’s are ~$150k+ hh’s.

Of course median incomes matter to SFRs. Even gentrifiers know that low income neighborhoods suck. The idea is to bring enough people in fast to move out the riff-raff. Not everyplace that starts to transition finishes this change. If the median income growth stalls then I feel the neighborhood and the house values are doomed. There are plenty of success and failures throughout the ages to study. I love the realtor speak “neighborhood in transition”. So non-judgmental, but really which way?

Pasadena, Torrance, and Culver City are not prime. They’re mid-tier. Add to that Mar Vista, Woodland Hills, West L.A., Eagle Rock, and Silver Lake.

Real prime (top tier) would be Bel Air, Malibu, Pacific Palisades, Westwood, Hidden Hills, Beverly Park, and parts of Santa Monica.

There are of course degrees in both tiers. Santa Monica is well below Beverly Park. But CC is not even in SM’s league.

100% true. Little if anything is prime in the 626 area code except for San Marino, maybe.

You don’t know what you’re talking about.

I kind of do. I live here. Maybe you are wishfull thinking a little?

Careful, if you say something reasonable you’ll get jumped on in here.

My CC neighborhood is literally full of doctors, lawyers, professors, and film industry professionals … and a few “cat food” old people who have been there since the 1950s. As they leave (or die), CC and its tax base are changing. Comparing apples to apples, median HHI in CC has risen dramatically between 2000 and present. Mostly young families moving in for the school district and saving $20K per kid per year on private school costs that they’d pay elsewhere.

Note that the median HHI in Beverly Hills is $96,312. So how do you explain the housing prices there? (Basically same thing – condos, renters, and old people who have been there forever.)

http://maps.latimes.com/neighborhoods/income/median/neighborhood/list/

Probably explains the declining inventory in CC which I’ve noted above.

@LG, there are two Culver Cities. SFR’s and apartment/condos. SFR’s are where the professionals live. The apartments/condos of Culver City are loaded to the gills with ghetto/barrio/slum/trash/cholo/gangster/hoodlum types. The contrast is quite remarkable, two very different worlds.

Well aware of that, thanks. Yes, there’s the CC mostly full of houses on the east side of the 405, and the “CC” (in name/zip code only) west of the freeway.

There’s the Santa Monica north of Wilshire (or Montana, if you want to get really tony) and the Santa Monica close to Venice that is was full of gangbangers not that long ago and still a bit dodgy. Two Mar Vistas, two Echo Parks, two Silverlakes, two Westchesters, two Venices, two Pasadenas… you get my drift. Probably why the “median income” indicators in a lot of these places are misleading.

I think the only place you have a chance of really finding homogenous communities is well out into the suburbs now.

@CAB, the declining inventory in CC and most mid-tier SoCal areas is best covered by banks pulling the plug on short sales in the mid-tier areas.

I sold one of my properties in Culver City in 2004. The person I sold it to was not able to get out of the mortgage until 2013 because they were underwater for almost 9 years, and the bank would not allow them to short sale the property. So they were pretty much stuck until early 2013.

Largely any one who bought in CC from 2005 to 2008 is still upside down on their mortgage and will have to pay the bank for the privilege of getting out of their mortgage.

China’s property bubble just popped:

http://www.marketwatch.com/story/chinas-real-estate-market-sees-land-sales-plunge-2014-06-09

Australia following suit despite 8 rate cuts since 2011:

http://www.marketwatch.com/story/australian-housing-finance-weaker-than-expected-2014-06-09-224855118

Spain housing in tailspin:

http://www.marketwatch.com/story/spains-decline-in-home-prices-slows-2014-06-09

Note the scary reference to Blackstone and Quantum. These guys are truly the .01% and are very active GLOBALLY. What happens to the world economy if/when they fail?

The first article was interesting because of the way the Chinese government is choosing to prop up property prices. Since the gov controls all the land, they simply stop selling it to developers to put dampers on new construction. They also have some loosening of credit too. They must really be in deep shit if they are going that far.

LA’er. Good point. But part of the overall problem in China is local government debt. Except for few prime areas, there is no property tax in China. Local governments depend on selling plots of land for tax revenue. This means that the boom has to keep going or it results in a cascading disaster.

The elephant in the room is that China has deep structural problems in domestic consumption and enough stability to encourage investment. Again, does no one else see it odd that so many Chinese nationals are working so hard to invest their money outside a country that supposedly has a 7.5% annual growth rate?

The chorus to raise rates is growing.

According to Feldstein, Inflation is over 2%:

http://blogs.marketwatch.com/capitolreport/2014/06/10/feldstein-warns-inflation-is-running-above-2/

Deutsche bank economist Lavorgna agrees:

http://www.marketwatch.com/story/fed-needs-to-start-raising-rates-top-forecaster-says-2014-06-10

As an aside, UK is in a massive housing bubble and the Brits are parroting the same comments that we heard leading up to the peak in ’06-’07 here.

Thanks DHB! I forgot that at these ridiculous prices prop taxes take a nasty bite. For the taxes on the places you are showing I can pay several mo. rent on a better place.

Unless people have no equity I don’t know why more people just don’t sell. Think nearly 1 mil on some of these places. At 5% return on investment after taxes that is $50,000/year or $4167/mo. You can rent a nice place for that without touching principle. Also, as we age we all get nearer to the managed care facility. How many people can really afford med care on site and die in the home? People we all are mortal and have to plan. You can only benefit from the housing “recovery” rainbow by selling. Take what you can while you can.

Leaf Crusher,

Where can I get 5% return on investment after taxes?

Agreed. 5% is more than recommended to take from your nest egg. I think 4% is considered okay, but even at that rate I am dubious in the ‘new normal’.

Also, the idea that you can live in a nice place for $4000/month is odd. You have to eat, travel etc. and then hope the rent doesn’t increase too much each year. you also have to hope your money remains safe despite looking for a 5% yield. I think this strategy is very risky.

invest in a European business to make euros then exchange for dollars =30%

If you have to ask then hire a money manager. Stock/Bond mix might be a place to start.

Oh you don’t live off the money from your sale, it just covers your future shelter concerns. House value today = rental security into the future. Also you don’t touch the principal til you are really old. Don’t worry there will be less of it as inflation slowly eats it. You will have other investment vehicles to supplement it though. At this point you should either work for money or have a retirement account. That will cover other living expenses e.g. food, leisure, internet, ect.

It is not as risky as overbuying house in the form of a 3bd+ shelter for 1 couple, planning on an illiquid asset like a house to be the main part of ones savings plan, or a reverse mortgage (although it may make sense for some).

Obama is capping student loan debt repayments: http://www.latimes.com/nation/nationnow/la-na-nn-obama-student-loans-20140609-story.html

Heard an economist on the radio tonight, who says this will boost the economy, as young people will have more money to spend, including on houses. Related story: http://www.latimes.com/business/realestate/la-fi-0420-student-debt-house-2-20140420-story.html

Good luck with that one. It affects only 5 million debt holders and for small amounts. If your student debt consumes 10% of your income, you are already in deep sh!t. It also only affects government loans, not others.

The example they gave was a teacher earning $40,000 with a typical loan would “save” about $1,500 a year on repayments. With all due respect, a teacher making $40,000 a year is not the one who will keep the housing prices propped up at this insane level.

Nobody is more of a hawk then me in real eastate ventures, but did you see the MSN article that buyers need to write love letters to sellers to get the house they want?

They even tell buyers what buzz words to use. I pretty much understand the markert is very fragile across the board, millions of sellers just want showings, forget the hearts and flowers, nonsense. Love letters to buy a house in this economny, I have seen it all now.

The only “love letter” that needs to be written to the seller is an offer. Anything more is absurd. This isn’t like adopting a dog from the Humane Society.

Buyer love letters? I’m not groveling to anybody, especially when I AM THE ONE paying them.

People are kooks.

I am just not certain then why OC and San Diego inventories are at a 2 year high and LA county getting there despite dropping sales. Looks like the story you heard was yesterday’s news.

Lottie…When I was in business many a nights I told my wife why is the public so difficult, then I remembered what my father said, “If they don’t buy, we can’t survive”.

No buyer of home needs to write letters to buy a home, if a buyers appreciates the condition you left you left a home after closing then by all means write, but if a buyers agent ask you to beg to get a home, get a new agent pronto.

Are you sure about 1984? Looks more like 1954 to me.

From LAT today, an interactive map showing the foreclosed homes in LA area. Interesting to see that the wealthier the area, the less foreclosures. Click here then scroll down to interactive

http://www.latimes.com/business/la-fi-foreclosure-registry-20140610-story.html

Los Angeles’ 4-year-old foreclosure registry requires banks to pay a fee and list a local property manager for every house they own in the city. The list included 4,300 properties in May. They are in every corner of the city, from Sylmar to San Pedro, Bel-Air to Boyle Heights. But they are concentrated in the same neighborhoods that suffered most during the housing crash: South L.A., the Eastside and parts of the San Fernando Valley.

I think the reason the wealthy areas aren’t on the map might be because they’re incorporated cities. Just guessing.

I noticed the same thing when looking at foreclosure activity in 09. Owners in the wealthier areas were less likely to pull out a bunch of cash and bury themselves in a crappy loan hence there were fewer foreclosures and short sales in those areas.

“Although Los Angeles County property records say U.S. Bank has owned the house since March 2012, bank spokeswoman Teri Charest said it gained access to the house only this spring. The previous owner, she said, had leased the house shortly before it was foreclosed upon, and it took a lengthy eviction process to get the tenants out and the place cleaned up.”

Another typical cub reporter boner.

By law, in most jurisdictions, the foreclosure process kills any tenancy.

The lease is instantly void.

In sum, US Bank was lying to the reporter — and he swallowed it hook line and sinker.

The REAL problem is that US Bank is swamped with REO.

That is all.

The phone lines to no-where are classic ‘tells’ that the institution is stiffing the public.

&&&

My last dealings with US Bank revolved around blatant fraud against my checking account. Upon dialing in, I discovered that their staff was emotionally and physically swamped. Their phones were ringing off the hook with bank customer complaints.

It quickly became apparent that the US Bank ‘system’ had completely broken down — many months earlier. They couldn’t deal with even flamingly obvious bank fraud upon their customers.

Instead, they pinned their loses upon their clients.

My account had been explicitly set up to have no ‘back-up’ credit facility. Overdrafts were to be bounced. (I haven’t had an over draft in my life.)

So, US Bank issues $1,000 jolts to a Western Union money transfer — when the account was deliberately low.

Then US Bank comes dunning yours truly for monies that they had no business advancing in the first place.

They did so because of the fees. US Bank charged massive fees upon my account for the fraudulent withdrawals — by computer — and in a flash.

Obviously, the crooks of America had gotten the word.

So US Bank sat there stunned as wave after wave of fraudulent withdrawals that they enabled hit their accounts.

These beat downs were assessed against their clients.

US Bank failed to initiate any corrective action until timely action was no longer possible.

(Banks operate under Federal regulations so as to shield them from lawsuits for malperformance and bad faith.)

Advice to Americans:

If your bank tells you to wait for a letter in the mail to initiate your claim — you’re being screwed. It won’t come it time.

There isn’t a reason in the world why any bank needs to send you a form by snail mail to report a fraud upon your accounts.

You should immediately draft a letter to your local Federal Reserve Bank branch. (Most of the bills in your wallet will have its name on them. (A through L = 12 branches) The Fed is the governing authority for all of the Big Banks in the nation. (Smaller banks may be regulated at the state level.)

Unlike US Bank, the Federal Reserve Bank is not underfunded for fraud.

It operates like the FBI — but just for its own regulated banks. Its lovefest with Big Bankers explains why they don’t get prosecuted. It’s their primary shield.

“By law, in most jurisdictions, the foreclosure process kills any tenancy.”

The 2009/2010 PTFA changed this. It protects legitimate tenants that have a lease signed prior to the trustee sale.

Perhaps you should give the “cub reporter” and US Bank on this one.

Just going out on a limb here but is it just possible that banks are more reluctant to issue a letter of nonpayment for a 5 million dollar mansion in the hills of Beverly Hills? I think it was a big property owner in Santa Monica that told me the old saying that if you owe the bank $100,000 and can’t pay you are in trouble. If you owe the bank $1,000,000 and can’t pay the bank is in trouble. There is really no data if the bank does not issue a letter of non payment.

http://forms.themls.com/forms/6-8-14_LA_Times_WS_CMYK%20(2).pdf

Interesting that these charts read right to left. I’m sure that doesn’t mean anything. Prices up and sales down totally makes sense.

I wish that I would have had someone that I trusted tell me when I was younger the following rule. If it is cheaper to rent then rent, if it is cheaper to buy then buy. Each time I violated this rule I either left money on the table or I lost a lot of money. Pretty simple, but pretty effective.

After months of searching & bidding (Nov 2013-March 2014) in San gabriel Valley area (North Alhambra, North San Gabriel, Temple City), we see that prices are insanely rising, even on properties we think are in unlivable conditions. So, we stopped. We decided to rent a SFR in Temple City for $2,300/month. Th cost to own this place would be $3,600/month after 20% down. It’s move-in condition, wood floor, 3 bedrooms with a master bedroom, 1 den, 1 living room, 1 family room, attached garage, walking distance to Ralph’s, Rite-Aid, bank, & others. We plan to re-consider buying again after 1 year. We have 800+ credit scores, > 200k income (but I plan to work part time in the future to raise our 2 children so we applied mortgage under 1 income which is 130k/year), 150k savings so we don’t want to settle for a crapbox. We hope we’re making the right decision this time as we rushed to buy in 2007 (now it’s a rental with slighly negative cash flow). Anyways, this housing market is crazy & unpredictable!

This just in! The grass isn’t always greener on the other side and there’s no free ride. Applicable to both rent vs buy and SoCal vs the rest of the world.

“like a giant ship, housing markets turn at very slow speeds.” Not if you hit an iceberg, then there can be a violent shudder and stop, dead in the water. Titanic appears to have been able to get the rudder full over from center in 5-7 seconds. At the hearings, the White Star Line and surviving crew were perfectly happy with all the speculation that the ship was under ruddered and unmaneuverable. This speculation, that continues to this day, just hides the fact that the crew just couldn’t see even large objects and the margin for safety at their speed wasn’t there under the conditions of that night. Despite the clear conditions, a reduction in speed was warranted due to the extraordinary darkness.

That is the problem in the housing market. We can’t see very far out, so we need to slow down. It was the stupid crew’s fault, not mine. I gave the orders, but due to drink on the part of unnamed individuals, the ship did not slow down in the darkness. It is like diving an automobile in the fog at excessive speed.

But these are foreign icebergs loaded with money, so full steam ahead because this ocean is different and familiar waters will never be reached again.

/sarc

Captain,

I think the real question is when did the captain, crew and passengers realize something was amiss. I would assume that certain crew members knew before impact that there was trouble brewing. I would also guess that the captain was alerted of the impending danger but may have had little insight to the severity of the ship’s condition. Did the passengers realize that they had hit an iceberg or did they think that everything was normal? I am sure there was a period of confusion for the passengers prior to the abandon ship command.

I wonder if the steel manufactures realized at the time that they were creating sub par steel. Did the ship designers realize that the riveting technology was flawed? Did the cruise line realize that the speed and course was risky? So many unanswered questions…

Even with Mello Roos, Eastlake southeast San Diego is a freakin steal. Beautiful homes, infrastructure, great schools and easy access to toll road for easy commute to most prime areas, all for under $600k. Just sayin, people are looking in all the wrong places and looking at the wrong things. Albeit, it helps to buy with all cash and bypass the criminal mortgage banksters. If you can’t afford it, reduce your expectations and compromise a little. Life sucks, but you gotta roll with the punches and make the best of it.

http://youtu.be/8rh6qqsmxNs here is the link to George Carlin’s stupid people. I also recommend searching YouTube for George Carlin it’s all bullshit and it’s all bad for ya.

How I Beat The System:

In California no less…

I’m a retired nurse but didn’t want to do that heavy lifting kind of work anymore, nor did I want to be on my feet for 12 hour shifts. After 50+ years in upstate NY I finally watched the Weather Channel with more than passing interest in my own snowy and/or thunderstormy situation, and realized there were places in the US with stellar weather year round, especially considering what I was ‘used’ to.

I gathered my few belongings up after giving most of them away, moved to the nicest place I could think of (Soquel near Santa Cruz, nicer than Malibu!) and took a job as an ‘overnight’ aide to a lovely nearly blind lady. She needs help getting ready for bed and with her meds and sometimes an evening snack, we have a nice talk and often go out for an ice cream or just a drive (she always buys the snacks and the employer pays the mileage) and then I tuck her in. I take my shower real quick before it’s lights out for the night.

I’m technically on call if she should need anything but usually she sleeps right through. In the morning when she gets up, there’s usually only a few minutes, if that, before the day aide comes in so there’s no cooking involved on that end, either. I really didn’t want to do kitchen duty…. Basically, I’m getting paid to sleep 🙂

There’s plenty of these jobs available, as the WWII generation ages, they are begging for aides willing to do this kind of work but because the pay is minimal, finding aides is difficult in expensive housing markets.

So, I *could* stay there during the day because this particular job includes ‘room and board’ but instead I rented a very small 120 SF office in a delightful location not far from the beach, several nice restaurants, the library and all sorts of other stuff. Not too awful far from SF if want to deal with that. I have a desk (so I look like I belong there), a sofa that I can nap on, access to a restroom and parking, and I’m good. Oh, and internet access and some nifty people in the other offices to talk to. Every day I meet new people and I’m free during the day and all weekend to socialize.

Total cost for the office: $600 a month and they’re making out like bandits on me because I don’t use the receptionist’s time, or the printer, or the fax, and very little electricity. Since I’m not ‘sleeping’ there, I’m not breaking any laws, and I don’t have to worry about my car overnight, either. If for some reason this job ended, I could probably live in the office for a bit until I found something else like it, I don’t think anyone would notice. Showers are about the only missing link and that’s easily fixed at the local gym for $39 a month.

With the money I make from being an aide, I’m clearing about 2K a month in savings and I’m living in Paradise, or close to it.

What I cannot understand about California is ALL the offices for rent, for cheap (they’re begging for tenants) and meanwhile, the housing is ridiculous. Meanwhile, as you rightly point out here, people are paying a non-small fortune to store their sofas while they’re gone all day paying for the matchstick places.

Houses are a terrible investment as of today. As a 35 year old, I have started to regularly put my money in physical gold and silver and wait for another +30 years while switching the stack depending on the gold/silver ratio. Only a fool can believe that with that time period in sight, gold and silver will not be significantly higher than it currently is. Gold and silver have always moved up if you invest long term. And we are not even talking about the fact that the government can’t tax it as they can with your retirement money, can’t practically confiscate it (good look with that!) or otherwise deprive you of your hard earned money.

Leave a Reply