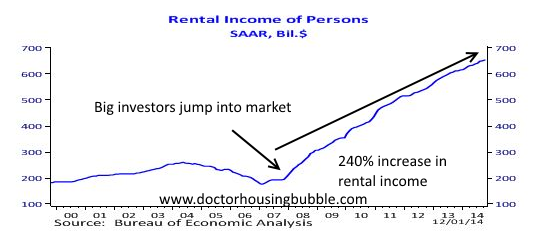

Let the serfs pay their rent: Rental income held steady from 2000 to 2007 but has now risen a whopping 240 percent since the Great Recession hit.

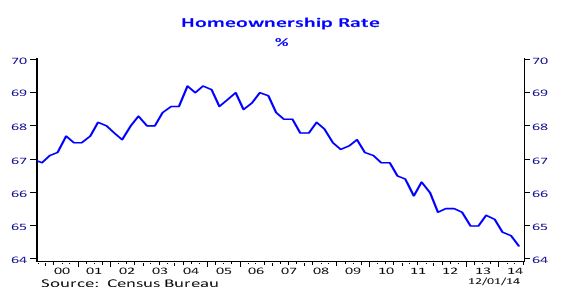

Being a landlord is no easy task. In the long run owning a rental property can be a nice addition to your investment portfolio but there is nothing sexy about it. Many small time landlords only start to see the benefits many years into holding the property. For the most part, this is why Wall Street and large hedge funds have avoided owning single family homes in their portfolios. That of course changed in 2007 when the market went into full on implosion mode and the mantra of the day was “chase yield anywhere you can find it.†There is this odd notion that somehow all the great deals went to other families that timed the market perfectly. The excellent deals of 2008 to 2011 were happening at a time when the economy was in crisis mode. Some of the best deals to be had were done via auctions and you needed to have a cashier’s check to play so many regular people had no access to this. 7 million foreclosures and many of these are now in the hands of investors. The homeownership rate is a clear indication of this. It should also be no surprise that we’ve added 7 million renting households. How big of a change have we seen? Rental income which held steady between 2000 and 2007 at roughly $200 billion per year is now up 240 percent coming in at $640 billion. Since few people actually own rentals, this is money flowing into a concentrated group.

Send those rent checks in

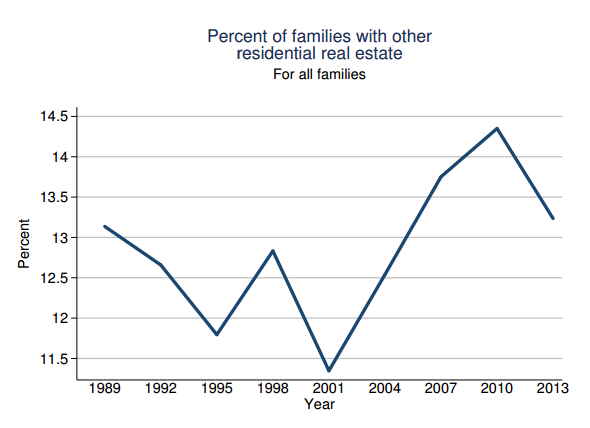

How many people in the US actually own rental property? The figures are hard to get but the number is very low. The Fed does an extensive survey on consumer finances and found that in 2013, roughly 13 percent of families had another property outside of their primary residence compared to nearly 50 percent that have some money in retirement funds. Keep in mind however, that this number includes vacation homes so these are not all rentals.

First let us look at the number of households with other real estate besides their own property:

Source: Fed Survey of Consumer Finances

This is interesting that the number has pulled back in recent years for families given the massive number of investor buying. What this tells us is big groups were the large beneficiaries of the recent rental buying boom.

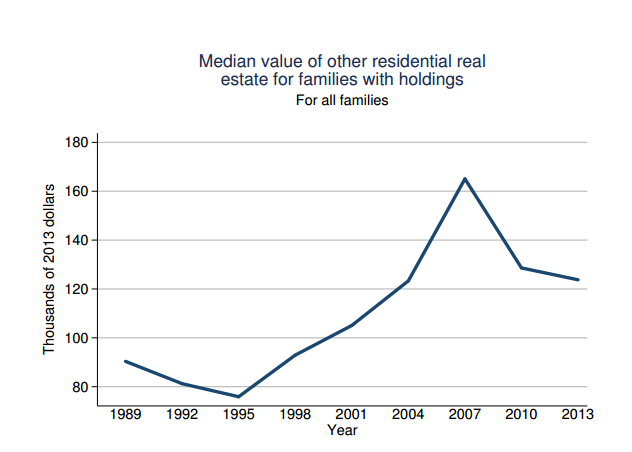

If you think families are owning incredibly expensive second homes think again. Take a look at the median value of those other pieces of real estate:

According to the survey the median value of these other pieces of real estate is close to $120,000. Certainly not your $700,000 crap shack in California. What we can also derive is that much of the recent buying is going to groups that are new to the single family game. Given constrained inventory, any marginal buyer (in this case large investors) easily pushed prices higher.

Look at it this way. From 2000 to 2007 we had the largest boom and bust in US real estate that we have ever known. You would think that many would have been diving in to buy investment properties for rents yet somehow, rental income held steady throughout this period. Most were using the easy access to debt to over leverage and buy more home than they could afford and used their homes like ATMs. Many others were aspiring flippers in it for the short game. The figures back this up. What we then see in 2008 is big money and investors that live and eat spreadsheets coming in strictly for rental income. The below chart couldn’t be any clearer:

Source: NAR, BEA

Rental income is up a whopping 240 percent from 2007. And the vast bulk of spoils are going to Wall Street and large investment funds. Rents are now up across the United States while incomes are stagnant. Simply more income is going to housing in either rents or higher mortgage payments. This is also why the homeownership rate has gone this way since the bust happened:

Follow the money carefully. If you do, you will see that big money is pulling back from real estate. The nation is largely becoming one of renters and the big juicy gains are going to recent landlords. This is also a reason why the market has stalled out in 2014 as investors have pulled back since current prices simply do not make sense for investment properties. There is much speculative thought in the market today. The number of people saying that they wished they would have bought smells of 2006 and 2007. If you are in it for the true long run and not some quick turnover property ladder enthusiast, then buying today assuming your income can support it should not be an issue. 30 years of inflation will eat a lot of things away. But is it a good investment? You have to factor in opportunity costs, additional outflows for owning versus renting, and ultimately your lifestyle choices. For many, buying today would seriously put a vice grip on your monthly budget. And what you are able to buy is one step above junk.

The fact that we’ve added so many more renting households is a trend that is not going away. Younger households are largely cash strapped and this has put a dent into the first time home buyer market. The good news though is that more rental income is going to larger landlords. The wonderful benefits of the bailouts, QE policy, circumventing regular accounting standards, and artificially controlling the market.

But you are itching to blow your money. So let me help you by pointing you the way to a place in Pasadena:

541 Sierra Madre Villa Ave, Pasadena, CA 91107

3 beds, 2 baths, 1,521 square feet

I love it! More deferred maintenance on the grass and trash cans in the photo. I love that the ad tells us to “fix and save!†as if we are getting the deal of a lifetime. The ad might as well say “hey sucker, we won’t even spend a few thousand bucks to get the lawn up to speed or try to take a good photo. The market is so hot, we can set the trash cans on fire and we would still get offers.†This place last sold in 1994 for $165,000. Today it is listed for $575,000. Here is the street view of the home:

Good idea to have a home directly on a major street especially if you are planning on having a family? Not if you are paying close to $600,000. Then again, this is SoCal so have at it folks!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “Let the serfs pay their rent: Rental income held steady from 2000 to 2007 but has now risen a whopping 240 percent since the Great Recession hit.”

Do we think that big investors will be pulling out of their rental properties anytime soon? Or will they hold them forever?

These properties were purchased at a 30% discount from the peak of bubble 1.0. They have no reason to sell. However, once interest rates rise to 2003 levels or higher, prices will adjust below that 30% mark. Prices will eventually land at a 50% discount level from bubble 1.0 levels.

1st time homebuyers are avoiding the Option ARMs that fueled the first bubble, hence their low participation rates. Investors and 1st buyers won’t be there to continue this artificially propped up market.

This statistic can be very misleading. First, that rent is likely replacing mortgage payments and since the new landlord class (REITs, specuvestors and come-lately-knife-catchers) is leveraged to the hilt all they are doing is skimming off of money that is going to the financial sector either way.

Now as far as the landlords holding properties the above macro statistic has nothing to do with the micro numbers of under performing properties. The people running the con, REITs and flippers have already made their money. Now can the cap rates for these properties as currently financed hold in the face of lower wages and demographic upheaval? I SERIOUSLY doubt it.

For SoCal the real prime (1%er) areas will hold for the most part as the worldwide sea of liquidity continues to enrich. Suburbs and especially the inland areas are going down hard. There is not a single mathematical way to keep the ponzi going except for MAJOR wage inflation. I’m talking a $15 an hour minimum wage and everyone else scaling up accordingly. That’s not happening over the next 2 years. The bust is about to pick up momentum…

Bought a used car off a woman about 6 months ago. I was telling her I used to live in San Diego, she said she loved it there and owned a condo in Carlsbad. She’s from NY. I said “Carlsbad, you lived there?”. Nope, she just visited, liked the place and bought a condo. She said she was just breaking even.

Yeah, I got a deal on the condo. Weak hands become strong hands.

“The people running the con, REITs and flippers have already made their money.”

Congrats on being one of the few here that actually gets it. Most here make misguided statements like “these investors won’t sell if prices fall” or “interest rates need to go up before these investors will sell”. Neither is required. The only requirement is net redemptions. The reason for net redeptions is irrelevant. Assuming that the vast majority of these REIT’s are directly or indirectly held by pension funds and 401k’s, I think there are many scenarios during flat price appreciation and ZIRP that you could see net redeptions in the near future. You don’t have to be a rocket scientist to figure that out. The only real question is does the flavor of the week QE sop up these REITS’s to stop the bleeding. We are in a time where there is no market just central bank policy and all eyes are on the fed not the underlying market fundamentals…

In the latest run-up, people have been buying real estate for the same reason they’ve always bought it: to make money. It was the wrong reason to buy. The 2008 crisis should have stoked fear that the quantity of paper claims on wealth far exceeds real tangible assets. The correct reason to buy was to lose as little money as possible.

As the growth of money and credit continues to outpace the growth of real tangible assets exponentially, it becomes increasingly flawed to think in terms of returns on your investment. At some point, people will start buying assets trying to calculate how small of a loss they can get away with.

In many places, it is possible to buy an investment property with 20% down using a conventional mortgage and have the tenant pay off the debt. Banks allow investors to obtain up to four such loans, so a handful of investors with well-paying jobs can make up for a majority with bad credit who can pay rent, but are unable to buy themselves. This window of opportunity is sure to close, and I’d be surprised if it’s still possible in 5-10 years.

Good posts NZ and What.

I’m just re-reading some of Doc’s entries from this year and last. He has wisdom.

Depends on the Return on Equity percentages … when the returns are lower than safer alternative investments then you might see the true investors start selling them off. Same calculations we used when my SFR investors started selling everything off back in 2005.

As Dr. HB points out… the big (true) investors have backed off of purchasing SFR properties for rental properties in 2014 because the cash on cash returns are no longer as lucrative as they were back in 2010 / 2011.

It’s really not rocket science.. some simple calculations determine if it’s a good time to buy for investment or to sell. Everything else is speculation..

http://www.rentalprotectionagency.com/rental-statistics.php

# of LANDLORDS in USA

22,368,028

The current rental clock for the United States as of DEC 4,2014 | 03:45 EST

# of RENTERS in USA

108,854,307

great post landlord

more demographics: 30-39 aka first time homebuyer cohort just started its reexpansion after being flat @ ~40m between 2006-late 2011. 20-29 growing until 2018 as well

california aggregate @ 43.09%

25-34 @ 27.9% renting from your post

35-44 @ 22.7%

30-39 ~ 10m renters, left or right

expecting to add another 5m between 30-39 between now and 2018 and another 5m between 20-29

any wonder why apartments are being built with the quickness?

without historical data can’t really tell what this means

but quick anecdote: all my friends under 30 who have been saying they’d never have kids after the 08 crash are now all having babies and looking for housing

say what you want about renting vs buying now, but people change

moreso when the pressure is biological

In a normal(non-manipulated) market, oil prices crashing from $100 to $65 would cause serious deflation in other markets as well. We have not seen that, anywhere else. Housing, stocks should be down if the oil crash itself is not manipulated. Who knows nowadays. Amgen laying of 3000(Nov 14′ to Apr 15′) people in the Thousand Oaks area hasn’t affected the housing market as far as i can see. There will be serious deflation first then the printing presses will go wild as Fed’s #1 enemy is deflation. But like i said before, have been wrong on my predictions for the last 5 years.

@shabfu as a lifelong resident of LA and some of that lifetime living in Thousand Oaks, the Amgen layoff of 3000 people seems like a blip on the radar screen. Figure half those people will find another job within commute distance and the other half of those people live within a 25 mile radius (could be 50 mile radius) then only a small percent of people will be living in Thousand Oaks. Did all the major aerospace layoffs in LA over the past 30 years ever show up as spikes in homes for sale and downward pressure in homeprices…? I doubt it.

@QE: I have a lot of friends that work at Amgen. They are saying that the atmosphere is not good. People are looking to get out of there. THere isn’t a big pharma replacement near TO that i know of. Baxter isn’t that big to take any significant workers. Couple of my friends are looking up North(SJ and SF). I believe a majority of these laid-ff workers will have to move out of the area to get another job, so that means either selling or renting out their current homes.

During the early 90s, we had a lot of aerospace move out of state due to the “peace dividend,” and that was correlated with the post 1989 housing recovery, but I can’t say there was a causal relationship. Manufacturing will likely continue to move out, but the engineers have other options locally. E.g., my company moved some manfacturing to Georgia and Texas, and it’s relatively easy to find local electronic techs in those states, but when a chunk of engineering moved to Arizona in the 90s, a noticeable fraction of engineers found other local jobs in aerospace and non-aerospace companies. For us in radar hardware and software (R&D), there’s a lot of spillover with wireless companies, and software people trickle out to general application software companies and Google.

However, young families who want to live on a single income either move out of state, jump to higher-paid tech jobs or move to the Inland Empire. I can afford my small house near the beach with my single income, but I have no children and bought the house during the five minutes in 2011 when prices were affordable.

At this point, the remaining aerospace engineering talent is somewhat sticky — they’ve survived many rounds of downsizing and refuse to leave the LA area, which by itself could be overcome (with some attendant attrition), but key engineering managers refuse to leave the area as well, and (I’m speculating that) the companies need to keep enough of a presence in CA to keep some influence on Washington politics.

I want to add that these are just my observations and opinions. Re-reading the “young families” comment sounded a bit like I was talking about an entire cohort, when it was actually regarding several coworkers of mine who moved to other states for that specific reason, and they agonized over it and discussed it for quite a bit of time before they left.

Biotech/Pharma is a tough business – layoff and mergers constantly. It’s hard to join startups as they usually just hire friends and people they went to grad school with. Jumping to a different company is really hard.

Some people think that houses on a busy street are less likely to burglarized. Burglars prefer quiet streets, where there are fewer prying eyes.

So being on a (somewhat) busy street has benefits as well as drawbacks.

“I’ve heard good things about the Pearl District and the Northwest of Portland.”

Son of L., QZ

What do you think about Beaverton?

I’ve never been to Beaverton. I’ve only once been to Portland, so I’m not the one to advise on it.

It was in July of 2006. I was surprised how hot it was. Well into the 80s. Not what I expected from the NW, even in the summer.

I was impressed by Portland’s mass transit system. I took the train from the airport to my hotel. It was real cheap, quick, and convenient.

Beaverton is the burbs. Carbon-copy strip malls. Flat. A tangle of poorly-planned traffic congested sprawl. Decent schools. None of the culture of the Pearl, Alphabet or various distinct neighborhoods of the funky inner NE.

Depends on what you’re looking for. Trying to recreate the SoCal living experience will be challenging.

Beaverton could be a poor man’s rainy copy of some CA burbs… reminds me most of areas of Walnut Creek, Fairfield, even Sac.

The commute to/from Beav is crappy. I wouldn’t live there unless you work nearby.

Personally I like the Forest Park/Sylvan H neighborhoods (NW Heights, Cedar Mill, Bethany) for lifestyle and proximity to downtown, but prices are a bit aspirational even by CA standards.

If anyone in your family has mold, grass or pollen allergies, I’d seriously reconsider moving to Portland, or Oregon in general.

Little discussed fact that the Oregon Coast is full of people who moved coastal because they could not handle their allergy symptoms while living inland. This is especially true of the Willamette Valley (“the grass sees capital of the world”) but Portland is not immune.

If you have any adverse health effects from the air quality in California’s Central Valley, or notice any mold allergy-related health effects during rainy season in CA, you may have compounded problems living in any close proximity to Oregon’s Willamette Valley.

People may joke about the high depression and suicide rates in the NW, but it was the poor air quality in Oregon/Washington that caused my family to relocate back to the bubbleland of coastal SoCal.

The pearl district is way way over priced. In addition, you need to read and understand Portland property tax. A 600k condo in pearl could have an annual tax of 7k while an identical condo built in 1996 could have a property tax of 3500.00

The reason being property values, for property tax purposes, were rolled back to 1996 assessments plus a 3 percent annual increase. For properties built after 1996, property taxes are the first sale plus an annual 3percent.

Example. Condo 1 built in 1990 is assessed at 1996 price of 175k plus 3 percent increase annually Condo 2 built in 2005 is assessed at its FIRST sale at say 600k plus 3 percent annually. Same scenario for single family.

Unlike california, a sale does not trigger a reassessment. BUT, if you do more than 10k of work per year in remodeling (not maintenance) you will trigger a reassessment.

Example…..A flipper picks up a house for 200 k and sells it for 500k, that triggers it. A homebuyer buys. 200k house and slowly improves it over the years, no new assessment is triggered.

Sounds fun doesn’t it?

Flyover, as others have mentioned, Beaverton is suburbia, which may or may not interest you. As one last ditch effort to stay in California near our friends and family, we moved from the Cahuenga Pass hills to Northridge a year ago. It was an experiment to see whether we could live in such a place, since the schools are good, and you get a lot more house, but the suburban vibe and intense heat aren’t for us, so we’re packing up and heading to Portland.

Of course, keep in mind that we prefer days colder than 60 degrees, like rain, I run my business from home, and we’re former musicians, so we may be unusual in our interests. We used to rent a bungalow in the Fairfax district off Melrose before we had our son, and, although Melrose isn’t exactly great, we loved being in a walkable neighborhood. Most of the close in neighborhoods in the NE and SE parts of Portland will allow for a similar (actually better) situation, and the homes are a fraction of the cost, although not exactly cheap compared to other parts of the country.

If I wanted to go cheap, I’d move to the Meridian Kessler neighborhood of Indianapolis (I grew up in Indiana.) That is among the most beautiful neighborhoods in Indy, and you wouldn’t believe the prices of amazing, large tudor homes from the ’30s. Indiana is just a little too far from our families in California, and, compared to Portland, Indy has real weather. So, after years of debate, Portland was our financial compromise, and we love the city.

I HATE PORTLAND. I’ve posted several times about my Portland experiences. I lived there 5 years and it was during the 5th winter, 2010, that I began to think about whether life was worth living. The sun hadn’t shined for 6 straight weeks. The landscape drained of color. The constant drizzle. I lived at 33rd and Broadway. Everything shuts down early except the breweries. Highest suicide rate in America, greatest % of people on meds, a large “creative” class with degrees in Russian studies and the like. Many living on student loans — professional students. Greatest number of strip clubs per capita in America, child sex trafficking capital, meth is a BIG problem. Hillsboro is boring and very suburban. I have lived many places — Portland defeated me. Finally, people are closed down. They are not open. Maybe the rain shuts people down psychologically. It was a blue color town. LA is very entrepreneurial. People are open. I pay a premium to live here no doubt BUT I discovered there is more to life than the size of the house and the price I paid. People there are pretentious in their sustainability and so called “open mindedness”. The city is 97% white. They are racially tolerant only in theory. If your hard working you’ll get tired of car bumpers putting down people who work and believe in capitalism. I could go on.

Portland IS the best city I ever lived in. I lived there for 30 years, love it, miss it…….but sadly can’t handle the weather, some can, I couldn’t any longer.

It is true…I wouldn’t be caught dead in Beaverton or Hillsboro, mainly because they all watch FOX news.

I think this is just illustrating how diverse we all are on this blog. I’m in my mid 30s, I make six figures owning a business, I’m fiscally moderate, and I have a wife and child, but I’m socially liberal, have long hair and tattoos, and I plan on spending my free time playing/watching music and being involved in the arts. If I could pick one place to live in LA, it would be Silver Lake. If I could pick any city in the country to live in, it would be Portland. In fact, that’s what I did, because we can leave LA and live just about anywhere in the US, outside of maybe the Bay Area and NYC, and Portland is what we chose.

If you like spending time at the beach (I spend zero,) you like weather over 75 degrees (I can’t stand it,) you hate rain (I love it,) and you’re put off by hipsters, Portland is probably not the place for you. Many of my good friends live there and love it, but it’s not everyone’s cup of tea. The fact that so many people find the above things attractive is a good thing, to me, because I hope it keeps more people from moving to Portland, but it doesn’t seem to be working, because the unemployment rate has improved, and people seem to be moving there in droves, just like we are.

Moving trucks come in 3 weeks. I can’t wait.

I agree with most of you about the weather in Seattle and Portland. I used to live for many years in Seattle, till I decided to move to Walla Walla. Sunny place, very dry, no traffic and I enjoy it.

Between Portland and Seattle, I like Seattle much more. It is a very wealthy, nice and civilized city, but I could not stand the rain and the traffic.

Agree, Seattle is like a grown up Portland, has much more going on but if you think L A has traffic problems, Seattle is right there.

Been to Walla Walla too. In fact there are many nice towns in eastern Oregon and Washington to choose from that are pretty great.

I would venture to guess that most people don’t have a clue that most of Oregon and Washington are high desert and have an abundance of sunshine.

One day my wife and I drove the almost the while state — from Portland to Ashland to Bend looking for sun. That’s crazy man. We never found it. Yeah, Eastern Oregon gets sun and bitter cold temps. There is no putting a propaganda spin on it — Oregon ain’t no Uptopia. And Portland is the whitest most medicated city in America.

Portland, Ore.

Overall rank: 1*

Depression rank: 1

Suicide rank: 12

Crime (property and violent) rank: 24

Divorce rate rank: 4

Cloudy days: 222

Unemployment rate (December 2008): 7.8%

http://images.businessweek.com/ss/09/02/0226_miserable_cities/2.htm

You forgot to mention that Porkland, is also number one in the other white meat, fat women. If you are interested in women, don’t leave SoCal for Porkland.

Man, I can’t imagine driving around to look for the sun. I came to LA 15 years ago for music, not the sun or beach. Now that music is no longer part of my career, there isn’t much I like about LA. The Bay Area is the only tempting place in California, for me, but I’m priced out. If we like living here in LA, we’d probably keep dealing with the insane housing price situations, since our family is here, but we’ve finally moved on.

I’m in northern Calif. sold my last place in early 2007, got out before the crash and did well as I’d bought in 1997. Tried to buy again in 2011/2012 and it was hopeless, all my bids (about 8, all at full price or slightly more) were ignored as I could not compete w/ 100% cash flippers and specuvestors…had lotsa cash for a down payment and a preapproved loan but that did me no good at all, gave up after a year of wasted time and disappointments. At that time the places I bid on were all about $250K, about 10 years rent…similar houses are now about $400K and buying makes no sense to me, fortunately am living in a rental I like and paying a reasonable price.

May try again after Bubble 2.0 pops but have zero interest in buying currently…

Come on up to Humboldt County, God’s country. The real estate is reasonable here. I am a farm advisor to some of the Google folks who got into farming in the Emerald Triangle. We have a much slower pace of life than The City.

There are no jobs in Humboldt County. Maybe if California legalizes marijuana in 2016…

It also rains. A lot.

Low wages. Humboldt county consistently makes the lists for poorest county in CA.

Meth. Suicide. Bath salts. Heroin. Humboldt has extremely high drug-related deaths and deaths per capita compared to the rest of CA.

And for people used to living in SoCal or the Bay, there are minimal shopping, entertainment, and culture options, so quality of life measured by these standards would be quite diminished.

Doesn’t sound like God’s country to me. I’ve met a lot of people that have lived in Humboldt county and they all say the best thing about it was leaving.

Seattle, I would not talk if I were you. Seattle has many social problems. It is a large city. Humboldt county may have the same social problems(losers wherever they live have problems), but we have the solitude, where one can go into deep thought about all types of religious and philosophical things. Truly God’s country. The losers should leave. In the Emerald Triangle, we have good farm land, unlike Washington, unless you like apples. I see very little “drug” use here when we grow the finest plants. We produce the largest agricultural cash crop in the state. How much does your apple farmers produce? Don’t put down the Google people. With the internet, they can do some of their finest work here. The whole NW is for losers, according to Forest Lady(she lives in the Santa Cruz mts, off 17, most of the time, sometimes I go there too, I have a spread in Los Gatos).

“we have good farm land, unlike Washington”

Farmer, you don’t know what you are talking about. Washington doesn’t grow just apples. It grows everything. Just google it. Agriculture in E. Washington gets billions in profits year after year and it is not just apples.

For wheat on Palouse valley they get the highest yield in the world/acre. It can not get any better than this, and that with dry farming. There is a reason why there so many millionaires in Walla Walla and the whole Palouse Valley. Hint: they didn’t make their money in stocks. What about all the vineyards and wineries (over 140 in a small town)? Do you thinks they plant vineyards in boulders?

FWIW an interesting Humboldt county RE listing I happened to see today on CL Sonoma Co…..not what I want but but a truly a one of a kind property…very cool address too, 11 Crab ST 😉

http://sfbay.craigslist.org/nby/reb/4791592481.html

I’m Thankful that I’m not a debt slave nor a wage slave and that I have plenty of free time

Same with me. Ain’t got much money, but I got a lot of free time.

And in the meantime, the super-wealthy chinese are buying up parts of CA:

http://www.latimes.com/entertainment/arts/la-et-cm-arcadia-immigration-architecture-20140511-story.html#page=1

BTW, the “super-wealthy” comment holds true for Europeans, Asians, and others as well. The middle class in America is getting priced out fast. Sigh.

In the Denver area new homes are going up everywhere and selling quickly, while existing homes are brisk as well. There is a nice 55+ community near me with beautiful ranch homes … 3000 sq ft, all the upgrades for the mid $500k. While I think that is nuts, I can only assume that the people buying these are ex-Californians who sold their home there to rich foreigners or suckers, are paying cash here, and still pocketing a nice pot of cash!

Prediction for 2015:

As I said back in late Summer 2015 will see our first interest hike. Labor force picking up, relax loan lending practices will take full hold in Jan, short sale sellers can buy a home after Jan 2nd. A very flat 2014 will see buyers in more of a hurry to beat the rate hike and increase pressure from more buyers entering the market in early to mid 2015.

I don’t think sellers will raise house prices very much if at all based on most had a huge scare in 2014 with little to no showings. They will be anxious to sell and move on to there next venture. Rentals will decrease in price which is good news for renters, especially the new projects will offer incentives to rent.

The West, SouthWest, SouthEast will be enjoying the fruits of buyers coming back in. NorthWest will be favored over the Rockies, energy concerns will be a real issue for the Northern and Central Rockies. MidWest will be a must escape from and competition will lead to price reduction so I see that area as fair to poor in 2015.

The East because of continue high taxes but wih wages going up is a tougher call. I believe Euro money coming in will slow down, I see thab region as very iffy in the upturn in housing and rent, flat to very slight increase in sales and rentals.

Mid-East ( rust belt) not good again, very few want to move there even if wages increase, most want to get out but they can’t get enough money from sale of homes to keep out with inflation of buying thus this region really dead again.

Deep South as always, lots of nothing really happening, housing will be same old same old, make very little on the sale and buyers have no interest in over paying for that region.

A note on The Great State of Texas, which I will separate from the SouthWest. Look for problems, energy will mean Houston suffers, Austin had its run and will be a housing problem, Dallas will be in a little better shape but not robust, San Antiono will be the best of the lot. PanHandle not good.

Ca. Will continue to see Asian money pour in, rentals will have to stay strong because any uptick in housing will see the country’s most increase in house prices as it always does. Silicon Valley to be very good to strong, San Fran and North not as strong but holding and not slipping. Central Ca. Very weak.

LA including all of LA county good to very good both housing and rental. San Diego county fair to good, Orange county early 2015 down, mid year to end year up housing down in rentals. Inland Empire most part holding steady but house price increase to be small to flat, good rental incentives for the area.

I generally agree with your predictions. Rentals will be strong because the landlords knows more jobs are coming. A couple of brutal winters in the east will send some people to the west looking for sunny CA. If you look at craigslists, the subletting business is booming many people from the east are seeking rentals in CA, though most only want to live near the beach. Rental will stay flats next year if credit get loosen up and more people could buy which should keep housing stable. I see 5% increase next year for OC maybe more for a short time when people try to beat rate hike but I don’t see rake hike coming anytime until end of 2015 or early 2016 or even at all. The only time rates will rise if people dump treasuries due to risks. The FED is stuck with low rates almost forever due to the current national debt situation. Most of the US debt is in shorter dated treasuries 10y or less so if the FED raised short term rates than it will be more expensive for the govt to issue new debts and the stock market will take a shock as well from the hike as they will almost the buybacks and fund new ventures. Everybody is addicted to cheap money. It will be a reckoning when it no longer cheap.

I don’t know how much higher rents can realistically go. My SO and I are finally rebuilding our lives after the recession and have higher-paying careers now. Rents seriously take up at least 40% of our net. We hardly have much left after food, transportation, insurance and utilities. We don’t live in prime areas, basically we’ve been living on the edge of a ghetto for the last 3 years, gunshots galore. If our rent went up anymore, we’d have to move into the ghetto. We can’t save enough for a DP on a house, and even if we could, the thought of homeowners insurance, maintenance, upkeep, and possible HOA fees scares the hell out of us. We never know when our cars are going to break down. The harder thing is that we’re never sure if our current job are going to last long-term so we can’t plan for the future. We are in our 30’s.

LAer, after reading your post I only have one question for you, “Why the hell are you still in here?” Unless you have absolutely unbreakable family ties here, there are many better alternatives for those who can’t afford to live in LA. If you seriously hear gunshots all the time, it’s time to pack up and go. Living in this city hasn’t been cheap in decades and the affordability gap between LA and most of the rest of the country keeps growing.

What is your game plan regarding housing? If you are hoping for the giant tank so you can buy on cheap…I would recommend you rethink your plan. As we witnessed the last go around, the big money gets the deals with housing. The rest of the ham and eggers will be fighting for scraps like buzzards late to the kill.

Personally, I think California real estate is a game of smoke and mirrors. I sold a house recently there that had the WOW factor … ocean view, large lot, great neighborhood. I was overjoyed at the bidding war over the property. After the sale, I found an appraisal done in 2000 on the house. If I apply a constant modest rate of inflation on that appraisal amount, it shows that the home only appreciated a bit over 1% per year over the last 14 years. I believe if I go back to the last boom, the late 80’s, I would be even more dismayed, because the market has crashed and risen 3 times since then. If you add the increase in taxes over time, the increase in utility bills, and the rising costs of maintenance, likely you would have a negative return.

We used to own 2 rentals but serious damage by the tenant to one unit curbed our enthusiasm a bit. When our city council started talking more and more about rent controls in our area we dumped both houses.

When it comes to generating revenue/income with money saved, most people have only two primary options as far as I am aware: 1) securities (stocks/bonds) or 2) real estate (rentals). Stocks are a total gamble currently and bonds don’t pay much. That leaves real estate, at least until the stock market crashes again and you can buy in at a reasonable price (I would probably only buy S&P 500).

I only have one rental property, but so far so good (it’s been 1.5 years so far). I charge below market rent, and only accepted tenants with good credit. Bad things can still happen obviously, but I think you can mitigate risk by careful tenant screening and not being greedy with the price of rent (you take care of tenants, tenants take care of you). I know other landlords that take the same approach, and do ok, too.

I am forever having debates with people who refuse to accept that planning and zoning causes increases in land and housing prices and volatility. One of their first arguments every time is this. “If supply of property was a factor, then rents would go up as fast as prices”.

This is nonsense because people’s ability to pay rent is in practice, constrained by what they can pay here and now out of their income. Landlords cannot “follow the house prices upwards”. House prices are affected by people’s ability to save money (and get assistance from family and other connections) and to borrow money.

The ease of credit actually makes surprisingly little difference – even in markets like South Korea, or many developing countries, where there is very tough credit and people pay cash for most of the purchase price of a home, house price median multiples can be well over 10 – worse than anything that happened in California.

It is the system of urban housing supply that determines who will be included and excluded in actual ownership of homes; and even the prices paid. Credit merely determines what proportion of this will be paid for by saving and what proportion by borrowing.

The property rentier/speculator class are in many cases taking up some slack in the “housing” of people excluded from ownership, by continuing to rent out properties at an operating LOSS because they are chasing capital gains. But obviously in some countries, the main outcome is informal slum housing. A lot depends on how developed the nation is, whether it has had a phase of strong increase in democratisation of home ownership in the past – always the result of suburban automobile-based growth – and is now returning to Victorian-era conditions of rentier versus serf; or whether it is a still-developing nation that has never known anything else.

If the problem of urban land rent is not resolved, and the formal housing market is left by default with “responsibility to solve the problem”, the outcome is always increased crowding and worsening conditions of housing for people of the lowest income groups. The infamous dumbells tenements of the Victorian era were a perfectly logical scientific outcome. In so far as regulations prevent the actual formal provision of “affordable” housing, there will be spillovers into “informal” housing.

Here is Hong Kong’s “formal” solution, they are quite strict about “informal” solutions:

http://www.dailymail.co.uk/news/article-2275206/Hong-Kongs-metal-cage-homes-How-tens-thousands-live-6ft-2ft-rabbit-hutches.html

Phil,

If I want to summarize what you say, I would say that it is not a must for prices to come down. It is possible to see a decrease in standard of living like in other countries (most of the developed nations). This is true for the very crowded metro areas like LA, SF, NY, etc.

In a free market prices would come down. As we saw for many years now, we do not have a free market economy. It is a heavily manipulated economy.

Starting in 1913 when the FED was created, we have a central planned economy with lots of connected interests to the center.

Unless you are very well connected, you never know what the elites (0.01%) are planning. You may guess something based on a set of assumptions. However, there is no guarantee that the assumptions you make are correct.

There are many incentives, within elites who can turn on each other, for a crash in real estate. It was only a year or so ago, many countries riding high. Russia (high oil prices), Saudi was throwing money around (now having to ensure it has money for its own social programs internally as oil slides in price). China clamping down on excess now.

If countries are now getting cold and stroppy with each other under the strain of market turn, it won’t be that long until individual market elites begin betraying one another in markets, and perhaps selling for lower prices, before others beat them to it. Pump and dump.

London is topping out now. New higher buyer tax came in at the higher end, just a few days ago, with immediate effect. Banks are imposing much tighter lending criteria, and many of the buyers using their own capital or shadow banks to pay super high prices.

http://doerupperdiary.blogspot.co.uk/2014_06_01_archive.html

Banks being stress tested for 35% real estate crash + hard recession and most passing that test. BoE Governor Carney the other week dismissed all talk of more easing, and said BoE much more focussed on tightening from this point. Deputy Governor at BoE saying they plan no interference on house prices, but their main concern is mortgage volume “which today is very low.”

One way to boost mortgage lending is to allow house prices to crash so they become more affordable to those in their 30s who rent and save. There is so much ‘dead money’ locked up in homeowners’ favor in their homes which is of little use to the banks. They are not interested in owners who are debt free or highly equity rich, with $500K-$1m houses. Much better for the banks to allow a 50% house price crash and get new fresh mortgage debt onto those houses.

Bank of England wrote:

“If countries are now getting cold and stroppy with each other under the strain of market turn, it won’t be that long until individual market elites begin betraying one another in markets, and perhaps selling for lower prices, before others beat them to it. Pump and dump.”

I think he meant:

“If countries are now getting cold and stroppy with each other under the strain of central bank turn, it won’t be that long until individual central bank elites begin betraying one another in central banks, and perhaps selling for lower prices, before others beat them to it. Pump and dump.”

There is no such thing as markets anywhere except maybe the place where you buy fish. I need to get spell check to start auto replacing “market” with “central bank”…

I am with Brain Of England on this. You can’t keep up this rentier ripping off serf racket forever. Ultimately in a democracy too many people with votes, are hurting.

It is not just a question of inequality in housing, the whole economy is distorted and undermined and ultimately a housing-rentier framework is like a cancer on a host organism – it thrives for a while but the host organism dies. The UK would be FAR better off with an economy that actually produced stuff competitively, and had a more effectively employed working age population.

It is to be hoped that more States that have only recently adopted these bad policies, revise them before they reach the stage of economic and social self-harm that the UK has reached.

Great post by the Doc as always,

I know a gal that owns several rental properties in the Long Beach and Lakewood area, for the first time she tells me that her tenants and some have been great no hassle long termers are getting behind in paying on time, first it was a few days late, then it was a partial payment on the first of the month and the rest on the 15th of the month, now its going beyond that, she knows things like a car breaking down, unexpected bills and just lifes unforseen curve balls can set you back at times and she understands this, but it seems to be happening more and more lately to her tenants especialy this year, she keeps her rents just a tad under market as well to keep them happy and less headaches.

Just goes to show you how expensive life has become here, their regular paychecks can only go so far, the days of affordable living in CA are becoming a challenge.

Happy Christmas, from the MSM (Mainstream Media), Investors, Son of a Landlord / Wall Street REIT investors / Older Owners / Asian buyers

Their Christmas Card to you: http://i.imgur.com/bczLReR.jpg

My alternative Christmas message, as a non-owner renter saver…. Hold on for a big house price crash in low-mid-and-high prime markets in 2015.

Being from Vancouver, I believe there is more to the rent market. I see it from the perspective of a market that has been flooded with foreign capital. Around one fourth of all the condos in Vancouver are empty. Their owners live overseas (mainly China). And they are generally not interested in renting their properties. So the demand does not meed with the offer. And this pushes prices up.

As I’d said, buyers from authoritarian/Communist countries are not looking for profits, but wealth preservation. Buying Western real estate so that, should they need to flee their home countries, they have hard assets they can sell to raise cash.

Doesn’t matter if the property rises or falls a bit in value, so long as most of the value is preserved. Buying Western RE is like putting money in a Swiss bank. A place to hide money overseas, so as not to be seized by the home govt.

Plus, investing money in Canada is one way to buy citizenship, isn’t it?

These Chinese are buying Western citizenships and real estate to have a safe haven should things turn ugly in China.

Turning 7 million families into renters and their properties into rented homes instead of self-owned live-in arrangements has but the following reason: if you pay too high a price and then cannot afford to pay the mortgage, your property will be foreclosed and auctioned at a lower, a “reasonable” or sustainable price. The rent calculated from this lower price now is lower than the mortgage payments were – and presto all of a sudden people of the same social class that overstretched their finances with the VERY SAME property before can now “afford” it. Were it not for the drama, casualties and suicides along the way we could call this the school of a nation of investors.

Leave a Reply