California Foreclosures: Foreclosures and Charting the REO Trend. Lord of the Mortgages.

Many of you in middle school had the opportunity to read William Golding’s Lord of the Flies. The book looks at two boys, Ralph and Piggy who find themselves on an island next to a plane crash site. Soon they find out that they are not alone on the island. At first, all is civil and cordial as they build bonds with the children on the island. Yet as time progresses one of the “others” branches out and begins to take on his hunter role more deeply. No, this isn’t Lost although the leader of the other hunter group is called Jack. Back to the story, one of the themes of the book is an examination into human nature and how culture created by man fails. What we have witnessed in California this past decade is a financial lord of the mortgages. People woke up one day and found easy access to credit and instead of harnessing this new found wealth diligently and prudently they savagely ate it up like a starving child trying to eat up all the food before his brother has any chance to eat.

Such is the mania that ensued during this housing speculation. There really was no one governing or regulating the industry. Think for a second how patently absurd zero down or no documentation mortgages are. Would you give a stranger off the street $10,000 because they told you they made $200,000 a year as some stunt double for a reality television show? Of course not. Yet banks over and over made $500,000 mortgages to strangers since it wasn’t their money which they were lending. Who really cares what happens to the money after all so long as you get your nice commission. Is it any wonder why FBI statistics show a massive jump in mortgage fraud over the last few years? This has been the largest financial heist in history and all it took was a bunch of people with suits and access to credit to perpetuate this mess.

And like Lord of the Flies, the group that has gone savage is attempting to capture Ralph who is still trying to get off the island and back to civilization. To capture Ralph, the others set the island on fire thus alerting a warship that is passing by even though they were trying to fry Ralph. The navy officer sudden arrival puts all the boys in order and is astonished at what has occurred. He expected better. Now we have politicians, authorities, financial institutions, and everyone else peering into the mortgage island and are “astonished” at what has been going on. Many of these lenders are still woefully optimistic that many of the Alt-A loans were made in good spirits and many of the borrowers will want to make diligent payments on a $600,000 home that is now seeing comps in the $400,000 range. Yeah right. Welcome to the island lenders.

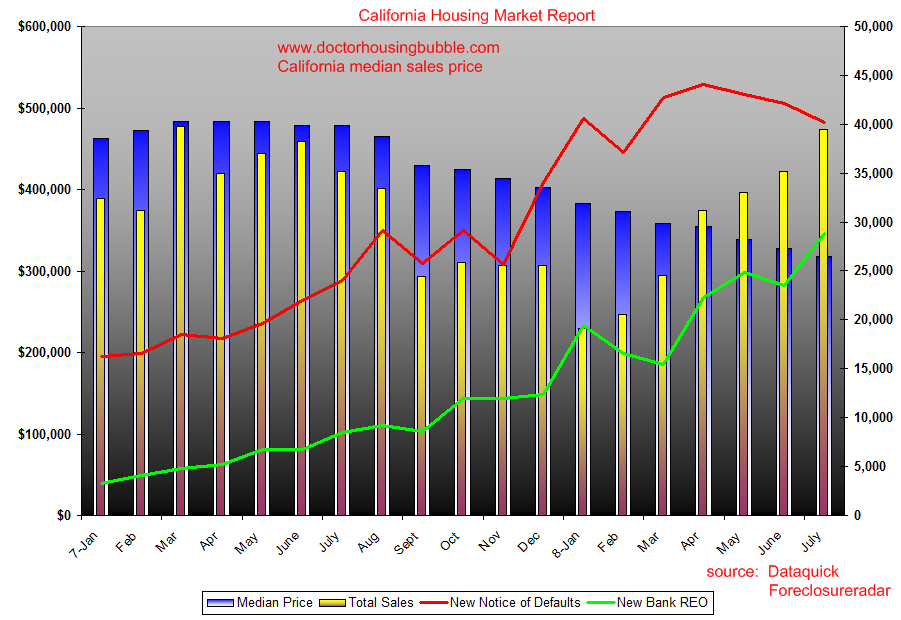

Before we go on, I’m going to post a graph showing four very important items. Many readers have been asking for a graph highlighting the California median price, monthly sales, REOs, and notice of defaults. Here it is:

*Click to Enlarge

I know the chart is a bit busy but it is useful to put all the data in one quick glance to quickly see what is happening. Let me highlight each of the 4 data points individually:

(1)Â Median Price

For this chart we are using the median price dished out by DataQuick. The data provided by the California Association of Realtors has a much higher median price but we’ll go with this for the time being. It is worth noting that these two measures were divergent on the way up but now they are crossing paths at the bottom. The peak was reached in March, April, and May of 2007 at $484,000. The current median price for a California home is $318,000. A drop of 34% in one year is no small potatoes. Yet much of this furious price discounting is the massive amount of foreclosure and distress sales going on. Many are trying to argue that this is skewing the data but as an intelligent buyer, why in the world would you buy a home from seller looking for prime value when you can negotiate with a desperate bank and make them an offer that they most likely will take?

This leads us to the next point in the chart which is the monthly sales.

(2)Â Monthly Sales

Without a doubt, sales have been perking up since spring of this year. And this is good news. Yet you need to dig through the spin to understand why sales are going up. Sales are going up because prices are dropping like a rock in a lake (refer to point #1 above). Any good student of economics realizes that price can have an impact on demand. Sellers weren’t lowering prices so the market hit a wall for a few months. Yet now that banks and lenders are the major players in the market they are willing and realistic about the current market conditions and are not shy about chopping prices lower. They have to keep slashing prices since their inventory numbers are skyrocketing.

Which leads us to our next point, notice of defaults.

(3)Â Notice of Defaults

The recent trend in housing spin is that notice of defaults (NODs) have hit a peak and are trending lower. Take a look at the graph. These are historical highs. So the fact that we have backed off a bit isn’t much of a big deal. Here is some quick math for you:

July 2008 Data

NODs:Â Â Â Â Â Â Â Â Â Â Â 40,219

Total Sales:Â Â Â Â Â 39,507

As you can see NODs are now above the amount of actual sales. Compare this to January of 2007 when we had 32,245 sales and 16,225 NODs. The big issue with this is the amount of NODs that are actually converting over into REOs and foreclosures. Some of these NODs will be sold as a short sale but most likely these will be taken back by the lenders as REOs. Since the vast majority will convert to defaults the sales we just saw are essentially just enough to recycle the distressed property. 44.8 percent of all the sales last month were foreclosure resales. That is a stunning number.

Which leads us to our final data point, that of REOs.

(4)Â Real Estate Owned

Lenders are overwhelmed with the amount of inventory they are seeing. If nearly half the sales each month are foreclosures, and distressed properties are now selling for 50 to 60 percent off peak values you can rest assured that the median price is going to get hammered even further. I saw a few homes that were on the market in the Inland Empire for 5 figures! Just imagine when that property sells what that will do to comps.

Look at the chart again. Last month banks took back 28,795 homes! So even though the sales number of 39,507 looks promising, banks just got a nice batch of 28,795 homes to sell. That is:

39,507 (sold) – 28,795 (REOs back to lenders) = 10,712 drop in overall inventoryÂ

You really have to look at it this way. Even though banks are seeing a bump in sales it is largely due to the massive discounting going on with these foreclosures and financing that is happening in the conforming areas (i.e., government conventional loans). You can rest assured that many of those NODs are going to become REOs in the upcoming months and thus add more inventory in a market that is already saturated. And many of the cheerleaders forget that our economy is in difficult times. Why would anyone buy if they suspect they’ll be losing a job or seeing a cut in their income? They won’t and this will happen as time goes on.

In addition, you need to remember that many of the $300 billion in pay option ARMs in California are going to default without notice. That is, it was a nice 3 or 5 year teaser rate but once the anniversary date hits you can rest assured many folks are simply going to stop making payments. No struggle but a conscious move to stop making payments on an overpriced asset. Currently with the negative amortizing payment it may be cheaper than renting. But once that payment resets there will be no point and they can try selling the home but once again look at the graph and the trend in NODs and REOs. This frankly has the potential to grind the entire economy to a sudden halt for the next few years.

If the lesson isn’t evident, it is that people were not responsible enough to handle having access to ungodly amounts of credit. This is fine if it was contained to a single institution. Why should we care if a bank is so irresponsible as to loan its own money to unqualified candidates. That is their choice and that is between them and their shareholders. But when they look at the government for help (aka you and everyone else that has been diligent) it becomes society’s problem. Time to send these toxic institutions and mortgage programs onto an island once and for all.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

15 Responses to “California Foreclosures: Foreclosures and Charting the REO Trend. Lord of the Mortgages.”

No kiddin!

How sick is it that the prudent must pay for the recklessness of the few. Maybe we’ll get lucky and our over-extended & bankrupt treasury will have to prioritize, hence eliminating these crony capitalism bailouts.

Doc, you will love this. It’s a quote from an email I received today from an old chum who happens to work inside CFC. Don’t hold it against him, he’s actually one of the good guys.

“Angelo is a well-intentioned (mostly) guy whose breathtaking arrogance left him totally unable to cope effectively with the growth of his company, and thus left him totally unprepared for the inevitable contraction. Dave Sambol is a soulless monster, and I say that with all respect and as much charitability as I can muster. Bank of America is a major upgrade.”

Dont know where else to ask:

How much is customary closing cost for a 500K house in OC California?

You have to remember that the pain will arrive earlier for Pay Option ARMs because the true “reset” date isn’t the end of the 3 or 5 year ARM fixed period, but when the borrowers hit neg-am ceilings. And remember that some 80% of borrowers are making minimum payments, so this problem applies to most. And also remember these resets are far more vicious than subprime or plain ARM resets, with monthly payments often doubling or even tripling!

See this Mr. Mortgage post with a Pay Option ARM reset chart taking neg-am ceilings into account:

http://mrmortgage.ml-implode.com/2008/07/17/mortgage-implosion-round-2-the-pay-option-arm/

The trouble will be here in late 2009, not mid-2011, as is often thought, and will spread out years and last longer.

“Foreclosure!” Coming to a theatre near you. Sounds like a trailer for a bad summer movie. Unfortunately, it is reality. 44.8% of all resales in California is truly astonishing. Add in the rising inventory, and we are headed for the “Perfect Storm”.

The market is now educating buyers to wait for “Foreclosure Pricing” and their simply is little reason not to wait. This will include all areas, as the mortgage meltdown has infected every level of housing. Stories are now eminating from the Inland Empire about buyers employing “Hit and Run” routines where they keep payments current on their first overpriced house, until they close on a foreclosed second house, only to let the first one return to the bank. Imagine what that will do to the Foreclosure resale rate.

I predict the Westside of Los Angeles will catch on to this strategy once banks begin to unload their REOs. It becomes a simple business decision for many “Educated” affluent buyers.

There is alot of pain ahead for the Westside.

http://www.westsideremeltdown.blogspot.com

Can we compare also total inventory for these time perios would be good.

Lot of people are clainign that the inventory is now so low that we will deplete ti in the next 6 months or 7 Months.

Still do not know what to belive.

I see people still buying new homes paying 700K plus and with a down payment of 200K.

Lennar just opened community in Bunea Park and They have sold 42 of 49 homes built in the last four months. All the houses priced above 600K.

I was expecting to see more inventory based on Dr.Bubbles date in the month of July and August, but looks like sales has gobe up in July and Inventory seems to be going down here in SoCal for august.

Dr. Do you think the banks wants to just wait and watch people walk away from thier houses. Even if that is true, but long will they want to do that.

Why do you think they may not become creative and start offering loans to meet the standards of home owner. Thats a win win for both Bank and the home owner.

Some could be better than nothing. Cost of forcloser and the cost of reselling, if accounted in and the bank can pass on that differnce to the current owner, then may be they can stop some forclosers.

Dr. How much do we know aboutn the people who got these Alt-A or ARM loans. And whose rates are xpected to change satrting next feew weeks or may be already started. No one knows, whats they income was when they bought the house abd whats thier income is today.

You missed that data, which may swing the balance a little bit.

I enjoy reading your ariticle and really respect the amaount of effort you put in to it. Your numbers really scared me, but will this be the truth, we have to waiti and see.

Not just US Economy is down, look at Europe, they are also moving in the same direction.

But can life stop just like that. I would say no. Life has to go on and there will be people who will continue to buy.

But you are true that the median prices will go down for sure for the next few months. But market may just saty at one spot fo a while before pickign up.

Keep writing.

Hi Doctor, thanks for the update.

>

I sold my house in Tucson after reading all you had to say on your website. 2000 square feet for $250K; sold in April. Had only two reasonable offers in 3 months; the first was $240K. My realtor wanted me to hold out for a higher price and I finally had to fire him to get his attention I wanted it sold.

>

At the time it sold, Zillow had the price estimated at $279.5K. Now their estimate is $257K. I don’t have access to the MLS, but it appears not much is selling in the old neighborhood either.

>.

Thanks for the advise. I sold at a good time and a good price; things have only gotten worse for sellers. By the way, this was the first time I made any money selling a house having owned 4.

what struck me is the timeline between NODs and REOs. I time shifted the REOs backwards to match up with NODs:

http://img135.imageshack.us/my.php?image=drhbuw3.jpg

You can see where I aligned it. Then look at the time difference in REOs – its taking longer and longer to get the NODs/FCs to market. Oh, and you heard the NODs levelled off, right? well the REOs will level off eventually, but take a wild guess where their headed for the next ~6mo 🙂

Regardless of size of the mortgage, closing costs break down into a couple major components each of which is unique to any closing. So let’s go down the list: (1) points, ie a percentage of the mortgage — count on at least one; (2) lenders charges — think an absolute minimium of $1,200; (3) closing agent’s costs (title seach, document prep, etc etc etc) including some “garbage” fees.

On a half mil mortage my wild ass guess would be $15 to $20K.

Fantastic and simple explanation of basic economics here. Boiled down to its simplest and most easy to understand explanation, home sales are going up because banks are dumping properties on the market with extremely deep price cuts. It requires only a loose grasp of basic economics to conclude that this will further undermine the value of housing and the equity people have in their homes. This will in turn force more homes into bank possession, which will in turn lead to banks cutting prices even further to unload their inventory. This is a classic race to the bottom. As long as banks are undercutting homeowner resale prices, the deflationary spiral in housing values will continue. It is only when the inflow of houses back to the balance sheets of banks abates that the bottom will be reached. When will that happen? Simple, when the REO properties are being listed at the same price as homeowner resales. At that point the undercutting of homeowner resale prices resulting from inventory dumping of the banks will subside because they won’t be creating any more inventory on their own balance sheets through the very process of inventory dumping. Whew! We are not anywhere near the end of this process. The race to the bottom is indeed underway. There is no govenrment program, no bailout, no bill that can stop this. The wonderful thing is that the end game here is affordable housing and a more balanced economy. Unfortunately this road we are all on is going to be a rough ride for many homeowners and the economy at large. Everyone make sure you’re buckled up! Maybe the next time around, whoever is in charge of navigation will actually look at a map before we embark on our journey rather than opting for the shortcut someone heard about last night at sometime around 2 am at the bar.

I think I read the “cliff notes” to Lord of the Flies. However, I do agree that the banks got too loose with their lending and were not staying on top of the potential problem. Not to mention those that thought they could just borrow and hopefully afford to pay it back. Sometimes I wonder what these folks were thinking or if they were just caught up in greed.

The people that are going to suffer for this are the ones that were smart with their money and did not go buy a house they could not afford!

@Aaron –

Hadn’t visited MIM in a while – good look. Fed / Treasury IM is next?

I’m not convinced that 09 is the date for blow up of the POA wave. IMO one of the drivers behind the lower Fed discount rate was to drive down the unprecedented runup in the LIBOR, along with it the MAT and COFI indices which underpin the POA. This lowering pushed the effective fully indexed rate of those toxic loans down from the mid 8’s into the mid 5’s. Had rates remained at the level they were in early 2007, at the fully indexed rate of 8.5, the POA wave would have hit by now, with resets on IMB (which had 110% caps) cresting first, followed by some CFC and WAMU at 115%, then the remainder at 125% (Downey, First Fed, CFC, EMC, etc.) These waves would be hitting now, some 3-1/4 years after loan inception (loans originated in 2004 and 2005).

By pushing the indices lower, the Fed / Treasury / FDIC effectively pushed the reset date back to pretty close to 5 years from origination, except for those loans which were pushed very close to the max LTV reset prior to August 2007.

However – I do agree that should the wave start to crescendo in 2009, the “synergy” of negative psychology may impel the nearly capped out to abadon their properties in advance of the reset occurring.

Either way, it won’t be pretty.

This is going to hit the taxpayer hard. Because regardless of who you put in office (Obama or McCain), both are bailout minded. McCain will bail out the banks, Obama will bail out the “homebuyers”. It’s lose-lose.

Keep the popcorn popping!

Leave a Reply