When housing becomes unaffordable for the young: The crushing burden of rents and student debt on future home buying.

Some people forget how economic corrections occur. Stock markets usually get hit first while real estate comes limping along. Real estate is like turning around a giant ship in the middle of the sea. Once it is on course, it usually stays on the path for some time. Here in California, we’ve been enjoying one of the biggest bull markets in our generation and a big part is being driven by tech company valuations. Just look at San Francisco for the idealized example. Yet an odd thing has happened and much of the young talent is priced out of the market when it comes to buying. You have old timers that purchased years ago or you have non-local buyers chasing after properties. Millennials are getting sucked into the rental Armageddon trend. The most unaffordable location is Los Angeles not tech driven San Francisco. Let us take a look at what happens when large metro areas become unaffordable to actual young workers.

Unaffordable to rent

People usually think that San Francisco or New York would lead the pack when it comes to unaffordable housing. Yet overall these markets are more affordable because on average, people make more money. In Los Angeles there is a lot of all hat and no cattle households. You have people addicted to debt and the perception of wealth. Many try to run some sort of con-game in trying to talk and pitch things. You definitely see this in real estate when people try to talk up crap shacks across multiple areas.

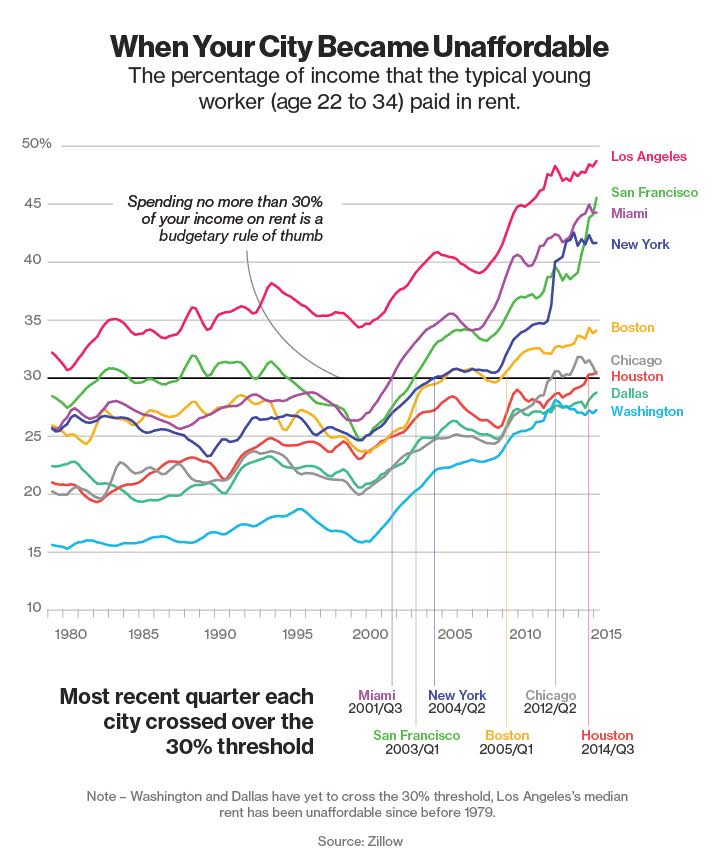

For the last six years we’ve had a good bull market in stocks. The run-off has filtered into real estate. We are now experiencing a slow down. But before this recent action, take a look at the numbers for unaffordable areas:

In Los Angeles your typical 22 to 34 year old is spending close to half of their income on rent. This is higher than many of the cities on the list. While cities like Dallas and Houston allow young workers to spend about a third of their income on rent thus allowing them to save for a down payment on a home.

In California we have 2.3 million adults living at home with their parents. Somehow, those that can’t foresee any correction have come to deify the Fed even though the Fed couldn’t stop prices crashing just a few years ago! They have forgotten about the graveyard of 7 million foreclosures. They also say “no more liar loans†but those were a small part of the graveyard. Most of the foreclosures happened on 30-year fixed rate mortgages where households just couldn’t cover the monthly nut. Unfortunately many people have bought the hype. And these people think that the Fed is looking after their crappy stucco box home when in reality, they are more concerned about protecting elite financial wealth (i.e., bonds, stocks, currency).

So far, with this bull market we have yet to see the young home buyer come out and now we are seeing some deeper changes in the market.

Renting or living with parents

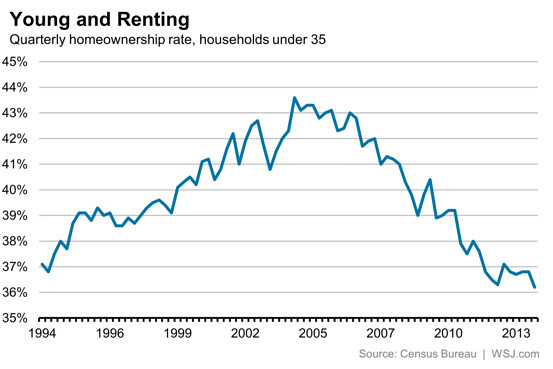

First the homeownership rate for young Americans has collapsed:

It has gotten even worse in places like California. This is why even in recovery, we have many more young adults now living at home:

The official end date of the recession was in the summer of 2009. Yet somehow, this recovery has done little to improve the homeownership rate for the young. Part of it has to do with stunted income growth but also, home prices soared merely because of:

-Juiced up debt markets

-Big investor demand

-Low inventory

-Hunger for yield

Yet young household buying is simply not a big factor here when in past recoveries young buying was a big deal (it signified healthy incomes for young workers looking to start families and settle down). What is troubling is you have seen at the tail-end many lemmings dive into the market leveraging to the max assuming the bull run in stocks and real estate was going to continue for another six years. As usual, markets boom and bust and they seem to have deeper volatility as central banks get more involved espousing stability.

Student debt with the young

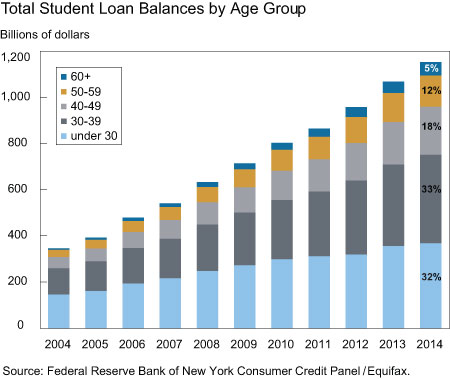

But another issue with buying homes for the young is the massive student debt they now carry, over $1.3 trillion. Most of this debt is with the young:

65 percent of all outstanding student debt is carried by those 39 and younger. This is causing massive changes to the homeownership rate dynamic in the country. Those laser focused on housing usually have an odd belief that real estate is a sacred cow that will never be left to correct, even though recent history shows the opposite. They have some sort of odd belief that the Fed is keeping rates low so crap shacks can be inflated in value. Last year alone oil was at $100 a barrel and the status quo was that oil would never dip below $100 again. I’m seeing $39.36 a barrel right now on Sunday night futures. The Shanghai Composite hit a high of 5,178 recently and supposedly was going to 6,000 in no time. Right now it is at 3,250. And keep in mind the central planners in China are doing everything they can and their real estate markets are well into correction mode. Yet somehow, a crap shack is only going to be “allowed†to fall within a tiny range because of some odd fetish for real estate?

Young Americans are priced out of buying homes and many are priced out from even renting. And somehow this is the group that is going to buy all the crap shack turnover once baby boomers decide to downsize either by choice or by nature.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

96 Responses to “When housing becomes unaffordable for the young: The crushing burden of rents and student debt on future home buying.”

Was this written by the National Association of Realtors? It is not necessary, and often not wise to purchase a home. Now is one of those times. Real estate is in a huge bubble, by almost any measure ever used. A reversion to the mean is coming. It always does. Always.

Housing To Tank Hard

SOON!!!

everything to tank in sept 2015

The real estate Apocalypse is coming!!

About 13,000 people on public assistance tumble into homelessness every month in Los Angeles County, according to a new study that experts say provides the clearest picture yet of extreme poverty in the region.

Although many quickly find work or rely on family to get off the streets, the number experiencing “continuous, unremitting, chronic homelessness” continues to grow, even after 10,000 people were housed over the last three years, according to the report being released Tuesday by the Economic Roundtable, a nonprofit research group in Los Angeles.

The report recommended that the welfare system intervene to help children and young adults who become homeless before their condition becomes chronic.

This. Save save save.

Yew, buying at this bubble isn’t a smart choice.

At the same time, if rent cost as much as a mortgage payment, you’re just throwing money away.

“At the same time, if rent cost as much as a mortgage payment, you’re just throwing money away.”

It really depends how you evaluate each circumstance; it’s not that simple. For instance, with a house, you’re throwing away property tax every month, and with a condo, you’re throwing away tax + HOA fees every month. You’re also likely throwing away a big chunk of money to the bank (interest) despite the tax deduction, since many people just take the standard deduction.

Conversely, if you think that RE prices will decrease by a given amount in a given time frame, you can do a bit of math to determine just how much money you are “throwing away” on rent each month versus how much you would save by waiting to buy a house.

Generally speaking, buying at the peak of the market is a pretty unwise thing to do. This is true even if you rent, presuming that you keep rental costs to a reasonable minimum.

In meantime, while waiting for the housing and equity crashes just keep on chunking $3000 per month into a small two bedroom apartment. Or move to Arkansas. And that’s the final answer: get the hell out of California if you want a decent affordable home in a place that isn’t run by the criminally insane.

It’s 5:30 am on the west coast. Can’t wait for the carnage to start in an hour.

If you are over 21, not driving and want play a drinking game today, turn on CNBC and take a drink every time someone says “buying opportunity”. Bonus points if it’s Bob Pisani or Jim Cramer. Disclaimer: play at your own risk; you may have to be taken to the ER with acute alcohol poisoning, which can result in death.

I’ll guess they’ll close the market down maybe 100 today, “healthy correction”; move along, nothing to see here. Lookee over there, maybe local news reporting on newly released photos of the Kardasian family posing with Janet Yellen. Yee boi!

I have a drinking game for TV commercials.

Every time you see an advertisement for a prescription drug grab a beer, wine and a whiskey.

When they mention the “Side Effects” get ready.

Beer = irritations, swelling, rashes etc. minor stuff

Wine = any ailment that this drug is supposed to cure. i.e. Blood Pressure pill may cause bleeding.

Whiskey= DEATH or hospitalization, or prolapses.

But hasn’t this strategy worked out well in every bear market for the last 30 years? Maybe this time it’s different. But experience teaches us to be wary anytime somebody this it’s different.

Looks like it might be time for another round of QE. We may have record low interest rates when this is all said and done. Wonder what that will do for housing?

I want to hear from the folks who were making a killing in the market because housing was a poor investment. God forbid they had their down payment “all in.”

THEY ARE DOING JUST FINE. BOB PISANI SAID THEY ARE BUYING MOAR DESIRABLE STOCKS ON DIPS. HAD TO HALT DESIRABLE STOCKS BECAUSE TOO MANY BUYERS CLAMORING TO BUY DESIRABLE NAMES! WELL OFF THE LOWS! CLOSE IT GREEN!

I’d like to know who really believes, besides LB, that RE will remain unscathed from the global economic turmoil despite record cheap debt? Or that people will flock to another risky asset, such as RE, near the top of its historical price range?

Closing prices for 8/24/2015:

Blackstone Mortgage -3.63%

Simon Property Group -4.16%

Equity Residential -5.21%

Starwood Property Trust -4.20%

@Prince of Heck, home prices in the tech cities (Santa Monica, Pasadena, Culver City, Venice, Marina Del Rey, Torrance, Playa Vista, the Beach Cities, et al) have been driven by the 6 year bull run in the stock market.

September is when most of the stock market crashes happen. This time is not different. I expect home prices to follow the stock market down as the two are joined at this hip in specific parts of SoCal (see above).

@PofH; I guess they think that this basic fact doesn’t apply to RE.

There are only 2 ways to buy things.

1) Cash you have in your pocket. or……

2) Someone willing to loan you the money instead.

If TSHTF, do banks lend? Take your chances on that idea if you like.

World markets are crashing, housing will not be far behind. We have hit the iceberg, panic , rush to the exits. The sharks are circling. Time to launch the lifeboats. Francesco Schettino will be responsible for the evacuation.

If the FED blinks on raising rates this year it’s only going to exacerbate things. Being exposed to the world as being stuck in a liquidity trap is ultimately far worse than a moderate equities correction. I find it hilarious when all the CNBC types rage at any type of living wage legislation. A $15 an hour minimum wage might be the only thing that could maintain these insane valuations in assets and equities. Heaven forbid the proletariat get an wage inflation. The Banksters, Specuvestors and Rentiers are going to see worse deflation in real dollar terms than they would have if a real correction was allowed in 2008.

So Walter Reuther visits a modern Ford plant, and there’s a worker there, one worker, who presses buttons and watches dials, and the supervisor comes by and says, “Well, walter, how do you like it? Are you wondering how you’re going to get all those robots to pay union dues?” And Reuther says, ” No, I’m wondering how you’re going to get those robots to buy cars.”

MR. Smith…I would agree on the world housing except for America. 1 million dollar house in America is a bargain compared to the world. International real estate is the jokes of all jokes most don’t even have gas to home and public sewer system. 2 or 3 car garage is for only the very rich. This country is downright cheap compared to the world, so yes CA- NY is out of control some areas not all, but over all we are still a bargain. I will say this because of energy like oil, if you are looking for property in Texas,CO,ND THINKS TWICE.

AZ, NV. Eastern WASH look safe bets, overall buy right, major inflation is coming sooner than you think.

In other words, for the hundredth time, every overpriced cities in America are international destinations. It’s as if airplanes and international transfers were invented 5 years ago.

The first domino has fallen (China). Without the prospect of turning a billion or so people into middle class consumers, we are in for a world of hurt. Look for money heading for the exits in overpriced real estate next.

The tide has turned.

http://www.westsideremeltdown.blogspot.com

2009, China doesn’t make the world go round, look for flight to US real estate why there is nothing better in the world to invest in. Yes it looks scary this morning but overall it tells the world America is still the safe haven, more money goes to USA, let these foreigners pay more for our houses and products, that is why you buy the worry and sell the happy. China makes junk products, if Japan or Germany go under worry that is not going to happen.

Can’t rely on millionaires parking their ill-gotten loot into American real estate forever. Sooner or later, China’s economic turmoil will have to be resolved or those millionaires will turn into thousandaires. BTW, China’s economic problems are big enough to threaten economies as far as Australia and Canada.

International stock markets are plunging. China’s market is definitely TANKING. Real Estate always follows shortly after. This isn’t going to be pretty.

Pop…Look this very different than sub- prime, what this means is folks will not list their homes driving inventory even lower and guess what nothing to buy, houses go higher for the ones who want to sell. Yes if we had a flood of bad loans in 2014 2015 than blood bath, but loans were in Check for almost every loan the past 1.5 years and cash buyers can now wait with no mortages, the collaspe of 2007 will not happen. Matter of fact please buy now at 4% and give a low bid to panic sellers , if you don’t have the money than enjoy cnbc and fox, or Bloomberg tv.

Ford F-150, 0 down, 72 months, 0% financing. SnapChat, 15bn valuation, 3mm in revenue – but wait — they’re inventing a new way to advertise.

It’s got to crash.

Robert…guess what you usually comes after the crash? A recession. What comes with the recession? People not affording their mortgages.

Good try.

9 Reason why first time home buyers are at a 21st century low with rates at the lowest rate curve post WWII

Remember how the media and others said, that with the 3% Down loan that first time home buyers would come back at 2015.

Lack of economic discipline.

9 reasons here

http://loganmohtashami.com/2014/11/03/demand-from-first-time-home-buyers-hits-21st-century-low/

2015 all purchase buyers are move up and investors, no first time home buyers that are going to close in 2015 and this is my best year ever, but you can see the demand curve is all on move ups

On another note for household formation. A lot of that formation came from ages over 35 it’s not the young that is driving the formation demand curve.

This means renting nation has legs for a few more years as the demand curve is about to kick into a 2nd gear

http://loganmohtashami.com/2015/07/17/renting-nation-still-has-legs/

Greed and fear are what drive stocks, fear is in the stock market, and now is a better time to buy and hold then 6 months ago. No one knows the future but I know greed will be back.

Housing is based on supply and demand. Supply low, demand high means prices will be high for a while. The 30 year old broke losers living with mommy and daddy are not part of the demand equation. They are future renters or good candidates to move to a cheaper part of the country. For those with money the supply is low so prices are high. Is supply going to jump drastically? No. So, that leaves demand which won’t go away anytime soon. The Chinese who bought homes in America instead of buying into the Chinese stock market were wise. Do you think they are going sell? They won’t ever sell, they plan to give them homes to great grand children.

With that said, the middle class is screwed. The real pain isn’t in the homes at 50% of income, its 40 years from now when they have no retirement or savings. But LA is all about short term gratification, hence the market is exactly where it should be based on SoCal values.

Want a good value and a place to raise a family in a safe area, go to flyover country. They would love to have you. For everyone else who wants the SoCal dream, get ready to open your wallet.

I’m not a realtor, I’m a realist.

I am not sure you can bet on Chinese not selling. If they go belly up they still have to afford that giant property tax bill. Just as the Japanese in the what late 80s 90s took up a bunch of property they went under also.

LOL. Nah, Chinese will never ever sell! They don’t have margin calls, or bills to pay like the rest of us. Keep dreaming.

I do agree with you that people should move to where life is more affordable. Even if you win the rat race, you’re still a rat. Plenty of quality of life away from the “prime” places.

And US isn’t the only place where the young can’t buy homes and start families. Europe, Aus, Japan, you name it. Lots of assets and capital tied up by the rentier class that’s choking economic growth. Hell, I make 6 figures and have a 7 figure net worth and I happily rent – I aint paying the prices they want around my hood. I may end up retiring very early (<50) and moving to some place that is nice and affordable – tell the rentiers to stick their "game" where the sun don't shine!

@Robert

Closing percentages of REITs on 8/24/2015:

Blackstone Mortgage -3.63%

Simon Property Group -4.16%

Equity Residential -5.21%

Starwood Property Trust -4.20%

That is fear in a fearful market. People are afraid of the rising interest rates. This has nothing to do with the sales changing in the last day or two.

However, I don’t trust REITs. To many hidden costs and unknowns. If you really want to be in real estate your name should be on the deed/title.

@Sean

Those companies large blocks of residential properties throughout the nation. Whatever affects their stock their RE portfolios. Whatever affects their RE portfolios will affect the overall RE market.

Edited from above

@Sean

Those companies own large blocks of residential properties throughout the nation and were primary buyers early on and drove up prices during the “recovery”. Whatever affects their stock will affect their RE portfolios. Whatever affects their RE portfolios will affect the overall RE market.

“Is supply going to jump drastically? No. ”

False assumption. Unless banks get even more time to sit on their properties.

But banks got about 7 million houses when buyers couldn’t pay those in previous crash and most of those are still out of the market.

Current law says they can hold them 10 years and that period is ending very soon.

And when the banks have to dump them, it will absolutely increase supply drastically, there’s no way around that.

You can believe that banks can circumvent it and it’s possible, but saying that supply can’t or won’t increase is an false assumption: There are still millions of houses hiding somewhere and those can’t hide forever.

@Andy: “It’s 5:30 am on the west coast. Can’t wait for the carnage to start in an hour”.

The PPT stepped in at 15,370 and started buying to prop the market up 600 points off the lows. TPTB are not letting this bubble pop without a fight.

Oh…TPTB certainly don’t think they can keep the bubble together forever, they just want to chose the time for the final prick to be pinned.

I think they want and need to drag it out to just after the elections like last time.

“TPTB are not letting this bubble pop without a fight.”

That’s true but based on what I am seeing they are loosing the fight. You can defy gravity only for so long.

You make the money buying carnage? If you don’t have money than enjoy the up and down, the movers and shakers are not watching TV, they are buying the dip and selling the movement up. The market is not for the faint of heart, buy the long term in life, if you can steal a home today because sellers panic do it at under 4 % rates. Never buy the good news always buy the bad news, 1% folks are making a ton of money this morning, since most folks should only worry about there numbers in life and you can buy a property low this morning because of worry on the sellers side than make a house deal today and don’t worry about what Apple is doing who cares.

“…1% folks are making a ton of money this morning…”

No they aren’t (didn’t). Any 1 percenter who was invested in equities lost money today. Exceptions to this include anyone who shorted the market, but that’s generally a short-term gamble unless you somehow know the future (or know TPTB).

This doesn’t necessarily pertain to Robert, but I like how some people think So Cal is some magical, insulated place that will be mostly immune from market pressures/conditions. You can be virtually guaranteed that So Cal real estate will tank right along with the rest of the country if such a tank happens. Maybe more desirable areas will fare slightly better, but my guess is that they will still tank.

Even if people have money invested in their homes (large down payment, whatever), that doesn’t mean that people are immune from losing their jobs or are immune from being otherwise forced or inclined to sell/shortsale/forclose for any number of reasons (strategic default, whatever).

For China, I see a replay of the Nikkei at 40K in ’89, dropping to 8K several years later. The CH government has tried to prop up the market to no avail. CH investors will dump US properties as the Yuan weakens. US RE markets will follow world currency devaluations down. I’m in cash, circling this mess from 30,000 feet. Already shorted the S&P, bought the VIX, then will buy oil at $33. Going to be fun watching this go nuclear.

The markets are due for a shake-out. The bull market began on March 10, 2009 and, @ 6+ years, is the second oldest since WWII. Real Estate doesn’t always follow, but I think it will.

Crude oil below $40 a barrel. Crazy!

Oil is probably going down to the $20 dollar range before this is over. Oil prices are a function of how well the world economy is performing. The world economy is wheezing like a chain smoker with emphysema. The crash in commodity prices is a harbinger for where the economy is going. Commodity prices crash before recessions hit.

LAer was talking about the rise in crime.

There was a gang execution in Pasadena last Friday, in broad daylight (5:30 p.m.): http://www.pasadenanow.com/main/peace-march-announced-in-wake-of-fridays-killing/#.VdukIJcn6SI

A profile of the victim: http://www.pasadenanow.com/main/who-was-shooting-victim-monte-russell-meet-him-through-the-eyes-of-his-mentor-friend-and-pastor-rickey-pickens/#.VdukgZcn6SI

Killing took place on Washington Blvd. A nice street right in the heart of Pasadena’s many “historic districts” north of the 210. This was between Bungalow Heaven and Historic Highlands, I think.

Very nice area, but incidents like this make me wonder about Pasadena’s longterm future. I hear much of northern Pasadena was bad in the 1990s. Will it revert? I dunno.

That historic area is an interesting evolution of urban development. It is a predominately African American community, but why it is so might escape the casual observer. It is just north of the large estates built in the early days of Pasadena. The servants who staffed all of those large mansions needed to live close enough to commute daily. The obvious choice for the land barons was to house them uphill. They weren’t that concerned about how long it took the servants to get home, just that trip to work in the morning was as fast as possible so downhill was the answer. As the south end got filled up the rich expanded to the east and west, but you won’t see many old large estates north of this area.

Sean, you are correct, the chinese were wise to get their money out of china and into American Real Estate. And the US government was leading the rush to bail out the banks and prop up the tax base of local governments with the HB-5 Visa, and guaranteed US citizenship in 3 years, or have your anchor baby and one of our nice birthing centers in LA.

Rich elite foreigners, bring your riches to the USA. Young militiary vets, just back from Afganistan, no homes for you, only rich foreigners… Our country has been sold out.

You need two things to buy a house, mortgage availability and a job, housing demand and housing inventory are impacted by both. With the stock markets collapsing how many billion dollar unicorns are we going to have going into the future? The next shoe to drop will not be housing it will be jobs, layoff galore in the tech sector, and don’t let any realtor tell you otherwise.

Right…because losing jobs and giant tech layoffs has no effect on housing!

@nathan,

Shawn is saying that housing won’t be the next thing to falter (not that it won’t falter), but it will be jobs once the tech bubble bursts and then shortly after the real estate market will crash. It’s just a cascading failure of events and I think it will be the order in which things will fall.

The crash is hitting housing harder than the DOW…

http://www.housingwire.com/articles/34849-black-monday-hits-housing-mortgage-finance-worse-than-dow-nasdaq

Lord Blankfein and Robert needed to read this before touting the unprickable RE bubble.

My friend is in escrow on a 3/2 condo for $550K in a Silicon Beach adjacent area. She has a $200K student loan but she’s able to do it because she’s getting a $200K down payment from her mom. It’s going to be a 30 year fixed, she was tempted to do an ARM but I told her for my mortgage I decided to do fixed just in case I wanted/needed to rent it at some point.

So if RE does well in the next few years she can flip it and help pay off her debt and if it doesn’t she has an asset to live in, or rent for likely more than her mortgage.

…or she could have used the $200K from her mom to pay off her student loan.

Your friend is taking on more debt? Leveraged to the eyeballs. I know plenty of people with huge student loans but nowhere near $200k Geez… hope she has a $200k a year job to pay that off. Mom should have paid off her student loans.. not given her more rope to hang herself – especially at the top of the RE bubble. Very foolish IMO but hey, its not my money. Thank god.

No kidding. Hmm…$200K in debt, so let’s pile on more leverage and taxes. Wow.

Smells like a bogus story

Any parent who would give their kid a $200K down payment would have paid for college

What if the house loses value and/or the expected rent doesn’t cover the monthly mortgage and expenses?

Perhaps a brilliant move. Maybe govt will forgive student loan debt. Maybe if RE values tank principal reduction, some new Fresh Start For A Happy America govt program will reduce/subsidize payments, or worst case scenario default, squat, BK. Game system, the new American Way! Perhaps all will be washed clean in a few years, do it again! Perhaps its time for new car, clothes, furniture, more Chinese made crap! DO YOUR PART to help Global Economy! Shop now! Hurry in for best selection!

Ouch. That’s a good chunk of change to put down on an already expensive property. Why not pay off the debt first, then get a good job before committing to buying RE? Sure, IF real estate does great in the next couple of years, she COULD flip and sell, but that’s a big gamble right now, IMO.

True story, that’s why I’m sharing, this is what she told me. Sign of a bubble if loans are going to people with that kind of debt? Or brilliant strategy if there’s a bailout again like @WeDontMakeThoseDrinksNoMore said. And questions about ‘what if the sky falls’, well she could always get roommates.

Another friend of mine bought in 2010 in Santa Monica. $10K down on a $650K house, PMI, huge loan. Appraised it a couple years later, the banks removed the PMI because it had doubled in value. Some people are willing to take the risk.

“Another friend of mine bought in 2010 in Santa Monica. $10K down on a $650K house, PMI, huge loan. Appraised it a couple years later, the banks removed the PMI because it had doubled in value. Some people are willing to take the risk.”

2010 was a good time to take a risk (depressed RE market and various other economic issues). 2015? Not so much.

Yeah, I have a few friends who made out well in 2009/2010, and I want to learn from their wise decisions (I wasn’t in a position to buy, then.) Buying now certainly would be a mistake.

In 2010, one of those friends put 3.5% down on a $425K FHA loan in Berkeley (in a not-so-great neighborhood,) and now his house is looking at $850K. Can you imagine that kind of return on $15K investment?!?! Crazy. Before it comes crashing down, he’s going to cash out and move his family to Kansas City with a lot of money in his pocket.

I will never predict anything about the markets especially is such a rigged game. That said, only if you are in a potion to offer on a property now and assured of being secure no matter what the market does, then I say go for it when the sellers are scared more than ever and rates are still at historic lows. Even if you steal a home and it losses value you have a roof over your head and you can wait to regain a loss. Real estate if bought right will recover and you will not make a killing but will do well.

If you have to put your last dime out, then all bets are on hold stay were you live and see what breaks either way. This advise I give is only for the secure investor or home buyer willing to stay in their home for at least 7 to 10 years. The investor who can take a small hit or has the patience to wait it out will make money. This is a opportunity that all capitalist have in cycles and trends.

If you believe China controls our fate don’t take the plunge, but if you step back , the USA can not only outlast them we can very well bury their economy, the other G7 countries know AMERICA BUTTERS THEIR BREAD, China just consumes bread and gives nothing back. Be cautious of course, but we are the worlds stable player and in the end China eithers get on board with us or be left behind. Remember these are the folks who couldn’t even track the 707 Malaysia plane let alone make a decent running car or TV?

Pride goeth before the fall.

http://www.reuters.com/article/2009/06/01/usa-china-dollar-idINPEK12423320090601?rpc=44

“A major goal of Geithner’s maiden visit to China as Treasury secretary is to allay Beijing’s concerns that Washington’s mushrooming budget deficit and ultra-loose monetary policy will undermine both the dollar and U.S. bonds. China is the biggest foreign owner of U.S. Treasury bonds.”

What are you talking about, Robert? My Lenovo Thinkpad (formerly IBM’s Thinkpad) is made in China. Many of my fine electronics are made in China.

Sure, plenty of my cheap stuff comes from China, but good stuff too. The Chinese are no slouches when it comes to electronics manufacturing. Why do you suppose Apple outsources its manufacturing to them?

China has a strong manufacturing base. Americans just consume it.

The only reason China is what it is now and the US is the way it is now is because the 1% perpetuate the only thing that makes them the 1%, ARBITRAGE.

Be it wages, lending, laws, regulations, liberties, health standards etc. etc.

They can get laws made and deals brokered that always gives them a cut and they have lots of cash left over for all the sleazy duschbag middlemen that accommodate this.

It is delusion to think that any of them, in this cabal, have any concern for the citizens of any of the countries that they have pitted against each other.

This article sums it up simply and effectively – “At its core, it’s untenable that the world can be so full of poverty while, at the same time, so full of resources (both raw and corporate) that nobody seems to want.

The water filter in the Frigidaire needs replacing, as does the SodaStream cartridge and this has been true for weeks, without affecting your life. You have 50 apps on your phone but only use a handful with any regularity. One of those apps, Seamless, lets you order food from more than a hundred restaurants that deliver to you, but not one of them appeals. You can’t even imagine what it is you want. Meanwhile, Apple wants to sell you a watch that can also order food. Elsewhere in the world (honestly, in your neighborhood), there is crushing poverty.

Capitalism, as we currently practice it around the world, has not done the best job of efficiently allocating resources. Broader distribution of wealth, in both countries like the U.S. and countries like China, would create a foundation of demand that could best utilize the resources we have available and fuel future growth.”

Read more: http://www.businessinsider.com/us-futures-rally-aug-25-2015-2015-8#ixzz3jpfYGuQK

I’ve come to realize that Netflix is like an entire refrigerator stuffed full of food, but there is nothing I want to eat.

Why pay money for Netflix when YouTube is free?

On YouTube, you can download tons of great films and TV series. I’ve downloaded every episode of One Step Beyond, Project UFO, Newhart, Hammer’s House of Horror, The Invaders, and more. (Yes, I like sci-fi, horror, and sitcoms). And plenty of films.

I only buy a handful of USED DVDs a year, from Amazon. I put a DVD on my wish list, then check back periodically, waiting for a cheap enough used DVD to go on sale.

I don’t know how Hollywood, much less indie filmmakers, continue to earn money. The old stuff is free, and just as good. Better, in many cases.

I rarely watch it, but Netflix is great for kids, and it’s only $8 a month, so it isn’t a big deal.

What happened to Argentina when it just started printing money?

“Inflation started rising prior to the 1980s debt crisis. However, in order to contain the recession that followed on from the crisis, Argentina started printing money. This led to an average annual inflation rate of 300% between 1975 and 1990. For example, during the 1980s, the purchasing power of the middle class shrunk by 30%. In 1985, in order to curb hyperinflation, the Argentinian currency, the peso, was replaced by the « austral », 1 austral being worth 1,000 pesos. However, monthly inflation rates remained high, exceeding 20% after 1988. In 1991, it was decided to anchor the Argentinian peso, which had once more become the official currency, to the US dollar. Money supply growth was also restricted by law.”

http://www.citedeleconomie.fr/10000-years-history-economics/contemporary-world/hyperinflation-in-argentina

I’m not sure of your point with this. Argentina’s economy tanked around 2004. Everyone lost 1/3 of their money when the realized the pegging to the dollar was unsustainable. There were so many working poor that they were digging into trash after stores and restaurants closed because they were starving. The banks had to shut when there was a run on them when people tried to remove their money. It was a MESS. I was there about 4-6 months after the crash, and people were hurting bad.

My point is that this is the most salient example what happens when countries start printing money that is pegged to nothing but vapor. That Argentina is small is irrelevant – the same things happens to a bug or an eagle when either hits the windshield of an in flight jet. Countries cannot just print money because they have printing presses and expect to forestall disaster forever. The fundamentals will always be important in the long run. This economy is built on the 1% funding ways to make life better for the 1%.

“My point is that this is the most salient example what happens when countries start printing money that is pegged to nothing but vapor”

Basically true but you have to remember that US dollar _is_ pegged to something and that something is oil.

It’s the only currency you can use to buy or sell oil. And US is brutally using military to keep it that way, by whatever means.

Without oil US dollar would be worthless in an year.

And everyone on top knows that (around the world) so US government is ready to start wars to keep the status quo.

Painful truth ^^^

Anybody who believes in free markets or controlled markets should realize the fed is out of ammo and the only thing buoying the grotesque valuations is irrational exuberance in RE and Stock Market investors. Where is the return 5 and 10 years out on these asset valuations?

Bumping up the market could be from long positions selling off. Well have to see how much volume traded today.

Homes are above where they were in 2007 in many parts of Costa Mesa/Newport and a lot of the Costa Mesa stuff is right next to the 405/55 and or 73 freeways. 600K to a cool million to live next to a freeway?

LA times Op-ed article says there is no housing bubble. Didn’t think an economist would point to the socal weather in part of his write up.

http://www.latimes.com/opinion/op-ed/la-oe-0818-yu-la-housing-bubble-20150819-story.html

Anyone have advice for a late 20’s guy working in West LA making the median wage with 60k down payment? Yo-ho Yo-ho condo life for me?

“Anyone have advice for a late 20’s guy working in West LA making the median wage with 60k down payment? Yo-ho Yo-ho condo life for me?”

Move to flyover country? Otherwise, if you want to live in L.A., definitely a condo, and probably a modest one. For the time being anyway.

If you can wait at least 3/4 years maybe the US will get some deflation (dollar going up contrary to the opine of the masses) plus in a serious recession/depression and RE will definitely drop some and that could be your entry point if you at least have saved over 100k. Probably many parts of LA is still not affordable so either commute or move out of state if you want to own single family home. IMO 15/16 could be the top for RE in many places especially if rates go up. Again, getting a loan during a recession might not be the easiest thing so you have to give your self the best chance to be the most qualified candidate with good credit/job etc…Take time to learn more about the mortgage/loan process and lenders.

McDuck: “Anyone have advice for a late 20’s guy working in West LA making the median wage with 60k down payment? Yo-ho Yo-ho condo life for me?â€

I have advice for you: avoid a condo, as it’s been pointed out to – it’s like renting with a mortgage. My first place was a condo purchase and I’m dealing with corrupt board members, owners who rent out their place even though it’s against the bylaws (including HOA president who lives offsite). What I’m saying is – condos are self-governing entities and if it can be avoided – AVOID.

You are still young enough to not feel too old to be renting. So rent, get a good roommate to share expenses, and SAVE. This is not the time to buy, and a dip in mean prices is a few years off IMO.

then when you have 200K down payment (or no less than 25%) you house shop near your job. Just remember property taxes are 1.25% of purchase price so be prepared to kiss goodbye a chunk of dough monthly, forever. And be prepared for maintenance. And remember, you are buying your neighborhood. Consider long and hard what your tolerance is for “transitional” neighborhoods full of uneducated working poor.

These are all things I wish someone would’ve told me.

Is this a sick joke? https://www.redfin.com/CA/Culver-City/11864-Bray-St-90230/home/6729897

Wow, that price is beyond absurd. More power to them if they can get a greater fool to buy for that price!

But what if Suzanne researched this?

https://www.youtube.com/watch?v=mHs40zpN20o

WHAT? THIS LISTING IS SPECIAL JOHN YOU GUYS CAN DO THIS

I’m getting tired of the fact that housing has become such a profit-driven high-stakes reality. I mean, for average person who will only ever have a primary residence, and not an actual business flipping houses, how can you afford this? That listing is a joke and I’m curious how it’ll play out. I guess it’s what the market can bear right?

If it’s a joke, it’s on the seller. I watched it sell for 570k back in April, thought that was funny. Looks like someone got cold feet halfway through a flip and is trying to find a greater fool.

Does anyone have any stats sq ft price during a normal real estate market? I tried to look for this info on Zillow and Redfin but no luck. I have read that price per sq ft is not a good way to value homes but after 8 months of looking to buy I think it is a pretty fair way to me. Sure some areas require a premium but not close to $100 per sq ft over similar homes in my opinion and if it does, well I’m not interested.

Anyways, any stats on this would be great.

“Does anyone have any stats sq ft price during a normal real estate market?”

Sorry, I can’t assist you with the stats you are seeking. However, I would like to point out that there is generally no such thing as “normal”. And like any investment advisor (which I am not) will tell you, past performance is not indicative of future performance. Therefore, I think that looking for stats on past markets which you feel may be “normal” will probably be of trivial utility. Unless you are aiming to pay the same $$ per sq ft as some arbitrary time period (which is still probably an exercise in futility).

Just tagging this on, current-affairs re housing, not so much that it follows on from Doc’s entry.

_____

Would YOU make 400 people homeless for an extra $16m? Decision time in Silicon Valley

Land owner to decide: $39m and his pals – or $55m

14 Aug 2015 at 23:36, Kieren McCarthy

Poll A trailer park owner faces an unusual conundrum: sell his property for $39m and keep the long-term residents on his land in their homes – or take $55m and watch property developers tear it all down.

That’s right, it could only be Silicon Valley.

continues http://www.theregister.co.uk/2015/08/14/39m_or_55m_whatll_be_trailer_park_owner_weighs_tough_choices/

Why are these people going to be homeless? Can’t they just move to another trailer park? This is no different than a landlord selling a property and telling his tenants their leases will not be renewed and they must move out. This happens all the time.

Unless the trailer park owner is in the charity business, he needs to sell to the developers asap!

I agree. Unfortunately, the city wants it both ways — affordable housing but higher property taxes. If Palto Alto wanted to make housing affordable, then it should lobby the Fed and government to cease their interventionist policies to prop up real estate prices. Spare the taxpayers from more subsidized housing and let the market decide. Chances are that these developers will lose their shirts in a few years when prices come crashing down.

Leave a Reply