Three Emerging Trends of a Depressed Economy: Pundits Screaming for Economic Socialism, People Going Back to College, and 99 Cent Stores Taste Inflation.

You would think that given the magnitude and sheer size of the Fannie Mae and Freddie Mac bailout that Americans would at least be more curious about the formula as to how this thing is going to unfold. [Cue the Crickets]. Instead, the public is focused on the “shiny things” once again like someone suffering from ADHD and needs to have new stimulus every minute. I felt this way watching CNBC this week. They have so many tickers, popping out yellow/red graphics, and special sound effects that you feel like you’re playing some kind of Wii game and if you take your eyes off the screen for one second a tennis ball is going to fly through and knock you out. Such is the world we live in today that even the “premiere” business station is more like an Ultimate Fighting Championship match.

To a certain extent it is necessary to keep people over stimulated given the absolute negative nature of the current economy. Yet this keeps people from actually focusing on the real problems that confront us because these problems are complex and multi-faceted that a single minded approach is not going to solve them. There was a great round table discussion on Charlie Rose this Monday discussing the Fannie Mae and Freddie Mac bailout:

*Click to Watch Video

Be forewarned, there are no flashy gold tickers or slapstick sound effects but there are plenty of reasons to be cautious about the current economy. As you can see from the screenshot, I’m not sure why they titled it “Fanny Mae” aside from it being a Freudian slip because all of us are going to get our collective fanny spanked. For what it is worth, Nouriel Roubini who is a guest on the show has been absolutely spot on regarding the current economic damage. If you go back, he was specific with exact details how this thing was going to play out. He has my utmost respect for standing up even when everyone else was running around claiming how fantastic the new innovations in the debt markets were going to revolutionize the world.

As I discussed in a previous article the California housing market is still in shambles and will continue to stay that way for years to come. Lehman Brothers, the struggling investment bank had this to say about California home prices:

(Calculated Risk)Â “[The Lehman] base case assumes national home prices drop 32% peak to trough, vs. 18% to date, with California down 50% vs 27% to date.”

Ian T. Lowitt, Lehman CFO

So basically what they are saying is California is only half way there. I would go on to say that this “bold” statement is nothing more than what we and others have been preaching for years but it takes an investment bank on the point of destruction for some people to listen. Why would you be listening to an investment bank that clearly has no idea how to invest or sustain profitability? Doesn’t that kind of defeat the purpose of being an investment bank? If people wanted to lose money this quickly they might as well take a flight to Vegas and get some fun out of it in the process.

Today, we are going to look at 3 emerging trends that signify a depression is in the wings. Frankly, the language has been so watered down in today’s world that many still don’t think we are in a recession! If you lost your home, job, and had no healthcare most people would consider this a depression. We don’t have soup lines like during the Great Depression but do you really need this to call a spade a spade? Money destruction is happening all around us. One of the trends is with pundits like Ben Stein and Jim Cramer being so flat out wrong and yet people provide these two a forum to spout incorrect information. You’ll love some of their past quotes and we’re going to hold them accountable. The next trend is one we have been predicting for sometime. What will those who lose jobs in the FIRE economy do afterwards? Time to go back to school. And finally, even the 99-Cent Stores are realizing that a dollar today is simply not worth what it once was.

Give me Free Money or My Head Will Explode!Â

Ben Stein frequently shows up on the KNX business hour, a daily radio show here in California that recaps local and national business information. Ben has been wrong so many times (what is up with economist named Ben these last few years?) that I wish I somehow had a searchable transcript of some of the shows. He has also shown up in print and has been flat out wrong. Now no one knows the future so I’ll give him that but it is also important to call people out where they have been wrong. This is from a New York Times article in December of 2007:

“This would occur, he said, if the value of the assets that banks hold plunges so steeply that they have to consume their own capital to patch up losses. With those funds used to plug holes, banks’ reserves drop further. To keep reserves in accordance with regulatory requirements, banks then have to rein in lending. What all of this means – or so the argument goes – is that losses in subprime and elsewhere that are taken at banks ultimately boomerang back, in a highly multiplied and negative way, onto our economy.

As the narrator in the rock legend “Spill the Wine” says, “This really blew my mind.”

So I started an e-mail correspondence with Dr. Hatzius, pointing out what I believed were a few flaws in his paper. Among them were his hypothesis that home prices would fall an average of 15 percent nationwide (an event that has never happened since the Depression, although we surely could be headed in that direction), and that this would lead to a drastic increase in defaults and losses by lenders.

This, as I see it, is a conclusion that is an estimation based upon a guess. I found especially puzzling the omission of the highly likely truth that the Fed would step in to replenish financial institutions’ liquidity if necessary. In a crisis like that outlined by the good Dr. Hatzius, the Fed – any postwar Fed except perhaps that of a fool – would pump cash into the system to keep lending on track.”

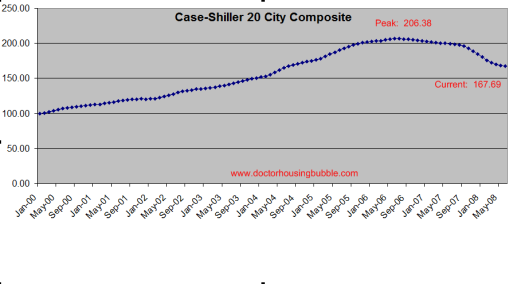

You should read the smugness this guy has over the economist and his well thought out paper that has proven right in a mere 9 months! We are now down 18.7 percent from the peak reached in the summer of 2006:

Not only is this one of his major miscalculation but this from a guy who thought subprime was contained. Sound familiar? Look at what he had to say back in August of 2007 during the credit crisis:

“(CNN Money) The stupid investor knows only a few basic facts: The economy has not had one real depression since 1941, a span of an amazing 66 years. In the roughly 60 rolling-ten-year periods since the end of World War II, the S&P 500’s total return has exceeded the return on “risk-free” Treasury long-term bonds in all but four ten-year periods-the ones ending in 1974, 1977, 1978, and 2002. The first three of these were times of seriously flawed monetary policy that allowed stagflation, and the last one was on the heels of the tech crash and the worst peacetime terrorist attack in the history of the Western world.

The inert, lazy, couch potato investor (to use a phrase from my guru, Phil DeMuth, investment manager and friend par excellence) knows that despite wars, inflation, recession, gasoline shortages, housing crashes in various parts of the nation, riots in the streets, and wage-price controls, the S&P 500, with dividends reinvested, has yielded an average ten-year return of 243%, vs. 86% for the highest-grade bonds. That sounds pretty good to him.”

I don’t need to tell you since that quick study of history from Mr. Stein the DOW, NASDAQ, and S&P 500 have dropped over 20% and are hopping in and out of bear market territory. This tired idea works because he doesn’t go back far enough, back to the Great Depression. By the way, this housing correction in terms of velocity is actually worse than the one experienced during the Great Depression. How can media outlets allow these people a mantle to speak out over and over yet be wrong on a reoccurring basis? Simple. They care about ratings and not the integrity of what is being said.

Let us now look at what Jim Cramer, the host of Mad Money on CNBC had to say this weekend. This weekend on TheStreet Cramer went off on a rant about how fantastic the Fannie Mae and Freddie Mac bailout is and implied it will somehow stabilize the market. As we are now seeing things play out, do you think Lehman and WaMu think a bottom is in place? Let us look at his overall argument:

“(The Street) We are now in a double-digit decline of housing that has made most houses bought since 2005 worth less than their mortgages. House-price depreciation has been so relentless, particularly in Florida and California, believe it or not, two states that could bring the whole financial edifice down, that if it isn’t stemmed then it’s difficult to stop a severe recession, if not depression, given the abrupt slowdown of the rest of the world and our own skyrocketing unemployment.

The only hope to break the chain of despair and turn around the endless declines in home values to the point where you SHOULD walk away from a home with a mortgage larger than the value of your house, is to stop this house-price depreciation.” [emphasis added]

Did you get that? This guy is looking for a floor on prices. The first thing you learn about capitalism is that the MARKET sets the price, not the government. That is why I’m so furious of these so-called free market capitalist turning out to be crony socialist when it comes to helping stop their losses. They are capitalist only when it benefits them.

Let us follow the logic and praise for the all glorious bailout of Fannie Mae and Freddie Mac:

“The Treasury’s takeover of Fannie and Freddie can change that because once mortgage paper packaged by the government enterprises is federal government paper, then ANYTHING can be worked out with the borrowers, and the borrowers represent the lions’ share of the troubled homeowners in the country who have not already defaulted.”

Wrong again! Does he think this is going to be free? I hate these arguments from folks who preach “no taxes” yet do side stepped Orwellian deals that are simply a hidden tax. It’s not called a tax but the American taxpayer is going to pay more to these entities. And Jim is so quick to say “ANYTHING” because it isn’t his money, its you and your neighbor’s money. That is why he is so quick to give the bailout a boo yah. Keep on reading to “blow your mind” on how a former Wall Street guy thinks:

“The government can cut the mortgage payments, and it can extend the terms, say to 45 years. It can take any hit to keep you in your home, and the paper is still insured.

Put simply, there will be no reason to foreclose, and no reason to walk away. That will DRAMATICALLY reduce the amount of foreclosed homes coming to the market. It will dramatically reduce the amount of money people owe on their mortgages.”

Are we advocating a socialism for housing now subsidized by prudent taxpayers who didn’t over extend themselves? The government can take any hit but it will come at a cost. This freaking bailout isn’t free. That is why it is a bailout! Cramer is wrong thinking this bailout will stymie the onslaught of foreclosures especially in California and Florida (2 states he mentioned) because people don’t want to pay for a house where they will get nothing out of it. The market will prove him wrong yet again in a few months as the $300 billion in option ARMs start hitting the market in full force here in California. Are you telling me Fannie Mae and Freddie Mac are going to buy some of these toxic mortgages? From reading the crony legislation, it doesn’t look like it. The 45 year idea is lame. Let us run some quick numbers to show you how pointless this is. Let us do the numbers for a $400,000 mortgage at 6.5%:

Principal and Interest:

30-year           $2,528

40-year           $2,341

45-year          $2,290

50-year           $2,254

So basically we are going to extend a mortgage 15 more years to save $238 a month? This is the type of long-term mathematical skills that got us into this mess in the first place. Why not do a 300 year loan and let the alien invaders pay for it when they arrive on the planet in 2308 AD? Let us keep going with the logic of Mr. Cramer:

“That’s how significant this takeover could be.

You need to forget its expense right now and the inflationary problems stemming from this. Those were the same reasons given when I suggested that we cut rates by 300 basis points last year and let everyone refinance when it was still worth it to do so.

I am tired of the moralizing based on a total lack of rigor and homework. We are at this extreme because our policymakers have simply been lazy, wrong, intransigent and foolish. If this were the private sector, all of these people would be candidates to be fired. If this were the NFL they would have been gone long ago. But because they are in high positions and considered somehow blessed with a ken far beyond reality, we are in this mess.”

Bwahaha! He’s telling you to forget that you are going to be screwed over by this bailout because that is the only way he can shove this argument down your throat. He’s tired of “moralizing” because he has been so utterly wrong. Being wrong on a consistent basis I imagine would get exhausting. But look at what he thinks will happen from this bailout:

“With bountiful credit and bank balance sheets cleaned up, we will get out of this moment, and we will be prepped to advance, just as the BKX, HGX and the retail index have been signaling. With mortgage paper turned into federal paper, the holders worldwide, from Russia to China to Europe, will be made whole. The world will rally and something good, at last, will occur.”

Bountiful credit is the reason we are seeing these problems. It will take years before the balance sheets of many banks will be cleaned up. Too bad the Cramer of Saturday couldn’t foresee the bailout and how the market reacted this week punishing Lehman Brothers and WaMu. The market had a nice rally on Monday which was quickly given up on Tuesday. Financials are back in shambles. A glutton for pain, Cramer proved how wrong he is again:

“I am tired of being laughed at for my July 15th call that the financials bottomed and my call for housing to bottom next year. I am weary of the catcalls and the attacks.

And, oh yeah, I am going to be right as of this weekend.

Maybe I just got lucky with this bailout, but it is better to be lucky than good.”

Let us look at how a bottom looks like in financials:

Need we say more?

The Miseducation of the California Worker

Just as we predicted, California’s education system is seeing an upsurge in non-traditional college students. Whenever the economy dips, people need to go back and get retrained. And there is no larger group that needs retraining than those in the real estate field. California has 110 community colleges across the state that serve 2.7 million students many who attend classes part-time. The L.A. Times has an interesting report on this emerging trend:

“Administrators say that when the economy dips, enrollment at community colleges typically surges. This fall, students are banking on these modest workhorses of California’s higher education system to ease their way through the economic downturn, opting for the closer, cheaper alternatives to state universities. Older students, in particular, are seeking training at two-year colleges to escape declining industries.

“There’s a sense of urgency in students to further their education at this time,” said Jennifer Coto, chairwoman of the counseling department at Santiago Canyon College in Orange, which is seeing an estimated jump of 9% this fall, notably among returning adult students. “Professionals that are now part of struggling industries are utilizing this time for the next upsurge.”

I’m not exactly sure if the next upsurge is going to happen anytime soon in California. In fact, many of the high paying 2-year careers are highly impacted at many community colleges. For example nursing is a very popular and in demand career yet providing these courses actually costs the state to train the workforce. At many schools there are waitlist that have students waiting for years simply to enter nursing programs. And if you haven’t noticed the state isn’t exactly cash rich right now. Our budget isn’t even in place. You think $20 a unit is going to provide a large income stream to the state? Some politicians keep claiming that the community college is going to retrain the future work force yet say they don’t want new taxes. You can’t have it both ways amigo.

And right on cue with the trend in California we get this:

“Real estate agent Jeannie Rothfuss decided to return to school for the first time in decades when the housing market soured. She chose the community college just over the hill from her Anaheim Hills home.

At $20 a unit, Santiago Canyon College was far more affordable than going to a state school or paying for online courses at $500 each. And she plans to transfer to Cal State Fullerton to earn a communications degree that she hopes will qualify her for a sales or marketing job.”

For those of you feeling sorry for this person, Anaheim Hills has a median price of $672,000 and $480,00 for their 2 zip codes. I would hate to tell Jeannie that her aspirations for sales and marketing are normally the first sections of a company to get slashed during a market downturn. So why else did she go back to school?

“”People weren’t buying houses, people couldn’t qualify for loans, said Rothfuss, 59, now in her second semester at Santiago Canyon College. “By going to school at least I know that by a certain month I will have accomplished something, whether it’s a sale or credits from college.”

Maybe it should be rephrased to people weren’t buying homes because people couldn’t qualify with their whacked out income now that we have to verify reality instead of fake no-doc loans. Many students transfer from the community college system to the Cal State system which has the ability to grant bachelor’s and master’s degrees. Many long-time readers remember me talking about the 10% tuition fee increase that hit this fall. Demand is still growing:

“Facing an enrollment boost of its own, California State University closed the freshman application period early this year, cutting off an estimated 10,000 fall students.”

The budget has cut education costs so now you are facing the repercussions of wanting everything without paying for it. But even people that are educated are coming back when they find out their industry isn’t paying as much as they once had thought:

“We’re sitting in an area that’s economically depressed, and we’re not turning anyone away,” said Los Angeles Southwest College president Dr. Jack E. Daniels III. Enrollment at his campus is up an estimated 12%, with gains in both recent high school graduates and older students. “We’re getting people trained and retrained for the work force,” he said.

Theresa Martinez, 24, signed up at Los Angeles City College after realizing that her degree in social work from UC Berkeley would command only mediocre wages in the tough economy. Now she is retraining as a nurse.

“When I get off work, I come here,” she said. Her job at a media research firm starts at 4 a.m. “So I don’t get much sleep. But I tell myself I went to Berkeley, so I can do it.”

Berkeley is one of the top public institutions in the country. So given that, you can see that even a degree from a prime school isn’t enough. There are only a handful of fields that are actually expanding so this isn’t the time to chase impractical degrees if you are looking to get hired quickly. The economy is simply that bad here in California.

“At Cypress College, classes that were canceled last year for lack of students are filled above capacity, with such vocational courses as air-conditioning and refrigeration, automotive technology and culinary arts all seeing double-digit enrollment jumps. Automotive classes are so in demand that instructor John Alexander advises would-be students to play “enrollment bingo”: obsessively check the college website for spots that open when others don’t pay their course fees.”

This is what happens. Reality is hitting. Not everyone can become a broker and agent and make six-figures with a high school degree. That game is over for this lifetime. Now reality is setting a gut check and it is time to get to business.

I Got 99 Problems But Money Ain’t One

The equivalent of Family Dollar in California is the 99-Cent Store. These stores sell nothing for over 1 dollar. Talk about having a title that conveys the theme of your store. Yet these stores are now facing the reality that the dollar is no longer worth what it once was. I remember buying some candy at a 99-Cent Store and found out that many of the bars are now reduced in size branding it as a “healthy” choice but of course being aware of the economy I realized they are simply scaling back without cutting the price. Clever marketers!

Well as you would suspect the 99-Cent Store is raising their price for the first time in 26 years:

“Sept. 8 (Bloomberg) – 99 Cents Only Stores will raise its top price for the first time in 26 years to 99.99 cents as rising fuel and commodity prices drive costs higher.

The 0.99 cent increase will take place at its 277 stores later this month, the City of Commerce, California-based retailer said today in a statement distributed by Business Wire.

The boost of less than 1 cent is “in response to dramatically rising costs and inflation,” Chief Executive Officer Eric Schiffer said in the statement. “Just as Motel 6 was eventually forced to raise its price above $6, after 26 years we are forced to raise our price by just about one cent.”

Wait. Motel 6 used to cost $6? When was that? Anyways, hiking prices to 99.99 cents isn’t such a big deal since they probably have tons of 9’s floating around to update their signs. Yet this is telling given that traffic and sales have been increasing at discount stores. People are shopping more heavily at places where they can purchase necessities. Why do you think the positive jump in Wal-Mart a few days ago wasn’t greeted with warm hugs by everyone else? Low margin products selling simply reflect societies entrance into another trend of forced frugality. Over a year ago in April of 2007 I did a report highlighting that since the start of 2000, that nearly 30 percent of all added jobs since the start of the decade where either directly or indirectly tied to real estate. My logic at the time still applies to what is going on today. That is, if so much of our industry is dependent on real estate what is going to happen when the bubble bursts? Most logical people realized that we would also face hard times in the economy yet some people couldn’t make this connection.

These three emerging trends: (1) pundits making wrong calls and screaming for crony bailouts, (2) people losing their jobs and going back to school, (3) and inflation from the bottom up is going to put an end to any sort of recovery for 2008 and I would venture to say for 2009 as well. California is going to look a lot worse because of the tsunami of round two in the option arm mortgages that is going to hit at the most inopportune time. Anyone outside of the state want to offer us a bailout please?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

15 Responses to “Three Emerging Trends of a Depressed Economy: Pundits Screaming for Economic Socialism, People Going Back to College, and 99 Cent Stores Taste Inflation.”

Charlie Rose Vid….WOW

Another thorough article. I appreciate your taking the time to do all the homework involved.

One small request…. Sometimes I find it difficult to follow the transitions between quoted material and your comments…. Can the quoted material be italicized to make it easier to differentiate?

I keep hearing the economy stinks. If you look at all the $150K jobs posted on employment sites, youd think this was a boom time…

http://www.linkedin.com (networking)

http://www.indeed.com (aggregating listings)

http://www.realmatch.com (matches you to the job)

There are attractive jobs out there for people if they know where to look.

Doc,

Never argue with someone whose initials are BS.

Besides, my take is he is actually a performance artist who has taken advantage of the fascination with celebrity (no matter how oblique), and his “economic” advice is really just an elaborate, multi-year joke. He laughs at night at the rubes who follow it, for he knows it’s as valid as a $3 bill. I mean, he can’t be SERIOUS with all that hoo-haw, can he? He’s a comedian, right? It’s all just a sick, twisted joke, right?

Oh. Right.

Motel 6 used to cost $6? When was that?

Back when dollar stores were called dime stores.

I remember watching Mad Money when Kramor was pushing Target. I never baught the stock. Two months go by & he screems at a caller to dump TGT. It was at that moment I thaught this man is both Psycho & full of shit. Although he was correct that TGT was going to “flatline”, wich it did, I couldn’t listen to him anymore after that. If you check youtube I’m sure you could find one of his meltdowns.

Don’t get me started on Ben Stein, he is a media ho. He never met a camera he didn’t like.

Cramer is just another CNBC spin doctor. Ivy league credentials but spin just the same. You have to admit he is entertaining! Just like the tennis ball!

>

Who is the federal government going to bail out next? The airlines? The auto industry?

>

If and when the Saudi’s lose the dollar peg and quit giving it support, we are toast.

>

Nakita Kruchev had it wrong. It was not the Amercan businessman that will sell the rope to hang America. The government will serve it up on a plate.

Suprise, suprise…..Fed hold “emergency” meeting about Lehman Bros. this Friday night. A new Bailout comming? I love how they do this on a Friday.

Little bit too pessimistic there (the whole “depression” talk). I was extremely bearish on housing back in ’05/’06, quickly unloaded all holdings, etc.

In the next six to nine months, unemployment will spike, we’ll have a large bank fail (WaMu or whoever), the DJIA will probably drop to 9K and some change, and then we’ll be out of the woods.

Life will go on, just like it does every business cycle.

The housing crash blogs are starting to sound A LOT like the housing boom blogs back in 2005, they’re the other extreme…

Why Friday you ask? Because that way it stays out of the Sunday papers & talking head shows maskerading as news. Beat the Press & Discrase the Nation. LOL

I can’t believe how many of you intelligent people posting these comments can’t spell.

I retired from the Ed Biz after 30 years in public and private institutions and agencies, so was pleased to see DHB take up this issue of the role of schooling in this socioeconomic mess.

~

One of the unacknowledged trends in this crash is the hyperinflation of degrees and training relative to jobs that has occurred since Baby Boomers were “marching” on their campuses in the 1960s. There have simply been too many people for the jobs available, work has been standardized, mechanized and downskilled, and the movement toward FIRE economics has reflected class war. I saw this first hand in Philadelphia, New York, Madison (Wisconsin), San Francisco, and Berkeley, and now in the Puget Sound. This amounted to selecting people for entry-level jobs that any reasonably mature working person could do according to whether they’d spent tens of thousands of dollars and four or more years in degree programs that were basically irrelevant. But the Ed Biz made out like champs and expanded like a flesh-eating virus in a hot-tub. A bachelor’s degree no longer means anything, and the only comforting thing is that, neither, really, does a master’s or doctorate. In some professions you acquire needed technical expertise in this way, but that’s no guarantee of anything.

~

For instance, the student mentioned in Doc’s column–with the bachelor’s in social work from UC-Berkeley. How could anyone in their right mind think that getting that degree was going to lead to anything but a need either for more expensive education, or a crappy job? Did this person have, or not have, professional experience during school? Where did this idea come from that just because you can get into this or that college/university, somehow you come out of it MORE QUALIFIED for the working world, and have a job waiting for you? Sometimes that’s the case–some training from some departments/programs does provide some people with better technical skills. But this idea is one that is also going to fall on hard times. Just because this person went to Berkeley really means nothing other than she went to Berkeley, and she feels that’s important. The idea of paying for some credits, sitting in a chair, and that equalling “an accomplishment” is mind-boggling. Just about any mouth-breathing no-neck carbon unit can go to college now. I reserve my full respect for the people who have built vigorous careers and meaningful job security out of genuine skills, work ethic, flexibility…and not what degrees they bought.

~

I have to say that the RealTor who hopes she can get a “communications degree to get a job in sales or marketing” is simply not adjusting to the real world. She’s still got the something-for-nothing mentality (“just buy this, and you can flip it for profit”). Lemme tellya, even at the height of the New World Super Duper Reaganomics Free(ish) Market Ultra Bubble, communications staff were always the first to get fired in crunch times. I always kept moving so didn’t have that problem.

~

I turned down several tenure track teaching jobs later in my career because I had no interest in trying to engage a bunch of seat-occupiers who were simply doing time till they could walk away with a degree, and then try to peddle it on the open market. Perhaps I’m being cynical, but that happens after 30 years of watching financial and arithmetical idiots run one’s beloved republic into the ground.

~

rose

PS, lest my cynicism run too far ahead of me, I wanted to note that I very much value education, probably above all other commodities beyond the survival basics. But the Ed Biz in my experience turned education into schooling and profit streams and “university-industry partnerships,” and that’s an entirely different kettle of sheepskin than systematically and courageously learning, growing, and evolving as humans.

~

rose

Jim Cramer has damaged the finances of untold numbers of people by convincing them they could time the market. His show makes me cringe.

Thank you Rose.

As a baby-boomer growing up in a small town with Depression raised parents, the option of college was just not there for me in 1975 due to money and their ignorance of the system.

I started working at age 17 and kept improving myself and my positions in various automotive dealerships, (starting as a service drive customer greeter back when the Ford Pinto gas tanks were blowing up in a rear end collision). I then then went into automotive manufacturing corporations until I was successfully reporting to the President of the company… all with only a high school degree.

I agree with you regarding meaningful education as I DID take several certificate courses over the years to gain knowledge of risk management, financing and transportation issues which I applied directly back to my position within the company.

Too bad… the automotive business took a dump… as bittersweet… I’d still be there but at LEAST in 2004 I went into another lucrative business… yep… you guessed it… REAL ESTATE. Sheesh! Do I know how to pick careers or what! Hey… I almost signed up for a $2000 computer programmer course!

A few good and a few hard years. In 2008 I still find that it’s what you put into the job that decides what you get out of it. My corporate experience has enabled me to run my real estate career as a business which I feel is why I am still making a decent living even though we are in such a tough market.

Every day is new… opportunities are there if hard work is incorporated.

I Love this column… very to the point and educational and a great read every day.

Leave a Reply