Housing market has come to a crashing stop: 1/3 of tenants not paying rents, Great Park in Irvine drops to almost no sales, and SoCal housing collapses to 6-year lows.

It was only a matter of time until housing, like every other sector of the economy took a big hit. Of course the housing cheerleaders thought somehow that a global pandemic would keep housing untouched while every other facet of the economy would come to a grinding halt. So it should come as no surprise that nearly one-third of renters (and soon mortgage holders) are having trouble making their rents. Banks are gearing up for waves of foreclosures. Only poor areas you say? In affluent Irvine, the Great Park area with a newly built section of homes went to close to zero sales from having steady sales in the past weeks. Did you also know the stay at home order hit on March 19, not even one month ago?

One-third of renters have trouble paying rent

It is no shock that renters are having a tough time paying their rents. I mean the economy just lost close to 17 million jobs in three weeks! And that is what we know of because many unemployment insurance systems came crashing down under the unprecedented volume. But of course, all is fine. Housing is only going to get a tiny cut from all of this health and economic carnage.

It is unlikely that things are returning to normal in April. Which means you have this full month ahead of economic pain.

Great Park in Irvine goes cold

In an affluent city in Orange County, Irvine you have seen new home building taking place. Recent areas of the city where bought largely by investors, and largely from investors from China. Hard to get people here with a travel ban and money is drying up.

“(OC Register). As February turned to March, the CEO of Five Point Holdings saw sales contracts at the Great Park Neighborhoods in Irvine running double the usual pace. One week, 24 homes sold. The next, 25.

Then, in mid-March, the coronavirus’ economic wallop hit. “Stay at home†orders scared house hunters and stymied sales effort.

Sales fell to nine in a week. And since then, basically, none).â€

That can’t be good right? And what do you expect? This is an economic crisis so of course poor and wealthy are going to get hit in varying degrees.

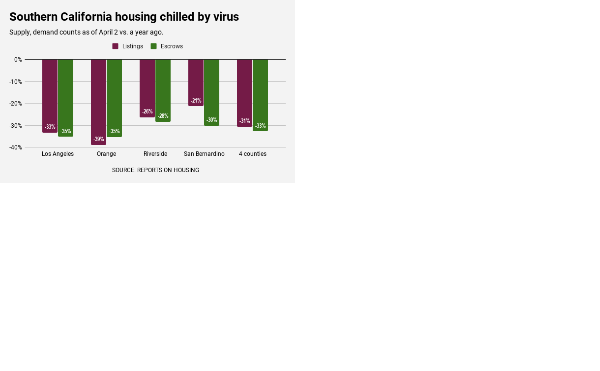

SoCal housing volume collapses to 6-year lows

See that? Housing volume has tanked to 6-year lows and it will go lower. Here in SoCal, people for the most part only started taking this serious about 2-weeks ago. And we are going to be operating in this mode for all of April and who knows how much longer.

People are leveraged up to their eyeballs here. You should see the forums with AirBnB landlords. The panic is so real you can feel it come through your screen. This is not good and housing values were already hyper inflated. The Fed can’t force people to borrow. What the Fed is doing is trying to keep the system from melting down. Same game plan as 2007-2009 and housing still got smashed.

We are just starting this and we had a mega 11-year bull run now being taken down by a virus. Housing is not immune.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

473 Responses to “Housing market has come to a crashing stop: 1/3 of tenants not paying rents, Great Park in Irvine drops to almost no sales, and SoCal housing collapses to 6-year lows.”

Yes, multi family and AirBnB landlords will get hit.

But waves of foreclosures? Just because sales volume is low doesn’t mean prices are collapsing. For a housing price crash you need the market to be flooded with inventory.

Wake me up when we see skyrocketing inventory. The opposite is the case at the moment. Sellers pull back.

And Rates aren’t going up anytime soon. I would bet my money on lower rates.

The impact on RE depends on how long we enforce the shutdown. My guess is we re-open the country gradually starting in May.

Cheers, millennial

Right on M, that’s exactly what I see also. Right now looking at buying a fixer up on the north Oregon coast. Just awaiting the price from the bank, they foreclosed on the place two years ago.

Obviously you don’t understand market dynamics. You have zero bids prices fall hard. See the stock market zero bids forced 1300 pts off the SPX in less than 3 weeks or around 35%. Sorry has nothing to do with a flood of sellers rather a dearth or zero bids.

Matt, I thought that for years….I was wrong. Zero bids means the seller will pull the property of the market. Either lives in it or rents it out. Unless you have mass layoffs of HIGH paying jobs you won’t see them selling at huge discounts. Tell me why they would if they don’t have to?

Ah yes, when there’s no demand on something its value falls to zero. I think it’s a constitutional amendment. If you ever see a property that’s on the market for years with no interest you can offer $0 and the seller must accept because he has no choice.

“My guess is we re-open the country gradually starting in May.”

What year?

2021

2020. We re-open in 1-2month gradually. Why wouldn’t we?

The flu killed 80,000 in 2017/2018. The corona virus kills old people that have already health issues. Isolate those and the rest should go back to work.

There are so any things that you forgot to mention. You are naive to think the economy is going to back to normal after this pandemic. There is going to be a huge aftershock of people not spending money and staying home because they are still scared of covid-19.

Economy being bad will affect EVERYONE. Especially those who are over leveraged which are the average Americans.

On top of that banks are putting stricter resections on loans. If you don’t have $$$ and good credit score of 700+ you will not get approved for a loan. Due to the forbearance banks and the mortgage sector is on the brink of collapse.

Shortage of goods due to the huge delays in CHINA. Which will make the economy worse and probably send us into a depression.

Foreign Money leaving. As US becomes the most severe country to be hit with COVID-19 you will expect the foreign investors AKA CHINA to start leaving in drove. They have already stop coming here for the past few years expect that to double.

There is nothing that will prop up this housing bubble.

Well you got low interest rates and low inventory and ENOUGH demand and ENOUGH people that will qualify for loans. That oughta do it.

You can look at the 5 gallon jug half empty and focus on what’s not there or you can look at it half full and see that there’s plenty of water to satisfy the thirst.

Inventory is light now, but that will change soon. What people forget is that no one HAS to buy, but many people HAVE to sell for any number of reasons. With zero buyers that inventory will start to swell.

“There is nothing that will prop up this bubbleâ€

Two errors here.

It’s not a bubble.

AND

You don’t have to artificially prop up this market since the prices are determined by supply and demand. You have little supply and historic low rates.

“I noticed our RE shills get a bit angrier each month since the bubble is slowly deflating. Now imagine how they act when we have a full on crash. It’s going to be very entertaining here soon!” -Millie

Maybe you can argue with yourself.

@M on one hand I miss our debates on the market, on the other hand I’m glad we can finally agree and prosper in RE using rational analysis based on real time market conditions and play with the cards were dealt with. Excellent insight ðŸ‘

New Age: Why do you completely ignore the fact that M is either not the same person as Millennial, and/or is/was a troll?

When the economy is facing a recession or depression how will there be a huge demand in real estate? The reason people kept buying these past few years is because they think housing prices will continue to rise into infinity. They had FEAR OF MISSING OUT. Once the housing prices start stagnated the demand will start to fall off.

If you don’t have job security and you no longer have the rising real estate wealth. On top of that the forbearance is going to cause a lot of people into huge debits that will lead to foreclosure.

Please tell me why a bad economy would mean real estate will stay the same let alone continue to rise?

Your Hero: I have no idea what the future holds with regard to real estate prices (just like everyone else). But based on recent political discussion, I think it’s possible that forbearance may not have a significant impact. From what I’ve heard, it appears that a lot of banks may just add the missed payments to the end of the loan. I’m not sure how many payments can be missed, but this might make a big difference in people avoiding foreclosure. I hope it’s all a ruse, though, because I’d love to pick up a cheap house.

Are you the same millennial that was getting ready to buy at 50-70% discount and arguing how renting is so much cheaper? Why are you arguing the opposite now, when you predictions are about to come true (partially)? Did you buy/inherit at the peak and chose a more convenient system of belief?

San Diego CPA: Because it’s either not the same person, and/or is a troll.

Now is not the time to buy. This coming November, another round of the Corona Virus. Don’t sell until we get a vaccine. Wait another 18 months before considering selling. Same goes for the stock market.

Actually there will be a lot of over-levered speculators who are selling out right now so absolutely as with Boeing being a buy at $90 US dollars a share so too is Southern California Real Estate. It’s not like the War Effort has gone anywhere and unlike Vietnam in the 1970s where funding for the War was cut off by Congress this is not true in this financial collapse. Quite the opposite. Another $500 billion just got put out by Congress today with another 2 plus trillion in infrastructure spending on tap. That makes for 5 TRILLION US Dollars going into election Year 2020 with 2.7 trillion US dollars already out the door. This excludes the trillions in Federal Reserve monies backing corporate bonds. Oddly enough the US Dollar surged today. That’s very good news for Southern California Real Estate and indeed all West Coast real estate. *Always closing!* Move along.

Yes, with currently 10% and rising of the total US workforce out of a job – record bankruptcies on both small and large businesses and a projected 50% of people planning to miss paying rent on May 1st ….. you’re totally right – housing market will be unaffected.

This is an IQ test you just failed spectacularly. Don’t worry – what does the economy and unemployment rate have to do with people holding or buying homes anyway? Dur..

Who is going to miss paying rent in May? Almost everyone is getting a $1200 check and is getting more money weekly than what they would get if they were working.

Even if people get the $1200, that’s not going to do much. I’ve read that a lot of people are still waiting and others may have to wait weeks or more. I’ve also read that state unemployment departments are massively overwhelmed and that many people have been waiting over a month for benefits (and are still waiting). The paycheck protection program is also a joke, as the spending limit has supposedly been reached and there are a ton of applicants that have received zero because of that, me included (will more spending be authorized? No idea). All in all, many people are starting to hurt more and more financially. Thankfully I can last many years on savings before I’m homeless, but I doubt that a ton of people are in such a position.

Greetings M,

Have you considered the scenario when severely over leveraged investment property owners in urban centers like SF, LA, or SD default on their loans en masse?

I am talking about those slick folks who bought up multiple properties to rent on VRBO and AirBnB for example. I am wondering how they will be able to float through the next couple of months mortgage payments when their income has been effectively terminated due to travel restrictions and social distancing protocols? And if this drags out another year to 18 months? What happens when tourism or short term renters disappear because people will be hurting financially for months to years after having to leverage themselves on credit cards just to put food on the table through this crisis?

I live in Los Angeles county, where 50% of people are either without a job or income, or severely reduced hours:

see: https://www.latimes.com/california/story/2020-04-17/usc-coronavirus-survey

Smells like massive and widespread defaults to me! Would you say that, at least in this scenario, it could force a glut of bank owned inventory onto the market?

Also, you don’t think lenders will be tightening up their home loans? JP Morgan Chase just changed their requisite minimum 5% down and 620 minimum credit score to minimum 20% down and 700 FICO this week. Not so sure banks are going to be gifting loans in the current economic conditions, even to those with sterling credit ratings as there is no precedence for these market conditions.

It really seems like a matter of how much longer and to what extent the shutdowns affect daily life. It is my assumption that RE prices will have to bend to the laws of Supply and Demand, and there are conditions in place for Lots of Supply and 0 demand.

If you are a cash buyer – its a different story of course.

Best of luck to you, Boomer!

A supply glut in what? Overpriced mutlifamily and vacation rentals? I wouldn’t call it a “glut” but I’m sure some of those will be hitting the foreclosures. That’s what happens when you overleverage just like SFH owners were overleveraged in 2007. So sure you might see deals start to pop up in that sector of RE but don’t bet on a massive crash. You said it yourself, if you have cash you’re good. You know who has boaloads of cash? Yep those property owning corporations that will gobble those properties up just like they did in 2011.

Good point. Boeing is planning to lay off 10,000 in La. So how is the Boeing buyout good for California real estate. In April lot of the layoffs were in sales and management. The real estate industry is fooling itself when several companies are layoff management for over a year. They just can refinance loans forever.

Woah! You said for past 2 years that inventory was everywhere. What changed?

Let’s pick this apart point by point:

1. “So it should come as no surprise that nearly one-third of renters (and soon mortgage holders) are having trouble making their rents.”

I’m going to assume that 1/3 figure is correct although as source would be nice. Anyways, comparing renters and mortgage is asinine. The people that lost their jobs are overwhelmingly renters. Don’t expect many defaults on the mortgage end.

2. “In affluent Irvine, the Great Park area with a newly built section of homes went to close to zero sales from having steady sales in the past weeks.”

That’s what happens when there’s a stay at home order. Who’s thinking “Oh gee let’s go look at model homes!” When the sales office is most likely closed and no one’s thinking about buying homes in this short window of restrictions. That’s like saying “Walmart sales fell to ZERO between the hours of 12 AM and 6 AM” when the store is closed for business during that time. See I can sensationalize things too.

3. “Housing volume has tanked to 6-year lows and it will go lower.”

See point #2. People are not worried about buying homes right now and sellers aren’t selling. What do you think will happen when things normalize? Not necessarily a swarm of buyers but business activity will pick back up steadily.

4. “You should see the forums with AirBnB landlords”

You should see Las Vegas casinos too. It happens when you got a pandemic that affects travel.

I cannot see how this translates to a major housing collapse. These arguments aren’t even relevant to the reality of the situation at hand. I’m not arguing that we’ll be back to the normal leaps in in YoY pricing but definitely we will not see a giant pullback in prices. The ONLY way that will happen is through an economic crisis that affects high earners and a dramatic increase in interest rates. The former is more likely to take hold than the latter once upcoming quarterly reports show less than stellar earnings and companies are forced to slash middle management jobs which are potential homebuyers. That’s why I say a 10-20% drop AT BEST. You’ll get more if and only IF interest rates shoot up to 5%+.

And for the love of God or whoever you believe in please stop mentioning 2007-2009! That era was a completely different era that was centered around RE so of course it got hit hard. Anybody with any ounce of brain matter could’ve seen that coming. This is not the same and it’s foolish to assume so.

Inb4 tHiS tImE iTs DiFfErEnT

Top response NewAge!

What will they cost when the dollar goes Wiemar ?

@Echback I’m willing to bet prices so high, it’d make the 2006 market look like the 2011. Happens with assets undergoing inflation. Might as well buy houses in gold coins at that point (which I definitely loaded up on 🙂

We’ve been hit by a different type of Gray Swan.

It definitely stopped the economic jet engine but the pent-up demand is still there for houses, dining out, Disney, Cruises, etc, etc.

Our FED pilot just made it cheaper to borrow to do all of these things when we get out of lock up.

That is something the FED pilot did not do quick enough during the 2008 Gray Swan.

Activity in large portions of the economy has ground to a halt. Those folks had jobs and spent money, and now they are not. Plus the uncertainty re: the path forward for the economy (how long do the stay at home orders last? Will there be future waves of COVID? Will the economy be able to restart like turning a key, or will it sputter?) will make investors and lenders nervous, which can have the effect creating a self-fulfilling prophecy.

Nobody knows what is going to happen. But to be so convinced that the real estate market is not going to be affected is just not defensible. There are very real and plausible pathways that lead to a real estate bear market.

Oh by the way, I work for a very large organization that is spends 10 digits a year on capital projects. We are rethinking everything.

@Steady

Good insight bit try looking at it in a different way. Instead of focusing on who’s losing their jobs why don’t you focus on who’s KEEPING their jobs? Prices aren’t affected by who CAN’T buy theyre dictated by who CAN buy and there’s plenty of those kind of people available to keep the prices steady +/-10%. The supply is even lower in an already historically low inventory market. It’s slim pickins for buyers so competition is high which means prices stay where they’re at.

And I’m not saying that RE won’t be affected, I actually do believe this will have some sort of effect the only difference is that I do not believe it will be a catastrophic collapse. You get a slight dip in prices because of uncertainty then they might freeze for a couple years so technically yes it could be a bear market but A house selling for 500K will not go down to 250 or even 350K so don’t hold your chips waiting for something that just won’t happen (at the current interest rates). My best year in real estate by far was last year when prices took a dip after interest rates shot up to 5% then immediately pulled back to sub 4. Houses were selling for 10% off which is a huge sum for flippers. I made three time the amount of my next best year because I knew how much of an impact interest rates have on our economy.

@M thanks man just trying to help people see the bigger picture and block off the noise!

1. “So it should come as no surprise that nearly one-third of renters (and soon mortgage holders) are having trouble making their rents.â€

“I’m going to assume that 1/3 figure is correct although as source would be nice. Anyways, comparing renters and mortgage is asinine. The people that lost their jobs are overwhelmingly renters. Don’t expect many defaults on the mortgage end.”

So don’t 1/3 of those renters pay 1/3 of mortgagees those rents? How does 1/3 of people not paying rent not at some point lead to 1/3 of mortgages not being able to be paid? Keep in mind lots of those renters rent homes, rent apartments in homes or even rent rooms in homes.

You could argue that many small business owners are home owners. With many of those small businesses closed or operating at a much lower capacity / profit margin, how long before they have to choose between rent / mortgage on the small business or mortgage on their home? Something has to default there. You’re not going to tell me that most can carry the cost of both for months. Some might, but you can bet most can’t.

When we get back to business, doubtful all small businesses will reopen and for those that do, doubtful all employees are hired back right away. The longer this closure goes, the more the former and latter are true. The longer those can’t pay rents, the higher the chance of defaults.

I think the fact that 1/3 of people can’t pay their rent is exactly why the mortgage defaults can go sky high. Remember it’s not just home rents, we’re talking about. It’s business rents, commercial rents,…..all of this eventually leads to some type of mortgagee default. Rents / mortgages are tied together, when the first one can’t fulfill the obligation, how does the second do so? My two cents….

Let’s ask some questions, point by point:

“I’m going to assume that 1/3 figure is correct although as source would be nice. Anyways, comparing renters and mortgage is asinine. The people that lost their jobs are overwhelmingly renters. Don’t expect many defaults on the mortgage end.”

Those who lost their jobs are overwhemingly renters? A source would be nice. Dr HB used OC as an example. Are those in the newly built developments overwhelmingly renters? If not, and the new buyers or potential buyers lost their jobs, how in the world wouldn’t there be many defaults on the mortgage end?

2.”That’s like saying “Walmart sales fell to ZERO between the hours of 12 AM and 6 AM†when the store is closed for business during that time. See I can sensationalize things too.”

I’m pretty sure Walmart counts that six hour down time when they figure the cost of the inventory while the store is closed and no one is there to buy Great Value hot dogs. However, how can a builder, with tens of millions in building loans make nut when his development is not selling and he has to make his building loan payment? I’m also pretty sure that a complete loss of home buyers for a few months was never figured into the builder’s pizza.

3. “See point #2. People are not worried about buying homes right now and sellers aren’t selling. What do you think will happen when things normalize? Not necessarily a swarm of buyers but business activity will pick back up steadily.”

Saw point 2 but it didn’t address the fact that housing volume decreased for the past six years before the Wuhan virus caused state governors to stop their economies. Normalize? What does that look like when governors can now shut down their economies in the future because they see someone sneeze? If a potential buyer, who in January, 2020 was confident that he’d be employed long enough to buy a house, what kind of confidence do you think he’ll have in the future when he believes he can at the drop of a hat, lose his job? What if that same buyer is foreclosed upon because of the Wuhan flu, or his credit is lowered after he goes back to work? So, what’s normal?

4. “You should see Las Vegas casinos too. It happens when you got a pandemic that affects travel. I cannot see how this translates to a major housing collapse.”

I think you picked the wrong city to make your point. Gaming is seventy percent of Nevada’s economy. The lion’s share comes from Las Vegas. Seventy percent of Nevada’s economy has stopped and will be stopped for months after governors lift their lockdowns. All business supporting gaming has also stopped including large percentages of police, firefighters, construction, road construction, maintenance, etc. People can live in foreclosed homes and live in rental house without paying rents when no one is employed to evict foreclosees and renters, but how in the world will there be no housing collapse in a place like Vegas? Who will be able to get a mortgage or qualify for rent even if housing prices only decrease by up to 20 percent?

One last question; will you go to Vegas, get a hotel room, go to a restaurant, gamble in the casinos, go to a show the day after the lockdown is lifted in Nevada? Didn’t think so.

My family was in Vegas in Mid-Februrary.. we all had a bad cough, nasal drip, and basically a moderate cold for a month… and recovered. We have a strong feeling we already had Corona.. so would definitely go back.. it was a nothing for us thanksfully.

Exactly LAOwner,

For most people this is a nothing burger. Isolate the sick and old and the rest needs to go back to work.

See Sweden.

That is why testing is of extreme importance.

Where are the tests? Where are the tests if you have the virus currently? Where are the tests that determine whether we have antibodies?

You might have had a common cold and the next time you visit Vegas, you will be in the hospital dying. Nobody knows. Not enough tests.

Political Rant.

South Korea had tests and a nationwide quarantine in February. They limited the virus death toll to 200.

The US, had no tests, had no quarantine, and now the US death toll is approaching 25,000. Why is our government so dismally incompetent compared to South Korea? Don’t give me a right wing rant because they have less people. True, they have 1/6 the population of the US. Why is the compensated death toll at nearly 25,000 in the US when we could have had a competent federal government with a death toll of 1200? I believed Dr Fauci in February. He was correct. Trump was saying this was a MSM Democratic hoax. Are murder charges appropriate for incompetence?

South Korea is testing everyone. The US is not. I won’t rant again.

Sweden is testing like the US and they have 13,000 confirmed cases and 1400 deaths. That’s an 11% death rate and exponentially growing. Don’t be like Sweden. with a 133M people in the US, that would leave us with 14M dead with an 11% death rate.

Testing is the key. If you test everyone and isolate only those that are contagious, we can get through this.

After a month, we are still all waiting for tests. Nobody can get tested around here, masks and bleach are still cleared from grocery shelves. but Trump tells us every night there are plenty of tests and PPE. If you say it enough times, some will believe it.

1. “So it should come as no surprise that nearly one-third of renters (and soon mortgage holders) are having trouble making their rents.â€

“I’m going to assume that 1/3 figure is correct although as source would be nice. Anyways, comparing renters and mortgage is asinine. The people that lost their jobs are overwhelmingly renters. Don’t expect many defaults on the mortgage end.”

So don’t 1/3 of those renters pay 1/3 of mortgagees those rents? How does 1/3 of people not paying rent at some point lead to 1/3 of mortgages not being able to be paid? Keep in mind lots of those renters rent homes, rent apartments in homes or even rent rooms in homes.

You could argue that many small business owners are home owners. With many of those small businesses closed or operating at a much lower capacity / profit margin, how long before they have to choose between rent / mortgage on the small business or mortgage on their home? Something has to default there. You’re not going to tell me that most can carry the cost of both for months. Some might, but you can bet most can’t.

When we get back to business, doubtful all small businesses will reopen and for those that do, doubtful all employees are hired back right away. The longer this closure goes, the more the former and latter are true. The longer those can’t pay rents, the higher the chance of defaults.

I think the fact that 1/3 of people can’t pay their rent is exactly why the mortgage defaults can go sky high. Remember it’s not just home rents, we’re talking about. It’s business rents, commercial rents,…..all of this eventually leads to some type of mortgagee default. Over the last 10 years, tons of people have bought homes / apartments as rental properties. You can bet those will start defaulting first, no amount of refi will cover the rent a tenant paid. Rents / mortgages are tied together, when the first one can’t fulfill the obligation, how does the second do so? My two cents….

New Age, our points are interesting. But some are debatable.

1. The unemployed are not just blue collar workers. No, this is affecting everybody. From the rich who have lost value in their assets and their businesses. To middle class salesmen who are no longer selling. To white collar workers whose companies are wobbly. Post Covid, we are going to see a recovery spike in employment, but tappering off to a labor market that is weaker. The economy will have to work itself out of its hole. Anyway, weak labor market means weaker housing market.

2. You’re right, people are not looking for homes right now as stay-home orders are in effect. You are also right that the market is characterized not only by less buyers but less seller. The volume of sales has been slashed. Sorry real estate brokers. It is too early to determined post-covid pricing when the market has been eclipsed.

3. Back to employment numbers. I suggested that the home buying class is not untouched economically. This will translate in some continued slowing in the market once Covid lifts. Yes, activity will shoot back up (from being shutdown) and work towards a new equilibrium. And that equilibrium will leave several holes of lower pricing. I predict luxury housing, which was overbuilt pre-virus. And marginal homebuyers will disappear as financing has tightened a bit.

4. A real estate crash, is defined by banks taking back mass quantities of properties. This time that might not happen, partially because borrowers affected by Covid may have a year of defeasance to catch up. I don’t see normal appreciation in the works for awhile. And there will be an uptick of shortsales for people that need to sell during the next two years. And yes, a sizeable uptick in foreclosures, but not an avalanche like 2009.

2.

Housing isn’t getting taken down by a virus. The virus is being used by the government to cover up an economic collapse that the central banks have engineered.

DR. SHIVA EXPOSES FAUCI, BIRX, GATES, AND THE W.H.O. COVID-19 ENDGAME

https://www.youtube.com/watch?v=zCT28MJ2edc&feature=youtu.be

You are batshit crazy if you listen to thst stuff.

PlanDemic!

The virus is used as a cover for something rotten which started to manifest in September. The FED was losing control and didn’t know how to justify their actions anymore. The virus provided the cover. It gave cover for massive bailouts and wealth transfer from the 99.99% to the 0.01% – more centralized power and control.

I agree with you, but I think it goes beyond that. I transcribed something from SGT Report the other day that sums up what I also believe is happening:

“Trump is the product of a coup d’etat. He’s not really a president. He’s a CEO in charge of managing a receivership for a bankrupt asset on the Fed’s balance sheet. That’s really what his role is. This (the lockdown) feels like we are in receivership to a group of Satanic international bankers who have called in IOU’s, and are now shutting everything down. They think they own everything anyway. They want to own the planet, these illuminati families that own the central banking printing presses. They think they own us all anyway, and we’re just collateral against the debt, and now they’re calling in the debt. I fear we’re in receivership, and the debts that they printed out of thin air, and have ensnared us with decade after decade, are being called in.” ~SGT Report, 4-10-2020

Interesting perspectives. I certainly don’t discount them.

However, with regard to Karin’s post: what would shutting down the economy do to help the bankers? It’s just punishment? It doesn’t really make sense to be honest.

Flyover, this could be happening.

This has happened before in Russia and Cuba during the 20th Century.

The people revolted. Fortunately, unlike then, we have an election process to save us and vote in a Democratic Socialist President (Like FDR) instead of a full-blown Communist.

The Illuminati don’t appear to be too bright since they don’t learn from history.

Shutting down the economy creates a situation where hard assets that are owned by the middle class and moderately wealthy are sold at a discount to the only people who still have cash available which is anyone who gets first access to the trillions of dollars that the fed is pumping out which isn’t the common person. Think of all those rental housing portfolios that were created at a discount during the last crash.

The way the “bailout” is structured creates an environment where the average person is forced to sell discounted assets because they can’t keep up with the monthly monetary cost to maintain it either due to a lost job or non-payment of rent from their tenants, or are forced to sell to keep paying other expenses, and the politically connected class with access to an essentially unlimited amount of zero interest loans can come in and buy up the assets which will be productive in a few years but just aren’t right now.

JR, I am glad you see the picture with 20/20 vision; glad I am not the only one – it gets boring being a lone wolf..:-))). Some people don’t see it because the MSM is telling them what to think, to look at the virus on the right while they steal on the left. Total distraction from what really matters. You can demonstrate against the virus and lockdown, but don’t you dare to demonstrate against the biggest wealth transfer in the US history by the Wall Street cabal. Since most economies are totally dependent on US financial system, they have to play in this scheme according to the script, more or less. Yes, the virus is real, but in the grand scheme of things, if people would get the perspective, it is nothing.

In few months, when the dust settles from this engineered economic fallout, the virus will be the least worry on the people’s minds.

19% of renters normally don’t pay their rent during any given month which seems high even in normal times.

Housing is DONE, stick a fork in it. JP Morgan Chase, the nation’s largest lender, announced that effective Tues. homebuyers will need FICO scores of 700 and 20% down payments to qualify for a mortgage. Housing prices will have to crash so most buyers, especially 1st time, can afford to put down 20%. Look out below!

https://twitter.com/PeterSchiff/status/1249154974749282305

AirBnB is about to crash the US housing market. Thousands of super-hosts who bought 10, 20, 30 properties with mortgages and are heavily levered…are all about to default.

Without travel there is no rental income to pay these mortgages.

In 2-3 months – 2008 all over again

Boom

https://twitter.com/govttrader/status/1244845607627501571

WSJ: No rent was paid in April by nearly a third of American renters

https://www.marketwatch.com/story/no-rent-was-paid-in-april-by-nearly-a-third-of-american-renters-2020-04-08?link=MW_latest_news

Realist,

Nothing has to crash. The only way to get lower prices is if inventory increases dramatically. Tell us how inventory will skyrocket?

Right now you have less demand and less supply. Lower sales volume doesn’t mean prices go down. Sellers are pulling back and will re-list when the country opens again.

Simple. No one HAS to buy a house, but a great number of people HAVE to sell for any number of reasons from financial to societal. With pretty much zero buyers inventory will grow.

Zero buyers? How come houses go into “pending†daily? Do you track data?

I really wanted to reply with a well formulated response but then I saw “2008 all over again” which tells me you don’t understand or completely ignored the factors in THIS market and there’s nothing I can say to change your bias mind so yep hold on to your cash that will rot in your bank and wait for that epic crash! It’ll be spectacular, I get you’ll get Newport Beach front mansion for $400K! Just keep holding that cash and whatever you do, don’t buy because your day will come and you can all tell us that you told us so while we’re all drowning in mortgage debt.

“JP Morgan Chase, the nation’s largest lender, announced that effective Tues. homebuyers will need FICO scores of 700 and 20% down payments to qualify for a mortgage.”

I need to point out that when the tide went out this month, an alarming number of irresponsible mortgage holders didn’t have enough savings to cover even one mortgage payment.

20% down and a 700 (Good) credit score should be a requirement.

None of us want any of these yahoos to be able to gobble up multiple homes in the next few weeks with zero down loans while having bad credit scores. It will just make things much worse.

Good. That means slight discount coming up that will vanish when things pick back up and banks revert back to their old lending.

Bob, I finally agree with you. You are right on this one.

All those AIRBNB loans are guaranteed by the GSEs. Nobody will take a loss on the bonds. MBS are one of the safest places to be as 98% of all mortgages since 2009 are backed by the GSEs. Who cares if people default, the bond holder will still get paid 100%.

The GSEs will just hand over the ownership of these properties to someone on Wall Street. They can use the playbook established after the real estate bubble.

No wave of foreclosures…

https://www.ocregister.com/2020/04/06/coronavirus-california-halts-lender-foreclosures-renter-evictions/

Cheers, millennial

The terms of forbearance are, you don’t have to pay for three months, but in the fourth month, FOUR payments are due. Anyone who hasn’t had a job–and won’t have one for at least two months–isn’t going to have four months of payments on the 1st of the fourth month. Sorry to say, lots of foreclosures coming down the pike.

Blame our legislators who drafted the law so sloppily.

Laws can be changed. Forbearances can be extended.

From Santa Monica: https://s3.amazonaws.com/smdp_backissues/040920.pdf

City Hall issued an order Wednesday strengthening a temporary moratorium on evictions enacted last month in response to the economic impacts of the coronavirus pandemic.

The original order City Manager Rick Cole signed March 14 protects renters from eviction if they prove with documentation that they cannot pay rent because they have been financially impacted by COVID-19. The order requires that tenants repay all deferred rent six months after the crisis is over. The moratorium was later broadened to protect businesses and prohibit Ellis Act evictions. …

“The order requires that tenants repay all deferred rent six months after the crisis is over.”

That just kicks the can down the road. Does anyone really think that the person who couldn’t pay their rent right now for however many months will magically be able to pay all past due rent within 6 months of the crisis being over? Or are they just going to keep saying that we’re in a crisis so the ultimate reckoning never happens but ends up flooding the market with now worthless rental properties as landlords desperately try get rid of a depreciating asset that has a monthly cost to maintain but doesn’t produce any income?

The terms of forbearance are, you don’t have to pay for three months, but at the fourth month, FOUR payments are due. Anyone who hasn’t had a job–and won’t have one for at least two months–isn’t going to have four months of payments on the 1st of the fourth month. Sorry to say, lots of foreclosures coming down the pike.

Blame our legislators who drafted the law so sloppily.

SoCal,

That’s not what I have heard from the lenders I know. The payments owed will be added to the END of the loan.

It can vary from lender to lender though as the legislation isnt specific on this.

Obviously, if the terms say you have to pay it all in the 4th month you would be in trouble. Do you happen to have a link?

Same with renters that can’t pay their rents within the next 3 month. No way they will just magically come up with the accumulated rent.

From the quoted OC Register Article:

“The state legislature is expected to address issues such as terms for repayment plans for missed housing payments during the coronavirus crisis when it reconvenes later this month.”

With a Democratic majority and a Democratic Governor, the ball is in the Democrats’ court. I’m with M on the chances of generous repayment terms.

I’m with M on this on too. I’m pretty sure the banks will just restructure loans in a way that the missed payments will be factored back in after a generous amount of time is granted to people who’ve lost their jobs. There might be more interest involved so banks don’t get shorted but it’ll be in a way where everyone wins.

Why didn’t they do that back in 2008 you ask? Because not even God himself can save borrowers with no income that never HAD income payback a bank that loaned them a mortgage on a house worth 1/3 of what they bought it for. There are certain circumstances where there’s room for compromise and there are certain circumstances where it was doomed from the start. This market is definitely the former.

Don’t really care about the RE market right now! I do, but don’t. I bought my properties for monthly lease income. All are paid for. No monthly mortgage to worry about. Use to worry about my renters. But they are all good because I give them a good deal. Really laughable watching all lines of home buyers in 2008-9.

Bully for you.

See that’s smart. Give someone a good deal and i do believe they will take care of your property

It is foolish to think housing will not be affected. Mortgages are paid by incomes, incomes are paid by jobs, jobs are paid by businesses, and jobs have stopped and are hemorrhaging. When this stops is unknown at this point. And when it stops, we will see how our economy reacts. How long can the government support individuals as things get back to ‘Normal� Will businesses use this as a way to restructure getting new employees to work for less in an employer’s market with so many applicants? You know government will protect businesses from a legal standpoint about having to “rehire†everyone who has been laid off. Social Darwinism will prevail. We are In un chartered territory with a pathological narcissist driving the boat. Time will tell, as the handling of the virus 🦠dictates our future. If history is a teacher, than our future is worrisome.

It is foolish to think housing will not be affected. Mortgages are paid by incomes, incomes are paid by jobs, jobs are paid by businesses, and jobs have stopped and are hemorrhaging. When this stops is unknown at this point. And when it stops, we will see how our economy reacts. How long can the government support individuals as things get back to ‘Normal� Will businesses use this as a way to restructure getting new employees to work for less in an employer’s market with so many applicants? You know government will protect businesses from a legal standpoint about having to “rehire†everyone who has been laid off. Social Darwinism will prevail. We are In un chartered territory with a pathological narcissist driving the boat. Time will tell, as the handling of the virus 🦠dictates our future. If history is a teacher, than our future is worrisome.

The point about inventory and Airbnb that the good doc is trying to make is;

Landlords will have to sell if they can’t make their monthly nut or be foreclosed on. Saw the crash in 80’s 90’s and 2000’s and will doom see another. Just the way the things go

OverLEVEREGED landlords will have to sell. The more landlords leverage their cash the more they have to gain but the more exposure to risk. So when things hiccup like now, it’s amplified into their whole portfolios. So I do agree with you there. Where we may disagree is that there are not enough landlords that did overleverage themselves to flood the market with foreclosures and the current demand should fill what little supply that will result.

Real estate is definitely taking a hit the only question is how big. It may not be that big, but with a freeze in credit which is happening and probable long term economic changes there will be an impact. Plus our governor already extended social distancing till May 15, acknowledging it may get extended again. We are still deep in the unknown at this point. However even if you just bought and this market crashes hard, take heart because we know it will rebound.

Right now I’m waiting until next week for my monthly statement from my rental management company. Last month I had a deposit of the full amount. One tenant is in healthcare and one gets government checks. If there is no money deposited to my bank account, then I’ll start to worry.

PS with no debts on the out-of-state properties I co-own, I’ll be OK for a while.

The statement came today. I guess I’m in the 2/3 not the 1/3. All is well!

It is foolish to think housing will not be affected. Mortgages are paid by incomes, incomes are paid by jobs, jobs are paid by businesses, and jobs have stopped and are hemorrhaging. When this stops is unknown at this point. And when it stops, we will see how our economy reacts. How long can the government support individuals as things get back to ‘Normal� Will businesses use this as a way to restructure getting new employees to work for less in an employer’s market with so many applicants? You know government will protect businesses from a legal standpoint about having to “rehire†everyone who has been laid off. Social Darwinism will prevail. We are In unchartered territory with a pathological narcissist driving the boat. Time will tell, as the handling of the virus dictates our future. If history is a teacher, than our future is worrisome.

God help us! A “pathological narcissist” to possibly be replaced by a serial groper and sniffer with family members on the payrolls of foreign political opportunists.

Haha. I’d rather have the pathological narcissist at the helm compared to the alternative. Uncle Joe has a hard time putting sentences together now, I can only imagine 4 years from now. Maybe we could put Hunter on the corona virus task force since he knows the ins and outs of China business. 🙂

Live near the city and you will not be hit as bad,if you live on the outskirts of town you will be pounded down a lot more.

Hi, Doc, and thanks for your continuing informative and insightful coverage over all these years. Will we now be seeing the rise of other sites online like the past’s Santa Monica Distress Monitor…perhaps a Culver City Calamity? Some properties I’ve been tracking show a rough 10% or so decline in asking prices from March. And as “Realist” pointed out, J.P. Morgan wants a 700 score and a 20% down payment for most borrowers. However, let’s all remember how CASH BECAME KING during the last downturn. Even a 20% down payment ultimately meant bupkis as the all cash vultures descended upon coastal California devouring any short sales/foreclosures/even “normal†sales with reduced prices. Will the locusts be reappearing?

Housing is done, stick a fork in it- All It Takes Is One Fire Sale Of A Comparable Home In Your Neighborhood

http://housingbubble.blog/?p=3163

Two million dead from Covid-19 might be preferable to locking down the economy: http://www.enterstageright.com/archive/articles/0420/natlockdown.html

We’ve heard much during the Wuhan flu crisis about a “worst case scenario†of two million dead Americans, a staggering number. But missing from the national conversation is something equally important:

What’s the worst case scenario given our present course of action, largely locking down the country and freezing life like an insect stuck in amber?

What if worse coming to worst means a great depression, descent into tyranny, millions more dead from other causes and a permanently impoverished nation? …

“ What if worse coming to worst means a great depression, descent into tyranny, millions more dead from other causes and a permanently impoverished nation? … we’ve already descended into tyranny…government tyranny.

When this is all said and done, Governmental reactions (probably based in good intentions) will have caused more harm than good.

9/11 brought us Patriot Act and TSA.

Let’s see what 3/11 will bring – my feeling is that Cov1d-19 is 91-1 on steroids.

Thank you for the post SOL. The issue is not life vs. dollars. That is how the MSM is trying to frame this for evil reasons.

The real issue is lives lost in both scenarios, and I agree that we are going to lose more lives if this lockdown continues vs. lives lost due to CV.

The way MSM is reporting is sick. They fabricate data, tell half truths or outright lies. Recently MSM announce that a newly born baby died of CV. I was surprised in light of all other data and I called my son who is a doctor. He said that the baby was born premature at 22 weeks. With or without CV, for a baby to survive at 22 weeks, chance are slim to none. The mom tested positive for CV with no symptoms. Therefore, the MSM reported the baby as dead from CV. This is just an example out thousands. For example, if a 95 year old has a heart attack and tested positive for CV, the death certificate says that he died of CV. Most likely, the 95 year old would have died with or without CV.

The virus is real but used as a cover for the greatest wealth transfer in US history. Like we need even more concentration of wealth and power in the hands of the 0.01%!!!!….

Not sure what MSM said. But the mother from Louisiana went to the hospital exhibiting covid-19 symptoms. She had shortness of breath/high fever and was placed on a ventilator. The oxygen deficiency as a result of the respiratory infection caused her to go into premature labor (22 weeks). So while a baby born that prematurely would likely have died, it was in fact a direct result of the mother’s symptoms. It’s officially reported as covid related.

Don’t worry.

We now have Trump Socialism.

It turns out it is better than Bernie or Yang Socialism. Not only does everyone get a check but all businesses, banks, and Wall Street get a massive bailout.

We’ll balance the budget when Biden gets elected in 2020. He’ll raise the taxes on businesses and the 1% to make it all back.

Bob, not sure if you got the memo, but Biden’s entire career has consisted of working for the 1%, especially including doing the bidding of credit card companies in Delaware. He’s the quintessential corporatist democrat who will undoubtedly further enrich his corporate overlords just like every other president, but worse. Unfortunately (for him), his apparent dementia will probably derail his aspirations for the presidency. I would feel sorry for the guy (Jill et. al forcing him into it maybe?), but he’s such a creep that I can’t.

When the Gravey Train STOPS, the ride is OVER- Earlier this week when we reported that JPMorgan has quietly halted all non-Paycheck Protection Program based loan issuance for the foreseeable future, we said that we didn’t buy the stated reason namely – the bank was drowning in (government-backstopped) applications and would be willing to forego millions in easy, recurring net interest income and that instead the real reason why JPMorgan would “temporarily suspend” all non-government backstopped loans such as PPP, is if the bank expects a default tsunami to hit, coupled with a full-blown depression that wipes out the value of assets pledged to collateralize the loans. We went on:

Furthermore, why issue loans that will default in months if not weeks, just as bankruptcy courts fill up with millions of cases (assuming the coronavirus clears out by then, as the alternative is simply unthinkable – a default tsunami without any functioning Chapter 11 or Chapter 7 process) when JPM can simply stick to the 100% risk-free issuance of government-guaranteed small-business loans which pay a handsome 1% interest, especially if it makes JPM look patriotic by doing its duty to bail out America.

Over the weekend our skepticism was confirmed when Reuters reported that JPMorgan, the country’s largest lender by assets and which will kick off earnings season tomorrow, will raise borrowing standards this week for most new home loans as the bank “moves to mitigate lending risk stemming from the novel coronavirus disruption.”

Starting Tuesday, customers applying for a new mortgage will need a credit score of at least 700, and will be required to make a down payment equal to 20% of the home’s value (something which we thought was the norm after the last financial crisis, but apparently lending conditions had eased quite a bit in the past decade).

https://www.zerohedge.com/economics/jpmorgan-scrambles-raise-mortgage-borrowing-standards-ahead-biggest-wave-defaults-history

Powerful stuff: https://www.theburningplatform.com/2020/04/12/the-road-to-perdition-is-paved-with-evil-intentions/

… The scare tactic death total was 2.2 million if we did nothing. In their own “expert†narrative, if we followed all social distancing protocols perfectly, the death toll would be 110,000 to 220,000. The country hasn’t followed the protocols perfectly and now their worthless models are saying 60,000 deaths – soon to be downgraded to 50,000. These are death figures on par with deaths from the annual flu. …

Just as the 300-page Patriot Act was sitting in a drawer waiting for the right crisis to come along, the 800-page, again ironically named, $2.2 trillion CARES Act was already written by corporate lobbyists waiting for the next crisis.

It’s a potpourri of mega-corporation goodies and bailouts for terribly run companies who spent the last decade wasting trillions of dollars buying back their stock with cheap debt provided by the Fed. The crumbs for the little people and dying small businesses is being distributed in a sloth-like manner, while the corporate and banking pigs have been gorging themselves at the government/Fed trough for a month. …

50%+ of infected don’t have symptoms. Social distancing measures have helped greatly. I wouldn’t be surprised if the fatality rate of covid19 will be similar to the seasonal flu. Back in business by summer!

Cheers, millennial

M: I wouldn’t be surprised if the fatality rate of covid19 will be similar to the seasonal flu.

I’ve been saying that for a month.

M: Back in business by summer!

Not necessarily. You’re assuming that Covid-19 is the reason for the shutdown, rather than a pretext.

@SOL – “Just as the 300-page Patriot Act was sitting in a drawer waiting for the right crisis to come along, the 800-page, again ironically named, $2.2 trillion CARES Act was already written by corporate lobbyists waiting for the next crisis.”

I am sure you never saw a government entity moving with the speed of light like when they had to distribute trillions to the 0.01%. On the other hand, they had time to prepare for this since September when they realized that they lose control of the system if they don’t do something radical to save the bond market (10 times bigger than the stock market).

My gut feeling is telling me that they played with fire and the hundreds of trillions of dollars derivative market could explode anytime into a supernova collapsing with it the bond market, stock market and RE market. I hope I am wrong, because these days the derivative market acts as a weapon of mass destruction – nobody will escape it.

If I am wrong and they can control the derivative market, for now it seems that they can control the bond market. We’ll see for how long they keep the lockdown in place. If they don’t open up the economy to the working healthy individuals very soon, the derivative market will explode. We’ll see only wreckage behind it, making the Great Depression a walk in the park (back then they government and corporations did not have so much debt as they do today and there was no derivative market).

We live in interesting times. For know I tried to avoid debt as much as possible (zero debt as of today) and if I borrow, it is only for investments, small amounts and only for very short term. I still bought lots of blue chip stocks when the market went down a lot.

Inevitably the economy we have will be fought tooth and nail regardless of who maintains it as long as humankind advances from a tribal system. Maybe when that happens future generations will look back at what the fuss was all about FIAT and depressions.

Unfortunately the 2.2M dead isn’t even near reality and comparing it to flu is just stupid: 100* more deaths and 6* faster/more effectively spreading disease.

Even in countries with good health care for everyone, death rate *in population* is between 1 to 3%. In US 40% of population has no health care at all, so it’s easily double. That means 7 to 22M deaths overall. Current situation isn’t even a begin yet, with 2k deaths per day. Lock down is biting though, it’s not growing exponentially daily anymore.

2.2M deaths is really serious understatement in that light: That amount will be reached in April/May and this will continue (assuming no cure/vaccine) to summer 2021. At least.

GOP using this as a tool to establish dictatorship is, on the other hand, easy to see: Major voter/voting suppression is already going on and >90% of “stimulus” goes to top 0.1%

GOP using this as a tool to establish dictatorship is, on the other hand, easy to see …

You mean that Pelosi, Cuomo, the media — they’re all fighting to reopen the economy? News to me.

Trump wants to reopen the country. Cuomo is fighting to extend the lockdown.

Trump initially asked for $1 trillion as a bailout. Pelosi wanted way more than the $2.2 trillion that was passed. And AOC wanted the bailout to include her Green New Deal.

And no sooner was the $2.2 trillion passed than Pelosi — not Trump — was demanding a second bailout of equal or larger size. Cuomo recently said the states need an additional half trillion.

The Democrats and media are far more aggressive in pushing for more wealth transfers, and police state lockdowns, than is Trump.

The majority of people who have the virus have mild or no symptoms. The fatality of covid19 rates are way overblown and continue to be revised downward. People who have no symptoms aren’t going to get a test, so they aren’t being counted and part of the fatality rate calc. People who like to sensationalize this virus for political reasons are cherry picking examples (and often we don’t have enough info on those examples). The deaths are tragic but you didn’t sensationalize the seasonal flu that killed 80,000 in 2017/2018, didn’t you?

All 3 governors on the West Coast are extreme liberals. Now, in their spat with the president, they claim the Constitutional state rights to lockdown and open their economies when they want. On this I agree with the governors, not the president. I am for state rights and against centralized power but I don’t agree that healthy people should be under house arrest (that is called TYRANNY). However, to assume the power and claim state rights and then to accuse the president for the consequences of the lockdown is disingenuous and that is the objective truth.

This crisis, like all the crises, will be used to strip the citizens of even more rights and freedoms than after 911 and the president is not the only actor; the governors are just as guilty and in the pocket of the same billionaire class. For example, Jay Inslee in WA is working hand in hand with Bill Gates who pays large amounts for his political campaigns. Bill Gates has some really nasty plans to treat people like cattle and Jay will comply.

Personally, in this crisis I don’t trust either the president or the governors.

It seems that the countries with “good health care for everyone” are the ones that are failing patients and the elderly. Italy and Spain being the 2 prime examples.

Banks stress test Version 2.0. The real thing. Domino effects may crash real estate market. Not sure anything can be done at this time. No demand for housing and payments missed results in cash flow issues.

31 Percent of Rents not paid in April”. This is misconstrued. 31% of rents were not paid between Apri 1-5. YOY in 2019 19% of rents were not paid between April 1-5. This is much different than how some are taking this. Still very significant, but represents an 11% increase. I guess a lot of people pay later and this year more did.

I do agree this housing market will have to fall at some point. Baby boomers have significant RE equity needed to fund retirement. There are not enough new market participants that earn the money needed to replace the boomer generations’ homes. Unfortunately, looks like all these deferments will just kick the can down the road until who knows when. Seems like this moral hazard of home ownership of non-payment is the new norm. Mortgages provide security as you can just not pay. sad

Them percentages again.

Increase from 19% to 31% isn’t 11%, it’s 63%. That is a very significant increase.

We are at war with China and Iran so it will take at least one or two decades to settle this war. The COvid-19 is similar to the Spanish Flu and it takes a few years. Please stay safe and stay strong.

Prices CAN’T collapse without sales.

Sales NEVER go to Zero. The can slow down a lot, but at any given moment there will be a sale and that price gives the new value for everything the appraisers use. It is the same for stocks – you might have a very low volume, and the new price per share which exchanged hands gives the value for the company. Those who don’t need to sell, take the property off the market; however, there are ALWAYS some properties which MUST sell for whatever price they can sell (forced sales).

Fulton County Sees 1,000 Eviction Filings Even As Court Halts Hearings

Stick a fork in it, Housing is done!

https://www.wabe.org/fulton-county-eviction-filings-coronavirus-pandemic/

M has been preaching 50% cut in Ca. real estate for a year or more at the same time claiming to be a real estate expert but until recently appears to have never bought any except at the top and yes this is the top, New Age who knows? likely bought at the top as well is likely highly leveraged to believe there will not be a huge downturn is big time Denial .

Housing is in a massive bubble in Ca. and this was due to happen as almost the entire economy it appears very few had or have 6mos. of savings to carry them through any severe problems it appears many carry huge debt loads and few if any can go without a paycheck for a month or more sorry about that but you are screwed.

A lot of us are from the old school : pay down debt, save and have cash reserves including physical gold and silver , live modestly , think and act opposite to the herd.

True capitalists ( not many here) to believe that the fed and the government will bail you you out because of poor planning on your part and a lack of discipline or responsibilty!! Good luck the fed and the treasury would have to spend trillions weekly to cover the defaults ,bailouts ,foreclosures and unemployment checks !!Deflationary spiral down on its way!!

I don’t see a problem with buying at the top as long as I can easily afford it.

If the market falls by 5-15% I buy an investment property.

Rates are historic low. If they continue to fall I refi.

My monthly payment for my Dream home can only go down not up.

People can change their views and admit they were wrong. I made my choice.

I couldn’t be happier with my purchase. It doesn’t matter to me if my house value goes down for the short term. That just opens opportunities to buy more stocks at discounts and/or a second house.

Cheers, millennial

Millie gets it. Only buy a home if you plan on owning long term and you can comfortably afford the monthly payment. Unlike an investment property, owning a primary residence is much more than tallying numbers on a spreadsheet and I consider it almost a requirement in socal. As I have said umpteen times, CA has a massive housing shortage, short millions of homes. Until this supply/demand imbalance gets addressed, rents go up and prices remain sticky.

I’m in same boat as Millie. If RE prices crater, I swoop in and buy an investment property. I could care less about the value of my primary residence since I don’t plan on selling and my carrying costs are similar to renting a 1 bedroom apartment. Have a diversified portfolio and tune out the noise. Hunkering down in an apartment low term and staying in cash sounds like a horrible strategy going forward.

🙂

“My monthly payment for my Dream home can only go down not up.”

And that’s exactly what RE prices has become. The monthly payment NOT the purchase price. And that’s why I say interest rates are what dictate which direction the market is heading in. Because they hold the most weight in the mortgage. Interest rates go up, prices fall and vice versa but the only constant is the mortgage because that’s what tells a buyer if it’s worth renting or buying. The only difference is that renting prices go up, your mortgage is locked in for 30 years so with time, it becomes less burdening on your monthly income (as wages rise).

So M did the perfect move in buying and building an asset over time that he really won’t lose out on. And now that he has his first he doesn’t care where the market goes. If it goes up, he wins since his asset goes up in value too. If it goes down, he buys cheap and now expanded his portfolio at bargain prices. This is 2006 where mortgage prices are two or three times the rent for the same property. We’re not even there yet!

There are those who think that the Corona Virus stimulus programs will translate into massive inflation when the virus is under control and the economy re-ignites. Some Billionaires are going to cash and some are buying assets and getting out of cash (like Mark Cuban vs Ray Dalio). So M may be having the last laugh or may be sitting in a badly deflated asset that he can still afford for a while if he’s working.

I can’t speak for Millennial but I assure you he did not buy at the top just because he changed his outlook on the market. I will, however, speak on myself. First off, I am not highly leveraged at all. All my rentals are in prime areas bought with 25% down currently netting me 3x my mortgage. The rental market can completely collapse and I’ll still be profitable. My risk tolerance is actually quite low in that sector of RE! I have no vacation rentals and don’t really plan on owning any unless I want a personal vacation home that I would rent on the side (haven’t any that suits me yet). All of my flips have been extremely profitable as well. I buy all cash to save time and money and if the market flops, what do I lose if I’m not upside down on a loan? As a matter of fact, around this time last year when home prices were dropping because interest rates peaked at 5%, everyone on this blog was telling me how foolish I was to buy flips and that it was all going to crash soon and the result? The most profitable year since I got into the business! I added a ton of physical gold to my portfolio at $1200 an ounce in 2018 so I can tolerate a little added risk in 2019 but to be honest, I saw no risk. My stock portfolio jumped 40% so I went all in in RE in 2019 and reaped the most rewards of my life! I know exactly what I’m doing trust me and I’m literally giving my secret sauce on a platter for free because I enjoy this blog and have been a contributor for years. And speaking of this blog, people have been so bearish for the last 6 or 7 years of my readership and what has that resulted in? Missed opportunity after missed opportunity. Keep doing you, though.

This is the top 22 million unemployed in weeks temporary maybe but many businesses are not coming back I have 90 acres I recently sold just outside a major city luckly just before the collapse happened ,that I bought in 2016 at a super bargain and got it back in shape on a major highway Shell recently built 2 miles from my property .Traded stocks long and short and did well but stepped back in 2017-18 went long volatility last year and have done quite well not setting in an apt or just setting on cash .Have many investments and some partnerships in RE outside the country as well ,nice making an assumption that I am hoarding cash and hunkering down waiting for the end ,ain`t happening but the reserve of cash is necessary and the deflation is coming in particular in RE believe what you want no jobs or reduced jobs and to listen to M god help me he will flip flop again in another year.

And you are right this will have to be long term it will take 5-7 yrs to recover though I am looking at very upscale area near the beach not in S Cal with about 10 acres not because I believe it will appreciate in the next 5yrs ( it won~t) but because I know how to increase the value through my own efforts . and it is area I have wanted to build and develope for my use with some rentals for income as it appears many of my pension benefits may be compromised in the near future and last I also bought gold and silver coins and stocks on a monthly basis for 4-5 yrs previous.

But this not a hiccup this is a disaster that will not end well to many people out there particularly in So Cal are highly leveraged with no cash reserves that will not make 1-2 mos without pay check and will never catch up same with many small businesses.

Good stuff: https://www.takimag.com/article/go-big-or-stay-home/

COVID-19 is the coveted excuse the global elite have been looking for to push through their agenda.

Washed-up former leaders sensing a second opportunity to rule, such as Gordon Brown and Mikhail Gorbachev, have already said the crisis means it is time “to create a temporary form of world government,†and to “revise the entire global agenda.â€

Our would-be world rulers are on a deadline. Failure to act immediately threatens to give more power to recent populist movements and turn the globalization project into The Tower of Babel: Part Deux. Henry Kissinger articulated this fear recently in The Wall Street Journal …

This is what makes the coronavirus pandemic the ideal vehicle for global government: It is the unprecedented, universal enemy of all nations.

The 20th-century political philosopher Carl Schmitt (who is incidentally experiencing a revival amongst China’s intellectuals) observed that “the notion of a world-state is absurd as long as humanity is not at war with an alien force.†Perhaps that is precisely what COVID-19 is now. …

Good post, SOL!…

A one world government = One world slavery with no individual rights and freedoms.

People will be treated like cattle and tracked like cattle. I don’t want to live in a world like that; I did already for decades of my life, but at least I had a place to run at least for few decades. Those people pursuing this agenda and those supporting them should be hanged from lamp posts.

It looks like even those who pretend to be populists are in fact globalists in sheep clothing.

Quarantine is when you restrict movement of sick people.

Tyranny is when you restrict the movement of healthy people.

Every person has learned a harsh lesson about social distancing. We don’t need a nanny state to tell people how to be careful. The government cannot guarantee a risk free life.

Tyranny is very detrimental to RE prices and to the economy in general. Ask the Russians how their economy faired under tyranny.

“Quarantine is when you restrict movement of sick people.

Tyranny is when you restrict the movement of healthy people.”

Yes and how you know who is healthy?

“No symptoms” is common even on those people who have tested positive for virus and are spreading it. Some sources say up to 50% of infected has no symptoms.

Reality is that you don’t know, so you have to quarantine everyone. Or no-one.

Sweden tried that, it was going *very badly* just in few weeks when amount of deaths was doubling every 3 days. Then they locked everything down, just like the others.

Those who trade freedom for safety, will lose them both.

I would rather die free than living a slave.

Your need of safety stop when you want to enslave me. House arrest is not safety and it tramples all the freedom guaranteed to me by the Constitution and Bill of Rights. If you want to live in a bunker, I’ll let you live there. You also have to let me live free – if I die, I die – none of your business. You can live under a jar, to be safe, for all I care.

After this PlanDemic, America will never be the same – mark my words.

That’s fake news Thomas. Businesses are open in Sweden. They practice social distancing but are open for business. Social gatherings/events like concerts etc have been cancelled.

I don’t come to this site very often anymore, but when I do, it’s to get Flyover’s take on things. Thus far on this article, each comment exceeds the other. After reading the following, I had to post:

“Your need of safety stop when you want to enslave me. House arrest is not safety and it tramples all the freedom guaranteed to me by the Constitution and Bill of Rights. If you want to live in a bunker, I’ll let you live there. You also have to let me live free – if I die, I die – none of your business. You can live under a jar, to be safe, for all I care.”

Love it.

As for America never being the same, you got that right. This is the NEW America. The old one will never come back. I knew as soon as the shutdowns were announced that this would never be over. I call it 9/11 2.0. “Ah, the virus may come back in the fall.” “Expect waves of pandemics forever.” Etc. It was a beta-test, just like in 2009 with the H1N1. Back then, America still had a pair, and resisted. Not anymore. Now they just ask, “please, sir, how far shall I bend over for you?” Too many Americans have become weak sisters, literally, and they drag down the ones that know what’s going on via social conformity and pressure, just like in Nazi Germany. I live in Sonoma County for now, and everyone around me is responding to each new edict by enforcing even stricter rules on themselves than even the government can think of. They’re mostly sheep, engaging in contests of who can bend over far enough for the government to give them a stamp of approval. It’s sickening beyond belief. I was looking for Republican-dominated counties when the lockdown happened, and so am stuck for now. But as soon as we get a temporary respite, I’m outta here.

Question for Flyover: what country DID you escape from? My family escaped East Germany.

In a world of corona virus hysteria, Sweden stands out. They are not shutting down the country, and the rate of deaths and infections is not all that dissimilar to other countries. Some say that Swedish culture is not as huggy as many other countries, and fewer Swedish households are multigenerational. Sweden has a strong welfare state mentality, so one would think that the government would have imposed restrictions quickly. But the Swedes may not worry as much about the consequences of getting sick. If you feel sick, it is easy to get the time off work there with full benefits. Politically, Sweden does not have a Presidential system like ours, but rather has a parliamentary system more like Britain.

Right now, Sweden has a liberal/left coalition government with about a third of the members supporting the government. The hard left party has abstained from voting so as to not cause new elections. The center parties will not form a coalition with the right party, the Sweden Democrats, which is trying to change Sweden’s immigration policies. In every election the Sweden Democrats gain strength. They even get immigrant votes especially from Middle Eastern Christian refugees. So the government is paralyzed. That and not some Swedish libertarianism is probably the real reason the Swedish Social Democrats are doing nothing. And a large percentage of Swedish corona virus cases are supposedly in the Muslim immigrant communities, leading to hand-wringing on the Left but so far, no action.

“They are not shutting down the country, and the rate of deaths and infections is not all that dissimilar to other countries”

You have obsolete information. Number of infections was low as they didn’t test anyone. They still don’t test anyone outside of hospitals.

When the amount of deaths started to be tens of people every day, they shut down everything, just like all the others. Currently >900 dead.

Too late, they’ll get hit very badly in April and May.

Thomas, why don’t you show us a link that supports your fake news so we can all have a good laugh?

Michigan 1768 deaths, Sweden 1203 deaths (as of today). Michigan 10.1 million, Sweden 10.1 million populations. I rest my case. Not too different, eh? You need to check your facts, not me.

The Swedish government doesn’t enforce a shutdown because it trusts its citizen to follow guidelines like social distancing, remote work and travel reduction. It’s been working except for areas that are populated by mostly immigrants (high density living).

I believe social gatherings with more than 50 people are prohibited but business and schools are still open except for higher education (online classes).

It’s essentially what we should do as well. Start with a soft opening in May.