Comparative Analysis of 3 U.S. Cities: Contrary to What Your Parents Told You, Not all Bubbles are Created Equally.

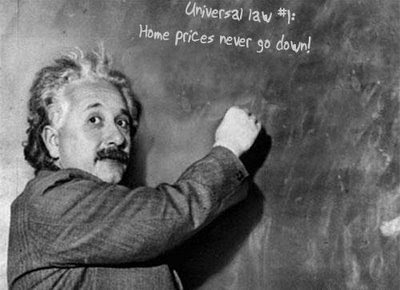

As we are witnessing the mortgage debacle unfold in California, there are other parts of the country that felt very little impact by this seven year credit bubble. For the most part, this bubble has been isolated to coastal metro areas. Not uncommon in beach locales, housing in prime locations always yields a commanding price in the market. But to what extent? Actually to the extent the market can sustain the price, sellers will ask for Pollyanna if they have the inclination they will get it. Yet this desire for higher and riskier mortgages has added fuel to a housing craze unparalleled in history.While the belief is that housing appreciated independently of any crutch, that is the crutch of the Federal Reserve and absolutely irresponsible mortgage lending, housing is vastly overvalued in many areas. This seduction of pseudo-wealth based on debt is slowly unraveling; if anything this is a policy that the current administration seems to champion. Do things quick, fast, and dirty without any regard for future ramifications. Debt does need repayment and actions in life do have consequences much deeper than the instant gratification of buying a McMansion, loading up the box with a Plasma, and then having your Benz in the driveway. After all, you being a debt slave doesn’t matter so long as you have the illusionary item in your possession. Ironically, the majority of the public rents these high priced items yet calls it ownership. True ownership comes from wealth yielding assets. Last time I check a leased overpriced luxury car does not throw off a monthly check. Debt is a form of slavery yet we equate this in modern society in some dejected form of wealth and status. Run national deficits to the point of bleeding rivers and let our kids and grand kids pay for it. Smart.

Today we will examine three cities, from coast to coast, and even in the heartland showing three very different environments in one nation. We will look at Los Angeles, West Palm Beach, and Memphis. After looking at these places in detail, we will realize that the housing craze was based on isolated pocket epidemics in metro areas that seemed global. While the reality is, many metro areas remained immune from the bubble and are actually fairly priced. However as most bubbles get out of control, they create a halo effect dragging all surrounding webs into its self implosion and ultimate pop.

#1 – Los Angeles (Code Red on the Bubble Scale)

Current Median Price: $565,000

Current Down Payment: $113,000

Current Income: $53,389

Payment/Income Ratio: 212%

Current Annual Mortgage Payment: $33,080

Current Mortgage Payment/Income Ratio: 62%

The city of glamour and glitz. The heart and epicenter of the housing mania. Fast money and fast cars. This is Hollywood baby! We even have the financier of the massive blockbuster bomb Redline, Daniel Sadek going belly up with his company Quick Loan Funding. Over 5 years Quick Loan issued $3.8 Billion in loans. Once with a staff of 700 he is now down to 125. His company is not the only one. We also have New Century Financial and their historic shenanigans that make Enron seem like a Girl Scout party. Los Angeles and Orange County are different beast. If you look at the above data for Los Angeles, you find that payment to income ratios are so out of whack, that ratios for LA are in the 212% range. After all, if the current metro median income is $53,389 and a median home is priced at $565,000, you don’t need to be a mathematician to figure out that you will not be able to comfortably afford this place. In addition, with tested ratios of 30%, housing to income cost were closely monitored by banks, yet we are now seeing ratios of 62%! Essentially if you want to play the housing game in LA you will be owned by your primary residence.

In Los Angeles we are in Wonderland. No need trying to apply economics to something driven by greed, corruption, and rules that are so inconsistent that you would think Angelie Jolie was a stable personality. A recent study by the L.A. Times found that 50% of stated income loans were overstated by 50%. And given the massive number of exotic loans, is it any wonder why these numbers are skewed? A lie built on a lie cannot stand on truth. Eventually reality does chip away at the cement of deception and this bubble and credit malfeasance will end.

#2 – West Palm Beach (Code Yellow on the Bubble Scale)

Current Median Price: $315,000

Current Down Payment: $63,000

Current Income: $55,319

Payment/Income Ratio: 114%

Current Annual Mortgage Payment: $18,443

Current Mortgage Payment/Income Ratio: 33%

Our next area takes us to West Palm Beach. Looking at the above data, we are still in a bubble but relatively minor compared to California. At this point, tens of thousands of dollars are thrown around like flies in the summer sky. Here at least we see a payment/income ratio nearly half of what it is in Los Angeles. Income is actually higher in this area and you still have sun and beaches. No protest there. The payment/income ratios seems to be in line but why is this area in a bubble? Because rents are vastly cheaper than a mortgage payment. Where you can rent a condo for $1,200 you will be carrying $2,200 in monthly mortgage cost for the same place. In addition, Florida is vastly over built and has created a quicker breakdown of housing prices than in California where archaic laws and regulations make it hard and profitable to create high density affordable housing which is needed.

Again Florida is no stranger to massive land and housing speculation. In the 1920s Florida was the main destination for people trying to escape the cold (sound familiar?). The population was expanding and housing needed to grow. Anecdotal examples given are land that was bought for $800,000 one year, would be sold the next for $4 million before crashing to pre-boom levels. Again, once everyone had the perception that land would go down the bubble burst with panic selling. Yet most savvy investors and those with common sense smelled this and jumped ship leaving the bag held by novice amateurs (which at that time was a large portion of the local population). How many speculators do we have in 2007?

#3 – Memphis (Code What? Bubble What?)

Current Median Price: $144,105

Current Down Payment: $28,821

Current Income: $44,006

Payment/Income Ratio: 65%

Current Annual Mortgage Payment: $8,437

Current Mortgage Payment/Income Ratio: 19%

Finally we arrive at Memphis Tennessee. A large city with 680,768 people, this is no little city and has plenty of economic diversification. For those of you only confined to the coastal regions I suggest for your own sanity to take a trip to numerous metro areas in the heartland and you’ll quickly realize that bubbles are very much local yet when they pop, they impact everyone. When we look at the median price of $144,105 we suddenly have images of Real Homes of Genius but we are actually talking about nice family starter homes in safe areas with good schools. This may sound like Latin to most readers of this blog but housing and speculation follows the quick and easy money. Much has been said about cultural differences even within our own country. For instance, the prevailing Southern California professional culture is all work and pure play. Balance in life seems to be an exercise in futility. And any new family buying a starter home is driven by this because of the gravitational pull of a massive mortgage. Even Newtonian physics has something to say about this; the larger the mass of an item the stronger its pull. With all the massive mortgages being issued I’m surprised the Earth isn’t shifting out of orbit.

However Memphis characterizes many areas where this housing mayhem is something of a spectator sport. They have pockets of overpriced homes but aren’t housing obsessed like those in high priced areas. We need to keep this in mind because our immediate area tends to be the epicenter of the universe. What we do, eat, and breath tends to be generalized to the whole. Yet taking a brief trip to other metro areas you will quickly understand basic tenets of this housing bubble. I recommend new readers to click on one of the four housing article buttons to the left sidebar to get a quick and fast education on the many angles and future impacts of this credit orgy. Even if you aren’t in a high priced area, you will be impacted. And all of us here in Southern California are all too familiar with the 500 square foot box for $400,000. It has become our credit induced hallucination of what constitutes a starter home.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

11 Responses to “Comparative Analysis of 3 U.S. Cities: Contrary to What Your Parents Told You, Not all Bubbles are Created Equally.”

Wow, what a surprise:

‘Flip This House’ star accused of fraud

http://tinyurl.com/2qxnql

A gross symptom of the bubble was/is the real estate shows. I mean, c’mon’, how freaking entertaining is buying, selling, and flipping homes; damn whores. The only exception to this rule is Tanya Memme–she is just juicy!

Tanya makes my loins twang like a tuning fork! (forgive my boldness)

Flip this house is a product of the current market place. Same thing with the housing network HGTV. An entire TV network dedicated to fixing your house seems a bit much for me. But again, look at other shows like Extreme Home Makeover and like anything, the mass appeal of housing is everywhere.

These shows started taking off in tandem with the bubble. Bob Villa had his show much before but it was on public access most of the time and some random time on the weekend on network TV between Saturday kids cartoons and cooking shows.

It’ll be interesting to see what happens. In terms of Tanya, first lesson in marketing is sex sells. There are many attractive real estate agents and brokers out there. I mean think about the industry, what other profession would you plaster your face on all your marketing material? Aside from Hollywood headshots, I’m not sure.

I drove down from Chicago to Nashville,TN over the weekend for a short getaway and was amazed at what I saw. I picked up a local ad book with homes for sale and found some very nice houses, in some nice locations that are close to the city and metro area for some unbelievable prices. A nice home that was built in 2006, 1,800sq ft, would not look out of place in say, Irvine,CA and is selling for…get this: $187,900!!!!

I almost fell off my chair. I’m moving…. I could only imagine the utter look of disgust of the though of your average SoCal’er of moving to TN.

Nashville offers:

-nice people (no luxury brand showoffs here)

-lots to do

-CLEAN cities

-excellent food

-mild weather

-CHEAP to live in (gas was $3.07/gal as of 6/2/07 and no sales tax on food or clothing)

Socalwatcher,

I’ve recommend the book life 2.0 by Rich Karlgaard on this site because it directly discusses this issue of overpriced metro areas and people migrating out. The constant pursuit of keeping up with the Joneses. You mention this in the fact that you acknowledge the fact that you felt less branding bombardment.

In areas such as Orange County and LA branding is so prevalent that it is second nature to us. It reminds me of wealthy cities in 3rd world countries where the disparity between rich and poor is so blatant, you can see a Ferrari cross a street while 10 beggars ask for change on the other side. Many would argue that we are not at this level but I would encourage you to take a trip to Skid Row in Los Angeles, right next to the financial district. In addition, if it weren’t for revolving debt, I’m not sure how long the illusion of wealth would last. Many other metro areas are more balanced than we are. It is a choice of what you want in life.

If you are nearing retirement and have a nice sum of equity, I would buy out of state and with the remaining equity purchase 2 to 3 rentals for passive income. As a young professional, that is the reason I am buying numerous investment properties out of state. This way, you achieve the benefit of owning real estate at prices that make sense and have the high income of Southern California – I imagine many are following this path. What constitutes a solid investment? I guess that’s the million dollar question. As an investor, my philosophy is buying under priced properties that will cash flow with little money down in established neighborhoods with diversified economies. Many people have their own investment philosophy but this is my bread and butter. Many California pundits will tell you that no one can compare with the diversity in California; take a look at how reliant we are on real estate and housing ancillary services and I beg to differ. We are diverse and will weather the storm but the guise of massive diversity is cloaked in deceit; it is a Catch 22, the economy has been strong because real estate has been strong. So you are using lagging information to predict the future. Now that housing is going down, we are seeing massive layoffs, housing prices dropping, and the economy showing signs that a recession is a few quarters away. If we were diverse, why would this even matter?

You are right socalwatcher that many will furrow their brow hearing that you are considering Tennessee without ever really visiting the city themselves. As someone that went there and living in SoCal, you are able to compare the two realities. It is a matter of preference and what you want out of your life. But being mortgaged to the hilt in a declining market with a high cost of living makes no economic sense. I’m having a harder time finding pundits talking about why now is a good time to buy. Their argument is becoming more of a Popeye response where they say “now is a time to buy because it is!†I am what I am. Great analytical thinking from the housing pundits.

DrHousingBubble, do you have any historical data on the average mortgage to income ratio for Los Angeles?

While I completely agree that LA is overvalued, I also believe that people have and will continue to pay a premium to live here over Memphis. I’m curious to see what a “normal” ratio for LA would be.

Great points, Dr. HB.

I have been to LA, San Diego, San Fran, etc. and see almost the same thing here in Chicago. I see about 5 brand new S-Class Benzes a day here but I think I saw maybe 5 Benzes the whole time in Nashville. No LV, no Chanel, no BEBE…even the pick up trucks and SUV’s were modest. They love Suburbans, BTW..and Escalades as HUMMERS were few and far between.

Sure, there are million dollar homes there. These home look like a million bucks set on large wooded lots and simple, southern plantation style.

You know what? The people were nice and pleasant and relaxed. We had alot of fun and never felt out of place or out of our league. No brand envy or conspicuous consumption.

I love SoCal but hate a vast majority the people. There is more to life than working for status symbols because you don’t own them, they own you.

(I will still have my beachfront home/studio in Santa Monica someday, though!!)

Jimmy,

Here is a snapshot of 2000 California data:

Median SFR Price: $211,500

Median Family Income: $47,493

Ratio of 4.4

California price is higher by $90,000 over nation median.

2007:

Median California home: $597,640 according to CAR

Median Family Income: $65,000

Ratio of 9.19

National median home price $212,300. Difference between California and nation, $385,340. The price-to-income ratio has increased over 100% in 7 years. Notice with the DIFFERENCE of our home prices, you can buy nearly 3 homes in other metro areas.

Yes, this is a bubble.

DHB, how are you handling the property management out of state? Local partners or entrusting a PM firm?

@real vapid bimbos of oc,

Definitely need a trustworthy team of:

Property Manager

Realtor

Maintenance crew

Lender

This is your circle of success in whatever city you invest in. Anyone planning to invest out of state needs to take a 2 week investigation trip to the prospective location. How is the employment of the area? Prospects for growth? Weather? Rental rates?

These things are all factors but here’s the nice thing for you, all this information is either free or very cheap. All it take is a little due diligence on your behalf.

I’m surprised how many people sign for a $500,000 loan not knowing the basic terms of what they have just entered into. Due diligence is vastly under used in my humble opinion.

Hi guys,,,,, Lookout for Lord Edward Davenport at 33 Portland Place London http://www.33portlandplace.com

Leave a Reply