A Comprehensive Look at the Southern California Housing Market: 60,000 Properties Listed on the MLS but over 100,000 in Shadow Inventory. California and Nationwide Median Home Price Trends since 1968. Say Good-Bye to Option ARMs.

You know things are going well for the economy when Bernard Madoff is fighting in prison over the stock market. Maybe the argument revolved around dollar cost averaging into this easy money rally. Here in California, specifically in Southern California there seems to be a lot of energy getting behind the housing bottom parade. Prices have stabilized to a certain degree. Yet is this really a bottom? It think it is important to frame the argument in relation to employment, incomes, and demographic trends. Simply saying we are at a bottom is like saying home prices will always go up just because. Hopefully people will learn from this bubble that housing prices can be inflated with interesting loans like Alt-A and option ARMs.

Speaking of option ARMs:

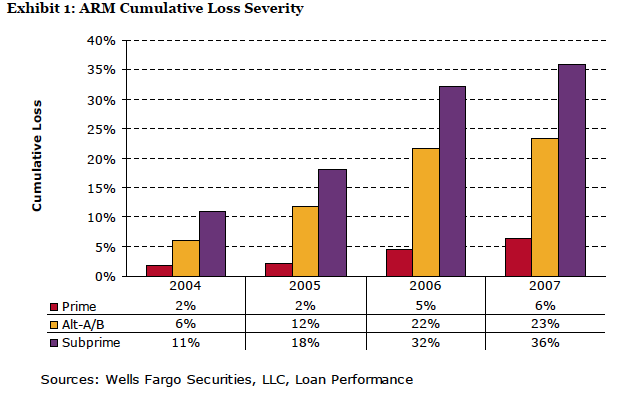

“(Housing Wire) Several of our investors have questioned the current loss severity in light of negative amortization and home price decline,†researchers wrote in the report. “Our analysis suggests that option ARM loss severity will likely range between 60% and 70% provided home prices have stabilized.â€

As we have highlighted before most Alt-A and option ARM products sit in California. Los Angeles County has the largest number of Alt-A loans of any county in the United States. Wells Fargo has a large option ARM portfolio brought on board through their acquisition of Wachovia but many of these are of the Pay Option ARM variety that have 10 year life spans. Even with that, many of these loans are imploding already:

Source:Â Housing Wire

On a positive note, the Governator signed new mortgage legislation that includes, the destruction of option ARMs:

“(LA Times) Late Sunday night, the governor signed AB 260 by Assemblyman Ted Lieu (D-Torrance). The measure, which takes effect Jan. 1, tightens restrictions on mortgage brokers so they cannot steer borrowers to riskier, higher-interest loans when they qualify for less-expensive ones.

The new law also bans so-called negative-amortization loans, which offer the option of monthly payments so low that the loan amounts can actually grow over time.

The law also limits prepayment penalties to no more than 2% of the loan balance and allows state regulators to enforce federal lending laws.”

Option ARMs never had any business of existing so this is positive news. Yet the option ARMs that will cause problems are already out there recasting from 2010 to 2012 and no one is originating option ARMs anymore since the government is the lender of first and only resort.

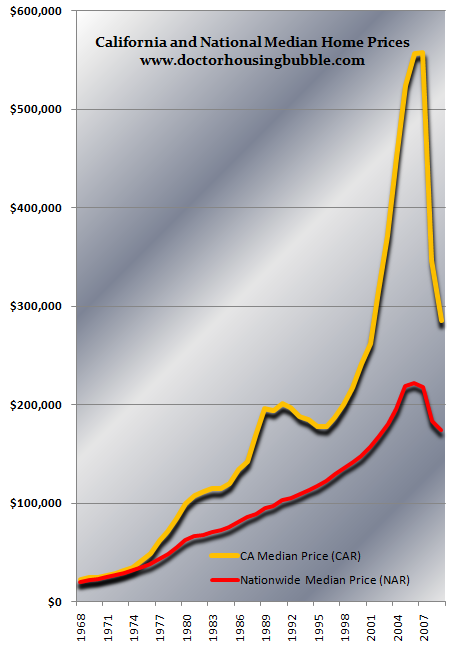

When we talk about a housing bottom we really need to look at history to gain some perspective. It wasn’t always the case that California had a higher median home price than that of the nation. Yet slowly over time California started disconnecting from the nationwide median price. I thought the best way to highlight this divergence is to plot data from 1968 comparing nationwide and California median home prices:

Now this is a fascinating comparison. Nationally, prices moved up steadily until the late 1990s when they seemed to disconnect from the trend. California however had a few surges. We see one occurring in the mid-1970s when prices started diverging from nationwide prices. Then, we see another surge in the 1980s when we had another real estate bubble. Finally, we hit a trough around 1995 and take off like a lunar expedition and the bubble of the century is born.

Prices have crashed as they do when bubbles burst. But are prices at a bottom? In the last peak in the 1980s California home prices cost about twice that of the nationwide median price. At the height of the current bubble, it almost reached 3 times the nationwide median price. Take for example the trough in 1996:

1996

California Median Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $177,270

Nationwide Median Price:Â Â Â Â Â Â Â Â Â Â $122,600

At this juncture, a California home cost roughly 44 percent more than a median price home throughout the country. Let us run the numbers as they stand today:

2009

California Median Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $285,480

Nationwide Median Price:Â Â Â Â Â Â Â Â Â Â $174,000

A California home will cost you 64 percent more than the nationwide median price home. Keep in mind that this bubble of course is unprecedented in nature but the argument that somehow prices are historically cheap doesn’t even line up with the 1980s bubble trough. Clearly this bubble that has wiped out over $12 trillion in household wealth is much larger.  Plus, we have yet to see the Alt-A and option ARMs hit the market and this will bring prices lower in mid to upper tier markets – in fact, this is where the action is going to take place in the next few years. Even if we go back to the trough ratios of 1996, we still need a 10 percent drop in prices. How significant is that? Well if you are using a FHA backed loan that will easily wipe out your saved down payment and some.

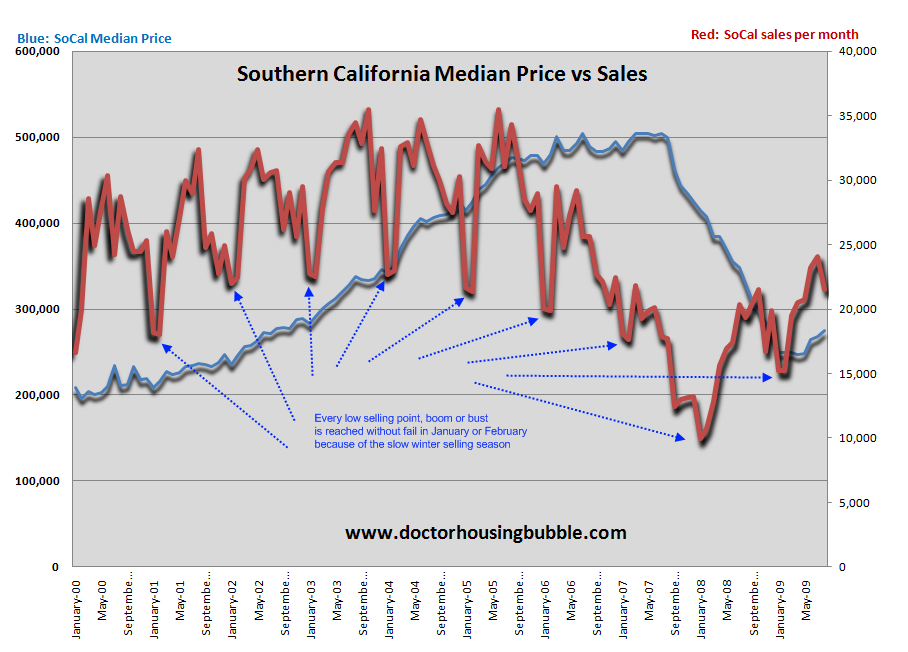

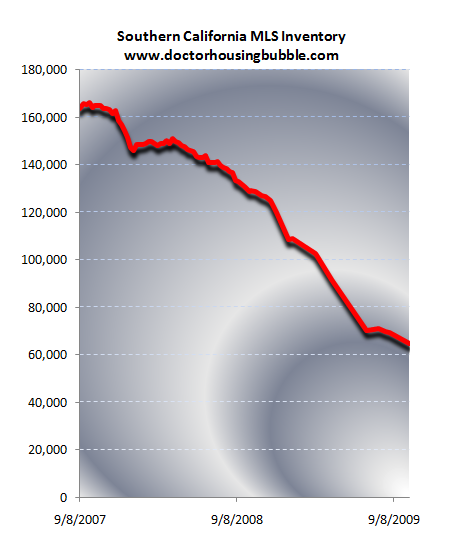

It is also important to understand that we are entering the slow selling season for real estate. Let us examine Southern California data:

Now this chart is worth exploring. Fall and winter are historically slow selling months. Spring and summer without fail bring out the buyers. Boom or bust these are typically good times for home sellers. As you can see from the above chart, without exception since 2000 the low season selling point is reached in January or February. Keep in mind the recent boom in Southern California was largely due to investors, first time home buyers lured by the $8,000 tax credit, low interest rates, and people looking at the first chart where prices have crashed and assuming it is now a good time to buy.

But what if the tax credit is removed as it should be? What will happen? You can rest assured that this coupled with the seasonal trends will only push sales lower and most likely prices. What you need to factor in as well is that foreclosures don’t care about seasons. They are going to happen no matter what because they are dependent on the real economy. We can run extend and pretend loan modifications but without employment growth, it is merely a paper façade. So for those just rushing to buy right now they are entering a market with so much artificial stimulus right before the following:

(a)Â Tax credit removal (it will happen at some point)

(b)Â Slower selling season

(c)Â Alt-A and option ARMs coming online in full force 2010 to 2012

(d)Â Banks holding off inventory and moving like snails with foreclosures

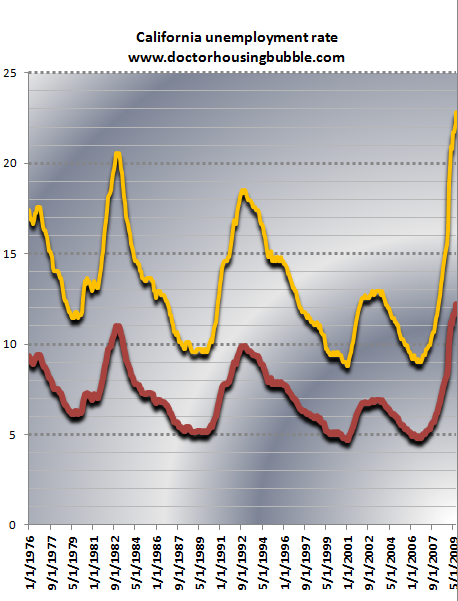

These are a few items that artificially boost the market and it has only stabilized prices, it has not created a boom. The reason prices will continue to have pressure on the downside is California employment is weak. 12.2 percent official unemployment with a under utilization rate of 23 percent:

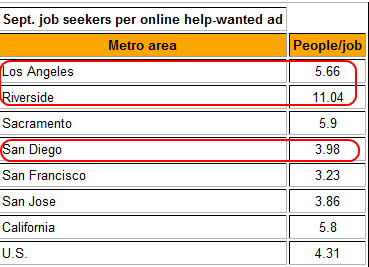

Without job creation housing prices will continue to face pressure to the downside. If you want to see some added job pressure just look at this data:

Source:Â OC Register

So prices are still too high reflecting the actual economy. You need to remember that California wages boomed in the 1990s because of the technology bubble and unemployment was relatively low and heading lower so home price increases made sense. Incomes went up, unemployment went down, and housing prices went up. Yet now we are to believe that incomes going down, unemployment going up, is somehow the reason for prices to move up? I don’t buy it.

I think most of us would agree that housing at the very minimum has to reflect the incomes of households in their community or potential buyers. Otherwise, your home will sit on the market. As a property owner I know this well. I can “want†$2,000 a month in rent but if the market is only paying $1,500 then guess what? I can sit back and have the place sit vacant for months losing monthly cash flow or I can work with the market rate. The difference with the current housing market is the government is trying to inject artificial stimulus by giving tax credits, artificially lowering rates, and trying to back stop the entire banking industry just so people can go and buy homes. But until the job situation recovers, there won’t be any sustained recovery. That is why this belief that a jobless recovery is no problem misses the entire point that people purchase homes when they feel secure in their jobs and have wages that will allow them to buy a home within their price range.

Let us look at the actual MLS data:

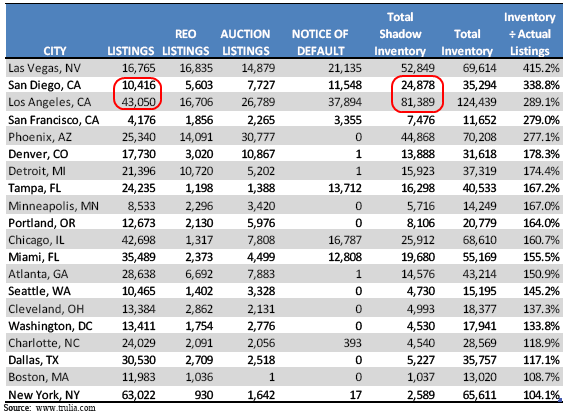

It is interesting since the peak in fall of 2007, the inventory number has steadily decreased. But this brings into question the big X-factor of the shadow inventory. Keep in mind this is MLS public data. The real factor is how many homes are in the shadows for Southern California. Here’s some interesting data from the Amherst Mortgage Insight study:

Source:Â Amherst Mortgage Insight

Now this is fascinating data. We need to also include the Inland Empire above and you have some of the top 5 areas with shadow inventory. In fact, that MLS number trend heading lower is dwarfed by the growth in shadow inventory. Factor in the shadow inventory for L.A. and San Diego and the shadow inventory is nearly twice as big as the actual MLS listed properties. We’ve never been in a spot like this so to assume things will play out nicely is ignoring the facts.

There is a false sense of security in the current market. If you are looking to buy, be cautious. The market is really artificially stimulated and the only outcome so far is stabilization (or at least on the surface). Remove this, and you can guess what will happen next year.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

31 Responses to “A Comprehensive Look at the Southern California Housing Market: 60,000 Properties Listed on the MLS but over 100,000 in Shadow Inventory. California and Nationwide Median Home Price Trends since 1968. Say Good-Bye to Option ARMs.”

great post. I keep wondering how come prices don’t keep coming down. When you look at the data regarding housing prices in california, I would like another graph, and that incorporates migration pattern inflows and GDP growth during this time period. We always hear about how there are more people in California, and that explains the increasing housing prices. Also, if California got wealthier compared to the rest of the country that could also partially explain increased prices. Keep up the great work…..

“A study by Fitch Ratings found that 46% of option ARMs were 30 days past due last month, even though just 12% of such loans have reset to higher monthly payments.” See: http://online.wsj.com/article/SB125530360128479161.html?mod=WSJ_hpp_sections_realestate

I think that the sub-prime areas have already hit bottom. The mid and high priced areas are next. Let’s see if the government can delay the inevitable past the slow selling season. They are doing their best.

All of your information always makes so much sense. Thank you so much. I really think you should submit all of your info regarding shadow inventory to Obama. It can’t be legal to do this.

The American public is being fed such lines from the banks and Realtor’s organizations that they should be prosecuted for false advertising.

I live in Sherman Oaks and would like to buy in this general area. The prices are still absurd here. I’m hoping this new wave of Alt-A and Option Arms will hit soon, so I can finally afford to buy where I want to live. Right now 1400 square foot homes are still going for $650K around here. Please let this insanity stop.

It’s been dragged on for way too long. Look in the 91423 and 91403 zip codes. It is criminal what these greedy SOBs are charging. Add us to your homes of genius please…..

When option ARMs are banned, do existing ones renew as same or must they be renewed as something more traditional and more expensive?

Also, Saskatoon saw an over 100% increase in house prices in the three years before I arrived here. Average prices in my subdivision were $110k then and are nearly $250k now. After the sticker shock I concluded that speculator money was sloshing in from Alberta’s oil boom (that has since cooled) and decided to sit on the fence. Already year over year is down 8%. (I ‘saved’ $25k+ interest by renting.)

And five year money just went up 35 basis points this week without the central bank touching it’s rate. So more to follow next July when our ‘fed’ is poised to move rates higher. If the central bank rate jumps to 2.5% in the next twelve months, how much dead time will there be before people have to start selling their houses? Many people I have talked to got as much house as they could for however much rope the bank would give them. And noone locked into anything long term. All one year variable rate terms. Somebody gonna get a hurt real bad.

Just when?

Great article as always.

One thing: when you say “Clearly this bubble that has wiped out over $12 trillion in household wealth is much larger” — I just want to state explicitly what you know, but didn’t state explicitly in the posting — that this $12T was “funny money”.

It was real in the sense that anyone who sold in the bubble saw real cash flow like the Nile into the bank account — but it was “funny money” in the sense that it was like a shell game, it wasn’t based on “real value”.

To be more direct, people who bellyache & moan about money they’ve “lost” should shut the hell up, it was money that they didn’t deserve in the first place.

“Remove this, and you can guess what will happen next year.”

Kinda like this spring when you said anyone who thinks this is bottom will be in for a “rude awakening” by late summer…

How did that one work out?

I’m with avs…when are homes prices in the $500-700k range going to fall and when will we see that inventory?

I just don’t see it in north SD and south OC. The low end seems to be selling, there’s a fair amount of listings for $900k+, but I seem to be missing it on the $500k homes.

Sherman Oaks….I can’t say for certain that the area will fall a ton…its a very desireable area and homes will always be higher priced than elsewhere in the Valley. But I can tell you that many homes in nicer parts of declining areas of the valley…particularly Valley Village, North Hills, Woodland Hills…North Hollywood…have been hitting the market at much lower prices than in the past. In this mix is several owner owned houses…not short sales or foreclosures. Some of these are gorgeous older Valley homes in very nice areas. Now I can’t say if its just an intent to induce bidding wars, or if its reflective of the overall market. We will find out in a few months. But comparable houses in these areas listed in the $400-500k range have sat stagnant for months now. Like I said, beautiful houses with the only strike against being the public schools(except for Woodland Hills). Now that they have dropped into the listing range of $270-360K, we shall see. My sane range for purchase has been $240-270K and I don’t need a 1900sq ft + place like these are.

The fact that several are owner occupied indicates to me that a growing number of people are realizing they better get what they can while they can.

Dean –

That one worked out just like Dr. HB said it would – my wife and I have been monitoring several homes on our wish list in Sherman Oaks, North Hills, Granada Hills, Studio City, West Hills and Woodland Hills – every one of them is still on the market, and every one of them has reduced their price by at least 10% since the beginning of the summer. Still, none of them have sold. Rents are dropping – while we’re waiting for a decent home to buy, my wife and I are moving into a larger townhouse. Last year the going rate for 3 bed/2 bath rentals in this neighborhood was $2,000/mo. The rent on the place we just moved into is now $1,500/mo. and it’s in the best school district in the LA area.

Prices didn’t bottom in the spring. And they still haven’t hit bottom yet.

I think one thing you missed on your list is (e) the fed’s purchase of MBS. This cannot go infinitely and will end and since they are the ONLY buyers of them what will happen to mortgage rates once this ends. I think a massive increase in mortgage interest rates is in store to get other investors to purchase the risk.

No kidding Dean! The permabearish view of this site (and its readers) to assume housing only goes down. I will note however, there is an element of doubt creeping into Doc’s posts.

Steve – way to bolster Docs view by using an anecdote based on homes on your wish list – Good Job!

This reminds me so much of 1996 when the doomers on the early days of the internet chat rooms were telling me CA housing prices had “another 30% down to go” we know how that one turned out too.

No shame in walking away from mortgage

Commentary By Mark Gimein Wed., Oct . 14, 2009

http://www.msnbc.msn.com/id/33295860/ns/business-the_big_money/

Retired and Broke

Hard-hit by the recession, today’s 55-and-over crowd is the age group most likely to declare bankruptcy.

http://www.newsweek.com/id/217539

The price divergence coincides with Prop 13, when greedy stupid Californians voted to freeze property taxes at purchase prices. Too many of them became speculators and landlords. Why the state taxes property like Disneyland at it’s 1977 value is beyond me.

“How did that work out?”…

Well, if you bought a home in the Spring 2009.. I’m sure your house is worth less than in Oct. 2009… Sure the rug wasn’t exactly pulled out from under the CA housing market.. It’s been pretty stagnant with minor drops overall in the past 6 months… But it’s definitely not getting better… At best the housing market will stay stagnant for 2-3 years… At worst another 30% drop….

Buckle down it’s going to be a long winter…. Everyone is waiting and seeing what will happen with the $8000 housing stimulus… If that goes away prices will fall.. If it stays.. not much will change.. prices will fall as normal seasonally because people will feel they can wait until Spring to buy now. If it gets increased to $15K and open to everyone… Who knows… That might cause another bubble in housing. And then we will be in a similar situation 5 years from now with a bubble collapse…

fun fun

@Dean,

We’re just trying to find the truth here so we don’t make foolish choices. We just don’t believe that the Government, bankers, news and Realtors are telling the truth. Do you? If you think things are fine and that all of the outrageous government intervention will work in the long run, than you’re a fool. There is no precedence in history to validate that position but many to indicate the opposite. Permabulls only say “this is going to happen”. They never give a logical argument as to why or show compelling figures. It’s all about faith. We want to know what, when, why, how much. Give me that in addition to your postulate that all is fine and I’ll read what you have to say. We know the markets can be rigged for a time, but tell us how this works out to the good.

I guess I am one of the permabears who reads this blog. I think that housing in CA will continue to fall because prices are still to high relative to net incomes. If a family of 4 has a gross income of $120,000 a year, they would have $10,000 a month. Of that $10,000 each month they will bring home ~ $6500 after taxes. If they have two car payments, car insurance, gas, cable, internet, cell phones, electric and gas, they are probably down to ~ $$5000. Food and household products for a family of four is around $1000. So now they are down to $4000. Assuming $500 a month for miscellaneous things like youth sports, clothes, etc. they are now down to $3500. Lets set aside another $500 a month for things that come up from time to time like doctor co-pays, new tires for the car, replacing an appliance, etc. What about childcare? If both parents are working, some childcare is likely to be needed. So lets add on another $500 a month. This leaves us with $2500 a month for a house. Is this enough? Yes, in some parts of the state. But where there are jobs that can support this income level, the homes cost more. And the median family income in CA is not $120,000. It’s probably closer to $80,000.

Which of these factors are likely to change in the near future? Taxes will almost certainly go up due to the incredible budget shortfall in CA and the insane spending in DC. Incomes don’t seem to be going up, so I don’t see much help there. Utilities are constantly going up, especially water bills. Is the price of gas going down? Is food getting cheaper? Car registrations getting less expensive? Anything at all on the horizon to lessen the monthly burden on family expenses? So where are the people going to get the money to support current home prices in places like San Diego, Los Angeles, Santa Barbara, San Luis Obispo, Santa Cruz, San Francisco, etc? It just doesn’t add up to me.

Admittedly, I am not an economist but I can add and subtract and the math doesn’t look good to me. Please permabulls, provide some data to justify your case. It doesn’t have to be scientific research, just something to show that housing prices, even at this level, can be sustained or increased.

I agree with you, Partyboy. Its happening all over the country like that. In the short term, things will be stagnant or move laterally. In the longer term (2-10) years, we’ll see property values continue to drop as there are no jobs coming back to support any rally whatsoever. And if you factor in the coming tax burdens that will pretty much kneecap the consumer, due to the debt level of both states and the federal gov’t, you have a clear recipe for a slide of epic proportions.

Reminds me of something Dolly Parton said once “You can’t put 50 lbs of mud in a 5 lb sack”. We have 50+ lbs of debt mud, and a 5 lb sack to pay it off from. Its just not going to be feasible unless we all go bankrupt.

FWIW – I recognize prices are too high, and think prices will move (mostly seasonally) up and down 5% for a decade or more. If that makes me a permabull, guilty as charged.

It became obvious to me that when the govt chose the path it did, they were sacrificing severe (in price) but short (in duration) price drops, for one where we get stagnation and a very very long duration while inflation works its magic to cause home prices to make sense.

The contrary argument for a long time was it wouldnt do anything to prevent price drops. Now that its clear it has, those same doomers who said it wont work (even for a second) are now suggesting it cant continue forever.

I agree, it CANT continue forever. If this goes on for more than 30-50 years we will have tremendous consequences from our debtholders abroad. Still, why are we to believe that the govt will after working so hard to achieve stability, suddenly reverse course and say “fu*k it, let it fail”? Moreover, if the market manipulation is removed, and prices start to tank, why are we to believe this time the govt will just stand idly by and let it happen?

Sorry, but its obvious that this blog is dedicated more to what could happen, than what is happening. How many times have we been told, the floodgates of the REO tsunami are going to open in XYZ time, only to be disappointed when the drip drip drip em out strategy of the last 18 months continues? Yet as soon as someone else’s “sources tell him the gates are opening” we get fired up thinking “its different this time”.

The writing is on the wall folks – it was the renters against the world, and it shouldnt be surprised the powers that be sided with the world and not us. There is no reason to go out and buy as im sure prices are not going up for years and years to come. Still, if you think a “cataclysm” is coming, get ready to be bitterly disappointed for years and years to come…

great article as always…..

“The difference with the current housing market is the government is trying to inject artificial stimulus by giving tax credits, artificially lowering rates, and trying to back stop the entire banking industry just so people can go and buy homes. ”

…i dont think the gov is trying to help people buy houses(ultimately), rather they are helping the banks by keeping housing prices up….since the banks use the housing loans as collateral for fed loans and also keep the securitizations up….

Kiki, I agree with you about the constant talk of the floodgates opening. I have no doubt that there is an abundance of “shadow inventory” but the only tool the banks have at their disposal to keep housing prices somewhat propped up is to utilize the law of supply and demand. As a result, we probably won’t see the massive influx of homes onto the market. That being said, if home prices do remain stagnant for several years, the banks would be much better off putting all of their inventory onto the market now and get it sold to avoid all of the carrying costs. If a bank is paying $500 a month in taxes and maintenance, it’s losing $6000 a year on that house. Do they think that the house will appreciate more than $6000 a year and they will make more by waiting? And if interest rates go up, they are in even more trouble. I just can’t imagine a scenario in which the housing market rebounds high enough and fast enough to make up for the losses being taken by the banks via property taxes, maintenance, HOA fees, etc.

It seems to me that the first bank to list all of their properties on the market would be the one who benefits the most. I don’t think that the prices would drop immediately if the market was flooded with properties, but by the time other banks followed suit, demand would be lower and prices would go down. It will be interesting to see if any major bank makes the first move and essentially steals all of the buyers from the market leaving all other banks hanging out to dry. Perhaps this would not happen, but it makes me wonder if all of the banks have some sort of agreement not to release mass inventory to benefit them all by keeping supply down. Not a conspiracy theorist, but it makes me wonder…

greedy banking, greedy stockmarket, corporations offshoring labor, our love affair with communist slaver countries, the same worker hating political vermin elected year after year by narcisitic (over fed and entertained) sheep, and on the lookout for that new drug, they can tell their doctor they need.solve those problems and maybe that overpriced, chinese products riddled house, built with illegal labor and sold by pizza delivery boys would be worth half the sherrif sale price.

Heck yes, why not pit the renters vs the buyers? The ultimate in that is that the institution that holds the note on the rented house wins. Over and over again.

As for the floodgates, they’ve already opened, and the water is already well downstream. The demand won’t go up as there are already so many houses on the market and such tight credit that we won’t see for a long time any improvement. What people are forgetting is that as long as the Fed thinks they control the dollar, (or should I say an illusion of controlling the dollar) this will go on indefinetely. However, something out of cycle, like a huge natural disaster or a sector of the banking industry still collapsing brings a whole ‘nuther twist to the scenario. My bet is on the unseen problem just ahead – the one they don’t count on triggering the next “event”.

As for Americans being upbeat and triumphing over all – I used to believe that was true. Not any longer. We have too many who don’t contribute to society but stay on the gov’t roles collecting a check, vs. the few that really work. And guess who they are penalizing? Those who -really- work. So I don’t see any improvement in that, either.

Partyboy: Doesn’t sound like a conspiracy theory at all. It’s very common for institutions in the same industry to collude. Massive collusion in this case , tied together by the govt via moratoriums and regulations requiring all homes to be tried for the HAMP prior to allowing foreclosure.

Partyboy, you’re right, the banks might be better served to unload now. Trouble is the strategic defaulters are beating them to it. Know any?

Too optimistic doctor bubble. Add in the ever increasing number mortages delinquent but with no notice of default.

Demand in the desirable areas of the San Fernando Valley (at least in the southeast area, that I know of: Burbank, Toluca Lake, Studio City, North Hollywood-south end) is high with multiple offers coming in way over list (& closing escrow!). There are many artificially-under-priced property listings to create bidding wars adding to the ridiculousness of this market. (Is this part of the bank MO?) Inventory that is available to actually show and sell is low. That’s not saying there aren’t empty houses… just that they are not available for agents to sell. How long can the banks hide these properties before some type of accountability is required? Oh, what-a-tangled-web…

BTW, how ’bout letting me re-write the balance of my 2yo car loan to what my car’s worth today?? I’m just sayin…

If there is one thing alone that shows how dire things are, the Fed has held interest rates a 0% for a very long time and did not even indicate that they will raise them next meeting–just some ambiguous Feduendo. Bull or Bear–nobody knows which direction this will go next, but it’s obviously a house of cards and all the jokers in the deck can’t hold it up forever.

Dow top at 10,000 and blood money moving to oil futures, despite drastically lowered demand, giant surpluses and summer driving season is over. I also read there is already more than enough heating oil for a normal US winter, so only fiat money gushing into oil futures will drive naked options through the roof again. That should be a big help to a recovering economy…think I’ll put some steaks on the grill…

California has some serious structural problems that not only do not bode well for real-estate, but for the state itself.

California tallies 12% of the population of the USA, but accounts for 33% of the welfare caseload!

California is losing 3,000 citizens/week to places like Colorado, Arizona, and Nevada.

(few of these people are in the aforementioned welfare demographic, many of whom are those who pay the taxes for said social welfare programs)

Unemployment hovers around 40% in agricultural areas devastated by the Government imposed drought.

The State Budget and Calpers are both in dire straits.

There is more, but clearly, a rebounding economy capable of absorbing the housing stock is not on tap anytime soon.

“Sorry, but its obvious that this blog is dedicated more to what could happen, than what is happening.”

—

On the contrary, Kiki, the record shows that this blog has been stunningly accurate in predicting trends.

You might consider the possibility of the government ATTEMPTING to continue to manipulate markets, and being unable to do so, having squandered the hard earned good name and good faith of the government bequeathed upon us by our forefathers.

I believe that falling rents will destroy house prices in Southern California. Landlords can’t play the shadow inventory game because there is no federal bailout for them. There are so many apartment vacancies and as every month goes by I am seeing asking rents going down as the landlords are getting desperate to get someone in. On top of that, there are many commercial properties for lease and there is no shadow inventory with them either. The deflation in rents and commercial leases will severly impact property values.

@Dfresh,

I don’t really understand what you mean by saying the strategic defaulters are beating the banks to it. What I am saying is that the banks are in competition with each other to sell they properties they have taken back because of a default. People who strategically default (or default for any reason at all) are not selling their homes, they are losing (or giving) their home to the bank.

I do wonder if a bank put all of it’s inventory on the market if it would drop prices and cause even more people to strategically default.

@ YoSig,

I agree with you that collusion is a better way to describe the banks banding together, not really a conspiracy.

Leave a Reply