A Lost Decade of Housing Equity: Los Angeles and Orange County will hit a Housing Price Bottom in May 2011 seeing May 2003 Prices.

The California housing market is facing a major calamity. In April of 2007 California reached a peak median price of $597,640 only to see those gains erased in the following year. By June of 2008, the median price in California is hovering at $368,250, a drop of 38.38% with no signs of slowing down. This is data gathered from the California Association of Realtors. Seeing a statewide drop of nearly 40% in one year may be a tempting incentive for people to jump back in the market. I’ve recently gotten many e-mails about people asking about a market bottom and whether they should be buying today.

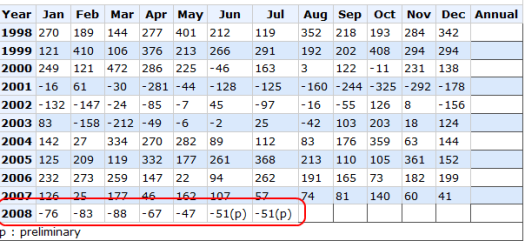

This bottom psychology has also taken hold on Wall Street. There seems to be a new campaign of getting people to jump back in with both fists with the idea that things are hitting a price bottom. This is a mistake. Just because something has become radically “cheaper” in relation to a peak price does not make it worth the current price. There has to be some underlying economic valuation that justifies the price. After all, the recent job report saw unemployment spike up to 5.7% and we also saw our 7th month of continued job losses:

Clearly there will be no second half recovery. In fact, here in California the Governor just signed an order to reduce the wages of 200,000 state employees to the minimum wage and laid off thousands of part-time employees. Do you think this is good for the California housing market? Who will be the future buyers of these homes? When we examine the data we realize that prices have further to come down. I’ll give you five reasons why prices will continue to fall in California:

(1) – State Budget Crisis means higher taxes and spending cuts (a combination of both).

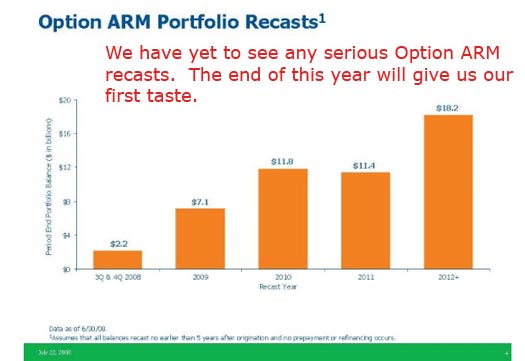

(2) – $300 Billion in Pay Option ARMs set to recast in the state.

(3) – Declining price momentum – 3 measures show prices crashing

(4) – Market psychology. Why buy today when prices will be cheaper tomorrow?

(5) – Real estate prices do not always go up.

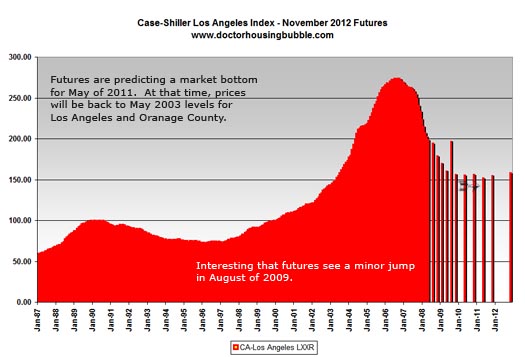

The combination of these factors is going to stunt any supposed recovery for the California real estate market. Yet for all the negative news on the economy and housing there will be a housing bottom at a certain point in time. When will housing actually hit a bottom? Some think we are already there. For those that are actually putting their money where their mouth is, there is the real estate futures market. And their bet is that housing for Los Angeles and Orange Counties will not hit a bottom until May of 2011.

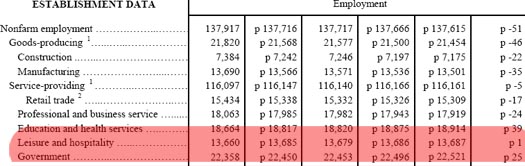

For those of you really impatient to get into the market, it does seem that there will be a bottom forming as of the fall of 2009. I went ahead and took the available futures contracts on the Chicago Mercantile Exchange (CME) which are based on the Case-Shiller Index and constructed a chart adding the actual Case-Shiller data and the futures contracts:

What is fascinating by the chart is that most people that are betting on the futures markets do not see a bottom for the Los Angeles index which also includes Orange County until May of 2011. Yet the more fascinating trend is that some are actually betting on a minor summer bounce in 2009. Are people betting on a suckers rally? Maybe.

The index itself isn’t necessarily looking at price but looks at a single home through time in relation to the base year of 2000. So given the bottom number of 152 in May of 2011, the last time the Case-Shiller Index faced that number for LA was in May of 2003.

I’ve collected data for Los Angeles dating back until 2000 so we can then see what the actual median price of a home was at that point in time. According to DataQuick the median price of a Los Angeles County home in May of 2003 was $313,000. Is this far fetched? Not necessarily given that the median price of Los Angeles County is:

CAR data (June 2008): $396,560

DataQuick (June 2008): $415,000

Let us use the $313,000 bottom price and look at the current DataQuick price since it is data from the same measure. The current price of $415,000 would have to drop an additional 24.5% to reach the bottom price of $313,000. If we are to apply this same drop rate for Orange County we get the following:

Orange County Media Price

DataQuick (June 2008): $495,000

Bottom median price: $495,000 and 24.5% correction = $373,725

The rate of decline in price is a fair assessment since Orange County is actually out pacing Los Angeles County in the rate of sales declining and the rate in price change is nearly identical:

June 2008 data

Los Angeles County drop in sales year over year: 25.1%

Orange County drop in sales year over year: 26.9%

LA County year over year median price drop: 23.9%

OC year over year median price drop: 23.3%

Now my assessment is that we will see major abrupt movements to the downside once the pay option ARMs start recasting in fall and winter of this year. These loans are viciously toxic and will prove to be more destructive than people can imagine. If we are to take a look at the WaMu folder and look at recast dates here in California, we get a sampling of what is to come:

That right there is $26.3 billion of the overall $300 billion in loans that will start recasting. In addition, the state unemployment rate is already at 6.9% and given that the Governator just fired thousands of part-time workers, that number will jump. The way employment data is calculated, part-time workers are factored into the overall employment rate even if they are seeking full-time employment and are underemployed. This will bring them onto the books quickly. Now why is this going to prove to be more destructive? Take a look at the recent employment data released on August 1st:

The only three sectors that saw job growth last month were government, health services, and leisure and hospitality (barely here). Clearly in California job growth via the government won’t be happening with the job cuts and also the Governor has put out hiring freezes. Lesirue and hospitality? Who will be spending when most sectors are contracting?

With this as the backdrop for Los Angeles and Orange Counties, there is no reason to believe that the market will reach a bottom anytime soon. I haven’t seen many articles attempt to pick a bottom but here you have it with actual price points. My guess is even after hitting a bottom, we may see a lost decade similar to Japan where prices simply move sideways for years. Given how our current government is trying to prop up institutions that should collapse, we are going to divert resources to organizations that clearly have mismanaged their own balance sheets. Money that can go elsewhere to improve the overall ability of our society to be competitive in research, infrastructure, and science. This money will now be spent on propping Fannie Mae and Freddie Mac and giving tax breaks for people to buy homes.

Should you buy a home today in Los Angeles County or Orange County? Look at the data above and tell me what you think.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

30 Responses to “A Lost Decade of Housing Equity: Los Angeles and Orange County will hit a Housing Price Bottom in May 2011 seeing May 2003 Prices.”

Housing is not like the stock market. You don’t have to time the bottom of housing prices, because, after hitting bottom, prices will ‘revert to mean’ (go back to their normal, non-bubble, appreciation behavior). Housing prices went up so drastically because of the implied wage inflation that cheap credit provided for a monthly mortgage payment. Getting a $700,000 toxic ARM mortgage with a monthly payment of only $1200 (at first) was the equivalent of getting a huge bump in income to afford that same home with traditional financing.

Larry Kudlow doesn’t believe you.

I believe he is single-handedly trying to talk the economy out of its funk and into its next level of Goldilocks. And he has all those people who agree with him. Watching that show is like watching pure fiction. Those smug bastards call an end to the bear cycle every single day. Housing? It’s always time to buy.

Mike P. that is true UNLESS there is a, to use the cliche, paradigm shift. I’ve been looking for a truck as my current one is nearing its 20th anniversary and though it only has 89,000 miles on it it is old. So, I started browsing for another. I found a 2005 Nissan Titan 4wd for $19,000. Thought that a very good price. Then I discovered I can buy a NEW one for $21,000. Paradigm shift. Nobody is buying big powerful gas guzzling trucks so tomorrow I head off to the Nissan dealer to get a ‘dinosaur’. Now it is probably true that the ‘core’ areas of big cities

will ‘recover’ and even begin to appreciate in value moderately at some point, but some housing has become ‘fossilized’. It will never recover. We’ve had a paradigm shift. California, in particular , will find its exo suburbs as obsolete as 4wd, V-8 giant pickup trucks and for the same reasons. The purchase price is only the initial cost of ownership. The extraneous costs of owning a home that is too big and too far from employment centers will leave them as ‘valuable’ as a used 13 mpg 4wd pickup truck. Don’t won’t to digress into other ‘non housing’ things at any length here but there are a number of ‘paradigm shifts’ and what have been dubbed ‘black swan’ events looming on the horizon. With that being the case one should approach purchasing a home as one would buying a new vehicle. Do I need it? Forget the swimming pool, prestige value and granite countertops. If things go south will I be able to still live here might be the best question to ask yourself because there are all those ‘headwinds’ the CNBC folks

allude to and one other 800lbs gorilla that won’t go away. Iran and its nuclear program. I’ll only point out that both George W. Bush and the Israeli government have both said Iran will not be allowed to develop atomic weapons. I believe them.

This is likely to mean that between now and January 20th 2009 this issue is going to be ‘resolved’.

Only 2003 prices? Hmmmm, I’m not sure…

In the neighborhood I’m in LA cty, but adjacent to Orange County, prices are definately below May 2004, when we moved here, and the are far more houses for sale…

In May 2004, my landlady paid $475 K for a 3B 1ba house that needs a lot of work. A house facing the park in a slightly more expensive street 3B 2ba with a bigger lot, just went for 389K.

Iknow, I know, my LL could be foreclosed on at any time… when she realizes the market is not going to bounce back and there is no point in her subsidizing our rent every month..

Scott, there truly are some amazing deals for cars out there. Prices have been dropping rapidly and this is the busiest time of the year. I inquired about a few cars and the dealerships would not stop calling and emailing me. I’m talking 2-3 times a day. I’ve decided to wait until December and will pay cash.

I’m preaching to the choir on a website like this one, but it does strike me as odd whenever people point out that housing is “cheap” compared to where it was a year ago. While I’m well-versed in economic theory and practice, I use a simple non-empirical “algorithm” to evaluate what a home price SHOULD be – read on. An affordable mortgage is 3-4 times a household’s gross income (and that rule of thumb is thankfully being enforced again). So you can take the home price, divide it by 3.5, and see what sort of income is needed to service the mortgage on that home. So, for example, I’m looking for a 3-bedroom home in Sherman Oaks. These now run about $900K-$1M. I ask myself – is this the kind of home somebody who makes $250-$350K/year lives in? Usually the answer is “clearly not”, and I press on knowing that this home will ultimately revert back to a price justified by the incomes of the kind of people who would buy this sort of home, or it just won’t sell.

This is an approximation since some buyers bring equity from other long-term holdings, inheritances, etc. to the table, but I do believe it will prove itself out in the long run.

Thanks for another good article Doc.

I agree with you Scott. Think there should be a (6) and that is energy prices. America saves nothing and there is little room in the budget for the price increases we have already seen in commodities and transportation. And this is just the beginning.

House prices have to fall down to be in comparison to rent prices. Also, most lenders now require 20% down, 30 year fixed including principal, excellent credit score just to get an interest rate of 6.5%, 6 months of credit card and bank statements, 3 years of income tax returns, and get this, 6 months cash reserve in case you lose your job!! Also lenders are requiring that 28% of your gross monthly income be applied to mortgage debt. House prices will be much lower in a year or two than now.

House prices will collapse down to 2000 levels in most areas. I believe that it will happen sooner than May 2011, possibly in a year. Ask anyone trying to get a loan now, they will tell you the same thing above. The fall will be dramatic and painful and wipe out a decades worth of home equity gains.

To make matters worse, unemployment will dramatically decline forcing home prices even lower. The housing bubble created a lot of HELOC wealth and people used it to buy, remodel, vacations, etc. All that money is now gone.

Lastly, to make matters the worst ever, oil has reached a peak worldwide production in May 2005!! Oil production is in an irreversible production decline and we will see $6-$7 a gallona gas in about a year. Go see peakoil.net.

The only hope is prayer and massive conversion to natural gas vehicles.

This article is on point. Anyone who lives on main street should have saw this correction coming. I thought it would happen a year before it did. I was talking to my friend (we are both tax accountants) and I told her the correction would take prices to 1/2 off their high although I still thought they might overcorrect to even a larger price decline. She thought I was crazy and thinks that current prices are great buys. I told her that the prices were so high it only seems like these are great prices but they are still too high. I think this is what most people think because they can’t comprehend that prices can go 1/2 off. We will wait and see. I am also one of those 200,000 state employees looking at getting paid $6.55 an hour. I was on the Sacramento Bee and people were glad that state employees were getting paid so little because they believe they are overpaid. We have great benefits, but certainly not overpaid. Anyways, I wrote a comment for those who thought it was great. I stated that 200,000 state employees and their families will not be going to Starbucks to buy coffee this month, they won’t be buying that TV, and they may not shop back to school or shop less, etc. How could this be good for California? I know I have been spending less because $1,100 won’t pay my rent let alone food, utilities, etc. and if I don’t spend less it will cost me to break a CD.

Doc,

I think May 2003 valuation as a bottom is particularly optimistic, unless you factor in the inflation kicker, and treat that $313k as the adjusted figure for a lower nominal value of some $250 – $270k or so .

> Real wages are lower now than 5 years ago.

> There was already a mania in 2003 in home prices and SIVA loans (though not NINJA, those came a bit later) were all the rage. The psychology is inverted now, and despite the pump by CNBC people want ‘deals’ below market, not at market price.

> There are fewer qualified new buyers now since the ‘hatchlings’ were all caught and not released by the factory fish farm Countryfried loan machine back in 2006 and 2007. These people normally would be entering the market but cannot since they were in it – and got screwed / screwed themselves already.

> Tighter lending standards exclude more potential borrowers, despite FHA looseness.

But, I admit to not having the exact math, and it may be only a quibble, but I think a bit earlier in the runup – say early 2002 prices – will be hit on the overshoot down.

I think you underestemate how far prices will fall.

1. The houses being sold currently will be the cream of the foreclosure price range or occupied short sellers. This will leave the others wilt. I live in a small town and it amazes me how fast vandals can take a house out.

2, You do not figure into your calculations anything associated with Baby Boomer flight. Cashing in and moving to a more retirement friendly areas. Many people who have raised children in California will move out for retirement. They won’t be moving to growth areas but to small cities. They will not have the ability to wait for the market to come back and may still be able to get a good return on the homes the purchased in the 70’s, 80’s and 90’s. They will be selling to maximize their gains once they figure out this won’t be over this year.

3. The main issue is that prices for houses have been in a bubble for 50 years and not just 5 years.

There needs to be a book: How the government and the banks tricked everyone into buying houses for investment” and robbed them blind with taxes and debt.

In Grand Rapids MI I found a very solid foreclosed house priced 60% below what it sold for in ’06. But, get this, it’s also 26% less than it sold for ’89. That’s 2 decades of equity wiped out and then some. However, on the very same block some occupied homes are still priced like 2005. The market remains uneven with many people still clinging to delusion. They will be crushed when these foreclosure sales start posting in a big way.

Thanks DR.

Mike P & Scott. Very interesting points.

I, like LB Renter, am not too sure that prices will settle in at ’03 levels. I’m thinking more along the lines of ’00/’01. Granted I don’t have the time to delve into this as deeply as you have Dr., but I’m guessing that when the next ‘tidal wave’ of foreclosures hits the market, there will be a race to unload at any price. In certain areas I’m thinking this will mean overshooting the ‘bottom’.

For me, it may not even matter. Our company is looking to move as many positions as possible out of California. Cost of doing biz here is crazy when compared to many other states. Have not seen statistics on businesses leaving CA, but would be interested if anyone has a clue.

In Grand Rapids MI I’ve found and example of 2+ decades of equity gone. There is a house priced about 60% less than it sold for in ’06. That doesn’t tell the whole story though, because it is also about 26% below what it sold for in ’89. On the very same block there is an occupied house for sale for still priced like 2005. Call the first house “A” and the second house “B.” If you look up B on zillow and check the similar houses it shows A at the 2006 price. To quote the doctor: “Bwahaha.” There is still a lot of delusion in this market that is going to come crashing down when the masses of foreclosure sales start posting.

The current composite-20 city Adjusted Case Shiller figure is still some 45% higher than the January 2000 starting point. A low for the 10 city ACS was attained circa 1997 at 80% of the January 2000 level. Just for a moment let’s say that this 1997 adjusted level could represent a low of sorts and the maths show that we would still have another 45% fall in inflation-adjusted prices. ie, 145% down to 80%. Of course this may not happen and the actual bottom in this hypothetical scenario would depend on inflation rates and length of time to get there. Personally, my view is that we are in a deep hole and there is no reason why prices will not go a lot lower. I sold my London appartment last year (luckily) for 530k GBP – over a million dollars. I bought it in 1993 for 63k! I rent in Carmel Valley, San Diego and pay $14 sq/ft in an area that is around $330 sq/ft to buy – that’s about a 4% return for my LL before property taxes and maintenance costs. Not good. I have the figure $200 sq/ft in my head as reasonable to buy and that would mean a further drop of 40%. Until then, I’m renting. It’s interesting that the stigma of renting seems to be disappearing at a very fast rate. All I would say to anyone is keep your powder dry, don’t jump into the housing or stock markets and put away as much cash as you can. When the time comes, cash will very definitely be king and in 4 years or so, there will be bargains galore.

long beach renter-

I’m with you on the ‘only 2003?’ thought until I realized: the more desirable areas started the bubble earlier than the not so desirable areas. In my area of Huntington, I’ve done some anecdotal research of prices, and have determined that things got VERY out of whack around 2001-2002 (one house went +30% in 2yrs [2000-2002]).

It wont surprise me to see the coastal areas be the last to fall, but they’ll fall to 01/02 prices. Now whether those are inflation adjusted or not… I hope not. I’m planning on buying 🙂

Is housing really a good investment? Jan 1990 Case Shiller=100, Jan 2010 maybe=150. 50% increase/20 years = 2.5% annual appreciation. Answer = NO!! Putting your money in an FDIC insured online savings account would be better than buying a pure “investment” property.

ed

August 3rd, 2008 at 4:07 pm

Comment by SCOTT:

“Mike P. that is true UNLESS there is a, to use the cliche, paradigm shift. I’ve been looking for a truck as my current one is nearing its 20th anniversary and though it only has 89,000 miles on it it is old. So, I started browsing for another. I found a 2005 Nissan Titan 4wd for $19,000. Thought that a very good price. Then I discovered I can buy a NEW one for $21,000. Paradigm shift. Nobody is buying big powerful gas guzzling trucks so tomorrow I head off to the Nissan dealer to get a ‘dinosaur’.”

Scott it’s great that even in these hard times you are able to afford a new truck. Did you even consider an American made truck? US made trucks are very high quality and a bright spot of American manufacturing and jobs.

I have a 1998 Ram with 160k on it that has never once been in the shop or failed to take me were I need to go. It also still feels tight, rattle free and smooth.

Just a suggestion.

Hello, why aren’t my comments posting?

“Hello, why aren’t my comments posting?”

I would immediately assume its some kind of conspiracy and go down in the basement to wrap tin-foil around my head…

Let me cut through all of the bullshit, don’t worry I’m not calling out any posters here. People are dancing around a bigger issue, namely what real estate types will hold there vallue longterm? Answer, if the property is on or near public transit routes. Both rail & bus lines with frequent services, rail in particular have held up better than comp properties NOT served buy transit. this comes from the Texas Transportation Institute @ UT Austin.

In some circles it is known as TOD or Transit oriented Development. In the LA area the best showcase can be found in Passadina along the gold line near Mamorial Park, Lake Avenue & the areas along Colorado Boulevard on the nearby streets.

You could also check out Long Beach along the Blue Line in the area around where Wal-mart is located. Pine Avenue , 5th Avenue, 6th avenue & Pacific Street. the train turns around on 1st avenue, allowing many residents to walk to a stop not far from where they live or work.

Once the market rebounds, these areas will recover much faster than most other places in the metro area. You can apply these principles to almost any city, not just LA.

As gas prices continue to rise, people WILL ride transit more. This is not just a New York thing any more. In some cities like Denver, so many people have been riding the busses & trains, that there is a problem accomidating everyone. Believe it or not, that is the best problem you could ever have, & LA is headded in that direction. Why you ask? Because it is the only way for the market to survive in tact.

Scott, technically the lower price of the new Nissan Titan is based on the oversupply. At $4/gallon for gas, demand for SUVs and large trucks is lower than at $3/gallon. That’s not a paradigm shift, but an example of an elastic market. Also, the older 2005 model is now ‘overpriced’ (to you) compared to a brand new one, and it’s price will have to fall accordingly to find a similar buyer. But if the 2005 model had a feature you wanted that was missing in the new one, you might have purchased the used one.

But, like you, some people still want (or need) large trucks and SUVs, just as some people want (or need) to live in the exoburbs, even today. There are people who will buy more house for their money further out, and adjust to higher gas prices in other ways (work locally, get a hybrid, carpool, etc). The fundamental problem is that demand is down while supply is way up.

With toxic mortgage products gone (along with their phony small initial monthly payments), housing prices are deflating back to historic norms. In areas now with systemic oversupply, like the exoburbs, more downward pressure will force prices even lower. Fortunately, we don’t have to try and time the exact bottom of the housing market (wherever you’re looking), but can wait for fundamentals to be restored.

Prices falling to 2003 levels will not be the bottom. The income to housing price ratios are still absurd. You will have to go back to 1999 levels for the median income family to afford a median priced home. You can already see affordable houses in Long Beach, Compton, Los Angeles, Lynwood but who wants to live in a 1 bedroom shack in shitville? Not me!!!!!

Having engineered a massive transfer of (tax free) wealth to landowners (er, sorry, homeowners), now the Congress, Paulson and Bernanke are mortgaging the country’s future to bail out the rich fat cats who invested in these mortgages.

Also, falling home prices are not a bad thing because they give a good deal to first time buyers.

The system is built on the first time buyer being always screwed, ie, the current generation having a party and leaving the trash for the children.

In any political system, especially a democracy, there is a danger of the current voters mortgaging the future of the children and having a party themselves. But America has made it a national policy.

(in the NYC subway, children above 5 pay full fare, while “senior citizens” get a 50% discount. Why? because children can’t vote and there’s no need to bribe them.)

Just for kicks, I ran the numbers on the $300B Option ARMs resetting in CA. Assuming that the typical house price that will reset is $1.25M, then there will be 240,000 homes that reset. If only 5% of these mortgages result in foreclosure, that’s 12,000 homes in CA that will enter the supply chain during this period…12,000 homes!!!!!

By testing the sensitivites on my assumptions, if you drop the typical home price to $500,000 then 600,000 homes will reset and only 2% of those homes need to forecolse to get the same 12,000 additional homes flooding the market. Any way you slice it, there are going to be a ton of homes that will increase supply and place further downward pressure on prices…particlarly in the “safe” zones like West LA and Manhattan Beach where home prices are higher and buyer credit scores are higher. I’ll be waiting when it does.

The logical bottom would be 1998 prices, when this bubble actually started. But it will overshoot to even lower than this. 2003 prices are still WAY over what people would be able to afford.

No way will housing prices bottom at 2003 levels unless inflation gets so bad that people flipping burgers at McDonald’s are making $25 an hour.

oh, and I forgot to say (nad this is directed towward our gratious host, Doc HB):

It would be really interesting to see some of these charts of price indices and futures normalized to inflation. I strongly believe that if we were to locate a inflation-oriented housing price trendline from a period of sensible house apprecation (such as the mid-90’s prior to the infiltration of dot-com money into the housing market but after the early-90’s correction stabilized), we should find a likely price support which, barring too much fed intervention or a lending apocalypse, should mark a bottom. Three to six months ago, it looked like this might come as early as next summer. With the current credit market, however, and the government’s attempts to put a band-aid on the mortgage industry’s gaping head wound, not to mention the likely pending doom from Alt-A and Option ARM recasts, the prices will likely fall below historic-inflationary levels until the financial sector starts to recover.

The excellent point to take home from today’s article, IMHO, is that prices are decoupling from the bubble and will not be stable until they find a bottom defined by wage sensibility. When we see prices suitable to purchase a median home with slightly-higher-that-median wages AND/OR when it becomes profitable to buy a house for the purpose of renting it out, the market should find a lower support. And hopefully, the next time it diverges, the fed will do the right thing and push the discount rate UP.

I typed a much longer (and very benign) post, but it never appeared. Any smart explanations for that?

I am just wondering… how long will the Banks be able to keep the

REO Flood from entering the market?

These properties are losing real value every month they sit empty,

are stripped and vandalized and have yards choked with weeds.

How are you going to sell one of these in a year or so?

There is no way that the current inventory is under 10 months.

It doesn’t make any sense – the banks are still writing off losses in

mortgages in record numbers which means folks are still losing their homes

and the notices of default are climbing and climbing followed by the foreclosures and real estate owned properties seem to be stagnant?

There is something fishy going on… I truly believe that the banks are only releasing a small amount of REO’s onto the market and are hiding the really crappy ones in their books for fear that they are undermining the already shaky estate market.

Let’s face it… there are many people that simply left their houses in such a mess that only a major overhaul and remodel would make their property attractive to a potential home buyer.

So they are waiting for the market to recover to spill the REO’s onto the market?

Which leads to my question: If a bank owns the property, does the bank have

to pay the property taxes on these houses?

Leave a Reply