A Tale of Two California Housing Markets: The Financial Gambling Psychology and Exploring the Distress Housing Market. 10 Charts Examining the Volatile California Housing Market.

“One vital national characteristic, which the United Provinces possessed in greater measure than any other nation in Europe in the first half of the seventeenth century, did more than anything to persuade precarious tradesman and artisans to try their luck in the bulb trade. This was the extraordinary belief that social mobility was the birthright of every Dutchman.â€Â - TulipoMania, Mike Dash

I’ve been reading about the tulip craze these last few weeks. The parallels to our housing bubble are similar except that the housing bubble brought the global economy crashing to its knees. Bubbles are nothing new and risk taking is as old as our first ancestors going out in the wilderness to chase prey. It is easy to describe the economics of the housing bubble. Easy credit fueled by our government and Wall Street allowed unqualified buyers to purchase homes beyond their means. In economic terms we can understand why the bust occurred. But what in the national psyche allowed for such rampant speculation to occur? In many ways, the same fire that lit a match back in the Great Depression. Many Americans felt it was their birthright not only to be rich, but to become extraordinarily rich through the road of speculation.

It wasn’t like over the decade, Americans suddenly became wealthier. To the contrary, wages were stagnant over the decade. Over the last three decades, Americans have become more and more immune to using credit (aka going into debt). So when it came time to buying a $500,000 Real Home of Genius with no money down, this seemed like no big deal. Every other infomercial during the housing boom talked about housing. Cries of “no money down!†or “overnight millionaire†plastered the airwaves. Even after the current bust, you will now find infomercials talking about profiting on the bust of the housing bubble! This get rich quick idea is simply too alluring for many because in reality, the standard of living for many has gone down in real terms. So why not leverage yourself into a leased BMW and McMansion even if it only lasts for a few years? Like the Dutchman struggling just to survive in the 1630s, it must have sounded sweet that you can make 3, 5, or even 10 years worth of salary simply by trading tulips.

We had our champions of the housing boom. Even our former President had this to say regarding homeownership:

“Part of being a secure America is to encourage homeownership.”

If it is put this way, it seems that homeownership is necessary like eating or breathing. Even in the current administration, there is this idea that everyone should be given the chance to homeownership. In fact, the reckless loans are now occurring with FHA insured loans. The FHA is probably six months to a year from requiring a government bailout. The fact of the matter is the housing gambling mentality is still strong. Now you have many buying foreclosures thinking they can flip them for a tidy profit. Who are people going to flip these homes to? Many of the current buyers are first timers that are using near zero-down FHA insured loans on lower priced homes. Looking for cash flow? Rents are falling in California so you better hope you have some conservative projections.

This is the mentality that allowed the housing bubble to form and expand. Let us now shift gears and look at some details of the California housing market. The California Association of Realtors had a good report last month showing the details of the California housing market. I’ll cover a few of the slides and try to put some of the current myths to rest.

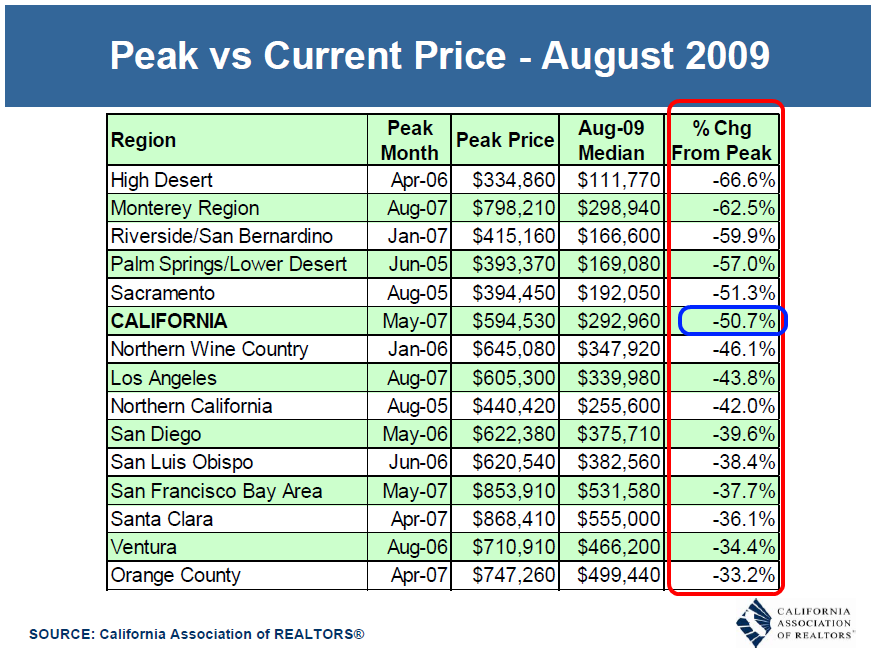

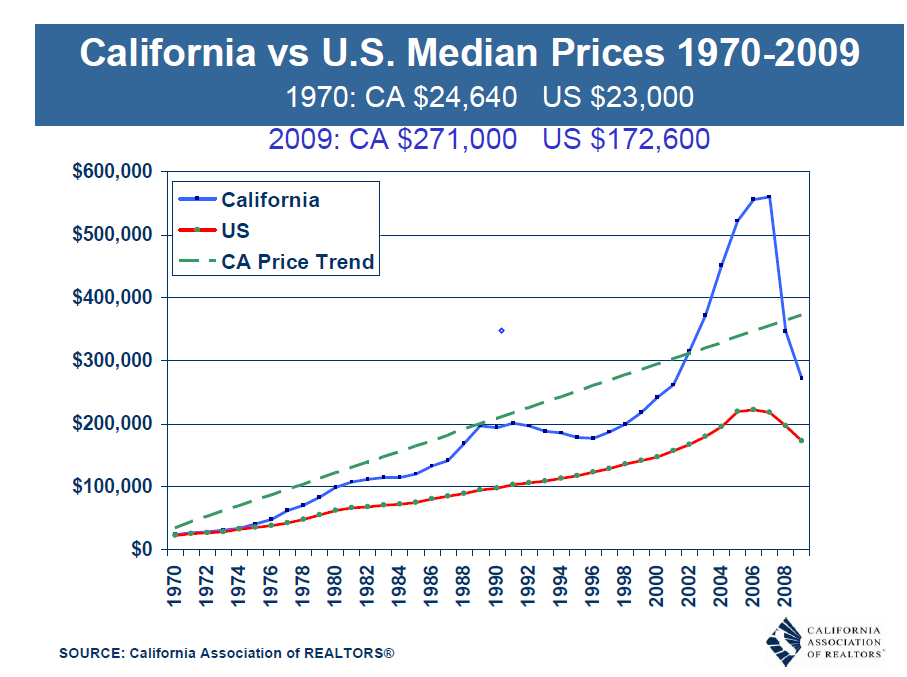

California Housing Market – Dr. Jekyll and Mr. Hyde

The above chart should put the first myth to rest. And that is, prices have recovered to the point of erasing some of the losses and are inching closer to their peaks. The above chart clearly shows that most areas are near their troughs. California as a state is still down by a stunning 50 percent from the peak. We still have the Alt-A and option ARM products hitting major recasts between 2010 and 2012 so what is that going to do with the higher priced markets? It won’t help in terms of getting closer to peak prices.

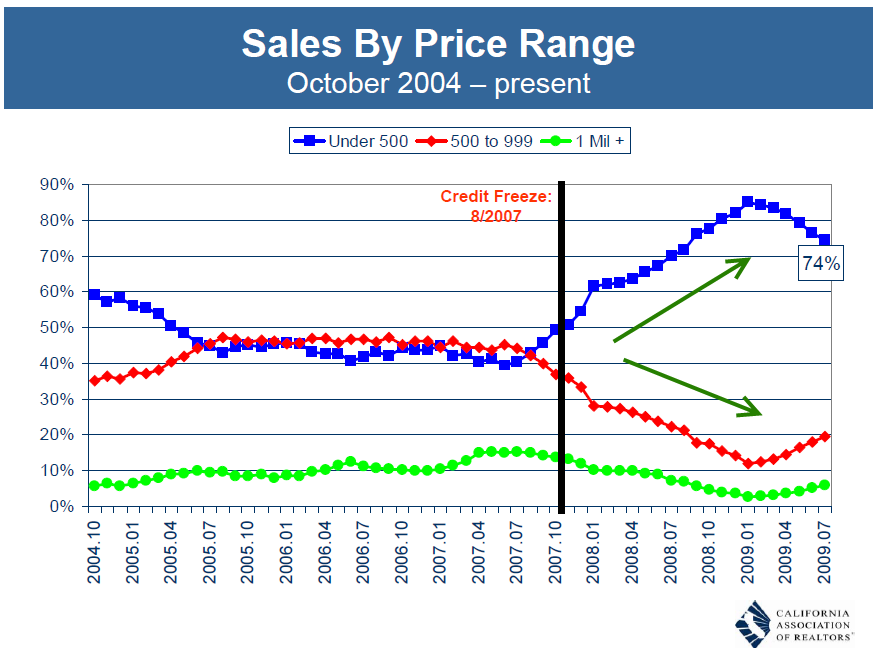

If we look at the details of the market, it becomes apparent that the action is at the lower-end:

This chart is probably the most telling. In fact, this chart gives us the solution to the housing market riddle. Prices need to fall! You will never hear that from our government or Wall Street. But this above chart shows that yes, the basics of demand and supply do work if you allow prices to reflect area fundamentals. Sales have gone up as prices have come down. Yet think of what all these bailouts are doing. They are artificially keeping prices higher and spurring mini bubbles. What you see above is a perfect example of the housing bubble fixing itself. Yet the government and Wall Street (is there any difference at this point?) are trying to keep prices artificially high.

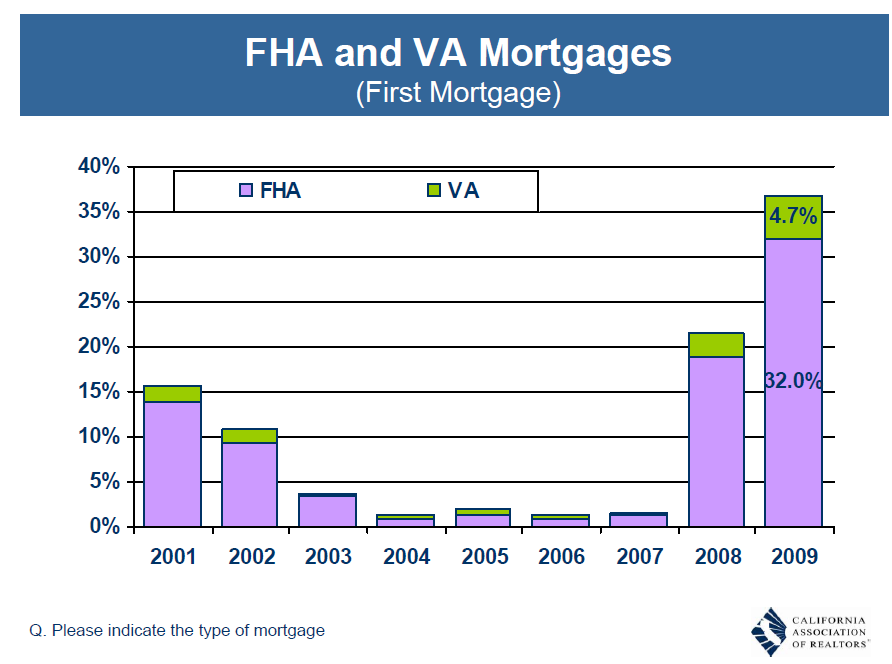

We are entering a new phase of the bubble. FHA insured loans have now replaced Alt-A and option ARMs in the California housing market. Remember, option ARMs are largely a California problem with 58% of loans here in the state. Now why are FHA insured loans a problem? People are financially stretching yet again with these loans. They only require a 3.5 percent down payment. Don’t think many in California are using these loans?

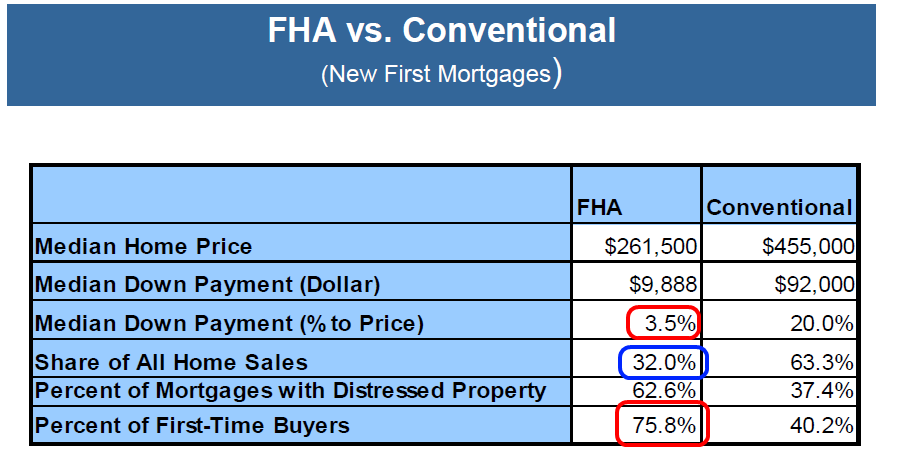

FHA insured loans are now a gigantic part of the California housing market. And these loans resemble some of the low document loans that have caused so many problems. Just look at the details of these loans:

What this tells you is a very important fact. People in California are once again over stretching. The median down payment on a FHA insured loan is 3.5% and people are going with the minimum! This is no buffer at all. Say home prices fall another modest 5 percent. Then all their equity is wiped out:

$261,500Â Â Â Â Â Â Â Â (home price)

-$9,888Â Â Â Â Â Â Â Â Â Â Â (down payment)

$251,612 Â Â Â Â Â Â Â (mortgage)

Home prices fall by 5%:

Home value:Â Â Â Â $248,425

Congratulations, you are now underwater by $3,187. This might not seem like much but this is roughly 30 percent of the initial down payment. Since FHA insured loans now make up 32 percent of the California housing market, this is only another problem that will hit down the road if the economy doesn’t improve. And don’t think that $261,500 is a cheap price:

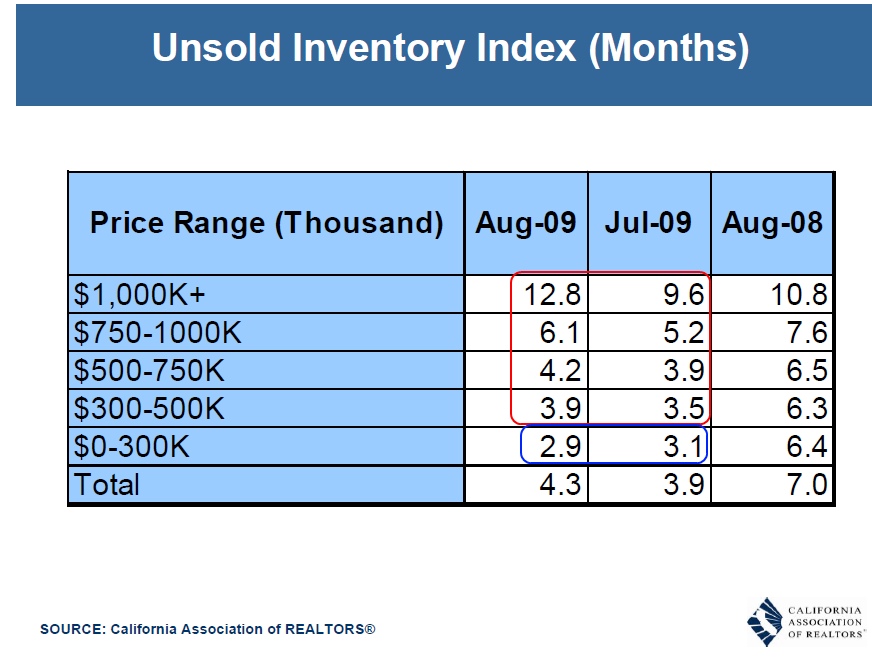

The California housing market is still over priced in many areas. Keep in mind that some heavily distress areas like the Inland Empire may be closer to their bottom than say Orange County. I know many in prime areas like to believe that they are immune for a variety of reasons but they are going to have to sit back. The sales are occurring where prices make sense:

Even over the last data point, from July to August, a time where housing bulls are claming all is well, housing inventory has increased at the top end of the market. The only market segment to improve is the sub-$300,000 market. Do you think FHA insured loans have something to do with that? And what is going to happen when the FHA is going to need to tighten lending standards after they go to the government for a bailout? We all know this is going to happen. Then what? Are we all going to once again start buying tulips and grow them in our gardens for future down payments?

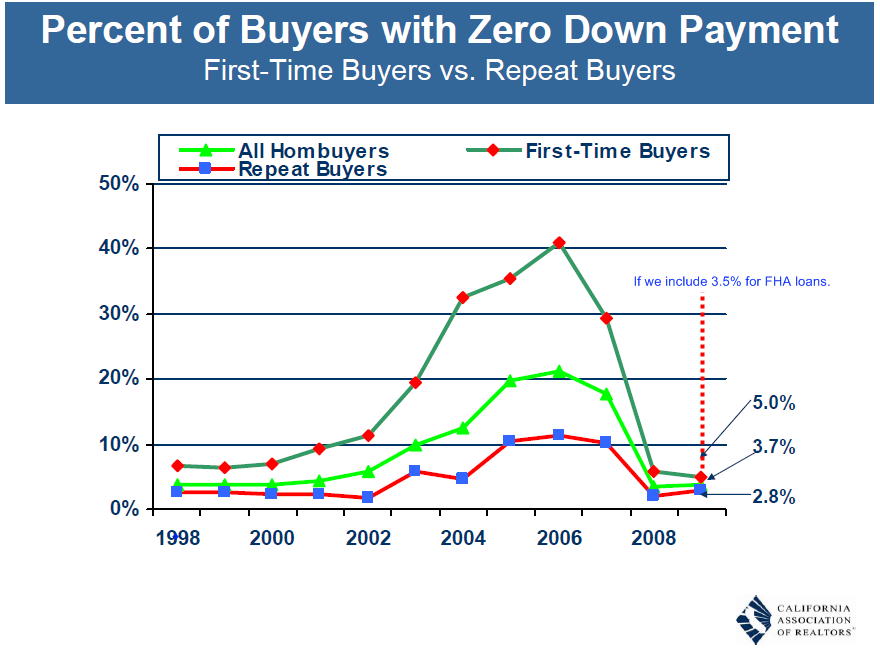

Some stats are a bit deceptive. Take for example the below chart showing the percent of zero down buyers:

First of all, this might look like an improvement at first. But I drew in the line of FHA buyers and the chart looks very similar. 3.5 percent down is nothing. It provides no buffer to any short term falls. Heck, you typically need two months worth of rent for leasing a place. All it would take is another 5 percent decline and we have a new batch of underwater California homeowners. Do we really need that? The number one factor in foreclosure is negative equity and here we are setting up over 32 percent of the market in this position. We need at a minimum, a 10 percent down payment on any government backed loans. Why? Because this is how you can develop a system of giving loans to people that actually saved money for one, two, or even three years and showed some sort of discipline. It also provides an inherent buffer to short-term fluctuations.

But the government and Wall Street know that people are still broke and therefore need to allow people to purchase homes at still inflated prices. They want the bubble to inflate again but clearly prices are not moving because the balance sheet of many Americans has been harmed by a little thing called jobs. So much focus has been given to housing, that the government now has to contend with a 17.5 percent underemployment rate nationwide and in California, it is up to 22 percent and here we are pumping out $250,000+ mortgages to people with 3.5% down! Most of which is going to come back via the tax credit! Can you hear that money flushing down the toilet?

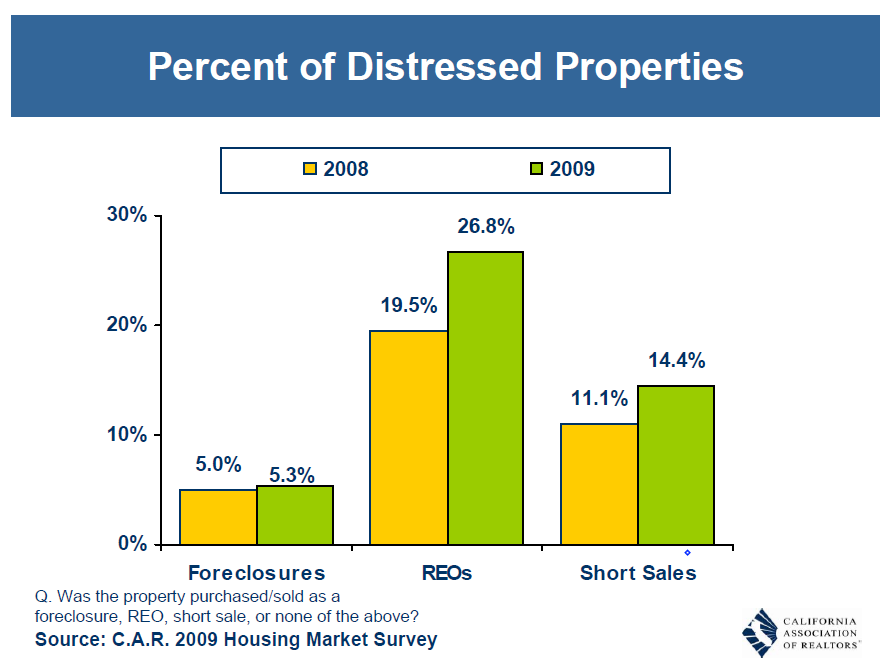

The distress sale market is still the market in California:

Over 46 percent of all sales in 2009 were distress sales. This without even having to contend with the Alt-A and option ARM wave that will hit in 2010 to 2012. What the above charts show us is a very clear picture. To sell homes and create a market, you need to lower prices. Or, if you want to be risky, finance loans with low down payments. People are willing to take out a million dollar loan if you let them. This bubble proved that. But it also proved that it ends badly for the economy when that happens.

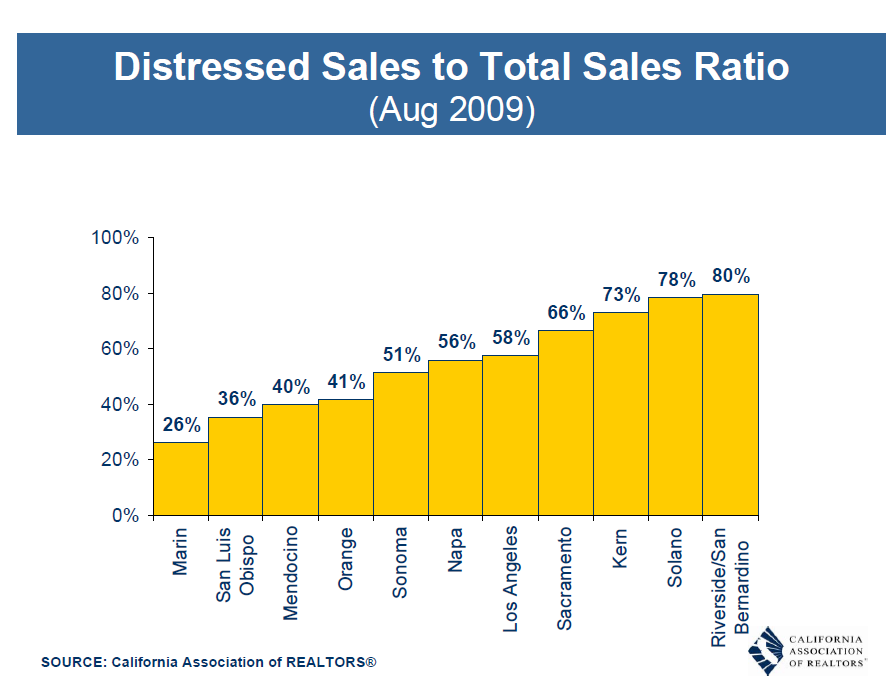

In some areas, the amount of distress sales is incredible:

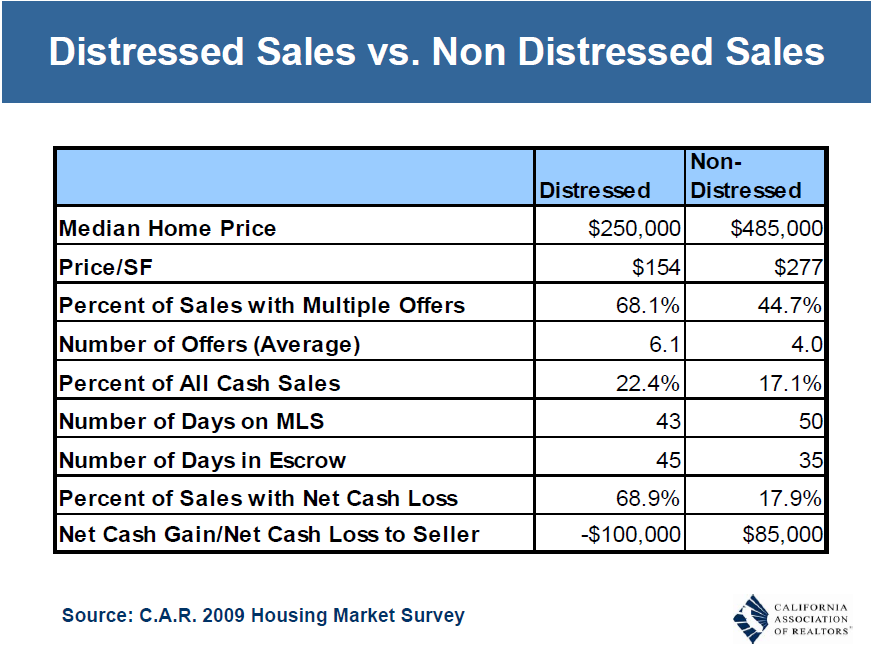

80 percent of sales in the Inland Empire were distressed sales! Is it any wonder these areas have seen such enormous price declines? But all areas have their large share of distress sales. The notion that the market is now somehow healthy is false. Each distressed sale causes a loss somewhere on the food chain:

Each distress sale costs about $100,000 for the seller, whoever that may be. For conventional home sales, sellers are actually gaining about $85,000 but this is a smaller part of the market. Again, you have to read into the data. Say someone in Pasadena bought a home in 2000 for $250,000, at the peak it would have sold for $700,000, and now they fetch $450,000. On paper, they’ve gained some $200,000. A nice sum indeed but it misses the bigger picture. By combining all the above factors it becomes clear that for California the large drivers for sales have been:

-Crashing prices

-FHA insured loans

-Investors buying distress properties

-People buying homes with conventional loans believing the bottom is in

Prices are still near their trough. Why are we to believe that a spike in prices will create more sales? The above shows us that there is a tale of two cities in California. Yet most of the action is happening in the lower priced city. The next question is whether the other city lowers its price because of the next wave of defaults.

I’ll end this post with another quote from TulipoMania:

“Compared to such insane wagers, tulips looked like a good investment. Growing bulbs was a lot easier than working an eighty-hour week hammering horseshoes or working a loom, and because demand for the flowers was steadily increasing, prices, at least for the finer varieties, consistently rose. No wonder Dutchmen thought they had chanced upon the dream of every gambler: a safe bet.â€

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

27 Responses to “A Tale of Two California Housing Markets: The Financial Gambling Psychology and Exploring the Distress Housing Market. 10 Charts Examining the Volatile California Housing Market.”

I personally think FHA is a great program for first time buyers to get in on the home buying experience. The limits on FHA loans keep the price tags to a realistic amount and the qualification is very stringent. If you’ve applied for one, you’d know. They’re nowhere near comparable in risk to that of past exotic loans such as NINJA loans on ridiculous price tags.

Given that California was founded on a get rich quick scheme (for what is a gold rush but a get rich quick scheme rit large?) Get rich quick is in the states DNA. This is demonstrated by the number of booms busts in real estate in CA over the years ranging from 1849 in SF, the 1880 in southern ca and many others. CA is just the end case of the US as a whole having get rich quick as a national societal concept. Recall that VA was founded at least partly as a get rich quick scheme.

It is interesting that MA was not, so ever since you have had 2 different points of view of what the US was about at a fundamental level.

In summary get rich quick is a fundamental part of US society since it came from the beginning.

FHA home buyers are qualified and can afford the homes that they are buying. The properties they are buying have real tangible living value. They aren’t playing the flipping game so the equity fluctuating down for a while isn’t such a risk.

I personally think FHA is a great program for first time buyers to get in on the home buying experience.

I personally think FHA is crap. And I object to my tax dollars going towards this black hole of fiat trash dollars.

If the sale of my home this spring is any indication most of those 3.5% down payments are being paid by the sellers as “closing costs” so in fact are zero down, and in some cases end up added to the sales price and loan amount.

It’s already to the point that the bailouts have exceeded the total $ amount of mortgages in the US, soon it will be cheaper if they just bought everyone a mansion and were done with it.

“But what in the national psyche allowed for such rampant speculation to occur?” The answer is simple: People who buy Lotto tickets think that they are going to win. People who do not buy Lotto tickets think that they are going to lose. People who buy houses now think that the housing prices are going up. People who do not buy houses now (except in the distressed areas) are the people who read this blog.

I must object to the idea that a “mentality” led to the housing crisis. I don’t think there is any place for this in a serious policy discussion. Human nature is what it is, as much as we hope, wish, or insist that it ought to be different.

The current FHA program is not what is used to be….it is not a good program even for the 1st time home buyer. FICO score minimum is at 640, only because when this program started becoming hot again (about 2 yrs ago), there were no minimim FICO score requirement, FHA is the new Subprime. Only contingency was no derogatories / collections for 12 months. Today, they are finally adding a minimum FICO. Still way too low IMO. Plus, in addition to this program that max DTI ratio is 55%. WAY to high to be safe. This is another program doomed for failure…

Twenty plus years ago anyone’s full DTI ratio maximum could be at 35%, this is where it should be today, not 55%, still way to high for anyone to live and buy food, along with the just menial expenditures.

Boy this is going to be a long ride. Such a shame more people do not realize the is a tsunami in the making.

FHA for the moment is the new SUBPRIME lending era. This is the reason why so many first time home buyers are purchasing. Not only small down, which truly is not the way to go, plus FICO scores are a bare minimum 640, IMO not a good score to get a home loan.

In addition the DTI ratio is maxed at 55%, OMG the max should only be 35%, not 55%, this is a tsunami in the making. I agree a minimum of 10%, down payment max DTI ratio really needs to be at 35% so people can still eat.

My wife and I stopped by a new condo development in Studio City, CA today. A gigantic, “FHA APPROVED! ASK FOR DETAILS!” banner hung across the front. The building is probably 75% vacant, and the minimum asking price was $550,000 for a two bedroom condo, $675,000 for three bedrooms. It does not take a genius to figure out what happens when a “buyer” with 3.5% equity in a $675,000 condo decides that the monthly payment is too much for them. Can anybody even imagine making the payments on an FHA backed $680,000 condo (including FHA costs and $400 HOA) with only 3.5% down? FHA purchases are basically leases. Just wait until the LA market falls another 10%. Lots of people will stop making payments on these things (negative equity), another moratorium will be enacted, and all these people with FHA backed “leases” will live rent free for a year while the renters and responsible owners pick up the tab.

Thank you for another great post DHB.

Let me get this straight.

1)The FHA entices hard working, rent paying folk whom hold no mortgage debt out of their rented apartments & houses to buy houses subsidized by the FHA at 0% down.

2) The housing market continues to drop for at least another 2 years as you have rightfully stated numerous times on your post.

3) The new FHA mortgages start to default & are repossessed by the FHA.

4) In the interim, the owners of the apartments these folk left behind are in a bind because they can’t make payments on un-rented space.

5) The government bails out commercial real estate (already being discussed!).

6) The government gets stuck with not only repossessed FHA houses but apartment buildings that are vacant.

Afterall, isn’t housing is a zero sum game unless you are moving in or out with relatives or friends?

Did I miss something here?

We still have a ways to go until the Westside is fully corrected. Off from 25-35% already, with another 15-25% more to go. Even North of Montana in Santa Monica (90402) is dropping. Standard lots once 2.2 million, are now 1.4 million.

Oh, but it couldn’t happen here in Santa Monica, could it?

http://www.santamonicameltdown90402.blogspot.com

Calif. is on an 8-10 year cycle up & down. Same cycle since the 1950’s. Profit from this cycle, and you can be smiling all the time 24/7/365 like me. Example: 2006 was top to the bottom will be 2006+8/10=2014/2016. 2006 minus 8/10=1996=bottom= Like DUH. 1996-8/10 years = 1986-1988 top! Top 1988-8/10= 1978-1980 bottom! And 1979-8/10=1969-1971 top. Simple for everyone!

2014-2016 bottom add 8-10 and you get 2022 to 2024 top! That’s a long time from now!

I must object to a sanctimonious Realtard™ shrill with a snazzy jacket and a 10th grade education trying to act like he holds some sort of moral high ground over reasonable folks like Dr. HB who are simply pointing out some of the intrinsic reasons that sheeple act in such an financially irrational manner during speculative periods; behavior, BTW, from which he and his buddies have profited richly in recent years. I don’t think there is any place people like this in a serious housing policy discussion among those of us who are not brain damaged.

Favid – That’s Realtard SHILL (a pitchman – though you may easily find a shrill Realtard!)

As usual, great post, Doc. Even in the never never land of San Francisco, they are starting to “get it”- the false shell game without even one pea. From the SF Chron- “(Supervisor) Avalos added the $35 million in decreased property tax revenue is an estimate based on 4,000 appeals by property owners to have their property tax assessments lowered. Avalos said there’s no telling whether those appeals will be approved by the assessor’s office.

Supervisor Sean Elsbernd said he expects the $35 million figure to wind up being conservative. He said 350 property owners had filed appeals by this time two years ago, and their properties were worth a total of $2 billion. This year, the 4,000 property owners represent property totaling $25 billion.” http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/11/17/MN001ALO7J.DTL&tsp=1 . Additionally, the continuous fix of zero interest rates means less $ for the tax coffers- since interest to savers is taxable at high rates. Again, save the biggest contributors to politicians at the expense of the tax payer. Since the big guys aren’t going to pay much, and the little guys are under duress, who is going to stem the tide of layoffs of government workers? Which, again, lessens taxable income. Oh well, at least the venture capitalists are available to buy up the latest Andy Warhol painting for $44 mill. What a country.

Americans should hunker down for more job losses

As a result of these terribly weak labor markets, we can expect weak recovery of consumption and economic growth; larger budget deficits; greater delinquencies in residential and commercial real estate and greater fall in home and commercial real estate prices; greater losses for banks and financial institutions on residential and commercial real estate mortgages, and in credit cards, auto loans and student loans and thus a greater rate of failures of banks; and greater protectionist pressures.

I feel so sorry for any home buyer who felt for the “oh it’s such a great time to buy reale estate now”. I had co-workers who belived that and I asked some questions and their only reply was based on emotion and not logic or facts.

Home prices still have a long way to go. How long? Well one day, we will see the social mood change to “oh dear God, real estate is not a good place to put your money”, “real estae sucks”, etc…. Once that social mood sets in, then it will be time to buy.

I have been following this blog ever since i decided with my wife to buy a house 18 months ago(that was when there were bargains). We have a joint income of nearly 200 K a year with savings for a 20% down payment & money left in the bank. We have been looking in the 5-600K market SFR which basically in Los Angeles means outer Valley or marginal East side areas for the most part. When a semi- decent house does come on the market competition is fierce. Just last week we put an offer in above little list price for a small but cute home & counter offers came back today asking 50K over list price with sellers & buyers realtors trying to force bids higher. My own realtard was telling me the house would be worth 100K more within 3 years. The whole thing is utterly depressing. I would like to believe what is being said here but this is not the reality of what is happening in the Los Angles market at least at this price point.

I just bought a house with an FHA loan. Am I subprime, I put $10,000 down, I earn $110,000 a year, I have stable employment with the State of California, i had a FICO of over 750. I didn’t buy during the “bubble” cause I didn;t want to lose my shirt, as I knew all in the real Estate game would. I love FHA, got me a dream house for $230,000.

Yeah….uhh…David Fox….if you aren’t interested in human behavior, then why even study any Market? Human behavior plays a big part of market dynamics. Or, did you not get the whole Bubble thing?

LOL “Stable employment with the State of California”. Buddy, with the stroke of a pen you could be joining your neighbors at the unemployment office.

Also, a “dream” house in southern california for $230,000? Is wouldn’t happen to be in Methville (anything Inland Empire) now would it?

Greeny:

You need to wait!! My husband and I seem to be in the same position as you and your wife (about 200k combined income, plenty of savings, no debt) . We have been waiting for over five years in LA and now in OC (for the last 3 years we have been waiting with our son). The market is still not rational at the mid to upper end. What is so wrong with renting? Why do you want to give this corrupt industry so much of your hard earned $$? I am 35 and my husband is 40. We may never own a home in socal!! This may seem unusual, but we want to preserve our marriage and family.

I would like to add to my previous post.

The statistics may show that prices many other decent areas, may have fallen 20 to 30% and are barely rising now, but that is not the real world.

The house and condo sales that created those statistics were for the most part for the well connected or the all cash buyers.

There is no question the “barrios” did decline and prices were available to all but anywhere else, not a chance.

Again, I am talking halfway decent areas within ten miles of the coast.

At the bottom of the market, here in the Inland Empire, it is almost impossible to buy a distressed property with FHA financing. I have been trying for 9 months but the banks always go with the cash offers, even if they are for less money. Most distressed houses also need repairs and do not meet FHA standards. Banks are unwilling to put a dime into repairs and would rather sell the houses off to cronies or investors (or do I repeat myself) for 60 cents on the dollar. This is in the 100-125k range.

Hi RL,

I would like to agree & sit back & wait but we have grown out of our apartment & i dread having to move & rent for another year or two. I don’t have any thing against renting, i am 41 & have been renting since the age of 19. I am glad i didn’t buy 2-4 years ago when everybody was telling me to but now i am ready. Sorry to reply so late as the topic has moved on but i wanted to reply.

Not everyone who uses VA/FHA is putting a single-digit percent down on a home. My DH and I are going VA because no conventional lender is willing to go 85% LTV on a larger loan regardless of income & credit score. We’d rather not go VA but that’s our only option given the current mortgage market.

Leave a Reply