The steady decline of all cash buyers: Investors pulling back but all cash sales still remain elevated. Fewer distressed sales means less opportunities for good deals.

Never in the history of U.S. home sales have we had institutional investors so involved in the single family home market. In many areas once the bubble popped, we had big and small investors swallowing up over half of all sales for many years. The deals are now harder to find and investors are pulling back in a big way. We also have fewer distressed properties on the market so the properties that do make it to the “for sale†section tend to have more wiggle room in terms of sellers being resistant to lowering prices. For example, back in 2009 nearly 50 percent of all sales were of the distressed variety nationwide. Today, it is slightly below 10 percent. It is a good thing to have fewer distressed properties out in the market. But what happened over the last decade is many of the 7,000,000 foreclosures shifted from individual families into the hands of large and small investors. This is how we have a very large swing to renting households. It might be useful to take a deep look at all cash sales today.

All Cash Sales

All cash transactions are hard to define since this only means a traditional mortgage was not used. You have small scale investors using hard money to buy places but this does not mean the place was loan free. You also have big investors which did use pools of their own funding typically drawn from investors.

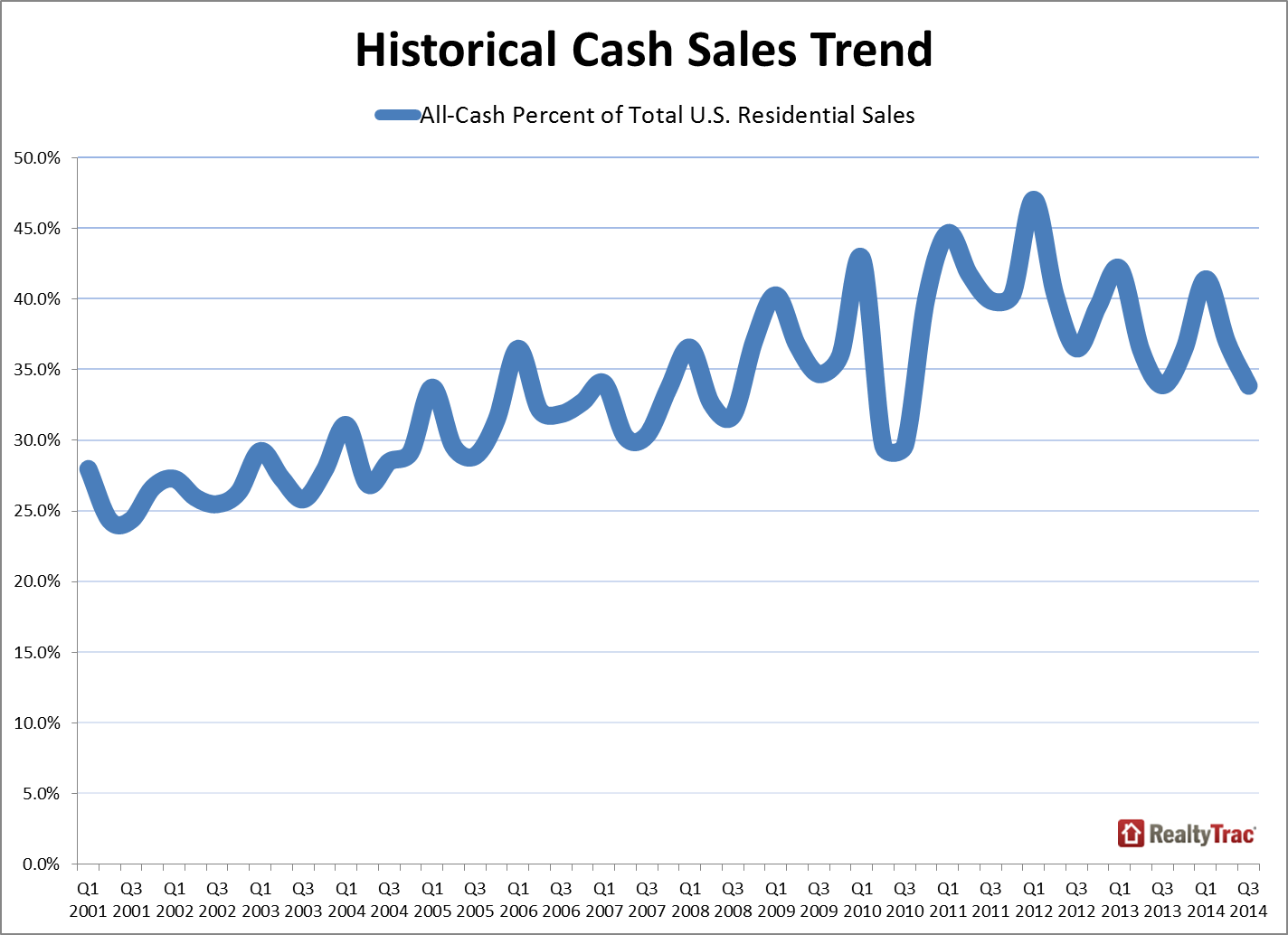

At one point, all cash sales were over 45 percent of all sales:

Source: RealtyTrac

The peak percentage of all sales seemed to hit in 2012. The trend is definitely to the downtrend but is still very high as a percent of all sales. It is important to note that overall sales have fallen dramatically as well so there are fewer transactions.

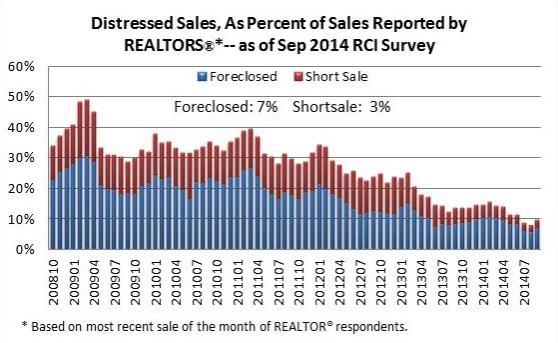

Investors are hungry for deals. Many were aiming to purchase distressed properties and this is where the bulk of the money was going. Big investors were buying up many of the homes in places like the Central Valley of California, Arizona, Nevada, and Florida. These markets were great for turning homes into rentals since the rental household trend was growing dramatically. Fewer distressed properties means fewer deals to be had:

Source:Â NAR

Distressed properties are now a small portion of all existing home sales. This also helps to explain why some sellers are pulling back in places like California when they are unable to fetch their pie in the sky price targets. Ultimately there will be a reconciliation of these two forces. Sales have plunged but many of these sellers have the ability to hold out. It is up to buyers whether they want to commit but many simply do not have the cash flow figures to make things work. The fact that the FHFA is looking at lowering the down payment from 5 to 3.5 percent is comical. People are looking to leverage every penny to get into a home. Even if it means mortgage slavery on their household balance sheet:

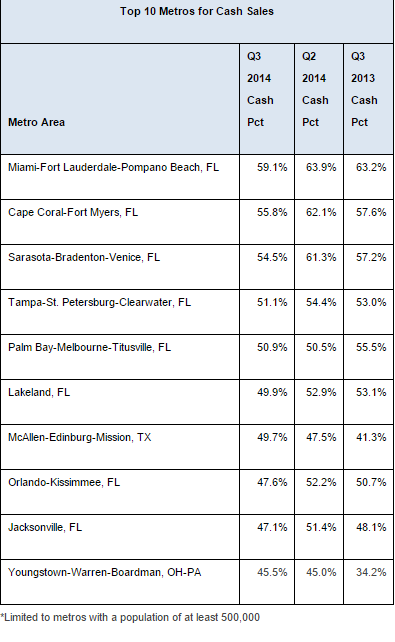

The top areas for all cash buying remain in low priced areas:

The leading areas for cash purchases as a percentage of all sales is definitely in Florida. We have Texas and Ohio pop up a few times as well. In some of these markets, like the McAllen-Edinburg-Mission area you can find solid homes under $100,000 that cash flow nicely. As an investor, this is a good market to look at. In California, the all cash purchases are usually done in trophy markets like Malibu, Palo Alto, La Jolla, Newport Beach, and other truly prime areas and flippers trying to squeeze out margins with HGTV upgrades in mid-tier markets.

It is an interesting trend we are seeing. There is a chasm growing in the country between the few that can afford sans a mortgage and those that can barely squeeze into a rental. Given that all cash buying from investors was a big deal and a big segment of the market, it is no surprise that sales have fallen with this big group pulling back.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

81 Responses to “The steady decline of all cash buyers: Investors pulling back but all cash sales still remain elevated. Fewer distressed sales means less opportunities for good deals.”

I feel the significant price drops (in the areas where they are to be had) are coming this summer. Specuvestor capitulation should kick in after the spring selling season bombs for the second year in a row. The question may come down to the FED response and where we are at stock market wise. I have a feeling they’ll keep the stock market juiced behind the scenes (Belgium again?) and continue to trot out BS employment statistics that don’t reflect the overall suck of the real economy. If that happens and the message is QE for treasuries and MB securities is dead then look out below. This actually works in the FED’s interests as absent wage inflation (which they were desperate yet unable to create) or further credit expansion (the consumer is already maxed out) increasing consumer purchasing power by lowering fixed costs is the only option. Bringing down sky high rents and mortgages could help un-seize the economy. Unlike Housing Bust 1.0 the losses will be borne by the specuvestors and not the banks. I truly believe that was all this last 6 years was about.

There is increasing evidence you are correct.

A significant price drop only occurs if interest rate rises above 6% or the stock market tanks 30%. Neither are likely to happen by next summer. I think we either see flat price or slight decline that goes hand and hand with rise in interest rate.

@Willie, the stock market tanking is a distinct possibility. Declining oil prices usually signify a weakening economy. Oil prices declined after the 1990, 2000 and 2008 recessions, and so did the stock markets.

The stock market tanking would likely slow the housing decline as the rush to the safety of treasuries would have downward pressure on mortgage rates. People moving out of equities would likely see RE as a safe haven. Conversely I believe we’ll see something like the mid to late 90s where stocks are strong based on shit fundamentals while RE reverts to the mean. This most serves the FEDs interests as I stated earlier.

Weather housing stagnates going forward or declines, the result is the same, an underperforming asset class.

At current prices, ( I am talking bubble markets like San Diego and LA,) the only way real estate as an investment makes sense is if prices rise. If prices stagnate, real estate is a money pit. With prices now the highest ever in history in relation to income, I would not bet on ever increasing prices.

The DJIA going up, up, up and oil going down, down, down…does that not remind people of something?

I think the gains in home sales are shifting to the stock market in response to the hope that the mortgage lending rules will ease to allow buyers to put little down on homes again. This is probably setting the stage like we saw in 06-07?

Looks bad. Pray we have an economy after this next crash.

all IMO

Yes, there will be a big push to loosen lending standards, reduce 20% downpayments to 3% now and recreate the mess of 2006-2008. I think this one will implode more quickly, however, as the speculators who gobbled up half the inventory of 2013-2014 are already running for the exits and inventory will jump in the next year. The 3% buyers are already sitting on the sidelines until there is some price movement and the number of buyers, even with significantly loosened lending standards, cannot consume the coming inventory. Also, those who put 3% down in 2012-2014 will be underwater by mid 2015 and some of them will start walking away just as the new Senate is trying to push to reduce lending standards and do away with 20% down. This should bring on some outrage and any republicans who are concerned with their ‘fiscal responsiblity’ mantra won’t like what their lobbyist lackeys are doing in DC around the time of the 2016 election. I predict they will screw around and try to keep the housing crash from happening until just after the 2016 election, but think it’s really too late already. Speculators are going to be moving back to stocks unless the double digit housing appreciation of 2012 returns. Housing in this country has now become a bigger and more profit-driven scam than healthcare.

http://finance.yahoo.com/news/u-regulators-agree-easier-mortgage-232500444.html;_ylt=AwrBJR4uxmRUFBEAAJGTmYlQ

There is know way in hell the GOP Congress loosens lending standards with a Dem in the White House. They WANT the RE crash to happen on Obama’s watch. the funny thing is it won’t help them in 2016 as they aren’t going to nominate Rand Paul and the rest of their field is a joke in a national campaign. It’s Hillary and a GOP congress for at least 2 years. I’m rather excited at the prospect because the last time I remember things being decent in this country was Bill Clinton VS The GOP in the 90’s. PLEASE GIMME GRIDLOCK! Like I said earlier Housing Tanks while Stocks Levitate IMHO.

I have noticed lots of interesting little financial tricks to help the consumer buy. For example my husband bought me a new Galaxy phone the receipt says it retails for $1000 however the reality is he paid $72 and $20 per month for a year at which time I get a new $1000 phone and then he pays another $20 a month for an additional year. So on paper they booked a thousand dollar sale but the reality is far different. In other words, to keep the fantasy going they have to give us back the goods and services at a lower price while marking it on paper as if it was a larger sale hence the fantasy continues.

Programs like T-Mo’s JUMP (which others later copied) are interest-free loans. In fact the paperwork you sign is just that, do you really think in their books they could classify that as a sale where they received cash? I think they finance it on their own…not sure of the details of their accounting though…

It’s an interest free loan with the option to trade in when your equity reaches 50%. Basically the same as leasing but with zero interest. If you can sell for more on eBay, you can do that. If less, you don’t…it’s all about the timing and depreciation of the phones.

How’s this for the flipper mania that defines West LA:

Bought less than 6 months ago for 190k, now on market for 499k

https://www.redfin.com/CA/Los-Angeles/2510-S-Rimpau-Blvd-90016/home/6897049

I went to see it, it’s beautiful. Nice finishes, good workmanship the nicest house on the block.

Only problem it’s in the straight up ghetto. 4 blocks east of LaBrea on Adams.

It’s comical, look at the street view it. When I went there was so much trash in the streets, and so many broken down cars it was crazy. Then shining like a jewel this super over renovated property.

If it was about 2 miles west, it’d be the deal of the year. At this location I doubt this guy’s gonna swing a 310k increase over his purchase price, reno or not.

The amazing part of this is the previous purchase price of $190K. It must have been a foreclosure and maybe a back-room bank deal even if it was in lousy condition. I have been watching home prices in 90016 for many years and fully agree with your take on the neighborhood. My guess is it will sell for $450K+ since the pig has all the lipstick.

Will be fun to see if it fares any better than the Culver City freeway adjacent now one month away from a year on the market flip jobber.

https://www.redfin.com/CA/Culver-City/5021-Purdue-Ave-90230/home/8136377

That’s the Del Rey neighborhood of Los Angeles. The Culver City Post Office handles mail delivery there. The school district is LA Unified not Culver City. It’s a barrio. So a future buyer should like Mexican music, having Cholos as neighbors and be able to speak Spanish.

I’m quite familiar with the area and this particular section is decent because it currently benefits from being shielded off by the 405 and that’s why it’s serviced by 90230. The immediate area around Sepulveda has gentrified quite a bit and the walkability from this property is good. Given all of that I think the place is overpriced and for good reasons it hasn’t been able to hook a buyer in almost an entire year of being on the market.

That property just went into pre-foreclosure. There’s two more properties on the same block that just when pre-foreclosure as well.

Flippers gonna get Hammed.

Housing To Tank Hard in 2014!

Haters gonna hate – hate- haaate but

Housing gonna tank -tank -taaaank

Tanking hard! Tanking hard!

Ah Ah

Tanking hard! Tanking hard!

Tanks for the memories! 🙂

Right on!~

please! not even!

In my dreamy social town the median price just dropped from 1.195K to 975K!

oops!

You’ve had all year…hundreds of innane “Tank Hard @ 2014” posts.

6 weeks Tanker….then STFU.

YOY LA Cty is +7%

YOY Orange Cty is + 10%

Horrible horrible call

Wow you must really feel strongly about the random comments made by this Jim Taylor guy.

Here is a flip. Newport Beach, but not the most desirable area … this one is right under the John Wayne flight path. Purchased 11 months ago. Remodeled with nice finishes. Under agreement in less than 1 week. Last sale was about 1.25M. Pending at nearly 1.9M. In my opinion, that buyer got a terrible deal.

https://www.redfin.com/CA/Newport-Beach/1714-Skylark-Ln-92660/home/3560457

In Palm Springs area, inventory up over 35% in 1 month Sept to October! Sales flat. This is a precursor to major price reductions in the months ahead.

Inventory is always up big between Sept and Oct in the desert. Snowbirds all fly into town. Not many list in the summer or should I say only the need to sell folks.

it’s just a ride …. bill hicks

if running in the hamster wheel is not fun … get off

1727 North Avenue 45 LA, CA 90041

https://www.redfin.com/CA/Los-Angeles/1727-N-Avenue-45-90041/home/7079706

My friend’s house recently sold for $540,000

Holy shit! That house sold for that price? Whoa, people are crazy. You can’t even do a proper teardown the lot is so small.

Now that one made me laugh out loud. A two bedroom ‘cottage’, a converted garage and a tent. Wow.

When is it going to rain…water is kind of important, more important than a house….

Water bills will rise by 7x if drought persists..and towns will begin to shrivel and people will seek water in other areas of the US….

House prices vs. Water…..I know the winner, do you?

Some people are too stupid to care about bills. Or they just don’t pay, go bankrupt every 7 years, way of life for some.

Water is just one underestimated cost … I read many if not most California homeowners don’t have earthquake insurance … I guess they’ll just walk when their house is leveled, leaving the bill to the taxpayers. L.A. is trying to figure out how to fix the roads … I read they are thinking of a $1 billion dollar bond issue, water main breaks have been front page lately … those water mains are an average of 49 years old I read. There are a lot of hidden gotcha’s and future liabilities that could make those bills go through the roof. Add that to the fact that most are already living well beyond their means ….

Here in southeastern North Carolina, 400 unit “luxury” apartment complexes are springing up all of the region, like poisonous mushrooms do after weeks of soaking rains. Since there is no dramatic population increase in this region, one can’t help but wonder just who will pay these up-market rents to live in these highly leveraged units.

Two weeks ago, I had lunch with one of these mega-unit apartment developers, and I voiced my concerns to him. He told me that he believed that most of the other projects going up were ill conceived, but that he had done an extensive demographic studies on the area of town in which his high rent project was located, and that he’d be fully rented within a couple of months after they were completed. I’m guessing that the developers of some of those ‘ill conceived’ giant apartment ventures feel just as confident as does the developer with whom I ate lunch with two weeks ago. One can only wonder how confident those single family house rental owners feel with all this new ‘luxury’ inventory coming online.

The same thing is happening in Franklin, TN – an upscale town 20 miles south of Nashville. Literally thousands of luxury apartments going up all around me, with dozens of semi skyscraper office buildings, a community college, Vanderbilt Med Ctr, hotels galore, etc. Less house building going on, though. My realtor says that they’re preparing for the expected influx of people moving from out of state. This place is literally booming. I’ve been letting my property build in value for awhile, and monitoring the California madness, in hopes of selling here and moving back home to California to buy there. Too bad I don’t have a crystal ball.

Same issue happening down here in Miami..lots of multi unit buildings going up..for renters/lease…could really hurt all those single-home investors in the coming year. Good for renters, as prices need to come down, I even had a brother-in -law move in with us recently.

But the prices never really come down do they? A shift in supply should impact price but it only ever sets the price higher.

I don’t think there are many cities where this isn’t happening. It’s all over Los Angeles. I’ve heard of it happening in Seattle, Charlotte, Austin, Denver and many more.

Case in point:

http://la.curbed.com/archives/2014/08/loads_of_luxury_apartments_break_ground_at_howard_hughes.php

skeptic – i like the 600 sq ft garage on sale for 499,999 on the same page but i wouldn’t pay more than 200,000

Reminds me of a blogger who called them, “collective debt service camps”.

“Luxury” apartment just means lots of amenities or nice appliances in a new-looking but super tight space, plus a floor on rent that’s roughly double that of existing rents. We’ve seen this in LA for a long time. I guess they’re nice for people who don’t mind living in rabbit warren and paying out each month for a viking stove. I wonder how many people are doubled up in those luxury apartments here in L.A.

I’m curious about the new luxury apartments going up in Pasadena near old town. Anyone got any thoughts on those?

Prices are down around 10% since the beginning of the year in South-West Riverside County. I’m not sure how big a drop quantifies as an echo bubble and bust, but we have to be getting close. I would call what happened in the past few years a mini-bubble at least mostly driven by investors.

There is big difference between price reductions and the market losing value. What we are seeing in many areas is sellers coming back to reality and reducing prices to meet the market These sellers were delusional and asking insane speculative prices based on future appreciation, still believing that housing fever is rampant. Reality is, the market has cooled and the fever has died down, but I still see well priced properties moving quickly with multiple offers. It’s the properties that were overpriced to begin with that are sitting and getting price reductions.

BTW DG, home prices in Riverside county are up 14% year to date and according to everything I’ve read & seen (Just purchased a investment property in Murrieta last week) the housing market in Riverside/IE is the healthiest it has been in many years. Foreclosures are finally down after being rampant in IE and I know for a fact that people are more then eager to submit multiple offers on desirable homes & condos in Riverside county, including all cash offers. I would like to see statistics on your so-called 10% decrease in home values.

@ DG –

I call BS. What’s your data set for that % drop? I just pulled all closings for SFR’s in Riverside county for the last 12 months. 1/2014 median sold price $291K. 10/2014 median sold price $305K. 1/2014 avg sold price $318,305. 11/2014 avg sold price $325,521.

Correction to above 10/2014 avg sold price $325,521.

YoY median sell price for RS County is up 11%.

That said, inventory and sales are rapidly moving in opposite directions. YoY inventory is up 60% and sales are down 16%. This trend is accelerating.

DG, which prices are you referring to – asking or actual sales?

I don’t see prices coming down in San Diego. Where is this hard tank I keep hearing about???

Soon. Just be patient.

@jim, SoCal real estate prices only tank during recessions. No recession, no tanking.

Prices are most definitely NOT coming down in LA. Inventory is low and prices are high.

They’re definitely coming down in the Sacramento region. My zip code and Sac metro as well. Some still stupid enough to list at last year’s bubble prices, but they are ALL sitting with no offers. See it everywhere, and know quite a few people here currently trying to sell, with no luck. One couple I know have their listing down to $5,000 above what they paid for it in 2009, and they’ve renovated and put in a gorgeous new kitchen. Talk about a BAD “investment”.

I’ve learnt over the years there are about 5% of all realtards out there that list realistically and get it sold, and the other 95% of the realtards (ie” unemployed and desperate for a listing/sale) “buy” their listings by convincing the seller they can get XXX for it, then it sits, and sits, and the inevitable price reductions start in.

Same ole, same ole. California RE merry go round.

Defenetly housing will tank…not sure if it is happening in 2014….check on youtube Fabian4liberty…he is saying 2016 is going to be worst then 2008…..

With that kind of name, I’m sure he/she is a real authority on the subject…

If I recall, Fabian is one of those doomsdayers who said gold would be $5,000 per ounce?…

If he is right on hosing, then hosing to tank hard in …. 2017?

If Taylor is right about hosing to tank hard in 2014, then it needs to be in the next 7 weeks, haha.

“It was another sub-par month for Southern California home sales. We’ve yet to see traditional buyers fill the void left by the drop-off in investor and cash buyers, which began in spring last year,â€

http://www.calculatedriskblog.com/2014/11/dataquick-october-southern-california.html

Hard data just released by DQ:

“Southland homes sold at the slowest pace for the month of October in three years as sales to investors and cash buyers continued to run well below October 2013 levels. Additionally, the median price paid for a home fell month-over-month again and the single-digit gain from a year earlier was the smallest in 28 months.”

“It was another sub-par month for Southern California home sales. We’ve yet to see traditional buyers fill the void left by the drop-off in investor and cash buyers, which began in spring last year,†said Andrew LePage, data analyst for CoreLogic DataQuick. “Of course, there are multiple reasons for this year’s lackluster sales. New-home transactions are still running at about half their normal level. The resale market is hampered by constrained inventory in many areas, in part because some people who want to put their homes up for sale still haven’t regained enough equity to purchase their next home. Then there are the would-be buyers who continue to struggle with affordability and mortgage availability, if not uncertainty over their employment or the direction of the housing market.”

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA141112.aspx

Here is some more HARD data from DQ:

OC home prices jump 10.2% in October from last year’s sales prices

http://www.ocregister.com/lansner/home-641793-orange-county.html

Somebody is going to have to explain how this equates into tanking HARD. 🙂

Clearly, you didn’t read the article or you would have read the last sentence that said that prices went up and sales went down. Realtor circle jerk. Silly shills…..

YoY prices have been up for some time now. Not exactly breaking news.

What continues to change is the walkdown in YoY pricing. It peaked @ 9% in August 2013 as has dropped ever since. YoY pricing was up 5.6% in Sept, and is poised to drop again in Oct.

http://4.bp.blogspot.com/-r4Hn4xjjLx0/VFjaOzrJBhI/AAAAAAAAhJU/J-vJKEiZ98Q/s1600/CoreLogicYoYSept2014.PNG

The problem with the DQ numbers is that there is no factoring in the mix of homes being sold. A far fetched example would be when only the top 10%’ers are able to buy $800K homes on annual incomes of $200K. Prices will continue to go up 10% a year, every year, forever! But the sales volume will be abysmal, and limited to the top 10%.

That’s why the Case-Shiller index is a better indicator of where housing is moving rather than the raw DQ numbers.

I don’t know where you’re getting your numbers EB, but only 3.92% of the people in California (one of the wealthiest states in the nation) make over 200K, not 10%.

@We’re gonna be rich!

In the zip code where I live, 20% of the population has a household income above $150K per year. Median household income in my zip code is about $105K a year, versus the Los Angeles-Long Beach-Glendale median of $53K, and significantly higher than the California median of $58K.

Oh, China!

Jiangsu Building Uses Bamboo Instead of Steel Rebar, Developer Claims It Is Playing a Prank on the Homeowner

http://www.chinasmack.com/2014/stories/chinese-homebuyer-discovers-bamboo-used-instead-of-steel-rebar.html

Ok, if anyone out there can youtube Fabian4liberty and tell me if this guy does not know what he is talking about….so far everything he predicted for last 2 years came thru….tell me if I am wrong, so I willl not listen to him anymore.

Here’s an odd price history in Woodland Hills: https://www.redfin.com/CA/Woodland-Hills/4769-Galendo-St-91364/home/4210639

It was initially listed in March for close to $1.2 million.

It then underwent FOUR PRICE DROPS of $100k each, until it was listing for just under 900k in October.

Now it’s been RELISTED at a HIGHER price of $1,052,600.

They couldn’t sell it despite four price drops, so they relisted it as a “New Listing” at a higher price?

I saw reality show about realtors last year. A Manhattan realtor had just signed on to sell a luxury co-op that was listed for a few million dollars, but had sat without takers for several months.

The realtor wanted to LOWER the price, but the seller refused. So the realtor instead INCREASED the price by a million.

His logic was that any movement in price was better than staying still. A higher price might convince some buyer that the co-op was increasing in value, so better buy now.

Oops, just checked Zillow again. It seems the house has gone into foreclosure: http://www.zillow.com/homedetails/4769-Galendo-St-Woodland-Hills-CA-91364/19944686_zpid/

It’s been “foreclosed to lender” for $675,000.

Zillow seems more informative than Redfin.

Below just for reference – with no inferences – I am lost in this highly stimulated – high intervention market.

_____

Foreclosure filings climb 15% in October

Published: Nov 13, 2014

[..] Despite October’s increase in filings, the pace of the foreclosure-related notices is trending closer to levels seen before the U.S. housing bubble burst.

http://www.marketwatch.com/story/drop-in-foreclosure-filings-slows-down-2014-11-13

Median sales prices are deceiving. It represent the mix of homes for sale/sold, not whether individual homes have moved in price from one period to the next. Median prices are up because fewer lower priced homes are available for purchase, hence the slowdown in sales.

Markar, Exactly. Half of the properties sold for more and the other half for less. Median prices can be deceiving.

In north county San Diego (no prime area) you can put 50K down to purchase a 2bed/2bath condo and end up with the same monthly payment as a renter. Why would any sane person buy a home in San Diego (and California in general) during these times……the prices can go nowhere but down…..and will adjust to household income as they are supposed to…..the median prices will be between 250k and 300k…..just be patient and watch….No one knows when it happens and what will trigger it….. but it will happen because the investors, fed, realtors, politicians and lenders need housing to go up…..let them lower the credit standards and wait until it all crashes once again.

What part of North San Diego county are you referring to? I know that in Temecula/Murrietta you can get a real nice 2/2 condo for around 200K purchase price. I know it’s not San Diego county, but real close by. Beats anything you can find in LA for that price, that is if you could find something in LA for that price. Hell, you can buy a small SFR home in Temecula for 250K.

yeah but its in murrietta. LOL

Im pretty sure I can buy a REAL nice 2/2 some place where no one wants to live for 150k…

location location location. Trying to compare LA to murrietta at the same price point really doesnt make any sense.

I recently moved to San Diego(Rancho Bernardo) area a few months ago. I got a promotion and I work for a aerospace company. My wife and I have been looking at homes and everything is overpriced. Right now we are renting and the rent is ridiculous in this area.

We are only in this area because of the excellent school district that is Poway Unified. I have a 5 year old that is in kindergarden. I was looking into maybe purchasing something in Temecula once my lease lends but might wait since I see prices on homes are dropping. The wife recently became a RN so she is looking for work.

We currently own a home in LA and that is being leased out to a tenant.

Does anybody know how good the schools are in Temecula/Murrieta area?

Thanks

I am referring to Oceanside. I am aware of Temecula and it’s prices. I agree that affordability is better but consider the cost of constantly running the ac during summer and the commute (unless you find a good job there).

Leave a Reply