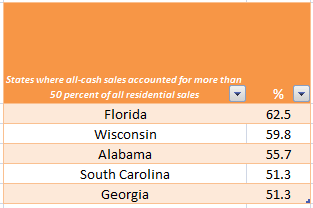

States where all-cash buying has gone wild for the new feudal lords: Florida witnessed 62 percent of all home sales going to all-cash buyers in December.

The growing disparity of income in the world is a major talking point at the World Economic Forum in Davos. Apparently there are only so many yachts and extra homes a rich hedge fund manager can buy. This large divide is only expanding and consequences are showing up in odd ways like large dark pools of money flooding into the once stale residential real estate market (the place where most Americans used to build their wealth). It was interesting to hear pundits act like apologists for the banking industry with the bailouts acting as if this would help the middle class. Well here we are in 2014 and most of the gains from 2009 have gone to a very small connected portion of our population. This new rentier class is dominating a large part of the residential market. In some states, more than 50 percent of residential real estate sales are going to investors. I was digging through some reports and saw that Florida, the younger sister of California had something like 62.5 percent of all sales going to all-cash buyers (that is, no mortgage was recorded on the sale). Who needs the plebs when you can buy up the entire Monopoly board!

All-cash buying gone wild

I doubt that anyone is going to act surprised that Florida is at the top of the list. Florida, also home to the real estate bubble back in the 1920s when wealth inequality rivaled that of today, is back at it again. 62.5 percent of all residential sales went to people/institutions buying up places recording no mortgage in December. Where is this financing coming from? A large amount is coming from hedge funds and Wall Street that basically circumvents the stale traditional mortgage system. Yet this group wants a profit and isn’t necessarily buying up properties for charity. However, this group is also fickle. If they sense the market is turning they are going to exit. What happens when half of your buyers start pulling back? No fun having vacant rentals. No fun when the plebs start yanking microwaves or stoves and putting giant holes in your wall because of economic troubles. Many of these new investors only know good times since they dove in starting in 2008 and 2009 during a time when the stock market went back up 100+ percent in a short-time.

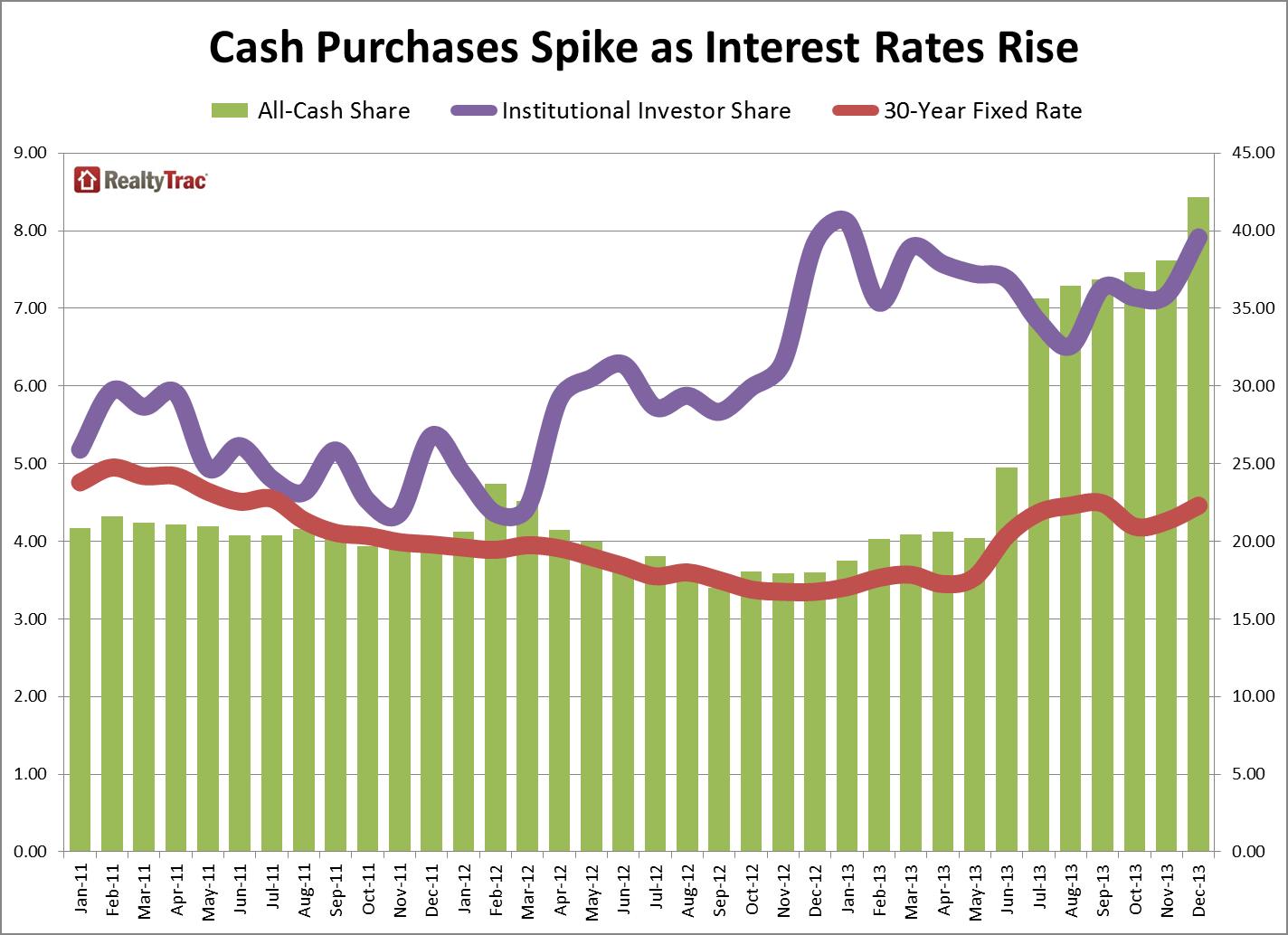

What is interesting is that the modest jump in interest rates last year basically put a boot to the neck of the regular traditional buyer that is now being eulogized at Davos:

How big of an impact did this rate increase have on the entire US market? We saw an 18 percent jump on all-cash buying from December 2012 to December 2013! Over 40 percent of the market is recording all-cash transactions in December (almost half nationwide). The numbers may be misleading because this would give the impression that overall sales are off the charts. They are not. Inventory is low. You basically have large pools of money seeking a home and prices being pushed up as these modern day feudal lords of Wall Street come into places like Las Vegas, Phoenix, and Florida and buy up most of the state.

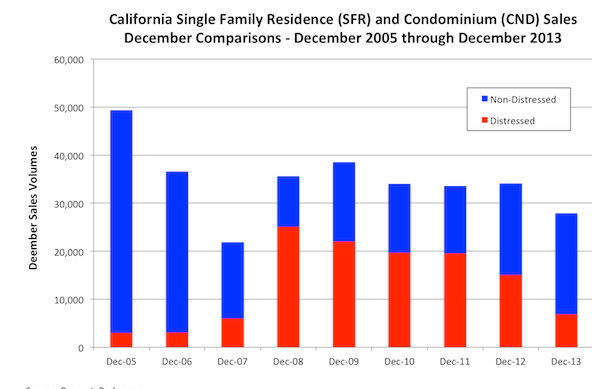

For example, home prices in California went bananas in 2013. It has dramatically slowed down recently but take a look at total sales:

Take a closer look at total sales back in December 2005. Close to 50,000 for California. This last December was the slowest December since 2007 when the market literally went unglued like a child throwing a tantrum at Ralphs. Yet real estate prices went up at a pace seen only during the heyday of the bubble on very slow sales volume. Again, a few people understand this is a hot money game. So long as the stock market and the Fed keep injecting easy money into the economy this can go on. But for how long? The Fed is already hinting at a taper ($4 trillion on a balance sheet is no tiny sum). Since 2009 the stock market has only seen one direction. A large part of the gains have come at cutting wages, benefits, and basically making it tougher for a middle class to grow. At the top however gains have been absolutely wonderful. In fact, beyond the hedge funds and Wall Street, you also have folks trying to plunk down some of that extra cash by diversifying their portfolios.  Know which group I’m excluding?  The bulk of the population.

In California we’re already seeing a slowdown of big money buying up inflated properties. Those coming in right now are like the Beverly Hillbillies trying to play a part of a game that is out of their league. Some of the rental securitization funds timed the market nicely by selling these at probably near a peak. Of course, you have delusional people thinking a new era is afoot. For example, tech in California. Even Eric Schmidt from Google alluded to this – Google makes the bulk of their cash from ad revenues. That is, regular people clicking on ads for purchases. The pool of people that is largely growing poorer. Apple? The student debt bubble is going strong and how many sales are going to college kids buying iPads or laptops that have more power than they need for browsing Facebook and entering a message on Twitter? Some are using aid to buy these items or are going into debt for them. So much of this economy is based on confidence that when tides shift, things can reverse quickly.

I don’t think most people follow things closely like Argentina going off the financial cliff (again) or what is unfolding in Ukraine. Last time I tried explaining to someone the all-cash buying locust plague to someone they looked at me as if I started speaking in tongues and flying dragons were floating out of my ears. Best to keep those conversations online with you fellow blog readers. Those cocktail party conversations of 2005, 2006, and 2007 where everyone was a real estate expert became common again in 2013. The fact that some states in our nation had more than 50 percent of sales going to non-traditional buyers tells you something. The regular Joe is not gaining much benefit from low rates and a wickedly strong stock market when their job is hanging on a razor’s edge. In a recent poll, 42 percent of Americans had not read a nonfiction book in the last year. How does that adage go about those that fail to learn from history? No wonder why our nation is now largely leaning to one of renters since the bailouts took place.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

78 Responses to “States where all-cash buying has gone wild for the new feudal lords: Florida witnessed 62 percent of all home sales going to all-cash buyers in December.”

Damn, the stock market took a big crap today (and yesterday too)!!! But… it’s awesome because it needed this price corrections and this reality check for all the people who believe the stock market could keep increasing forever at this rate. The DOW at an all time high of +16,000 when there really is no real economic recovery? It just didn’t make sense. The high prices were all driven by cheap funny money and full of greedy speculators.

Hopefully, the day will come when housing prices can also be corrected as well. We have all these greedy all-cash investors who are driving prices out of the roof… meanwhile the average Joe can’t even afford these prices. If the average Joe can’t afford it now… does it makes sense that the average Joe will be able to afford them later in the future when the prices goes up even higher??? Investors are not buying these homes to live in like the average Joe so the moment the market starts to look gloomy, they possibly could just unload them as fast as they can and take whatever profit they can. I doubt investors will sit it out for the long haul.

KEn, YOU are the investor holding these bad investments if you have a pension or 401k. So, you will be the one to lose the hedge fund managers and the investment banks will be just fine. These guys are just the middle men in between the free money from the fed and the sale of the asset to your pension or 401k fund. They already made their money. They can’t lose because they are already cashing in their chips and you are still at the table all by yourself… (i.e. the captain and crew are abandoning ship).

Exactly! its like giving somebody someone else’s money to go to Las Vegas and Gamble if they win they get to keep the profits if they lose they still keep the 30% fee they stole off the top ( or any side hedges they bet on i.e. credit default swaps) and pass off all the losses to the taxpayer, sorry that was your bet. Anyway it’s so rigged it’s not even really gambling anymore they are the house after all. The house always wins.

Ken, investors get nothing for their money, getting even half the amount of rent they get now is still better than nothing…. They own the housing free and clear…. just taxes, and why insure individual properties, just put all your investment properties under an umbrella policy…. Investors won’t sell…. it costs them nothing to hold on and get half the rent, and just ride the waves…..

it depends, if you’re talking about large institutional investors they do have to be concerned with the return on investment when selling securitized rent rolls. I’m sure the prospectus lays out what that percentage will be. It would have to take into account the cost of a property management company as I doubt whether Goldman Sachs or JPEG Morgan will be servicing their properties, Not only property taxes but also maintenance and insurance even if it was bought as a blanket umbrella for millions of properties were still talking about some money there, oh and HOW fees, Can’t forget those! When people can’t afford the increasing rents they will have to lower them this will lower their return on investment this will continue because more and more rental properties means more and more competition. I can’t see securitizing rent rolls ending well.

sorry my smart phone is quite stupid. It thinks it can spell better than me, and knows what I want to say better than I do. So please change JPEG Morgan to just JP Morgan and change HOW to HOA.

“Own the houses free and clear” I see we need another Myth Busting…

These so called cash buyers are using nearly all OPM (Other People’s Money) and leverage is at levels EXCEEDING Housing Bubble 1.0. They don’t own shit except overvalued collateral on loans that won’t be repaid.

I see that 12/13 is healthier than 12/07. There is more “non distressed” sells in 12/13 than 12/07. No doubt that the SS Titanic(California real estate) that we are in, is going in the fog and the future is very uncertain. We know that there are so many different kinds of icebergs out there.

Let’s get busy and start moving these deck chairs. I’ll take starboard and you take port…

no, I will be like Capt. Francesco Schettino of the Costa Concordia who apparently did not “fall” into a lifeboat after the ship hit rocks, as he contends, but he jumped in the lifeboat. Some people say to go to cash with alarm over the stock market collapsing Friday, and futures down for a big drop again on Monday, but this is all nonsense like when the first warning came at 09:00 from RMS Caronia reporting “bergs, growlers and field ice”.

Housing To Tank Hard in 2014!!!

I love it when you say that.

Me too, keep it up Jim

It appears it’s the stock market that is going to tank in 2014. Maybe you are on to something. Once people feel less wealthy and uncertain about their future employment the average home buyer is less likely to buy a home.

I think you may be correct. I think it is absolutely impossible to time the market but I think that there is a more and more likelihood that we will see an event sooner rather than later and 2014 is as good a year as any. When I tell folks to only keep money in the stock market that they are willing to lose 50% in the short run they look at me as if I said I enjoy eating babies…

This is a little light reading for the casual investor on some danger signs ahead.

http://www.businessinsider.com/stocks-crash-2014-1

Always remember that the market can remain irrational longer than you can stay solvent…

Thanks for checking in Jim.

You are just like the first warning that came at 09:00 from RMS Caronia reporting “bergs, growlers and field ice”. At 13:42, RMS Baltic relayed a report from the Greek ship Athenia that she had been “passing icebergs and large quantities of field ice”. At 13:45, the German ship SS Amerika, which was a short distance to the south, reported she had “passed two large icebergs”. SS Californian reported “three large bergs” at 19:30, and at 21:40, the steamer Mesaba reported: “Saw much heavy pack ice and great number large icebergs. Also field ice.”A final warning was received at 22:30 from operator Cyril Evans of the Californian, which had halted for the night in an ice field some miles away. The Titanic(California real estate) is unsinkable regardless of all these warnings. Didn’t Nobel Prize Winner Robert Shiller say that we are starting a real estate bubble caused by investors who over stimulate. Open the champagne on the party deck. But I will keep an eye on the lifeboat, like Capt. Francesco Schettino.

Full steam ahead this ship is unsinkable and we need to show the world how we have tamed this world and we are no longer subject to the laws of nature. We are truly great men living in great times…

Hey, what was that noise???

PRIME prime California real estate IS unsinkable.

I saw a house on La Mesa Drive (the richest street in Santa Monica) listed at $30,000,000. That house is HUGE, with a full-sized indoor basketball court, TWO auditoriums (one large enough to seat 100s), TWO living rooms — one so big it looks like the lobby of a grand hotel, and the usual Olympic-sized pool, tennis courts, etc.

Two streets below that, on Georgina Ave., houses routinely sell for over $10,000,000.

People who buy PRIME prime houses like that don’t care about price. They’ll continue to pay high for those houses, even if most of California RE sinks.

It’s the mid-tier “prime” markets — Culver City, Pasadena, etc. — that’s on more shaky ground.

People too often talk about prime markets, when they’re really talking about pretty-good-but-less-than-prime markets.

SOL, you really need to get out a little more often. I have a great idea for you. Spend a week in Newport RI. Go visit all the mansions from the gilded age and find out what happened to the houses when it was too expensive for the families to keep them up. Ask how much they were worth when the age was not so gilded… It really opened my eyes to what can happen to “prime” real estate over looking the ocean…

I love these Titanic Analogies. Edward J. Smith knows his history well!

Jim, now that we have all heard you loud and clear for about the tenth time, I hope that the next time you post it won’t be a copy and paste. Cheers!

Jeff, why single out Jim Taylor? A lot of the regulars here post the same predictions time and again. Jim simply gets straight to the point. His “copy and paste” comes across as a bit more sincere than the longer winded veneer of hopium-biased predictions we tend to get from some others.

It’s not so unreasonable to assume the stock price jump, and even realestate spike, are inflationary responses to diluted currency. Dejavu – 1976 all over again, where homes appreciated 7-fold (72-84 – Los Angeles correlation) and stocks doubles/tripled. Not the same cause, but similar effect. Gold – solid long-term hold, Realestate – solid long-term hold, and stock – not a bad hedge against inflated currency, when distributed correctly… my 2c

mR, I believe we are simply witness to asset bubble inflation. I am not convinced that the actual money supply has grown. Remember our friends at the Fed are in a battle with deflation and we are currently in a tug of war with an inflationary Fed and deflationary public debt.

KEn, not so fast. Don’t think for a second that the government, the big banks, Wall Street, etc… will allow housing prices to tank. They will do everything they can, both legally and illegally to make sure home prices do not tank. If you and I break the law that is illegal. But if the government does it in order to “help” others and switches the rules, regulations or writes another law then it is not illegal. After the housing bubble went pop back in 2006 to 2009 the government and the banks did everything under the sun to make sure prices did not collapse. For a while, we experienced deflation but the government, The Fed, Wall Street stepped in to make sure the deflationary spiral would not continue.

I agree. Obama and Congress wil not allow a housing tank in an election year. The only plausible scenario is if Tea Party types gum up the w

You are right Chris, Obama and Company re-wrote economics, what the legal system is or was, and what America will look like for many years to come. It will take 20 years to get back to the Constitution, enforce and re-write laws, get Washington out of business… and all the other BS that is killing America. It’s not just Obama. The R.I.N.O.’s caused plenty of pain too…. We no long have a two party system, Washington is all the same…. It will take The TEA PARTY to get America back to Constitutional standards. All you have to do is look at the USA with a Constitution and Mexico with a Washington (current) type Government….. everything else being equal, the USA was a much better place to live than Mexico…. but we are starting to look a lot like Mexico anymore.

The most dangerous words ever uttered “Obama and Company re-wrote economicsâ€. There is no such thing as re-wrote/re-write/re-anything when it comes to economic forces. This is not the new, new, new, new, new, new, new, new, new, new, new, new, new, new, new, new era. It is the same ole shit different ass…

just to clarify Tea Party members are Republican, Bernanke was appointed by George W Bush, a Republican and Bernanke is a Republican, but of course it’s all Obama’s fault, a Democrat. It’s always been understood that the Democrats are not the most fiscally responsible, so maybe George W Bush and Bernanke were closet Democrats, because again it’s always Obama’s fault when policies that Republicans put in place fail.

Anyone still buying into the false Red V Blue paradigm needs to leave the site now and let us adults have a conversation. Both Bush and Obama suck. They both support wars of aggression. Both supported/support higher taxation either directly or through inflation. It’s a big fucking club, and we ain’t in it.

that’s true, but you have to keep thinking it through and look at the bigger picture if the inflationary prices are fake and the bonds backing them are fake then the bonds will disintegrate and then turn matter into anti matter or in the financial sense disintegrate the false appreciation.

Nzero is right….red/blue…conservative/liberal…Dem/Rep — all noise of distraction from the Lord Manors to the serfs via a corrupt election process that gets obfuscated by an oligarchical, self-serving media.

In a truly global economy (first time ever in recorded history), there is a long-term evening-out trend in terms of labor costs. It’s simple. First-world countries’ SOL goes down and developing countries’ SOL goes up. The top get phenomenally wealthy, the poor get fed crumbs, the middle goes away and the 10% go to the blogosphere to vent.

The only game in town for fed government (who get paid by the 1% and pander for votes to the rest of us) is to play to both sides (i.e., section us into “interest groups” to be pitted against one another as well as against the fed government itself [LOL]) while sailing against this ferocious global headwind.

Government intervention into the overall economy is here to stay and will only get more pervasive. It started with agriculture, moved to transportation, then to military spending and has fully permeated into the “manufacturing” sector. Meanwhile, the serfs are fed Section-8, SNAP, FUTA, disability, public pensions, public housing, etc. America, as a entitled, global power, is behind an historical 8-ball. We’ll see a continuing surreptitious battle of subsidies (to uber-rich and to poor) until the 10% (the real economic engine) wakes up and uses their remaining wealth, intelligence and influence to attempt to keep itself from disappearing, too.

I like your reference to the 10% – probably as good a shorthand as any I’ve heard for those of us sufficiently well to do to invest and own RE, but not rich enough (or well connected enough) to have a place at the trough.

My question is: To the 90% are the 10% indistinguishable from the 1%? In other words, when the tumbrels start rolling through the streets will there be just as warm a spot waiting for us as the hated PTB. Less fancifully, since we have neither the resources of the 1% nor the numbers of the 90 will we need to make common cause with one or the other to not end up ground between…

I hate it when I agree with you…

“No fun when the plebs start yanking microwaves or stoves and putting giant holes in your wall because of economic troubles.”

Reminds me of a property we bought a few years ago. When viewing the place during inspection, I noticed the hood over the stove was so thick with grease, some creative gangsta (maybe the former resident?) saw an opportunity and had dragged his fingers through the grease, tagging it with gang signs. Good times.

2014 will continue to be dominated by “investors” – whether bigtime funds or smalltime poseurs. The only “regular” buyers will be ones who have to buy, or at least feel like they have to. The rest of the buyer pool has to sit this one out. They either A) can’t afford these nosebleed prices or B) are well aware that investors are juicing the market. I don’t see much if any euphoria this time around. Just speculation by a relatively small number of players and a resigned sit-and-wait mentality by the rest.

Pwned,

The prices have risen past the point of bringing any reasonable return for an investor. So the sophisticated investors are looking elsewhere and leaving the “Late night flipper show watchers” as the current investor pool

Bill, that is EXACTLY what is happening in 91361 ca where I live. One 3+2 worth 500k to a flipper or 550k to a retail buyer went up for auction in early jan but did not meet the reserve. The top bid was 595 and not even an hgtv watcher could imaging profiting at that price. It’s going to be stupid money or families buying in 2014. Smart money will dump as soon as Roi comes in under 5%. I think stupid money has a lot of ties to China so might panic soon.

Dave, I saw the Westlake auction as well. What was interesting was that people were bidding on a quitclaim deed, which can be problematic.

Money is looking for a home that’s relatively safe. Residential real estate is now a target for this money and will probably remain so for at least another year. As govt debt gets higher and higher and produces so little yield, money will flow into “safer” bets.

With all the swirl going on in the world, RE in the good old US of A is definitely a safe bet…especially in the prime areas. While I certainly don’t expect anymore gains in prices, I also don’t expect any big “correction.” The only exception could be the places absolutely dominated by investors (Vegas, Phoenix, etc).

A big jump in interest rates would definitely lower prices instantly. I am very confident that simply won’t be allowed to happen. The last I checked 30 year mortgage rates were at 4.375%. That is still dirt cheap money! I have a feeling this will be yet another extremely frustrating year for people sitting on the fence hoping for a good entry point.

You’re right if you believe the Federal Reserve will be successful in reducing QE and raising interest rates on their timeline. Keep in mind that economics is not a hard science and forecasts can easily be thrown for a loop.

The long term effects are going to be ugly. When I deal with Senior Citizens that purchased a home years ago and eventually paid it off, they are ok and can survive with living off of Social Security.

The ones that rented the majority of their lives can barely eat after paying rent and what they are eating is low grade unhealthy garbage.

We have a whole generation that is a HUGE demographic (Generation Y) growing up right now that are going to be very, very poor because they don’t own anything of real value that will be worth anything 10 years from now and are loaded with bad debt.

If you know the true definition of wealth, you know where this is going and the income disparity is only going to continue to get much, much worse.

Dear Just,

That’s some future Congressperson, Senator or President’s problem.

Signed,

Your Congressperson, Senator and President

Your observations regarding keeping these comments to yourself is spot on. Just the mention of these sorts of potential housing problems turns people off.

Also, its so amazing that so many people don’t know their own basic history. Yes its true, most have NOT read a non-fiction book in the last year…… or ever. I work with highly trained college grads who don’t even know America’s basic history. Its sad.

Maybe this new approach will work. We’ll see. By the way, we’ve been living in a new enlightened political era where all the inequality was going to be fixed. I think things might be worse for many. Hello!

“By the way, we’ve been living in a new enlightened political era where all the inequality was going to be fixed. I think things might be worse for many. Hello!”

That’s a wise observation, and sadly, I think you are 100% correct.

The inequality will be fixed in communist style – making everyone, besides the elite, EQUALLY POOR.

The communists, without exception, if they didn’t take the power by force, they always promised equality. What they never explained to the people was that they will be equal poor. Our politicians today promise the same thing – eradicate inequality, declare war on poverty (although they waged this war for half a century and the poor are increasing). The truth is they will make everyone equally poor because the elite and the poor feed from the same middle class till it disappears completely. The bulk goes to the elite by taxing and the crumbs go to the poor to buy the votes. That is the real reason the middle class is a dying breed.

The statement above is the overall description. What we can talk forever are the details.

A few days ago another poster made a very good point that the percentage of cash transactions is probably much higher (than the overall number) for typical middle class SFR houses…this certainly was my perception when I wasted a year trying to buy one in 2011 and 2012, I lost out to 100% cash bids from flippers and specuvestors several times and eventually retired to the sidelines in disgust.

Anyway, if a breakdown of cash deals by property type and/or price is available it might be a good topic for this most excellent blog

@ Bluto – I’m curious where you were attempting to buy where you consistently lost out to all cash offers? Santa Monica? Pasadena? Inland Empire?

Sorry, I should have posted my location…I’m up north in Sonoma Co. and was trying to buy in Santa Rosa specifically. FWIW I found several houses I liked for about $250K or so and made offers at or slightly above asking price but was ignored as I was competing with 100% cash buyers…had enough cash for up to 50% down, good job, great credit, a preapproved loan to $350K, etc. and none of that mattered. By contrast when I bought in 1997 I easily found a place in Mendocino Co. and bought it with a 100% VA loan.

The next huge crash is going to be farm land. Corn is about half price from a couple of years ago…. and heading south. Farmers have been paying over 14k an acre not long ago, if not still. They need $7 corn to make that work. LPG to dry down their crop is upward of $5/gal I hear these day. They had to harvest at a high moisture content, and it cost them many so much LPG to dry it down there is now a shortage…..

It won’t be long until we hear some Country Western singer hosting “FarmAid” again….

Wall Street’s plan to be your landlord.

And you thought getting the plumbing fixed was a problem when your landlord was only 50 miles away.

http://billmoyers.com/2014/01/24/wall-street%E2%80%99s-frightening-new-plan-to-become-america%E2%80%99s-landlord/

excerpts:

Anyone who has ever struggled to get her landlord to fix a broken appliance can imagine how much worse it could have been if she were paying rent to a faceless hedge fund based thousands of miles away. That tenant’s nightmare may be on its way to reality for hundreds of thousands of Americans, as Wall Street firms have snapped up 200,000 family houses with the intention of renting them out.

With Wall Street buying up hundreds of rental properties and turning them into the same sort of complex investment products that caused the last financial crisis, Rep. Mark Takano (D-CA) thinks Congress has a responsibility to hold hearings and monitor the very new and potentially risky practices of this class of investor-landlords….

In a previous post a commenter posted a link to the1994 interview of Sir James Goldsmith regarding GAT. I was impressed. http://www.youtube.com/watch?v=4PQrz8F0dBI&list=PLD255EEFDD0D9F07E

I sense that DrHB has the belief that was is happening is abnormal and will correct in time. If Goldsmith assertions are correct, this may just be a continuation of the decline in the American standard of living to renter and paying a high percentage of income towards rent.

(Goldsmith’s prognoses reminds me of the beginning of the Industrial Revolution with the manufacturing of cloth. It became so cheap that the people with manual looms went out of business, became destitute. and migrated to the cities looking for work. Will America in the next generation wilt get are own “Charles Dickensâ€.)

So, is it an aberration because of the Fed and QE and will correct, or the new normal? As for Florida, where are all the new, replacement, retirees going to get the wealth and income?

Dr. HB,

“New Feudal Lords” is cumbersome. Post-Cyberpunk author Neal Stephenson coined them “Equity Lords.”

There is the flip side of the coin too. If you pay for a property with cash – as long as the cash flow comes in – it’s like owning a dividend paying stock with monthly payments. Why would anyone in there right mind sell into capital gains. Combined rate in CA is 33%. I would borrow against my rentals before paying this outrageous tax. I have cash flow every month and do not have to work. San Diego market is extremely tight – my properties will not be available to an owner occupy till I’m an old man. That’s my perspective….

What’s the cap rate on your properties? The hedge funds subtract higher management fees, lower quality tenants, higher maintenance costs and debt servicing because they’re quite leveraged. Would your properties look so rosy to them then? Not saying it doesn’t work for you, by their model is doomed. And if the model doesn’t work then the run up is over because specuvestors are the ONLY thing driving this market.

I am earning 6% cash on cash. The only reason I bought investments was due to the fabulous rates on CD’s – and oh yeah – at tax time I had to pay tax on the interest. I never expected the appreciation to be so great in the last two years but my timing was spot on. I manage and repair myself. My units are show very well, are in good parts of town and are a little under market. Hedge Funds – I would not touch – I agree with you on that point. The only people I feel for are those who are trying to buy a place to live in but are beat out by all cash offers. All investments have their cycles – in time different opportunities will present themselves. The key is recognizing them. From the tone of the messages on this board – a lot of people are sour grapes…I never found life to be fair.

This Jeff guy is really something else. Sour grapes? I got news for ya buddy, when things are broken, people are gonna raise a stink. That’s what’s going on here and it’s part of the price you’re paying for collecting rents from the system. Enjoy your sour grapes.

Anon – I’m not really something else. That is the reality we are living with today. If you interpreted what I wrote – you would understand my reasons for investing in Real Estate. I had no other choice. I needed assets that I have direct control over – not the stock market. You fail to realize that with inflation I was losing money on my savings. My last purchase took 9 months and about 8 offers – which was a lot of effort. If you want to complain about why we are in this situation look to the current administration and the Fed. And no – people are not going to raise a stink. People more now than ever are accepting of being screwed. Politicians do what they want and lie – and allow it. Go figure…

I was specifically referring to your “sour grapes” comment – I thought that was obvious.

Dear Dr. HB,

Great analysis as always. I comment fairly regularly but I don’t think I have ever told you how much I greatly appreciate your blog. I recommend it on a regular basis and since I’m in marketing I call hundreds of calls per day talking to people about all kinds of things the number one thing that comes up though is the economy. I often talk to people that tell me they’re buying a home and they live in California, I tell them before they buy anything check out your blog. It is very unfortunate that the majority of Americans don’t have the time, energy, luxury, of being able to research and pay attention to what’s going on in the world today, or read a nonfiction book. Even if they do there is not much that they can do about it so they choose to keep their head buried in the sand and avoid that Pandora’s box. It is a double edged sword knowing the truth of our economy both micro and macro being controlled and manipulated by the powers that be however physics dictates that what goes up must come down what expands must explode. Everything in our universe is held together with bonds in chemistry terms. It makes you think, bonds are what hold our financial reality together. When it’s based on artificial manipulated elements the bonds weaken, the bonds eventually will fail because they’re not real bonds backed by matter. Bonds are what make matter, matter. So if Bonds in the chemistry sense are what hold everything together then if bonds in the financial universe are fake, it stands to reason that everything will fall apart. It’s science.

Sorry Lynn you are dead wrong. Nobody should ever base a major decision in life on a blog or social network. For every negative blog there is a positive blog with opposing graph that can make it seem all is good?

You as a person, make your own call, a fortune was made during the depression, if you have a opportunity in life and in a country this size there is always a opportunity, searching a blog and keep hearing the sky is falling is bad, you can’t realize your dreams, the misery of folks who are down on their luck guess what, they want you to experience their disaster, remember (misery loves company).

I research then do what is best for me and my family, based on sound principals such as, buying zip codes, health of the city the property resides in, research the financial records of the person I am dealing with.

A blog or social forum is matter of ones perspective of their life experiences, it has nothing to do with making life altering decisions?

Doctor Housing Bubble – I think we need to have a full discloser clause for all commenters in the FIRE industry. I believe a wise man once said that you will never see an asset bubble if you have a financial incentive not to. The last person in the world I would take financial advice from would be someone in the FIRE industry…

nonsense….I’ve been following thehousingbubbleblog and oftwominds since 2005 or so and by the spring of 2007 thanks to what I read was convinced (correctly) that the bubble pop was imminent, put my house on the market and by “discounting” it slightly by $10K or so had a buyer within a week, the best “major decision” I’ve made in a long time.

Plenty of blogs are garbage but if your judgement is good enough to follow the best ones there is some excellent info…I sure as hell don’t trust 90% of what I read in the MSM when it comes to real estate, finance, the “recovery”, etc….

Yet, here you are.

Just a change up from housing, did you see where Hilary Clinton stated, she hasn’t driven a car since the 90’s?

She said she wished she could but must be driven and protected by the SS. Miss Secretary, you live in America, if you really want to be among the people, pleased start up any car drive to a super market, fill the car with gas, then you and the administration will know what the cost of living really is in this country, it may surprise you?

Folks, this is known as a diversion tactic. Let’s talk about anything other than the housing bubble because I make my living one sucker at a time…

Ding!

Yes, Robert, reminds me of that photo op for George H Bush at the supermarket checkout lane, as he stood starry eyed wondering what this “scanner” thing was all about. Scanners had been well-established in stores for over a decade.

Oh, it wasn’t even a real grocery store…it was a mock-up at a trade show.

Real man of the people.

Wisconsin is a nice place to live — I spent two decades there, at various times — but what the hell? I can see foreigners, and investors, buying in sunny states, but … Wisconsin!? Or do the foreigners/investors know something about global warming I don’t?

The metric is the rate, not the absolute value of sales – in the same way a sparrow may accelerate faster than a jet even if it can’t match the top speed. Thus the metric doesn’t tell you where the most $$ or properties are moving, just the share.

Even in Wisconsin people work and live, and you have a few places with high demand and higher prices (Madison) and a lot of swaths where spreading some cash around buys a lot of property. And since it’s not a state that massively overbuilt, rationally a lot of properties probably have good prospects for renting or reselling as long as unemployment doesn’t worsen.

People with fabulous wealth (e.g. for Orange Co. Bill Gross or Donald Bren) are a pretty rare commodity. I’d say stop worrying about them and start worrying about yourself. House flippers don’t get all of the houses, and they certainly aren’t in the elite class of wealth I mentioned previously.

My Daughter and her husband are in their early 30s, but they now own a house in a nice (but not wealthy) North Orange Co. neighborhood where they have about 50% equity at today’s high market price. He has a good Government job, and she’s on maternity leave from another good Government job. But that’s not great wealth. Their equity share could go down quite a bit if the housing prices drop, but that doesn’t affect the monthly payment. You can rent and never have anything to show for it, or you can save and buy a starter property when you find a good buy. I’m living in a paid-for Orange County house that isn’t huge but holds us nicely and has a nice yard for the dogs. So I am not in Beverly Hills or Brentwood; who cares?! If you think you’re in a good position to live somewhere for the next ten years or more, keep an eye on the market, save some cash and go for it at the next big drop.

Remember:

1) Demographics favors the generation born between 1980 and 2000.

2) Landlords can be a pain to deal with.

Joe R: >> Demographics favors the generation born between 1980 and 2000.<<

Favors them how? Economically?

“You can rent and never have anything to show for it, or you can save and buy a starter property when you find a good buy.”

I see what you did there. Included “starter” and “good buy” as an out in case anyone brings up the fact that history is full of accounts where many have purchased and lost with nothing to show for it.

“Demographics favors the generation born between 1980 and 2000.”

Nope, mobility favors that generation and therefore makes it a stretch to “think you’re in a good position to live somewhere for the next ten years or more.”

“Landlords can be a pain to deal with.”

And banks, municipal taxing authorities, and repairmen are your friends! Get real. There’s no greener grass.

All I can say is that it worked for my family. Anyone in our position should benefit. And I’m not a high salary worker, never having made a six figure income in my life. Not all young people are wanderers. My Daughter and her husband both got government jobs at a young age. So they are rooted in SoCal for the foreseeable future. I know plenty of other people (friends of my Daughter and of our family) who have done the same, often with a boost from their middle class parents. The low prices and interest during the housing crash helped out a lot. Opportunity is what it is, and the market is looking like it may be topping now, so that’s why I’m for patience.

As for demographics, the boomer generation peak year kids will hit 66 in 2023. But there are a lot of us ahead of the peak. There will be more opting not to retire than in the past (like me, probably) but a lot will move on, including a sizable number who will sell out and move to lower housing cost markets. That means opportunity for Generation Y. Not all of Gen. Y are stuck in the mud now, either!

“Not all young people are wanderers.”

That’s a straw man. Mobility means being flexible enough to seek out opportunity elsewhere. Wandering assumes aimlessness.

The ones who make inflexible choices will have less opportunistic options. That’s the trend. It includes getting married, having children, and purchasing a home. Tough pill for the older generation to swallow, however, it’s becoming time for them to take their meds.

Nothing “Tanks” until the Fed stops monetizing! Fight ’em, with their own private “Dollars” and they’ll clean your clock!

Leave a Reply