Alt-A and Option ARM Economic Disaster Update: California Solution? Workout 3,430 Alt-A loans in March. Good Job. All we have is an additional 643,000 Alt-A Loans in the State. At this Rate it will take us 15 years to Modify or Alter all Alt-A Loans.

The Alt-A and Option ARM tsunami still looms large casting a dark shadow over the state of California housing. This is on top of the reality that we are now talking about issuing IOUs for only the second time since the Great Depression. I’m not sure if this is what many had in mind when Bernanke started talking about his imaginary friend Mr. Green Shoot. There is definitely no green shoots in California. I’ve gotten many e-mails asking for clarification regarding the California Foreclosure Prevention Act (CFPA) and, the recently released figures of loan workouts and modifications. I’ll go into those precious details in this article but to sum it up, it is a joke and a pure theatre worthy of its own Comedy Central show. The CFPA applies more can-kicking down the road logic while the loan modifications and workouts are like giving a drunk another shot of tequila to get over a hangover.

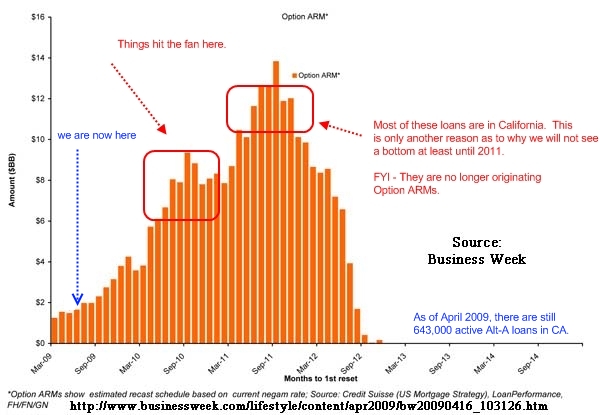

First, before we go forward let us take a look at where we are at in this process (updated chart with gorgeous blue arrow):

As you can tell, much of what is occurring is status quo. It will remain that way until the end of the year, when we shift from less than $2 billion in option ARM recasts per month to close to $4 billion at the end of Q4 of 2009. Most of these loans are in California. Of the over 2 million in Alt-A loans 643,000 are in California. If you think we are doing much to address this look at these facts:

March 2009 Active Alt-A loans

CA:Â Â Â Â Â Â Â Â 651,000+

April 2009 Active Alt-A loans:

CA:Â Â Â Â Â Â Â 643,000+

If you think this adjustment is occurring because of fabulous workouts and loan modifications, think again. Much of the losses are occurring because these loans are defaulting left and right and we have yet to hit the major recast wave as the above chart shows. Alt-A and option ARMs are toxic waste and will be hitting California at a time where the state is financially vulnerable. That is why when people ask me, “should I buy now in a semi-prime location?” I can only shake my head. Why buy now? The largest X-factor is looming less than a year away and you want to jump in to swim with the sharks? What I have realized is psychologically, many people still believe in the bubble. When I created the title of this blog, Dr. Housing Bubble – How I Learned to Love SoCal and Forget the Housing Bubble I was word playing with an old Stanley Kubrick film. In Dr. Strangelove a delusional Brigadier General Jack D. Ripper sets off a chain reaction which leads into a nuclear nightmare because of one bad step after another built on a totally false premise (that the Soviet Union is looking to sap precious bodily fluids of Americans) but with real world consequences. The housing bubble is this. Initially, we started with easier lending standards, followed by dropping rates, then subprime, then we entered the Alt-A and option ARM world where we flat out gave fiscal time bombs to borrowers and now the global economy is facing the deepest recession since the depression.

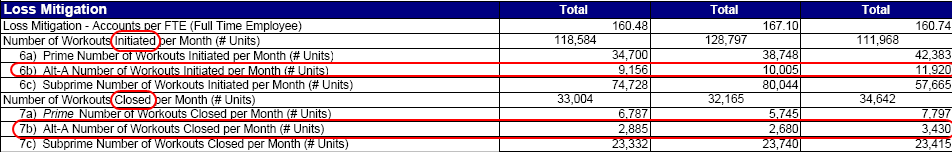

Much was being made about a report released last week from the California Department of Corporations. The report touts that loan modifications have jumped to a whopping “20,000” a month. The report is pertinent because it surveys servicers that work with 3.3 million of the state’s active loans, approximately half the total loans. But all you need to do is read the report behind the headline to realize what a supreme comedy it is:

Click for sharper image

Now you know the rest of the story as Paul Harvey would say. Here is the meat and potatoes of the issue. First, let me clarify the top 3 rows. This is for January, February, and March 2009 data. So in March for example 111,000 loan workouts were initiated. This of course may look good but means nothing since this is only the first step and doesn’t mean anything has happened aside from someone starting the ball rolling. If we look at how many workouts actually closed, we see the real story. Only 34,000 of the 111,000 initial workouts were complete. Not bad you say. Well if we dig deeper, only 3,430 Alt-A loans were worked out in March which at this rate will take us 15 years to modify all the loans! Bwahahaha! A load of crap-o-la being spun as some sort of good news. Keep in mind, many servicers are now getting $1,000 for kicking the can down the road. Oh, but it gets better:

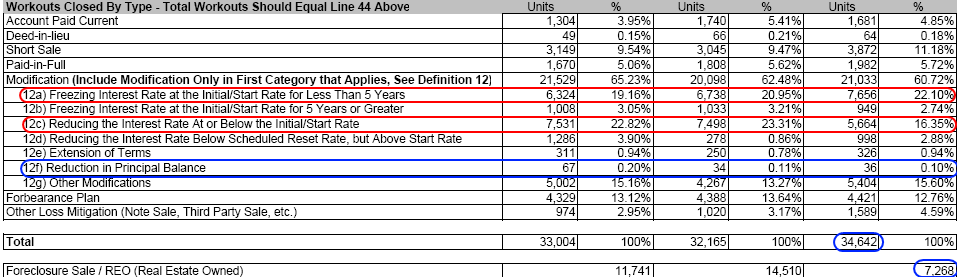

This is where you grab your monitor and let out a savage scream and say, “what kind of load-of-crap is this!?” So now let us breakdown those 34,000 workouts in March. What is their idea of a workout? Well for 22 percent of the loans, they basically froze the interest teaser rate for less than five years. The next option which was used on 16 percent of the loans was lowering the interest rate to another teaser level. So already, nearly 40 percent of the “workouts” are being dealt with artificially low rates! This is the damn reason the Alt-A and option ARM loans are so toxic in the first place, they had freaking teaser rates to begin with. And this is the most popular method of fixing these loans? Come on now. 11 percent where kicked out the door through short-sales which really isn’t a workout and 5 percent were paid off. These are probably those folks buying in semi-prime and prime areas jumping in while they miss the next housing bubble. But you know what I love? Only 36 loans actually had their principal balance reduced! Bwahahahaha! Give me one second. Bwahahahaha! Their idea of a workout is basically turning underwater homeowners into indentured servants who have fewer options than renters. The only way these people will ever sell their home without coming to the table with money is if we have another housing bubble. This leads us to the ridiculous CFPA.

The CFPA FAQ gives us their idea of fixing the mortgage problem:

“While a sustainable loan modification may be different for different borrowers, the potential ways a loan may be modified include any of the following:

–An interest rate reduction, as needed, for a fixed term of at least 5 years.

-An extension of amortization period for the loan term, for up to 40 years from the original date of the loan.

-Deferral of some portion of the principal amount of the unpaid principal balance until maturity of the loan.

–Reduction of principal.”

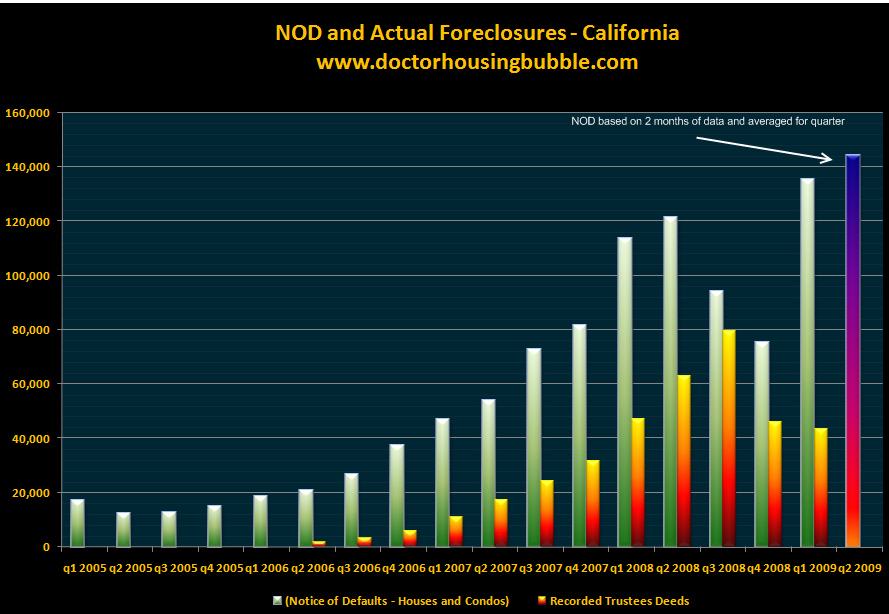

The government is basically advocating that these loans all become option ARMs. 40 year mortgages? Deferral of principal amount? What is this? Did the government hire New Century Financial as consultants to devise this program? Even those prime workouts are being pushed into this crap. As we have seen from the actual data the reduction of principal is such a joke (see why the banking industry didn’t want cram-downs?). 36 loans out of the entire pool had their principal reduced in March of 2009 for the state of California. So all this is doing is buying more time for the inevitable. We all know that notice of defaults are skyrocketing even after the 2008 moratorium:

So these programs are really a joke and basically waste more money but that seems to be the way we operate. Now keep in mind that we have seen very little plans that actually address the major issue. JOBS! JOBS! JOBS! Have people forgotten how you pay a mortgage? You pay it with a thing called wages which you earn from working. More and more Californians are losing those wages since we now have an 11.5 percent unemployment rate so how are they going to pay those 40-year mortgage payments? Maybe on future loan modifications we’ll allow people to use unemployment insurance as their primary source of income.

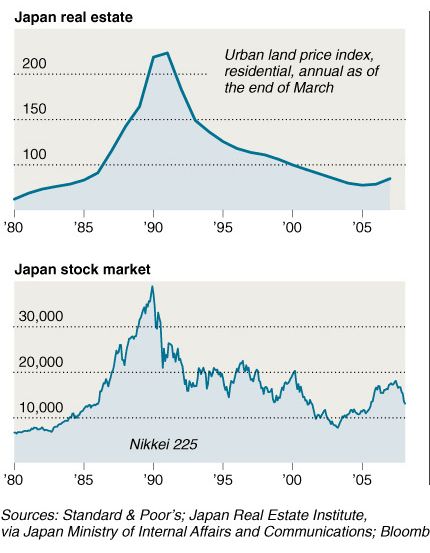

As you can see, the Alt-A and option ARM tsunami is still heading this way. Many of these programs being devised are betting (not explicitly) that another housing rebound is just minutes away. This is utter nonsense. Say you bought a $500,000 home that is now worth $250,000. Does a 40-year mortgage and a lower interest rate sound appealing to you? You are simply a renter. By definition you won’t be building up any equity given that one of the options in the CFPA is negative amortization. And do you really think that home will go up again? If you wanted to sell you would find yourself in the same position as today. Either a generous short-sale is approved or you walk away. And for those that think real estate can’t stay down for a long time I offer you Japan:

Japan has seen stagnant housing prices for nearly two decades. So by 2029 with a 5% 40 year mortgage, you will finally be at $250,000. Congratulations! You can now sell your home and get a whopping zero at closing (assuming you pay nothing on a sales commission).  Isn’t that basically renting? The bottom line is many borrowers are going to look at these terms and if they have any sense, will simply stop making their payments and walk away. Yet some banks are now using a strategy of not letting you foreclose!

“(WaPo) And even though a delayed foreclosure can be a blessing for some troubled homeowners, for others, it simply prolongs the financial distress, leaving them on the hook for the condition of the property. Even if they move out, they cannot move on.

“I have even begged them for a foreclosure,” delinquent mortgage-holder Charlotte Jensen said. When she realized she couldn’t save her Glen Allen home last year, she filed for bankruptcy, packed up her family and moved out. Nearly a year later, Bank of America has yet to take back the home.”

And since banks like pinching pennies from customers while bleeding taxpayers dry, they would rather a hot body stay in the place and maintain it instead of squatters or teenagers looking to practice their break dancing moves in the home.

The latest data still shows 2 million Alt-A loans floating in the United States. California’s solution to the Alt-A and Option ARM problem? The solution is to turn more loans into Alt-A and option ARMs. This is great thinking that we have come to expect from Sacramento. The easy solution is this; those that over leveraged themselves should lose their home through foreclosure and find a rental. Nothing to be ashamed about. Lenders will need to eat their losses. However, I get the deep feeling that the public-private investment program that starts next month is going to eat a lot of this crap up. My sense is lenders are merely kicking the can down the road until they can kick the can to you.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

34 Responses to “Alt-A and Option ARM Economic Disaster Update: California Solution? Workout 3,430 Alt-A loans in March. Good Job. All we have is an additional 643,000 Alt-A Loans in the State. At this Rate it will take us 15 years to Modify or Alter all Alt-A Loans.”

“However, I get the deep feeling that the public-private investment program that starts next month is going to eat a lot of this crap up. My sense is lenders are merely kicking the can down the road until they can kick the can to you.”

If you think this is going to happen, which im sure it will. How can you see housing prices fall more in the short term? By that comment and some of the facts you have presented it would look like prices would stay stagnant at what they are now.If you or anyone can explain why prices will still drop even though PPIP program is about to take effect i would appreciate it.

“Americans will always do the right thing, once all other options have been exhausted.” Churchill?

No reason to suspect any change of tactics. Nobody’s gone to prison over the housing debacle, and considering the corruption of the S&L crisis and few convictions, why not keep the party going? Crime does pay, evidently.

Now that the inmates are running the asylum, there is no reason to expect rational decision making. Still, eventually this will have to work out somehow, but most of us over 50 don’t have time to start over. The Empire Strikes Back…This generation may be lost.

Thank you Doctor Bubble, this is the best RE blog on the net, bar none!

“Jensen visits her home weekly to ensure it hasn’t been vandalized or taken over by squatters. She pays landscapers to keep the lawn mowed. When the home caught fire in January, the police department knocked on the door of her new home, confused about whether to notify her or the bank. When neighbors complained about the mess left from the fire, Jensen returned to clean up.”

This story would make more sense if Ms. Jensen were picking up a rent check while visiting, or better yet still living there! She might have even consulted a RE attorney to see if paying property taxes would preserve any of her rights in lieu of a foreclosure.

“However, I get the deep feeling that the public-private investment program that starts next month is going to eat a lot of this crap up.”

Does this statement reflect that the anticipated doom and gloom (30%+ price drop) in the mid-upper price real estate area in the next few years may not happen?

I understand the taxpayers eat it, I understand some wall street fat cats are going to make ton o money, I understand that some of the idiot Alt A/Option Arm folks are going to get rewarded–but are those of us who were conservative, held the line, did the “Right Thing” and are now awaiting justification just going to be disappointed that these are now minor corrections in the next few years versus a 30% slide in home prices due to this PPIP? Anyone who really understands the PPIP and what is really going to happen please speak out because I share the sentiment that this PPIP thing may really turn the corner. I had plans to bail on my current residence (at a decent profit and wait for the housing armageddon). But if it doesn’t happen or if 30% just becomes 10% or less, I may rethink the strategy.

regarding 2029 in your article, on a 40 year mortgage, depnding on the interest rate, you typically wouldn’t hit the halfway point until year 25 (4%) or 30 (6%). So it would be more like 2034 – 2039.

“However, I get the deep feeling that the public-private investment program that starts next month is going to eat a lot of this crap up.”

Is this PPIP going to change viewpoints on the housing Armageddon of 2011?

@Yoggi Bear: Through this housing price mess in the last few years, prices have fallen largely because they were much higher than what could be afforded with sane lending. It has only been in the last 4-5 months that they have fallen for the first affected sectors to become affordable, and then, and that affordability was based on 4.5-5% mortgages being written. In the last 3 weeks, with what’s been going on in the treasuries bond markets, those low mortgage rates are rapidly rising. Many lenders are up to around 6% without points paid. This will have the very real effect of stifling any kind of price increases and if the rates rise high enough, will push prices down considerably. In fact, I would not be surprised to double digit mortgage rates within a year and prices being forced down to around 25-35% of their bubble highs under such conditions.

The banks are hiding their losses (loan mods keep these houses on the books as assets – even though they won’t work). But wouldn’t PPIP put the losses squarely on the taxpayer? If so, wouldn’t the banks start coming clean. Aren’t they only “kicking the can” long enough until PPIP is in place?

If I’m way off, please explain…

“I have even begged them for a foreclosure,” delinquent mortgage-holder Charlotte Jensen said. When she realized she couldn’t save her Glen Allen home last year, she filed for bankruptcy, packed up her family and moved out. Nearly a year later, Bank of America has yet to take back the home. ”

>>>

>>>

Oh for heaven’s sake! Just have a quit claim deed drafted transferring the property to the lender. Execute it as required by law (typically means having it notarized.). File a copy with the county office that registers deeds. Mail a copy of the quit claim deed and the keys to lender by certified mail.

>>

I wouldn’t charge a client more than $100 – 150 for preparing the quit claim deed, recording it and shipping the package to the lender.

>>

Once the quit claim is filed transferring the owner/borrower’s interest to the lender, they are no longer the owner of record. The person to whom the property is transferred does not have to sign a thing. You do it without their involvement.

>>

(Quit claim merely says that the owner of record of an interest is transferring what ever interest they have to someone else and this instance it is the bank. A warranty deed transfers whatever interest the owner has AND warrants that the title is clear of defects or liens.)

>>>

Just give the lender a quit claim deed and the bloody keys! Then as far as anyone else is concerned, the lender owns it.

>>

And since the bank now ‘owns it’ via the quit claim deed, they have no cause of action for foreclosure (with the exception of having the right to collect for a deficiency if it doesn’t bring as much as is owed when they auction it and which deficency collection is permitted in some states in certain circumstances.)

>>

Have a 1st mortgage and one or more HELOCS? Just make the quit claim deed out naming all of them as the transferee and let them fight it out amongst themselves as to who gets what.

Yogi

The PPIP will not slow or have any impact at all on the housing price descent. It will just change who bears the losses (from Wallstreet to the Taxpayer).

Sane lending, as dangermike said, will continue to depress housing prices since that will be based on incomes (think lower wages and unemployment) and what people can afford. Not to mention that negative sentiment about owning a house is already prevalent as so many people have gotten burned.

If interest rates do really rise, look out below.

Doug

Many middle and upper managers are losing (or have lost ) jobs.You can try to re-set all you want, but with no job, many of these people will walk away.

Meanwhile, our friendly govt. workers at BART(Bay Area rapid tranist)

are getting ready to strike unless they get a 3% raise. (Average salary and benefits now are ONLY $114,000.)

Suggest we all take up a collection for the poor, underpaid govt. worker.

more at

http://www.pensiontsunami.com

Another fine post Dr. HB…just wish more folks understood the truth.

Thanks to the education you have given me, I am now doing the right thing. My path to foreclosure began May 1st.

It didn’t help that my employer eliminated my position and my draw against commission on March 31st. I am working on straight commission but will not be paid on any projects until they are paid…so I’ve worked for free since April 1. Our Industry (direct mail) has beed decimated. Volumes down 68%. The work is never coming back.

Bought in Santa Ana (nice area in 92706) in December 2005. Paid $812K. The foreclosure 3 doors down sold recently for $400K. My home is a bit bigger and might fetch $500K. Chase holds my 5/1 Option ARM 1st and “2nd”, yep, another 100% loan!

I bought into the mania..thought I’d be priced out if I didn’t buy…thought I could refi in a year…thought I would continue to work and make good money. Plus I distinctly remember hearing that this wasn’t a bubble! Hold on – I actually trusted my Realtor, the advisor/mortgage broker, and the marketplace to protect me (on things like valuations, market trends, etc.) After all, how often does one buy real estate?!

Obviously, I wasn’t reading economic, financial or real estate blogs back then. Now that I am educated, the responsible thing to do is to let go – and pay the price. I made a bad decision. Why delay what is coming?

I love this home and had hoped to stay here for many years. No granite countertops or stainless steel appliances to be found! One TV. Just a cute ranch house with a real front porch. Great neighborhood, wonderful neighbors. I am sad to be leaving. Will be ready when the day arrives.

The only way to work through this mess – on a personal, State, and National basis – is to face the truth head on. The sooner we return to reality – property values in alignment with incomes – the better of we will all be.

You say anyone with an alt-A and any sense will walk away, but shouldn’t you expand that to be anyone with any loan type that bought in 2004-2006? I guess it does still depend a lot, but many many prime loans given in these years were 80/20 FRMs. If you had 100% financing as I did why would you say in the house? As you said I am sure it will be past the year 2025 before I could sell my house if I needed to. For me though it less about that and more about conserving cash. I am paying double the going rate rent to essentially rent a place. If you were correct about renting a house in the inland empire for $800 then I am actually paying almost 4x the going rate of rent to be upside down in my house for 20+ years. No thanks to that. I am in a similar situation and I keep wondering if I will still be sitting in my house by this time next year not having made a payment for 18 months. As great as this sounds to many I really want to move on with my life and get this over with. You can’t start rebuilding credit until a foreclosure actually occurs. So please stop with all these waste of time programs. Foreclosure is the really the answer to a lot of the country’s debt problems. Over the long term all these foreclosures will be a good thing because it allows the country to get out of debt.

Can you show the current stock market on the same plot as the Japanese stock market plot in this article? With the proper offset and normalization of the data they might look similar.

As always Great Job

Thanks

Jeff

DHB, long time reader, first time commenting. For readers of this blog, Matt Taibbi’s recent article in Rolling Stone on how Goldman Sachs has engineered (and profited immensely of course!) every major market bubble since The Great Depression, including the Housing Bubble, is a must read. Be forewarned however – you will be so pissed off and saddened by what he reveals that you may want to renounce your citizenship and head to New Zealand. Amazing read – http://zerohedge.blogspot.com/2009/06/goldman-sachs-engineering-every-major.html.

Good article. It’s clear that ARMs were created so that Wall Street could create a timed implosion. Big brokerage houses like Goldman Sachs knew exactly when to start shorting CDOs because they knew that the ARMs comprising them would reset at specific intervals.

Glenn

MFI-Miami.com

http://www.mfi-miami.com

Dear Whattado:

Unemployment is skyrocketing, small businesses are closing shop every where you look, unemployment benefits will run out, gas prices are back up over $3, the State of California has to cut $24 billion, and banks are lending only to people with excellent credit, 20 -30% down cash, 30 year fixed and little other debt allowed, and you actually have the audicity to think

that that PPIP will rescue housing in mid-upper class neighborhoods?

You must be a realtor and still think that your Culver City 1000 square foot shack is actually worth $750K when it will actually sell for $300K by 2011!

REPLY TO JEFF 6/26/09:

Go here to get your stock exchange comparison data:

http://www.dshort.com/charts/mega-bear-comparisons.html?mega-bear-quartet

Buy hard assets…

If one had a 10/2 Option Arm Mortgage and bought in 2005, when would it reset?

Matt,

Believe me–I am far from a realtor trying to ignite the next bubble. I’m just trying to figure out what to do. If you read my first post:

“those of us who were conservative, held the line, did the “Right Thing†and are now awaiting justification just going to be disappointed that these are now minor corrections in the next few years versus a 30% slide in home prices due to this PPIP”

I am one of those conservative folks who throughout the downward trends in interest rates just kept doing refis at lower rates and kept paying my principal down. I went from a 300K mortgage 10 years ago to under 150K now. I was thinking about selling, taking the cash and waiting. But I was just trying to figure out what the likelihood of success on this PPIP thing is. I’ve been reading these posts for some time now and Dr. Housing Bubble’s comment RE: PPIP was the first sign of doubt I had ever seen from him (or her). Being conservative, I have a nice home right now with an ultra low mortgage and low property taxes. If this PPIP thing manages to stop or slow down the slide, I may not want to sell right now.

I’m asking for anyone with insight to please comment on the likelihood of success of PPIP. I did some checking after I posted the comment which seems to indicate that there are some serious hurdles to it even going into effect, so if you do have some thoughts on PPIP, please share those. Again, if you believe in Dr. Housing Bubble, you must admit that those comments are the first sign of doubt you have seen.

What I have seen–like many folks is that banks are holding the foreclosure inventory and not releasing onto the market. If the thought is that the banks just dump these and let PPIP hold onto them for the next however long and the taxpayers end up holding these assets until prices recover in the next century–that will be a horrible thing and I should not sell.

I’m honestly looking for advice on what to do.

Peace.

Eventually, all those modified under PPIP will understand they have

only elected to be modified to life-long renters and they will start to

walk away. A recovery in housing prices can only be lifted by a

rise in affordable. This is impossible if PPIP holds the line on

price declines. What this will do is prolong the drop to the bottom.

The plunging graph line will curve out into a flat-bowl bottom and

be held there for a decade or two as more and more PPIP adjusted

walk way. I think the government wants to soften the landing and

keep people in THEIR homes for as long as possible before

they wake up to the only possible final scenario. Does it matter

if the Titanic goes down in 2 hours or 8 hours, if there is no possible

rescue and the water temperature stays the same?

I am also curious about the PPIP. These programs are never what they appear to be.

How much longer can they kick the tin can down the street? When are they going to break their feet?

Whattado-

PPIP and whatever PP comes out of the government next year can only transfer losses on the loans from bankers to the taxpayers. They cannot “stabilize” the housing market. The government NEVER creates the primary economic trend, but they can distort it. Every government interference so far has been designed to fail either due to greed and/or ignorance. Do not rely on apparatchiks to save you or “fix” the housing market. Make your decision based on the market forces Dr. HB so eloquently presents – they will trump government policies.

Adam,

Thank you.

Indeed Dr. HB’s top 10 rationale for California Housing is sound. My only concern is that the bailout will supply the banks with the cash they need to earn 7 figure bonuses for their top guys, so they won’t need to sell the homes to raise capital. So we may have thousands of unoccupied homes just sitting around. I’ve read a lot about the shadow inventories and I’m just wondering whether the PPIP will create a larger black hole inventory and keep supply low and demand artificially inflated.

Thanks again Doc. You’ve saved me and countless others from buying at the worst possible time.

And many thanks to Jeff 2 – maybe gold coins aren’t so impractical anymore.

Simply the most articulate explanation of the tsunami. All your posts are point-by-point explanations of why it is going to happen, how it cannot be stopped, and why we need to continue to come here to get educated. First time commenting.

I live in Augusta, Georgia – far from California. My military travels took me to several places in Cali, and I loved it. It is sickening to think one of the most beautiful places on earth has to endure this kind of adjustment.

What about this?

http://www.latimes.com/business/la-fi-petruno27-2009jun27,0,2308676.column

http://www.youtube.com/watch?v=vVkFb26u9g8

It is time to WAKE UP !!!

Dizzle

Interesting thoughts. IMO–for a bill like this to pass through the Senate (where Nebraska, Idaho, the Dakotas, etc. count the same as California, Florida, Nevada and Arizona) would be near impossible. Can you see the local headlines–US Government proposes to bailout California Millionaires? Any Senator in a all but the top 10 foreclosure states will be in serious jeopardy of losing their tenure. Things like PPIP and TARP are more palatable (even though they only help out the banks) because people in Nebraska, Idaho, the Dakotas, etc. still need to borrow money. No one in the MW or South wants to bail out someone buying a million dollar home in Sunny California or Florida.

Well worth a read to see how North America, and much of the developed world, got to where they are now. In debt.

“The Inevitable Collapse – North America’s Leveraged Economy and its Effect on Canadian Home Prices”

http://www.americacanada.blogspot.com/

Although the Doctor’s reasoning has still got me sold on that this is NOT the time to buy, I’m starting to have the same fears that Whattado has. If all those loans do get into the hands of the Treasury (us), It seems soooooo plausible to me that either 1) deadbeat mortgagers will be allowed to live completely rent free INDEFINITELY. (After -all who’s going to know?) or 2) Abandoned walk-away houses will remain that way for a decade. Cities will protest, but it will fall on deaf ears. Sadly, it seems plausible to me. once again, the joke is on the responsible saver.

@Jonathan,

Excellent article–nicely explains what should be obvious and perfectly relevant to this thread. Oz was a good man but a terrible wizard, and now that Toto has pulled back the curtain, America and Canada may have to come to terms with the fact that the show may be over. Can we really really just survive servicing one another? And that with technology even a lot of our service sector is going overseas…Housing, not readily outsourced, was the chosen bubble because you cannot import big houses competitively.

How this plays out will be interesting.

Sorry I’m off topic. The doctor would have much to add to the angle on the following article:

http://www.businessinsider.com/henry-blodget-next-segment-of-the-housing-market-to-crash-1-million-mcmansions-2009-6

In light of recent events, will you discontinue the use of your lingo on those walking away from underwater mortgages to be “moon walking away” from a house? I still like the visual (eh, he hew! maybe some crotch grabbing directed towards the bank on the way out) 🙂

I’m surprised by all the doom and gloom talk as well regarding the Option ARM. Isn’t the IO payment dropping below the Min payment at this point anyways? The MTA is at .49 for christ sakes. The media just needs to continue to beat this thing to death. I have a tendency to agree with linked bloggers article. The people that were going to foreclose, already have. With interest rates continuing to dip, and the neg am gone on their loans, why leave.

Too bad these loans were so abused- they had their merits. Case and Point: http://www.bankapedia.com/mortgage-encyclopedia/faqs/674-advantages-to-the-option-arm

Just a matter of time before they become illegal

Leave a Reply