Alt-A and Pay Options ARMs: Four States make up 46% of Alt-A loans. Examining California, Florida, Nevada, and Arizona. From Bubble Housing Glory to Housing Bust Toxic Mortgage Pain.

Four states have felt the joy of housing appreciation and the agony of the housing bust in a very deep and extreme way. Without a doubt, this economic crisis is touching every corner of the global economy but four states have seen the multifaceted punishment of this housing and credit bust. Those states are California, Florida, Nevada, and Arizona and these past days I was able to see first hand three of the states. Spending time in these few states and contributing my own economic stimulus to these economies, I realize that the housing downturn still has further to go.  These states are ground zero for the coming Alt-A and pay Option ARM wave that will be crashing down on us later in the year.

Driving through these states and the vast subdivisions hugging the desert you can quickly put a face to the economic devastation. How many of these homes sit empty? Will these homes ever have occupants? How much money has been lost in this pursuit of endless housing wealth? You also witness the countless commercial real estate developments that encircle these areas with your typical chain fast food restaurants and your mega shopping center. Some don’t realize that these commercial real estate developments are usually brought out 12 to 18 months after the construction of the new subdivisions. That is, the commercial real estate bust is the next big thing to watch since these stores were developed to service a population that isn’t moving in.

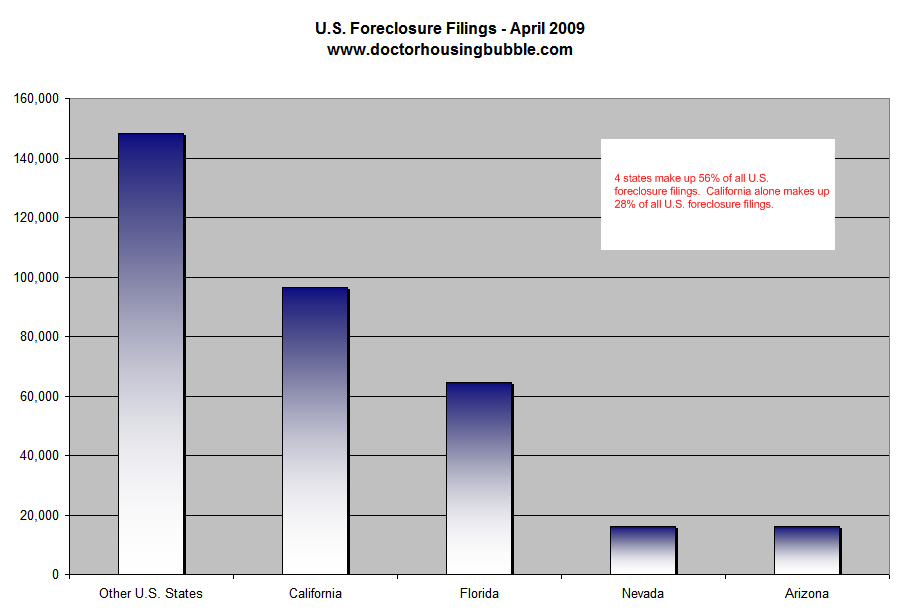

Let us first take a quick look at the numbers:

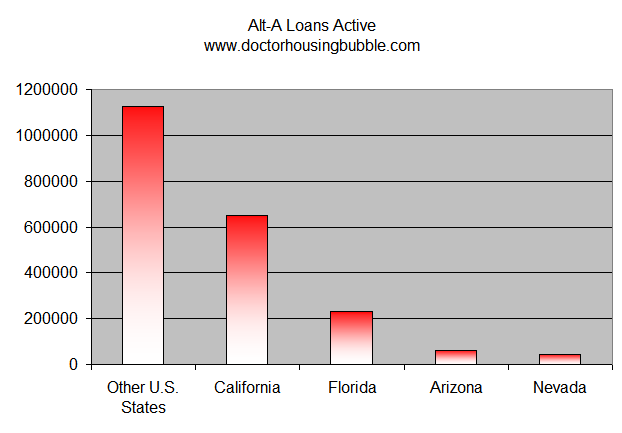

These four states make up 56% of all U.S. foreclosure filings. And this trend does not show any signs of abating given that these states also hold a disproportionate amount of Alt-A loans which are tied to some of the more toxic recast type mortgages that I have discussed. So how many Alt-A loans reside in these states? Let us break down those numbers further:

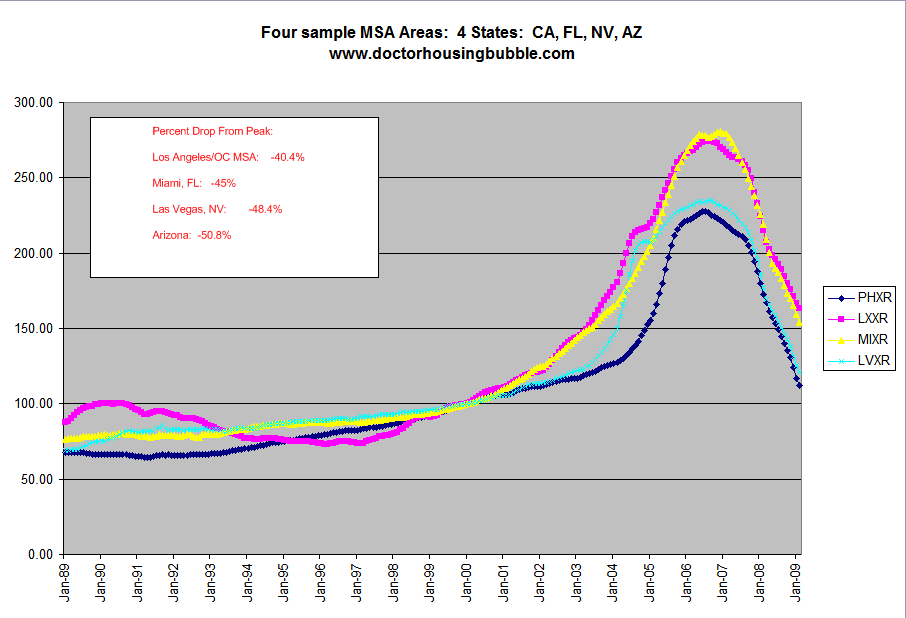

Again, what you will find is that these four states hold a disproportionately high amount of Alt-A loans. To be precise, these four states hold 46 percent of all active Alt-A mortgages. Now why would this be so problematic? A large portion of these loans have yet to face a serious recast. Forget about the resets that are tied to LIBOR for example, with rates at historically low levels. This isn’t the issue. The problem with the recast is the massive jump in payments that can easily double the monthly payment as I have discussed in detail in a previous article. The major concern is these four states have seen there large metropolitan areas face some of the deepest year over year price drops in history. Take a look at the Case-Shiller price drops for the largest MSA data series for each state:

Florida and California have multiple MSA data points in the Case-Shiller monthly reports but I used Miami and Los Angeles as samples for the two states. For Nevada and Arizona I used the Las Vegas and Phoenix MSA data which is the largest for each state. And herein lies the coming tsunami. The L.A. MSA is doing the best out of the four and that is now down 40.4% from the peak reached in September of 2006. Arizona with Phoenix is being slammed with a 50.8% drop in housing prices. In fact, the 111 mark assigned to this MSA now puts us back in 2001 price territory. These markets are flooded with inventory. So when the recasts hit with those Alt-A mortgages they will be hitting a market that is extremely depressed. Keep in mind that many of these Alt-A products have negative amortization which allowed the principal balance to actually increase. This has created a time bomb with these mortgages. They will be going off in the most depressed markets possible. The endgame is a flood of foreclosures in markets that already have a flood of foreclosures.

Someone sent me over this must watch video called Lost Vegas from Vanguard:

The video highlights the troubles faced by Las Vegas. In the episode, you will see a story that is all too common where a would-be investor bought a property and “forgot” to tell the renters that he was being foreclosed on. You will also see projects stalled since growth has halted given the current economy. We also see a former mortgage company worker who is now an exotic dancer and calls it a “big step up” from her previous job. It is definitely worth watching.

These states are facing the double whammy of the debt bubble. A fall from grace is always painful. States that did not see major housing bubbles are still having difficulties but these four states went from perma-growth and never ending housing appreciation to an absolute bust.

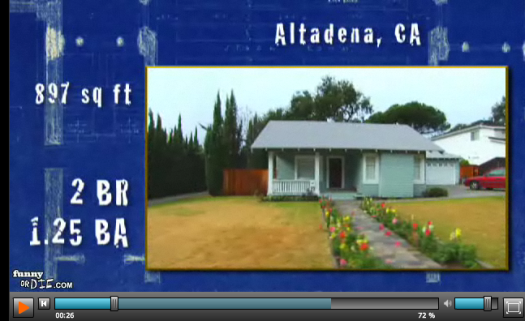

It would appear that financial prudence is now going mainstream and I saw this funny clip from a show being aired on ABC this Friday called Un-Broke. In this one clip, Seth Green highlights a Real Home of Genius here in California:

You have to watch the clip, it is hilarious. But aside from the humor, I couldn’t believe that I was getting better financial advice in two minutes from Seth Green rather than on CNBC, a supposedly self labeled financial network. In this little clip, we are told about living within your means, driving a paid off car, and not buying a McMansion. Living prudently has now gone mainstream in a big way.

Yet going back to our four states, living within your means is something that has been foreign for over a decade. The massive McMansions that I saw in three states is a sad reminder to the perma-debt growth model. In this model, you couldn’t have enough fast food chains or auto dealers and forget about the mega department stores. If we were to study this as an ecological environment, you would think that humans as a species only had one purpose in life. That purpose was to eat junk food, buy gigantic cars, and upgrade every countertop in the globe to granite.

Yet there is a finite number of what we can consume and we hit it. The empty subdivisions are a testament to this over building and over consuming era. And that is a large reason I do not see a second half recovery. Because to recover, we have to assume we are going back to the ways of old. Do you see that happening? Do you see us once again going back to buying massive gas guzzling highway tanks and buying 3,000 square foot McManions again in a mega way? I don’t and that was a large contributor to our growth. Let us not even talk about the ancillary crony banking system and lenders that fed on this bubble for their life. The two biggest purchase items for Americans are homes and cars. How are those two industries doing?

So looking at these four states, I’m not sure I see a second half recovery. We are still heading directly into the Alt-A and pay Option ARM tsunami and these four states are hurting in a big way. Need we examine the California budget boondoggle? If these four states are any indication, we won’t be out of this mess in 6 months. The clock starts next week.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “Alt-A and Pay Options ARMs: Four States make up 46% of Alt-A loans. Examining California, Florida, Nevada, and Arizona. From Bubble Housing Glory to Housing Bust Toxic Mortgage Pain.”

I watched that vid about Shit hole Vegas. Heres a news flash. Dont get married to someone who cant provide. Go to f**king college. Dont put yourself in a situation that you have two kids and you fu**ing work at Target. Its so unfair to these kids. The quality of parents in America is the worst. Dont fu*king spawn beyond your means. Sound familiar? Imagine all the heart break kids have to go thru because of the greed and self centeredness of stupid-ass American parents.

Oh shit I’ll keep going. Both parents working is the norm in the US. On NPR they had a story of a couple that lost both their jobs. The wife was 5 months pregnant and was going to have the germ wagon and go back to work. Some Guatemalan nanny or the like was going to be used. Well she loses her job that is soooo important to society, give her such meaning. They say Suzy pick your shit, your laid off. This is Jim the security guard and he will be escorting you out. Wow I guess she thought herself and her job were more important then the company did. For the kids sake I hope she never gets a job and raises her own kid so he’ll grow up to be a productive adult.

Thanks for the post DHB.

I left the Arab world about a year ago where Sharia law is enforced. It is rumored thousands of cars were abandoned at the Dubai airport from high-rollers leaving the country to avoid debtors prison.

Wonders are what would happen if we had the same law in the west. I doubt people would have been so quick to borrow more than they could afford.

NYT columnist and Nobel prize winning economist Paul Krugman wrote in his Monday column about his concerns that California budget and housing woes may be canary in a coal mine warning for entire US economy. Not a good thing.

Fantastic post. And thank you, though I can’t say I’m overjoyed with my coordinates here… I mean, I can think of eleventy billion places I’d rather be instead of the “eye of another financial hurricane”. Oh well, at least some of us are aware of what’s going on, and can act appropriately. Others, it seems, are perfectly to go about their business buying 4 bedroom, 3 bath single family homes at $500K-$650K. While I do wonder how in the hell these buyers manage to afford such prices in OC California, a second question comes to mind about the level of confidence these individuals must possess about their future employment prospects.

I just hope local banks are not continuing the doling out of silly money to the unqualified.

But why the F do we have to pay the price of our fellow American dipsh*ts ? They got duped by the big banksters due to their own greed and ignoramus qualities and now we all have to go down with the ship ?

Someone please tell me there is a happy ending to all of this. Wait, maybe there is, the stock market is ripping today !! YAH !!

Yes, there is a lot of silly money going around…courtesy of the NEW and IMPROVED sub-prime lender, the FHA, also known as us taxpayers!. On a related note, I understand some 38% of recent sales are being made in CASH!?! I figure there must be a lot of knife catching investors offloading the last of their bubble wealth at auctions, etc. I can’t see that rate of CASH purchases going on forever. Part of me is worried about some conglomerates being created to buy up massive amounts of distressed properties and rent them out indefinitely, permanently distorting the market. I figure if they pay cash for their props it will take them a very, very long time to make back their investment, but anything’s possible.

Another article that helps me stay the course………but………..I gotta say, with San Diego Country loosing between 10 and 30 houses of inventory EVERYDAY, I am starting to get a little nervous.

When the stock market opened this morning the futures were down due to home prices being down 19%, then GM said they would likely seek bankrupsy since bond holders were not taking the bait. Yet the maket rallies 200 points because consumer sentiment was higher than expected. This is pure insanity. Soon we will not be building cars, computers or making clothes. All we need to do is to go back to the mall and buys things (made in China) we don’t need with borrowed money and all we be well. It’s a great business model, How come all the other countries don’t do the same? Are they stupid? Don’t they realize how easy this is?

@ Andy:

You’re glad a woman lost her job and think it’s best so now she can stay home and raise her kid herself? How is she going to do that when her husband is unemployed and there is no income coming in? How is that better? Do you assume women only work for vanity and not survival?

Yes, gael, that remark about the woman being able to “stay home” and take care of her kid got my back up, too. Women work for the same reasons men do… for economic survival, independence, and hopefully to get ahead economically… and YES, so they can take care of their kids and STAY OFF WELFARE. Would that commenter be happier with the woman if she applied for AFDC? The kids need a financially stable home much more than they need Mommy hovering over them all day. In this woman’s case, her income was obviously an economic necessity, as it is for most moderate-income families. Only women whose husbands are in the top 10% of wage earners can stay home with their kids without worry.

The Las Vegas video highlights the plight of the innocent victims.. in this case, renters who payed their rent and were still evicted. This could happen to me or you. We renters have no means to protect ourselves.

We need legislation that will require the financial institution to notify the renters of a property at the same time they are notifying the owners. What are the people in this video going to do? Good thing for them it doesn’t rain too often in Vegas, what with their belongings stacked up allover the lawn and no help in sight.

Andy, how is some woman supposed to know for a fact that her husband can provide? Maybe he did before he got laid off.

There is nothing wrong with a household where Mom works. The kids do not need momma hovering over them all day. They need a home that is not on welfare or unemployment. The stone truth is that most working-class and moderate-income families in this country must bring home two paychecks to maintain a modest standard of living in a rental apartment. Here in Chicago, it has been determined that a minimum wage worker cannot afford an apartment, and it take two people earning moderately good incomes to buy a two-bed condo, even at reduced prices. Why? Because American workers have been steadily losing economic ground since 1970.

Surprise! Two-salary homes are not a 20th century development, but were commonplace two hundred years ago. The 18th century economic theorist, Adam Smith (The Wealth of Nations) reckoned that it took a common working class couple a 12-hour a day job each to support two children at subsistence levels. And guess what? The kids had to go to work by the age of 10. Let’s hope like hell that this country does not become so impoverished that we have to go back to putting our kids to work in factories for pennies a day. In most poor countries, kids work at grueling, dangerous jobs for barely enough to eat.

My mother had to work or we would not have eaten. It was very commonplace for the women in my neighborhood, in that long-past time several decades ago, to state that “I’m only working temporarily. I’m basically a housewife.” Yeah, she was only working temporarily, for sure… like until she retired. These women did not believe in leaving their kids to go to work but they did it anyway because the alternative was destitution.

Can you say that you have ever had more uncertainty with regard to the future than right here, right now? Behind every door is a ghoul…what is the right step now? Somehow the fiat money will make it all work for a little while, although many will be devastated. I doubt we will ever look back at this decade and laugh…what a mess.

I think Andy still believes in the Leave It To Beaver world where a single income can support a family. Unfortunately, that stopped being reality maybe thirty years ago. That’s how long wages have been stagnant in the country and, until that changes, there’s really no hope for the future. The reality for three decades or more is that it takes two incomes to support a family. And now that we’ve exported all of our manufacturing, there will be no more real jobs.

~

The most irritating aspect to this fiasco is how the elites (cronies) have essentially written the whole country off, happily shoveling what’s left of the treasury and the country’s credit into their offshore accounts.

~

And by now it should be obvious to everyone that Obama isn’t going to be any “agent of change.” His cabinet picks were the giveaway to many but, as time goes on, this realization is beginning to sink in for more and more people.

Well, my guess is that we would have lots of high rollers leaving their cars at the airport… that law doesn’t seem to have stopped the problem in Dubai, right?

Comrade Housing Bubble,

What kind of crazy vacations do you take? I know you’re trying to make a living like the rest of us but you might want to consider something a bit more serene and zen-like (I recommend one of the music festivals in Telluride). I would hate to see you turn into the next James Howard Kunstler!

Be brave Comrades!

lets look at how all of this seems to be engineered, I mean are we all happy about joining the one world government show…..look at how by this fall the dollar is losing reserve status and probally two A’s of our now current AAA rating…..and wall street and washington act like they have all the answers…..yea their answer is take the money and run…..and then their big answer is going to be to join the world-union or whatever it will be called….we are a constitutional republic, it is not the citizens fault that the gvt. and corporate entities have stripped this once great nation of all it’s wealth. Corruption is always followed by dysfunction…..are We The People gonna fall for b.s. anymore???? I’m not holding my breath….gvt does not have the answers…..we do…..

Sentiment Soars, but Home Prices Continue Slide.

Check out the picture of vehicles at the

Exurban nation website.

There are hundreds of BMW SUV’s stored at an airport in So. Cal.

The docks are full, so they had to expand storage space.

When there are no buyers for upscale cars, this state is in serious trouble.

Great article again. Yes the US and CA state governments do need to be taken back by the people. All this deficit spending has gotten out of control, everyone wants a hand out, and no one wants to balance the budget, which is insantity year after year repeating itself. Unfortunately both the Democrats and Republicans have caused this problem, and its time for a new political movement as the current system is broken.

Hey, blutown–ain’t no better Zen than at the heart of the whirlwind!

😀

~

rose

PSPS

I do it. Friends of mine do it.

I wonder if we’ll start knocking down homes like they did in Texas during the Depression.

Did “Nobel prize winning economist Paul Krugman” foresee this obviously inevitable crisis? Nope. Nobel prizes in economics are a laugh.

Dialecticus, to be fair, no one really predicted the downfall of the housing market correctly. Even the Wall Street guys lost their hats on this one, and I don’t think it’s because they knew they would emerge stronger as some conspiracy theorists point out. When the market mentality is profit profit profit, it’s hard to argue otherwise. Just like now, when things are looking so down, no one is predicting a rebound in the near future. Once/if it happens, everyone will start saying why things started looking up.

http://www.therealestatebloggers.com/2009/05/05/cheaper-to-tear-down-new-homes-than-sell-them/

It’s already begun.

Whats wrong commentators here? You are crying out as if you were not aware of deliberate intentions. Put is this way, you do no this crisis is by design and is but one of many prior and one of many to go, correct? Just checking.

Leave a Reply