Alt-A, Option ARM, and Subprime Loans will Turn California into a Zombie Mortgage State. 28 Percent of Alt-A loans in California 60 Days Late. Alt-A Mortgages by California Region. 1.1 Million Alt-A and Subprime Mortgages Still Active.

The green shoots are now officially guiding the Southern California housing market. The sentiment has shifted in the region. Even though some 40,000 foreclosed homes are sitting off in some fantasy banker balance sheet, many people are jumping back into the housing game. For those purchasing at rock bottom prices in distressed areas like the Inland Empire, this may not be so bad. After all, if you are able to purchase a home for $100,000 that once sold for $300,000 that in fact may be a good deal. But if you are jumping into those mid-tier markets like Pasadena, Culver City, or Palms for example you will need to gear up for the next few years.

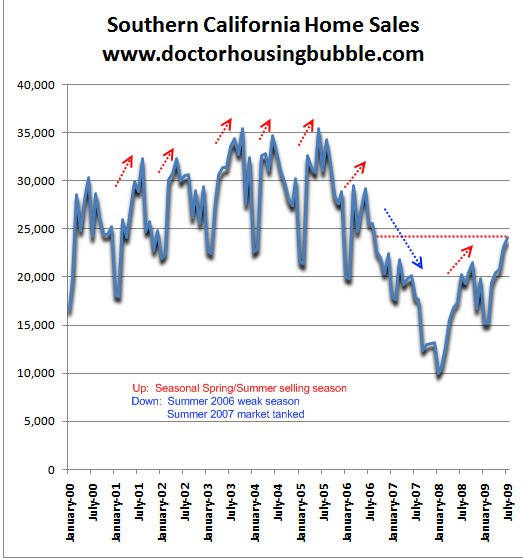

Earlier this week the Southern California home sale numbers showed another pop in sales and stabilization in price. We have discussed how this can be a deceiving indicator especially for those mid-tier markets. But let us look at the sales trend:

This data reflects the entire Southern California housing bubble for the decade. What you’ll clearly see is the spring and summer seasonal jump in sales. Like clockwork, this happened every single year until 2006 when the pop was weak. In 2007, the market imploded and sales simply cratered. Since that time, over 50 percent of home sales have been foreclosure resales. Even last month, some 43 percent of homes that sold in the region were foreclosure resales. Some would like to think that all the Alt-A and option ARM problems are long gone from the system. Thanks to data from Loan Performance, I am now able to look at specific regions of the state and see how deep the Alt-A problems go.

We already know that Alt-A loans are toxic mortgage sludge. These are loans spawned during the housing bubble and only served a devious purpose to feed the mania. Option ARMs are a subset of the Alt-A universe and are arguably the worst mortgage product ever created. These should be outlawed. No good came from these loan products. Of course, the housing industry would like you to believe that only doctors and high paid sitcom actors with 1099s took on these loan products, but the reality is these were given to HGTV hungry homebuyers who wanted to buy that $700,000 shack on a $100,000 income. After all, they were then going to flip it in 2010 for $1 million.

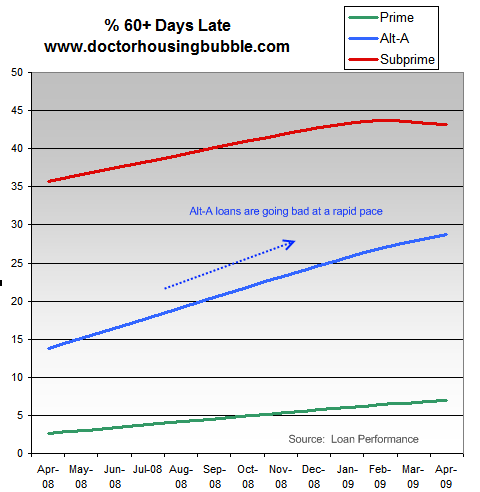

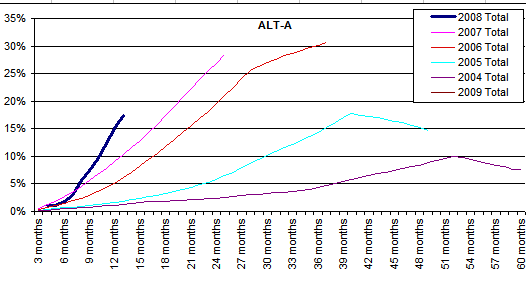

This is the first article that I have seen that will break down the Alt-A mortgage universe for the entire state of California by region. I’ve done many articles talking about the coming Alt-A problems but it focused more on statewide data. This time we can dig deeper into the state. The first thing we should establish is how toxic these mortgages are:

Source:Â Loan Performance

What you’ll notice is that subprime loans have hit a plateau. That is, of the current active loans nearly 45 percent are 60 days late. The reality is, most of these loans will go bad and we still have a good number of subprime loans in the state. The state still has over 500,000 subprime loans that are active. We already knew this. But take a look at the skyrocketing distress in Alt-A loans. In April of 2008 13 percent of Alt-A loans in California were 60 days late. As of April of 2009, that rate has jumped up to 28 percent. Alt-A loans are toxic and with an average balance of $443,000 many are so underwater, that they don’t even qualify for refinances with the revised 125% LTV levels.

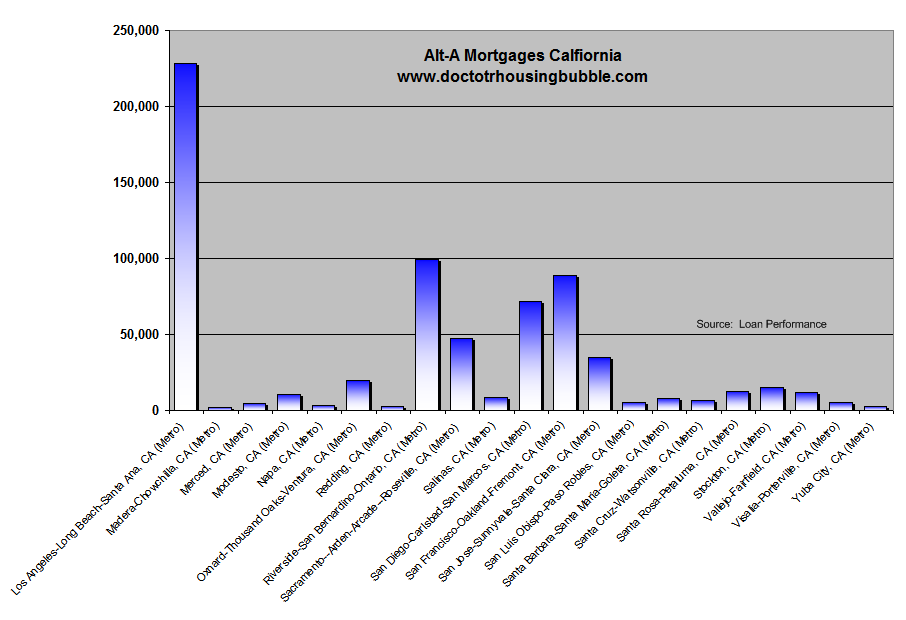

So let us take a look at where these loans are in California:

Source: Â Loan Performance

What a shocker. Millions, including myself just happen to live in the capital of Alt-A mortgages. The vast majority of the Alt-A mortgages are in the Los Angeles and Orange County markets. Of course, we have given examples of people in Pasadena, Culver City, and other so-called prime markets who over extended themselves and are now losing their homes. Over 225,000 active Alt-A mortgages reside in the Los Angeles and Orange County markets. Not to be out done, the Inland Empire (another region of Southern California) has close to 100,000 active Alt-A loans. The San Diego market has over 70,000 Alt-A mortgages active. All combined Southern California itself has roughly 400,000 active Alt-A mortgages and 28 percent of these loans in California are now 60 days late! I think that puts the 24,000 homes sold in the region last month into perspective.

Referring back to the chart, you can see that Southern California wasn’t alone in this. The Bay Area has approximately 90,000 active Alt-A mortgages. San Jose and the Santa Clara region have over 35,000 active Alt-A loans. What does this mean? With the shadow inventory mounting and the losses growing, California is entering a housing zombie mode.

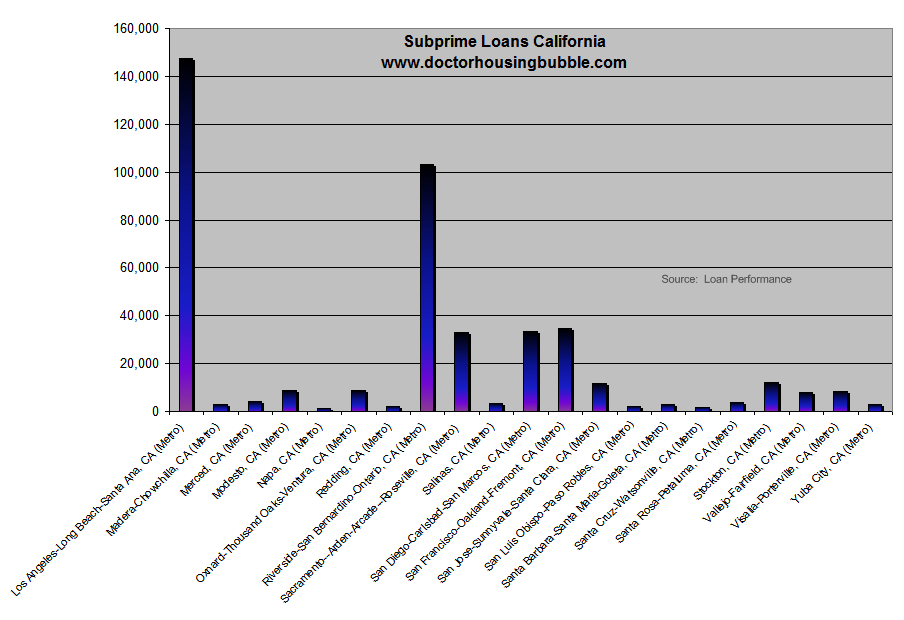

Let us not forget those subprime loans:

A ton of these toxic mortgages still exist. The same players emerge yet again. What this means is additional losses to banks and their already weak balance sheets. But don’t think that California is alone here. Nationwide there are over 2.5 million active Alt-A loans. And the distress is resembling the California trend:

Source: Â Loan Performance

The unfortunate aspect of this is we are making many mistakes that Japan did after their asset bubble burst. We are bailing out the banks and allowing them to keep toxic assets on their books. So instead of taking our medicine and finding true asset prices after the bubble burst, we are allowing banks to keep toxic waste on their books while they keep going to taxpayers for additional capital to keep them afloat. That is why when Fannie Mae came back to the trough for billions it was no shock. And some people were talking about them turning a profit when we took them under conservatorship. Yeah right! As you can tell from the earlier chart, prime loans are also facing higher distress.

One fact that stuck out with the Southern California sales data is the monthly mortgage payment. Last month, of those that bought in the region the typical monthly mortgage payment was $1,180. This is down from $1,710 reached last year. Did you get that? The typical monthly payment came in at $1,180. This probably has to do with the following:

(a)Â 43 percent of home sales were foreclosure re-sales

(b)Â 19 percent of buyers were absentee or investors

Many investors are all cash buyers or have big change to put down so I’m sure this has pushed the mortgage payment average lower. Put this in contrast with the September 2007 data when the typical monthly mortgage payment came in at $2,400. And I bet some of that included those Alt-A and option ARM toxic waste! A teaser on a $600,000 mortgage. We are not out of the woods.

Be wary for the following reasons:

(a) Alt-A loans will be a problem. How big? We will find out in 2010 – 2012.

(b) Shadow inventory IS a big deal. Banks might be holding off simply to avoid taking further write-downs. Their window is closing. They are probably praying that the public-private investment program (PPIP) takes off soon. Yet even if this gets shifted to the public, these loans are still junk. At a certain point, the market will have to set the price. If the banks continue holding off and then the government steps in, we have repeated Japan’s mistakes and you can kiss a few decades goodbye.

(c) California is still over priced in many regions. These regions just happen to have the biggest concentration of Alt-A loans. With defaults spiking and distress rates looking like subprime, there is little rush to jump into the market right now. And some believe prices will go up? Hard to believe some people are using the priced out argument again.

(d)  The nation may be squeaking out of recession (by technical standards) but California is deeply rooted in a recession. With an 11.6 percent unemployment rate and a 21 percent underemployment rate we have years of struggles facing us. Ultimately you have to pay for your mortgage with an income and job losses do not help in this regard. Many fail to understand the incestuous decade California experienced. High paying jobs directly related to housing allowed those in the field to buy homes and thus create a mini self-sustaining bubble. People drank their own Kool-Aid. I’ve met only a couple of mortgage brokers for example that stashed away money during the good times. Most blew it all.

(e) We are entering the slow selling season. Fall and winter are typically slower months for home sales. This is going to align directly with the first massive wave of recasts hitting in Q1 of 2010. And don’t forget we have the commercial real estate bust gearing up next year. Some estimates put losses at 50 percent!

The Alt-A and option ARM tsunami is now on the horizon. Instead of backing away, some people are getting their surfboards and jumping straight into the 100-foot wave.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “Alt-A, Option ARM, and Subprime Loans will Turn California into a Zombie Mortgage State. 28 Percent of Alt-A loans in California 60 Days Late. Alt-A Mortgages by California Region. 1.1 Million Alt-A and Subprime Mortgages Still Active.”

The reason sub-primes are plateauing at under 50% is because the banks are finally starting to foreclose on these homes. If the foreclosure rate picks up the percentage of loans 60+ days late will go down.

I have seen many properties with Notice of Defaults that do not go to foreclosure, some in over a year. The stealth inventory at one time gave me hope that eventually they will be forced to sell.

However, what would make a bank take the hit and loss? Why ever sell? People are squatting for a year. Some places just sit empty, but still not listed for sale. There’s talk about inflation – hyperinflation. So are banks waiting for inflation to set in which will consequently cause real estate prices to increase back to peak, avoiding a loss entirely? Are they kicking the can until peak prices return?

If this is the strategy, then the voluminous stealth inventory is inconsequential if it never lists. The government continues to intervene and as long as they can print monopoly money, then mounting stealth inventory means nothing if it never gets listed.

Unemployment will be the big drag on the Calif. economy until at least 2011.

Yes, the number of lay offs is slowing, but does that mean the economy here is healthy.? You can have all the mortgage resets you want, but if the wife or husband looses their job, it is a moot point- you can’t pay the mortgage in this state, without 2 jobs.

If you are a cash buyer, the deals by the end of 2010 will be incredible.

” some people are getting their surfboards and jumping straight into the 100-foot wave.”

They’re gonna get PITCHED!!

The Option Arms adjustment would cause no effect. The incomes never qualified for the loans. Once the exposure of fraud became exposed nationally, payments came to a hault. Left are those who did lie enjoying their colorful granite tops and swimming pools trying to buy time with a modification; along with the believers who are still investing every penny thinking goverment is on it’s way. It’s become a wasted argument as to who lied. Although, one signature on one page of apllication with a tripled imaginary income doesn’t have the employee power to process and enforce a loan. After a $76,000 down payment with $17,000 in materials and years of labor I wish someone would had let me in on the lie. Now they want me to plead guilty with a modification. The one satistic these articles will never have access to is the list of imaginary incomes these financial brokers and lenders will never have to explain.

Doc Said…”Shadow inventory IS a big deal. Banks might be holding off simply to avoid taking further write-downs. Their window is closing.”

Uh, not so fast there Doc. Looks like the head of foreclosure radar.com is now coming out and saying the upcoming tsunami of shadow inventory is “unlikely”

http://www.foreclosuretruth.com/blog/sean/waiting-catch-wave-surge-reo-listings-unlikely

So instead of that window “closing” it looks like they put a jamb in it to keep it open for a looong time

Thanks for the FACTS once again Dr. HB. This should be a shocker to most people, except for those that can’t bear to accept it. With tools like loan performance at your fingertips, I believe the coming crash in Southern California’s mid and higher end tiers could be swifter than people think. The coming Alt-A and Prime Foreclosure Wave will force the hand of many and some banks as well. At some point, the Govt will need to accept the problem and try to muddle through it realizing their efforts are fruitless. We can only HOPE for 2-4 years of serious pain and not 10 years of slow water torture (Like Japan).

With 2 weeks left of the summer selling season, and foreclosures appearing in all zip codes, The Westside is about to get smacked.

http://www.westsideremeltdown.blogspot.com

Unemployment is a major factor for foreclosures, unless the loan was based on imaginary income. According to some data I have seen, the majority of the “stated income” loans were based on fictitious numbers. How can you be fired from your imaginary job?

Doc,

I sincerely hope you’re right, since I sold my house to step aside and wait for prices to further decline, but:

(1) When you say that “Shadow inventory IS a big deal. Banks might be holding off simply to avoid taking further write-downs. Their window is closing.” – what are you talking about? What window closing? As long as banks do not have to apply market to market accounting to the assets pledged against the nonperforming loans, and the Fed lends them money at 0%, there is no window and it sure ain’t closing. Undewater shadow inventory will remain non-inventory unless and until something forces banks to foreclose and take it to auction. Currently, there is nothing on the horizon that provides them an incentive to do so. Maybe when the FedFunds rate goes up substantially, the increased carrying costs will get them off the dime, but that isn’t going to happen anytime soon.

“With 2 weeks left of the summer selling season, and foreclosures appearing in all zip codes, The Westside is about to get smacked.”

.

It will huh…Kind like in 2007 when you said

.

“By the end of the next selling season ( Summer of 2008 ) you will see declines of 45% in Santa Monica off of it’s peak in August of 05′.”

.

How did that one work out?

Just like a real Tsunami. The ocean rushes out and people invariably go out to see the amazing creatures flopping around on the now-exposed sea floor, and then wonder why everyone is screaming and running to the hills. Despite our massive brains–each of us is equipped with a Cray Supercomputer– we make the most foolish choices possible. Ron Paul was the only candidate with any semblance of knowledge of what is going on, and they laughed him off stage like in the movie idiocracy.

Keep drinking the Brawndo, SoCal. Looks like Planet of the Alt Apes is going to be a double feature, and get some more popcorn and another box of Goldman Snacks…this is going to be a long movie. Just because the tide is way out doesn’t mean you’re not underwater.

I have two questions, I wish you would address in future articles.

1) What would force banks to actually put on the market all the homes they have already foreclosed on? (I’m seeing tons of homes being foreclosed on that don’t make it to market that are still sitting empty – I’m assuming this means they’re also not getting sold at auction).

2) In a lower-priced area where the bubble has already burst, how much are properties likely to go down when mid to upper range areas pop the bubble? I’m looking at foreclosures, trying to estimate if they’re at reasonable prices, but the only measurement I have is what I can afford, not what I should be getting for the money. We all know Zillow’s comps are completely out of whack with reality, and that we won’t really have a grasp on where “the bottom” is until we’ve gotten there.

For example, I looked at a nice starter home – 2 BR, 1 B, in a decent zip that’s a foreclosure. At peak it sold for 670K, it’s listed by the bank now for 300K (and has been on the market for 4 months). I think it’s worth 200-250K (leaning more towards 200K). It sold for 221K in 2001, and 196K in ’96. Should I be graphing this out?? Where does “reasonable” actually fall on this sort of thing? It’d be great if there was a general rule of thumb, like “its sale price from 1995-2001” plus 10% or something like that. Maybe I’m crazy.

Thanks Latesummer! After going to the site you referenced I saw the instructions for finding foreclosures with addresses. I didn’t want to join one of those sites that provides the actual address-and all the free sites would tell me the street name but not the actual street number. I’m probably way behind everybody else when it comes to being “in the know” but I’m going to copy the instructions here in case there is anyone else who didn’t know this stuff.

And to Doc:

As a forty-something with 20-something children who want to buy NOW you have been the voice of reason that they have heeded. What they began reading on your site two years ago has come to pass…and you have saved them hard-earned down-payment money that would be long gone if they had bought two years ago. Both of them are following you closely and are not even considering buying in their chosen area for a good while. A million thanks!

Here’s the info I just pasted from the site Latesummer referenced:

Go to Google maps first.

) Type in your city and zip code

2) Hit the “search options” link

3) Scroll down where it says “All Results”

4) Select “Real Estate” from the type of maps

5) Hit search

6) Check the Foreclosure Box and POOF!

I think before any meaningful recovery in real estate prices can take root, we need to overcome three major obstacles…

“Rebound Obstacle #1: Inventory Glut. Nearly 10% of all homes built this decade are sitting vacant, compared to a historical average of 2.2%. In total, we’re sitting on almost 10 months worth of inventory versus a historical average of four months. If we factor in the “shadow inventory†– the roughly 600,000 homes that banks are withholding from the market – the problem worsens. Excess supply always erodes prices.

Rebound Obstacle #2: Loan Resets. Forget subprime. We’ve already worked through 80% of those resets and written down $1.47 trillion in the process. Now we’re facing a $2.5 trillion mountain of Alt-A loan resets. The first big wave hits mid-2011, with the peak expected to come in early 2013. So we’ve still got time, but the early stats hardly instill confidence. More than 20% of Alt-A loans are already 60-plus days late, up from an average of about 3% for the last decade. If interest rates creep up even modestly in the next two years – a near cinch given the likelihood of inflation – payments will increase notably. In turn, so too will default rates.

Rebound Obstacle #3: Foreclosures. One in four homeowners are now underwater. If we break it out by loan type the picture gets worse – 25% of prime loans, 45% of Alt-A loans, 50% of subprime loans are severely underwater. Add in the 6.5 million Americans out of work since the recession began and it doesn’t take an Einstein to predict where foreclosures are heading. Since the rosiest prediction doesn’t expect unemployment to peak until early 2010, as the MBA acknowledges, “…It is unlikely we will see much of an improvement [in foreclosure rates] until after that.â€

Read More: http://www.housingnewslive.com

John W We all did not know the magnitude of government innervation in the market, we all foolishly thought we are in a capitalism country just to discover that we are in a banana republic. Without this massive government innervation that prediction would have been right on target. This prediction is still stated, but due to the obove it will take longer and harder, but we will get there, you can’t fight with nature.

@John W

What you say is true. There was no way to predict how things would go with precise timing, but consider the Trillions of dollars that no one could have imagined would be used to prop up housing prices and the players involved. If it were a matter of the somewhat free market machinations, all hell would still be loose. But do you believe that all this can just disappear with no ramifications (except of course for an entire generation’s savings and retirement funds sucked into the Goldman’s Sacks). The S&L crisis didn’t just go away–Treasury started the printing presses 24/7 and they have not stopped since. The currency is debased and propped up by nefarious manipulation of the currency markets. (Fed buying at Treasury Auctions?!? WTF?)

People have tried to manipulate markets for centuries, and while it can work well for a time, it always ends badly for the rest of us. Yes, the rich Khazars will continue to drink the blood of the American middle class, and maybe prime-time can go on indefinitely. Citibank, the giant bankrupt ponzi zombie is well over $4/share. Things are so f’d up right now, anything is possible.

Cash for Clunkers is over, so who wants to buy a brand new car now? We’ll see.

Wait until the Cash for RHG’s program comes out next. Bet that’ll pull SoCal up by the jock strap. Cowabunga, Dude.

The Doc could be right about the future of housing prices, but something deeply worries me. Throughout history, inflation has always been a monetary phenomenon. In Weimar Germany in the 1920’s, the unemployment rate reached well over 40%, yet hyper-inflation raged. Some now say that with unemployment nearing Depression-era levels, and people afraid to spend, there can’t be any inflationary pressures. History seems to show that theory is wrong – print enough money, and bread, gasoline, and home prices will soar – even if unemployment reaches 90%. The US government is creating out of thin air (aka adding to the national debt) something close to five billion dollars a day. In sixteen days, this money that appears out of thin air is valued by the world as highly as all the gold mined on planet Earth in a year (80 million ounces of gold @ $1000/ounce = $80 billion dollars). I just can’t see that going on indefinitely. And the Wall Street Journal a few days ago said that if the debt of Fannie Mae and Freddie Mac were added in, as it should be (since that debt is fully guaranteed by the US government), then the national debt would be over 14 trillion right now, and rising fast. Maybe buying an overpriced house right now would be the smartest thing to do to protect yourself, if you can see the inevitable massive devaluation of the dollar coming….. Just sayin’

http://www.mcclatchydc.com/homepage/story/74106.html

“What Rebound? Foreclosures Rise as Jobs, Income Drop”

http://www.mcclatchydc.com/homepage/story/74104.html

Florida foreclosures 23 percent

Chris Durant

That is exactly my thinking. What happens to my cash while I wait for housing to plunge?

@Chris,

There is a huge difference between the US and post WWI Germany. You won’t read most in the history books because history is written by the victors. Germany was forced to pay reparations and even the basic commodities of life were in short supply. They had no clout on the world scene.

The US has virtually all world oil contracts denominated in dollars and will crush any country that won’t give their commodities for our paper. As long as we have enough fire power to destroy the planet our currency is backed by oil and missiles, and there is no disputing how valuable a commodity those are.

The reason we intentionally create housing bubbles is that it is the one thing that is not feasible to build more cheaply in another country and import. The premise that these brilliant economists were shocked by these results is like someone being shocked that they got dead drunk and wrecked their car. No shock. It was all planned. And then some smug John W thinking everything is cool because the wealthy can still drive their jags over the corpses of the middle class–yep that’s how it is. One nation, under fraud.

Hey St. A

That’s starting to get closer to it – watch William Black, former S & L investigator describe the current mortgage fraud in the Don’t Ask Don’t Tell Economic Disaster here: http://www.informationclearinghouse.info/article23243.htm

The other great guy to read and understand is Nathan Martin at http://economicedge.blogspot.com/

Paulson, Bernanke and the rest of the GS crew have taken over the Treasury and they already have the Fed; so there’s not much left to steal – they will now run the show their way – since the banks get to value the assets as they choose for their own internal purposes they have no need to sell, short, foreclose or modify – in fact they have every reason NOT to do any of those – the only question is how long the American people will sleep through the Corporate/Banking theft of their nation – as Nate says “we need a new set of rules – and we need separation of corporation and State; just as we have separation of church and State.” Whether or not we have the guts to demand and get them is another matter –

William Black is working with Ron Paul and others to put this whole matter in front of the people – but most people are too busy watching Tout TV and Financial Entertainment channels where all the news is that the recession is over – and now to see how the “recovery” will look. I think my favorite quote so far was that a jobless recovery would be weak.

N Sh*t Sherlock.

lol

ah well, you gotta have a laugh sometimes anyhow.

Oh – speaking of laugh – check out the Artist’s Impression of Goldman Sachs Bonus Securitization Offering at zeroheadge : http://www.zerohedge.com/article/artists-impression-goldman-sachs-bonus-securitization-offering

Hysterical!!!

“That news is no surprise to Karen Weaver of Deutsche Bank. She startled everyone a few weeks ago when she predicted that, by 2011, nearly half of American mortgage holders would be underwater (meaning that they’ll owe more on their mortgages than their houses were worth).

Half of mortgage holders means about one-third of American households. Put another way, Weaver forecasts 25 million mortgage holders will be under water by 2011, up from an estimated 14 million currently.”

(GASP) My, my!! What a shocker. She’s predicting now what you’ve been saying for HOW LONG? Thank you for your site. It prevented me from making a costly mistake a couple of years ago.

Doc, first thanks for all the great info you supply. You have kept my sanity and me on the sidelines watching and waiting. I’m curious what the parameters are for low/mid-tier/high price. If as in this post Culver, Pasadena, Palms are mid-tier I’m wondering if areas in the better part of the valley might be low mid tier. I’m starting to wonder if good livable homes in those areas, priced in the 350k-475k range, are close to the bottom. I’m speaking of Lake Bal, Valley Glen, flat lands of Encino, etc.. I have access to a direct sale 2/2 1/2 townhome in Valley, so there won’t be no lunatic bidding war, but I’m not sure if it’s value is going to fall another 20%. Currently it’s 25% down from it’s peak. Current direct sale price is 320k.

Call me confused on what low / mid / high price range is in those areas.

Thanks

DR HBB really needs to start elaborating on why he sees the banks’ window is closing. I’m starting to get worried because I don’t see that it is. I think they are working out a way to keep the excess stock off the market indefinitely. There can be no doubt anymore that our “leaders”, and their bankster butt buddies, wish to keep the American people stuck with the 2 lousy choices indefinitely: A. being perpetual renters or B. debt-slaves. They can go f*** themselves.

GeekGirl – Thanks for the link. If only everyone would watch to know and understand the TRUTH!!

@Tony

350-475 in the valley seems outrageous to me for a couple of reasons.

1. Big portion of valley residents are in the film and tv biz – below the line workers like gaffers and caterers. Friends of mine in this type of work are finding work hard to come by as more and more productions leave LA –

http://www.latimes.com/business/la-fi-ct-runaway-production-2009-gb,0,84237.graffitiboard?slice=2&limit=10

2. UE and outmigration in LA – I read somewhere that 40K people left LA in the last year. Small # for a city of 3 million but I see that trend continuing because of unemployment. Many of my friends (late 20’s to early 30’s) have left recently because they were laid off. My question is where will the next generation of buyers in the LA market come from?

3. Overall cost of living in LA and it’s satellite cities is REALLY high. I moved to LA six years ago and moved out one year ago because I couldn’t afford the 10% tax on internet access, the junk fees everywhere, the higher rates on all types of insurance there, higher gas prices than other cities in CA – each thing on its own was OK but in total, it was like a thief stealing money one dollar at a time – hard to save anything even when our income was close to 100K a year.

Prices will come down because incomes in LA because these factors will decrease demand for a long time. Wait, and you will reap the rewards.

Leave a Reply