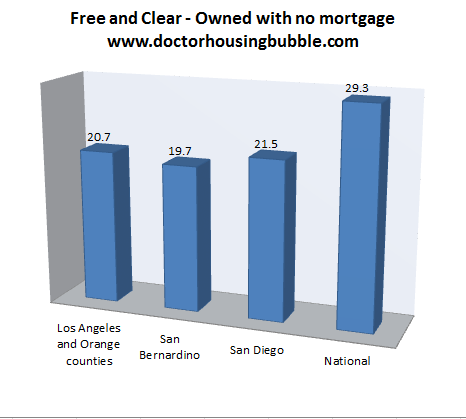

The no mortgage myth: Free and clear homeowners. New trend or old news? In 1970 39 percent of Americans owned their home with no mortgage versus 29.3 percent today. Over 34 percent of those 20 to 24 own their home free and clear?

One of the oddest pieces hitting my e-mail box in the last few days is regarding an analysis of homeownership and the number of Americans that supposedly own their homes free and clear. The slant is odd because Americans are massively in debt with mortgages and more have gone into deep debt with FHA insured loans that require only 3.5 percent down. These loans went from a tiny portion of the market to a dominant force over the last five years. The research starts out by pointing out that nearly 30 percent of Americans own their homes free and clear. Okay. But that isn’t something new. In fact, in 2000 the rate was 30 percent and in 1990 and 1980 it was at 35 percent, in 1970 it was 39 percent, and in 1960 it was up to 42 percent. Of course none of this is listed in the analysis because hey, everyone owns their home free and clear right? In fact, the official figure is 29.3 percent so it actually is at the lowest on record when looking at data going back to 1960. The numbers are what they are but it is interesting how people viewed this as some kind of dynamic shift. Let us dig into the actual figures.

Owned free and clear

First, let us examine the actual figures from Census data. How many people really own their homes free and clear?

Source:Â Census

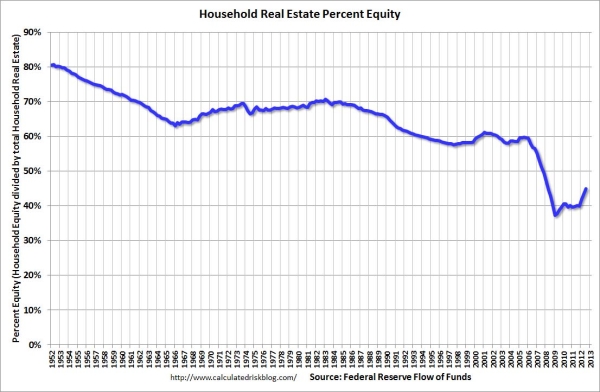

Sure doesn’t look like most people own their homes outright especially in contrast to where we were in previous decades. To the contrary, the vast majority of Americans have been going deeper and deeper into debt to own homes:

Households have very little equity because that has been the trend. Think of FHA insured loans that provide a stunning 30x leverage and will put homeowners in an immediate LTV position above 95 percent. Yet I’ve noticed that most of the recent headlines fail to acknowledge the massive push coming from investors and low supply. If you look at the above chart you will find that actually, Americans are mortgaged to the hilt (at least your typical home buyer). In the next few years, we may see a push up in the free and clear figure thanks to the large number of all cash investors. However, the articles on this try to make it appear that suddenly a new wave of upper-middle income people are buying properties thanks to a sudden turn in the economy. The biggest stretch comes from pointing out the number of young homeowners who own a home free and clear.

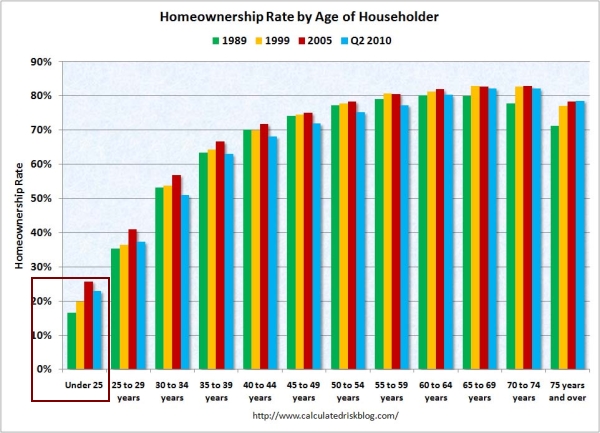

Homeownership by age

The research concludes that 34.5 percent of those 20 to 24 own their home with no mortgage. My goodness! Where did all these rich young adults come from? Reading something like that, you would think that the homeownership rate for the young actually zoomed up because of a shift of young buyers. Forget about all the data showing a younger and less affluent generation. When we dig deeper, we actually do not see a positive shift of ownership for the young:

Over the last 20 years, the homeownership rate has fallen for virtually all groups except for older Americans. It has fallen particularly harder for younger Americans because many are entering a weak workforce and many are deeply in debt. For those under 25, slightly above 20 percent even own a home, forget about going free and clear.

So what the data is telling us is something different. Only those young and wealthy, either by their own efforts or because of parents passing on wealth, can own a home free and clear. However, the notion and implication is that somehow, younger Americans are suddenly buying more homes when the overall data is far from that as you can see above.

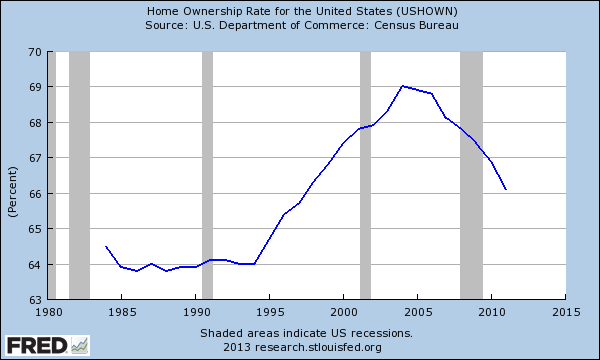

In fact, the homeownership rate overall has moved much lower since the bust:

Free and clear? Sure, for all those investors buying with cash. But to think that somehow some hidden money is creeping out because of better jobs and higher incomes goes against the overall data. That is the main reason why FHA insured loans are such a big deal and low interest rates are aggressively being pushed. Americans have very little savings overall and need all the leverage they can to squeeze into a home.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “The no mortgage myth: Free and clear homeowners. New trend or old news? In 1970 39 percent of Americans owned their home with no mortgage versus 29.3 percent today. Over 34 percent of those 20 to 24 own their home free and clear?”

Lets keep in mind that until the 1970’s, wages were rising enough to keep pace with inflation & purchasing power wasn’t eroding as rapidly as it does today. That is why debt is what keeps any purchasing power alive now.

Debt is a deal with the devil. If our leaders have no other way to grow the economy than through debt, which is clandestine (invisible) inflation, and is a form of imprisoning their own people, instead of providing them with higher salaries, then they (we) get what they deserve.

It is Bernanke (and Greenspan) who created and continue to create a greater wealth disparity — and it is Wall Street and their natural allies in the Republican Party whose zeal to destroy America’s unions that also destroyed wage growth in America, making debt slavery the only option for most middle class and lower working class Americans.

By inflating the cost of everything but computer chips from 1983-present, and by working together to destroy wage growth in America for 80% of Americans, the forces of the rich 1% (or even 20%) have taken major steps to destroy America. Bernanke sees that America is being destroyed. He just refuses to take responsibility for it, blaming it on differing ‘levels of education’. This man is not so stupid as that. He knows what he is doing. He is a politician after all.

America will have a civil war if this continues. Obama needs to wise up. Bernanke is not his friend. Bernanke is the devil in the details. Bernanke is the dark force is ruining America. He needs to be stopped. He is a thief, by his own master’s definition.

also the democractic pary

You mean the Republican Party and FAUX news, both sponsored by the Billionaire Koch brothers

Lets be clear. I have problems with both parties, one favors corporate welfare and one favors public welfare. Republicans favor deficits when in office, but against them when the other party is in office. Democrats don’t mind deficits weather they or the other party is in office.

While Republicans and Democrats are running through the streets as if their hair is on fire, babbling over the 83billion a year in sequester cuts, the FED is quietly printing that much and more each month and has said they will do more if Washington cuts spending.

In my humble opinion the FED has been the biggest enemy to the middle class over the last 20 some years.

Greenspan is/was a Republican, as is Ben Bernanke. They were both initially appointed by Republicans. Bernanke was appointed by Republicans even after the famous “helicopter speech” where he promised to print money till the cows come home if given the chance!

I have fond memories of a Democrat, appointed by a Democrat, named Paul Volker, who thought the value of ones hard earned savings were more important than Wall Street profits.

Volker was appointed because Carter had absolutely no idea who he was.

Ya might want to look at the guy he replaced…the “G” man.

Volker’s greatest luck in life is holding that position with Reagan as president.

Stupid people and memories…….view with great caution.

Why do you call them our leaders? We elect representatives, not leaders, don’t we?

Free and clear = inherited from the GI generation.

Not necessarily…. I’m 54 and we’ll have our house free & clear in less than 2 years. Our cars are old, but paid for. Cut my own grass using a push mower. But mostly, I’ve been lucky. We bought in 1996 before prices went nuts. Pretty crappy that it seems to boil down to luck when dealing with the housing market.

If prices had not skyrocketed and I could have had a few more years, earning what I was earning in the late 90’s (and still earn today), I could have bought and paid off by now. There’s where I feel I missed the boat, by a few years.

Correct, buying a house in California is all about timing. And that mostly comes down to luck since nobody can predict the future. For those lucky enough to have bought in 1996, there is a good chance you have your house paid off in full and you are living on easy street. For those who bought ten years later in 2006, there is a good chance your financial life is a giant mess…lost the house, bad credit, etc. The first example could lead to somebody in their 40s having a paid off house. The second example could lead to somebody in their 40s starting from square one. That is the unfortunate reality many face.

Or they had a lot of cash on hand.

And come April 1st, when the PMI for the life of the loan takes affect for FHA buyers, the only people buying real estate will be the top 5 percent and the investors. Some of the idiots will think twice about buying FHA with PMI for 30 years. But then again some of them just don’t give a crap. Real estate in California is like buying a new car to most people. In and out every 5 years….

MIP for life of loan takes effect June 3, 2013

Annual MIP increase effective April 1st.

See: http://portal.hud.gov/hudportal/documents/huddoc?id=13-04ml.pdf

@ norcalboon perhaps this is the reason why there is a mad dash to purchase a home – the MIP will endure for the life of loans signed after June 2013?

I think the answer to your question posed below is that this program is not for the homeowner but to backstop HUD so that homeowners will finance the dreams of the 1% bankers. I see this revision as a license to steal. I will fortunately not have to make a choice about participating. It also indicates that they do not have faith in the housing market – this is on the face a bet against home equity growing not just in the short term but in the long term.

You’d think it would have an effect, but I don’t think it will. I think people are conditioned to just add a hundred or so to their monthly payment for PMI. It’s monthly payment that seems to matter, not the total paid over the life of the loan.

You may be right, but at 135bps the 3.5%DP FHA buyer paying $500K for a starter box in SoCal is going to have to cough up $562/mo in PMI – for the life of the loan. But hey, why fund your IRA when you could have the AMerican Dream?

According to the graph, about 20% of the 20 to 24 year olds are “homeowners”. According to the stats, 34% of this group own their home free and clear. Doing the math, that means that 7% of the 20 to 24 year old group are owners of a home, free and clear of any mortgage. In other words, this 7% are trust fund babies or they inherited their home or mommy and daddy gifted them a house.

That means 1 in every ~11 persons between the age of 20-24 own their home outright. To me, that is a shockingly high number.

Ack, damn typo couldn’t fix it but I meant 1 in every ~14 persons between the age of 20-24. That to me, is still a very high number.

7% is about right. You figure that the top 3% to 5% of the income earners buy their kid a home as a graduation or marriage gift. Then another 1% to 3% get their homes due to the home being passed down from generation to generation. Toss in another 1% to 3% who get the massive inheritance. Factor in another 1% to 3% who acquire a home due to their parents purchasing real estate for rental income. Now that that kids leave the nest, the parents gift them one of their rental properties.

Remember that the median home price in the U.S. is about $175K. If you eliminate SoCal, the SF Bay Area, NYC metro, Boston and Arlington VA/Washington DC home prices, then the U.S. median SFR is probably closer to $125K. So a 7% free and clear ownership rate amongst the 20 to 24 age group is certainly reasonable.

thanks for responding to that comment. i’ve been reading your blog for a few weeks now and have started to pay attention to the comments. there is a lot of useful information in them, but some of it, my guess, is not reliable.

Highly skeptical of that 20-24 figure. Sounds like it was pulled out of somebody’s rear.

This is a chart I point to a lot that is indicative of why the market isn’t moving – the sad state of affairs for those under 40 who “own” a home. Goodbye move up buyer, for a long time.

http://www.zillowblog.com/2012-08-30/under-40-and-underwater-a-list-of-the-top-100-u-s-metros/

One factor that may contribute is being in your early 20’s. When you’re young, you aren’t quite as concerned about taking risks and you have a lot of energy. Can always go back home if you make mistakes. So possibly a lot of speculative young ones out there making high risk financial decisions. Those that luck out, are buying.

The one thing that doesn’t add up would be where they get the money in the first place.

It may not be mainstream, but make no mistake. There is no shortage of real money out there. It’s just in the hands of far too few.

why own free and clear? leverage and make the big bucks on the increase. the taxpayers bare the downside risk.

Own free and clear to get the monthly off my back. This is month two free….working on improving the worn out old cars I drove to get me here. Took 13 years. Not for sale.

Glad to hear this. Really, getting rid of the monthly payment can mean one or more thousands a month.

Congrats to you. Paying down in 13 years is well ahead of the curve. My take on Glendale is why in the heck is it that people think that paying 2 to 3 times what they have to for an asset is a good idea, inflation or not. In most cases I would hazard the inflation accrued on the leverage plan will only lead to a break even in out of pocket spent. And this is done in the face of the compounding value of paying it off at in many cases less than 50% of the amortized mortgage. That said if you are using leverage on rental property where it is someone else’s money paying it, yes use the leverage and increase the size of your portfolio then over the long term the compounding works for you.

This is month one of being free and clear. I am 68. Bought home number 1 in 1978 in Oakland Ca. Sold in 1992 when relocated to Columbia, SC and used entire equity ($115k) down on home. Bought the home on standard 30 year but opted to make payments every 2 weeks instead of monthly. This small adjustment cut 7.5 years off the life of the loan with little impact on monthly finances. It feels good not to make mortgage or vehicle payments as I enter the last years of my life. Damn good.

Well done Stan, and others.. I’m reading this entry again, as it corresponds somewhat with Doc’s latest entry… the comments scare me a bit of all these owners who are relieved at having paid off their mortgages during a long-haul of years… having bought for peanuts ages ago. What chance buyers of today at silly high prices? We shall find out.

_____

1 other

Not necessarily…. I’m 54 and we’ll have our house free & clear in less than 2 years. Our cars are old, but paid for. Cut my own grass using a push mower. But mostly, I’ve been lucky. We bought in 1996 before prices went nuts. Pretty crappy that it seems to boil down to luck when dealing with the housing market.

It’s always see a nice claims like “34% of age group x own their homes free and clear”.

Only small little detail, like “only 20% of that age group have a home” is omitted.

And therefore only 7% of the age group x own a free and clear home. Looks quite different than 34%.

And 7% is something which is very believable number, inherited properties at young age or gifts from wealthy parents.

I have talked to friends and relatives who are buying homes, and always advise them to get a 15 year mortgage. That way, the house is paid off, by the time that

the kids are going off to college.

Most of the people, however, go for a 30 year loan, because they want to “save”

the money, for other things-cars that depreciate, fancy dinners out,etc.

I was able to retire at 55, ONLY because we paid off the house, and could live on a LOT less, once we had no house payments.

After all, what is YOUR biggest expense every month?

“After all, what is YOUR biggest expense every month”

that’s an easy one, TAXES…..without question.

Mike–Yeah, I agree on 15-yr fixed loan. In fact, I refinanced last year from a 30 yr fixed, with 24 years remaining, into a 15 yr fixed, knocking 9 years off the life of the loan. Don’t know if I’ll be here in 14 or 15 years, but if I am, the house is paid for.

When I pay my mortgage each month, there is a space to pay additional principal (optional, of course). Now a days, with rates so low, the argument isn’t as strong to pay the additional principal. But back when rates were much higher, it made a lot more sense to do so.

Not intending to diss what you chose to do however in many states you can take a 30 year loan for less cost and pay it off in 15 to 16 years pretty much the same as a 15 year loan with the added protection of lower payments should you run into a crisis. All in all though kudos to you on your good financial sense.

My brother and I own our property free and clear. It was passed down to us from WWII vet. father. It has been in our family 50 yrs now and we have no intention of selling.

Forget “ownership” or “free and clear,” I’d love to see where we are as a country in terms of average or median loan to value. The picture wouldn’t be too pretty, I imagine.

DFresh, this may help:

http://www.zillow.com/visuals/negative-equity/#4/39.98/-106.92

Age 20-24 with free and clear mortgages? Hmmm……nationalities? Or the type

of business that produces these results? A lot of questions.

The really major tax loophole for average Americans is the interest tax deduction on your home mortgage. As taxes going up, fed and state, that deduction becomes more valuable. Getting a 4% loan on 50% of your house just makes good financial planning.

Sure you get a few bucks thrown back at you from the federal government, but then what do you do with that money? Well, I’ll tell you what I do with that money – I pay property taxes.

I’ve realized it’s not that much of a break. Have to consider comparison between itemized and standard deduction.

For me, last year the standard deduction was more than itemizing – would have needed $2K more in charitable contributions to equal the standard deduction.

Same here, Sadie.

The mortgage interest deduction always seems like an overhyped point that realtors use to sell homes and over leveraged/paying buyers use to justify such. Now that we have these low interest rates, that deduction is even less significant than before.

I don’t understand how this fallacy continues. How is it an advantage to pay the bank $10,000 in interest per year so you can get a $2,000 “deal” on your taxes? I would rather pay the $2,000 and keep the other $8,000 in my pocket. Plus I eliminate the chains of debt.

An analysis of what’s really going on with housing and the potential risks.

http://www.oftwominds.com/blog.html

One common denominator amongst owners I work with, is that they got their foot in the door via assistance from an older family member.

Second to that would be a spouse that makes as much or more than us.

That’s more common than people would like to think.

I know a lot of people like to think that young people are makin’ it on their own.

But it’s because people don’t like to talk about it. MANY young people get a lot of help from older relatives (parents, uncles, etc.)

(And congrats – noticed the name change.)

From Charles . Smith

“Federal subsidies and Federal Reserve policies enabled a vast expansion of debt that masked the stagnation of income. Now that the housing bubble has burst, this substitution of housing-equity debt for income has ground to a halt”. Since housing is the largest component of most households’ net worth, it is also the primary basis of their assessment of rising (or falling) wealth (i.e., the “wealth effect.”) No wonder Central Planners are so anxious to reflate housing prices. With real incomes stagnant and stock ownership concentrated in the top 10%, there is no other lever for a broad-based wealth effect other than housing.

http://www.oftwominds.com/blog.html

If the Dollar rises and gets stronger, housing prices will fall — as will stock prices and commodity prices, and inflation. Why is that so bad? Why is more affordable housing, natural resources, and stocks, and food being fought so voraciously by Mister Bernanke? Is there more to this than meets the eye? Is he not the Mister Scrooge, who hates the world’s poor, as I am seeing him to be?

Yesterday, Bernanke appeared before Congress — and he appeared snappy and tired. If he does not keep the Dollar down, his whole bubble-building plan will collapse, and with it most of America’s banks. But if he keeps spending like a drunken sailor to try to keep the Dollar weak, he will own a worthless balance sheet of assets that will implode in value when interest rates rise. He is like some Promethean figure who must, for the rest of eternity, spend money he does not have in order to keep inevitable reality from occurring.

QE is running out of room, out of time. Bernanke is hitting the wall. His suppression of interest rates to weaken the Dollar to support asset bubbles and the appearance of prosperity returning…CANNOT WIN –. No wonder the Fed Board was boiling at their last meeting. Even those Fed members who do not support Bernanke’s policies have tried to put a good face on all of this, fearing a meltdown around the world.

Is the punchbowl going away? And if it goes away, what then? Ben Bernanke has painted himself into a corner; and now things are getting hard for him.

Watch the Dollar. If it continues to rally, Ben Bernanke is losing his power.

We are being led to the slaughterhouse by a man (Bernanke) who says proudly: “We are sailing into uncharted territory now…!”

When all you own is a hammer, everything starts to look like a nail.

As the USD rallies, watch the Bernanke increase QE.

I can’t claim to comprehend Bernanke’s macro-economic policies, but how can the dollar strengthen with the debt balance the government has? Isn’t inflation inevitable from these actions? And I don’t get how they will keep hyper-inflation under control.

If I understand the QE correctly, basically the Fed is buying up all US housing that has mortgages on it. So the Fed owns the US, instead of the US owning the Fed…

Like I said, I probably don’t understand this correctly.

“He is like some Promethean figure who must, for the rest of eternity, spend money he does not have in order to keep inevitable reality from occurring.”

The best damn sentence I’ve ever read in a comment or blog. This image is succinct, graphic, spot on and in some sense scary as heck. Kudos for your writing.

I’ve stopped considering the equity in my house as part of my net worth. (I know it’s an incorrect calculation, by definition.) I did this because it is only worth that if you sell it and buy a less expensive replacement home. It also motivates me to get my “net worth” to zero (the point at which I can pay off the mortgage, if I wish).

The Federal policy of high home ownership, FHA, Fannie Mae, dept of HUD was pushed for one over riding reason: debt-incumbent home owners are reluctant to go on strike. If by some miracle that home ownership rate dips below fifty, and I pray God that it does, you will see a vast shift in the labor share of income in this country. A mobile workforce of renters will have vastly more bargaining power than the pathetic, anxious, tied-down wusses making up our laborforce today.

“the pathetic, anxious, tied-down wusses making up our laborforce today”

@Cameron

Great line, made me laugh:)

I don’t think that kind of generalization makes any sense to this conversation – there are still valid reasons for buying a home today, and a few of the regulars here have made their case quite reasonably. Having a family and some sense of control regarding one’s finances would factor into a lot of people’s decisions to buy now, regardless of the whether the market’s still in a bubble.

So, what about leveraging one’s Portfolio to obtain cash to buy property? I was told it is “The New Way to Buy”. Seems to me, if this is true, it gives an unfair advantage to those who have that. Please, someone expand on this.

Obviously (I hope), people with more cash have an advantage over people with less. What’s exacerbating the RE scene in So Cal is: 1) low interest rates are forcing people with money to chase yields (including RE); 2) constrained inventory and still high number of distressed sales is making this a “seller’s market,” where certainty of closing is paramount, and therefore those with more cash are preferred over those looking to finance

I remember many years ago as a millennial then in the very late 70’s I bought my first house. At the time interest rates were going up weekly it seemed. I signed a 30 year fixed at 8.5% in October but by first week of December interest rates were 11.5% and still no closing. Every week the mortgage company had an excuse for a delay and could I come up with just a little more cash down. Many years later I discovered they were suckering me into paying the higher interest rate so they could sell my discounted mortgage to another bank for a tidy quick profit the next year. I don’t think I had the same bank or servicer for more than two years during the 10 years I owned the house. By the 8th year I finally figured out what they were doing to me (sucker) so I decided to get even. At the start of the 8th year I paid lump sum the remaining principal to the 28th year and then resumed paying monthly. It didn’t take but a few months before a letter came from the latest mortgage servicer, “Would you mind or consider retiring the final 22 months as we would be most appreciative…” or something to that whine. I did mind and they were paid off month to month per the terms of the 30 year agreememnt. The next house I bought I decided I wasn’t going to put up with any more of this real estate financing crap this time so I sold some stock and with other savings wrote a check for the selling price eliminating the bank altogether. I’ve never regretted it and am amazed even today how crooked the banking, mortgage, servicing, government and other related real estate industry is. They’ve gotten away with murder for decades and the nothing has really changed to this day.

And the statistics I’d like to see?

How many young people are living in houses they inherited and feel stuck & wish they could make a move but feel they can’t.

You could also add into that equation the number of young people using their relative’s financial assistance in buying their homes today, but I don’t believe there’s any way to quantify that factor.

“How many young people are living in houses they inherited and feel stuck & wish they could make a move but feel they can’t.”

Unless I’m misunderstanding, probably very few?

Unless there’s a stipulation in the will that the heirs can’t sell the inherited home, why would they live somewhere they’re unhappy. They can rent it out or sell and buy a home somewhere they’d like to live. In that age group I can also see them selling the home and buying a few shiny gadgets and cars as well.

The headline surprised me until the Dr. showed what is behind the statistics. I would say the stats are right – roughly 1 in 14 having no recorded debt on a home. Many families come up with alternatives to bank financing and many, particularly immigrants and small business owners, believe in hard assets formming a base of long term wealth. Additionally, many families buy 4 year housing instead of renting for college and more than a few of the titles go to the child with the property turning into investment property after graduation or being used for the aging child’s downpayment in late 20’s. Also, the figures are not picking up the huge differences in markets – several slices of data would be revealing and convince skeptics. I think…one is the average purchase price of the youngest age cohort (many townhomes sell for less than $45k in most of the country.) I bet the number of 20-30 owning outright at $45k in OKC is higher than cohort in SFO where a shack goes for $500k. Another is seing the habits by ethnicity..for example, in Bay Area the Italians are second and third generation with tradition of helping kids own. These are not trust fund babies but savers who look at ZIRP and cry.

I did a google search on and found a spreadsheet on ‘quarterly vacancy and homeownership rate by state’ from US Census, here in Kalifornia, it shows the decreasing homeownership rate as follows for Q1 of each year:

2005: 59.9% 2006: 59.8% 2007: 58.4% 2008: 56.9% 2009: 56.8% 2010: 56.5% 2011: 55.3% 2012: 54.4%

and Q4 for 2012: 54.1% looks like there is some confirmation that homeownership continues to erode.

The median income of a 20-24 yr old is probably about ~30k

The unemployment rate of that bracket is about 15%

Yet 11% of that group are homeowners and 7% own it free and clear. Wow.

That tells me there’s a disconnect when people use median income or unemployment rates to estimate what housing prices ‘should’ be. There’s a lot of wealth out there. Even more than ever thanks to the enormous increase in money supply in the last few years.

Incomes are no longer the only way people buy homes and economic inequality is increasing.

Oh get a grip everyone. A quick check of the 2010 Census say there are approximately 21,585,999 20-24 year-olds. If 20% of them are home owners that is 4,317,200 people. Out of that group 34% own their home free and clear which is 1,467,848. Seems like a high number, but then considering there are 196,899,193 people that are ages 21 and over, this seems like a drop in the bucket. So their owning free and clear can totally be explained by inheritance or gifting of a house, and considering there is a lot of middle America where a house or condo can be had for very little. I’d like BlahBlah to ask fourteen random 20-24 year-olds in southern California and see if he can find one that owns a house free and clear.

A number of inner city areas have had programs where they sold houses for $1, and many cities with high crime rates have single-family houses that sell for less than $10,000. Lots of city kids with a job could stay home with mom until they had the money to move out and pay cash. By paying cash, they don’t have to have to qualify for a loan, or mess with the bank at all. Once they move in, they can spend the money that would otherwise go toward rent/mortgage to make repairs and improvements.

If you’re referring to the death spiral that is currently Detroit, then what they’re doing may work somewhat, but it’s borne out of complete desperation. Last time I was there on business, the blight started about 10 minutes in from the airport, and got only worse as I stopped off downtown, right beside Comerica Park. Sure, you could take a chance on a home in that area, but you’d be literally taking a huge chance with your life – that’s how bad it is right now.

A favorite blog of mine some here might enjoy, features incredible photography/stories of housing/architectural/industrial decay in Detroit. Beautiful, sad, fascinating.

http://detroitfunk.com/

Blofeld:

Your comment is confusing: ” You figure that the top 3% to 5% of the income earners buy their kid a home as a graduation or marriage gift. ”

If you mean literally the top 5% of earners in the country as in the individuals with the highest incomes in the US then you are correct but I am positive that the top 5% as measured by median do not. Why? average income of the top 5% of people in the US is around 160K. At that income stream it is very difficult to purchase a quality home in today’s market so even if the parent has a home free and clear they most likely do not have the liquid cash to purchase a home outright for their child.

Dr. Housing Bubble, are your calculations based on number of Americans, or on number of Americans with houses?

This is Jan 2024.

I have had a mortgage last 10 years, 5 1/2%. Im 77. Lucky to have very small permanent stick built home with city water and sewer. Social security only income, provide home for son also.

30 year history of work, husband body man deceased. No assets, no burial policy, just shop tools approx $50,000 disappeared with his death. Homeless for decades.

What I have seen is that there is no interest in care of the younger generation, they are abandoned by social services, leading to inability to foresee college education. The push is for us to be indebted for furnishing another body shop for son. The grab is for the house by indebtedness when the house itself is the most valuable, something the community knows. Very stressful knowing I have only a few more years to protect the property from indebtedness by people planning to use my son.

Ms Kate Sisco

1226 N 9th Ave

Iron river Mi 49935

Leave a Reply